Professional Documents

Culture Documents

Using Big Data To Make Better Pricing Decisions

Uploaded by

paulsunnyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Using Big Data To Make Better Pricing Decisions

Uploaded by

paulsunnyCopyright:

Available Formats

JUNE 2014

Using big data to make

better pricing decisions

Walter Baker, Dieter Kiewell, and Georg Winkler

Harnessing the flood of data available from customer

interactions allows companies to price appropriately

and reap the rewards.

Its hard to overstate the importance of getting pricing right. On average, a 1 percent price

increase translates into an 8.7 percent increase in operating profits (assuming no loss of volume,

of course). Yet we estimate that up to 30 percent of the thousands of pricing decisions companies

make every year fail to deliver the best price. Thats a lot of lost revenue. And its particularly

troubling considering that the flood of data now available provides companies with an opportunity

to make significantly better pricing decisions. For those able to bring order to big datas complexity,

the value is substantial.

Were not suggesting its easy: the number of customer touchpoints keeps exploding as digitization

fuels growing multichannel complexity. Yet price points need to keep pace. Without uncovering

and acting on the opportunities big data presents, many companies are leaving millions of dollars

of profit on the table. The secret to increasing profit margins is to harness big data to find the best

price at the productnot categorylevel, rather than drown in the numbers flood.

Too big to succeed

For every product, companies should be able to find the optimal price that a customer is willing to

pay. Ideally, theyd factor in highly specific insights that would influence the pricethe cost of the

next-best competitive product versus the value of the product to the customer, for exampleand

then arrive at the best price. Indeed, for a company with a handful of products, this kind of pricing

approach is straightforward.

Its more problematic when product numbers balloon. About 75 percent of a typical companys

revenue comes from its standard products, which often number in the thousands. Time-consuming,

manual practices for setting prices make it virtually impossible to see the pricing patterns that

can unlock value. Its simply too overwhelming for large companies to get granular and manage the

complexity of these pricing variables, which change constantly, for thousands of products. At its

core, this is a big data issue (exhibit).

Many marketers end up simply burying their heads in the sand. They develop prices based on

simplistic factors such as the cost to produce the product, standard margins, prices for similar

products, volume discounts, and so on. They fall back on old practices to manage the products

as they always have or cite market prices as an excuse for not attacking the issues. Perhaps worst

of all, they rely on tried and tested historical methods, such as a universal 10 percent price hike

on everything.

What happened in practice then was that every year we had price increases based on scale and

volume, but not based on science, says Roger Britschgi, head of sales operations at Linde Gases.

Our people just didnt think it was possible to do it any other way. And, quite frankly, our people

were not well prepared to convince our customers of the need to increase prices.

Web 2014

Pricing

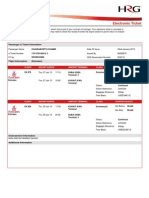

Exhibit 1 of 1

Exhibit

Patterns in the analysis highlight opportunities for differentiated

pricing at a customer-product level, based on willingness to pay.

Product discount per customer (1 dot

represents 1 customer)

Cluster of homogeneous

customers

Discount, %

0

20

40

60

80

100

10

100

1,000

Product sales, thousand

Source: The Linde Group; McKinsey analysis

10,000

Four steps to turn data into profits

The key to better pricing is understanding fully the data now at a companys disposal. It requires

not zooming out but zooming in. As Tom OBrien, group vice president and general manager for

marketing and sales at Sasol, said of this approach, The [sales] teams knew their pricing, they

may have known their volumes, but this was something more: extremely granular data, literally

from each and every invoice, by product, by customer, by packaging.

In fact, some of the most exciting examples of using big data in a B2B context actually transcend

pricing and touch on other aspects of a companys commercial engine. For example, dynamic

deal scoring provides price guidance at the level of individual deals, decision-escalation points,

incentives, performance scoring, and more, based on a set of similar win/loss deals. Using smaller,

relevant deal samples is essential, as the factors tied to any one deal will vary, rendering an

overarching set of deals useless as a benchmark. Weve seen this applied in the technology sector

with great successyielding increases of four to eight percentage points in return on sales (versus

same-company control groups).

To get sufficiently granular, companies need to do four things.

Listen to the data. Setting the best prices is not a data challenge (companies generally already sit

on a treasure trove of data); its an analysis challenge. The best B2C companies know how to

interpret and act on the wealth of data they have, but B2B companies tend to manage data rather

than use it to drive decisions. Good analytics can help companies identify how factors that are often

overlookedsuch as the broader economic situation, product preferences, and sales-representative

negotiationsreveal what drives prices for each customer segment and product.

Automate. Its too expensive and time-consuming to analyze thousands of products manually.

Automated systems can identify narrow segments, determine what drives value for each one, and

match that with historical transactional data. This allows companies to set prices for clusters

of products and segments based on data. Automation also makes it much easier to replicate and

tweak analyses so its not necessary to start from scratch every time.

Build skills and confidence. Implementing new prices is as much a communications challenge

as an operational one. Successful companies overinvest in thoughtful change programs to help

their sales forces understand and embrace new pricing approaches. Companies need to work

closely with sales reps to explain the reasons for the price recommendations and how the system

works so that they trust the prices enough to sell them to their customers. Equally important is

developing a clear set of communications to provide a rationale for the prices in order to highlight

value, and then tailoring those arguments to the customer. Intensive negotiation training is also

critical for giving sales reps the confidence and tools to make convincing arguments when

speaking with clients. The best leaders accompany sales reps to the most difficult clients and

focus on getting quick wins so that sales reps develop the confidence to adopt the new pricing

approach. It was critical to show that leadership was behind this new approach, says Robert

Krieger, managing director of PanGas AG. And we did this by joining visits to difficult customers.

We were able to not only help our sales reps but also show how the argumentation worked.

Actively manage performance. To improve performance management, companies need to

support the sales force with useful targets. The greatest impact comes from ensuring that the

front line has a transparent view of profitability by customer and that the sales and marketing

organization has the right analytical skills to recognize and take advantage of the opportunity.

The sales force also needs to be empowered to adjust prices itself rather than relying on a

centralized team. This requires a degree of creativity in devising a customer-specific price

strategy, as well as an entrepreneurial mind-set. Incentives may also need to be changed

alongside pricing policies and performance measurements.

Weve seen companies in industries as diverse as software, chemicals, construction materials,

and telecommunications achieve impressive results by using big data to inform better pricing

decisions. All had enormous numbers of SKUs and transactions, as well as a fragmented portfolio

of customers; all saw a profit-margin lift of between 3 and 8 percent from setting prices at much

more granular product levels. In one case, a European building-materials company set prices that

increased margins by up to 20 percent for selected products. To get the price right, companies

should take advantage of big data and invest enough resources in supporting their sales repsor

they may find themselves paying the high price of lost profits.

Walter Baker is a principal in McKinseys Atlanta office, Dieter Kiewell is a director in the

London office, and Georg Winkler is a principal in the Berlin office.

Copyright 2014 McKinsey & Company. All rights reserved.

You might also like

- Label-Based Indexing (Loc) : DF - Loc (Row Label(s), Column Label(s) )Document5 pagesLabel-Based Indexing (Loc) : DF - Loc (Row Label(s), Column Label(s) )paulsunnyNo ratings yet

- Solid Mask Catalogue Reduced FileDocument13 pagesSolid Mask Catalogue Reduced FilepaulsunnyNo ratings yet

- AWS Certified Developer Associate Updated June 2018 Exam GuideDocument3 pagesAWS Certified Developer Associate Updated June 2018 Exam GuideDivyaNo ratings yet

- My InvitationDocument1 pageMy InvitationpaulsunnyNo ratings yet

- In America Growing Up Rural: U.S. Complement To The End of Childhood Report 2018Document32 pagesIn America Growing Up Rural: U.S. Complement To The End of Childhood Report 2018paulsunnyNo ratings yet

- Indian Driver License Verification ChecklistDocument3 pagesIndian Driver License Verification ChecklistpaulsunnyNo ratings yet

- Productflyer - 978 1 4842 3218 7Document1 pageProductflyer - 978 1 4842 3218 7paulsunnyNo ratings yet

- Managed Services: Information and Communication TechnologyDocument14 pagesManaged Services: Information and Communication TechnologypaulsunnyNo ratings yet

- Procurement Data Analyst RoleDocument3 pagesProcurement Data Analyst RolepaulsunnyNo ratings yet

- Productflyer - 978 1 4842 3218 7Document1 pageProductflyer - 978 1 4842 3218 7paulsunnyNo ratings yet

- Exam 70-533: Implementing Microsoft Azure Infrastructure SolutionsDocument6 pagesExam 70-533: Implementing Microsoft Azure Infrastructure Solutionsgojkob1No ratings yet

- Manual Structure Cheat Sheet: Section Contains DescriptionDocument1 pageManual Structure Cheat Sheet: Section Contains Descriptiongururaj_hebbarNo ratings yet

- Vodafone Payment Receipt O726167820Document1 pageVodafone Payment Receipt O726167820SSSSNo ratings yet

- Exam 70-533: Implementing Microsoft Azure Infrastructure SolutionsDocument6 pagesExam 70-533: Implementing Microsoft Azure Infrastructure Solutionsgojkob1No ratings yet

- Kerala Hotels and Places To VisitDocument3 pagesKerala Hotels and Places To VisitpaulsunnyNo ratings yet

- TVM To TCR Bus TicketDocument2 pagesTVM To TCR Bus TicketpaulsunnyNo ratings yet

- Ticket Confirmation Details: Welcome AnitDocument1 pageTicket Confirmation Details: Welcome AnitpaulsunnyNo ratings yet

- Job Description - Value ConsultantDocument1 pageJob Description - Value ConsultantpaulsunnyNo ratings yet

- ReceiptDocument1 pageReceiptpaulsunnyNo ratings yet

- Travel Itinerary and E-Ticket ReceiptDocument2 pagesTravel Itinerary and E-Ticket ReceiptpaulsunnyNo ratings yet

- Senior Consultant with Expertise in Business Analysis, Project Management, and Software EngineeringDocument2 pagesSenior Consultant with Expertise in Business Analysis, Project Management, and Software EngineeringpaulsunnyNo ratings yet

- HLL Academy DetailsDocument14 pagesHLL Academy DetailspaulsunnyNo ratings yet

- Business AnalyticsDocument8 pagesBusiness Analyticsssssstt62201450% (2)

- CAP HandbookV3Document40 pagesCAP HandbookV3paulsunnyNo ratings yet

- 29614Document7 pages29614Jigyasa Gautam0% (3)

- SQL QueriesDocument2 pagesSQL QueriespaulsunnyNo ratings yet

- TicketDocument1 pageTicketpaulsunnyNo ratings yet

- Productflyer - 978 0 387 77777 1Document1 pageProductflyer - 978 0 387 77777 1paulsunnyNo ratings yet

- Jose SunnyDocument1 pageJose SunnypaulsunnyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NG-HNDQS-10-27 AccDocument17 pagesNG-HNDQS-10-27 Accmophamed ashfaqueNo ratings yet

- KNC 3262 Engineering EconomyDocument11 pagesKNC 3262 Engineering EconomyFazlie IslamNo ratings yet

- Accounting Hub Solution Brief - A4 - WEBDocument8 pagesAccounting Hub Solution Brief - A4 - WEBperez warrenNo ratings yet

- Fortis HealthcareDocument13 pagesFortis HealthcarePrithvi AcharyaNo ratings yet

- Forex Fibonacci BookDocument7 pagesForex Fibonacci Bookramkumar1967No ratings yet

- Nature and Scope of AccountingDocument10 pagesNature and Scope of AccountingRohan Kumar100% (4)

- Economic Instructor ManualDocument30 pagesEconomic Instructor Manualclbrack100% (2)

- Case Competition SummaryDocument3 pagesCase Competition SummaryRichard WangNo ratings yet

- 2015-04-01 Media Markt - Sales Modelling PresentedDocument105 pages2015-04-01 Media Markt - Sales Modelling PresentedRohit NayalNo ratings yet

- 30 Years of Infosys: PDF Processed With Cutepdf Evaluation EditionDocument214 pages30 Years of Infosys: PDF Processed With Cutepdf Evaluation EditionMalik NasirNo ratings yet

- Financial AccountingDocument1,056 pagesFinancial AccountingCalmguy Chaitu96% (28)

- Accounting/Series 3 2004 (Code3001)Document20 pagesAccounting/Series 3 2004 (Code3001)Hein Linn Kyaw100% (1)

- Phdthesis Hum Aditi 2012Document213 pagesPhdthesis Hum Aditi 2012Rahul SavaliaNo ratings yet

- Diagnosing OrganizationsDocument17 pagesDiagnosing OrganizationsNina MartianaNo ratings yet

- United States Court of Appeals Tenth CircuitDocument10 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- MORD Data BoookDocument123 pagesMORD Data BoookRakesh YadavNo ratings yet

- Year Long Project-Indian Paint IndustryDocument20 pagesYear Long Project-Indian Paint IndustryNivas Ramalingam100% (1)

- Fishing Sustainable Livelihood - A Discussion Paper On The Livelihood of Coastal Fisherwomen in IndiaDocument95 pagesFishing Sustainable Livelihood - A Discussion Paper On The Livelihood of Coastal Fisherwomen in IndiaHansen Thambi Prem100% (1)

- OM Version 1Document497 pagesOM Version 1Sushant SinghNo ratings yet

- An ExaminationDocument28 pagesAn ExaminationZulfadly UrufiNo ratings yet

- All Project 3Document108 pagesAll Project 3Raju Sureliya100% (1)

- Naga CorpDocument153 pagesNaga Corptycoonshan24No ratings yet

- Ipasset ManagementDocument48 pagesIpasset ManagementSiddharth GhorpadeNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- EVA Financial Management at Godrej Consumer Products LTDDocument28 pagesEVA Financial Management at Godrej Consumer Products LTDRahul SaraogiNo ratings yet

- Apple Inc. Performance Case Study: Jobs' Leadership & Cook's SuccessionDocument9 pagesApple Inc. Performance Case Study: Jobs' Leadership & Cook's SuccessionSalma Yassin100% (1)

- Financial Ratio AnalysisDocument41 pagesFinancial Ratio Analysismbapriti100% (2)

- Report On Marketing AuditDocument12 pagesReport On Marketing Auditm_dhrutiNo ratings yet

- HSC Business Studies Summary Notes by Nathan ReidyDocument35 pagesHSC Business Studies Summary Notes by Nathan ReidyDivesh Singh100% (3)

- Production Theory Circular Flow ModelDocument22 pagesProduction Theory Circular Flow ModelGISCAR MINJANo ratings yet