Professional Documents

Culture Documents

Rural Area Development and Society Performance Improvement in Ghana

Uploaded by

Journal of TelecommunicationsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rural Area Development and Society Performance Improvement in Ghana

Uploaded by

Journal of TelecommunicationsCopyright:

Available Formats

15

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

Rural Area Development and Society

Performance Improvement in Ghana

Sudhakar Murugesan, Nivash Thirunavukarasu and Nicholas Asabere

Abstract:

This study examined the performance and future improvements of Ghanaian society. Moores law,

Amdahls law and Regression analysis was the major tools used to analyze the data collected. The

development of computer information and communication technology has continually affected the creation

of new applications based on emergent technologies. The dark side of Moores law is our societys

insatiable need to constantly upgrade our computing devices. As per Moores law demonstrates the

potential benefits of reusing mobile phones by analyzing their design for accumulate energy. The main

aim of this research paper is to improve rural people life style in Ghana and Ghana economy. The first

wave of these efforts is commonly identified as Green computing where the emphasis has been

primarily minimizing power usage for datacenters and technical equipments. As part of ensuring

productivity in the both urban and especially the rural areas of Ghana we propose an Electronic pay- in

system (E-pay-in). where a customer of a bank just needs to reload a recharge card to our system and

the said amount shall be credited to his bank account of the respective bank of the customer.

Keywords: Moores Law, Green IT, Amdahls Law

Introduction:

Mainly

growth in telecom networks, while ensuring that

information

communications

the 2.5 percent of global emissions does not

technology (ICT) industry alone accounts for

significantly increase over the coming years.

about 2% or 860 million tones of the worlds

Many a time, people in the rural areas of Ghana

greenhouse

main

travel some distances to transact business with

contributing sectors within the ICT industry

their banks which affect production. On the

include the energy requirements of PCs and

other hand, some banks have choose to offer a

monitors (40%), data Centers about 23% and

door-tp-door services. Where sometimes bank

fixed and mobile telecommunications contribute

officers either defraud or run away with their

about 24% of the total emissions. Compared to

customers money. The E-pay-in system is a

the other sectors such as travel and transport,

system that interoperates with both banks and

construction and energy production, the ICT

telecommunication service providers.

sector

Scope:

is

gas

and

emissions.

relatively

The

energy-lean

with

telecommunications contributing just 0.7 percent

or about 230 million tones of green house gas

emissions. The challenge for the banking and

telecom service providers, telecom equipment

manufacturers and the government is to pursue

We would measures and will be undertaken to

reduce the banking and telecom sector footprint

under the following categories:

Adoption of energy efficient equipment

and innovative technologies

16

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

Infrastructure Sharing

A. Double Spending :

Use of Renewable sources of energy

Must allow spending of e-cash only once,

Better network planning: more outdoor BTS,

safeguards must be in place to prevent

less BTS.

counterfeiting.

B. Transferability

Existing system:

Currently the best way rural peoples enjoy

banking service conveniently is the door-to-door

services(SUSU) which has various demerits.

Now the real identity and the credibility of these

transactions are unsafe placing the customer at

vulnerability.

It should be independent and portable i.e. it

should be freely transferable between any two

parties regardless of network, software/hardware

or storage mechanism. And most importantly it

should be convenient.

C. Divisibility

With divisibility we mean the ability to make

Proposed Method:

With the E-pay-in system, the customer only

have to buy a recharge card and load it with

short code(eg: *133*card number#). When this

is done the equivalent amount will be credited to

the customers bank account at same time

customer also get a text message from the bank

confirming the transactions. This method is

made feasible by mapping the bank account to

the customers phone number.

MOBILE MICRO MONEY:

change. So micro money will come in rupees or

smaller denominations that can make highvolume, small-value transactions on the Mobile

phone practical. Mobile micro money will be

stored like fungible talktime, which is separate

from the air talk time, provided already by the

MNO. MNO would issue micro money to the

individual in exchange for cash deposit, which is

held in an account under the individuals name.

Individuals can spend the micro money for all

kinds of transactions, if they know the UID

number of other party with whom they are

Individuals will use micro money in place of

hard cash at all the access points to make

purchases, to transfer money etc, This would

mean replacing hard cash with micro money in

the hands of people. Therefore it is important

that micro money should satisfy some basic

properties of physical money to be robust and

fool proof. Some important characteristics of

micro money should be

transacting.

Transactions

like

buying

commodities, buying airtalktime, paying utility

bills, transferring money to other mobile micro

money accounts etc can be easily done.

Individuals can access their mobile micro money

accounts using a simple SMS based application

on their mobile phones.

17

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

Opening of Mobile Micro Money

Step 2:

Any individual interested in opening

Retailer/Correspondent sends the

information electronically to the MNO.

mobile micro money account has to approach

Step 3:

the retail shop, working on behalf of MNO or

customers details to UIDAI server through

the correspondent of MNO. The necessary

SWITCH.

documents to open mobile micro money account

Step 4:

should be similar and not as stringent as the

customer with the UIDAI Server.

current KYC norms of banks.

Step 5: Mobile micro money account is created

Architecture and Design of proposed system:

by MNO.

MNO sends request to verify the

MNO verifies the UID number of the

Step 6: MNO stores the mobile micro money

Customer

account details, customers mobile number and

UID number in the Account Mapper.

Step7

Step 1

Step 7: Both the customer as well as the

retailer/correspondent is intimated via message

Retailer/

on their mobiles.

Corresponde

nt

Stp:6 Stp:2

Cash Deposit for Mobile Micro Money :

Step: 5

Stp:3

MNO

UDI

Switch

Stp:5

Customer

Step:4

Stp:4

Step:1

Retailer/

Correspondent

Step:3

Account

Step:2

MNO

Mapping

mapping

Fig: 1Activate Mobile Micro Money account

Fig 2: Cash Deposit for Mobile Micro Money

Consider the case when retailer and customer

Step 1: Customer has to approach the nearest

belong to the same MNO. Following are the

retailer shop or the correspondent of MNO to

steps involved in the process of depositing cash.

enable the mobile micro money account.

Step 1. Retailer gets the information about UID

Customer gives his UID number, mobile number

number and the amount to be transferred from

and

customer.

other

KYC

details

retailer/Correspondent of MNO.

to

the

18

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

Step 2. Retailer sends the information to MNO

Step 4: An SMS is sent to both the beneficiary

through the SMS based application.

and the customer about the transaction status.

Step 3. MNO has the database of all the

Now consider the scenario when the beneficiary

individuals who have enabled mobile micro

and the customer belong to different MNOs.

money accounts under it, by using UID number,

Literature survey on Ghana population:

MNO gets the details of mobile micro money

account number of customer.

The final results of the 2010 Population and

Step 4. It then performs the appropriate action of

Housing Census (PHC) showed that the total

debiting retailers micro money account and

population of Ghana as at 26th September, 2010

crediting customers micro money account.

was 24,658,823. The results indicated that

Step 5. An SMS is send to both customer and

Ghanas population increased by 30.4 percent

over the 2000 population figure of 18,912,079.

retailer involved in the transaction.

Cash Transfers in Mobile micro Money

The recorded annual intercensal growth rate in

2010 was 2.5 percent as against 2.7 percent

Sender

Step:4

recorded in 2000.

The results revealed that there were 12,633,978

Step:1

females and 12,024,845 males. This implied that

MNO

Step:3

Step:2

Receiv

er

Fig 3: Transaction belong to the same MNO

Step 1: Customer enters the UID number of the

beneficiary and the amount to be transferred, in

the SMS based application (which is installed on

the mobile phone).

Since the beneficiary also belongs to the same

MNO, MNO gets the details of the beneficiary

like micro money account number directly, by

doing query on its own database using UID

number.

Step 2: MNO debits customers mobile micro

money account.

Step 3: MNO Credits beneficiary mobile micro

money account.

females

constituted

51.2

percent

of

the

population and males 48.8 percent, resulting in

sex ratio of 95 males to 100 females. It also

showed increase in population density from 79

people per square km in 2000 to 103 per square

km in 2010.

From the final results, Greater Accra (16.3%)

and Ashanti (19.4%) regions had the greater

share of the population while upper East (4.2%)

and Upper West (2.8%) regions had the smaller

share of the population. According to the

national population projection, the current

population of Ghana in 2014 is estimated to be

27,043,093 with 48.97% being representing

male population and 51.03 representing the

female population. The population growth rate is

fairly high in Ghana.

19

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

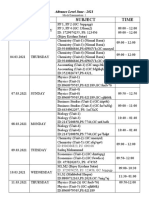

Year

2010

Male

12,024,845

Female

12,633,978

Total

24,658,823

leader

2011

12,319,770

12,915,498

25,235,268

market share.

2012

12,621,125

13,203,795

25,824,920

2013

12,928,916

13,498,844

26,427,760

2014

13,242,709

13,800,384

27,043,093

with

subscriber

base

of

11,615,801 representing 45.33% of total

Vodafone's subscriber base increased to

5,175,377 which represent 20.20 % of

total market share.

Tigo had a marginal subscriber base

decrease, closing at 3,673,934 which

represents 14.34 % of the market while

Airtel increased its subscriber base to

30000000

Year

25000000

20000000

3,132,615 representing 12.23% of the

total market share.

male

15000000

10000000

current subscriber base of 1,578,446

Female

5000000

GLO decreased its subscriber base; its

represents 6.16 % of the total market

0

1

2

3

4

5

6

share.

Total

PopulaMon

Expresso

though,

decreased

its

subscriber base to 168,572.The 168,572

Bank operators in Ghana:

represents 0.66 % of the total market

share

In Ghana we have different types of banks.

Conclusions:

27 first class banks. (Eg: Ghana

commercial Banks, GT bank, Hfc Bank,

Barclays Bank)

137 Rural banks. (Eg:Atwima Rural

Bank Ltd, Atiwa Rural Bank Ltd,

Bonzali Rural Bank Ltd)

Mobile Network operators in Ghana:

In terms of security, reliability and convenience

are the hall mark of E-pay-in system. E-pay-in

system promotes productivity and hence

improves the economy of Ghana as well as

creating employment. This will also help the

rural people get access to telecommunication

network(s) thereby improving their living

standard.

In

the

end

this

system

utilizestechnology to improve the banking

system in Ghana.

The Total Cellular/Mobile Voice Subscriber

Base in Ghana as at November, 2012 stood at

25,344,745.

MTN had a marginal increase and

maintained its position as the market

References:

1.

Graeme Philipson - founder of

Connection Research to discuss research

he had conducted for Fujitsu on the

present and future of Green IT.

JOURNAL OF TELECOMMUNICATIONS, VOLUME 28, ISSUE 2, DECEMBER 2014

2.

Zhiwei Xu Chinese Academy of

Sciencies, Beijing 0018-9162/12 @

2012 IEEE .

3.

Telecom

Ghana

4.

Bank branch rules by Bank of Ghana

5.

Goodfriend, M. & McCallum, B. T.

(2007), `Banking and interest rates in

monetary policy analysis: A quantitative

exploration', Journal of Monetary

Economics

54(5),

1480{1507.

Hamermesh, D. S. & Pfann, G. A.

(1996), `Adjustment costs in factor

demand',

Journal

of

Economic

Literature 34(3)

6.

Cathles LM, Brown L, Taam M and

Hunter A. (2012). A commentary on

The greenhouse gas footprint of natural

gas in shale formations by R.W.

Howarth, R. Santoro, and A. Ingraffea,

Climatic Change, doi:10.1007/ s10584011-0333-0.

7.

Selected Asian Economies: Real GDP,

Consumer Prices, Current Account

Balance, and Unemployment World

Economic Outlook (WEO) by IMF,

September 2011.

8.

Zhiwei Xu Chinese Academy of

Sciencies, Beijing 0018-9162/12 @

2012 IEEE .

Regulatory

Authority

Of

20

You might also like

- A Survey On 5G Multi-Carrier Waveforms - Evaluation and Comparison For Diversified Application Scenarios and Service TypesDocument11 pagesA Survey On 5G Multi-Carrier Waveforms - Evaluation and Comparison For Diversified Application Scenarios and Service TypesJournal of TelecommunicationsNo ratings yet

- System Model of TH-UWB Using LDPC Code ImplementationDocument7 pagesSystem Model of TH-UWB Using LDPC Code ImplementationJournal of TelecommunicationsNo ratings yet

- Blackhole Attack Effect Elimination in VANET Networks Using IDS-AODV, RAODV and AntNet AlgorithmDocument5 pagesBlackhole Attack Effect Elimination in VANET Networks Using IDS-AODV, RAODV and AntNet AlgorithmJournal of TelecommunicationsNo ratings yet

- Optimization of Smart Grid Communication Network in A Het-Net Environment Using A Cost FunctionDocument8 pagesOptimization of Smart Grid Communication Network in A Het-Net Environment Using A Cost FunctionJournal of TelecommunicationsNo ratings yet

- Patient Monitoring Using Bluetooth and Wireless LAN: A ReviewDocument6 pagesPatient Monitoring Using Bluetooth and Wireless LAN: A ReviewJournal of TelecommunicationsNo ratings yet

- Performance Enhancement of VANET Routing ProtocolsDocument6 pagesPerformance Enhancement of VANET Routing ProtocolsJournal of TelecommunicationsNo ratings yet

- DMVPN (Dynamic Multipoint VPN) : A Solution For Interconnection of Sites IPv6 Over An IPv4 Transport NetworkDocument6 pagesDMVPN (Dynamic Multipoint VPN) : A Solution For Interconnection of Sites IPv6 Over An IPv4 Transport NetworkJournal of TelecommunicationsNo ratings yet

- 4G or 3G, Does It Signify An Improvement in Telecommunication Technology in Cameroon?Document13 pages4G or 3G, Does It Signify An Improvement in Telecommunication Technology in Cameroon?Journal of Telecommunications100% (2)

- Reflectionless Filters With Arbitrary Transfer FunctionsDocument3 pagesReflectionless Filters With Arbitrary Transfer FunctionsJournal of Telecommunications100% (1)

- Controlled Sink Mobility For Efficient Design of A Wireless Sensor NetworkDocument4 pagesControlled Sink Mobility For Efficient Design of A Wireless Sensor NetworkJournal of TelecommunicationsNo ratings yet

- Optimal Pilot Matrix Design For Training - Based Channel Estimation in MIMO CommunicationsDocument7 pagesOptimal Pilot Matrix Design For Training - Based Channel Estimation in MIMO CommunicationsJournal of TelecommunicationsNo ratings yet

- Programming Considerations For The Design of Token Ludo Game Using Petri NetsDocument5 pagesProgramming Considerations For The Design of Token Ludo Game Using Petri NetsJournal of TelecommunicationsNo ratings yet

- Secured and Efficient Transmission of Wireless Information Depending On Frequency Hopping System With 63 ChannelsDocument4 pagesSecured and Efficient Transmission of Wireless Information Depending On Frequency Hopping System With 63 ChannelsJournal of TelecommunicationsNo ratings yet

- Implementation Scenarios For An Adaptable LTE Turbo Decoder Based On BLERDocument8 pagesImplementation Scenarios For An Adaptable LTE Turbo Decoder Based On BLERJournal of TelecommunicationsNo ratings yet

- Analysis of Spurious RF Signal Caused by Retardation in Optical Two-Tone Signal Generator Utilizing Polarisation ManipulationDocument4 pagesAnalysis of Spurious RF Signal Caused by Retardation in Optical Two-Tone Signal Generator Utilizing Polarisation ManipulationJournal of TelecommunicationsNo ratings yet

- Micro Controller Based Remote Sensing and Controlling Using Cellular NetworkDocument7 pagesMicro Controller Based Remote Sensing and Controlling Using Cellular NetworkJournal of TelecommunicationsNo ratings yet

- Development of A Sign Language Tutoring System For People With Hearing DisabilityDocument5 pagesDevelopment of A Sign Language Tutoring System For People With Hearing DisabilityJournal of TelecommunicationsNo ratings yet

- Applying Optimum Combining To A DS/CDMA Code Diversity SystemDocument7 pagesApplying Optimum Combining To A DS/CDMA Code Diversity SystemJournal of TelecommunicationsNo ratings yet

- Simulation of A Communication System Using Verilog LanguageDocument13 pagesSimulation of A Communication System Using Verilog LanguageJournal of TelecommunicationsNo ratings yet

- Optimization of Passive FTTH Network Design Using Vertical Micro DuctingDocument4 pagesOptimization of Passive FTTH Network Design Using Vertical Micro DuctingJournal of TelecommunicationsNo ratings yet

- QoT Aware Dynamic Routing and Wavelength Assignment Technique Using Fuzzy Logic Controller in WDM NetworksDocument10 pagesQoT Aware Dynamic Routing and Wavelength Assignment Technique Using Fuzzy Logic Controller in WDM NetworksJournal of TelecommunicationsNo ratings yet

- Study of UWB On-Body Radio Channel For Ectomorph, Mesomorph, and Endomorph Body TypesDocument5 pagesStudy of UWB On-Body Radio Channel For Ectomorph, Mesomorph, and Endomorph Body TypesJournal of TelecommunicationsNo ratings yet

- Automated Teaching Step-by-Step The Operations of TCP/IP Model (A-Step-TPC/IP)Document6 pagesAutomated Teaching Step-by-Step The Operations of TCP/IP Model (A-Step-TPC/IP)Journal of TelecommunicationsNo ratings yet

- Error Correction Scheme For Wireless Sensor NetworksDocument8 pagesError Correction Scheme For Wireless Sensor NetworksJournal of TelecommunicationsNo ratings yet

- SFN Monitoring For DVB-T/T2 NetworksDocument3 pagesSFN Monitoring For DVB-T/T2 NetworksJournal of Telecommunications100% (1)

- Improving The Performance of DWDM Free Space Optics System Under Worst Weather ConditionsDocument5 pagesImproving The Performance of DWDM Free Space Optics System Under Worst Weather ConditionsJournal of Telecommunications100% (2)

- Learning An Online Control Experiment Platform Using Labview SoftwareDocument6 pagesLearning An Online Control Experiment Platform Using Labview SoftwareJournal of TelecommunicationsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Curtis E50 Pump Parts ListDocument8 pagesCurtis E50 Pump Parts ListrobertNo ratings yet

- Ake Products 001 2016Document171 pagesAke Products 001 2016davidNo ratings yet

- MECHANICAL ENGINEERING DEPARTMENT - Copy (Repaired)Document10 pagesMECHANICAL ENGINEERING DEPARTMENT - Copy (Repaired)Wan Mohd AfnanNo ratings yet

- KTO12 Curriculum ExplainedDocument24 pagesKTO12 Curriculum ExplainedErnesto ViilavertNo ratings yet

- Channel Line Up 2018 Manual TVDocument1 pageChannel Line Up 2018 Manual TVVher Christopher DucayNo ratings yet

- Event Rulebook Authorsgate 3.0 IEEE SB KUETDocument9 pagesEvent Rulebook Authorsgate 3.0 IEEE SB KUETKUET²⁰²¹No ratings yet

- Service Manual 900 OG Factory 16V M85-M93Document572 pagesService Manual 900 OG Factory 16V M85-M93Sting Eyes100% (1)

- Document E202 - 2008: Building Information Modeling Protocol ExhibitDocument9 pagesDocument E202 - 2008: Building Information Modeling Protocol ExhibitAndres Cedeno TutivenNo ratings yet

- Tuomo Summanen Michael Pollitt: Case Study: British Telecom: Searching For A Winning StrategyDocument34 pagesTuomo Summanen Michael Pollitt: Case Study: British Telecom: Searching For A Winning StrategyRanganath ChowdaryNo ratings yet

- Standard OFR NATIONAL L13A BDREF Ed1.1 - 24 - JanvierDocument640 pagesStandard OFR NATIONAL L13A BDREF Ed1.1 - 24 - JanvierosmannaNo ratings yet

- Porter's Five Forces: Submitted by Subham Chakraborty PGDMDocument5 pagesPorter's Five Forces: Submitted by Subham Chakraborty PGDMSubham ChakrabortyNo ratings yet

- ZF 4hp14 - 2Document9 pagesZF 4hp14 - 2Miguel BentoNo ratings yet

- #1 Introduction To C LanguageDocument6 pages#1 Introduction To C LanguageAtul SharmaNo ratings yet

- Everything You Need to Know About TimberDocument63 pagesEverything You Need to Know About TimberAkxzNo ratings yet

- Adv - Student - HandbookDocument61 pagesAdv - Student - HandbookOmkar BezzankiNo ratings yet

- SNS Bank XS0382843802Document7 pagesSNS Bank XS0382843802Southey CapitalNo ratings yet

- 005-012 Fuel Injection Pumps, In-Line: InstallDocument14 pages005-012 Fuel Injection Pumps, In-Line: InstallMuhammad Ishfaq100% (3)

- Mock Examination Routine A 2021 NewDocument2 pagesMock Examination Routine A 2021 Newmufrad muhtasibNo ratings yet

- Wellmark Series 2600 PDFDocument6 pagesWellmark Series 2600 PDFHomar Hernández JuncoNo ratings yet

- Hypac C 766 C 778Document4 pagesHypac C 766 C 778Dave100% (1)

- Piccolo: Operating and Maintenance Instructions For The Deck OvenDocument44 pagesPiccolo: Operating and Maintenance Instructions For The Deck OvenAdam B100% (1)

- Learn About Steganography TechniquesDocument11 pagesLearn About Steganography TechniquesashaNo ratings yet

- Research 3Document30 pagesResearch 3Lorenzo Maxwell GarciaNo ratings yet

- Trade ReportDocument6 pagesTrade ReportIKEOKOLIE HOMEPCNo ratings yet

- OhmDocument15 pagesOhmRhonnel Manatad Alburo88% (17)

- Line BalancingDocument21 pagesLine Balancingarno6antonio6spinaNo ratings yet

- Map Book 4Document58 pagesMap Book 4executive engineerNo ratings yet

- Memory Slim CBLT PDFDocument4 pagesMemory Slim CBLT PDFMichell ben ManikNo ratings yet

- Dinosaur Bones - American Museum of Natural HistoryDocument7 pagesDinosaur Bones - American Museum of Natural HistoryNicholas FeatherstonNo ratings yet

- Energy Conservation Opportunities Sugar Industry IDocument8 pagesEnergy Conservation Opportunities Sugar Industry INikhil MohiteNo ratings yet