Professional Documents

Culture Documents

Configuring The General Ledger

Uploaded by

Kui MangusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Configuring The General Ledger

Uploaded by

Kui MangusCopyright:

Available Formats

FINANCIALS: CONFIGURATION AND SET UP

This document describes how to configure the opentaps Financials General Ledger and

importing your initial balance sheet and inventory.

Change Log

May 23, 2006 Updated for new configuration screens

May 2 2006

Updated for opentaps 0.9

April 5, 2006

Updated to describe how payments are actually posted.

March 17

2006

Updated to reflect inventory adjustment GL account classes

March 8

2006

Initial version with information from the old accountingext documentation

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

Running the Financials module

The Financials module is included in the opentaps release. You can also download it into your

ofbiz/hot-deploy/ directory, and it should load automatically and show up as a Financials tab

between Facility and Manufacturing on your OFBiz applications tab bar. Be sure to use [Web

tools] > [XML Import Dir] to import all the seed data from hot-deploy/financials/data/

Configuring Your Users

Users who will be responsible for creating business transactions which are posted to the general

ledger need to have the security permissions ACCOUNTING_ATX_CREATE and

ACCOUNTING_ATX_POST associated with their user logins.

Users who will be responsible for configuring the general ledger in the Financials application will

need to have the permission FINANCIALS_CONFIG associated with their user logins.

Configuration Screens

Beginning with version 0.9.1, you will see a [Configurations] tab next to [Logout] in the Financials

application. This tab allows you to configure some commonly used features of the Financials

application:

1. Chart Of Accounts: You can view your chart of accounts, add new accounts, associate an

existing account with this organization, or deactivate an account from the organization.

Adding a new account actually does two things: it will create a new GL account and then

associate with the current organizations chart of accounts. The screen will prompt you for

account code, account name, account class, account type, description, parent GL account,

and initial balance. The account code will be used as the glAccountId as well. The resource

type for GL accounts created this way will always be MONEY.

If you click on [Add Sub Account], you will be taken to the add new account form with the

original account as the parent account and its fields pre-populated in the

Associate an existing account can be used to associate existing GL accounts, such as those

for another organization, with the current organization. You will be prompted for the account,

an initial balance, and effective dates.

Updating an account will allow you to change all its fields, including some which are not

available when you first create the account. Note that a change here will change this GL

account for all organizations with which it is associated.

Deactivate an account with first check that this account is not associated with any payment

methods, payment types, invoice types, or GL account type defaults. If none of these are

associated with this account, it will be marked expired on the organizations chart of accounts.

2. GL Account Type Defaults: You can see the default GL accounts created for various types

of GL activities, such as Accounts Receivables, Inventory, Revenues, and Cost Of Goods

Sold, here and assign or re-assign GL accounts here.

3. Payment Methods: You can assign GL accounts for the payment methods of this

organization, such as the Companys checking or credit card accounts. The payment

methods need to be created in Party Manager.

4. Time Periods: You can view time periods which are closed, which are currently opened,

close time periods, and create new time periods automatically by specifying the

beginning date, ending date, and time period type.

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

The configuration screens and related services require the FINANCIALS_CONFIG permission,

which is by default configured to be part of the FULLADMIN security group in

financials/data/FinancialsSecurityData.xml

Setting up an organization

The first step in configuring the accounting application is to set up an organization for accounting

and configure its accounting preferences. The organization is created in the Party and

PartyGroup entities. The organization must have a PartyRole of INTERNAL_ORGANIZATIO

("internal organization.") If the organization is a subsidiary, it must also have PartyRole of

ORGANIZATION_UNIT. Parent/subsidiary relationships must be defined in PartyRelationship,

with the parent's role being INTERNAL_ORGANIZATIO and subsidiary's role being

ORGANIZATION_UNIT.

The accounting preferences of an organization are defined in PartyAcctgPreference. Currently,

this entity defines the tax form of choice, Cost of Goods Sold (COGS) method, and base currency

of the organization. COGS method should be consistent with the inventory reservation method of

the product stores associated with this party. The initial settings can be defined in [Accounting] >

[Companies] >> [Admin] >>> [Preferences]. Note that once defined, they cannot be modified

there. The system does not support changing key accounting practices such as COGS method

or default currency right now. If youve made a mistake, use [Web Tools] > [Entity Data

Maintenance] to correct it.

All facilities of the organization which may hold inventory needs to have its ownerPartyId

("Owner") field set to the organization's partyId. This can be done in the Facility Manager when

editing a facility. Do not set this ownerPartyId to that of a non-accounting sub-party of the

organization, as we are not doing rollups right now.

Finally, the organization's year end, quarter end, month end dates should be defined with the

CustomTimePeriod entity. These can be created and loaded in an XML file or with Web Tools.

Note that CustomTimePeriods are defined as Dates without time values, so 2006-01-01 would be

2006-01-01 at midnight (00:00:00.) Therefore, time periods need to be defined as from, say,

2006-01-01 to 2007-01-01 rather than 2007-12-31 (or 12/31/2007 would be missed.)

Creating a Chart of Accounts

The second step in configuring the accounting application is to create a Chart of Accounts, which

is a list of General Ledger (GL) accounts that are used to track financial transactions for all

companies and subsidiaries. You can create a Chart of Accounts by populating the GlAccount

entities using an entity-engine-xml file similar to

applications/accounting/data/DemoGeneralChartofAccounts.xml.

Alternatively, you can use the web interface to manually enter your accounts through [Accounting]

> [Chart of Accounts] > [Navigate Accounts].

There are two fields on the GL account which are important: glAccountClassId and

glAccountTypeId. They are both used to classify the GL account. Currently, glAccountClassId

classifications are used for financial reporting purposes (balance sheet, income statement,

statement of cash flows), while glAccountTypeId is used for internal classifications and reports

such as AR/AP balances, inventory valuation, and aging.

Inventory variance GL accounts must be set up not as a NON-CASH EXPENSE but as a

INVENTORY_ADJUST gl account class. The reason is that for a statement of cash flow,

changes to inventory are considered non-cash and added back to operating cash flow. If the

offsetting account is also a non-cash account, it would cause double counting.

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

Associating GL accounts with an organization

The Chart of Accounts is a generic list of accounts which are available. To be "active" for a

particular organization, a GL account needs to be associated with an organization using the

GlAccountOrganization entity.

Setting up GL accounts for Invoicing

To post to the correct GL accounts, they must be associated with various transactions such as

invoices or payments. Configuring the default GL accounts is done in one of four ways:

1. In the InvoiceItemType, a GL account can be specified as the default GL account for this

invoice item type.

Note that the accounting for the sales tax invoice item (ITM_SALES_TAX) will probably not be

used, as the GL accounts for tax items will be in the TaxAuthorityGlAccount entity. It is nice to

set it up as a "failsafe" setting, though.

2. In InvoiceItemTypeGlAccount, you can override your preferences from above by setting a

different GL account for each invoice item type for a particular company.

3. In the GlAccountTypeDefault, a GL account can be specified for each type of transaction and

a particular company. For example, you can configure the default "Accounts Receivable" GL

account for "Company A" with this entity.

4. For products, you can specify the different types of GL account used for a particular product.

For example, you can specify the SALES, COGS, INVENTORY accounts for a particular

product.

Setting up GL accounts for payments

If the Payment is a DISBURSEMENT, transaction entry is a debit to the offsetting

(PaymentGlAccountTypeMap) GL account and a credit to the Payment GL account. If the

Payment is a RECEIPT, the transaction is a debit to the Payment's GL account and a credit to the

offsetting (PaymentGlAccountTypeMap) GL account.

GL accounts for payments are configured in the following ways and will be used in the following

sequence:

1. A glAcccountId for a particular PaymentMethod (such as particular credit card or checking

account.) Usually this is done for the company's internal credit cards, although it can be done

for customer cards as well.

2. If the Payment Method is a Credit Card, then use glAccountId in the CreditCardTypeGlAccount

entity, so you can define different receivables accounts for different credit cards.

3. A glAccountId in PaymentMethodTypeGlAccount, defining the glAccount for this generic

payment method type (CHECK, CREDIT CARD, etc.) for a company.

4. defaultGlAccountId in the PaymentMethodType.

Important

To handle incoming and outgoing payments correctly, make sure that the

company's internal payment methods (used for outgoing payments) have the

right GL accounts associated with them.

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

To configure the correct GL account for various payment types, create

PaymentGlAccountTypeMap values which map payment types to gl account types (and hence,

from above, to gl accounts.) You can create as many payment types and match them to as many

gl account types as you need.

Important

You can create a hierarchy of payment types as long as the ultimate parent of

your payment type is either a DISBURSEMENT or a RECEIPT.

Tip

Best practice for configuring payment GL accounts is:

For each internal payment method (ie, the Company's checking accounts

and credit cards), put a glAccountId in the PaymentMethod entity value.

For external payment methods (ie, customers' credit cards or checking

accounts), use PaymentMethodTypeGlAccount to put in a glAccountId for

each PaymentMethodType.

Avoid using the defaultGlAccountId for PaymentTypes, as these are

ambiguous. For example, the PaymentType of "CREDIT_CARD" is used

for credit cards of customers and employees, so it is not possible to set

the right GL account for all credit cards.

Tip

Here is an example for configuring GL accounts for vendor payments using a

company checking account:

Create a PaymentType of "Vendor Payment"

Create a PaymentTypeGlAccountMap of

paymentId="VENDOR_PAYMENT",

glAccountTypeId="ACCOUNTS_PAYABLE". This says that all vendor

payments will be set off against the "Accounts Payable" GL account.

Create a PaymentMethod of paymentMethodId="COCHECKING",

glAccountId = "111000" (ie, Cash in Checking Accounts) This says that

the "COCHECKING" payment method" will be booked against account

"111000".

Create a GlAccountTypeDefault which maps glAccountTypeId="Accounts

Payable" and glAccountId="210000" This says that the Accounts Payable

account will be "210000".

Special GL accounts for Purchasing

Two accounts need to be set up for purchasing and accounts payable invoicing:

UNINVOICED_SHIP_RCPT and PURCHASE_PRICE_VAR. UNINVOICED_SHIP_RCPT

is a temporary liability account used to record the value of inventory that has been

received, but whose corresponding vendor purchase (ie, accounts payable) invoice has

not arrived. Such inventory is valued at the original purchase order's price.

PURCHASE_PRICE_VAR is an expense account and is used to record the difference between

original purchase order prices and actual invoice prices. When purchase invoices are actually

posted to the general ledger, the system will go back and match the prices on the invoice with the

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

prices on the original purchase order. If actual purchase invoice prices were higher, the

differences will be expensed with this account.

For inventory variance, configure the GL account for expensing inventory at the product-specific

level (using ProductGlAccount), which can be done in the Catalog Manager's "GL account" tab for

a product. Or, use the VarianceReasonGlAccount entity to configure a default glAccountId for

your organization for each variance reason (found in VarianceReason entity.)

For customer credits to work correctly, be sure to configure the EXT_BILLACT payment method

type to the right G/L account (ie, ACCOUNTS RECEIVABLE) using the

PaymentMethodTypeGlAccount entity. This is because customer credits are all created as

payments to a billing account with paymentMethodTypeId of "EXT_BILLACT".

Special Accounts for Gift Certificates

Gift certificates are set up as a special payment method type of GIFT_CERTIFICATE and can be

either a GC_DEPOSIT or GC_WITHDRAWAL payment type. GC_DEPOSIT is a sub-type of

RECEIPT, and GC_WITHDRAWAL a sub-type of DISBURSEMENT. Both payment types are

configured to use a glAccountTypeId of CUSTOMER_GC_DEPOSIT, and the payment method of

GIFT_CERTIFICATE is configured to a GL account. By configuring CUSTOMER_GC_DEPOSIT

to a GL account such as Unredeemed Gift Certificates, the default GL account setting is causes

the following transactions to be posted:

Debit Accounts Receivables,

Credit Unredeemed Gift Certificates for Gift Certificate Deposits and

Debit Unredeemed Gift Certificates,

Credit Accounts Receivables for Gift Certificate Withdrawals

These postings are consistent with the rules for payment GL account settings above.

Taxes

Set up the GL account for tracking tax liabilities in the TaxAuthorityGlAccount entity. Tax liabilities

are tracked by tax authority party and geo id's. You can thus set up a different GL account for

each geo id covered by the same tax authority.

Initial Company Financials

To set up a company's initial financial information, follow the following steps:

Create a time period immediately preceding the current one. For example, if you're

implementing the GL system as of August 1, 2005, create a time period that ends August

1, 2005.

Then, create accounting transactions and entries in that time period which describe the

company's financial condition before it was transferred into opentaps/OFBiz. These can

be done as a series of transactions all as of the last second of the time period (ie, July 31,

2005 at 23:59:59). You can create one transaction for the entire balance sheet with

entries for every GL account, or a series of transactions.

If you are importing inventory values, create an accounting transaction entry for each

product in your inventory, with their productId and amount of inventory value for the

product. Also, create an InventoryItem record with their quantities and unit costs.

Next, if these transactions were created in a file, import them into OFBiz.

2006 Open Source Strategies, Inc. All Rights Reserved.

FINANCIALS: CONFIGURATION AND SET UP

Once the transactions are in the system, go to [Financials] > [Transactions] > [Post

Transaction]. You should see the transactions there and can post them one by one.

After posting the transactions, check that your trial balances and balance sheets are

corrected.

If everything is correct, close out this time period. Then the initial financial conditions can

no longer be changed, and you can start using your company with the opentaps

Financials.

Some Less Typical Transactions

If you need to enter transactions which are not currently supported directly, you can still do so

with [Financials] > [Transactions] > [Create Transactions] and then manually post them. Over

time, we will be adding support for more standard types of transactions. (Theyre also pretty easy

to write yourself.)

Look in data/DemoOrgBalanceSheet.xml for some sample examples of how accounting

transactions are created.

2006 Open Source Strategies, Inc. All Rights Reserved.

You might also like

- PNPCE Logical DatabaseDocument12 pagesPNPCE Logical DatabaseАндрей АпрельскийNo ratings yet

- How To SELECT in SAP BW Transformations PDFDocument11 pagesHow To SELECT in SAP BW Transformations PDFgeneNo ratings yet

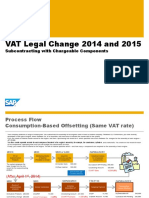

- VAT Legal Change 2014 and 2015: Subcontracting With Chargeable ComponentsDocument8 pagesVAT Legal Change 2014 and 2015: Subcontracting With Chargeable ComponentsTaro YamadaNo ratings yet

- Senior Business Analyst Job in MumbaiDocument1 pageSenior Business Analyst Job in MumbaiKetan VadorNo ratings yet

- SAP Hybris Q ADocument2 pagesSAP Hybris Q ADipankar BiswasNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- SAP NetWeaver Business Intelligence Integrated Planning PDFDocument60 pagesSAP NetWeaver Business Intelligence Integrated Planning PDFdatta77No ratings yet

- R/3 IDoc Interface OverviewDocument61 pagesR/3 IDoc Interface OverviewkoyalpNo ratings yet

- GSW 5.1 VDA Users GuideDocument122 pagesGSW 5.1 VDA Users GuideUnique HullettNo ratings yet

- CompuStat Technical Guide (Tape, 2000)Document180 pagesCompuStat Technical Guide (Tape, 2000)carmo-netoNo ratings yet

- Central Authentication Service CAS Complete Self-Assessment GuideFrom EverandCentral Authentication Service CAS Complete Self-Assessment GuideNo ratings yet

- Software Requirements SpecificationDocument7 pagesSoftware Requirements SpecificationrdkutaaNo ratings yet

- Cash Desk SAP PDFDocument15 pagesCash Desk SAP PDFsandeep swamyNo ratings yet

- SAP User Types GuideDocument102 pagesSAP User Types GuideViSpNo ratings yet

- SAP Performance Analysis - ACDocument99 pagesSAP Performance Analysis - ACRamesh Harshan0% (1)

- IBM Review of Simple Finance 3.0 Process: Accounts ReceivableDocument9 pagesIBM Review of Simple Finance 3.0 Process: Accounts ReceivableMOORTHYNo ratings yet

- SAP EHP Tech - Business Functions With Specific Enterprise ServicesDocument3 pagesSAP EHP Tech - Business Functions With Specific Enterprise ServicesUgur UyganNo ratings yet

- Restaurant Manager Back Office Manual v1.01Document15 pagesRestaurant Manager Back Office Manual v1.01abigail_tito123No ratings yet

- Reduce Your Company's Spending With Automatic Clearing of Vendor Down PaymentsDocument16 pagesReduce Your Company's Spending With Automatic Clearing of Vendor Down PaymentsSarfraz MohammedNo ratings yet

- Ofbiz DebuggingDocument4 pagesOfbiz DebuggingKui MangusNo ratings yet

- Mexico ISR Federal Income TaxDocument34 pagesMexico ISR Federal Income TaxyurijapNo ratings yet

- SAP Invoice ManagementDocument3 pagesSAP Invoice ManagementvarunrideNo ratings yet

- What Are Business Transaction EventsDocument20 pagesWhat Are Business Transaction EventsSaket ShahiNo ratings yet

- Oracle Smart View For Office 10 Tips & Tricks You Must Know Key Performance Ideas, IncDocument6 pagesOracle Smart View For Office 10 Tips & Tricks You Must Know Key Performance Ideas, IncRama RaoNo ratings yet

- What Is SAP Reconciliation Account - ERProofDocument10 pagesWhat Is SAP Reconciliation Account - ERProofShailesh SuranaNo ratings yet

- Toaz - Info Refx Configuration Document PRDocument110 pagesToaz - Info Refx Configuration Document PRnew gstNo ratings yet

- OpenText VIM Basic ConfigurationDocument7 pagesOpenText VIM Basic ConfigurationADRIANO MOURANo ratings yet

- F To H Transaction CodesDocument50 pagesF To H Transaction CodesVenkatNo ratings yet

- Automatic Payment Program - F110Document21 pagesAutomatic Payment Program - F110Bala RanganathNo ratings yet

- SAP APP TheoryDocument9 pagesSAP APP TheorypaiashokNo ratings yet

- Srs Template IeeeDocument13 pagesSrs Template IeeeRohan ShahNo ratings yet

- What's New in SAP Business One 8.81Document21 pagesWhat's New in SAP Business One 8.81Javed Ahmad QureshiNo ratings yet

- GSI Fusion GL - Budget Entry and Reporting - R11Document10 pagesGSI Fusion GL - Budget Entry and Reporting - R11rasiga6735No ratings yet

- F-13 Vendor Automatic Account ClearingDocument6 pagesF-13 Vendor Automatic Account ClearingDipak kumar PradhanNo ratings yet

- 01 Kuwait Private SectorDocument15 pages01 Kuwait Private SectorPavan DonepudiNo ratings yet

- Error Handling in Central FinanceDocument6 pagesError Handling in Central FinanceGK SKNo ratings yet

- Bonus Depreciation in 2010Document9 pagesBonus Depreciation in 2010Neelesh KumarNo ratings yet

- AMX BPM Overview Presentation From TibcoDocument56 pagesAMX BPM Overview Presentation From TibcoPoorna Cherukumalla100% (1)

- SAP ERP CONNECTING WebSphere Adapters and IIBDocument34 pagesSAP ERP CONNECTING WebSphere Adapters and IIBf5598No ratings yet

- Reimbursement Claim Process FlowDocument7 pagesReimbursement Claim Process FlowvijayjeoNo ratings yet

- FSG Report Builder GuideDocument29 pagesFSG Report Builder GuideahsanseebNo ratings yet

- Public Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionFrom EverandPublic Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionNo ratings yet

- Payments (Promise To Pay)Document19 pagesPayments (Promise To Pay)Srinu GourishettyNo ratings yet

- Vertex Indirect Tax Accelerator For SAP Activation Guide PDFDocument24 pagesVertex Indirect Tax Accelerator For SAP Activation Guide PDFOsvaldo FerreiraNo ratings yet

- Duplicate Invoice CheckDocument17 pagesDuplicate Invoice CheckrajankunalNo ratings yet

- Escort 9500ix Passport Owners ManualDocument18 pagesEscort 9500ix Passport Owners ManualQueremosabarrabás A BarrabásNo ratings yet

- Itab To ExcelDocument1 pageItab To Excelzidan650No ratings yet

- EC Payroll Slides DetailedDocument56 pagesEC Payroll Slides DetailedAjayNo ratings yet

- Erp2005 Ehp 07 en 43Document130 pagesErp2005 Ehp 07 en 43sky025263No ratings yet

- Sap ClientDocument66 pagesSap ClientRajkumarNo ratings yet

- SAPFiori Travel MTEDocument16 pagesSAPFiori Travel MTETRbLack100% (1)

- 13 Leave PassageDocument14 pages13 Leave PassageRamy Mahmoud100% (1)

- Moeller CatalogDocument659 pagesMoeller CatalogGregg JamesNo ratings yet

- Ofbiz BirtDocument12 pagesOfbiz BirtKui MangusNo ratings yet

- Applications OverviewDocument8 pagesApplications OverviewKui MangusNo ratings yet

- NameDocument1 pageNameAamir Shahzad AfridiNo ratings yet

- Payments Screens: This Document Describes How The Payments Screens in The Financials Application WorkDocument3 pagesPayments Screens: This Document Describes How The Payments Screens in The Financials Application WorkKui MangusNo ratings yet

- Dump BdinDocument1 pageDump BdinKui MangusNo ratings yet

- Plant Guilds Ebooklet - Midwest PermacultureDocument36 pagesPlant Guilds Ebooklet - Midwest PermaculturePaul Ghinga100% (2)

- BSC MakesDocument1 pageBSC MakesKui MangusNo ratings yet

- Pos ManualDocument3 pagesPos ManualKui MangusNo ratings yet

- Work Effort - GeneralDocument3 pagesWork Effort - GeneralKui MangusNo ratings yet

- Webtools Special FeaturesDocument2 pagesWebtools Special FeaturesKui MangusNo ratings yet

- Inventory ValuationDocument7 pagesInventory ValuationKui MangusNo ratings yet

- Manufacturing AccountingDocument9 pagesManufacturing AccountingKui MangusNo ratings yet

- AR AP ReportsDocument4 pagesAR AP ReportsKui MangusNo ratings yet

- General User DocumentationDocument9 pagesGeneral User DocumentationKui MangusNo ratings yet

- Pick ListsDocument5 pagesPick ListsKui MangusNo ratings yet

- Inventory ValuationDocument7 pagesInventory ValuationKui MangusNo ratings yet

- Pick ListsDocument5 pagesPick ListsKui MangusNo ratings yet

- Managing InventoryDocument4 pagesManaging InventoryKui MangusNo ratings yet

- CRM/SFA Developers' Overview: Change LogDocument3 pagesCRM/SFA Developers' Overview: Change LogKui MangusNo ratings yet

- Security DocumentationDocument3 pagesSecurity DocumentationKui MangusNo ratings yet

- Ofbiz NutshellDocument35 pagesOfbiz NutshellShatanand PanditNo ratings yet

- CRM/SFA Developers' Overview: Change LogDocument3 pagesCRM/SFA Developers' Overview: Change LogKui MangusNo ratings yet

- Data ImportDocument4 pagesData ImportKui MangusNo ratings yet

- Ofbiz Menu Widget CookbookDocument1 pageOfbiz Menu Widget CookbookKui MangusNo ratings yet

- Main DocumentationDocument11 pagesMain DocumentationKui MangusNo ratings yet

- Ofbiz Menu Widget CookbookDocument1 pageOfbiz Menu Widget CookbookKui MangusNo ratings yet

- Ofbiz Bigdecimal CookbookDocument6 pagesOfbiz Bigdecimal CookbookKui MangusNo ratings yet

- New Government Accounting SystemDocument3 pagesNew Government Accounting SystemShaira BugayongNo ratings yet

- India's Leading Infrastructure Services CompanyDocument25 pagesIndia's Leading Infrastructure Services CompanyArdhendu ShekharNo ratings yet

- Economics 102 Orange Grove CaseDocument21 pagesEconomics 102 Orange Grove CaseairtonfelixNo ratings yet

- Unit - 1 - Advertising Sybms - IIIDocument69 pagesUnit - 1 - Advertising Sybms - IIIMilan JainNo ratings yet

- PNJ Jewery: PNJ Silver's NecklaceDocument10 pagesPNJ Jewery: PNJ Silver's Necklaceminh anhNo ratings yet

- Riding The VUCA Wave (Indian Management, Nov 2017)Document5 pagesRiding The VUCA Wave (Indian Management, Nov 2017)Suhayl AbidiNo ratings yet

- FILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.Document2 pagesFILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.zacNo ratings yet

- Othm L7Document50 pagesOthm L7Ishan IsmethNo ratings yet

- Affordable Lawn Care Financial StatementsDocument8 pagesAffordable Lawn Care Financial StatementsTabish TabishNo ratings yet

- Citrix Service Provider Program Guide: WelcomeDocument31 pagesCitrix Service Provider Program Guide: WelcomeVikasNo ratings yet

- No. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountDocument3 pagesNo. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountMond NaNo ratings yet

- RFQ Bus TerminalDocument84 pagesRFQ Bus TerminalsombansNo ratings yet

- 1223.9 F Benefit Payment Application ISS6 - 1021 - HRDocument4 pages1223.9 F Benefit Payment Application ISS6 - 1021 - HRCam Kemshal-BellNo ratings yet

- Amazon's Business Analysis, Amazon Go - Case Study, & Jeff Bezos's LeadershipDocument34 pagesAmazon's Business Analysis, Amazon Go - Case Study, & Jeff Bezos's LeadershipHamzat Abdul Azeez AdelekeNo ratings yet

- Ch2-Iso QMSDocument10 pagesCh2-Iso QMSSubramanian RamakrishnanNo ratings yet

- Group Presentation Guides: Real Company Analysis Improvement InitiativesDocument9 pagesGroup Presentation Guides: Real Company Analysis Improvement InitiativesVy LêNo ratings yet

- Ensuring Global Insurance Compliance with Local LawsDocument9 pagesEnsuring Global Insurance Compliance with Local LawsDjordje NedeljkovicNo ratings yet

- Innovation: 2 0 1 5 - 1 6 AnnualDocument136 pagesInnovation: 2 0 1 5 - 1 6 AnnualAnimesh ChoubeyNo ratings yet

- Questionnaire For Client AcquisitionDocument4 pagesQuestionnaire For Client Acquisitionvikramnmba100% (1)

- Sports TourismDocument14 pagesSports TourismJaipurnetNo ratings yet

- Sana HNMDocument12 pagesSana HNMSana MirNo ratings yet

- LogisticsDocument394 pagesLogisticsRbkNo ratings yet

- E-Commerce Survey of Kalyan, Ulhasnagar, Ambernath & BadlapurDocument16 pagesE-Commerce Survey of Kalyan, Ulhasnagar, Ambernath & BadlapurSupriya RamNo ratings yet

- KPJ Annual Report (Pp. 44 To Form), 2008Document114 pagesKPJ Annual Report (Pp. 44 To Form), 2008h3gd7h2tNo ratings yet

- Kool King DivisionDocument6 pagesKool King DivisionAkhil GoyalNo ratings yet

- CaseDocument2 pagesCaseAman Dheer KapoorNo ratings yet

- Bimodal ITDocument3 pagesBimodal ITandreasang89No ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Capital Gains Tax Calculation GuideDocument9 pagesCapital Gains Tax Calculation GuideAffan AliNo ratings yet

- Attachment 1Document7 pagesAttachment 1Taqi TazwarNo ratings yet