Professional Documents

Culture Documents

ASX Appendix 4E Results For Announcement To The Market: Ilh Group Limited

Uploaded by

ASX:ILH (ILH Group)Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ASX Appendix 4E Results For Announcement To The Market: Ilh Group Limited

Uploaded by

ASX:ILH (ILH Group)Copyright:

Available Formats

ILH GROUP LIMITED

ACN: 120 394 194

ASX Appendix 4E

RESULTS FOR ANNOUNCEMENT TO THE MARKET

Current reporting period:

Previous corresponding period:

Year ended 30 June 2013

Year ended 30 June 2012

Percentage

change

EARNINGS

Revenue from ordinary activities

Revenue and other income from ordinary activities

Profit from ordinary activities after tax

(before fair value adjustments)*

flat

Amount

$A

31,719,416

flat

32,309,496

UP(+)/DOWN(-)

+42%

790,253

Profit from ordinary activities after tax attributable to members

-9%

1,021,088

Net profit for the period attributable to members

-9%

1,021,088

Reported profit from ordinary activities after tax

2013

$A

1,021,088

2012

$A

1,116,006

Less: Other income from movement in fair value of financial liabilities

(230,825)

(559,861)

790,253

556,145

*Reported profit from ordinary activities after tax reconciliation

Profit from ordinary activities after tax

(before fair value adjustments)^

^The above measure is not a financial measure recognised by International Financial Reporting

Standards (IFRS). This measure has been inserted because it provides an understanding of the

Groups underlying financial performance. The movement in fair value of financial liabilities

represents non-cash and accounting adjustments arising from acquisition transactions in 2011 and

2013, being deferred consideration liabilities which were ultimately not payable.

It is recommended that the Appendix 4E be read in conjunction with the Companys ASX release

dated 14 August 2013 and all public announcements made by ILH Group Limited and its controlled

entities (the Group) during the year ended 30 June 2013 and subsequently in accordance with the

continuous disclosure obligations under the ASX listing rules.

ILH GROUP LIMITED

ACN: 120 394 194

ASX Appendix 4E

RESULTS FOR ANNOUNCEMENT TO THE MARKET

Amount

per share

0.40 cents

0.20 cents

0.60 cents

0.80 cents

Franked

amount

per share

at 30%

Australian

tax rate

0.40 cents

0.20 cents

0.60 cents

0.80 cents

30 June 2013

Amount

$

4,701,956

30 June 2012

Amount

$

4,304,212

111,521,145

101,734,515

4.22

4.23

DIVIDENDS

2013 final dividend (fully entitled shares)

2013 interim dividend

Total

Previous corresponding period (2012)

Record date for determining entitlements to the

1 November 2013

2013 final dividend

Payment date for the 2013 final dividend

22 November 2013

DIVIDEND REINVESTMENT PLAN

The Company operates a dividend reinvestment plan (DRP). Further details are disclosed in the

dividend details section of this report.

DRP discount rate

5%

Date for receipt of DRP election notices

25 October 2013

NET TANGIBLE ASSET BACKING

Net tangible assets

Total number of shares on issue

Net tangible asset backing per security

The group does not have any interests in joint ventures outside the group.

During the current period, the Group made an investment in the following business:

ENTITY NAME

Rockwell Bates Pty Ltd

25% interest

A further 24% interest (bringing total interest to 49%)

Investment

Date

2 July 2012

1 November 2012

AUDIT REPORT

The preliminary final report is based on accounts which are in the process of being audited.

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

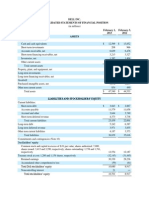

Consolidated Statement of Financial Position

Note

ASSETS

Current Assets

Cash and cash equivalents

Trade and other receivables

Dividends receivable

Work in progress

Income tax receivable

Total Current Assets

Consolidated

As at

30 June 2013

$

Consolidated

As at

30 June 2012

$

1,164,462

10,749,159

125,906

2,928,984

227,602

15,196,113

1,312,035

10,789,460

2,288,190

31,063

14,420,748

2,861,383

983,162

14,590,139

666,330

3,717

19,104,731

34,300,844

1,342,820

14,590,139

167,540

2,862

16,103,361

30,524,109

LIABILITIES

Current Liabilities

Trade and other payables

Interest bearing loans and borrowings

Provisions

Other liabilities

Total Current Liabilities

3,378,660

623,115

991,027

114,494

5,107,296

3,941,157

676,225

1,074,147

404,072

6,095,601

Non-Current Liabilities

Interest bearing loans and borrowings

Provisions

Deferred tax liabilities

Other liabilities

Total Non-Current Liabilities

TOTAL LIABILITIES

NET ASSETS

8,374,908

387,748

310,340

162,127

9,235,123

14,342,419

19,958,425

4,794,054

347,625

106,733

118,205

5,366,617

11,462,218

19,061,891

34,831,886

(17,368,147)

2,494,686

19,958,425

33,917,382

(17,368,147)

2,512,656

19,061,891

Non-Current Assets

Investment in an associate

Plant and equipment

Goodwill

Intangible assets

Other assets

Total Non-Current Assets

TOTAL ASSETS

EQUITY

Issued Capital

Accumulated Losses

Reserves

TOTAL EQUITY

6

7

8

The above Consolidated Statement of Financial Position should be read in conjunction with the

accompanying notes.

3

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

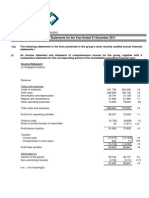

Consolidated Statement of Comprehensive Income

Note

Professional fees

Total revenue

Movement in fair value of financial liabilities

Share of profit of an associate

Interest revenue

Dividend revenue

Other income

Total other income

Occupancy expenses

Salaries and employee benefits expenses

Depreciation and amortisation expenses

Advertising and marketing expenses

Administrative expenses

Other expenses

Finance costs

Share based payments expense

Total expenses

Profit before income tax

Income tax expense

Profit after income tax

Net profit for the year

Other comprehensive income

Net gains/(losses) on available-for-sale financial assets

Other comprehensive income/(losses) for the year,

net of tax

Total comprehensive income for the year

Basic earnings per share (cents)

Diluted earnings per share (cents)

3(a)

3(b)

3(c)

Consolidated

2013

$

Consolidated

2012

$

31,719,416

31,719,416

31,690,208

31,690,208

230,835

301,341

32,916

138

24,850

590,080

559,861

112,781

133

43,882

716,657

(2,811,707)

(21,641,716)

(609,624)

(577,478)

(4,111,781)

(666,850)

(522,955)

(37,226)

(30,979,337)

1,330,159

(309,071)

1,021,088

1,021,088

(2,814,989)

(22,324,957)

(530,198)

(459,652)

(3,629,873)

(836,018)

(350,513)

(41,644)

(30,987,844)

1,419,021

(303,015)

1,116,006

1,116,006

856

(574)

856

1,021,944

(574)

1,115,432

0.94

0.94

1.10

1.10

The above Consolidated Statement of Comprehensive Income should be read in conjunction with

the accompanying notes.

4

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Consolidated Statement of Cash Flows

Note

Cash flows from operating activities

Receipts from customers

Interest received

Dividends received

Other revenue

Payments to suppliers and employees

Interest and other costs of finance paid

Income tax paid

Net cash flows from/(used in) operating activities

Cash flows from investing activities

Purchase of plant and equipment

Payment for intangible assets

Proceeds from the disposal of plant and equipment

Payment for the acquisition of businesses

Net cash flows used in investing activities

Cash flows from financing activities

Proceeds from loans received

Repayment of borrowings

Dividends paid

Payments for share issue expenses

Net cash flows from financing activities

Net decrease in cash held

Cash and cash equivalents at the beginning of the

financial year

Cash and cash equivalents at the end of the financial year

Consolidated

2013

$

Consolidated

2012

$

34,373,555

32,916

34,413

24,850

(33,693,453)

(448,414)

(303,479)

20,388

32,026,219

112,781

133

43,882

(32,924,236)

(250,222)

(346,897)

(1,338,340)

(166,085)

(620,319)

(2,017,809)

(2,804,213)

(662,227)

(167,540)

1,491

(1,253,580)

(2,081,856)

4,418,135

(949,818)

(813,661)

(19,641)

2,635,015

3,633,027

(907,058)

(448,735)

(13,017)

2,264,217

(148,810)

(1,155,979)

1,279,636

1,130,826

2,435,615

1,279,636

The above Consolidated Statement of Cash Flows should be read in conjunction with the

accompanying notes.

5

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Consolidated Statement of Changes in Equity

CONSOLIDATED

Balance as at 1 July 2011

Issued

Capital

Accumulated

Losses

Net

Unrealised

Losses

Reserve

33,397,152

(16,926,589)

(649)

Profit for the year

Other comprehensive losses

Total comprehensive

(losses)/income for the year

Transactions with owners in

their capacity as owners

(574)

(574)

Transfer to general reserve

Dividends paid

Share based payments

Issue of shares

Transaction costs on issue of

shares

Income tax on items taken

directly to or transferred from

equity

Balance as at 30 June 2012

CONSOLIDATED

Balance as at 1 July 2012

1,542,749

18,012,663

1,116,006

1,116,006

1,116,006

(574)

1,115,432

(586,434)

41,644

41,644

487,700

487,700

(13,017)

(13,017)

3,903

3,903

(17,368,147)

(1,223)

Issued

Capital

Accumulated

Losses

Net

Unrealised

Gains/

(Losses)

Reserve

33,917,382

(17,368,147)

2,513,879

(586,434)

19,061,891

General

Reserve

Total

Equity

(1,223)

2,513,879

19,061,891

1,021,088

1,021,088

Other comprehensive income

Total comprehensive income

for the year

Transactions with owners in

their capacity as owners

856

856

Dividends paid

Balance as at 30 June 2013

Issue of shares

Transaction costs on issue of

shares

Income tax on items taken

directly to or transferred from

equity

441,558

Profit for the year

Share based payments

Total

Equity

33,917,382

(441,558)

General

Reserve

856

1,021,088

1,021,944

(1,039,914)

(1,039,914)

37,226

37,226

898,395

898,395

(19,641)

(19,641)

(1,476)

34,831,886

(17,368,147)

(367)

(1,476)

2,495,053

19,958,425

The above Consolidated Statement of Changes in Equity should be read in conjunction with the

accompanying notes.

6

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These preliminary consolidated financial statements relate to ILH Group Limited and the entities it

controlled during the year ended 30 June 2013.

2) SEGMENT INFORMATION

Operating segments

The ILH Group Limited has identified its operating segments based on the internal management

reporting that is used by the executive management team (the chief operating decision maker) in

assessing performance and allocating resources.

ILH Group Limiteds operating segments have been identified based on how the financial and

operating results of the Group are monitored and presented internally to the executive management

team. The reportable segments are based on aggregated operating segments determined by the

similarity of the products sold and the services provided, as these are the sources of the Groups

major risks and have the most effect on the rates of return.

Rockwell Olivier (Sydney), Civic Legal, Signet Lawyers, Rockwell Olivier (Perth) and ILH Group Head

Office Division are operating segments within the legal services sector in the Australian market and

have been aggregated to one reportable segment given the similarity of the services provided,

method in which services are delivered, types of customers and regulatory environment.

As the Group is aggregated into one reportable segment, there are no inter-segment transactions.

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

3) REVENUE AND EXPENSES

a) Depreciation and amortisation expenses

Depreciation of plant and equipment

Consolidated

2013

Consolidated

2012

524,876

500,498

84,748

29,700

609,624

530,198

Amortisation of intangible assets

b) Other expenses

Consolidated

2013

Consolidated

2012

Author royalty fees

47,537

55,308

Consulting fees

29,102

118,812

Bad and doubtful debts

435,386

431,034

Bank fees

150,705

210,830

Other expenses

4,120

666,850

20,034

836,018

c) Finance costs

Consolidated

2013

Consolidated

2012

Interest external entities

506,604

307,694

Interest accretion

16,351

522,955

42,819

350,513

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

4) DIVIDENDS DECLARED

2013

2012

Cents

per share

Total

$

a) Dividends declared, recognised

and paid

Interim dividend (fully franked)

0.2

222,036

b) Dividends declared and not

recognised

Final dividend (fully franked)(c)

0.4

446,485

c) Final Dividend Details

Amount per share

Amount franked

Record date to determine entitlements to the dividend

Date the final dividend is payable

Cents

per share

0.8

Total

$

816,276

0.4 cents

Fully franked at a 30% tax rate

1 November 2013

22 November 2013

d) Unrecognised dividends

A 2013 final dividend of 0.4 cents per ordinary fully paid share, fully franked at 30% was announced

on 15 August 2013 and is payable on 22 November 2013 to shareholders registered on 1 November

2013. The 2013 final dividend has not been recognised in the financial report because it was

determined, declared and publicly announced subsequent to year end.

The final dividend amount of $446,485 has been determined based on the number of eligible

ordinary shares on issue at the date of this financial report.

The Groups DRP will apply to the 2013 final dividend.

e) Dividend Reinvestment Plan

The Company operates a dividend reinvestment plan (DRP) which offers eligible shareholders the

opportunity to reinvest all or part of their dividends in additional shares in the Group.

The shares are issued at a price derived by applying a 5% discount to the volume weighted average

market price of shares (on an ex-dividend basis) during the five trading days immediately preceding

and inclusive of the record date.

The last date for receipt of an election notice for participation in the DRP with respect to the above

final dividend is 25 October 2013.

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

5) CASH AND CASH EQUIVALENTS

Cash at bank and in hand

Consolidated

2013

Consolidated

2012

1,164,462

1,312,035

Cash at bank earns interest at floating rates based on daily bank deposit rates. The carrying amounts

of cash and cash equivalents approximate fair value.

Consolidated

2013

Consolidated

2012

Reconciliation to statement of cash flows

For the purposes of the statement of cash flows, cash and cash

equivalents comprise the following at 30 June:

Cash at bank and in hand

Short-term deposits

Bank overdrafts

1,160,712

1,308,285

3,750

3,750

(33,636)

1,130,826

(32,399)

1,279,636

10

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

6) ISSUED CAPITAL

a) Ordinary shares

Consolidated

2013

Shares

Fully paid shares

Partly paid shares

Forfeited shares held in trust

Consolidated

2012

Shares

Consolidated

2013

$

Consolidated

2012

$

109,857,645

100,543,515

34,677,520

33,800,242

1,763,500

1,491,000

154,366

117,140

(100,000)

111,521,145

(300,000)

101,734,515

34,831,886

33,917,382

b) Movements in ordinary share capital

Shares

Opening balance as at 1 July 2011

Issue of shares at 11.5 cents per share to vendors of PLN Lawyers

in part satisfaction of consideration payable on 1 August 2011

Issue of shares under the Dividend Reinvestment Plan

Costs associated with issuing shares

Income tax on items taken directly to or transferred from equity

Issue of shares under the Deferred Employee Share Plan

Forfeited shares under the Deferred Employee Share Plan

Balance as at 30 June 2012

97,164,328

33,397,152

3,043,478

1,251,926

574,783

(300,000)

101,734,515

350,000

137,700

(13,017)

3,903

54,093

(12,449)

33,917,382

Shares

Opening balance as at 1 July 2012

Issue of shares at 9.5 cents per share to vendors of Rockwell

Olivier (Melbourne) for a 25% interest in the business on 2 July

2012

Issue of shares at 9.5 cents per share to vendors of Rockwell

Olivier (Melbourne) for a further 24% interest in the business on

1 November 2012

Issue of shares at 10.0 cents per share in part satisfaction of 2011

& 2012 Principal profit share entitlement on 13 March 2013

Issue of shares under the Deferred Employee Share Plan

Forfeited shares under the Deferred Employee Share Plan

Issues of shares under Dividend Reinvestment Plan on

2 November 2012

Issues of shares under Dividend Reinvestment Plan on

3 May 2013

101,734,515

33,917,382

3,152,958

299,531

3,026,842

287,550

850,605

472,500

(200,000)

85,061

54,920

(17,694)

1,880,797

176,803

602,928

49,450

Costs associated with issuing shares

Income tax on items taken directly to or transferred from equity

Balance as at 30 June 2013

111,521,145

(19,641)

(1,476)

34,831,886

11

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

7) ACCUMULATED LOSSES

Consolidated

2013

Consolidated

2012

Accumulated losses

(17,368,147)

(16,926,589)

Balance at beginning of year

Transfer to general reserve (refer note 8)

Balance at end of the year

(17,368,147)

(17,368,147)

(16,926,589)

(441,558)

(17,368,147)

8) RESERVES

Accumulated losses on available-for-sale financial assets

General reserve

(a)

Consolidated

2013

Consolidated

2012

(367)

(1,223)

2,495,053

2,494,686

2,513,879

2,512,656

a) General reserve

Due to accumulated losses incurred prior to the listing of the company on 17 August 2007, the

Directors resolved to isolate profits derived from trading activities since listing through the

establishment of a General Reserve.

During the period, $nil was transferred to the General Reserve from Accumulated Losses

(2012: $441,558).

12

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

9) INVESTMENT IN AN ASSOCIATE

Investment in Rockwell Olivier (Melbourne) Pty Ltd (formerly known as Rockwell Bates Pty Ltd)

On 2 July 2012 the Company entered into a Share Purchase Agreement to acquire a 25% interest in

the Melbourne based legal practice of Rockwell Olivier (Melbourne).

Under that agreement, the investment would be increased to 49% over the next two years.

On 1 November 2012, the planned investment increase was accelerated with the acquisition of an

additional 24% interest in the business.

The consideration for the initial transaction was a combination of the issue of 3.15m shares at 9.5

cents per share and cash. The consideration for the subsequent transaction was a combination of

the issue of 3.03m shares at 9.5 cents per share and cash.

Deferred consideration was expected to be paid in July 2013 to Rockwell Olivier (Melbourne). As the

agreed performance criteria were not met during the year ended 30 June 2013 this amount is no

longer payable and has been added back to other income as a movement in the fair value of

financial liabilities. Should the business achieve the budgeted net profit before tax in the 2014

financial year, deferred consideration of $151,322 will be payable in July 2014.

The carrying value of the investment as at 30 June 2013 is $2,861,383 and includes the Groups

share of the associates after tax profit for the period of $301,341 (25% interest from 2 July 2012 to

31 October 2012, then 49% interest from 1 November 2012 to 30 June 2013).

13

ILH Group Limited

Appendix 4E - Preliminary Final Report

for the Year Ended 30 June 2013

ACN: 120 394 194

Notes to the Consolidated Financial Statements

10) SUBSEQUENT EVENTS

Acquisition of Capricorn Investment Partners Limited (CIPL)

ILH proposes to acquire 100% of the shares in CIPL, and the business and assets of Pentad, for an

initial consideration of $9.25m. The initial consideration will be satisfied by the proposed issue of

52.7m ILH shares at 9.0 cents per share and the payment of $4.51m cash. In addition, deferred

consideration of up to $5.0m is payable over a two year period in scrip and cash if certain

performance conditions are satisfied.

The initial cash component will be sourced from ILHs existing cash reserves and borrowing capacity.

ILH has had funding approval from their lenders to increase the companys existing commercial bill

facility from $10m to $14m with the term extended a year to 15 December 2015.

The initial shares component will be fully paid ordinary shares in the Company and will rank equally

with the Company's current issued shares, except for any final dividend payable in respect of the

2012/13 financial year, where the shares will not participate.

The transaction is subject to shareholder approval for the issue of shares to the CIPL and Pentad

vendors pursuant to ASX Listing Rule 7.1.

Final Dividend 2012/13

The Directors have declared a fully franked final dividend in respect of 2012/13 of 0.4 cents per

share, down from 0.8 cents fully franked in the previous corresponding period.

The dividend will have a record date of 1 November 2013 and a payment date of 22 November 2013.

The dividend reinvestment plan will operate with respect to the final dividend.

14

You might also like

- 1Q2013 AnnouncementDocument17 pages1Q2013 AnnouncementphuawlNo ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- CHEM Audited Results For FY Ended 31 Oct 13Document5 pagesCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngNo ratings yet

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocument19 pagesUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNo ratings yet

- Beximco Hy2014Document2 pagesBeximco Hy2014Md Saiful Islam KhanNo ratings yet

- POAL Financial Review 2013Document13 pagesPOAL Financial Review 2013George WoodNo ratings yet

- MMDZ Audited Results For FY Ended 31 Dec 13Document1 pageMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Adamjee InsuranceDocument80 pagesAdamjee InsuranceMohsan SheikhNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- 2Q13 Financial StatementsDocument52 pages2Q13 Financial StatementsFibriaRINo ratings yet

- PD 2013 Fin StatementsDocument4 pagesPD 2013 Fin StatementsdignitykitchenNo ratings yet

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- IFRS FinalDocument69 pagesIFRS FinalHardik SharmaNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- Financial Statements Year-End Results 2012Document2 pagesFinancial Statements Year-End Results 2012Bernews AdmnNo ratings yet

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocument23 pagesFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- GT Kendisinin 49 Sfinancial Statements Ri13 enDocument39 pagesGT Kendisinin 49 Sfinancial Statements Ri13 enkazimkorogluNo ratings yet

- Pre q12013fsDocument27 pagesPre q12013fsKatie SanchezNo ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- 174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsDocument28 pages174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsASX:ILH (ILH Group)No ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansNo ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- FIDL Audited Results For FY Ended 31 Dec 13Document1 pageFIDL Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- Q2 13 Statements of Cash FlowsDocument1 pageQ2 13 Statements of Cash FlowsanujloveyouNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- African Overseas Enterprises 2012 Annual ReportDocument57 pagesAfrican Overseas Enterprises 2012 Annual ReportAdilNzNo ratings yet

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- Cognizant 10qDocument53 pagesCognizant 10qhaha_1234No ratings yet

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Document13 pagesFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNo ratings yet

- Easycred 2013 IFRS FS - Final For IssueDocument56 pagesEasycred 2013 IFRS FS - Final For IssuerefreshgNo ratings yet

- SGXQAF2011 AnnouncementDocument18 pagesSGXQAF2011 AnnouncementJennifer JohnsonNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument81 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- Hannans Half Year Financial Report 2010Document18 pagesHannans Half Year Financial Report 2010Hannans Reward LtdNo ratings yet

- Financial Statement Fy 14 Q 3Document46 pagesFinancial Statement Fy 14 Q 3crtc2688No ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Q4FY2013 Interim ResultsDocument13 pagesQ4FY2013 Interim ResultsrickysuNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- 260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedDocument2 pages260.ASX ILH March 16 2015 Sale of Shares in Law Central and Capricorn CompletedASX:ILH (ILH Group)No ratings yet

- 253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementDocument2 pages253.ASX ILH Dec 24 14.19 Binding Agreement Restructuring AnnouncementASX:ILH (ILH Group)No ratings yet

- 252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedDocument2 pages252.ASX ILH Dec 24 14.18 2014 Binding Agreement ReachedASX:ILH (ILH Group)No ratings yet

- 248.ASX ILH Dec 10 2014 Trading HaltDocument1 page248.ASX ILH Dec 10 2014 Trading HaltASX:ILH (ILH Group)No ratings yet

- 247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHDocument2 pages247.ASX ILH Dec 3 2014 Becoming A Substantial Holder FRENCHASX:ILH (ILH Group)No ratings yet

- 236.ASX ILH Oct 22 2014 Investor PresentationDocument18 pages236.ASX ILH Oct 22 2014 Investor PresentationASX:ILH (ILH Group)No ratings yet

- 235.ASX ILH Oct 22 2014 First Quarter Financial UpdateDocument2 pages235.ASX ILH Oct 22 2014 First Quarter Financial UpdateASX:ILH (ILH Group)No ratings yet

- 227.ASX IAW Aug 29 2014 Preliminary Financial ReportDocument16 pages227.ASX IAW Aug 29 2014 Preliminary Financial ReportASX:ILH (ILH Group)No ratings yet

- E4a 2 Teaching U1 U2Document22 pagesE4a 2 Teaching U1 U2Mi NhonNo ratings yet

- T09 - Not-for-Profit Organizations PDFDocument9 pagesT09 - Not-for-Profit Organizations PDFriver garciaNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Nfjpia Mockboard 2011 BLTDocument12 pagesNfjpia Mockboard 2011 BLTVon Wilson AjocNo ratings yet

- Finance Online ExamDocument4 pagesFinance Online ExamShahenda HabibNo ratings yet

- Stock-Picking Strategies - Introduction - Investopedia2Document5 pagesStock-Picking Strategies - Introduction - Investopedia2Rishikesh DevaneNo ratings yet

- Growth SaverDocument9 pagesGrowth SaverKugilan BalakrishnanNo ratings yet

- Sources of Business FinanceDocument3 pagesSources of Business FinanceNishant RavNo ratings yet

- Final Accounts With Case Solution & Dindorf SolutionDocument39 pagesFinal Accounts With Case Solution & Dindorf SolutionRajat srivastavaNo ratings yet

- PARCORDocument14 pagesPARCORChristine DaelNo ratings yet

- EVELYN BIRGITA TUGAS ADV Intercompany Sales of PpeDocument10 pagesEVELYN BIRGITA TUGAS ADV Intercompany Sales of PpeShirly WillyanaNo ratings yet

- Private Placement Memorandum (Series A Round)Document15 pagesPrivate Placement Memorandum (Series A Round)api-3764496100% (6)

- Financial Forecasting For Strategic GrowthDocument2 pagesFinancial Forecasting For Strategic GrowthElizabethNo ratings yet

- Catapang Hazel Ann E.Document4 pagesCatapang Hazel Ann E.Johnlloyd BarretoNo ratings yet

- f9 Question Bank Tuition Pack 20q Bank June 2017Document21 pagesf9 Question Bank Tuition Pack 20q Bank June 2017Ranjisi chimbangu0% (1)

- HW Assignment 3Document6 pagesHW Assignment 3Jeremiah Faulkner0% (1)

- Adv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1Document12 pagesAdv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1ria fransiscaieNo ratings yet

- Introduction To Accounting: Financial Statements AnalysisDocument15 pagesIntroduction To Accounting: Financial Statements AnalysisFaizal AbdullahNo ratings yet

- Ex10 - Working Capital Management With SolutionDocument9 pagesEx10 - Working Capital Management With SolutionJonas Mondala80% (5)

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Bhpannualreport2022Document248 pagesBhpannualreport2022ozbrat2000No ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- What Is A CooperativeDocument45 pagesWhat Is A CooperativeMariNo ratings yet

- Mukand Annual Report FY 2010 11Document82 pagesMukand Annual Report FY 2010 11amartya palitNo ratings yet

- African Barrick V TRA (Income Tax) (JMT Mar 2016)Document23 pagesAfrican Barrick V TRA (Income Tax) (JMT Mar 2016)Mwambanga Mīkhā'ēlNo ratings yet

- Articles of Association As Per New Companies Act 2013Document14 pagesArticles of Association As Per New Companies Act 2013greeshmaNo ratings yet

- CFAS Chap 4Document16 pagesCFAS Chap 4Jansen Alonzo Bordey100% (1)

- Simple and Compound InterestDocument43 pagesSimple and Compound InterestAnne BergoniaNo ratings yet

- Annual Report & Accounts Annual Report & Accounts: Document2 12/23/04 12:07 PM Page 1Document92 pagesAnnual Report & Accounts Annual Report & Accounts: Document2 12/23/04 12:07 PM Page 1thestorydotieNo ratings yet

- Carbon Anode Production Plant PDFDocument94 pagesCarbon Anode Production Plant PDFRay Romey100% (1)