Professional Documents

Culture Documents

Electronic Funds Transfers

Uploaded by

IjctJournalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Electronic Funds Transfers

Uploaded by

IjctJournalsCopyright:

Available Formats

International Journal of Computer Techniques - Volume1 Issue 1

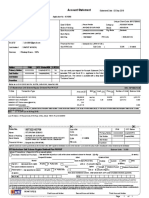

Electronic Funds Transfers (EFTs)

S. Rajeshwar, M. Naveen Kumar, B. Nehru and V. Biksham ,Syed Shah M. and Farooq Javed Sri Indu

College of Engineering and Technology

Abstract:

Use a discount broker:

EFT stands for "Electronic Funds Transfer"

and represents the way your business can receive

direct deposit of all payments from the

Commonwealth to your company bank account.

Once you sign up, money comes to you directly

and sooner than ever before. EFT is Fast, Safe,

and means that your money will be confirmed in

your bank account quicker than if you have to

wait for the mail, deposit your check, and wait

for the funds to become available. All you have

to do is complete the form, print it, sign, and

mail to the Department you do business with.

We will take care of the rest. Within three to

four weeks you will be fully established on EFT

and can start receiving your money sooner.

When trading, one of the best things you can do

is open an account with a discount broker. These

are brokers that usually offer online investing

services at a discount. You can get discounts

(usually a flat rate) on trades, being charged

mainly when you buy or sell. Usually, a discount

broker comes with two advantages: you dont

pay as much for trading and the account

minimums are usually lower. However, when

you use a discount broker, you are usually on

your own when it comes to choosing

investments; no expert advice. (Some discount

brokers do offer advisement services la carte.)

Automatic Investments:

Exchange traded funds represent one of the

fastest growing investments available today.

While ETFs are a relatively new investment

vehicle, they are growing in popularity due to

their relative simplicity, built-in diversity and

low costs. There are many who see advantages

in ETFs, since they are not only well-suited for

long-term, buy and hold investing, but can also

be adapted for use in short-term trading

strategies and even options and shorting.

Dont trade too often:

Buy and hold is one of the most effective ways

to save money on any investing. Whether you

are looking for a mutual fund with low turnover

or investing in individual equities, it can be to

your benefit to avoiding trading too often the

fees will start to stack up. Because ETFs are

traded like stocks on the market, you incur the

same brokerage fees and/or commissions that

any normal stock would end up with. If you

trade ETFs often, you will start to rack up fees.

ISSN: 2394 - 2231

Page

Look for ETFs with low expense ratios:

Funds have expense ratios. Some funds have

higher ratios than others. The same is true of

ETFs. Expense ratios on ETFs are often in the

0.15% to 0.50% range, although there are some

ETFs with lower or higher expense ratios. As

you might guess, the lower your expense ratio,

the more of your money is actually invested.

While this is important, it is important to realize

that choosing a good ETF goes beyond expense

ratios. Per-trade fees can erase your potential

and your expense ratio savings. So choose

wisely (low expense ratio), and dont trade to

often. This is actually sound advice when you

are buying index funds and mutual funds as

well. However, realize that index funds and

ETFs have lower costs than mutual funds.

Be aware of taxes:

Taxes will get you every time. If you are not

careful, you will find yourself owing taxes.

Everyone talks about how ETFs have great tax

efficiency, but you have to know what you are

doing in order to take advantage of ETFs. You

http://www.ijctjournal.org

1|

International Journal of Computer Techniques - Volume1 Issue 1

have to pay taxes on dividends earned from

ETFs. For qualified dividends, you are taxed

between 5% and 15%, depending on your tax

bracket. In the highest bracket, you only pay

15%. However, with unqualified dividends, you

pay the same rate as your income tax bracket. If

you want to invest in ETFs that pay dividends,

make sure you know whether they are qualified

or not. Also, consider long-term vs. short-term

capital gains. Try to wait at least a year to sell

your investment, since long-term capital gains

taxes are lower than short-term capital gains

taxes. (Since I am not a tax professional, it is a

good idea to consult one to get an even better

idea of your situation, and what you can do to

reduce costs.)

Watch out for automatic investment plans for

ETFs:

This means that there are the same sort of

mutual fund fees involved. You might be

surprised, if you do not do your due diligence

when investigating ETFs, to find that the costs

are higher than you expected because you

might not be invested in a true ETF.

Watch out for brokerage fees:

Even with a discount broker, there are fees.

Make sure you understand what the broker fees

are for, and try to avoid them. Watch for

recurring fees, and make sure you maintain the

required account minimum. Also, realize that

dividends from ETFs are paid in cash, and not

automatically reinvested. While some brokers

will allow you to reinvest the dividends into an

ETF for no extra fee or charge, there are brokers

who will charge you the transaction fee when

you reinvest.

One of the mistakes you can make when when

investing in ETFs is to get too into dollar cost

averaging. While dollar cost averaging can be a

good strategy for any type of investment, it is

important to be careful when using it with ETFs.

Since ETFs (unlike mutual funds) are traded like

stocks, you are charged the transaction fee each

time. A weekly investment of $25 or even $50

into an ETF can quickly be eroded. On the other

hand, you can use dollar cost averaging with

ETFs on a monthy or quarterly basis. Dollar cost

averaging is just regularly putting in the same

amount of money. You can do this more spread

out with ETFs to lower your costs. $200 a month

or $800 a quarter into an ETF will be more costefficient than breaking it up into a weekly thing.

Online Security at Fidelity:

Avoid non-ETF ETFs:

How we keep you safe:

To protect your information and assets, Fidelity

employs extensive physical, electronic, and

procedural controls, regularly adapting them as

technology and new threats evolve. Our security

measures are designed specifically to protect

you and your accounts regardless of how you

access uson a computer, on a mobile device,

Let me explain. There is a definite difference

between exchange-traded funds that are really

closed-end mutual funds and ETFs. Closed-end

mutual funds are traded during the day in a way

similar to stocks. However, they are still mutual

funds, and they are usually actively managed.

ISSN: 2394 - 2231

Page

We employ the latest technology and security

best practices to keep your accounts safe. You

can also take action to help us protect you

online.

http://www.ijctjournal.org

2|

International Journal of Computer Techniques - Volume1 Issue 1

or by phone. We want your access to be secure

as well as convenient. Although we cannot

disclose all of our security tactics, here are just a

few of the measures we take.

electronic barriers that prevent unauthorized

access to our networks.

Implementing username

requirements :

Fidelity has special deals with leading virus scan

vendors, helping you protect your computer. The

software is easy to install and runs in the

background without slowing down your

computer.

and

password

When you set up your online access, you create

your own unique username and secret password,

allowing you safe and secure access to your

accounts. We have proprietary monitoring and

other protective procedures in place, some of

which are visible to customers, such as limits on

password entry attempts.

Free software offers :

Secure email :

The technology we deploy for our customer

emails enables us to digitally sign our messages

so that our customers can verify that the

messages have not been forged or altered.

Customer verification :

Timed logoff :

No matter how you contact Fidelityonline, by

phone, or at an Investor Centerwe verify your

identity before granting you access to your

accounts.

Our websites automatically log you off after an

extended period of inactivity. This reduces the

risk that others could access your information

from your unattended computer or mobile

device.

Security questions :

Transaction Security :

If you or someone else tries to log in from a

computer we dont recognize, we may challenge

you with one of the enhanced security questions

which you previously answered when you

enrolled. This helps us ensure that it is really

you accessing your account.

Strong encryption :

We employ some of the strongest methods of

encryption commercially available today,

protecting your personal information, like your

username and password or the contents of your

portfolio, as it travels from your computer to our

systems.

Firewalls :

Certain transactions on Fidelity.com require a

six-digit code as an extra layer of security. To

receive these codes via text message.

Constant systems surveillance :

Our security teams monitor our systems around

the clock, ensuring you have timely and secure

access to your accounts.

Security at Fidelity worksites:

Because we also print and deliver documents

containing sensitive personal information, all

such work areas are monitored continuously and

restricted to only authorized personnel.

To block unauthorized access, all of our

computer systems are protected by firewalls or

ISSN: 2394 - 2231

Page

http://www.ijctjournal.org

3|

International Journal of Computer Techniques - Volume1 Issue 1

Restricted access to customer data :

Protect Your Accounts:

Just as we limit physical access to our work

areas, we also restrict access to systems

containing customer data and constantly monitor

access to these systems.

Use strict password criteria:

Employee education :

Our employees receive thorough training on our

security policies and are held accountable for

adhering to them. Employees who work directly

with customers also receive training on

emerging risks, such as identity theft.

Payment system:

The payment system is an operational

network - governed by laws, rules and

standards - that links bank accounts and

provides the functionality for monetary

exchange using bank deposits.[1] The

payment system is the infrastructure

(consisting of institutions, instruments,

rules, procedures, standards,and technical

means) established to effect the transfer of

monetary value between parties discharging

mutual obligations. Its technical efficiency

determines the efficiency with which

transaction money is used in the economy,

and risk associated with its use.

What makes it a "system" is that it employs

cash-substitutes;

traditional

payment

systems are negotiable instruments such as

drafts (e.g., checks) and documentary credits

such as letter of credits. With the advent of

computers and electronic communications a

large number of alternative electronic

payment systems have emerged. These

include debit cards, credit cards, electronic

funds transfers, direct credits, direct debits,

internet banking and e-commerce payment

systems. Some payment systems include

credit mechanisms, but that is essentially a

different aspect of payment.

ISSN: 2394 - 2231

Page

A tough password can be your first line of

defense against someone trying to access

one of your online accounts.

Avoid predictable or easily guessed

passwords:

This includes your date of birth, nickname,

pets name or your Social Security number,

which is fairly easy for someone to obtain.

Many sites will prevent you from using your

SSN or date of birth as a password.

Dont reuse password:

Passwords can be difficult to remember, but

if an unauthorized person can gain access to

one of them, many more accounts for which

you have the same login could be

compromised.

Keep your passwords and reminders safe:

Treat your passwords as you would the key

to your home. If you must write them down,

keep them in a safe place or in a computer

file with an unassuming filename. Consider

using a password vault or password keeper

application to help you remember your

passwords.

Never provide your password in response

to an email:

No reputable company will ever ask you for

your username and password in an email. If

you get such an email, it is likely a scam or

phishing.

Take advantage of password recovery

features:

Many websites ask you to keep a secret

question on file in the event you forget your

password or need to change it. Some can

http://www.ijctjournal.org

4|

International Journal of Computer Techniques - Volume1 Issue 1

send you a random code via text message to

allow you to reset it.

Reference:

[1] L. Yi-bo, X. Hong, and Z. Sen-yue, The

Wrinkle generation method.

[2] Y. Rener, J. Wei, and C. Ken, Down

sample- based multiple description coding and

post- processing of decoding.

[3] H. Demirel, G. Anbarjafari, and S.

Izadpanahi, Improved motionbased .

[4] Y. Piao, I. Shin, and H. W. Park, Image

resolution.

[5] H. Demirel and G. Anbarjafari, Satellite

image resolution.

ISSN: 2394 - 2231

Page

http://www.ijctjournal.org

5|

You might also like

- 1.10 Advantages of Mutual Funds:: 1. DiversificationDocument6 pages1.10 Advantages of Mutual Funds:: 1. DiversificationSmartboy AmitNo ratings yet

- Mutual FundDocument5 pagesMutual FundVikas JhaNo ratings yet

- Introduction PROJECTDocument73 pagesIntroduction PROJECTarshad778866No ratings yet

- Top Online Brokers Compared: Find the Best for Your NeedsDocument7 pagesTop Online Brokers Compared: Find the Best for Your NeedsKevin Johan OlarteNo ratings yet

- Top 5 Technical Indicators for ETF Trading: Illustrated by ExamplesFrom EverandTop 5 Technical Indicators for ETF Trading: Illustrated by ExamplesRating: 3 out of 5 stars3/5 (7)

- Stock Trading GuideDocument4 pagesStock Trading GuideJuneil M. GoNo ratings yet

- Binary Options: Welcome ToDocument25 pagesBinary Options: Welcome ToSimon GnosticusNo ratings yet

- Online Trading SecuritiesDocument17 pagesOnline Trading SecuritiestusharsatheNo ratings yet

- Begin with Mutual Funds and ETFs for Easy InvestingDocument3 pagesBegin with Mutual Funds and ETFs for Easy InvestingNiña Rica PunzalanNo ratings yet

- Make Your Money Work For You With Equity InvestmentsDocument7 pagesMake Your Money Work For You With Equity Investmentsreddyreshma44_414448No ratings yet

- ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term InvestingFrom EverandETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term InvestingRating: 2 out of 5 stars2/5 (1)

- Insurance As An Investment StrategyDocument33 pagesInsurance As An Investment StrategySimran khandareNo ratings yet

- What Is A Share ?: Share Market Basics - Explained Demat Account Definition Demat Refers To A Dematerialised AccountDocument18 pagesWhat Is A Share ?: Share Market Basics - Explained Demat Account Definition Demat Refers To A Dematerialised Accountmanish_khabarNo ratings yet

- How To Invest in Stocks For The First Time: A Beginner's GuideDocument6 pagesHow To Invest in Stocks For The First Time: A Beginner's GuideKevin Johan OlarteNo ratings yet

- MF EducationDocument5 pagesMF EducationVikash ChaurasiaNo ratings yet

- 20 Advantages of Futures Over Forex, Stocks and ETFsDocument4 pages20 Advantages of Futures Over Forex, Stocks and ETFsFco Jav RamNo ratings yet

- Investors Guide PDFDocument8 pagesInvestors Guide PDFadeelshahzadqureshi8086No ratings yet

- Demat AccountDocument31 pagesDemat AccountTina ChoudharyNo ratings yet

- Exchange Traded Funds ETFs ExplainedDocument13 pagesExchange Traded Funds ETFs ExplainedjeevandranNo ratings yet

- Dar Wong Chia Wei Ten Minutes Power Trading STrategiesDocument40 pagesDar Wong Chia Wei Ten Minutes Power Trading STrategiesapi-3816484No ratings yet

- 621df4802ba7d 621df4802ba7dDocument9 pages621df4802ba7d 621df4802ba7dArun PrasathNo ratings yet

- MRPDocument52 pagesMRPJAI SINGHNo ratings yet

- Binary Options e BookDocument14 pagesBinary Options e Bookjules629475% (4)

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeFrom EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeNo ratings yet

- How To Start Investing in StocksDocument5 pagesHow To Start Investing in StocksBackground StoryNo ratings yet

- Thesis Unit Trust Management FundsDocument7 pagesThesis Unit Trust Management Fundsgjhs6kjaNo ratings yet

- Online Stock Trading Process With The Different Intermediary Institutions As in Practice in Stock Exchange in IndiaDocument6 pagesOnline Stock Trading Process With The Different Intermediary Institutions As in Practice in Stock Exchange in IndiaNirupam NayakNo ratings yet

- Online Stock Trading Process With The Different Intermediary Institutions As in Practice in Stock Exchange in IndiaDocument6 pagesOnline Stock Trading Process With The Different Intermediary Institutions As in Practice in Stock Exchange in IndiaNirupam NayakNo ratings yet

- Black Book (Project)Document10 pagesBlack Book (Project)Anuradha kondeNo ratings yet

- PHD Thesis Stock ExchangeDocument4 pagesPHD Thesis Stock ExchangeWebsiteThatWillWriteAPaperForYouSingapore100% (2)

- Stock MarketsDocument8 pagesStock MarketsKrishnarao PujariNo ratings yet

- How To Buy Mutual Funds?Document18 pagesHow To Buy Mutual Funds?Sainath KumbharNo ratings yet

- 5 Best Stock Trading Apps You Should Get in 2022Document5 pages5 Best Stock Trading Apps You Should Get in 2022Wahyu HidayatullahNo ratings yet

- Comparing ETFs and index funds costs and taxationDocument4 pagesComparing ETFs and index funds costs and taxationAmrita JuhiNo ratings yet

- Stock Exchange DissertationDocument5 pagesStock Exchange DissertationPaySomeoneToWriteAPaperForMeUK100% (1)

- Step 4. Start Investing With A Low-Cost Online Service: Use A Robo AdvisorDocument3 pagesStep 4. Start Investing With A Low-Cost Online Service: Use A Robo AdvisorNiña Rica PunzalanNo ratings yet

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomFrom EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomNo ratings yet

- 621df4802ba7d 621df48021ba71dDocument9 pages621df4802ba7d 621df48021ba71dArun PrasathNo ratings yet

- Stock Market - Simran EditDocument4 pagesStock Market - Simran EditManinder KaurNo ratings yet

- Forex EnvyDocument12 pagesForex EnvyTradingSystemNo ratings yet

- Copy Trading in Pakistan (Instructions)Document4 pagesCopy Trading in Pakistan (Instructions)IRP assignmentsNo ratings yet

- Investment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmceDocument3 pagesInvestment Options: Trade In: Nse, Bse & MCX-SX, MCX, Ncdex, NmcePawan LohanaNo ratings yet

- Forex DissertationDocument5 pagesForex DissertationWritingPaperServicesCanada100% (1)

- What Is Meant by Secondary Market?Document74 pagesWhat Is Meant by Secondary Market?Manu SharmaNo ratings yet

- Demat Account: Demat Account Is An Easy Way of Online TradingDocument3 pagesDemat Account: Demat Account Is An Easy Way of Online TradingMohammed JashidNo ratings yet

- Secondary MarketDocument40 pagesSecondary Marketnaresh singlaNo ratings yet

- Dividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsFrom EverandDividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsNo ratings yet

- 8 Minute Options Trading Cookbook 2022Document46 pages8 Minute Options Trading Cookbook 2022Damon RamesNo ratings yet

- Mutual FundDocument4 pagesMutual Fundrain leeNo ratings yet

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- Demat Account OpeningDocument8 pagesDemat Account OpeningNivas NowellNo ratings yet

- Share Market Fundamentals: Made by Rajesh PandeyDocument18 pagesShare Market Fundamentals: Made by Rajesh Pandeymyscribd1209No ratings yet

- 70517-0310 Mutual FundsDocument16 pages70517-0310 Mutual FundsRaman BuiucliNo ratings yet

- Trading in Foreign Exchange (Forex) : Key MessagesDocument3 pagesTrading in Foreign Exchange (Forex) : Key MessagesAntoine Nabil ZakiNo ratings yet

- Depository System in IndiaDocument4 pagesDepository System in Indiaaruvankadu100% (1)

- Investing Cheat SheetDocument47 pagesInvesting Cheat Sheetrichyken123No ratings yet

- Investment Management 1Document6 pagesInvestment Management 1Romelyn PacleNo ratings yet

- (IJCT-V3I4P17) Authors:Rachel Hannah, Praveen Jayasankar, Prashanth JayaramanDocument6 pages(IJCT-V3I4P17) Authors:Rachel Hannah, Praveen Jayasankar, Prashanth JayaramanIjctJournalsNo ratings yet

- (IJCT-V3I4P16) Authors: A.Senthil Kumar, R.SathyaDocument4 pages(IJCT-V3I4P16) Authors: A.Senthil Kumar, R.SathyaIjctJournalsNo ratings yet

- (IJCT-V3I4P15) Authors: K. Ravi Kumar, P. KarthikDocument4 pages(IJCT-V3I4P15) Authors: K. Ravi Kumar, P. KarthikIjctJournalsNo ratings yet

- (IJCT-V3I4P8) Authors: Mrs. Sangeetha Lakshmi .G, Ms. Arun Kumari .GDocument9 pages(IJCT-V3I4P8) Authors: Mrs. Sangeetha Lakshmi .G, Ms. Arun Kumari .GIjctJournalsNo ratings yet

- (IJCT-V3I4P5) Authors:S.Baskaran, V.Anita ShyniDocument4 pages(IJCT-V3I4P5) Authors:S.Baskaran, V.Anita ShyniIjctJournalsNo ratings yet

- (IJCT-V3I4P14) Authors: Mrs. Vidhya A., Ms. Abarna N.Document8 pages(IJCT-V3I4P14) Authors: Mrs. Vidhya A., Ms. Abarna N.IjctJournalsNo ratings yet

- (IJCT-V3I4P13) Authors: Ms. Swathi G., Ms. Abarna NDocument10 pages(IJCT-V3I4P13) Authors: Ms. Swathi G., Ms. Abarna NIjctJournalsNo ratings yet

- (IJCT-V3I4P9) Authors: Ms. Sivashankari .A, Mrs. Kavitha .S.KDocument9 pages(IJCT-V3I4P9) Authors: Ms. Sivashankari .A, Mrs. Kavitha .S.KIjctJournalsNo ratings yet

- (IJCT-V3I4P12) Authors: Mrs. Sandhiya V., Ms. Abarna N.Document9 pages(IJCT-V3I4P12) Authors: Mrs. Sandhiya V., Ms. Abarna N.IjctJournalsNo ratings yet

- (IJCT-V3I4P11) Authors:Mrs. Komathi A, Mrs. Shoba. S. ADocument8 pages(IJCT-V3I4P11) Authors:Mrs. Komathi A, Mrs. Shoba. S. AIjctJournalsNo ratings yet

- (IJCT-V3I4P10) Authors: Ms. Asma Banu R., Mrs. Shoba S. A.Document7 pages(IJCT-V3I4P10) Authors: Ms. Asma Banu R., Mrs. Shoba S. A.IjctJournalsNo ratings yet

- (IJCT-V3I4P7) Authors:Mahalakshmi S., Kavitha SDocument6 pages(IJCT-V3I4P7) Authors:Mahalakshmi S., Kavitha SIjctJournalsNo ratings yet

- (IJCT-V3I3P7) Authors:P. Anjaneyulu, T. Venkata Naga JayuduDocument5 pages(IJCT-V3I3P7) Authors:P. Anjaneyulu, T. Venkata Naga JayuduIjctJournalsNo ratings yet

- (IJCT-V3I4P3) Authors:Markus Gerhart, Marko BogerDocument10 pages(IJCT-V3I4P3) Authors:Markus Gerhart, Marko BogerIjctJournalsNo ratings yet

- (IJCT-V3I4P6) Authors: Bhavana Gujarkar, Ms.S.M.BorkarDocument5 pages(IJCT-V3I4P6) Authors: Bhavana Gujarkar, Ms.S.M.BorkarIjctJournalsNo ratings yet

- Ijct V3i2p12 PDFDocument6 pagesIjct V3i2p12 PDFIjctJournalsNo ratings yet

- (IJCT-V3I4P4) Authors:N.Roja Ramani, A.StenilaDocument5 pages(IJCT-V3I4P4) Authors:N.Roja Ramani, A.StenilaIjctJournalsNo ratings yet

- (IJCT-V3I4P2) Authors: Omrani Takwa, Chibani Rhaimi Belgacem, Dallali AdelDocument5 pages(IJCT-V3I4P2) Authors: Omrani Takwa, Chibani Rhaimi Belgacem, Dallali AdelIjctJournalsNo ratings yet

- Ijct V3i2p13Document8 pagesIjct V3i2p13IjctJournalsNo ratings yet

- (IJCT-V3I3P9) Authors:AnumolBabu, Rose V PattaniDocument5 pages(IJCT-V3I3P9) Authors:AnumolBabu, Rose V PattaniIjctJournalsNo ratings yet

- (IJCT-V3I3P6) Authors: Markus Gerhart, Marko BogerDocument15 pages(IJCT-V3I3P6) Authors: Markus Gerhart, Marko BogerIjctJournalsNo ratings yet

- (IJCT-V3I4P1) Authors:Anusha Itnal, Sujata UmaraniDocument5 pages(IJCT-V3I4P1) Authors:Anusha Itnal, Sujata UmaraniIjctJournalsNo ratings yet

- Ijct V3i2p16Document9 pagesIjct V3i2p16IjctJournalsNo ratings yet

- Ijct V3i2p12 PDFDocument6 pagesIjct V3i2p12 PDFIjctJournalsNo ratings yet

- Ijct V3i2p15Document5 pagesIjct V3i2p15IjctJournalsNo ratings yet

- Ijct V3i2p10Document5 pagesIjct V3i2p10IjctJournalsNo ratings yet

- Ijct V3i2p14Document7 pagesIjct V3i2p14IjctJournalsNo ratings yet

- Face Detection - A Literature Survey: AbstractDocument4 pagesFace Detection - A Literature Survey: AbstractIjctJournalsNo ratings yet

- Ijct V3i2p11Document8 pagesIjct V3i2p11IjctJournalsNo ratings yet

- Ijct V3i2p8Document8 pagesIjct V3i2p8IjctJournalsNo ratings yet

- Personal Finance 10Th Edition Kapoor Solutions Manual Full Chapter PDFDocument53 pagesPersonal Finance 10Th Edition Kapoor Solutions Manual Full Chapter PDFshelbyelliswimynjsrab100% (8)

- Project Chapter 1Document62 pagesProject Chapter 1HUMAIR123456No ratings yet

- The Little Book of Common Sense Investing: The Only Way To Guarantee Your Fair Share of Stock Market Returns, Updated and RevisedDocument2 pagesThe Little Book of Common Sense Investing: The Only Way To Guarantee Your Fair Share of Stock Market Returns, Updated and RevisedArsip 123No ratings yet

- Marwadi Shares Finance LTDDocument100 pagesMarwadi Shares Finance LTDashokNo ratings yet

- ContributedDocument62 pagesContributedSimi SandhuNo ratings yet

- 2023 Report PDFDocument60 pages2023 Report PDFPruthvi BrahmbhattNo ratings yet

- "International Market Entry" Indian Stock Market: Project ONDocument92 pages"International Market Entry" Indian Stock Market: Project ONJai GaneshNo ratings yet

- Tata Ethical Fund Kim Oct 2021Document24 pagesTata Ethical Fund Kim Oct 2021MohammedNo ratings yet

- Reading 48-Portfolio Management An OverviewDocument24 pagesReading 48-Portfolio Management An OverviewAllen AravindanNo ratings yet

- Crisil Amfi Mutual Fund Report Digital Evolution PDFDocument56 pagesCrisil Amfi Mutual Fund Report Digital Evolution PDFShubham SinghNo ratings yet

- Practice Questions For A: Search DocumentDocument1 pagePractice Questions For A: Search DocumentjayramNo ratings yet

- Investment ProjectDocument30 pagesInvestment ProjectRaj YadavNo ratings yet

- Comprehensive Study on India's Mutual Fund IndustryDocument69 pagesComprehensive Study on India's Mutual Fund Industryvaibhav_sharma_6100% (1)

- Fund Managers Report - Conventional - May 2023Document14 pagesFund Managers Report - Conventional - May 2023Aniqa AsgharNo ratings yet

- Module 08 Exclusions From Gross Income 2Document14 pagesModule 08 Exclusions From Gross Income 2Joshua BazarNo ratings yet

- 1 PDF 03256517614Document1 page1 PDF 03256517614DrdcNo ratings yet

- Financial IntermediariesDocument63 pagesFinancial Intermediariesjustin razonNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document15 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538axzc sNo ratings yet

- Project On Mutual FundDocument79 pagesProject On Mutual FundParvinder KumarNo ratings yet

- Sources of FundsDocument13 pagesSources of FundsSenelwa Anaya0% (1)

- SEB Annual Report 1997Document100 pagesSEB Annual Report 1997SEB GroupNo ratings yet

- ADRHPDocument578 pagesADRHPKaran TeckchandaniNo ratings yet

- Choice IntroductionDocument22 pagesChoice IntroductionMonu SinghNo ratings yet

- Ultimate Guide to Investing in Stocks in the PhilippinesDocument75 pagesUltimate Guide to Investing in Stocks in the PhilippinesPatrick John Estrada GayoNo ratings yet

- The Impact of The Arab Spring and The Ebola Outbreak On African Equity Mutual Fund Investor DecisionsDocument13 pagesThe Impact of The Arab Spring and The Ebola Outbreak On African Equity Mutual Fund Investor DecisionsKelsey GaoNo ratings yet

- BFM Sem Vi 1920Document8 pagesBFM Sem Vi 1920Hitesh BaneNo ratings yet

- Avantrade WMS Product Detail PDFDocument67 pagesAvantrade WMS Product Detail PDFMario BayuNo ratings yet

- Isgpore PDFDocument16 pagesIsgpore PDFGabriel La MottaNo ratings yet

- FIN-072 SAS Day-2 INDocument9 pagesFIN-072 SAS Day-2 INangel vien guecoNo ratings yet

- Baroda BNP Paribas Balanced Advantage Fund 1 4022Document4 pagesBaroda BNP Paribas Balanced Advantage Fund 1 4022priyanshNo ratings yet