Professional Documents

Culture Documents

Financial Literacy

Uploaded by

lDalton132Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Literacy

Uploaded by

lDalton132Copyright:

Available Formats

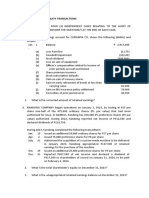

Quiz 1 Financial Literacy

Understanding the Midshipman Pay System

-

Midshipman Pay is 35% of the base pay of an O-1 with under 2 years of service

In 2014 that Pay is $1,017

1/C get between $430-$805

My Pay

o Mypay.dfas.mil/mypay.aspx

o Maintained by the Defense Finance and Accounting Service

o Provides paycheck and tax info for military members, retirees and civilian works

o Must change password every 60 days

Leave and Earning Statement (LES)

o A comprehensive list of a leave and earning statements

o It is the Midshipmans responsibility to monitor pay, identify issues and inform the

disbursing office.

Advance for Clothing and Equipment (ACE) Loan

o Interest free loan for equipment usually around $17,500

o Midshipman can apply for outside funding that can subsidize their loans and repay them

Pay Day

o Midshipman get paid on the first day of a month for the previous months work

Held Pay

o Extra pay that is accumulated each month to pay for expenses

o Paid out in December and July

o 1/C do not receive this because they receive their full pay

Taxes

o Midshipman are subject to:

Federal income Tax Withholding

Federal Insurance Contribution Act Withholding

State Income Tax Withholding

o Marital Status: Single, Number of exemptions: 01, State of Legal residence ________

Servicemember Group Life Insurance (SGLI)

o Rates are 6.5 cents per $1000 in coverage

o Increments of 50k up to 400k

Naval Academy Business Services Division (NABSD)

o In charge of Mid Store, Uniform Store, Textbook Store

o The more you charge on the Midstore card, The less Held pay you get

Charitable Allotments

o Able to donate to Combined Federal Campaign and Navy Marine Corp Relief Society

o CFC January March, NMCRS April June

Travel Reimbursement

o All official travel will be reimbursed

Commuted Rations (COMRATS)

o You earn $11.85 per day on leave

Personal Finance

Financial Tools The following is a list of financial tools, Learn how to use them and not abuse them

-

Checking account Very liquid form of storage easy to withdraw or deposit

Savings Account A deposit held at a bank earns modest interest not as liquid

Money Market Account An interest bearing account that has higher interest rates but

withdraws can be limited

Certificates of Deposit (CD) An account that is set of a specific time, your money is unavailable

until that time, Interest bearing

Bonds When you give money to an entity (corporate, government) for a set time and you get it

back with interest

Mutual Funds When a group pools money and then invests it in securities

Exchange Traded Funds Similar to a stock, but compiles a section of the market instead

Stocks A type of security for a cooperation, Common allows you a shareholder vote, Preferred

does not

Individual Retirement Accounts (IRA) An investing tool to earn earmark savings for retirement

when your 59.5 withdrawal from Traditional are taxed, Roth are not

Money Habits

-

Good Habits

o Budgeting

o Saving

o Spending within your means

o Not carry a credit card balance

o Save for retirement

Bad Habits

o Lack of budgeting

o Not saving Money

o Living above your means

o Maxed out credit cards

Assets vs. Liabilities

-

Assets Things that put money in your pocket

Liabilities Things that take money out of your pocket

Interest

-

Compound counts the money that you have already made off of interest

Simple Only counts the initial money that you put into the account

Service Members civil relief act caps all interest on pre-military loans/credit cards at 6%

Credit Reports

-

Get from myfico.com or annualcreditreport.com

The three agencies are Experian, Equifax and Transunion

You are your only auditor

o <630 Bad

o 630 689 Fair

o 690 719 Good

o 720 850 Excellent

US NAVY can look at credit score to determine security clearance

Report any credit fraud at said websites

USNA Contacts

-

Mid Dispusing Officer

LT Deschamps

3-3307

4002

Mid Financial Advisor

LTJG Lopez

3-7023

3008

You might also like

- Personal Budgeting Research ProperDocument46 pagesPersonal Budgeting Research ProperKrislynNo ratings yet

- TOPIC: Mismanagement of Financial Aid Among Student in Usim: Section A: Demographic ProfileDocument2 pagesTOPIC: Mismanagement of Financial Aid Among Student in Usim: Section A: Demographic ProfileMuhammad Amirull Adlan0% (1)

- 02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementDocument9 pages02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementLee K.No ratings yet

- Spending Pattern of Department of Education Personnel in The Province of Ilocos Norte Basis in Crafting Financial Empowerment ProgramsDocument36 pagesSpending Pattern of Department of Education Personnel in The Province of Ilocos Norte Basis in Crafting Financial Empowerment ProgramsAngelica De Castro ObianoNo ratings yet

- QUESTIONNAIREDocument1 pageQUESTIONNAIREKaye Jay EnriquezNo ratings yet

- Chapter 1 Introduction To Personal Financial ManagementDocument9 pagesChapter 1 Introduction To Personal Financial ManagementLee K.No ratings yet

- Questionnaire On The Financial Management Behavior and Financial WellDocument2 pagesQuestionnaire On The Financial Management Behavior and Financial WellJenalyn Miranda Cayanan - MarayagNo ratings yet

- QuestionnaireDocument11 pagesQuestionnaireReven Villarta50% (2)

- Correlation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONDocument11 pagesCorrelation of Spending Habits of Grade 11 Studets To Their Financial Literacy in WITI. II AIONrainier reoladaNo ratings yet

- Survey Questionnaire Dear Respondents,: Check Mark On The Space Provided That Corresponds To Your ResponseDocument12 pagesSurvey Questionnaire Dear Respondents,: Check Mark On The Space Provided That Corresponds To Your ResponseJeffrey R. Abad100% (3)

- Financial Literacy and Management of Junior High SchoolDocument20 pagesFinancial Literacy and Management of Junior High SchoolJianne AbinalesNo ratings yet

- Reviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLDocument3 pagesReviewed QUESTIONNAIRE ON THE FINANCIAL MANAGEMENT BEHAVIOR AND FINANCIAL WELLJenalyn Miranda Cayanan - Marayag100% (1)

- TheLevelofSpendingHabitsamongAccountancyBusinessandManagementStudentsofTacurongNationalHighSchoolBasisforProgramIntervention PDFDocument48 pagesTheLevelofSpendingHabitsamongAccountancyBusinessandManagementStudentsofTacurongNationalHighSchoolBasisforProgramIntervention PDFJosie GimenaNo ratings yet

- Draft 2 Financial Literacy Survey Questionnaire NewDocument2 pagesDraft 2 Financial Literacy Survey Questionnaire NewEarvin John Medina86% (49)

- QuestionnaireDocument6 pagesQuestionnaireKyle Angela TrinidadNo ratings yet

- Financial Literacy of High School Students: Lewis MandellDocument2 pagesFinancial Literacy of High School Students: Lewis MandellDUDE RYANNo ratings yet

- Financial Literacy of Senior High Teachers QuestionnaireDocument3 pagesFinancial Literacy of Senior High Teachers QuestionnaireFatima Portillo Caro100% (2)

- Financial LiteracyDocument13 pagesFinancial LiteracyMaica Amoyo MadeloNo ratings yet

- Saving and SpendingDocument3 pagesSaving and SpendingRaenessa FranciscoNo ratings yet

- Financial Management Among StudentsDocument4 pagesFinancial Management Among Students우김민No ratings yet

- Article 16 Assessment of Family Income PDFDocument16 pagesArticle 16 Assessment of Family Income PDFCrystel Jane Nantes ResumaderoNo ratings yet

- QuestionnaireDocument22 pagesQuestionnaireJennifer100% (1)

- KweengDocument39 pagesKweengJulius Allen dawisNo ratings yet

- Chapter Two Review of Related Literature This Chapter Does A Review On Relevant Literature From Articles, Journals, Books andDocument11 pagesChapter Two Review of Related Literature This Chapter Does A Review On Relevant Literature From Articles, Journals, Books andJimbo ManalastasNo ratings yet

- Questionnaire Financial Crisis FinalDocument12 pagesQuestionnaire Financial Crisis FinalTushar PuriNo ratings yet

- Saving Habit in Unisza StudentDocument16 pagesSaving Habit in Unisza StudentRj Firdaus Ramli75% (4)

- O o o o o o o o o o o o o o o o o o o O: Financial Literacy Survey QuestionnaireDocument5 pagesO o o o o o o o o o o o o o o o o o o O: Financial Literacy Survey QuestionnaireNerissa Daluyen100% (2)

- Determinants of Saving BehaviourDocument11 pagesDeterminants of Saving BehaviourGeda wakoNo ratings yet

- Survey Questionnaire FinalDocument2 pagesSurvey Questionnaire FinalJan Dave Ogatis100% (1)

- Revised Theorical Literature & Financial Literacy OnlyDocument14 pagesRevised Theorical Literature & Financial Literacy OnlyHara DoNo ratings yet

- Questionnaires Survey Financial Literacy Personal Financial Management Practices Amongst Working Adults in Klang Valley MalaysiaDocument6 pagesQuestionnaires Survey Financial Literacy Personal Financial Management Practices Amongst Working Adults in Klang Valley MalaysiaNirvana Nircis100% (3)

- 2023 Financial Literacy QuestionnaireDocument1 page2023 Financial Literacy QuestionnaireDUDE RYANNo ratings yet

- Financial Literacy and Personal Saving BehaviorDocument15 pagesFinancial Literacy and Personal Saving BehaviorTitser FjaneNo ratings yet

- Spending and BehaviorDocument5 pagesSpending and BehaviorJulius Neil Robin100% (1)

- Spending & Saving Habits of Youth in The City of AurangabadDocument8 pagesSpending & Saving Habits of Youth in The City of Aurangabadthesij100% (2)

- Chapter 1Document5 pagesChapter 1Aron Matthew Dela Cruz MolinaNo ratings yet

- Chapter 1Document14 pagesChapter 1Van Frederick PortugalNo ratings yet

- Survey QuestionnaireDocument2 pagesSurvey QuestionnaireJess Jess100% (1)

- The Impact of Money Attitude On PersonalDocument10 pagesThe Impact of Money Attitude On PersonalMotiram paudelNo ratings yet

- Keywords:-Financial Literacy, Financial Behavior, LocusDocument10 pagesKeywords:-Financial Literacy, Financial Behavior, LocusInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Research Group 3Document21 pagesResearch Group 3Ella RamosNo ratings yet

- Chapter 2Document11 pagesChapter 2Josalyn Cervantes AbudaNo ratings yet

- Students That Are Given The Responsibility To Manage Their Own Expenses Coupled With A Higher Cost of Education Puts The Students in A Situation That It Is Vital To Live On A Restricted BudgetDocument3 pagesStudents That Are Given The Responsibility To Manage Their Own Expenses Coupled With A Higher Cost of Education Puts The Students in A Situation That It Is Vital To Live On A Restricted BudgetchristineNo ratings yet

- Financial Literacy and Decision MakingDocument12 pagesFinancial Literacy and Decision MakingFaizan JavedNo ratings yet

- The Impact of Financial Literacy On Personal Retirement Planning in Sri LankaDocument1 pageThe Impact of Financial Literacy On Personal Retirement Planning in Sri LankaBhagya SewwandiNo ratings yet

- Financial Literacy of Professional and Pre-ServiceDocument9 pagesFinancial Literacy of Professional and Pre-ServicejosephNo ratings yet

- Definition of TermsDocument5 pagesDefinition of TermsAdonis Corowan100% (1)

- Philippine Christian University Union High School of Manila Senior High SchoolDocument24 pagesPhilippine Christian University Union High School of Manila Senior High SchoolDaniela Mae Pangilinan100% (1)

- The Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024Document19 pagesThe Relationship Between Money Allowance and Budgeting Skills of Abm Students in Holy Nazarene Christian School Year 2023-2024neilcasupang1No ratings yet

- RRLDocument15 pagesRRLVince Cinco Parcon100% (1)

- Spending Habits Among Malaysian University Students1Document6 pagesSpending Habits Among Malaysian University Students1Julia PerezNo ratings yet

- Reviews of Related LiteratureDocument7 pagesReviews of Related LiteratureShereen Grace GaniboNo ratings yet

- Philippine Women's College of Davao Strategies in BudgetingDocument14 pagesPhilippine Women's College of Davao Strategies in BudgetingKarl NepomucenoNo ratings yet

- Financial Literacy Among SHS Students This Time of PandemicDocument21 pagesFinancial Literacy Among SHS Students This Time of PandemicRovecil FloresNo ratings yet

- Personal Financial Management Practices and Lived Experiences of Teachers in The Third Congressional District of QuezonDocument10 pagesPersonal Financial Management Practices and Lived Experiences of Teachers in The Third Congressional District of QuezonPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Saving HabitDocument5 pagesSaving HabitAtiqah Zawani100% (2)

- Likert ScaleDocument4 pagesLikert ScaleSefNo ratings yet

- Unit 4: Investment VehiclesDocument29 pagesUnit 4: Investment Vehiclesworld4meNo ratings yet

- Accounting 202 Notes - David HornungDocument28 pagesAccounting 202 Notes - David HornungAvi Goodstein100% (1)

- Lesson 22 - FinanceDocument9 pagesLesson 22 - FinanceStyven KyomenNo ratings yet

- New Balance CR$100.00 Minimum Payment Due $0.00 Payment Not RequiredDocument6 pagesNew Balance CR$100.00 Minimum Payment Due $0.00 Payment Not RequiredKendall Battaglini100% (1)

- Debt Collection Article PDFDocument38 pagesDebt Collection Article PDFAlexandria BurrisNo ratings yet

- CHAPTER 18: Mutual Funds: Types and FeaturesDocument18 pagesCHAPTER 18: Mutual Funds: Types and Featureslily northNo ratings yet

- Engr 222 NotesDocument89 pagesEngr 222 NotesnandiniNo ratings yet

- Case Studies - Various Sources of Frauds in ADCsDocument15 pagesCase Studies - Various Sources of Frauds in ADCsJayant RanaNo ratings yet

- Submitted By: Anmol Hindwani (Pgsf1907) : Bank Performance AnalysisDocument20 pagesSubmitted By: Anmol Hindwani (Pgsf1907) : Bank Performance AnalysisSurbhî GuptaNo ratings yet

- Xavier Institute of Management: PGPBFS 2010-2011Document21 pagesXavier Institute of Management: PGPBFS 2010-2011Tanmay MohantyNo ratings yet

- BIR RULING NO. 100-17: SGV & CoDocument10 pagesBIR RULING NO. 100-17: SGV & CoThe GiverNo ratings yet

- SHR TCDocument2 pagesSHR TCManikandanNo ratings yet

- The Revenue CycleDocument36 pagesThe Revenue CycleGerlyn Dasalla ClaorNo ratings yet

- Excel Shortcut Master KeyDocument15 pagesExcel Shortcut Master KeyBajazid NadžakNo ratings yet

- 04 2013-2014 Financial AgreementDocument2 pages04 2013-2014 Financial Agreementapi-234678525No ratings yet

- Mutual FundDocument47 pagesMutual FundSubhendu GhoshNo ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingJunaid IslamNo ratings yet

- Personal Financial PlannerDocument18 pagesPersonal Financial PlannerBeastPlaysNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Nafith Logistics Services LLC Tax InvoiceDocument1 pageNafith Logistics Services LLC Tax InvoiceMaan JuttNo ratings yet

- English Q1W1-G5Document221 pagesEnglish Q1W1-G5JONALYN EVANGELISTANo ratings yet

- KTT - CASH - TRANSFER - AGREEMENT - 2022 - 02 - 01 10B (1) SignedDocument11 pagesKTT - CASH - TRANSFER - AGREEMENT - 2022 - 02 - 01 10B (1) SignedDEPO KELAPA BANG WAHYU100% (1)

- C1 - Guaranty Trust Bank PLC Nigeria (A)Document15 pagesC1 - Guaranty Trust Bank PLC Nigeria (A)Anisha RaiNo ratings yet

- Statement of Cash FlowsDocument13 pagesStatement of Cash FlowsAldrin ZolinaNo ratings yet

- Ud. Buana Jurnal Penyesuaian: Bulan Desember 2021Document10 pagesUd. Buana Jurnal Penyesuaian: Bulan Desember 2021jefrifirmantoeNo ratings yet

- Montis Investor DeckDocument22 pagesMontis Investor DeckWalid El AmineNo ratings yet

- Equity Exercises 1Document3 pagesEquity Exercises 1alcazar rtuNo ratings yet

- Coral - Commitment LetterDocument283 pagesCoral - Commitment LetterMarius AngaraNo ratings yet

- Financial Statement Analysis and Valuation of Ratanpur Steel Re-Rolling Mills Ltd. & GPH Ispat Ltd.Document33 pagesFinancial Statement Analysis and Valuation of Ratanpur Steel Re-Rolling Mills Ltd. & GPH Ispat Ltd.Imtiyaz Khan100% (3)

- Modern Theory of Interest: IS-LM CurveDocument36 pagesModern Theory of Interest: IS-LM CurveSouvik DeNo ratings yet

- 7a Exact and Ordinary InterestDocument9 pages7a Exact and Ordinary InterestVj McNo ratings yet

- Application New 2023Document8 pagesApplication New 2023SFS LOANSNo ratings yet

- Invoice IXITRS185875952789718Document1 pageInvoice IXITRS185875952789718PatriotNo ratings yet