Professional Documents

Culture Documents

Fundamental of Finance MIF Pre-Course Training Finance

Uploaded by

talkam27061981Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental of Finance MIF Pre-Course Training Finance

Uploaded by

talkam27061981Copyright:

Available Formats

MIF Pre-Course Training

Study Guide: Fundamentals of Finance

1

2

3

Introduction ................................................................................................................................. 1

Textbook ...................................................................................................................................... 1

Study Guide ................................................................................................................................. 2

3.1

Financial Statements (Chapter 2) ..................................................................................... 2

3.2

Arbitrage and Financial Decision Making (Chapter 3) ................................................. 3

3.3

The Time Value of Money (Chapter 4) .......................................................................... 4

3.4

Interest Rates (Chapter 5) ................................................................................................. 5

3.5

Investment Decision Rules (Chapter 6).......................................................................... 6

3.6

Fundamentals of Capital Budgeting (Chapter 7) ........................................................... 7

3.7

Valuing Bonds (Chapter 8) ............................................................................................... 8

3.8

Valuing Stocks (Chapter 9) ............................................................................................... 9

3.9

Capital Markets and the Pricing of Risk (Chapter 10) ................................................ 10

3.10 Estimating the Cost of Capital (Chapter 12)................................................................ 11

3.11 Capital Structure in Perfect Markets (Chapter 14) ...................................................... 12

3.12 Debt and Taxes (Chapter 15) ......................................................................................... 13

3.13 Financial Options (Chapters 20, 21) ............................................................................. 14

4

Further Reading......................................................................................................................... 15

5

Checklist ..................................................................................................................................... 15

1

Introduction

The Fundamentals of Finance course is designed to introduce you to or refresh your

knowledge of basic corporate finance and investments. Topics covered are outlined above.

The course has 12 units, each being based on a chapter of the textbook we are using (see

below). For each unit, you will have to complete an assignment at MyFinanceLab, an elearning platform that accompanies the book.

2

Textbook

The Fundamentals of Finance course requires you to purchase the following book:

Berk/DeMarzo, 2010, Corporate Finance, 2nd edition, Pearson Education

(including MyFinanceLab student access code card)

See blackboard for more information on the textbook.

3 Study Guide

3.1

Financial Statements (Chapter 2)

Key concepts:

Balance sheet & fundamental balance sheet equation

Types of assets and liabilities

Market versus book value

Balance sheet analysis

Enterprise value

Income statement and income statement analysis

Statement of cash flows; change in cash and cash equivalents

Cash versus non-cash expenses

Read:

All sections

You may also want to give chapter 1 a quick read

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.2

Arbitrage and Financial Decision Making (Chapter 3)

Key concepts:

Market prices and decision-making

Time value of money

Net present value

Arbitrage and the Law of One Price

No-arbitrage and securities prices

Short sales

Value-additivity

Read:

Sections 3.1 to 3.5

Further reading (optional): Appendix

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.3

The Time Value of Money (Chapter 4)

Key concepts:

Timelines

Discounting and compounding

Annuities and perpetuities

Internal rate of return

Finance functions in Excel

Read:

All sections

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.4

Interest Rates (Chapter 5)

Key concepts:

Effective annual rates (EAR) versus annual percentage rates (APR)

Loan amortization

Opportunity cost of capital (Section 5.5)

Read:

Sections 5.1, 5.2, and 5.5

Further reading (optional): Sections 5.3 and 5.4, Appendix

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.5

Investment Decision Rules (Chapter 6)

Key concepts:

NPV rule

IRR rule and its problems

Choosing between projects

Read:

Sections 6.1 to 6.4

Further reading (optional): Section 6.5

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.6

Fundamentals of Capital Budgeting (Chapter 7)

Key concepts:

Capital budgeting

Incremental earnings

Unlevered net income

Opportunity costs and externalities, sunk costs

Free cash flow & calculation of free cash flows

Accelerated depreciation

Sensitivity and scenario analysis

Read:

All sections & Appendix

Note on Cash Flows and Valuation (blackboard site)

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.7

Valuing Bonds (Chapter 8)

Key concepts:

Bond prices, yields, and coupons

Zero coupon bonds and coupon bonds (annual and semi-annual coupons)

Bonds trading at par, at a discount, or at a premium

Bond price dynamics

Bond arbitrage and pricing of bonds

Read:

All sections

Further reading (optional): Appendix

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.8

Valuing Stocks (Chapter 9)

Key concepts:

Dividend discount model

Total return = Capital Gain Rate + Dividend Yield = Cost of Capital

Enterprise Valuation Approach / Free Cash Flow Valuation

Excess cash versus operating cash (footnote 6)

Weighted Average Cost of Capital

Valuation based on comparables

Market efficiency

Read:

All sections

Note on Cash Flows and Valuation (blackboard site)

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

3.9

Capital Markets and the Pricing of Risk (Chapter 10)

Key concepts:

Measures of risk and return

Computing historical return

Variance and volatility of returns

Tradeoff between risk and return

Diversifiable versus systematic risk

No arbitrage and the risk premium

Beta, Cost of Capital, and CAPM

Read:

All sections

Further reading (optional): chapter 11

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

10

3.10 Estimating the Cost of Capital (Chapter 12)

Key concepts:

Equity cost of capital

Market portfolio

Market risk premium

Beta estimation

Debt cost of capital

Asset/unlevered cost of capital and beta

Cash, net debt, and beta

Industry asset betas

Pre-tax and after-tax weighted average cost of capital

Read:

All sections

Further reading (optional): Appendix

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

11

3.11 Capital Structure in Perfect Markets (Chapter 14)

Key concepts:

Concept of perfect capital markets (no taxes, etc.)

Equity versus debt financing in perfect capital markets

Modigliani-Miller I

Modigliani-Miller II

Capital structure fallacies

Conservation of value principle

Read:

All sections

Optional: McKinsey Tutorial on Value Creation (link on blackboard site)

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

12

3.12 Debt and Taxes (Chapter 15)

Key concepts:

Interest tax shield

Valuation of interest tax shield: permanent debt versus target debt-equity ratio

Recapitalizations and tax benefits

Read:

Sections 15.1 to 15.3

Further reading (optional): Sections 15.4 and 15.5

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

13

3.13 Financial Options (Chapters 20, 21)

Key concepts:

Option contracts and payoffs

Put-call parity

Exercising options early

Binomial option pricing model

Black-Scholes

Risk-neutral probabilities

Read:

Sections 20.1 to 20.5, Sections 21.1 to 21.3

Further reading (optional): Sections 15.4 and 15.5

Test your knowledge:

Review chapter summary

Review some of the chapter problems

Do practice exercises on MyFinanceLab

Do assignment on MyFinanceLab

14

Further Reading

Here are some hints for further reading in case you wish to prepare more (all of the topics

below will be covered in subsequent courses):

Chapter 5, Section 5.3 on determinants of interest rates

Chapter 11 on portfolio selection and the CAPM

Chapter 13 on behavioral finance

Chapters 16 and 17 on capital structure and payout policy

Chapters 23 and 24 on equity and debt financing

5

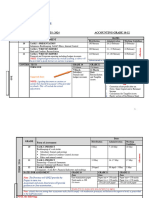

Checklist

Unit

Chapter

Read chapter

Understood key

concepts

Did MyFinanceLab

assignment

10

10

12

11

14

12

15

13

20,21

15

You might also like

- Bloomberg Assessment Test Pre Course: 10 Hours in 10 ClassesDocument24 pagesBloomberg Assessment Test Pre Course: 10 Hours in 10 ClassesShivgan JoshiNo ratings yet

- Clearing and Settlement - DTCC - Following How A Trade Gets ClearedDocument8 pagesClearing and Settlement - DTCC - Following How A Trade Gets ClearedAsha Pagdiwalla100% (1)

- Robert T. Kiyosaki - Rich Dad's Conspiracy of The Rich - The 8 New Rules of Money (, Grand Central Publishing)Document245 pagesRobert T. Kiyosaki - Rich Dad's Conspiracy of The Rich - The 8 New Rules of Money (, Grand Central Publishing)Refianto Damai50% (2)

- Introduction To Financial Analysis PDFDocument489 pagesIntroduction To Financial Analysis PDFYuva Varnica100% (1)

- Financial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetDocument3 pagesFinancial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetAarnaaNo ratings yet

- Best Intraday TipsDocument4 pagesBest Intraday TipsGururaj VNo ratings yet

- What I Wish I Had Been Told 20 Years AgoDocument181 pagesWhat I Wish I Had Been Told 20 Years AgoDavide CellittiNo ratings yet

- Merrill Lynch 2007 Analyst Valuation TrainingDocument74 pagesMerrill Lynch 2007 Analyst Valuation Trainingmehtarahul999No ratings yet

- Application Program InterfacesDocument86 pagesApplication Program Interfacestalkam27061981No ratings yet

- Derivatives and Foreign Currency TransacDocument2 pagesDerivatives and Foreign Currency TransacJade jade jadeNo ratings yet

- General Motors Foreign Exchange Risk Management Policy Finance EssayDocument9 pagesGeneral Motors Foreign Exchange Risk Management Policy Finance EssayHND Assignment Help100% (1)

- MB-310 Dynamics 365 FinanceDocument13 pagesMB-310 Dynamics 365 Financedebugger911No ratings yet

- Mt Kenya University Management Accounting IDocument127 pagesMt Kenya University Management Accounting IJames75% (4)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Basic Accounting Concepts: A Beginner's Guide to Understanding AccountingFrom EverandBasic Accounting Concepts: A Beginner's Guide to Understanding AccountingNo ratings yet

- DAS GuideDocument12 pagesDAS Guidetalkam27061981100% (1)

- Random Problem 2 (Pinky)Document23 pagesRandom Problem 2 (Pinky)spur iousNo ratings yet

- GB550 Course PreviewDocument8 pagesGB550 Course PreviewNatalie Conklin100% (1)

- Introductory Financial ModellingDocument73 pagesIntroductory Financial ModellingWilliam WilliamsonNo ratings yet

- INSEAD - Executive Master in Finance - CurriculumDocument17 pagesINSEAD - Executive Master in Finance - CurriculumJM KoffiNo ratings yet

- INSEAD - Master in FinanceDocument25 pagesINSEAD - Master in FinanceJM KoffiNo ratings yet

- Cost Benefit Analysis: Prepared by Lekshmi Krishna M.RDocument23 pagesCost Benefit Analysis: Prepared by Lekshmi Krishna M.RLekshmi NairNo ratings yet

- CERTIFICATE IN QUANTITATIVE FINANCE (CQFDocument12 pagesCERTIFICATE IN QUANTITATIVE FINANCE (CQFShravan VenkataramanNo ratings yet

- Intermediate Financial ModellingDocument95 pagesIntermediate Financial ModellingWilliam WilliamsonNo ratings yet

- Financial Strategy: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDocument30 pagesFinancial Strategy: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedYadav Krishna100% (2)

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate FinancevivekNo ratings yet

- Institute of Business Management College of Business Management Department of Accounting and FinanceDocument6 pagesInstitute of Business Management College of Business Management Department of Accounting and Financeace rogerNo ratings yet

- Course HighlightsDocument14 pagesCourse HighlightsWittsteinNo ratings yet

- Outline BBA 5th Managerial AccountingDocument3 pagesOutline BBA 5th Managerial AccountingAbroo ZulfiqarNo ratings yet

- BAF2202 Management Accounting IDocument127 pagesBAF2202 Management Accounting IKafonyi John100% (1)

- SyllabusDocument6 pagesSyllabusstoryNo ratings yet

- Fins3625 Week 1 Lecture SlidesDocument13 pagesFins3625 Week 1 Lecture SlidesVinit DesaiNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF Scribdwalter.herbert733100% (40)

- Associate Wealth Manager AWMDocument8 pagesAssociate Wealth Manager AWMShweta ChhabraNo ratings yet

- Accounting T2 Study Guide 2024Document3 pagesAccounting T2 Study Guide 2024youssefwessa1771No ratings yet

- FIN 401 Financial ManagementDocument5 pagesFIN 401 Financial ManagementHafsah AnwarNo ratings yet

- 80434-Fixed Assets in Microsoft Dynamics NAV 2013Document4 pages80434-Fixed Assets in Microsoft Dynamics NAV 2013amsNo ratings yet

- Intermediate Finance: Session 1Document24 pagesIntermediate Finance: Session 1rizaunNo ratings yet

- I 6CoprorateAccountingDocument2 pagesI 6CoprorateAccountingAsad AliNo ratings yet

- Hold vs. Dispose Analysis Full Book 2413Document50 pagesHold vs. Dispose Analysis Full Book 2413Shawn Salimian100% (1)

- Forecasting Financial StatementsDocument25 pagesForecasting Financial Statementstarun slowNo ratings yet

- Ch 4 Nonroutine Decisions Relevant CostsDocument40 pagesCh 4 Nonroutine Decisions Relevant CostsJaypee FazoliNo ratings yet

- Lecture 2-BEPDocument12 pagesLecture 2-BEPharsimran KaurNo ratings yet

- EMBA 25 26 Portfolio Management Prof. Rachana BaidDocument5 pagesEMBA 25 26 Portfolio Management Prof. Rachana BaidShravan DeekondaNo ratings yet

- CORPORATE FINANCE II: COST OF CAPITALDocument58 pagesCORPORATE FINANCE II: COST OF CAPITALleducNo ratings yet

- SDM - Course OutlineDocument5 pagesSDM - Course OutlinePuneet GargNo ratings yet

- Course Outline: Financial Management - I Course Code: Credit:3, Core Course Area: Finance Program: PGDM-B&FS Term: II Academic Year: 2020-22Document6 pagesCourse Outline: Financial Management - I Course Code: Credit:3, Core Course Area: Finance Program: PGDM-B&FS Term: II Academic Year: 2020-22KaranNo ratings yet

- Mbf843 Capital Investment and Financial DecisionsDocument122 pagesMbf843 Capital Investment and Financial DecisionsAchraf NajredNo ratings yet

- BBA Financial Management Exam GuideDocument9 pagesBBA Financial Management Exam GuideTanvir Hasan SifatNo ratings yet

- Masters of Business Administration: (Financial Strategy and Policy)Document12 pagesMasters of Business Administration: (Financial Strategy and Policy)Tanveer AhmedNo ratings yet

- AcF 304-22-23 Revision SessionDocument39 pagesAcF 304-22-23 Revision Session郭晶No ratings yet

- Fma401v Tutorial101Document40 pagesFma401v Tutorial101darl1No ratings yet

- Chapter 1 Cost of Capital PDFDocument58 pagesChapter 1 Cost of Capital PDFGiáng Hương VũNo ratings yet

- Business Finance AF-340 Financial Management I FN-400: Program BBADocument5 pagesBusiness Finance AF-340 Financial Management I FN-400: Program BBAHamza BurhanNo ratings yet

- Module IiDocument38 pagesModule Iishuchi606No ratings yet

- 2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - RevisedDocument41 pages2022 - ISB-MADM-Session 1-Chapters 1-3, 4 (P. 116-118, 132-133) - Revisedtushar gsNo ratings yet

- Most Imp Topics Vardeez'Document74 pagesMost Imp Topics Vardeez'irvinNo ratings yet

- Capital Budgeting and Financial Planning Course: Learn NPV, IRR, Cash Flow AnalysisDocument31 pagesCapital Budgeting and Financial Planning Course: Learn NPV, IRR, Cash Flow AnalysisPal QtaNo ratings yet

- Business Plan Basics: Robin Jones January 18, 2006Document19 pagesBusiness Plan Basics: Robin Jones January 18, 2006lycheechuaNo ratings yet

- 005 - BAV Mr. Dipak KapurDocument4 pages005 - BAV Mr. Dipak KapurGaurav KhatriNo ratings yet

- Advanced Financial Management Cash Flow GuideDocument43 pagesAdvanced Financial Management Cash Flow GuideMithunNo ratings yet

- POA Final ExamDocument13 pagesPOA Final ExamPhương Anh NguyễnNo ratings yet

- Syllabus EMBA12weeksDocument19 pagesSyllabus EMBA12weeksakcelik04No ratings yet

- Ratio Analysis: Robinson, Munter, GrantDocument30 pagesRatio Analysis: Robinson, Munter, Grantmastermind_asia9389No ratings yet

- Analysis of Key Financial RatiosDocument37 pagesAnalysis of Key Financial RatiosTom HerreraNo ratings yet

- Equity Valuation I:: Investment Management Internship ClassDocument38 pagesEquity Valuation I:: Investment Management Internship ClassRohit BajajNo ratings yet

- Oracle BI ApplicationDocument181 pagesOracle BI ApplicationPurnawati ShresthaNo ratings yet

- CE AF Week Four LectureDocument30 pagesCE AF Week Four LectureKhosi GrootboomNo ratings yet

- FIN3102 01 IntroductionDocument88 pagesFIN3102 01 IntroductioncoffeedanceNo ratings yet

- AA - Screen Build ErrorsDocument9 pagesAA - Screen Build Errorstalkam27061981No ratings yet

- Ai PDFDocument162 pagesAi PDFtalkam27061981100% (1)

- FDDocument27 pagesFDtalkam27061981No ratings yet

- FRDocument29 pagesFRtalkam27061981No ratings yet

- Temenos T24 CSS Fault Reports - Customer Support Service How To' GuideDocument11 pagesTemenos T24 CSS Fault Reports - Customer Support Service How To' Guidetalkam27061981No ratings yet

- App AcctDocument40 pagesApp Accttalkam27061981No ratings yet

- Euro ImplementationDocument18 pagesEuro Implementationtalkam27061981No ratings yet

- Managerial Accounting Homework 1 Comprehensive CVP AnalysisDocument3 pagesManagerial Accounting Homework 1 Comprehensive CVP AnalysisMK ZNo ratings yet

- Comm 457 Solutions To Practice MidtermDocument9 pagesComm 457 Solutions To Practice MidtermJason SNo ratings yet

- Difference Between Financial Accounting and Management Accounting PDFDocument2 pagesDifference Between Financial Accounting and Management Accounting PDFYakkstar 21No ratings yet

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionDocument69 pagesA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshNo ratings yet

- Capitallization Table Template: Strictly ConfidentialDocument3 pagesCapitallization Table Template: Strictly Confidentialsh munnaNo ratings yet

- ADMG - Annual Report 2019Document308 pagesADMG - Annual Report 2019rosida ibrahimNo ratings yet

- Tiga Pilar Sejahtera Food TBK Class A AISA: Last Close Fair Value Market CapDocument4 pagesTiga Pilar Sejahtera Food TBK Class A AISA: Last Close Fair Value Market CapadjipramNo ratings yet

- HUKUM SekuritisasiDocument17 pagesHUKUM SekuritisasiAninditaNo ratings yet

- Valuation of The Deal Between Vedanta and CairnDocument8 pagesValuation of The Deal Between Vedanta and Cairndnss_007No ratings yet

- Jain BBA Financial Management Practice PaperDocument2 pagesJain BBA Financial Management Practice PaperRavichandraNo ratings yet

- 037 Practice Test 03 Corporate and Other Laws Test Solutions ObjectiveDocument7 pages037 Practice Test 03 Corporate and Other Laws Test Solutions Objectivedeathp006No ratings yet

- Mastering Moving Averages in TradingDocument2 pagesMastering Moving Averages in TradingBiantoroKunarto50% (2)

- IDSBA - Rough - DataDocument19 pagesIDSBA - Rough - DataVivek VashisthaNo ratings yet

- Impact of Corona Virus On Mutual Fund by Sadanand IbitwarDocument14 pagesImpact of Corona Virus On Mutual Fund by Sadanand Ibitwarjai shree ramNo ratings yet

- FAC1601 Assignment 5Document73 pagesFAC1601 Assignment 5Kgomotso RamodikeNo ratings yet

- Portfolio Theory and Pricing RiskDocument17 pagesPortfolio Theory and Pricing RiskmshaeedNo ratings yet

- Currency Appreciation and Depreciation BiblographyDocument3 pagesCurrency Appreciation and Depreciation BiblographyJohn Jayanth BalantrapuNo ratings yet

- Revised 2024 Accounting Assessment Dates - Grade 10-12Document3 pagesRevised 2024 Accounting Assessment Dates - Grade 10-12maziwisalianNo ratings yet

- All LowerbandDocument2 pagesAll Lowerbandprana132No ratings yet

- 4.2 Costs, Scale of Production and Break-Even AnalysisDocument10 pages4.2 Costs, Scale of Production and Break-Even Analysisgeneva conventionsNo ratings yet

- Lo 1Document3 pagesLo 1Uzma SiddiquiNo ratings yet

- Optimize portfolio returns with expert managementDocument73 pagesOptimize portfolio returns with expert managementArunKumarNo ratings yet