Professional Documents

Culture Documents

QS09 - Class Exercises

Uploaded by

lyk0texCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QS09 - Class Exercises

Uploaded by

lyk0texCopyright:

Available Formats

Accounting 225 Quiz Section #9

Chapter 8 Class Exercises

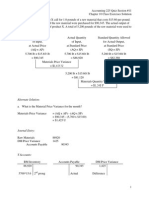

1. Crydon Inc. manufactures an advanced swim fin for scuba divers. Management is now

preparing detailed budgets for its third quarter, July through September, their busiest time. They

have assembled the following data to help with the preparation.

The marketing department estimates sales of pairs of swim fins as follows:

Month

# fins

Month

# fins

July

6,000 October

4,000

August

7,000 November

3,000

September

5,000 December

3,000

The fins sell for $50 a pair.

All sales are on account. Based on past experience, cash from sales is expected to be

collected in the following pattern:

30% in the month of the sale

60% in the month following the sale

10% uncollectible

The beginning accounts receivable balance (excluding uncollectible amounts) on July 1 is

expected to be $165,000.

Crydon Inc. is fairly confident of its sales forecasts and has limited production capacity.

They therefore maintain finished goods inventories equal to 25% of the following months

sales. The inventory in finished goods on July 1 will be 1,500 pairs.

Each pair of fins requires 2 pounds of geico compound. To prevent shortages, the company

would like the inventory of geico compound on hand at the end of each month to be equal to

30% of the following months production needs. The inventory of geico compound on hand

on July 1 is expected to be 3,750 pounds.

Geico compound costs $5 per pound. Crydon Inc. pays for 60% of its purchases in the

month of purchase; the remainder is paid for in the following month. The accounts payable

balance for geico compound purchases will be $11,400 on July 1.

a) Please prepare a cash receipts budget for July through September.

b) What is the total sales revenue for June?

Accounting 225 Quiz Section #9

Chapter 8 Class Exercises

c) What is the balance of accounts receivable (excluding uncollectible amounts) at September

30?

d) Please prepare a production budget for July through September.

July

August

September

2. The Covey Company is preparing its Manufacturing Overhead Budget for the fourth quarter of

the year. The budgeted variable factory overhead rate is $4.00 per direct labor hour; the budgeted

fixed factory overhead is $64,000 per month, of which $18,000 is factory depreciation.

a)If the budgeted direct labor time for October is 8,000 hours, then the total budgeted factory

overhead for October is:

(a) $64,000

(b) $76,000

(c) $78,000

(d) $96,000

b)If the budgeted cash disbursements for factory overhead for November are $90,000, then the

budgeted direct labor hours for November must be:

2

Accounting 225 Quiz Section #9

Chapter 8 Class Exercises

(a)

(b)

(c)

(d)

2,000 hours

6,500 hours

11,000 hours

22,500 hours

c) If the budgeted direct labor time for December is 4,000 direct labor hours, then the total

budgeted factory overhead per direct labor hour is:

(a)

(b)

(c)

(d)

$15.50

$16.00

$20.00

$24.50

3. The Khaki Company has the following budgeted sales data:

Februar

January

y

March

April

Credit Sales....................................................................................................

$400,000 $350,000 $300,000 $320,000

Cash Sales......................................................................................................

$70,000 $90,000 $80,000 $70,000

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month

following sale, and the remainder in the second month following the month of sale. There are no

bad debts.

a) The budgeted cash receipts for April would be:

(a)

(b)

(c)

(d)

$313,000

$320,000

$350,000

$383,000

b) The budgeted accounts receivable balance on February 28 would be:

(a)

(b)

(c)

(d)

$175,000

$210,000

$215,000

$250,000

Accounting 225 Quiz Section #9

Chapter 8 Class Exercises

4. The Orr Company makes and sells only one product called a Bobb. The company is in the

process of preparing its Selling and Administrative Expense Budget for the last half of the year.

The following budget data are available:

Variable Cost

Monthly

Per Bobb Sold

Fixed Cost

Sales Commissions........................................................................................

$0.90

-Shipping.........................................................................................................

$1.10

-Advertising.....................................................................................................

$0.40

$10,000

Executive Salaries..........................................................................................

-$40,000

Depreciation on Office Equipment................................................................

-$15,000

Other..............................................................................................................

$0.45

$25,000

All of these expenses (except depreciation) are paid in cash in the month they are incurred.

a)If the company has budgeted to sell 30,000 Bobbs in August, then the total budgeted selling

and administrative expenses per unit sold for August is:

(a)

(b)

(c)

(d)

$2.85

$3.00

$5.35

$5.85

b)If the company has budgeted to sell 26,000 Bobbs in November, then the total budgeted

variable selling and administrative expenses for November will be:

(a)

(b)

(c)

(d)

$37,700

$62,400

$74,100

$90,000

c)If the company has budgeted to sell 28,000 Bobbs in September, then the total budgeted fixed

selling and administrative expenses for September is:

(a)

(b)

(c)

(d)

$65,000

$75,000

$79,800

$90,000

d) If the budgeted cash disbursements for selling and administrative expenses for October total

$160,500, then how many Bobbs does the company plan to sell in October?

(a)

(b)

(c)

(d)

25,000 units

30,000 units

46,042 units

56,316 units

You might also like

- Chapter 9 Review QuestionsDocument8 pagesChapter 9 Review QuestionsKanika DahiyaNo ratings yet

- Chapter 9 Multiple Choice and Practice Problems Budget Review"TITLE"Budgeting Chapter 9 MCQs and Practice Problems" TITLE"Master Budget Chapter 9 Questions and ExercisesDocument5 pagesChapter 9 Multiple Choice and Practice Problems Budget Review"TITLE"Budgeting Chapter 9 MCQs and Practice Problems" TITLE"Master Budget Chapter 9 Questions and ExercisesHotcheeseramyeonNo ratings yet

- Review Myron Corporation's seasonal product sales budget and production requirementsDocument8 pagesReview Myron Corporation's seasonal product sales budget and production requirementsmohammad bilalNo ratings yet

- Chapter 07 - Exercises - Part IIDocument4 pagesChapter 07 - Exercises - Part IIRawan YasserNo ratings yet

- Cash Budget and Schedules for Garden SalesDocument11 pagesCash Budget and Schedules for Garden SalesAshish BhallaNo ratings yet

- Chap07 Rev. FI5 Ex PR 1Document10 pagesChap07 Rev. FI5 Ex PR 1Beyond ThatNo ratings yet

- Chapter 8 Case QuestionsDocument2 pagesChapter 8 Case QuestionsMcCoy BroughNo ratings yet

- Cost and Management Accounting -II - Work SheetDocument7 pagesCost and Management Accounting -II - Work SheetBeamlak WegayehuNo ratings yet

- Auditing 2019 P S CH 8Document16 pagesAuditing 2019 P S CH 8barakat801No ratings yet

- Assignment 2Document4 pagesAssignment 2Ella Davis0% (1)

- Sol Q5Document3 pagesSol Q5Shubham RankaNo ratings yet

- Cost Accounting - Cash BudgetDocument4 pagesCost Accounting - Cash BudgetRealGenius (Carl)No ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- THE FOUNDATIONAL 15Document8 pagesTHE FOUNDATIONAL 15Shafa AlyaNo ratings yet

- CMA Individual Assignment 1 & 2Document3 pagesCMA Individual Assignment 1 & 2Abdu YaYa Abesha100% (2)

- Practice Problems 1Document16 pagesPractice Problems 1James AguilarNo ratings yet

- Cash Budgeting TutorialDocument4 pagesCash Budgeting Tutorialmichellebaileylindsa100% (1)

- Cost and Management Accounting II AssignmentDocument8 pagesCost and Management Accounting II AssignmentbetsegawabebeaNo ratings yet

- Budgetary Planning True-False and Multiple Choice QuestionsDocument17 pagesBudgetary Planning True-False and Multiple Choice QuestionsIsh Selin67% (3)

- Budgeting and Variance Analysis QuestionsDocument13 pagesBudgeting and Variance Analysis QuestionsAli Rizwan100% (1)

- Chap07 Rev. FI5 Ex PRDocument11 pagesChap07 Rev. FI5 Ex PRKhryzha Hanne Dela CruzNo ratings yet

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- PR Akmen 3Document3 pagesPR Akmen 3Achmad Faizal AzmiNo ratings yet

- Sol Q5Document5 pagesSol Q5Elle VernezNo ratings yet

- Accmana Exercise Master Budget AY 2016Document2 pagesAccmana Exercise Master Budget AY 2016NaomiGeronimoNo ratings yet

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Document9 pagesCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNo ratings yet

- Sampleexam 2 BDocument13 pagesSampleexam 2 Btrs1234No ratings yet

- Accounting ReviewDocument68 pagesAccounting Reviewcrazycoolnisha75% (4)

- HW 15-2 Task Budget Prep MCQ StudDocument5 pagesHW 15-2 Task Budget Prep MCQ StudКсения НиколоваNo ratings yet

- Chapter 7 PracticeDocument9 pagesChapter 7 Practicehola holaNo ratings yet

- BUDGETINGDocument3 pagesBUDGETINGkhyla Marie NooraNo ratings yet

- Chapters 6-12 Managerial Accounting ProblemsDocument7 pagesChapters 6-12 Managerial Accounting ProblemsVivek BhattNo ratings yet

- Managerial Accounting Problems on Budgets and Budgetary ControlDocument10 pagesManagerial Accounting Problems on Budgets and Budgetary ControlParthasarathi MishraNo ratings yet

- Budgets Exercises StudentDocument5 pagesBudgets Exercises Studentديـنـا عادل0% (1)

- BASTRCSX-Learning-Activity-5_with-answersDocument10 pagesBASTRCSX-Learning-Activity-5_with-answersChel EscuetaNo ratings yet

- BUDGET SCHEDULES /TITLEDocument9 pagesBUDGET SCHEDULES /TITLEalice horanNo ratings yet

- Day 12 Chap 7 Rev. FI5 Ex PRDocument11 pagesDay 12 Chap 7 Rev. FI5 Ex PRkhollaNo ratings yet

- EXAMMINEEEEENNNNDocument5 pagesEXAMMINEEEEENNNNLopez, Azzia M.No ratings yet

- Completing A Master BudgetDocument2 pagesCompleting A Master BudgetPines MacapagalNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- Chapter 07 - Exercises - Part IDocument2 pagesChapter 07 - Exercises - Part IRawan YasserNo ratings yet

- DocxDocument6 pagesDocxMico Duñas CruzNo ratings yet

- Exam 3 Review ProblemsDocument8 pagesExam 3 Review ProblemsEmily ArchieNo ratings yet

- Adoption of variable costing for managerial decision makingDocument6 pagesAdoption of variable costing for managerial decision makingFabian NonesNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 7aDocument14 pagesProgrammazione e Controllo Esercizi Capitolo 7aMavzky RoqueNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- BudgetingDocument28 pagesBudgetingJade Gomez50% (2)

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- 3129 - Acctg 202 - Midterm - Take-Home Activity #1 - BudgetingDocument1 page3129 - Acctg 202 - Midterm - Take-Home Activity #1 - Budgetingsheardy limNo ratings yet

- Study Guide For Mgr. Exam 2Document10 pagesStudy Guide For Mgr. Exam 2Skirmante ZalysNo ratings yet

- Tip-Top Cleaning Supply budget and cash collection analysisDocument39 pagesTip-Top Cleaning Supply budget and cash collection analysisNguyễn Vũ Linh NgọcNo ratings yet

- Bella Beauty Salon Adjusting Journal EntriesDocument7 pagesBella Beauty Salon Adjusting Journal EntriesFawad ShahNo ratings yet

- Basic Operating BudgetDocument6 pagesBasic Operating BudgetalyNo ratings yet

- Quizz C1Document10 pagesQuizz C1Phương Vy TrầnNo ratings yet

- Accounting FEDocument14 pagesAccounting FEWee CanNo ratings yet

- Tutorial Revision QuestionsDocument5 pagesTutorial Revision QuestionsJoan LauNo ratings yet

- Profit Planning ExerciseDocument9 pagesProfit Planning ExerciseIftekhar Uddin M.D EisaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- QS17 - Class Exercises SolutionDocument4 pagesQS17 - Class Exercises Solutionlyk0texNo ratings yet

- QS14 - Class Exercises SolutionDocument4 pagesQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS17 - Class ExercisesDocument4 pagesQS17 - Class Exerciseslyk0texNo ratings yet

- QS16 - Class ExercisesDocument5 pagesQS16 - Class Exerciseslyk0texNo ratings yet

- QS15 - Class Exercises SolutionDocument5 pagesQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS15 - Class ExercisesDocument4 pagesQS15 - Class Exerciseslyk0texNo ratings yet

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- QS16 - Class Exercises SolutionDocument5 pagesQS16 - Class Exercises Solutionlyk0texNo ratings yet

- QS12 - Class ExercisesDocument2 pagesQS12 - Class Exerciseslyk0texNo ratings yet

- QS14 - Class ExercisesDocument4 pagesQS14 - Class Exerciseslyk0texNo ratings yet

- QS13 - Class ExercisesDocument2 pagesQS13 - Class Exerciseslyk0texNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class ExercisesDocument5 pagesQS11 - Class Exerciseslyk0texNo ratings yet

- QS12 - Class Exercises SolutionDocument2 pagesQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS08 - Class ExercisesDocument4 pagesQS08 - Class Exerciseslyk0texNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- QS10 - Class Exercises SolutionDocument2 pagesQS10 - Class Exercises Solutionlyk0texNo ratings yet

- QS10 - Class ExercisesDocument1 pageQS10 - Class Exerciseslyk0texNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- QS07 - Class ExercisesDocument8 pagesQS07 - Class Exerciseslyk0texNo ratings yet

- QS06 - Class Exercises SolutionDocument2 pagesQS06 - Class Exercises Solutionlyk0texNo ratings yet

- QS06 - Class ExercisesDocument3 pagesQS06 - Class Exerciseslyk0texNo ratings yet

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- QS04 - Class ExercisesDocument3 pagesQS04 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class ExercisesDocument2 pagesQS05 - Class Exerciseslyk0texNo ratings yet

- QS04 - Class Exercises SolutionDocument3 pagesQS04 - Class Exercises Solutionlyk0texNo ratings yet

- Baye Teaching Note AAirlines Case 6eDocument4 pagesBaye Teaching Note AAirlines Case 6evancouverkt100% (2)

- Digital Marketing For The Agribusiness Industry - IDSDocument4 pagesDigital Marketing For The Agribusiness Industry - IDSSanat KumbharNo ratings yet

- Accrual EngineDocument6 pagesAccrual EngineSatya Prasad0% (1)

- ICICI Bank Key Financial Ratios AnalysisDocument2 pagesICICI Bank Key Financial Ratios AnalysisSriharsha KrishnaprakashNo ratings yet

- A Short Review On Basic FinanceDocument4 pagesA Short Review On Basic FinanceJed AoananNo ratings yet

- The Multichannel Challenge at Natura in Beauty and Personal CareDocument14 pagesThe Multichannel Challenge at Natura in Beauty and Personal CareMaría José Chávez Estrada0% (1)

- Accounting for Merchandising OperationsDocument4 pagesAccounting for Merchandising OperationskanyaNo ratings yet

- IFM Case 2 Hedging Currency RiskDocument15 pagesIFM Case 2 Hedging Currency RiskPreemnath Katare0% (1)

- Marginal Costing vs Absorption Costing: Key DifferencesDocument23 pagesMarginal Costing vs Absorption Costing: Key DifferencesPei IngNo ratings yet

- A-Level Economics - The Price System and The Micro Economy (Objectives of Firms)Document43 pagesA-Level Economics - The Price System and The Micro Economy (Objectives of Firms)l PLAY GAMESNo ratings yet

- Case 2Document4 pagesCase 2Christian King IlardeNo ratings yet

- Amundi Etf Euro InflationDocument3 pagesAmundi Etf Euro InflationRoberto PerezNo ratings yet

- Financial Accounting & ReportingDocument4 pagesFinancial Accounting & Reportingkulpreet_20080% (1)

- The State of The Influencher China 2023Document46 pagesThe State of The Influencher China 2023Shield ShieldNo ratings yet

- Advanced Cost and Management AccountingDocument3 pagesAdvanced Cost and Management AccountingSharvin MoorthyNo ratings yet

- SCI (Function of Expense Method) Tiger CompanyDocument2 pagesSCI (Function of Expense Method) Tiger Companypatricia0% (1)

- SEGMENTATION STRATEGY NestleDocument3 pagesSEGMENTATION STRATEGY Nestlekamranullah50% (4)

- Innovative Financial Instruments in IndiaDocument44 pagesInnovative Financial Instruments in IndiaAnkit VermaNo ratings yet

- Analyzing Divisional Performance and Transfer PricingDocument44 pagesAnalyzing Divisional Performance and Transfer Pricingbryan albert0% (1)

- FMCG Industry Report - PWCDocument9 pagesFMCG Industry Report - PWCHemanth19591No ratings yet

- Intro to Regional Econ and Theories of Firm LocationDocument12 pagesIntro to Regional Econ and Theories of Firm LocationLolita IsakhanyanNo ratings yet

- Unmmad Sponsorship Vertical TaskDocument2 pagesUnmmad Sponsorship Vertical TaskTavish MeenaNo ratings yet

- Gladstone Company Tracks The Number of Units Purchased and SoldDocument1 pageGladstone Company Tracks The Number of Units Purchased and SoldFreelance WorkerNo ratings yet

- EOQ & Reorder Point ActivityDocument2 pagesEOQ & Reorder Point ActivityCatherine OrdoNo ratings yet

- Chapter 05 Supply, Demand, and Government PoliciesDocument10 pagesChapter 05 Supply, Demand, and Government PoliciesAdiba ZuberiNo ratings yet

- Bus Software Week 3Document4 pagesBus Software Week 3Ashley Niña Lee HugoNo ratings yet

- Chapter 22 Impairment of AssetsDocument13 pagesChapter 22 Impairment of AssetsPacifico HernandezNo ratings yet

- Https Blog - Ipleaders.in Financial Strategies Can Adopt Non ProDocument19 pagesHttps Blog - Ipleaders.in Financial Strategies Can Adopt Non ProShingirayi MazingaizoNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Break-Even Point: Break Even Point Is The Level of Sales at Which Profit Is Zero and Loss IsDocument3 pagesBreak-Even Point: Break Even Point Is The Level of Sales at Which Profit Is Zero and Loss IsZahid BabaićNo ratings yet