Professional Documents

Culture Documents

Module 01

Uploaded by

brojas35Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 01

Uploaded by

brojas35Copyright:

Available Formats

Module 01/Contents

7/28/04

3:07 PM

Page I

NATIONAL TREASURY

PPP MANUAL

MODULE 1: SOUTH AFRICAN REGULATIONS FOR PPPs

NATIONAL TREASURY PPP PRACTICE NOTE

NUMBER 02 OF 2004

In accordance with section 76(4)(g) of the Public Finance Management Act,

1999 (PFMA), National Treasury may issue instructions to institutions to

which the PFMA applies in order to facilitate the application of the PFMA

and the regulations promulgated under the PFMA.

This National Treasury PPP Practice Note Number 02 of 2004 South African

Regulations for PPPs applies to departments, constitutional institutions,

public entities listed or required to be listed in schedules 3A, 3B, 3C and 3D

to the PFMA and subsidiaries of such public entities.

Module 01/Contents

7/28/04

3:07 PM

Page II

PPP PROJECT CYCLE

Reflecting Treasury Regulation 16 to the

Public Finance Management Act, 1999

NATIONAL

TREASURY

Phase I

PPP Manual reference

Module 1

Module 2

INCEPTION

Register project with the relevant treasury

Appoint project officer

Appoint transaction advisor

Phase II

Prepare a feasibility study comprising:

Needs analysis

Options analysis

Project due diligence

Value assessment

Economic valuation

Procurement plan

Treasury Approval: I

Module 6

Module 1

Module 2

MODULE 4

Module 6

Module 7

Module 8

Module 9

PROCUREMENT

Design a fair, equitable, transparent, competitive,

cost-effective procurement process

Prepare bid documents, including draft PPP agreement

Treasury Approval: IIA

Phase III

PROJECT PREPARATION PERIOD

FEASIBILITY STUDY

MODULE 3

Pre-qualify parties

Issue request for proposals with draft PPP agreement

Receive bids

Compare bids with feasibility study and each other

Select preferred bidder

Prepare value-for-money report

Treasury Approval: IIB

Module 1

Module 2

Module 4

MODULE 5

Module 6

Module 7

Module 8

Module 9

Negotiate with preferred bidder

Finalise PPP agreement management plan

Treasury Approval: III

Phase IV

DEVELOPMENT

Phase V

DELIVERY

Phase VI

PROJECT TERM

PPP agreement signed

EXIT

II

Measure outputs,

monitor and

regulate

performance,

liaise effectively,

settle disputes

Report progress

in the Annual

Report

Scrutiny by the

Auditor-General

Module 1

Module 2

Module 5

MODULE 6

Module 7

Module 8

Module 9

Module 01/Contents

7/28/04

3:07 PM

Page III

ABOUT THIS MODULE

Module 1: South African Regulations for PPPs opens with brief notes on how PPPs

and this Manual itself fit within South Africas public finance management system

in national and provincial government.

The substance of Module 1 presents Treasury Regulation 16 to the Public Finance

Management Act, 1999 (PFMA), the legal foundation for PPPs, in an annotated

form, taking the reader through the regulations and answering frequently asked

questions. The module closes with specific instructions to institutions considering

application for exemption from treasury approvals required in terms of Treasury

Regulation 16 to the PFMA.

The PPP project cycle depicts the phases and stages of Treasury Regulation 16 to

the PFMA. This PPP project cycle is referenced throughout National Treasurys

PPP Manual.

Treasury Regulation 16, 2004, is attached as Annexure 1: Treasury Regulation 16.

Institutions and private parties will find Module 1 useful when they first consider a

PPP and want an understanding of the legal foundation for PPPs. The module is

also useful as a quick reference throughout the PPP project cycle. Cross-references

to other modules in National Treasurys PPP Manual refer the reader to detailed

guidance and information about the various phases and stages of developing a

PPP.

III

Module 01/Contents

IV

7/28/04

3:07 PM

Page IV

PPP Manual Module 1: South African Regulations for PPPs

Module 01/Contents

7/28/04

3:07 PM

Page V

CONTENTS

INTRODUCTION

UNDERSTANDING TREASURY REGULATION 16

ANNEXURE

Annexure 1: Treasury Regulation 16

issued as National Treasury PPP Practice Note Number 02 of 2004

15

16

Module 01

7/28/04

2:35 PM

Page 1

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 1

INTRODUCTION

South Africa has established a firm regulatory framework in terms of which

national and provincial government institutions can enter into public private

partnership (PPP) agreements. The central legislation governing PPPs for national

and provincial government is Treasury Regulation 16 issued to the Public Finance

Management Act, 1999 (PFMA).

PPPs for municipal government are governed by the Municipal Systems Act,

2000, and the Municipal Finance Management Act, 2003. Municipalities are not

subject to the PFMA or to Treasury Regulation 16. National Treasury will issue a

separate PPP Manual for municipalities.

National Treasurys PPP Manual

National Treasurys PPP Manual and Standardised PPP Provisions are founded on

the PFMA and Treasury Regulation 16, and have been produced for national and

provincial departments, constitutional institutions, and public entities listed or

required to be listed in schedules 3A, 3B, 3C and 3D of the PFMA, and any

subsidiaries of such public entities.

Each module of National Treasurys PPP Manual, together with Standardised

PPP Provisions, is issued by National Treasury as a PPP Practice Note, in terms of

section 76(4)(g) of the PFMA. These PPP practice notes, which will be updated

from time to time, constitute instructions in terms of section 76 of the PFMA,

aimed at facilitating the application of the PFMA and its regulations.

National Treasury PPP Practice Note Number 01 of 2004:

Standardised PPP Provisions: First Issue: 11 March 2004

National Treasury PPP Practice Note Number 02 of 2004:

National Treasurys PPP Manual Module 1: South African Regulations for PPPs

National Treasury PPP Practice Note Number 03 of 2004:

National Treasurys PPP Manual Module 2: Code of Good Practice for BEE in PPPs

National Treasury PPP Practice Note Number 04 of 2004:

National Treasurys PPP Manual Module 3: PPP Inception

National Treasury PPP Practice Note Number 05 of 2004:

National Treasurys PPP Manual Module 4: PPP Feasibility Study

National Treasury PPP Practice Note Number 06 of 2004:

National Treasurys PPP Manual Module 5: PPP Procurement

National Treasury PPP Practice Note Number 07 of 2004

National Treasurys PPP Manual Module 6: Managing the PPP Agreement

National Treasury PPP Practice Note Number 08 of 2004

National Treasurys PPP Manual Module 7: Auditing PPPs

National Treasury PPP Practice Note Number 09 of 2004:

National Treasurys PPP Manual Module 8: Accounting Treatment for PPPs

National Treasury PPP Practice Note Number 10 of 2004:

National Treasurys PPP Manual Module 9: An Introduction to Project Finance

issued as National Treasury PPP Practice Note Number 02 of 2004

Module 01

7/28/04

2:35 PM

Page 2

The instructions contained in National Treasurys PPP Manual are presented in

the form of detailed best practice guidance, based on National Treasurys PPP

Units experience in PPPs to date. An institution to which Treasury Regulation 16

applies which seeks materially to deviate from this guidance should inform the

relevant treasury of such intentions prior to execution, and justify its reasons for

such material deviation in the relevant application(s) for treasury approvals in

terms of the regulation.

The PFMA

The PFMA approach to financial management focuses on outputs and responsibilities and is a cornerstone of governments strategy to improve financial management in the public sector.

Government is increasingly focusing its efforts on outputs and outcomes,

wanting to ensure that, in spending taxpayers money, it produces the intended

result. The PFMA makes the heads of departments (the accounting officers) of

national and provincial departments and the CEOs or boards of schedule 3 public

entities (the accounting authorities) responsible for implementation. They are

directly accountable to Parliament or the provincial legislature for the effective and

efficient management of their budgets to achieve their public mandates. These

responsible officials need constantly to evaluate value-for-money choices. A PPP

choice for the delivery of a public service, or to achieve a public good, warrants

such investigation.

By its nature, a PPP entails:

targeted public spending, principally on outputs to agreed standards

leveraging private sector finance and efficiencies

allocating risks to the party best able to manage them.

As a mechanism of delivery, a PPP is firmly in line with the intent of the PFMA.

Treasury Regulation 16 to the PFMA

The PFMA provides, in section 76, that National Treasury must make regulations

for a range of matters to do with the effective and efficient management and use of

financial resources. Many of these matters are relevant to PPPs, and National

Treasurys Regulation 16 provides precise and detailed instructions for PPPs. The

regulations have been amended since they were first issued in May 2000 to take

account of experience in implementing PPPs.

Treasury Regulation 16 to the PFMA defines a PPP, and sets out the phases

and tests it will have to go through.

The gazetted regulation is reproduced here, annotated at the points at which

questions are frequently asked. The regulation is also attached as Annexure 1:

Treasury Regulation 16.

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 3

UNDERSTANDING TREASURY REGULATION 16

TO THE PFMA

16.1 Definitions

In this regulation, unless the context indicates otherwise, a word or expression to

which a meaning has been assigned in the Act, has the same meaning, and

affordability1 means that the financial commitments to be incurred by an

institution in terms of the PPP agreement can be met by funds

(a)

designated within the institutions existing budget for the institutional

function to which the agreement relates; and/or

(b) destined for the institution in accordance with the relevant treasurys future

budgetary projections for the institution;

institution means a department, a constitutional institution, a public entity

listed, or required to be listed in schedules 3A, 3B, 3C and 3D to the Act, or any

subsidiary of any such public entity.

Which national and provincial government institutions are subject

to Treasury Regulation 16?

All references to institution(s) in Treasury Regulation 16 are to these particular institutions of government:

all national and provincial government departments

all constitutional institutions listed in schedule 1 to the PFMA

all national and provincial public entities listed in schedules 3A, 3B, 3C and 3D to the

PFMA and any subsidiary of any such public entity.

The major public entities listed in schedule 2 to the PFMA are not subject to Treasury

Regulation 16. Municipalities are not subject to the PFMA or to its regulations.

institutional function means

(a)

a service, task, assignment or other function that an institution is entitled or

obliged to perform

(i) in the public interest; or

(ii) on behalf of the public service generally; or

(b) any part or component of or any service, task, assignment or other function

performed or to be performed in support of such a service, task, assignment

or other function;

1. Affordability is dealt with in detail in Module 4: Feasibility Study and in Module 5: PPP

Procurement.

issued as National Treasury PPP Practice Note Number 02 of 2004

Module 01

7/28/04

2:35 PM

Page 4

private party means a party to a PPP agreement, other than

(a)

an institution to which the Act applies;

(b) a municipality or a municipal entity under the ownership control of one or

more municipalities; or

(c)

the accounting officer, accounting authority or other person or body acting

on behalf of an institution, municipality or municipal entity referred to in

paragraph (a) or (b);

How is a private party defined?

The regulation defines a private party to a PPP agreement in the negative, explicitly

excluding public institutions. PPPs in South Africa are thus specifically defined to exclude

public-public partnerships. Not-for-profit entities are not excluded from the definition of

a private party but their capacity to carry substantial financial, technical and operational

risk in a project will determine the role they are able to play in a PPP.

project officer2 means a person identified by the accounting officer or accounting authority of an institution, who is capable of managing and is appropriately

qualified to manage a PPP to which that institution is party from its inception to

its expiry or termination;

public private partnership or PPP means a commercial transaction between

an institution and a private party in terms of which the private party

(a)

performs an institutional function on behalf of the institution; and/or

(b) acquires the use of state property for its own commercial purposes; and

(c)

assumes substantial financial, technical and operational risks in connection

with the performance of the institutional function and/or use of state

property; and

(d) receives a benefit for performing the institutional function or from utilising

the state property, either by way of:

(i) consideration to be paid by the institution which derives from a revenue

fund or, where the institution is a national government business enterprise or a provincial government business enterprise, from the revenues

of such institution; or

(ii) charges or fees to be collected by the private party from users or

customers of a service provided to them; or

(iii) a combination of such consideration and such charges or fees;

What does a PPP entail?

A PPP is a contract between a public sector institution and a private party, in which the

private party assumes substantial financial, technical and operational risk in the design,

financing, building and operation of a project.

2. The project officers role and functions are dealt with in detail in Module 3: PPP Inception.

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 5

Two types of PPPs are specifically defined:

where the private party performs an institutional function

where the private party acquires the use of state property for its own commercial

purposes.

A PPP may also be a hybrid of these types.

Payment in any scenario involves one of three mechanisms:

the institution paying the private party for the delivery of the service, or

the private party collecting fees or charges from users of the service, or

a combination of these.

What is a PPP not?

The way that a PPP is defined in the regulations makes it clear that:

a PPP is not a simple outsourcing of functions where substantial financial, technical

and operational risk is retained by the institution

a PPP is not a donation by a private party for a public good

a PPP is not the privatisation or divesture of state assets and/or liabilities

a PPP is not the commercialisation of a public function by the creation of a stateowned enterprise

a PPP does not constitute borrowing by the state.

What types of PPP does the regulation cater for?

Treasury Regulation 16 caters for a wide variety of PPP types. It allows such projects to

be developed in South Africa with a range of different characteristics, combining private

party risk in various ways for designing, financing, building, operating, infrastructure

and services, and for owning and transferring assets. This wide variety of PPP types is

reflected in international experience.

What PPP financing structures and funding sources3 does the regulation

provide for?

Treasury Regulation 16 is not prescriptive about the financing structure of a PPP. It is

assumed that these will vary widely from project to project and sector to sector, and will

be closely linked to the funding sources that can be secured for each deal.

However, PPPs typically involve the private party raising both debt and equity to

capitalise the project. National Treasurys Standardised PPP Provisions have been developed for this typical PPP financing structure and sources of funding.

PPPs may involve a degree of capital contribution by the institution to the initial costs

of the project. Some PPP projects do not involve debt finance at all, being initially funded

either wholly through corporate finance or by a combination of government funds and

private equity. In end-user-pay projects there may also be an element of government

funding support to either or both the capital and the operating costs of the project.

3. Financing structure and funding sources are dealt with in Module 4: PPP Feasibility Study. Refer

also to Module 9: An Introduction to Project Finance.

issued as National Treasury PPP Practice Note Number 02 of 2004

Module 01

7/28/04

2:35 PM

Page 6

In essence, Treasury Regulation 16 provides that affordability limits, value-for-money

considerations and the risk profile of the project will determine a PPP projects financing

structure and sources of funding.

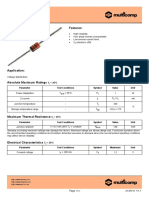

Figure 1.1: Typical PPP structure

Institution

PPP agreement

Shareholders

Shareholders

agreement

Private party

Construction

subcontract

Construction

subcontractor

Direct agreement

Financing

agreement

Lenders

Operations

subcontract

Operations

subcontractor

preferred bidder4 means the bidder, including any bidding consortium, to be

appointed as preferred bidder in terms of regulation 16.5.4;

PPP agreement means a written contract recording the terms of a PPP

concluded between an institution and a private party;

relevant treasury means the National Treasury unless delegated in terms in

section 10(1)(b) of the Act;

Which treasury is the relevant treasury?

National Treasury currently has the responsibility for regulating PPPs in terms of Treasury

Regulation 16 to the PFMA. These powers may be delegated to provincial treasuries,

thus the regulation refers throughout to the relevant treasury.

4. The process for choosing the preferred bidder is covered in Module 5: PPP Procurement.

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 7

state property includes all movable and immovable property belonging to the

state as well as intellectual property rights vested in the state;

transaction advisor5 means a person or persons appointed in writing by an

accounting officer or accounting authority of an institution, who has or have

appropriate skills and experience to assist and advise the institution in connection

with a PPP, including the preparation and conclusion of a PPP agreement; and

value for money6 means that the provision of the institutional function or the

use of state property by a private party in terms of the PPP agreement results in a

net benefit to the institution defined in terms of cost, price, quality, quantity, risk

transfer or a combination thereof.

16.2 Exclusive competency of accounting officers and accounting authorities

16.2.1 Only the accounting officer or the accounting authority of an institution

may enter into a PPP agreement on behalf of that institution.

16.3 Project inception7

16.3.1 As soon as the institution identifies a project that may be concluded as a

PPP, the accounting officer or accounting authority must in writing

(a) register the PPP with the relevant treasury;

(b) inform the relevant treasury of the expertise within that institution to

proceed with a PPP;

(c) appoint a project officer from within or outside the institution; and

(d) appoint a transaction advisor if the relevant treasury so requests.

What does the PPP project cycle involve?

The PPP project cycle enables the three regulatory tests of affordability, value for money,

and risk transfer to be applied at every stage of preparing for, procuring and managing a

PPP agreement. Regulation 16 sets out six distinct phases to the project cycle. It requires

that the institution apply these tests throughout, and that specific treasury approvals are

given at phases II and III of the project cycle. (See the PPP project cycle chart.)

16.4 Feasibility study 8 Treasury Approval: I

16.4.1 To determine whether the proposed PPP is in the best interests of an

institution, the accounting officer or the accounting authority of that

institution must undertake a feasibility study that

5. The transaction advisors role and functions and the appointment process are covered in

Module 3: PPP Inception.

6. Value for money is covered in Module 4: PPP Feasibility Study and Module 5: Procurement.

7. The steps in 16.3.1 are covered in Module 3: PPP Inception.

8. How to do a PPP feasibility study is covered in Module 4: PPP Feasibility Study.

issued as National Treasury PPP Practice Note Number 02 of 2004

Module 01

7/28/04

2:35 PM

Page 8

(a) explains the strategic and operational benefits of the proposed PPP for

the institution in terms of its strategic objectives and government policy;

(b) describes in specific terms

(i) in the case of a PPP involving the performance of an institutional

function, the nature of the institutional function concerned and the

extent to which this institutional function, both legally and by

nature, may be performed by a private party; and

(ii) in the case of a PPP involving the use of state property, a description of the state property concerned, the uses, if any, to which such

state property has been subject prior to the registration of the

proposed PPP and a description of the types of use that a private

party may legally subject such state property to;

(c) in relation to a PPP pursuant to which an institution will incur any

financial commitments, demonstrates the affordability of the PPP for

the institution;

(d) sets out the proposed allocation of financial, technical and operational

risks between the institution and the private party;

(e) demonstrates the anticipated value for money to be achieved by the

PPP; and

(f ) explains the capacity of the institution to procure, implement, manage,

enforce, monitor and report on the PPP;

What are the tests for a PPP?

Whatever the PPP type, structure, payment mechanism, or sources of funding, all South

African PPPs governed by Treasury Regulation 16 are subjected to three strict tests:

Can the institution afford the deal?

Is it a value-for-money solution?

Is substantial technical, operational and financial risk transferred to the private party?

16.4.2 An institution may not proceed with the procurement phase of a PPP without

prior written approval of the relevant treasury for the feasibility study.

16.4.3 The treasury approval referred to in regulation 16.4.2 shall be regarded as

Treasury Approval: I.

16.4.4 If at any time after Treasury Approval: I has been granted in respect of the

feasibility study of a PPP, but before the grant of Treasury Approval: III in

respect of the PPP agreement recording that PPP, any assumptions in such

feasibility study are materially revised, including any assumptions concerning affordability, value for money and substantial technical, operational and

financial risk transfer, then the accounting officer or accounting authority

of the institution must immediately

(a) provide the relevant treasury with details of the intended revision,

including a statement regarding the purpose and impact of the intended

revision on the affordability, value for money and risk transfer

evaluation contained in the feasibility study; and

8

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 9

(b) ensure that the relevant treasury is provided with a revised feasibility

study after which the relevant treasury may grant a revised Treasury

Approval: I.

16.5 Procurement 9 Treasury approvals IIA and IIB

16.5.1 Prior to the issuing of any procurement documentation for a PPP to any

prospective bidders, the institution must obtain approval from the relevant

treasury for the procurement documentation, including the draft PPP

agreement.

16.5.2 The treasury approval referred to in regulation 16.5.1 shall be regarded as

Treasury Approval: IIA.

16.5.3 The procurement procedure

(a) must be in accordance with a system that is fair, equitable, transparent,

competitive and cost-effective; and

(b) must include a preference for the protection or advancement of persons,

or categories of persons, disadvantaged by unfair discrimination in

compliance with relevant legislation.

How is the private party chosen?

The regulation sets out clear PPP procurement steps that must be followed by institutions, and prescribes distinct treasury approvals that must be obtained in this phase.

The Promotion of Administrative Justice Act, 2000 (PAJA), imposes a range of obligations arising from section 33(1) of the Constitution of the Republic of South Africa to effect

citizens rights to fair administrative action. These values are lawfulness, reasonableness

and procedural fairness.

Each administrative action in a PPP procurement process must be in accordance

with the law and prescribed procedures; there must be accountability, responsiveness

and openness in the decision-making of the institution; all bidders at each stage of a

procurement process must have an equal chance of competing for the contract; and no

action taken by government may prejudice their competitiveness.

How is BEE10 applied in PPPs?

In providing that active measures must be taken to promote black economic empowerment (BEE) at all stages of PPPs, the regulations are in line with broader government

BEE policy. Module 2: Code of Good Practice for BEE in PPPs informs how BEE must be

approached. The code is to be issued by the Minister of Trade and Industry in terms of

the Broad-based Black Economic Empowerment Act, 2003 (the BBBEE Act). The

Preferential Procurement Policy Framework Act, 2000 (PPPFA) also applies.

9. The stages and steps for procuring the PPP are covered in Module 5: PPP Procurement.

10. BEE is dealt with in all the modules as applicable to a particular phase, stage or step in the PPP

process. Module 2: Code of Good Practice for BEE in PPPs provides the policy and specific

guidance.

issued as National Treasury PPP Practice Note Number 02 of 2004

Module 01

7/28/04

2:35 PM

Page 10

16.5.4 After the evaluation of the bids, but prior to appointing the preferred

bidder, the institution must submit a report for approval by the relevant

treasury, demonstrating how the criteria of affordability, value for money

and substantial technical, operational and financial risk transfer were

applied in the evaluation of the bids, demonstrating how these criteria were

satisfied in the preferred bid, and including any other information as

required by the relevant treasury.

16.5.5 The treasury approval referred to in regulation 16.5.4 shall be regarded as

Treasury Approval: IIB.

16.6 Contracting PPP agreements Treasury Approval: III 11

16.6.1 After the procurement procedure has been concluded but before the

accounting officer or accounting authority of an institution concludes a

PPP agreement, that accounting officer or accounting authority must

obtain approval from the relevant treasury

(a) that the PPP agreement meets the requirements of affordability, value

for money and substantial technical, operational and financial risk

transfer as approved in terms of regulation 16.4.2 or as revised in terms

of regulation 16.4.4;

(b) for a management plan that explains the capacity of the institution, and

its proposed mechanisms and procedures, to effectively implement,

manage, enforce, monitor and report on the PPP; and

(c) that a satisfactory due diligence including a legal due diligence has been

completed in respect of the accounting officer or accounting authority

and the proposed private party in relation to matters of their respective

competence and capacity to enter into the PPP agreement.

16.6.2 The treasury approval referred to in regulation 16.6.1 shall be referred to as

Treasury Approval: III.

16.7 Management of PPP agreements12

16.7.1 The accounting officer or accounting authority of the institution that is

party to a PPP agreement is responsible for ensuring that the PPP agreement is properly implemented, managed, enforced, monitored and reported

on, and must maintain such mechanisms and procedures as approved in

Treasury Approval: III for

(a) measuring the outputs of the PPP agreement;

(b) monitoring the implementation of the PPP agreement and performances under the PPP agreement;

(c) liaising with the private party;

11. See Module 5: PPP Procurement.

12. Module 6: Managing the PPP Agreement covers the processes in detail.

10

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 11

(d) resolving disputes and differences with the private party;

(e) generally overseeing the day-to-day management of the PPP agreement;

and

(f) reporting on the PPP agreement in the institutions annual report.

16.7.2 A PPP agreement involving the performance of an institutional function

does not divest the accounting officer or accounting authority of the institution concerned of the responsibility for ensuring that such institutional

function is effectively and efficiently performed in the public interest or on

behalf of the public service.

16.7.3 A PPP agreement involving the use of state property by a private party does

not divest the accounting officer or accounting authority of the institution

concerned of the responsibility for ensuring that such state property is

appropriately protected against forfeiture, theft, loss, wastage and misuse.

16.8 Amendment and variation of PPP agreements

16.8.1 The prior written approval of the relevant treasury is required for any

material amendments to a PPP agreement including any material variations

to the outputs therein, or any waivers contemplated or provided for in the

PPP agreement.

16.8.2 The relevant treasury will approve a material amendment only if it is

satisfied that the PPP agreement, if so amended, will continue to provide

(a) value for money;

(b) affordability; and

(c) substantial technical, operational and financial risk transfer to the

private party.

16.8.3 The accounting officer or accounting authority must substantially follow

the procedure prescribed by regulations 16.4 and 16.6 for obtaining such

treasury approval.

16.9 Agreements binding on the state

16.9.1 A PPP agreement or an agreement amending a PPP agreement, binds the

state only if the agreement was entered into on behalf of an institution

(a) by the accounting officer or accounting authority of that institution;

and

(b) if all treasury approvals required in terms of this regulation 16 have been

granted by the relevant treasury in respect of the PPP.

Are unsolicited bids provided for?

The regulation makes no provision for unsolicited bids, and National Treasury is not in

favour of them. Unsolicited bids are difficult to manage, threaten to violate constitutional protections of fair administrative process and competitive procurement, and

internationally, have not proven to deliver faster or secure better value for money in

PPPs. National Treasury encourages institutions to listen to innovative ideas from the

private sector but, in so doing, not to acquire associated intellectual property rights, and

issued as National Treasury PPP Practice Note Number 02 of 2004

11

Module 01

7/28/04

2:35 PM

Page 12

not to make any commitments that will undermine competitive procurement. If the

ideas seem promising, institutions should register the project with the relevant treasury

in terms of Treasury Regulation 16 and follow the project cycle as regulated.

16.10 Exemptions

16.10.1 The relevant treasury may, subject to any terms and conditions that it

considers appropriate and upon written application from an institution,

exempt that institution whether in relation to a specific PPP or in general,

from complying with any or all of the provisions of this regulation 16.

Applying for exemption from Treasury Regulation 16

An institution may be exempted from obtaining the prescribed treasury approvals, and

the procurement of a PPP may thus be able to go ahead without the oversight and

statutory approvals of the relevant treasury.

The relevant treasury will consider two kinds of exemption application:

for the duration of a particular project; and/or

for the institution itself, for a specific period.

National Treasury has set the following conditions for such exemptions:

No exemptions will be given to institutions from complying with the regulatory tests

or phases of a PPP that are prescribed by Treasury Regulation 16.

The application must clearly demonstrate the institutions capacity to manage a PPP

to the standards and phases outlined in Treasury Regulation 16 by addressing the

issues outlined below.

An exemption from treasury approvals does not exempt the institution from applying

Standardised PPP Provisions, as set out therein.

An exemption from treasury approvals does not exempt the institution from substantively following procedures outlined in National Treasurys PPP Manual.

An exemption from treasury approvals does not exempt the institution from complying

with the Code of Good Practice for BEE in PPPs.

No exemptions will be given retrospectively.

Only the accounting officer/authority may apply to the relevant treasury on behalf of

an institution.

Part A: Exemption for a particular PPP

The application must demonstrate the institutions capacity to manage the PPP through

the phases and to the standards set by Treasury Regulation 16 without the oversight and

approvals of the relevant treasury.

The following must be addressed:

1. Give a short description of the project.

2. What institutional function and/or use of state property is envisaged?

3. What is the envisaged extent of public funding and/or revenue from users?

4. What is the proposed extent of private sector capital/skill/infrastructure?

5. What risks are to be transferred to a private party?

12

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 13

6.

7.

What is the anticipated duration of the PPP agreement?

How does the institution propose to determine affordability, value for money and

appropriate risk allocation for the project?

8. Give a short history of similar projects undertaken by the institution.

9. Outline the policy and actual procedures followed to date by the institution in three

similar projects, specifically in relation to approving project feasibility studies,

compiling and approving bid documents, managing the competitive bidding process,

evaluating bids, determining value for money, establishing contract management

systems and negotiating and managing contracts.

10. Outline the institutions management system for the project, attaching relevant

resums of key personnel.

11. Submit the curriculum vitae of the appointed project officer, together with his or

her job description.

Part B: Exemption for an institution

National Treasury views the past experience of the institution in successfully planning

for, procuring and implementing PPP projects as the key factor in granting an institutional exemption. The application must therefore demonstrate the capacity of the

institution established for procuring and managing all its possible PPPs through the

phases and to the standards set in Treasury Regulation 16 without the oversight and

approvals of the relevant treasury. The exemption may be granted for a specific period,

and re-applied for after that. The application must state the extent to which such

institutional capacity relies on the experience of specific individuals.

The following must be addressed:

1. Give a short description of the institution.

2. Motivate the period of time for which an exemption is sought.

3. What institutional function and/or use of state property is envisaged for PPPs?

4. What is the extent of public funding and/or revenues from users, for projects

envisaged?

5. What is the extent of private sector capital/skill/infrastructure envisaged?

6. What risks are likely to be transferred to the private sector?

7.

Provide a summary of the PPP projects undertaken by the institution to date.

8. Outline the institutions policy for determining project affordability, value for money

and appropriate risk allocation.

9. Outline the actual procedures established in the institution for approving project

feasibility studies, approving bid documents, managing the competitive bidding

process, evaluating bids, determining value for money, establishing contract management systems, and negotiating and managing PPP agreements.

10. Outline the institutions capacity to manage and administer PPPs, attaching relevant resums of key personnel.

11. Submit the curriculum vitae of people who will be assigned as project officers for

the institutions envisaged PPP projects, together with their job descriptions.

issued as National Treasury PPP Practice Note Number 02 of 2004

13

Module 01

7/28/04

2:35 PM

Page 14

Module 01

7/28/04

2:35 PM

Page 15

ANNEXURE

ANNEXURE 1

Treasury Regulation 16

16

Module 01

7/28/04

2:35 PM

Page 16

TREASURY REGULATION 16 TO THE

PUBLIC FINANCE MANAGEMENT ACT, 1999

as published in Government Gazette, 2004.

16. Public private partnerships

16.1 Definitions

In this regulation, unless the context indicates otherwise, a word or expression to

which a meaning has been assigned in the Act, has the same meaning, and

affordability means that the financial commitments to be incurred by an

institution in terms of the PPP agreement can be met by funds

(a) designated within the institutions existing budget for the institutional

function to which the agreement relates; and/or

(b) destined for the institution in accordance with the relevant treasurys

future budgetary projections for the institution;

institution means a department, a constitutional institution, a public entity listed,

or required to be listed in schedules 3A, 3B, 3C and 3D to the Act, or any subsidiary

of any such public entity.

institutional function means

(a) a service, task, assignment or other function that an institution is

entitled or obliged to perform

(i) in the public interest; or

(ii) on behalf of the public service generally; or

(b) any part or component of or any service, task, assignment or other

function performed or to be performed in support of such a service,

task, assignment or other function;

private party means a party to a PPP agreement, other than

(a) an institution to which the Act applies;

(b) a municipality or a municipal entity under the ownership control of one

or more municipalities; or

(c) the accounting officer, accounting authority or other person or body

acting on behalf of an institution, municipality or municipal entity

referred to in paragraph (a) or (b);

project officer means a person identified by the accounting officer or accounting

authority of an institution, who is capable of managing and is appropriately

qualified to manage a PPP to which that institution is party from its inception to

its expiry or termination;

16

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 17

ANNEXURE 1: TREASURY REGULATION 16

public private partnership or PPP means a commercial transaction between

an institution and a private party in terms of which the private party

(a) performs an institutional function on behalf of the institution; and / or

(b) acquires the use of state property for its own commercial purposes; and

(c) assumes substantial financial, technical and operational risks in

connection with the performance of the institutional function and/or

use of state property; and

(d) receives a benefit for performing the institutional function or from

utilising the state property, either by way of:

(i) consideration to be paid by the institution which derives from a

revenue fund or, where the institution is a national government

business enterprise or a provincial government business enterprise,

from the revenues of such institution; or

(ii) charges or fees to be collected by the private party from users or

customers of a service provided to them; or

(iii) a combination of such consideration and such charges or fees;

preferred bidder means the bidder, including any bidding consortium, to be

appointed as preferred bidder in terms of regulation 16.5.4;

PPP agreement means a written contract recording the terms of a PPP concluded

between an institution and a private party;

relevant treasury means the National Treasury unless delegated in terms of

section 10(1)(b) of the Act;

state property includes all movable and immovable property belonging to the

state as well as intellectual property rights vested in the state;

transaction advisor means a person or persons appointed in writing by an

accounting officer or accounting authority of an institution, who has or have

appropriate skills and experience to assist and advise the institution in connection

with a PPP, including the preparation and conclusion of a PPP agreement; and

value for money means that the provision of the institutional function or the use

of state property by a private party in terms of the PPP agreement results in a net

benefit to the institution defined in terms of cost, price, quality, quantity, risk

transfer or a combination thereof.

16.2 Exclusive competency of accounting officers and

accounting authorities

16.2.1 Only the accounting officer or the accounting authority of an institution

may enter into a PPP agreement on behalf of that institution.

issued as National Treasury PPP Practice Note Number 02 of 2004

17

Module 01

7/28/04

2:35 PM

Page 18

ANNEXURE 1: TREASURY REGULATION 16

16.3 Project inception

16.3.1 As soon as the institution identifies a project that may be concluded as a

PPP, the accounting officer or accounting authority must in writing

(a) register the PPP with the relevant treasury;

(b) inform the relevant treasury of the expertise within that institution to

proceed with a PPP;

(c) appoint a project officer from within or outside the institution; and

(d) appoint a transaction advisor if the relevant treasury so requests.

16.4 Feasibility study Treasury Approval: I

16.4.1 To determine whether the proposed PPP is in the best interests of an

institution, the accounting officer or the accounting authority of that

institution must undertake a feasibility study that

(a) explains the strategic and operational benefits of the proposed PPP for

the institution in terms of its strategic objectives and government

policy;

(b) describes in specific terms

(i) in the case of a PPP involving the performance of an institutional

function, the nature of the institutional function concerned and the

extent to which this institutional function, both legally and by

nature, may be performed by a private party; and

(ii) in the case of a PPP involving the use of state property, a description of the state property concerned, the uses, if any, to which such

state property has been subject prior to the registration of the

proposed PPP and a description of the types of use that a private

party may legally subject such state property to;

(c) in relation to a PPP pursuant to which an institution will incur any

financial commitments, demonstrates the affordability of the PPP for

the institution;

(d) sets out the proposed allocation of financial, technical and operational

risks between the institution and the private party;

(e) demonstrates the anticipated value for money to be achieved by the

PPP; and

(f ) explains the capacity of the institution to procure, implement, manage,

enforce, monitor and report on the PPP;

16.4.2 An institution may not proceed with the procurement phase of a PPP

without prior written approval of the relevant treasury for the feasibility

study.

16.4.3 The treasury approval referred to in regulation 16.4.2 shall be regarded as

Treasury Approval: I.

16.4.4 If at any time after Treasury Approval: I has been granted in respect of the

feasibility study of a PPP, but before the grant of Treasury Approval: III in

respect of the PPP agreement recording that PPP, any assumptions in such

feasibility study are materially revised, including any assumptions

18

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 19

ANNEXURE 1: TREASURY REGULATION 16

concerning affordability, value for money and substantial technical, operational and financial risk transfer, then the accounting officer or accounting

authority of the institution must immediately

(a) provide the relevant treasury with details of the intended revision,

including a statement regarding the purpose and impact of the intended

revision on the affordability, value for money and risk transfer

evaluation contained in the feasibility study; and

(b) ensure that the relevant treasury is provided with a revised feasibility

study after which the relevant treasury may grant a revised Treasury

Approval: I.

16.5 Procurement Treasury approvals IIA and IIB

16.5.1 Prior to the issuing of any procurement documentation for a PPP to any

prospective bidders, the institution must obtain approval from the relevant

treasury for the procurement documentation, including the draft PPP

agreement.

16.5.2 The treasury approval referred to in regulation 16.5.1 shall be regarded as

Treasury Approval: IIA.

16.5.3 The procurement procedure

(a) must be in accordance with a system that is fair, equitable, transparent,

competitive and cost-effective; and

(b) must include a preference for the protection or advancement of persons,

or categories of persons, disadvantaged by unfair discrimination in

compliance with relevant legislation.

16.5.4 After the evaluation of the bids, but prior to appointing the preferred

bidder, the institution must submit a report for approval by the relevant

treasury, demonstrating how the criteria of affordability, value for money

and substantial technical, operational and financial risk transfer were

applied in the evaluation of the bids, demonstrating how these criteria were

satisfied in the preferred bid and including any other information as

required by the relevant treasury.

16.5.5 The treasury approval referred to in regulation 16.5.4 shall be regarded as

Treasury Approval: IIB.

16.6 Contracting PPP agreements Treasury Approval: III

16.6.1 After the procurement procedure has been concluded but before the

accounting officer or accounting authority of an institution concludes a

PPP agreement, that accounting officer or accounting authority must

obtain approval from the relevant treasury

(a) that the PPP agreement meets the requirements of affordability, value

for money and substantial technical, operational and financial risk

transfer as approved in terms of regulation 16.4.2 or as revised in terms

of regulation 16.4.4;

(b) for a management plan that explains the capacity of the institution, and

issued as National Treasury PPP Practice Note Number 02 of 2004

19

Module 01

7/28/04

2:35 PM

Page 20

ANNEXURE 1: TREASURY REGULATION 16

its proposed mechanisms and procedures, to effectively implement,

manage, enforce, monitor and report on the PPP; and

(c) that a satisfactory due diligence including a legal due diligence has been

completed in respect of the accounting officer or accounting authority

and the proposed private party in relation to matters of their respective

competence and capacity to enter into the PPP agreement.

16.6.2 The treasury approval referred to in regulation 16.6.1 shall be referred to as

Treasury Approval: III.

16.7 Management of PPP agreements

16.7.1 The accounting officer or accounting authority of the institution that is party

to a PPP agreement is responsible for ensuring that the PPP agreement is

properly implemented, managed, enforced, monitored and reported on, and

must maintain such mechanisms and procedures as approved in Treasury

Approval: III for

(a) measuring the outputs of the PPP agreement;

(b) monitoring the implementation of the PPP agreement and performances

under the PPP agreement;

(c) liaising with the private party;

(d) resolving disputes and differences with the private party;

(e) generally overseeing the day-to-day management of the PPP agreement;

and

(f) reporting on the PPP agreement in the institutions annual report.

16.7.2 A PPP agreement involving the performance of an institutional function does

not divest the accounting officer or accounting authority of the institution

concerned of the responsibility for ensuring that such institutional function is

effectively and efficiently performed in the public interest or on behalf of the

public service.

16.7.3 A PPP agreement involving the use of state property by a private party

does not divest the accounting officer or accounting authority of the institution concerned of the responsibility for ensuring that such state property is

appropriately protected against forfeiture, theft, loss, wastage and misuse.

16.8 Amendment and variation of PPP agreements

16.8.1 The prior written approval of the relevant treasury is required for any

material amendments to a PPP agreement including any material variations

to the outputs therein, or any waivers contemplated or provided for in the

PPP agreement.

16.8.2 The relevant treasury will approve a material amendment only if it is satisfied

that the PPP agreement, if so amended, will continue to provide

(a) value for money;

(b) affordability; and

(c) substantial technical, operational and financial risk transfer to the

private party.

20

PPP Manual Module 1: South African Regulations for PPPs

Module 01

7/28/04

2:35 PM

Page 21

ANNEXURE 1: TREASURY REGULATION 16

16.8.3 The accounting officer or accounting authority must substantially follow

the procedure prescribed by regulations 16.4 and 16.6 for obtaining such

treasury approval.

16.9 Agreements binding on the state

16.9.1 A PPP agreement or an agreement amending a PPP agreement, binds the

state only if the agreement was entered into on behalf of an institution

(a) by the accounting officer or accounting authority of that institution;

and

(b) if all treasury approvals required in terms of this regulation 16 have been

granted by the relevant treasury in respect of the PPP.

16.10 Exemptions

16.10.1 The relevant treasury may, subject to any terms and conditions that it

considers appropriate and upon written application from an institution,

exempt that institution whether in relation to a specific PPP or in general,

from complying with any or all of the provisions of this regulation 16.

issued as National Treasury PPP Practice Note Number 02 of 2004

21

Module 01

7/28/04

22

2:35 PM

Page 22

PPP Manual Module 1: South African Regulations for PPPs

You might also like

- Ch04 Introduction To International MarketingDocument9 pagesCh04 Introduction To International Marketingsfimarpgdm2012No ratings yet

- Brand Identity ModelDocument3 pagesBrand Identity Modelbrojas35No ratings yet

- Product Strategies: Branding & Packaging DecisionsDocument17 pagesProduct Strategies: Branding & Packaging Decisionsyeschowdhary6722No ratings yet

- Ch06 Introduction To International MarketingDocument10 pagesCh06 Introduction To International Marketingsfimarpgdm2012No ratings yet

- Marketing Module II Answer SheetDocument3 pagesMarketing Module II Answer Sheetbrojas35No ratings yet

- FedEx Marketing Plan - Marketing MixxDocument3 pagesFedEx Marketing Plan - Marketing Mixxbrojas35No ratings yet

- Marketing Plan of Emirates Airline - Marketing MixxDocument4 pagesMarketing Plan of Emirates Airline - Marketing Mixxbrojas35No ratings yet

- Marketing Plan of Tesco PLC - Marketing MixxDocument3 pagesMarketing Plan of Tesco PLC - Marketing Mixxbrojas35No ratings yet

- Marketing Plan of Nike - Marketing MixxDocument3 pagesMarketing Plan of Nike - Marketing Mixxbrojas35No ratings yet

- Nokia Brand Equity AnalysisDocument32 pagesNokia Brand Equity Analysisbrojas35No ratings yet

- Marketing Plan of Emirates Airline - Marketing MixxDocument4 pagesMarketing Plan of Emirates Airline - Marketing Mixxbrojas35No ratings yet

- MBL Module IDocument3 pagesMBL Module Ibrojas35No ratings yet

- Marketing Plan of McDonald's - Marketing MixxDocument3 pagesMarketing Plan of McDonald's - Marketing Mixxbrojas35No ratings yet

- Marketing Plan of BMW - Marketing MixxDocument4 pagesMarketing Plan of BMW - Marketing Mixxbrojas35No ratings yet

- How Does Star Bucks Create Brand EquityDocument6 pagesHow Does Star Bucks Create Brand Equitybrojas35No ratings yet

- Coca Cola's Value Proposition as a Product LeaderDocument2 pagesCoca Cola's Value Proposition as a Product Leaderbrojas3586% (7)

- Apple Iphone Marketing PlanDocument32 pagesApple Iphone Marketing PlanMohamed Bahram93% (41)

- Question q1Document1 pageQuestion q1brojas35No ratings yet

- Case Book Harvard HBS 2004Document114 pagesCase Book Harvard HBS 2004zeronomity94% (35)

- Marketing Plan CCDocument12 pagesMarketing Plan CCbrojas35No ratings yet

- Brand AttributesDocument14 pagesBrand Attributesbrojas35No ratings yet

- Macdonalds Brand EquityDocument57 pagesMacdonalds Brand Equitybrojas3589% (9)

- Module 04Document76 pagesModule 04brojas35No ratings yet

- Building PPPDocument95 pagesBuilding PPPbrojas35No ratings yet

- ICA Guide 2006 - Infra Project Preparation - EnG (Importante)Document61 pagesICA Guide 2006 - Infra Project Preparation - EnG (Importante)brojas35No ratings yet

- Building PPPDocument95 pagesBuilding PPPbrojas35No ratings yet

- Building PPPDocument95 pagesBuilding PPPbrojas35No ratings yet

- Full Feasibility AnalysisDocument12 pagesFull Feasibility Analysisbrojas35No ratings yet

- Green Infrastrucutre FinanceDocument76 pagesGreen Infrastrucutre Financebrojas35No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Why Some Like The New Jim Crow So Much - A Critique (4!30!12)Document14 pagesWhy Some Like The New Jim Crow So Much - A Critique (4!30!12)peerlesspalmer100% (1)

- CASE DIGEST ON MADEJA V CARODocument1 pageCASE DIGEST ON MADEJA V CAROPearl AudeNo ratings yet

- StarBus - UTC Online 4.0Document1 pageStarBus - UTC Online 4.0Jitendra BhandariNo ratings yet

- USA2Document2 pagesUSA2Helena TrầnNo ratings yet

- Love Is AliveDocument3 pagesLove Is Alivesteven harrisNo ratings yet

- Commencement of A StatuteDocument110 pagesCommencement of A StatutePrasun Tiwari80% (10)

- Manage Your Risk With ThreatModeler OWASPDocument39 pagesManage Your Risk With ThreatModeler OWASPIvan Dario Sanchez Moreno100% (1)

- The Period of Enlightenment 1872 1898Document24 pagesThe Period of Enlightenment 1872 1898Myung KimNo ratings yet

- Canadian History VocabularyDocument3 pagesCanadian History VocabularyJessica WilsonNo ratings yet

- Instant Download Foundations of Analog and Digital Electronic Circuits Issn PDF FREEDocument32 pagesInstant Download Foundations of Analog and Digital Electronic Circuits Issn PDF FREEjoyce.parkman948100% (43)

- 0 PDFDocument1 page0 PDFIker Mack rodriguezNo ratings yet

- Zener DiodoDocument4 pagesZener Diodoyes-caliNo ratings yet

- Title Pages 1. 2: 22167 Sexuality, Gender and The Law STUDENT ID: 201604269Document21 pagesTitle Pages 1. 2: 22167 Sexuality, Gender and The Law STUDENT ID: 201604269Joey WongNo ratings yet

- Coca-Cola income statement and cash flow analysisDocument3 pagesCoca-Cola income statement and cash flow analysisAnnisa Nabila KantiNo ratings yet

- Form OAF YTTaInternationalDocument5 pagesForm OAF YTTaInternationalmukul1saxena6364No ratings yet

- Legal Profession Cases CompilationDocument13 pagesLegal Profession Cases CompilationManuelMarasiganMismanosNo ratings yet

- Technical Report 2014 0055Document25 pagesTechnical Report 2014 0055Trisno SupriyantoroNo ratings yet

- Islamic Studies Ss 1 2nd Term Week 2Document6 pagesIslamic Studies Ss 1 2nd Term Week 2omo.alaze99No ratings yet

- Tacas Vs Tobon (SC)Document7 pagesTacas Vs Tobon (SC)HenteLAWcoNo ratings yet

- Life of St. Dominic de GuzmanDocument36 pagesLife of St. Dominic de Guzman.....No ratings yet

- Understanding ASEAN: Its Systems & StructuresDocument59 pagesUnderstanding ASEAN: Its Systems & StructureskaiaceegeesNo ratings yet

- KCIC's Capital Goods Duty ExemptionDocument3 pagesKCIC's Capital Goods Duty ExemptionRian Rizki YantamaNo ratings yet

- ATSSDKGuide 750Document208 pagesATSSDKGuide 750Deniz KutanNo ratings yet

- Expert committee review engineering projectsDocument4 pagesExpert committee review engineering projectsSyed AhmedNo ratings yet

- Early Education of Rizal UsitaDocument13 pagesEarly Education of Rizal Usitajuriel velascoNo ratings yet

- Republic Act No. 7638: December 9, 1992Document13 pagesRepublic Act No. 7638: December 9, 1992Clarisse TingchuyNo ratings yet

- Significance of Wearing of Complete UniformDocument13 pagesSignificance of Wearing of Complete Uniformcherry mae rosaliaNo ratings yet

- FR Configurator2 Installation Manual: 1. Compatible Operating SystemDocument2 pagesFR Configurator2 Installation Manual: 1. Compatible Operating SystemRafael GagoNo ratings yet