Professional Documents

Culture Documents

Cheat Sheet - Accounting

Uploaded by

Jeffery KaoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheat Sheet - Accounting

Uploaded by

Jeffery KaoCopyright:

Available Formats

1.

Money measurement - a

record is made only of

information that can be

expressed in monetary terms

2. entity - is any organization

or activity for which accounting

reports are prepared

3. going concern - an entity

will continue to operate for an

indefinitely long period in the

future (liquidity)

4. cost - record items at cost

value rather than fair value

5. dual aspect - Assets =

Liabilities + Owners equities

6. accounting period accounting measures activities

for a specified interval of time

7. conservatism - Revenues

are recognized only when they

are reasonable certain,

whereas expenses are

recognized as soon as they are

reasonably possible

8. realization - the amount

recognized as revenue is the

amount that customers are

reasonably certain to pay

9. matching - when a given

event affects both revenue and

expenses, the effect on each

should be recognized in the

same period: (1) costs

associated with activities of the

period are expenses of the

period and (2) costs that

cannot be associated with

revenues of the future are

expenses of the current period.

10. consistency - Use the

same method, unless there is a

sound reason to change

11. materiality - Insignificant

events may be disregarded,

but there must be full

disclosure of all important

information

--------------------------------Cash flow indirect meth

Net income

(+)Depreciation expense

()Accounts receivable

()Inventories

()Prepaid expense

(+)Accounts payable

(+)Unearned revenue

()Gain on disposal of plant,

property and equipment

(+)Loss on disposal of plant,

property and equipment

Operating cash

----------------------------------Cash Receipts from

Customers =

+Net Sales+ Beginning

Accounts ReceivableEnding

Accounts Receivable

Cash Payments to Suppliers

=

+Purchases+ Ending

InventoryBeginning

Inventory+ Beginning Accounts

PayableEnding Accounts

Payable

Cash Payments to

Employees =

+Beginning Salaries

PayableEnding Salaries

Payable+ Salaries Expense

Cash Payments for

Purchase of Prepaid Assets

=

+Ending Prepaid Rent, Prepaid

Insurance etc.+ Expired Rent,

Expired Insurance etc.

Beginning Prepaid Rent,

Prepaid Insurance etc.

Interest Payments =

+Beginning Interest

PayableEnding Interest

Payable+ Interest Expense

Income Tax Payments =

+Beginning Income Tax

PayableEnding Income Tax

Payable+Income Tax Expense

-----------------------------------Future

rev

Match

with

rev

Acc Meth

Land

Prob

No

Plant/eq

u

Patent

Prob

Prob

Depe

nds

Yes

Renewa

l license

Prob

No

R&D

Mainten

ance

New

Aqu/Bet

terment

Goodwil

l

Not Prob

Not Prob

No

No

Cap+not

amort

Cap +

dep

Cap +

amort

Cap +

not

Amort

Exp

Exp

Prob

Yes

Cap +

dep

Prob

No

Cap +

Amort +

Impair

test

----------------------------------------Depreciation methods systematic & rational

Straight line - (book value salvage value) / service life

Accelerated method

Double declining method =

straight line * 2 (no

salvage value deduction)

Years digits method

Units of production method =

(units produced / capacity in

units) * Book value

-------------------------------------------Inventory costing methods

Specific identification

Average cost

FIFO

LIFO

LIFO reserve

LIFO reserve = FIFO inv end LIFO inv end

Delta LIFO reserve = LIFO

reserve end - LIFO reserve beg

Delta LIFO reserve = FIFO

gross margin - LIFO gross

margin

-------------------------------------------Acct quality determined by:

relevance, objectivity,

feasibility

---------------------------------------Accounting boards

Jap GAAP - Acct Standards

board of Jap

US GAAP - Fin Acct Standards

board

IFRS - Int Acct Standards board

---------------------------------------Liquidity ratios

WC = Current assets - current

liabilities

Current ratio = current

assets / current liabilities

desirable

>2

Times Int earned = Pretax op

profit +interest / Interest

Acid test = monetary current

assets / current liabilities

---------------------------------------------Acquisition purchase

method

Days cash = (cash / cash

expense) * 365 - Period cash

would pay cash expenses

1.

Days receivable =

(Receivables / Sales) X 365

Inventory turnover = COGS /

Inventory

Days Inventory = (COGS /

inventory) * 365

Days payable = (op payables /

pretax cash exp ) * 365

-------------------------------------------Profitability ratios

Gross Margin = Gross

Profit/Sales

Operating Margin =

EBIT/Sales

Net Margin = Net

Income/Sales

-------------------------------------------Overall performance

measures

Return on Assets (ROA) =

(NI +(1-Tax Rate)*Interest

Expense)/Average Total Assets

Return on Beginning Equity

(ROBE) = Net

Income/Beginning Equity

Return on Equity = NI/

Average Equity

Return on Invested Capital

(ROIC) = (NI+(1-Tax

Rate)*Interest Expense)/

( Average Long term liabilities

+ Average Equity)

Pretax Return on Invested

Capital = EBIT/Interestbearing Debt + Equity

Return on Investment = NI /

Investment

Return on Equity = Pretax

margin % * Asset turnover

ratio * Financial leverage

ratio * Tax retention rate

NI/equity = (Pretax

profit/rev)*(rev/Assets)*(Assets

/Equity)*(1-tax %)

---------------------------------------------Test investment Utilization

Asset turnover = rev/assets

Inv cap turnover = rev/IC

Equity turnover = rev/equity

---------------------------------------------Test Financial condition

Financial leverage = Assets /

equity

Revalue acquirees

tangible assets and

applicable intangible

assets (e.g, patents,

licenses) to fair value.

Intangible assets need to

be a) Entitled, 2)

Seperable 3) Salable.

2.

Revalue acquirees

liabilities assumed by the

acquirer to fair value.

Report asset goodwill for the

excess of purchase price over

the revaluated net assets (i.e.,

total assets total liabilities)

---------------------------------------------Consolidation of financial

statements

1.

Eliminate inter-company

transactions.

a.

Accounts

receivable and

accounts payable

b.

Revenue and

costs of sales

c.

Dividend and

dividend revenue

2.

Report minority interest

above owners equity on

balance sheet, and above

income on income

statement.

---------------------------------------------Pooling method

Under pooling treatment the

balance sheets of A and B

would simply be added

together to arrive at the new

consolidated balance sheet for

A, which is the surviving entity.

------------------------------------------Further definitions

Journal

Chronological record of

accounting transactions Diary

of accounting

Must maintain double-entry

system

Adjusting entry

Journal entry for accounting

transaction without

accompanying clear transfer of

goods (services) or money

Revenue recognition

Delivery (earned)

o

Substantially performed

task

o

Transfer risk and reward

Reliable measurement

Realization

o

Readily convertable to

cash

Adjust revenue to

realizable amount

discount

bad debt

returns

Allowance for bad debt

methods

% of sales = % * acc rec

= % *gross rev

Aging schedule

------------------------------------------Inventory calculation

Periodic method

Inv beg + purchase ending

balance = COGS

Perpetual method

Inv beg + purchase COGS =

ending balance

-------------------------------------

Why is conservatism

important in accounting?

- Accounting requires certain

estimates and judgments.

Conservatism improves the

process of estimation by

allowing accountants to assign

values to certain transactions.

- Conservatism makes

accounting numbers credible.

- Lenders bear the downside

risk without upside potential;

therefore, lenders would like to

get the bad news more timely.

Conservatism allows for this.

- Conservatism improves

investor believability of public

companies financial

statements.

------------------------------------------

statements and forward

estimates.

- Important for the auditors

that review the financial

statements.

- Establishes the internal

control system through which

transactions are properly

authorized, reported, and

recorded

Why is objectivity

important in accounting?

- Information produced by

managers alone is not

believable. Outside investors

demand independently audited

financial information.

- Allows investors to better

trust the information contained

in the financial statements.

- Allows for consistency in

financial information among

the different firms. Analysts

and investors can then

compare various companies on

the basis of their financial

Ownership

<20%

Influence

not signif

Fair value

Not determinable

Acc Method

Cost meth

(available for sale)

Fair value (available

for sale)

<20%

not signif

Determinable

20-50%

20-50%

not signif

Signific

Not determin

--

Cost/fair value

Equity (investment)

>50%

Control

--

Consolidate

(acquisition

purchase method)

----------------------------------------

Revaluation

N/A

Div

As rev

Applicable (debit

available for sale,

credit unrealized

gain)

As rev

Investee income

reported as rev

(credit), Debit invest

on BSN

Consolidated

statement +

goodwill impairment

Decreases (credit)

investment

N/A

You might also like

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetHectorNo ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Target Costing & Variance AnalysisDocument1 pageTarget Costing & Variance AnalysispinkrocketNo ratings yet

- Class of AccountsDocument5 pagesClass of AccountssalynnaNo ratings yet

- Accounting Cheat Sheet FinalsDocument5 pagesAccounting Cheat Sheet FinalsRahel CharikarNo ratings yet

- Business ValuationDocument52 pagesBusiness ValuationAnand SubramanianNo ratings yet

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- Cheat Sheet For Financial AccountingDocument1 pageCheat Sheet For Financial Accountingmikewu101No ratings yet

- Midterm Cheat SheetDocument3 pagesMidterm Cheat SheetHiếuNo ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (5)

- Keyboard Shortcuts in TallyPrime - 1Document15 pagesKeyboard Shortcuts in TallyPrime - 1perfect printNo ratings yet

- Intl Finance Cheat SheetDocument6 pagesIntl Finance Cheat Sheetpradhan.neeladriNo ratings yet

- ACCT 101 Cheat SheetDocument1 pageACCT 101 Cheat SheetAndrea NingNo ratings yet

- Basic Financial Accounting Notes Very Helpfull Must SeeDocument5 pagesBasic Financial Accounting Notes Very Helpfull Must SeeBabar AbbasNo ratings yet

- Accounting Fact SheetDocument1 pageAccounting Fact SheetSergio OlarteNo ratings yet

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- Inbm 110 - Accounts Study Sheet: Chapter 1 & 2Document5 pagesInbm 110 - Accounts Study Sheet: Chapter 1 & 2Laura TaiNo ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheetdiscreetmike50No ratings yet

- Cheat Sheet For AccountingDocument4 pagesCheat Sheet For AccountingshihuiNo ratings yet

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- Financial AccountingDocument944 pagesFinancial Accountingsivachandirang695491% (22)

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- BVA CheatsheetDocument3 pagesBVA CheatsheetMina ChangNo ratings yet

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Final Paper18 RevisedDocument922 pagesFinal Paper18 RevisedSukumar100% (2)

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- Acct Cheat SheetDocument3 pagesAcct Cheat SheetAllen LiouNo ratings yet

- Fin Cheat SheetDocument3 pagesFin Cheat SheetChristina RomanoNo ratings yet

- Tally - Erp9 Module 1Document27 pagesTally - Erp9 Module 1Sumit JoshiNo ratings yet

- Financial Ratios - Formula SheetDocument4 pagesFinancial Ratios - Formula SheetDuke EphraimNo ratings yet

- Dividend Discount and Residual Income Models ExplainedDocument2 pagesDividend Discount and Residual Income Models ExplainedMohammad DaulehNo ratings yet

- Business CalculusDocument88 pagesBusiness CalculusAvreile100% (1)

- The Statement of Cash Flow - Cheat SheetDocument3 pagesThe Statement of Cash Flow - Cheat SheetSayorn Monanusa Chin100% (1)

- "Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadDocument17 pages"Trial Balance ": by Srinivas Methuku Asst. Professor, SLS HyderabadMuthu KonarNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Accounting DefinitionsDocument5 pagesAccounting DefinitionsAli GoharNo ratings yet

- CFO April May 2020 PDFDocument52 pagesCFO April May 2020 PDFDaniel EstebanNo ratings yet

- 8th and Walton Retail Math Cheat SheetDocument1 page8th and Walton Retail Math Cheat SheetSurabhi RajeyNo ratings yet

- Comparable Company Analysis GuideDocument11 pagesComparable Company Analysis GuideRamesh Chandra DasNo ratings yet

- Cheat SheetDocument3 pagesCheat SheetjakeNo ratings yet

- Basics Accounting PrinciplesDocument22 pagesBasics Accounting PrincipleshsaherwanNo ratings yet

- ACC 201 Accounting Cycle WorkbookDocument70 pagesACC 201 Accounting Cycle Workbookarnuako25% (20)

- The Ultimate Financial Management Cheat SheetDocument3 pagesThe Ultimate Financial Management Cheat SheethazimNo ratings yet

- Chapter 1 - Introduction To Accounting: Concepts and PrinciplesDocument25 pagesChapter 1 - Introduction To Accounting: Concepts and Principlesd_hambrettNo ratings yet

- Ch-04 - Understanding Income StatementDocument27 pagesCh-04 - Understanding Income StatementSadia RahmanNo ratings yet

- Measuring Financial Performance with Income StatementsDocument4 pagesMeasuring Financial Performance with Income StatementsbullshittttNo ratings yet

- Amodia - Notes (SIM 3)Document2 pagesAmodia - Notes (SIM 3)CLUVER AEDRIAN AMODIANo ratings yet

- Introduction To Cash Flow Analysis and Real Estate InvestingDocument26 pagesIntroduction To Cash Flow Analysis and Real Estate InvestingHorace BatisteNo ratings yet

- Chapter 2 (Accounting Income Ans Assets - The Accrual Concept)Document32 pagesChapter 2 (Accounting Income Ans Assets - The Accrual Concept)Tonoy Roy67% (3)

- PFS StudyDocument19 pagesPFS Studyigorwalczak321No ratings yet

- Day 4 Income Statement and Statement of Cash FlowDocument31 pagesDay 4 Income Statement and Statement of Cash FlowSue-Allen Mardenborough100% (1)

- Corp Financial ReportingDocument7 pagesCorp Financial ReportingJustin L De ArmondNo ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- Lesson 7 - Financial ForecastingDocument24 pagesLesson 7 - Financial Forecastingkylasaragosa04No ratings yet

- Review sessionDocument25 pagesReview sessionK60 Bùi Phương AnhNo ratings yet

- Cash Receipts and PaymentsDocument5 pagesCash Receipts and Paymentsmh bachooNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- CotterDocument4 pagesCotterJeffery KaoNo ratings yet

- Personal Code of Ethics SyllabusDocument2 pagesPersonal Code of Ethics SyllabusJeffery KaoNo ratings yet

- KW Report Instructions 2015v2Document3 pagesKW Report Instructions 2015v2Jeffery KaoNo ratings yet

- Flow Diagram: SHOULDICE HOSPITAL - Simplified ProcessDocument1 pageFlow Diagram: SHOULDICE HOSPITAL - Simplified ProcessJeffery KaoNo ratings yet

- Questionnaire For Marketing Research & Analysis Final Term-JeffDocument11 pagesQuestionnaire For Marketing Research & Analysis Final Term-JeffJeffery KaoNo ratings yet

- Final PresentationDocument23 pagesFinal PresentationJeffery KaoNo ratings yet

- Lehigh SteelDocument6 pagesLehigh SteelJeffery KaoNo ratings yet

- Janime Segments BiplotDocument1 pageJanime Segments BiplotJeffery KaoNo ratings yet

- Eskimo WorkbookDocument2 pagesEskimo WorkbookJeffery KaoNo ratings yet

- Rosetta StoneDocument2 pagesRosetta StoneJeffery KaoNo ratings yet

- Team 7 Agreement on Support, Respect, Accountability & CollaborationDocument1 pageTeam 7 Agreement on Support, Respect, Accountability & CollaborationJeffery KaoNo ratings yet

- Rosetta StoneDocument2 pagesRosetta StoneJeffery KaoNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- HRM Final Cheat Sheet (All)Document3 pagesHRM Final Cheat Sheet (All)Jeffery KaoNo ratings yet

- EvaluationDocument18 pagesEvaluationJeffery KaoNo ratings yet

- Memory AssignmentDocument1 pageMemory AssignmentJeffery KaoNo ratings yet

- CORP Cheat SheetDocument2 pagesCORP Cheat SheetJeffery KaoNo ratings yet

- Jeffery Kao - ICS Resume-RevisedDocument1 pageJeffery Kao - ICS Resume-RevisedJeffery KaoNo ratings yet

- Rock ShoesDocument22 pagesRock ShoesJeffery KaoNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- MBAA 602 Financial & Managerial Accounting OverviewDocument4 pagesMBAA 602 Financial & Managerial Accounting OverviewuglaysianNo ratings yet

- Corporate Finance II: Professor Tomonori ItoDocument1 pageCorporate Finance II: Professor Tomonori ItoJeffery KaoNo ratings yet

- Idterm Ourse Valuation: More Case DiscussionDocument1 pageIdterm Ourse Valuation: More Case DiscussionJeffery KaoNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Home Price per Square Foot AnalysisDocument7 pagesHome Price per Square Foot AnalysisJeffery KaoNo ratings yet

- Lipman Bottle JeffDocument3 pagesLipman Bottle JeffJeffery KaoNo ratings yet

- CORP Cheat SheetDocument2 pagesCORP Cheat SheetJeffery KaoNo ratings yet

- National Occupational Safety and Health Profile of OmanDocument105 pagesNational Occupational Safety and Health Profile of OmanKhizer ArifNo ratings yet

- The Effect of Management TrainingDocument30 pagesThe Effect of Management TrainingPulak09100% (1)

- 05 - GI-23.010-2 - QualityDocument18 pages05 - GI-23.010-2 - QualityHernanNo ratings yet

- Insurance Law Review 2015Document43 pagesInsurance Law Review 2015peanut47No ratings yet

- Application Form Application Form: Bologna Bologna November NovemberDocument4 pagesApplication Form Application Form: Bologna Bologna November NovemberKiran MalviyaNo ratings yet

- Operational Effectiveness + StrategyDocument7 pagesOperational Effectiveness + StrategyPaulo GarcezNo ratings yet

- 11th Commerce 3 Marks Study Material English MediumDocument21 pages11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNo ratings yet

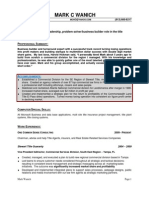

- Senior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichDocument2 pagesSenior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichMarkWanichNo ratings yet

- SupermarketsDocument20 pagesSupermarketsVikram Sean RoseNo ratings yet

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- Skill Developmetn Instituter Project RepotDocument7 pagesSkill Developmetn Instituter Project RepotPriyotosh DasNo ratings yet

- Saron Asfaw Resume2017-2Document2 pagesSaron Asfaw Resume2017-2api-354537429No ratings yet

- Chapter 5 Solutions Chap 5 SolutionDocument9 pagesChapter 5 Solutions Chap 5 Solutiontuanminh2048No ratings yet

- Group 6 - Persimmon Analysis & ValuationDocument66 pagesGroup 6 - Persimmon Analysis & ValuationHaMy TranNo ratings yet

- 2018 Lantern Press CatalogDocument56 pages2018 Lantern Press Catalogapi-228782900No ratings yet

- Describe The Forms of Agency CompensationDocument2 pagesDescribe The Forms of Agency CompensationFizza HassanNo ratings yet

- AEXQ1283 AcrossTheTableDocument112 pagesAEXQ1283 AcrossTheTableRoque Bueno ArchboldNo ratings yet

- E StatementDocument3 pagesE StatementBkho HashmiNo ratings yet

- Introduction To "Services Export From India Scheme" (SEIS)Document6 pagesIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- 2017 Virtus Interpress Book Corporate GovernanceDocument312 pages2017 Virtus Interpress Book Corporate GovernanceMohammad Arfandi AdnanNo ratings yet

- Test Bank For Financial Accounting 47 - 68Document4 pagesTest Bank For Financial Accounting 47 - 68John_Dunkin300No ratings yet

- 'Air Astana ' Airline Industry OrganisationDocument5 pages'Air Astana ' Airline Industry OrganisationФариза ЛекероваNo ratings yet

- Psa 210Document3 pagesPsa 210Medina PangilinanNo ratings yet

- 2nd September General StrikeDocument15 pages2nd September General StrikeasokababuNo ratings yet

- Archon Umipig Resume 2018 CVDocument7 pagesArchon Umipig Resume 2018 CVMaria Archon Dela Cruz UmipigNo ratings yet

- LpoDocument4 pagesLpoNoushad N HamsaNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Fin Model Class2 Excel NPV Irr, Mirr SlidesDocument5 pagesFin Model Class2 Excel NPV Irr, Mirr SlidesGel viraNo ratings yet

- BA2 PT Unit Test - 01 QuestionsDocument2 pagesBA2 PT Unit Test - 01 QuestionsSanjeev JayaratnaNo ratings yet

- GR 177592 Alilin v. Petron, 2014Document2 pagesGR 177592 Alilin v. Petron, 2014Ellis LagascaNo ratings yet