Professional Documents

Culture Documents

VAT, Luxury Tax, Entry Tax and Excise Duty Changes in Karnataka Budget 2014-15

Uploaded by

Raghu CkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT, Luxury Tax, Entry Tax and Excise Duty Changes in Karnataka Budget 2014-15

Uploaded by

Raghu CkCopyright:

Available Formats

Value Added Tax

Reliefs

o Tax exemption on paddy, rice, wheat, pulses and products of rice

and wheat continued for one more year.

o Reduction in tax on scented arecanut powder excluding mixture from

14.5% to 5.5%

o Increase in registration limit from Rs.5 lakhs of annual turnover to

Rs.7.5 lakhs.

o Waiver of penalty payable for default in filing of returns by small

dealers who have no tax liability and opt for cancellation of their

registration.

o Increase in minimum sale value fixed for obtaining electronic

delivery note (e-SUGAM) from Rs.20000 to Rs.25000.

o Exemption to works contractors from compulsory registration

provision.

o Suitable administrative measures to enable dealers to rectify

mistakes in the returns which have no tax implication.

o Provision for single second appeal against reassessment for several

tax periods of one financial year.

Additional Resources Mobilization Measures

o Levy 5.5% VAT on liquor sold by bar and restaurants operating in

urban areas and by clubs, lodging houses and star hotels.

Rationalisation measure

o Provision for filing of annual statements by dealers.

Luxury Tax

Reliefs

o Increase in minimum daily rent for taxation from Rs.500 to Rs.750.

Entry Tax

Reliefs

o Tax exemption on ethanol brought for mixing with petrol.

Rationalisation measure

o Provision for filing of monthly returns by dealers and deemed

acceptance of such returns as under VAT.

Excise

o Revenue collection target of Rs.14,400 crores fixed for the year

2014-15.

Additional Resources Mobilization Measures

o Increase in Additional Excise Duty on Beer from 122% to 135 %

o Increase in Licence fee of Primary Distillery, Indian Liquor

Manufacturing Distillery and Brewery by 50%.

o Increase in Licence fee of MSIL retail liquor shops (CL-11C) from

Rs.1 lakh to Rs.3 lakhs.

o Increase in fee for shifting of shops from one place to another, from

existing 25% to 50% of the Licence fee charged on the Licence in

respect of such shops.

Stamps and Registration

o Revenue collection target is fixed at Rs.7450 crores for 2014-15.

o Stamp Duty exemption on subsequent sale deed relating to alternate

site allotted by the Bangalore Development Authority, consequent to

the denotification of the land.

1.

The rate of CST on inter-State sale to registered dealers (against Form-C)

shall stand reduced from 4% to 3% or the rate of VAT applicable in the State of the

selling dealer, whichever is lower.(Present rate of CST Is 2 %)

2.

The rate of CST on inter-State sale other than sale to registered dealers

shall be the rate of VAT applicable in the State of the selling dealer.

3.

The rate of CST on inter-State sale to Government Departments shall also

be the rate of VAT applicable in the State of the selling dealer, indicated at (b)

above. The facility of inter-State purchases by Government Departments against

Form-D stands withdrawn.

so after these amendments ,tax rates in various possible situation has been

explained in the table given below

SR NO

PARTICULARS

WITH C FORM

WITHOUT C FORM

1

If Goods are exempted from tax unconditionally

Nil

Nil

2

if vat rate in the state from which material sold, is less than the Normal CST

rate at present CST rate is 2 %

vat rate of the state from which goods sold will be applicable

vat rate of the state from which goods sold will be applicable

3

if vat rate in the state from which material sold, is more than the Normal

CST rate at present CST rate is 2 %

2 percent

vat rate of the state from which goods sold will be applicable

4

Sale to unregistered dealer

N.A

vat rate of the state from which goods sold will be applicable

5

sale to registered Dealer

2 percent or state vat rate which ever is less

vat rate of the state from which goods sold will be applicable

Now point wise answer to your queries are given here under.

1.

Sale with C-form rate of CST or Vat rate for that good of seller's state,

which ever is less will be applicable .In case of sale without form C ,Vat rate of

seller's state is applicable.

2.

Sale of Govt Department is now treated like a unregistered dealer so Vat

rate of the seller's state is applicable in sale to Govt Departments.

- See more at: http://www.simpletaxindia.net/2009/03/cst-rate-without-c-form-d-forminput.html#sthash.z8TPyF2Y.dpuf

You might also like

- Highlights of Budget 2023-2024Document4 pagesHighlights of Budget 2023-2024Ayesha ZafarNo ratings yet

- Vat IndiaDocument3 pagesVat IndiarajailayaNo ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet

- Tax Hand Book: Finance Bill 2016Document27 pagesTax Hand Book: Finance Bill 2016Rone garciaNo ratings yet

- Changing in Taxation 2017 FinalDocument3 pagesChanging in Taxation 2017 FinalWajahat BhattiNo ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- VAT Scope and Rates GuideDocument11 pagesVAT Scope and Rates GuideAjay Kumar MahtoNo ratings yet

- India Highlights of Budget 2016 at A GlanceDocument5 pagesIndia Highlights of Budget 2016 at A GlanceKARTHIK145No ratings yet

- Budget Briefing 2015Document63 pagesBudget Briefing 2015Noor AliNo ratings yet

- TRAIN LAW SUMMARYDocument60 pagesTRAIN LAW SUMMARYLex Dagdag100% (3)

- SUMMARY Enhanced Business Permitting and Licensing SystemDocument6 pagesSUMMARY Enhanced Business Permitting and Licensing SystemLea MonticalboNo ratings yet

- A Brief On VAT (Value Added Tax)Document8 pagesA Brief On VAT (Value Added Tax)San Deep SharmaNo ratings yet

- Changes to Philippine Excise Taxes and VATDocument6 pagesChanges to Philippine Excise Taxes and VATGf NavarroNo ratings yet

- Bangladesh Budget Highlights FY 2020-21Document4 pagesBangladesh Budget Highlights FY 2020-21AirenNo ratings yet

- Budget Red Eye 2013Document5 pagesBudget Red Eye 2013Envisage123No ratings yet

- Tax Highlights 2020Document4 pagesTax Highlights 2020JehanzaibNo ratings yet

- BPL Process Flow - SAZDocument34 pagesBPL Process Flow - SAZRaymond LimpiadoNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- Composition Scheme and Registration Unit 2Document9 pagesComposition Scheme and Registration Unit 2Cupid FriendNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Tax Proposals in Financial Budget 2013-14: Ravi ChhatwaniDocument4 pagesTax Proposals in Financial Budget 2013-14: Ravi ChhatwanirockyrrNo ratings yet

- Value Added TaxDocument20 pagesValue Added Taxrpd2509No ratings yet

- TDS On Sale of Property by NRI in 2022 Complete GuideDocument7 pagesTDS On Sale of Property by NRI in 2022 Complete Guideoffice201 207No ratings yet

- UntitledDocument8 pagesUntitledsuyash dugarNo ratings yet

- CHAPTER 6 TaxDocument24 pagesCHAPTER 6 TaxVencint LaranNo ratings yet

- SAP CIN VAT PresentationDocument13 pagesSAP CIN VAT PresentationSrinivasa KirankumarNo ratings yet

- Mindanao Shopping Vs DuterteDocument5 pagesMindanao Shopping Vs DuterteJoey Mapa100% (1)

- MSDC VS DuterteDocument3 pagesMSDC VS DuterteMarlowe Cris MenceroNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- 1997 Tax Code vs. TRAINDocument4 pages1997 Tax Code vs. TRAINCyrine CalagosNo ratings yet

- GST Composition Scheme: Key Eligibility RulesDocument2 pagesGST Composition Scheme: Key Eligibility RulesRohan SinhaNo ratings yet

- Ease of Paying TaxDocument3 pagesEase of Paying TaxjhnplmcsNo ratings yet

- TDS - Cash WithdrawalDocument1 pageTDS - Cash WithdrawalChandra PrakashNo ratings yet

- Everything You Need to Know About Pakistan's New VAT LawDocument4 pagesEverything You Need to Know About Pakistan's New VAT LawMuneeb Ghufran DadawalaNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- 2022 FinalsDocument49 pages2022 FinalsJane GaliciaNo ratings yet

- Sales Tax System in IndiaDocument7 pagesSales Tax System in IndiaKarthi_docNo ratings yet

- Budget Highlights 2013Document12 pagesBudget Highlights 2013Souma MukherjeeNo ratings yet

- Greetings in The 63 Year of The Hotel & Restaurant Association (Western India) - !!Document7 pagesGreetings in The 63 Year of The Hotel & Restaurant Association (Western India) - !!KAILASH KUSHWAHANo ratings yet

- Key Highlights of the Union Budget 2012-13Document5 pagesKey Highlights of the Union Budget 2012-13Cn NatarajanNo ratings yet

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaNo ratings yet

- VAT GUIDE 2nd EditionDocument28 pagesVAT GUIDE 2nd EditionLoretta Wise100% (1)

- Final PPT - VatDocument60 pagesFinal PPT - Vatmd1586No ratings yet

- California Tax Information For City and County OfficialsDocument83 pagesCalifornia Tax Information For City and County Officialswmartin46No ratings yet

- CIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialDocument20 pagesCIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialPriyabrata RayNo ratings yet

- TRAIN Law (PWC Philippines)Document16 pagesTRAIN Law (PWC Philippines)Rose Ann Juleth Licayan100% (1)

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- Sales Tax Practice Questions With SolutionsDocument6 pagesSales Tax Practice Questions With Solutionshanif channa100% (1)

- Tax Reform For Acceleration and Inclusion LawDocument28 pagesTax Reform For Acceleration and Inclusion LawGloriosa SzeNo ratings yet

- Edit (Econ)Document7 pagesEdit (Econ)Anonymous B6CLMEYHKiNo ratings yet

- VatDocument9 pagesVatmayurgharatNo ratings yet

- Value Added TaxationDocument6 pagesValue Added Taxationapi-3822396No ratings yet

- 2307Document3 pages2307Anonymous yCFuth7BL80% (1)

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- 2307Document5 pages2307jblopez66No ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Electoral System in IndiaDocument13 pagesElectoral System in IndiaRaghu CkNo ratings yet

- Business EthicsDocument9 pagesBusiness Ethicskartikeya1067% (3)

- Hra Rule 2aDocument3 pagesHra Rule 2aRaghu CkNo ratings yet

- 07 Chapter 2Document21 pages07 Chapter 2Raghu CkNo ratings yet

- Basic Concept of AccountingDocument24 pagesBasic Concept of AccountingRaghu CkNo ratings yet

- Composition Scheme Under GSTDocument8 pagesComposition Scheme Under GSTRaghu CkNo ratings yet

- Basic Concepts of Income Tax ActDocument14 pagesBasic Concepts of Income Tax ActRaghu CkNo ratings yet

- Bonded Labour in IndiaDocument16 pagesBonded Labour in IndiaRaghu CkNo ratings yet

- Income Tax Changes FY 2017-18Document22 pagesIncome Tax Changes FY 2017-18soumyaviyer@gmail.comNo ratings yet

- Composition Scheme Short NotesDocument1 pageComposition Scheme Short NotesRaghu CkNo ratings yet

- 1Document11 pages1thecoltNo ratings yet

- Competency Mapping TelcoDocument64 pagesCompetency Mapping TelcoRaghu CkNo ratings yet

- Sa 200 AuditingDocument32 pagesSa 200 AuditingRaghu CkNo ratings yet

- Benami Transactions Prohibition Amendment Act 2015Document33 pagesBenami Transactions Prohibition Amendment Act 2015Latest Laws TeamNo ratings yet

- Composition Levy Under GSTDocument65 pagesComposition Levy Under GSTRaghu CkNo ratings yet

- ACS 1803 Accounting General Ledger SystemDocument5 pagesACS 1803 Accounting General Ledger SystemRaghu Ck100% (1)

- International Financial FlowsDocument12 pagesInternational Financial FlowsAkhil James XaiozNo ratings yet

- Being As A Team Leader Why You Are Not Looking For Same Kind of Position Instead Why Are You Looking For Associate Level of JobDocument2 pagesBeing As A Team Leader Why You Are Not Looking For Same Kind of Position Instead Why Are You Looking For Associate Level of JobRaghu CkNo ratings yet

- Important Acts Related To BankingDocument1 pageImportant Acts Related To BankingRaghu CkNo ratings yet

- Competency Mapping TelcoDocument64 pagesCompetency Mapping TelcoRaghu CkNo ratings yet

- HTMLDocument8 pagesHTMLRaghu CkNo ratings yet

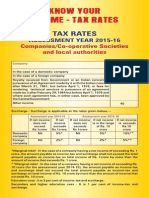

- Companies Tax RatesDocument2 pagesCompanies Tax RatesRaghu CkNo ratings yet

- International Harmonization of Financial ReportingDocument8 pagesInternational Harmonization of Financial ReportingRaghu Ck100% (1)

- SBI Computer QuizDocument2 pagesSBI Computer QuizRaghu CkNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate GovernanceRaghu CkNo ratings yet

- Business EthicsDocument9 pagesBusiness Ethicskartikeya1067% (3)

- A Study On Training & DevelopmentDocument76 pagesA Study On Training & DevelopmentPradeepnspNo ratings yet

- Categories of E-CommerceDocument5 pagesCategories of E-CommerceRaghu CkNo ratings yet

- Online Shopping ProjectDocument11 pagesOnline Shopping ProjectRaghu CkNo ratings yet

- Survey Report on Import-Export Trade in UttarakhandDocument123 pagesSurvey Report on Import-Export Trade in UttarakhandVikas MNo ratings yet

- Expanded Senior Citizens Act (7432)Document28 pagesExpanded Senior Citizens Act (7432)Mae Joan AbanNo ratings yet

- REf 2Document29 pagesREf 2yakyakxxNo ratings yet

- LAP Terms and ConditionsDocument5 pagesLAP Terms and Conditionsgarretmc100% (1)

- Inventory ExercisesDocument9 pagesInventory ExercisesJo KeNo ratings yet

- Assess the Role of Services in the EconomyDocument5 pagesAssess the Role of Services in the EconomySai Krishna Teja PamulaparthiNo ratings yet

- Profile and Taxation of The Fast Food IndustryDocument4 pagesProfile and Taxation of The Fast Food IndustryCha chaNo ratings yet

- Plants in Foreign CountriesDocument10 pagesPlants in Foreign CountriesjshafiNo ratings yet

- CPAR General Principles (Batch 93) - HandoutDocument12 pagesCPAR General Principles (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- JKTR002046216Document2 pagesJKTR002046216Yohanes LimbongNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- 62740810australia MiningDocument14 pages62740810australia Miningpgay340248No ratings yet

- Computer Software Business PlanDocument43 pagesComputer Software Business PlanHemantSharmaNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Tender Doc SwimmingpoolDocument149 pagesTender Doc SwimmingpooldawnNo ratings yet

- Peoplesoft FIN ESA Rel89 Bundle23 Release NotesDocument34 pagesPeoplesoft FIN ESA Rel89 Bundle23 Release Notesrajiv_xguysNo ratings yet

- TCS Process Documentation For FI Postings: Posting Customer Invoice Via FB70Document8 pagesTCS Process Documentation For FI Postings: Posting Customer Invoice Via FB70srinivasNo ratings yet

- 2016 Tax 2 Bar Q&ADocument3 pages2016 Tax 2 Bar Q&Achristine100% (1)

- Fresh Fruits Market Brief: Report NameDocument6 pagesFresh Fruits Market Brief: Report NameBenjamin FloresNo ratings yet

- Finance Management Pro 25+ Years ExperienceDocument3 pagesFinance Management Pro 25+ Years ExperienceYousef F.FawazNo ratings yet

- SAP S/4HANA Enterprise Management SAVIC Solution for Discrete ManufacturingDocument2 pagesSAP S/4HANA Enterprise Management SAVIC Solution for Discrete ManufacturingSiddhartha PurohitNo ratings yet

- RTB Taxation II Course Outline 2016-2017Document21 pagesRTB Taxation II Course Outline 2016-2017Victor LimNo ratings yet

- Domestic Application Form - Valve World Expo India 2024Document15 pagesDomestic Application Form - Valve World Expo India 2024REYNOLD VALVESNo ratings yet

- 10% Spot DP Agreement Annex BDocument38 pages10% Spot DP Agreement Annex BAnya RieNo ratings yet

- Snow Solutions (Final Exam)Document11 pagesSnow Solutions (Final Exam)pavneetsinghrainaNo ratings yet

- SCM Supplier Registration Form PDFDocument23 pagesSCM Supplier Registration Form PDFBùi Duy TâyNo ratings yet

- Rics Small Business Lease Inside Act v2Document8 pagesRics Small Business Lease Inside Act v2R JNo ratings yet

- TAX 06 Preweek LectureDocument16 pagesTAX 06 Preweek LectureJohn DoeNo ratings yet

- 36 - PILIPINAS TOTAL GAS vs. CIRDocument2 pages36 - PILIPINAS TOTAL GAS vs. CIRLEIGH TARITZ GANANCIALNo ratings yet

- Online Price Guide January 2024 v1Document19 pagesOnline Price Guide January 2024 v1ayawe888888No ratings yet