Professional Documents

Culture Documents

PX From Gas Condensate

Uploaded by

stavros7Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PX From Gas Condensate

Uploaded by

stavros7Copyright:

Available Formats

Paraxylene from Gas Condensate:

Competitiveness with conventional refinery-based production routes

PCI Xylenes & Polyesters Ltd

79 Portsmouth Road / Guildford / Surrey / GU2 4BX / England

PCI Xylenes & Polyesters Asia Sdn Bhd

Suite 1208 / Menara PJ / AMCORP Trade Ctr / No 18 Jalan Persiaran Barat

46050 Petaling Jaya / Selangor Darul Ehsan / Malaysia

Paraxylene from Gas Condensate:

Study Cost:

Competitiveness with conventional refinery-based production routes

US$7,500

This study by PCI Xylenes & Polyesters

and KBC Advanced Technologies

explores condensate feedstock

availability and cost competitiveness

with refinery based units so that the

paraxylene cost base and price setting

mechanisms are clearly identified.

Study Deliverables:

The study covers the period through

the next paraxylene cycle out to 2020

and is focussed on the regions where

paraxylene production from gas

condensate-based units are being built

(Asia & the Middle East).

99

Condensate supply & demand including demand from

new aromatics assets

99

Condensate pricing mechanisms

99

Paraxylene supply & demand including supply from

condensate based units

99

Paraxylene and Benzene pricing mechanisms

99

Competitiveness of simple condensate splitters vs

conventional refineries from a refining fuels perspective

99

Competitiveness of condensate splitters vs conventional

refineries from a paraxylene perspective

99

Condensate quality variations and implications for both

refining fuels and paraxylene economics

After an extended period of paraxylene margin strength, the polyester market is forecast to transition through

KBC Advanced Technologies is a leading

Study Output:

a series of different cost setting layers during 2014 with 8 major new worldscale paraxylene units coming on

independent consultancy to the global

line, each of which have different configurations, technologies and feedstocks. Traditionally paraxylene units

energy and refining industries, with market

Summary Report (pdf)

have been built as part of integrated refineries processing crude oil and providing heavy naphtha feedstock for

specialists in each of the key energy markets

aromatics production. Aromatics units sourcing heavy naphtha from gas condensate units are now becoming

(Houston, London, Singapore). KBCs

99

99

99

more prevalent and will form an influential part of the emerging asset base in the Middle East and Asia. Both

expertise includes leading edge refinery

conclusions and any follow up questions

types of processing routes are expected to increasingly rely on transalkylation to generate additional mixed

process simulation and analysis using its

99

Summary output from the modelling

xylenes supplies to maximise the output of paraxylene per tonne of naphtha supplied.

simulation software suite, Petro-SIMTM.

Executive Summary (Powerpoint Presentation)

Online meeting/presentation to discuss the

This study provides insights into the relative competitiveness and merits of the differing routes to

paraxylene production.

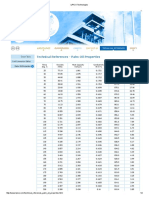

The Study Team modelled a typical condensate asset and typical conventional refinery in both North East Asia

and the Middle East. Two crude oil price set scenarios are covered. The models were also used to explore the

economic sensitivity of the relevant condensate quality variations.

Contact us for more details:

Gordon Haire

PCI Xylenes & Polyesters Ltd

ghaire@thepcigroup.com

T +44 1483 302267

Steve Jenkins

PCI Xylenes & Polyesters Asia

sjenkins@thepcigroup.com

T +60 3 7954 8202

You might also like

- Petrochemicals From Oil Sands: Petroleum SocietyDocument8 pagesPetrochemicals From Oil Sands: Petroleum SocietyEleonora LetorNo ratings yet

- Integration of Petrochemical and Refinery Plants As An Approach To Compete in Hydrocarbon MarketDocument31 pagesIntegration of Petrochemical and Refinery Plants As An Approach To Compete in Hydrocarbon MarketHuiJooHweeNo ratings yet

- A Comparative Study Between Propane Dehydrogenation (PDH) Technologies and Plants in Saudi ArabiaDocument16 pagesA Comparative Study Between Propane Dehydrogenation (PDH) Technologies and Plants in Saudi ArabiaBihina HamanNo ratings yet

- CO2 Utilization Pathways Techno-Economic AssessmenDocument8 pagesCO2 Utilization Pathways Techno-Economic AssessmenNestor TamayoNo ratings yet

- Refinery Configuration (With Figures)Document9 pagesRefinery Configuration (With Figures)phantanthanhNo ratings yet

- Simulation of Crude Distillation Unit ofDocument6 pagesSimulation of Crude Distillation Unit ofSiddharth SharmaNo ratings yet

- Simulation of Crude Distillation Unit of Eastern Refinery Limited (ERL) Using Aspen PlusDocument6 pagesSimulation of Crude Distillation Unit of Eastern Refinery Limited (ERL) Using Aspen PlusAndre BasantesNo ratings yet

- 4 Stranded Gas Monetisation Presented by ShellDocument11 pages4 Stranded Gas Monetisation Presented by Shellplyana100% (2)

- SMR (PDF - Io) PDFDocument286 pagesSMR (PDF - Io) PDFvivekpatel1234No ratings yet

- 4244-Article Text-12672-1-10-20180730Document15 pages4244-Article Text-12672-1-10-20180730bilal canitezNo ratings yet

- 4244 12672 1 PB PDFDocument15 pages4244 12672 1 PB PDFVinh Do ThanhNo ratings yet

- Claudia Bassano, Paolo Deiana, Giuseppe Girardi: HighlightsDocument11 pagesClaudia Bassano, Paolo Deiana, Giuseppe Girardi: HighlightsSorrawit TantipalakulNo ratings yet

- 32 - Coconut Methyl Ester (CME) As Petrodiesel Quality EnhancerDocument37 pages32 - Coconut Methyl Ester (CME) As Petrodiesel Quality EnhancermrjevinNo ratings yet

- A Comparative Study Between Propane Dehydrogenation (PDH) Technologies and Plants in Saudi ArabiaDocument15 pagesA Comparative Study Between Propane Dehydrogenation (PDH) Technologies and Plants in Saudi ArabiaManojNo ratings yet

- Recycled Carbon Fibres in AutomobilesDocument8 pagesRecycled Carbon Fibres in AutomobilesANo ratings yet

- Refinery Operations Planning Final ReportDocument31 pagesRefinery Operations Planning Final ReportMohamed AlaaNo ratings yet

- Simulation and Performance Analysis of Propane Propylene SplitterDocument4 pagesSimulation and Performance Analysis of Propane Propylene SplitterAnonymous UY9QffNo ratings yet

- Session 4 Sanjiv ShahDocument36 pagesSession 4 Sanjiv Shahकुमोद गुप्ताNo ratings yet

- KBC White Paper - Maximising Margin in A Competitive EnvironmentDocument4 pagesKBC White Paper - Maximising Margin in A Competitive EnvironmentAndrew J RobertsNo ratings yet

- 2019-09 Further Assessment of Emerging CO2 Capture TechnologiesDocument278 pages2019-09 Further Assessment of Emerging CO2 Capture Technologiestopspeed1No ratings yet

- FCC家族新技术在向化工型炼油厂转型过程中核心桥梁角色Document5 pagesFCC家族新技术在向化工型炼油厂转型过程中核心桥梁角色a1s2d3q1No ratings yet

- Techno-Economical Feasibility Studies On Establishing Petro Refineries and Their Advantages in IranDocument10 pagesTechno-Economical Feasibility Studies On Establishing Petro Refineries and Their Advantages in IranByron VivancoNo ratings yet

- Software Approach On Crude Oil Yields Prediction: A Case Study of Tema Oil RefineryDocument19 pagesSoftware Approach On Crude Oil Yields Prediction: A Case Study of Tema Oil RefineryKen OtooNo ratings yet

- Khusaini 2021 J. Phys. Conf. Ser. 1912 012059Document7 pagesKhusaini 2021 J. Phys. Conf. Ser. 1912 012059Quratulain Raza KhanNo ratings yet

- 1 s2.0 S0016236124004162 Main2Document18 pages1 s2.0 S0016236124004162 Main2dragonmasterleyNo ratings yet

- Crude Oil-to-Chemicals - Future of Refinery - FutureBridgeDocument9 pagesCrude Oil-to-Chemicals - Future of Refinery - FutureBridgeEnergy 2Green50% (2)

- 31 March 2023Document3 pages31 March 2023Andiswa TotoNo ratings yet

- CHT - Journal - 26-07-2022-Green-Cover - 1659440211Document156 pagesCHT - Journal - 26-07-2022-Green-Cover - 1659440211VijayakumarNarasimhanNo ratings yet

- An Analysis of The Value Chains of The Petrochemical Industry With A Focus On The New Approach of Petro-RefineryDocument18 pagesAn Analysis of The Value Chains of The Petrochemical Industry With A Focus On The New Approach of Petro-RefinerySerge Désiré KohemunNo ratings yet

- CV - Nainish Sahare Oil and GasDocument5 pagesCV - Nainish Sahare Oil and GasNitai DuraisamiNo ratings yet

- Resume DR Steve Wittrig and Kinetic Emergy Overview May18Document7 pagesResume DR Steve Wittrig and Kinetic Emergy Overview May18SteveWKENo ratings yet

- Pinch Technology, Process Optimization. Case Study - A Wax Extraction Plant PDFDocument58 pagesPinch Technology, Process Optimization. Case Study - A Wax Extraction Plant PDFVirnia PatziNo ratings yet

- The Feasibility of Short Term Production Strategies For Renewable Jet FuelsDocument23 pagesThe Feasibility of Short Term Production Strategies For Renewable Jet FuelsTéfo OliveiraNo ratings yet

- TNO Halland Euro 6 ComparisonDocument6 pagesTNO Halland Euro 6 ComparisonVikrant BhaleraoNo ratings yet

- UOP Aromatics Paraxylene Capture Paper1Document16 pagesUOP Aromatics Paraxylene Capture Paper1thanga1981100% (1)

- Business Trends-Couch (Honeywell UOP)Document14 pagesBusiness Trends-Couch (Honeywell UOP)baiju79No ratings yet

- Hydrogen Purification by Pressure Swing Adsorption Uni - 2Document2 pagesHydrogen Purification by Pressure Swing Adsorption Uni - 2asamad54No ratings yet

- LNG Terminal Flow SheetDocument11 pagesLNG Terminal Flow SheetHari Krishna Raju100% (1)

- Point Source CaptureDocument4 pagesPoint Source Captureengr.okaforaugustineNo ratings yet

- Design Project Description 2013Document10 pagesDesign Project Description 2013Eunice MayhoongNo ratings yet

- Ps2 3 KHDocument14 pagesPs2 3 KHBranden933No ratings yet

- Making PropyleneDocument4 pagesMaking PropyleneChem.Engg100% (1)

- Industrial Training ReportDocument56 pagesIndustrial Training ReportDipta Bhanu BakshiNo ratings yet

- Integration of Petrochemical and Refinery Plants ADocument13 pagesIntegration of Petrochemical and Refinery Plants Aکبری ادریس رسولNo ratings yet

- Review: Darren A. Baker, Timothy G. RialsDocument16 pagesReview: Darren A. Baker, Timothy G. RialsERICK RCHNo ratings yet

- Research Paper On Petrol EngineDocument7 pagesResearch Paper On Petrol Enginemlgpufvkg100% (1)

- Heavy-Duty Diesel Engine NO Reduction With Nitrogen-Enriched Combustion AirDocument69 pagesHeavy-Duty Diesel Engine NO Reduction With Nitrogen-Enriched Combustion AirrizalNo ratings yet

- CarboDocument7 pagesCarboBajrang SwarnkarNo ratings yet

- Refrigeration Compressor Driver SelectionDocument27 pagesRefrigeration Compressor Driver SelectionsppramNo ratings yet

- Waste Tire 1Document13 pagesWaste Tire 1May PassarapornNo ratings yet

- GTLDocument11 pagesGTLSyahrinNo ratings yet

- Artikel 23Document18 pagesArtikel 23M Ikhtiar Roza XII MIA 5No ratings yet

- Kutipan (Bayu Gilang Purnomo) Pengaruh Penggunaan Intake ManifoldDocument9 pagesKutipan (Bayu Gilang Purnomo) Pengaruh Penggunaan Intake ManifoldHidayat Restu PurnamaNo ratings yet

- (Li Et Al., 2016)Document17 pages(Li Et Al., 2016)Gabriel DiazNo ratings yet

- 03BCABRSMOPTIMIZATIONDocument12 pages03BCABRSMOPTIMIZATIONshamirah98No ratings yet

- SPE-101089-MS-P - Development of An Integrated Production Network - Heera (Manual)Document13 pagesSPE-101089-MS-P - Development of An Integrated Production Network - Heera (Manual)msfz751No ratings yet

- PP Feasibilty Study in INDIA PDFDocument18 pagesPP Feasibilty Study in INDIA PDFMahmud RezaNo ratings yet

- 1 s2.0 S0016236118304976 MainextDocument19 pages1 s2.0 S0016236118304976 MainextPriyam NayakNo ratings yet

- Carbon Capture Technologies for Gas-Turbine-Based Power PlantsFrom EverandCarbon Capture Technologies for Gas-Turbine-Based Power PlantsNo ratings yet

- Results of PAC + OSH Certification 15 July 2016Document4 pagesResults of PAC + OSH Certification 15 July 2016stavros7No ratings yet

- CarbonblackuserguideDocument28 pagesCarbonblackuserguideJose NinNo ratings yet

- Investor Presentation US RoadshowDocument29 pagesInvestor Presentation US Roadshowstavros7No ratings yet

- 2016-07-21 IOC Presentation - ExxonMobil Acquisition of InterOilDocument10 pages2016-07-21 IOC Presentation - ExxonMobil Acquisition of InterOilampatNo ratings yet

- Business Corporations Act - YukonDocument243 pagesBusiness Corporations Act - Yukonstavros7No ratings yet

- OSH Announcement - No New BidDocument2 pagesOSH Announcement - No New Bidstavros7No ratings yet

- Philippine Airlines Codeshare Winter 27dec2007Document1 pagePhilippine Airlines Codeshare Winter 27dec2007stavros7No ratings yet

- Carbon BlackDocument10 pagesCarbon BlackEugene CollinsNo ratings yet

- KBR PhenolDocument2 pagesKBR Phenolstavros7100% (2)

- Malaysia Airlines Schedule End 2007Document114 pagesMalaysia Airlines Schedule End 2007stavros7No ratings yet

- Oil Search Commencement of PRL 15 CertificationDocument1 pageOil Search Commencement of PRL 15 Certificationstavros7No ratings yet

- Infrastructure: RATE SummaryDocument26 pagesInfrastructure: RATE Summarystavros7No ratings yet

- Belgian Consulting IndustryDocument18 pagesBelgian Consulting Industrystavros7No ratings yet

- Oil Search Drilling Report For March 2015Document4 pagesOil Search Drilling Report For March 2015stavros7No ratings yet

- Final CrudeOil and Petroleum Product TerminalsDocument14 pagesFinal CrudeOil and Petroleum Product Terminalsbalavengu100% (1)

- 1604 Credit Suisse Asian Investment Conference, HK - OIL SEARCHDocument29 pages1604 Credit Suisse Asian Investment Conference, HK - OIL SEARCHstavros7No ratings yet

- Golar FLNG PresentationDocument19 pagesGolar FLNG Presentationstavros7100% (1)

- Tankfarm Brochure SiemensDocument10 pagesTankfarm Brochure Siemensstavros7No ratings yet

- LNG Terminal DesignDocument76 pagesLNG Terminal Designsatishchemeng93% (14)

- Air Niugini Schedule Dec - March 2016Document51 pagesAir Niugini Schedule Dec - March 2016stavros7No ratings yet

- TRA Melbourne Ballarat Airport Infrastructure Upgrade Web Project Review1Document1 pageTRA Melbourne Ballarat Airport Infrastructure Upgrade Web Project Review1stavros7No ratings yet

- NJ Nexmtbe and Nexetbe BrochureDocument2 pagesNJ Nexmtbe and Nexetbe Brochurestavros7No ratings yet

- Session 5 Keynote Address NNPC David Ige Samue LndukweDocument34 pagesSession 5 Keynote Address NNPC David Ige Samue Lndukwestavros7No ratings yet

- ICIS Olefins OutlookDocument3 pagesICIS Olefins Outlookstavros7100% (1)

- Refinery - Petrochemicals Master Plan Article - KBRDocument7 pagesRefinery - Petrochemicals Master Plan Article - KBRstavros7No ratings yet

- 2014 Infrastructure PlanDocument96 pages2014 Infrastructure Planstavros7No ratings yet

- TP Apac Feb2013 WebDocument20 pagesTP Apac Feb2013 Webstavros7No ratings yet

- Infrastructure Master Plan Section 2Document2,494 pagesInfrastructure Master Plan Section 2stavros7No ratings yet

- YLNG March 2011 WebDocument6 pagesYLNG March 2011 Webstavros7No ratings yet

- National Integrated InfrastructureDocument29 pagesNational Integrated Infrastructurestavros7No ratings yet

- Altivar® 28 Adjustable Speed Drive Controllers User GuideDocument88 pagesAltivar® 28 Adjustable Speed Drive Controllers User GuideplsalmrajNo ratings yet

- Introduction To ENERGY: Overdevelopment and The Delusion of Endless GrowthDocument6 pagesIntroduction To ENERGY: Overdevelopment and The Delusion of Endless GrowthPost Carbon InstituteNo ratings yet

- Crusher Guide Ch440Document5 pagesCrusher Guide Ch440biro_4100% (1)

- SolarPro2 2Document100 pagesSolarPro2 2lgv2No ratings yet

- Scie3001 Business Pitch PresentationDocument13 pagesScie3001 Business Pitch Presentationapi-269217871No ratings yet

- Maintenance Patterns and Fmea AnalysisDocument11 pagesMaintenance Patterns and Fmea AnalysisAdaaNo ratings yet

- Tissot PRS516Document4 pagesTissot PRS516shanksuNo ratings yet

- David L Ellis Resume 2007Document2 pagesDavid L Ellis Resume 2007dleoelNo ratings yet

- Indian Coal and It'S Use S: Presented byDocument19 pagesIndian Coal and It'S Use S: Presented bySiddharth KishanNo ratings yet

- Energy Efficiency Policy: Dr. Paul KomorDocument21 pagesEnergy Efficiency Policy: Dr. Paul KomorsulemankhalidNo ratings yet

- CBI Lummus I-FCC-12Document2 pagesCBI Lummus I-FCC-12stavros7No ratings yet

- CA Marathon 14 JanDocument1,491 pagesCA Marathon 14 JanSherlin NatashaNo ratings yet

- Suppliers Rating Evaluation: Apo Cement CorporationDocument1 pageSuppliers Rating Evaluation: Apo Cement CorporationAljon Angeles Tan100% (1)

- Combustion Turbine TipsDocument4 pagesCombustion Turbine Tipssevero97100% (1)

- Electrical Drives Paper April 11Document2 pagesElectrical Drives Paper April 11vinxtremeNo ratings yet

- Karnataka FundoodataDocument14 pagesKarnataka FundoodataRajeev VarmaNo ratings yet

- Camden 2012 Price ListDocument52 pagesCamden 2012 Price ListSecurity Lock Distributors100% (1)

- Vadilal Industries LimitedDocument29 pagesVadilal Industries LimitedSubhash YadavNo ratings yet

- Strategic Comparison of PEL and Singer PakistanDocument30 pagesStrategic Comparison of PEL and Singer PakistanArslan Nawaz67% (3)

- The Implementation of NUD Process - Joe Powell - FINAL - REVIEWEDDocument39 pagesThe Implementation of NUD Process - Joe Powell - FINAL - REVIEWEDShawn DeolNo ratings yet

- Vincent Aloysius - Role of Private Sector in Greening Skills - Experience From IndonesiaDocument11 pagesVincent Aloysius - Role of Private Sector in Greening Skills - Experience From Indonesiairisann0702No ratings yet

- FGD InstallationsDocument6 pagesFGD InstallationsdsoNo ratings yet

- Almig Screw Air CompDocument8 pagesAlmig Screw Air CompMohamed HarbNo ratings yet

- 3796 i-FRAME Self-Priming Pump - Goulds PumpsDocument3 pages3796 i-FRAME Self-Priming Pump - Goulds Pumpsmostafa fayed100% (1)

- An Empirical Study of Electricity Theft From Electricity Distribution Companies in PakistanDocument16 pagesAn Empirical Study of Electricity Theft From Electricity Distribution Companies in PakistanM Usman RiazNo ratings yet

- Acid Regeneration TechnologyDocument5 pagesAcid Regeneration TechnologyNadia WhiteNo ratings yet

- Tera Ts Catalogue PDFDocument16 pagesTera Ts Catalogue PDFVishab FredNo ratings yet

- Electrical MotorsDocument53 pagesElectrical MotorsSuda KrishnarjunaraoNo ratings yet

- Technologies Palm OilDocument2 pagesTechnologies Palm OilediasianagriNo ratings yet