Professional Documents

Culture Documents

A Comparative Study of Shopping Mall

Uploaded by

Nitish313309Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Comparative Study of Shopping Mall

Uploaded by

Nitish313309Copyright:

Available Formats

Comparative Study on Shopping Malls

A

DISSERTATION REPORT

ON

SUBMITTED IN THE PARTIAL FULFILLMENT OF

THE

AWARD OF THE DEGREE OF

MASTERS DEGREE IN BUSINESS ADMINISTRATION

(2008-2010)

UNDER GUIDANCE OF:

MR.VIKAS GAIROLA

SUBMITTED TO:

MS. ANURADHA DOGRHA

SUBMITTED BY:

CHANDAN KUMAR

Roll No. 08360500020

DOON BUSINESS SCHOOL, DEHRADUN (U.K.)

Comparative Study on Shopping Malls

TABLE OF CONTENTS

TOPICS

Introduction

Executive Summary

Industry Overview

Literature Review

Retailing in India

Global Formats

Key Facts About Retail Sector in India

Foreign Investment in Indias Retail Sector

Rationale of the Study

Shopping Malls Scenario in NCR

Objectives of the Research Study

Hypothesis of the Study

Comparative Study of Five Malls

Research Methodology

Data Analysis Preparation

Survey Discussion

Conclusion

Recommendations

Bibliography

Annexure

Questionnaire

Comparative Study on Shopping Malls

ACKNOWLEDGEMENT

Perfect is a famous saying and when a person gets practical experience

under the guidance of experts of the respective field, the knowledge gained

is priceless.

With a sense of great pleasure and satisfaction, I present this project report

entitled A Comparative Study Of Shopping Mall completing a task

successfully is never a one-man effort. Similarly completion of this report is a

result of invaluable support and contribution of number of people in direct

and indirect manner.

In the light of the foregoing, first of all my heartfelt gratefulness and thanks

goes to Mr. VIKAS GAIROLA without his indispensable cooperation the

project wont have been completed within the stipulated timeframe.

Finally, I would like to thank all the people, without whose insights and

opinions, this project would have been impossible.

CHANDAN KUMAR

MBA 4TH SEM

ROLL NO. 08360500020

Comparative Study on Shopping Malls

EXECUTIVE SUMMARY

Till the early nineties, the organized retail industry had not evolved. There

was no consumer culture, there were limited brands and people bought what

was available. There were no shopping areas. The retail industry lacked

trained manpower. It was difficult to compete with the unorganized sector

because they operated with minimal labor costs and overheads. Tax laws

and government restrictions added the problem. Liberalization has changed

all this. Today customer is with more spending power, is better educated,

and more importantly, exposed to brands and products through television

and foreign trips. The Indian consumer now has the desire to acquire.

Personal consumption is on the rise. Customer segments, already diverse,

have been sub-divided with joint families giving way to nuclear families, and

the increasing number of working couples. These changes along with

increased availability of retail space and qualified manpower have had a

positive impact. New players are now entering the market. Instead of retail

evolution, there is a retail revolution in India.

The emerging purchasing power of the urban educated middle class and the

growing work culture of the working women has changed the buying habits

of families, who are experiencing a growth in income and dearth of time.

Rising incomes have led to increasing convenience and service.

Consumers have started caring about where they would like to shop, be it

multi brand outlet, exclusive stores or malls with development around them

Comparative Study on Shopping Malls

but are also more demanding. They want superior quality at an affordable

price and they want it instantly.

Thus, we see that there is a strong trend in favor of one-stop shops like

malls and supermarkets. A Mall/supermarket appeals because of its pleasant

surroundings, better product display and the availability of a wide variety of

brands. The store has accurate measure controls and allows economies of

scale. A shopper also has the option of shopping for all household

necessities under one roof. In the future, with more dual income families, the

consumer ability to spend will increase, but at the same time, it is predicted

that the time available for shopping will go down. In such a scenario, the

retailers will have to increasingly develop shopping as an experience and at

the same time, the more successful ones will be those that provide faster

service. Malls, in particular, are contributing hugely to the development of

organized retail.. Malls are coming up both within cities and at the outskirts

vowing to create destinations that will attract thousands of customers every

day.

India is experiencing a mall boom. Shopping malls are set to one of the

most visible faces of the Indian retail scene in the next few years. According

to estimates apart from the metropolitan and larger cities, as many as 50

new malls will be coming up by 2005 in the smaller cities as well.

In India Shopping Malls industry is upcoming industry in India. Today in India

Shopping Mall industry is worth 17000 Cr. Industry. In NCR (National Capital

Region) Gurgaon is the most favorite place for the shopping malls. M.G.

(Meharuli Gurgaon) Road is the place for all famous shopping malls in

2

Comparative Study on Shopping Malls

Gurgaon. On M.G. Road Gurgaon MGF Group has two shopping malls in

operation MGF Metropolitan Mall, MGF Plaza, Sahara Group has its Sahara

Mall and DLF Group has its City Centre.

This project involves around the study of THE Consumer Behavior and

Experience about Shopping Malls; A Comparative Study. The methodology

adopted to study the project is through survey in Sahara, Ansal Plaza,

Center stage Mall, Shipra Mall and Metropolitan shopping malls on M.G.

Road, 100 consumers were surveyed. The survey is done through the

personal interviews by putting a set of structured questionnaire to the visitors

of Shopping Mall.

Consumer purchasing power is the main factor, which determines their

buying behavior and brand of shopping malls. Shopping Malls are the places

for the fun & entertainment, family outing, shopping and eatings. In

shopping Malls age factor is also one of the dominant factors in daily footfall.

What I studied that in different shopping malls different age group

consumers come and they impact on the buying behavior.

With new shopping-malls having become operational in many cities across

India, it is interesting to observe how the shopping-behaviour of consumers

in the vicinity of these malls has changed and thereby draw some lessons

that could be of some use to the developers of hundreds of new malls that

are currently under planning or construction across India.

It is still not too long ago that the operators of a particular new shopping-mall

at Mumbai had to contemplate restricting entries of visitors by imposing

Comparative Study on Shopping Malls

conditions that such entry was limited to those having mobile phones or

credit cards a.k.a., the income tax department's one in six criterion for filing a

tax return.

Mall developers also have to create distinctive identities for their specific

malls, much like the identities that have developed over time for major

shopping-high streets in various cities in the country.

Their work is not done just when the mall has been commissioned! As for the

would-be retailer tenants, it is important to realize that merely moving into a

mall does not guarantee business for them.

They have to work as hard to draw consumers to their own stores once the

latter have entered the mall, and then have the right value proposition for

them to get converted into customers, and then become repeat customers.

The final, obvious, conclusion is that mall developers have to invest in

getting a better understanding about the retail business, while retailers have

to get a better understanding about the dynamics of operating at a new

location.

Comparative Study on Shopping Malls

INTRODUCTION

Malls in India are a relatively new format for retailing. While this format may

have existed in the Western economies for several decades, in India this

phenomenon could be estimated to be only about fifteen odd years old.

One of the earliest large floor-area retailers in India was "Shopper's Stop".

However, the first of the current format of the malls was the Crossroads mall

in Mumbai, which was established by the Piramals in period around 200001. Crossroads then had the highest rent per sq. meter of establishment that

the vendors had to bear. Due to the exorbitant rent, Crossroads initially had

a rough ride. Also, the mall format was new, and was a novelty for most

Indian consumers. This led several visitors to the mall, but never converted

to actual purchases, since most were visiting the place out of curiosity.

However, the situation had changed drastically now. Malls seem to be

springing up across several cities in India. Notable among these is Gurgaon,

a upcoming city near NCR.

INDIA A Vibrant Economy & Resplendent Market

-

4th Largest economy in PPP terms after USA, China & Japan.

To be the 3 rd largest economy in terms of GDP in next 5 years.

2 nd fastest growing economy in the world.

The US $ 580 billion economy grew 8.2 percent in the year 03-04

Among top 10 FDI destinations

Comparative Study on Shopping Malls

Stable Government with 2 nd stage reforms in place

Growing Corporate Ethics (Labour laws, Child Labour regulations,

environmental protection lobby, intellectual and property rights, social

responsibility).

Major tax reforms including implementation of VAT.

US $ 130 billion investment plans in infrastructure in next 5 years

2nd Second most attractive developing market, ahead of China

5th among the 30 emerging markets for new retailers to enter

With over 600 million effective consumers by 2010 India to emerge as one of

the largest consumer markets of the world by 2010.

Five Reasons why Indian Organized Retail is at the brink of Revolution:

Scalable and Profitable Retail Models are well established for most of

the categories

Rapid Evolution of New-age Young Indian Consumers

Retail Space is no more a constraint for growth

Partnering among Brands, retailers, franchisees, investors and malls

India is on the radar of Global Retailers Suppliers

Looking Ahead

Many strong regional and national players emerging across formats and

product categories Most of these players are now geared to expand far more

Comparative Study on Shopping Malls

rapidly than the initial years of starting up Most have regained / improved

profitability after going through their respective learning curves.

Malls in India

A decade ago not a single mall

A year ago less than half a dozen

Today 40 malls

2 years from now 300 malls

Comparative Study on Shopping Malls

LITERATURE REVIEW

Retailing consists of the sale of goods/merchandise for personal or

household consumption either from a fixed location such as a department

store or kiosk, or away from a fixed location and related subordinated

services. In commerce, a retailer buys goods or products in large quantities

from manufacturers or importers, either directly or through a wholesaler, and

then sells individual items or small quantities to the general public or end

user customers, usually in a shop, also called store. Retailers are at the end

of the supply chain. Marketers see retailing as part of their overall

distribution strategy.

Shops may be on residential streets, or in shopping streets with little or no

houses, or in a shopping center. Shopping streets may or may not be for

pedestrians only. Sometimes a shopping street has a partial or full roof to

protect customers from precipitation.

Shopping is buying things, sometimes as a recreational activity. Cheap

versions of the latter are window shopping (just looking, not buying) and

browsing.

Kinds of Retailers

There are three major types of retailing. The first is counter service, now rare

except for selected items. The second, and more widely used method of

retail, is self-service. Quickly increasing in importance are online shops, the

third type, where products and services can be ordered for physical delivery,

downloading or virtual delivery.

8

Comparative Study on Shopping Malls

Even though most retailing is done through self-service, many shops offer

counter service items, e.g. controlled items like medicine and liquor, and

small expensive items.

A large shop is called a superstore. A shop with many different kinds of

articles is called a department store. Local shops can be known as brick and

mortar stores in the United States.

Many shops are part of a chain: a number of similar shops with the same

name selling the same products in different locations. The shops may be

owned by one company, or there may be a franchising company that has

franchising agreements with the shop owners (see also restaurant chain).

Some shops sell second-hand goods. Often the public can also sell goods to

such shops. In other cases, especially in the case of a nonprofit shop, the

public donates goods to the shop to be sold (see also thrift store). In giveaway shops goods can be taken for free.

The term retailer is also applied where a service provider services the needs

of a large number of individuals, such as with telephone or electric power.

Retail Pricing

The pricing technique used by most retailers is cost-plus pricing. This

involves adding a markup amount (or percentage) to the retailers cost.

Another common technique is suggested retail pricing. This simply involves

charging the amount suggested by the manufacturer and usually printed on

the product by the manufacturer.

Comparative Study on Shopping Malls

In Western countries, retail prices are often so-called psychological prices or

odd prices: a little less than a round number, e.g. $6.95. In Chinese

societies, prices are generally either a round number or sometimes a lucky

number. This creates price points.

Often prices are fixed and displayed on signs or labels. Alternatively, there

can be price discrimination for a variety of reasons. The retailer charges

higher prices to some customers and lower prices to others. For example, a

customer may have to pay more if the seller determines that he or she is

willing to. The retailer may conclude this due to the customer's wealth,

carelessness, lack of knowledge, or eagerness to buy. Price discrimination

can lead to a bargaining situation often called haggling a negotiation

about the price. Economists see this as determining how the transaction's

total surplus will be divided into consumer and producer surplus. Neither

party has a clear advantage, because the threat of no sale exists, whence

the surplus vanishes for both.

Chain stores (also called retail chains) are a range of retail outlets, which

share a brand and central management, usually with standardized business

methods and practices. They are a type of business chain. Such stores may

be branches owned by one company or franchises owned by local

individuals or firms and operated under contract with the parent corporation.

Features common to all chains are centralized marketing and purchasing,

which often result in economies of scale, meaning lower costs and

presumably higher profits.

10

Comparative Study on Shopping Malls

These characteristics also apply to chain restaurants and some serviceoriented chain businesses. Some argue that the standardized products

which result from such centralization are culturally detrimental; for example,

chain music stores are frowned upon by some for stocking works of more

popular music if they exclude less well known, usually independent artists.

Critics of chains allege that they are economically damaging to communities

because they extract capital that otherwise would recirculate in the local

economy with independently owned businesses.

The displacement of independent businesses by chains has generated

controversy in many nations and has sparked increased collaboration

among independent businesses and communities to prevent chain

proliferation. Such efforts occur within national trade groups such as the

American Booksellers Association and Council of Independent Restaurants

of America as well as community-based coalitions such as Independent

Business Alliances. National entities like the American Independent

Business Alliance and The New Rules Project promote these efforts in the

U.S. In Britain, the New Economics Foundation promotes community-based

economics and independent ownership.

By 2004, the world's largest retail chain, Wal-Mart, was the world's largest

corporation in terms of gross sales.

11

Comparative Study on Shopping Malls

A department store is a retail establishment, which specializes in selling a

wide range of products without a single predominant merchandise

line. Department stores usually sell products including apparel,

furniture, appliances, and additionally select other lines of products

such

as

paint,

hardware,

toiletries,

cosmetics,

photographic

equipment, jewelry, toys, and sporting goods. Certain department

stores are further classified as discount department stores. Discount

department stores commonly have central customer checkout areas,

generally in the front area of the store. Department stores are usually

part of a retail chain of many stores situated around a country or

several countries.

12

Comparative Study on Shopping Malls

RETAILING IN INDIA

Despite being one of the largest employing industries in India and

contributing a significant portion to GDP, it still lacks a clear policy which

would allow Indian retail players to firmly establish themselves and enable

them to face competition on an equal footing.

Indian retailing industry has made huge strides over the last 10 years. The

retail trade in India is expanding by 22 per cent per annum with addition of

25 million middle class customers. Despite the recent boom in the retail

sector in India, organized retail forms only around 3 per cent of the entire

industry.

Despite being one of the largest employing industries in India and

contributing a significant portion to GDP, it still lacks a clear policy which

would allow Indian retail players to firmly establish themselves and enable

them to face competition on an equal footing.

Large-format retailing in India has added razzmatazz to the urban shopping

experience. The interesting part, however, is how retailers are using modern

management to turn profitable.

For a while, there was disappointment. What had promised to be an

engaging 'Store Wars' saga had ended up as just another beauty contest. A

few glamorous mega-stores here and there, with people pausing to look

them up and down, before getting back to their old shopping routines at the

round-the-corner kirana stores.

13

Comparative Study on Shopping Malls

Years and years into liberalization, it seemed as if big-format retailing would

never come to India. Well, guess what - things have started changing.

Retailing, investors have realized, can be good business proposition, if

infused with cutting-edge management processes and strategies.

Globally, retailing is big business, worth a staggering $6.6 trillion, according

to a recent report published by McKinsey Co. in partnership with the

Confederation of Indian Industry (CII).

In India, the sector is the second-largest employer after agriculture, and is

the world's most fragmented too. There are some 12 million retail outlets in

India (compared to 905,000 in the US), half of which are low -cost kiosks

and pushcarts. In fact, if there is any sector that shows how starkly India

differs from the West, it is the way Indians shop. The organised sector

accounts for just 2 per cent (and modern stores just 0.5 per cent) of the

estimated $ 180-billion worth of goods that are retailed in India every year.

That total figure is the equivalent of the turnover of one single US-based

chain: Wal-Mart.

But it won't be that way for long. The growth of high-income, time-starved

nuclear families is prodding change. More than a third of India's population is

in the 20-44 age-group, says Urvi Piramal, vice chairperson, Piramal

Enterprises Ltd, who runs Crossroads, a swanky mall in Mumbai that has

become an island of glamour in a sea of greying concrete. "Attitudes are

changing", she says, "and people are more exposed to the world

environment, where they see so many brands and so many different

lifestyles. They try to emulate that. Also, import restrictions will soon be lifted,

14

Comparative Study on Shopping Malls

and the whole scene will change. People will want convenience and

service".

Besides, Indian youth desperately need 'hangout' places that satisfy their

notion of a 'cool' ambience.

McKinsey expects the organised sector to be around $ 18 billion (6 per cent

of the retail market) by 2010, which could support at least a couple of $450million-plus chains in grocery retailing and some $250-million-plus chains in

grocery retailing and some $250-million-plus stores in apparel, perhaps even

specialized categories like CDs and books. At the moment, more than half

the retail sales in India are groceries, which meet needs at the base of

'Maslow's hierarchy'.

"The investment wave has begun. Large format supermarkets are coming

up. Among centrally air-conditioned malls, Crossroads is the main test case.

Other than that, there is Chennai's Spencer Plaza and NCR's Ansal Plaza.

All of them seem perpetually crowded. The result: some 50 new malls,

making up around five billion sq. ft of fancy mall space, are currently under

development across the country. More will follow.

In all, around Rs. 3500 crore of investment is being put in. Construction firms

form one set of players. The other are industrial houses such as the RPG

and Piramal groups, which are looking at the retail sector as a high-growth

area that could create huge enterprises over the next decade. Other

industrial houses are getting ready for action too. This is one sector where

local expertise counts for a lot making it easier to compete with global

businesses if and when they are allowed in (foreign investment is not

permitted in retail).

15

Comparative Study on Shopping Malls

WHERE IT STANDS

Retail sales in 1998 (in $ billion)

2500

2325

2000

1500

1000

500

365

337

325

France

UK

China

180

0

USA

India

Size of largest player (in $ million)

200000

165000

150000

100000

50000

25505

24500

737

140

China

India

0

USA

France

UK

Source: CII/McKinsey

Small store domination

12000

12000

10000

8000

6000

4000

2000

1179

1071

MEXICO

BRAZIL

905

0

INDIA

16

USA

Comparative Study on Shopping Malls

GLOBAL FORMATS

Supermarkets: Classic self-service 4000-20000 sq. ft stores with

shopping carts, as popularized in India by 'Crazy Boys' firms, with typical

focus on regular groceries, household goods and personal care products,

Tesco and Safeway are famous chains. In India, Nanz, Food World and

Nilgiris.

Hypermarkets: These are huge (over 40000 sq. ft.) out of town stores

with ample parking, aimed at the monthly bulk shopper. They store a

wider variety of products (electronics, clothing and so on, apart from

groceries et al). Europe's leader Carrefour is famous here with its typical

100,000 sq. ft format.

Mass-merchandizers: These, like Wal Mart, are large 'destination' stores

that sell almost everything, often at comprehensive prices. These have

cross-country operations with centralized sourcing and hub-and-spoke

distribution.

Discounters:

Aimed

at

bargain

buyers,

these

are

bare-frame

supermarkets that offer less choice in each category but deep discounts

(on bulk-sourcing deals). Costs are kept super tight and inventories low.

Germany's Aldi is famous for this format.

Convenience stores: These are small (under 2000 sq.ft) stores located

at such convenient points as petrol stations that keep long hours and

sometimes do odd jobs for time-starved customers (clothes laundry,

17

Comparative Study on Shopping Malls

medicine prescription pick-up). These are designed for 'streamlined'

shopping.

Specialists: These like Toys 'R' Us, are seen as 'category killers'. Like

boutiques and high-end restaurants, these often have skills that can't be

duplicated and are closely related to the product. These are moving

towards 'consultative shopping', where salesmen are trained well enough

to offer specialized advice to customers.

Mom-and-pops: Traditional format. These are small (under 1000 sq.ft)

family-owned corner shops.

18

Comparative Study on Shopping Malls

KEY FACTS ABOUT RETAIL SECTOR IN INDIA

Even though India has well over 5 million retail outlets of all sizes and

styles (or non-styles), the country sorely lacks anything that can

resemble a retailing industry in the modern sense of the term. This

presents international retailing specialists with a great opportunity.

It was only in the year 2000 that the global management consultancy AT

Kearney put a figure to it: Rs. 400,000 crore (1 crore = 10 million) which

will increase to Rs. 800,000 crore by the year 2005 an annual increase

of 20 per cent.

Retailing in India is thoroughly unorganised. There is no supply chain

management perspective. According to a survey b y AT Kearney, an

overwhelming proportion of the Rs. 400,000 crore retail market is

UNORGANISED. In fact, only a Rs. 20,000 crore segment of the market

is organised.

As much as 96 per cent of the 5 million-plus outlets are smaller than 500

square feet in area. This means that India per capita retailing space is

about 2 square feet (compared to 16 square feet in the United States).

India's per capita retailing space is thus the lowest in the world (Source:

KSA Technopak (I) Pvt Ltd, the India operation of the US-based Kurt

Salmon Associates).

Just over 8 per cent of India's population is engaged in retailing

(compared to 20 per cent in the United States). There is no data on this

sector's contribution to the GDP.

19

Comparative Study on Shopping Malls

From a size of only Rs.20, 000 crore, the organised retail industry will

grow to Rs. 160,000 crore by 2005. The total retail market, however, as

indicated above will grow 20 per cent annually from Rs. 400,000 crore in

2000 to Rs. 800,000 crore by 2005 (Source: survey by AT Kearney)

Given the size, and the geographical, cultural and socio-economic

diversity of India, there is no role model for Indian suppliers and retailers

to adapt or expand in the Indian context.

The first challenge facing the organised retail industry in India is:

competition from the unorganised sector. Traditional retailing has

established in India for some centuries. It is a low cost structure, mostly

owner-operated, has negligible real estate and labour costs and little or

no taxes to pay. Consumer familiarity that runs from generation to

generation is one big advantage for the traditional retailing sector.

In contrast, players in the organised sector have big expenses to meet,

and yet have to keep prices low enough to be able to compete with the

traditional sector. High costs for the organised sector arises from: higher

labour costs, social security to employees, high quality real estate, much

bigger premises, comfort facilities such as air-conditioning, back-up

power supply, taxes etc. Organised retailing also has to cope with the

middle class psychology that the bigger and brighter a sales outlet is, the

more expensive it will be.

The above should not be seen as a gloomy foreboding from global retail

operators. International retail majors such as Benetton, Dairy Farm and

20

Comparative Study on Shopping Malls

Levis have already entered the market. Lifestyles in India are changing

and the concept of "value for money" is picking up.

India's first true shopping mall complete with food courts, recreation

facilities and large car parking space was inaugurated as lately as in

1999 in Mumbai. (This mall is called "Crossroads").

Local companies and local-foreign joint ventures are expected to more

advantageously positioned than the purely foreign ones in the fledgling

organised India's retailing industry.

These

drawbacks

present

opportunity

to

international

and/or

professionally managed Indian corporations to pioneer a modern retailing

industry in India and benefit from it.

The

prospects

are

very

encouraging.

The

first

steps

towards

sophisticated retailing are being taken, and "Crossroads" is the best

example of this awakening. More such malls have been planned in the

other big cities of India.

An FDI Confidence Index survey done by AT Kearney, retail industry is

one of the most attractive sectors for FDI (foreign direct investment) in

India and foreign retail chains would make an impact circa 2003.

21

Comparative Study on Shopping Malls

FOREIGN INVESTMENT IN INDIAS RETAIL SECTOR

After much deliberation and vacillation, on January 18, 2006, India opened

its retail sector although only a small crack- to foreign investment, by

amending its FDI regulations to allow single brand retail stores to be set up

in India, with not more than 51% foreign shareholding.

This means that single product brands like Rolex, Louis Vuitton, Versace,

and multiple product umbrella brands like Samsung, Sony and Hitachi,

would be able to invest in captive retail stores in India, through structures

having 49% or more of the shareholding being held by Indian partners /

shareholders.

This decision comes after strong internal opposition from within the coalition

government, especially from the Communist Party of India (Marxist) which

saw the entry of large players as a threat to the small unorganized retailers

that presently account for more than 95% of retail sales in India. The

government was able to prevail upon its coalition members by justifying the

move as part of Indias market access commitments to the WTO and also

submitting that premium, single brand outlets do not compete with the small

retailers.

However, foreign brands are not exactly waiting to crash in. Our reasons:

Many premium brands, as a policy, do not follow a captive retail

model in international markets, and work with franchised outlets.

Therefore, retail investments are not made by the brands themselves.

22

Comparative Study on Shopping Malls

India already allows franchising and authorized retail outlets on a third

party basis, for nearly all kinds of products, and most internationally

known brands are already present in India through this route.

Ownership of retail operations will only increase statutory costs for

foreign brands, in form of employment regulations, social security

(provident fund) registrations, and complicated closure, relocation and

exit procedures (closure and relocation of retail units is more common

than industrial manufacturing establishments). The authorized dealers

route does not impose any such requirements on the foreign brand.

Previous experience suggests that premium brands derive their

aspiration value from their exclusivity and inaccessibility. As a result, they

tend to lose their franchise among their highest echelon consumers,

when they become easily accessible in local markets.

There is a proliferation of grey market and parallel imports in many

luxury goods, which competes formidably against official retail outlets.

Often, such competition is not discouraged by the global headquarters,

on grounds that Indian import tariffs are the very reason for the grey

market in the first instance. Authorized service centres are obliged to

handle products bought on the grey market or from parallel import

channels, as long as they are not counterfeit.

A 51%-49% does not give the foreign partners sufficient management

control over Indian operations, as an Indian partner with more than 25%

shareholding has veto powers on several important subjects, under the

23

Comparative Study on Shopping Malls

Companies Act 1956.

Under the present conditions, the justification for owned retail outlets can

only come from other considerations, such as:

A compelling need to combat spurious and counterfeit products,

Ownership benefits of retail real estate (high appreciation),

An expectation that eventually, investment regulations would be

relaxed to allow 100% foreign ownership, or

Mainstreaming of indirectly-funded franchise outlets, in which

currently the brand reimburses all costs of exclusive retail outlets through

a management or administrative margin over and above the normal sales

commissions (this is practiced by at least one leading consumer

electronics company)

Repositioning brands through a retail strategy of exclusive store

formats.

Table: Indias Retail Sector Revenues, By Product Category, Rs Billion

6150

800

435

350

330

320

300

2003-04

Organised

retail

29

109

9

20

22

25

5.5

130

100

82

28

8

25

8

11

Total

Food & Grocery

Clothing, Textiles & Fashion

Jewellery

Catering Services (F & B)

Furniture & Furnishings

Consumer Durables

Health & Beauty care Products (including

Pharmaceuticals)

Mobile handsets and accessories

Footwear

Books, Music & Gifts

Watches

24

Share

0.5%

14%

2%

6%

7%

8%

2%

6%

25%

10%

40%

Comparative Study on Shopping Malls

Health & Beauty care Services

25

Entertainment

25

Total

9300

Source: Statistical Outline of India and several primary surveys

1.5

6

280

6%

3%

3%

After leading the it bandwagon, India is poised to grow as a retail hub. it is

imperative to sustain the modernization of the retail sector and cater to the

growing taste of the Indian consumer and dispel the myth that the game is

big vs. small or traditional vs. modern or organized vs. unorganized or local

vs. foreign. What is needed is to promote consumption which will ultimately

lead to economic growth of the country. For the Indian consumer, the gradual

and step-wise entry of foreign companies in retail involves three pivotal

changes modern technology, better transparency in dealings and sharing

best practices.

Key initiatives that the government and the industry need to take together

Ensure that the opening of this sector to foreign players is a win-win

for all

To ensure that Indian retail dynamics are very different from other

countries. hence to ensure that though we learn from global

experiences, we do not go all out to copy global models

Defining the way forward

FDI would serve the purpose of much needed capital and bring a boom in

the retail sector. As, some of the global retailers are already coming in

through other channels there is no justification to keep fdi in retail on hold.

However, the industry also feels that capital formation is needed and this will

take at least 2 to 3 years time. Hence, retailers, for capital formation, need

25

Comparative Study on Shopping Malls

this lead-time, reiterating the fact that fdi should be allowed gradually. But

this should not constrain the growth of the retail sector. Since objective of fdi

is to increase investment, there is also a need to explore alternative funding

routes, in addition to FDI. For example, if a capital turnover ratio of 1:5 is

assumed, then it requires at least Rs. 20,000 crores of investment. hence

foreign institutional investors (FIIs) and venture capital (vc) firms should be

legalized and encouraged for investment in the primary market.

FIIs and VC firms are currently allowed to participate in the growth of the

listed retail companies present in the secondary market; they have the

necessary financial muscle and are increasingly on the lookout to invest in

India. Retail is a sunshine sector with tremendous growth potential

allowing them to invest in retail companies in the primary market will enable

many of these emerging companies to increase operations, improve

infrastructure, set up the latest systems, achieve critical mass and enhance

employment opportunities.

Another objective of FDI is to enhance infrastructure. While there is no

dearth of potential investors in metro cities, the tier-2 and lesser cities are

getting sidelined. FDI should be initially allowed in tier2 and lower cities to

facilitate infrastructure building. The more such investment, the more

incentives to operate in metro cities. Models similar to airline operators and

telecom operators need to be explored. With this the focus would be on

incremental business and create a level playing field for all and not on

cutthroat competition. The government is already considering a host of

conditions for bringing in FDI. One of them is to impose a minimum limit of

26

Comparative Study on Shopping Malls

10,000 sq ft on the floor space of foreign retail chains and limit the number of

stores to one per million once FDI in retail is allowed. this also serves to

create level playing fields for all players. also, inclusion of a clause for

reserving at least 500-600 sq ft (out of 10,000 sq ft) of retail space for foods

& processed foods alone will further help to protect the interests of certain

sectors like agriculture and integrate them with the organized retail supply

chain. These measures are to be applicable for a short while only, as the

department of industrial policy and promotion (dipp) is considering easing

some of these restrictions with time. Hence, with an objective of enhancing

Indian economy by increasing consumption, a recommended CII policy for

introducing FDI in retail is as follows:

FDI should be gradually allowed first in relatively less sensitive

sectors garments, lifestyle products, house ware, entertainment etc.

Alternative funding mechanisms and investment opportunities should

be considered like FII and venture capital in the primary market, in

addition to FDI.

At least 2-3 years lead-time should be given to the Indian retail

industry for much needed capital formation by Indian retailers and to

promote a level playing field for all.

Promote FDI in tier 2 and less developed cities to focus on the thrust

for infrastructure growth.

27

Comparative Study on Shopping Malls

RATIONALE OF THE STUDY

Shopping Mall industry is an upcoming industry in India, as Shopping Malls

are changing the way middle-class Indians shop. With fully air conditioned

stores, escalators and quality service resembling any international Mall.

Today a customer pays greater attention to product availability, display, instore service and of course, the ease of shopping. Indian families are also

looking at entertainment as a escape. Entertainment is equated with

shopping, food and options like cinemas and bowling alleys.

The decade old economic reforms have engendered a new, shop till you

drop breed of middle class Indians who after experiencing the shopping in

big cities overseas, have fueled the demand for the rise of Shopping Malls.

There are number of families who are starved of attractive entertainment

options and with rising disposable income, who want to spend a greater

proportion of their expenditure on shopping in world class ambience where

convenience is combined with entertainment. From boring oh no routine to a

fun filled yes outing for the entire family, shopping for the typical household

has come a long way indeed. Multi-Storyed malls have most definitely made

an impact offering shopping, entertainment and food all under one

comfortable roof.

Giant malls are coming thick and fast in Gurgaon to completely transform the

$200 billion Indian retail sector. More than 200 malls are in planning and

construction stage across the country and to in-cash the sudden resurgence

of interest in shopping India, big corporate such as the TATAS, PIRAMALS,

28

Comparative Study on Shopping Malls

RAHEJAS, SAHARA , DLF AND RPG ENTERPRISES are racing to

revolutionize the Indian retail industry and fuel a construction boom.

India is becoming the hub of Shopping Malls. In Gurgaon particularly lots of

shopping malls are opening up. In October 2004 Indias first Mall exclusively

dedicated to Jewelry (Gold Souk) was opened in Gurgaon, on the outskirts

of the capital. The Gold souk's retail space has been leased out or sold with

about 70 retailers including 35 major national and international brands for

business.

Leading brand names have occupied space in the gold souk

include Hammer Plus, Espirit, Hugo Boss, Citizen, Celeste, Asmi, Sangini

and Nakshtra.

This project helps me in finding out how the Shopping Malls are changing

the Indian retail industry in general and redefining consumers shopping

experience due to increase in their overall exposure to the different varieties

of product under one roof.

29

Comparative Study on Shopping Malls

SHOPPING MALLS SCENARIO IN NCR

Shopping Malls across the world contribute in a major way to shopping

requirements of domestic and foreign tourists. Of late the concept of

Shopping Mall has become popular with Indians too. But no real Shopping

Malls have come up in anywhere in the country. What we do have are really

hyper markets, huge shopping complexes etc.

A shopping mall (or simply mall), shopping center, or shopping arcade is a

building or set of buildings that contain stores and have interconnecting

walkways that make it easy for people to walk from store to store. The

walkways might be enclosed. In the United Kingdom and Australia these are

also called shopping centres, shopping arcades as well as shopping malls.

In North America the term "mall" is preferred.

Strip malls are a recent development, corresponding to the rise of suburban

living after World War II in the United States. As such, the strip mall

development has been the subject of the same criticisms leveled against

suburbanization and suburban sprawl in general. In the United Kingdom

these are called retail parks or out-of-town shopping centres.

Malls in NCR

Pacific Mall, Kaushambi (Having 3-D movie theater also)

Ansal Plaza, South NCR

Ansal Plaza (Factory Outlet Mall), Vaishali

Centrestage mall, NOIDA

30

Comparative Study on Shopping Malls

SAB Mall, NOIDA

Shipra Mall, NOIDA/Ghaziabad

Pacific Mall, NOIDA/Kaushambi

Shopprix Mall, NOIDA

Spice World Mall, NOIDA

Senior Mall, NOIDA

MGF Metropolitan Mall, Gurgaon

Sahara Mall, Gurgaon

DLF City Centre, Gurgaon

SRS Plaza, Faridabad

East End Mall, Ghaziabad

The India Mall, New Friends Colony

TDI Mall, Rajori Garden

City Sqare,Rajouri Garden

The retail business in India is set for a heady growth in the coming years

with the number of shopping malls in Asia's third largest economy rising to a

staggering 358 by the end of 2007, according to a study.

The country has some 100 malls now, with the National Capital Region

(NCR) and Mumbai accounting for maximum numbers of the gleaming

shopping centers.

31

Comparative Study on Shopping Malls

But the retail sector is expected to see over 34 million sq ft of shopping

centre space by the yearend, said the report on shopping centre

development in India.

"Performance beyond expectation is all the more significant in the backdrop

of adverse reports and predictions on this sector," said Amitabh Taneja,

director (India) of International Council of Shopping Centers.

According to Images, there are a total of 96 operational malls in India with a

total built-up area of 21.6 million sq ft. The number will rise to 158 malls by

the end of the current year. Droves of middle-class Indians have broken off

their love of traditional stand-alone Indian stores that have no air

conditioning, organised parking and other public amenities.

Experts say malls throughout the country are getting bigger as they are now

being positioned as a one-stop-shop for shopping, entertainment, leisure

and eating-out needs rather than a place only for shopping for fashion

products.

By 2007, north zone will account for 39 percent of total mall space, followed

by west zone (33 percent), south zone (18 percent) and east zone (10

percent), says the Images study. The study also added that a lot more

activity on the mall development front was expected from the smaller cities in

the coming years.

The retail industry in India is currently estimated at $205 billion, which is

likely to grow at a rate of five percent per annum in the coming years. It is

32

Comparative Study on Shopping Malls

projected to grow at the rate of 25-30 percent per annum to touch $8 billion

by 2005 and $24 billion by 2010, said the study.

The fast growing middleclass population, the rise in women workforce and

consumerism over the decade has been the major forces in driving demand

in the retail sector.

33

Comparative Study on Shopping Malls

OBJECTIVES OF THE RESEARCH STUDY

The first step in any Marketing Research calls for the researcher to define

the project scope and then define problem carefully and formulate the

research Objectives. An old age says, A problem well defined is half

solved.

1. To study the reasons behind the growth of Shopping malls in India

2. To study the recent trends in Shopping malls in India.

3. To understand the implications of opening up of FDI in Retail sector

4. To understand the strengths and weaknesses of shopping malls in India

5. To study the inherent benefits of Shopping malls to the end user.

6. To study the profile of consumers visiting different Shopping Malls along

with their motives.

7. To find out different buying behaviors of consumers in different Shopping

Malls at NCR & NCR.

8. To analyse the future of shopping Malls in India.

34

Comparative Study on Shopping Malls

HYPOTHESIS OF THE STUDY

Shopping malls in India are poised to change how

retailing is done in India.

35

Comparative Study on Shopping Malls

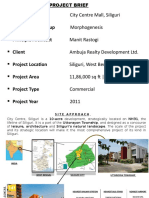

COMPARATIVE STUDY OF FIVE MALLS

ANSAL PLAZA

HUDCO PLACE, KHEL GAON MARG ANDREWS GANJ,

NEW NCR - 110 049 TEL :+( 91)-(11)-26261305, 26255532

A part of HUDCO Place built on 35 acres of land, Ansal Plaza is a shopping

complex situated near South Extension, one of the posh markets of rich

South NCR. Branded cloths, trendy jewellery and other designer items are

some of the things that you can shop for at Ansal Plaza. The Plaza complex

competes with the best international shopping complexes in the world in its

architectural splendor, aesthetic details and shopping experience. A perfect

hangout destination, it is built in a circular fashion around an amphitheater

with a center stage. Different cultural functions are organized here from time

to time such as fashion shows, live band performances and performing arts

to promote the retail area. One can access the retail floors of the complex

through lifts and escalators.

The 45-feet high atrium with a French glass curtain wall that filters out

ultraviolet and other harmful radiation is visually appealing. The second and

third floors of the complex house corporate offices and are accessible

through elevators. The twin-level basement car parking area can

accommodate 700 cars while another 300 cars can be parked on the ground

level. There are water cascades and fountains all around and corridors,

passages and lobbies of the complex are laid with granite and marble

combination flooring. Smoking is not allowed here. Easy accessibility,

36

Comparative Study on Shopping Malls

environment-friendly design and ample infra-structural facilities make Ansal

Plaza, the best shopping complex in NCR.

37

Comparative Study on Shopping Malls

SAHARA MALL

MEHRAULI-GURGAON ROAD

GURGAON - 122002

TEL :+( 91)-(124)-5048592, 2387741

This is Indias first Brand Super Mall launched in March 2001 spread over

3.89 acre on the main Mehrauli-Gurgaon road. Created with a project worth

of Rs.13814.5 lac, the mall comprises company owned brand outlets and

flagship stores promising complete range of products and latest offerings. A

shopping mall that has set new standards in contemporary design and latest

facilities making it one of the most preferred shopping zones for the

consumers, with international class retailing environment. It has earthquake

resistant construction, a classy entry, multiple openings and wide corridors

besides two-level parking lots in the basement. It offers an international class

environment global brands and a comprehensive package recreational and

leisure activities.

From ground floor to the third floor there is an array of international and

national brands including Pantaloon, Big Bazaar, Airtel, L.G., Cafe Nescafe,

Nakshatra, Archies, Planet-M, Hallmark, Effinity, Haldirams, Panjabi Tadka,

Ros Thai, Tangerine, Crave and Odyssey. The grand atrium welcomes the

customers and invites them to experience a world of class and lavishness.

Matching the occupants it has been built with full dignity and grace. The

renowned firm Chesterton Meghraj has taken the responsibility of managing

the mall.

This is India's first Brand Super Mall launched in March 2001 spread over

3.89 acre on the main Mehrauli-Gurgaon road. Created with a project worth

38

Comparative Study on Shopping Malls

of Rs.13814.5 lac, the mall comprises company owned brand outlets and

flagship stores promising complete range of products and latest offerings. A

shopping mall that has set new standards in contemporary design and latest

facilities making it one of the most preferred shopping zones for the

consumers, with international class retailing environment. From ground floor

to the third floor there is an array of international and national brands

including Pantaloon, Big Bazaar, Airtel, L.G., Caf Nescafe, Nakshatra,

Archies, Planet-M, Hallmark, Effinity, Haldirams, Panjabi Tadka, Ros Thai,

Tangerine, Crave and Odyssey. The grand atrium welcomes the customers

and invites them to experience a world of class and lavishness. Matching the

occupants it has been built with full dignity and grace. The renowned firm

Chesterton Meghraj has taken the responsibility of managing the mall.

39

Comparative Study on Shopping Malls

MGF METROPOLITAN MALL

Mehrauli-Gurgaon Road,

Gurgaon - 122002

Tel :+( 91)-(124)-5014606-07

Close to the NCR-Haryana border on the Mehrauli Gurgaon Road is this

mega shopping mall that is a promising leisure and entertainment centre.

The favorite eating joints of childrens and teens like McDonald's Debonair's

Pizza and Hot & Juicy Corner are on the ground level while formal family

restaurants have the rooftop zone reserved for the.

The facility is fully equipped with central air-conditioning, power back-up,

ample parking, state of the art safety management systems, modern

telecommunication

system,

property

management

services

and

computerized parking access.

400,000 sq. ft fully air conditioned state-of-the-art Shopping Mall with 7screen Multiplex (Operator PVR), Departmental Store, Shops and Food

Court. The Project has been a landmark Mall development in Gurgaon and

it's tenants include Shoppers Stop, McDonald's, PVR, Nike, Benetton to

name a few. The facility is fully equipped with central air-conditioning, power

back-up, ample parking, state of the art safety management systems,

modern telecommunication system, property management services and

computerized parking access. The Metropolitan Mall is truly a Shoppers

paradise.

From furnishings to cosmetics, jewellery to designer wear, the complex

covers varying budgets, tastes, and needs. The Metropolitan promises a

40

Comparative Study on Shopping Malls

veritable feast with its 6 specialty restaurants offering Continental, Chinese,

Mediterranean and Frontier cuisine. In jazz bar exclusively for musically

inclined, live performance from talented musicians and groups are organized

to attract the music lovers to stay there for longer hours. Also theme based

restaurants like sports cafes appeal to the younger crowd. Metropolitan top

floor have a multiplex PVR Cinema hall to screening the latest blockbusters

to draw crowds to upper floor stores, encouraging impulse buying.

Metropolitan also has a discotheque which serves as a crowd puller during

after commercial hours, along with serving as a venue for exciting events

and promotions. It has a host of arcade games, pool, bowling, crazy cars

and virtual reality games which aimed to attract the younger crowd .the

constantly changing signage and cutouts of recent attractions add variety.

Exclusive fitness club boasting modern equipment and facilities are also

featured by the club along with the branded parlors and trial outlets by

leading fashion names are the features of Metropolitan Mall.

It also has an atrium which is designed as the heart of the complex which

serves as the converging point for the flow of visitors and as the primary

node from which they can start their journey to the Mall. To give ease to the

customers once they are finished with the shopping there are designated

resting areas for the visitors

41

Comparative Study on Shopping Malls

SHIPRA MALL

SHIPRA SUN CITY,

INDIRAPURAM, GHAZIABAD,

UTTAR PRADESH (U.P.) 201012

Shipra Group launched its largest mall in NCR inspired by classical Romanstyle architecture. Situated at Indirapuram with 4.5 lakh sq. ft of total area,

Shipra Mall commits to offer a unique shopping experience with over 100

national & international brands and entertainment. The mall has been

designed as a one-stop-destination for entertainment and leisure. Its stateof-the-art 3 Screen Multiplex, Just About Movies (JAM) has one of the

widest and the largest screens in India.

The new Shipra Mall has taken retail to a mega scale. With a total area of

4,50,000 sq ft comprising of 3,60,000 sq ft of retail space, Three New

Generation of Cinemas, 17,000 sq ft of Kids Zone, 15,000 sq ft of Food

Court, Amphi Theatre & parking for 1000 cars. 80 percent of mall space has

already been leased out to retailers like Shoppers Stop, Globus, Food

Bazaar, Fashion Station etc. The mall has been designed with twin atriums

for better space and visibility for the retailers and free flow for shoppers.

Shipra Mall, developed by Shipra Motel & Restaurants Limited is

designed to be more than just a Cineplex / Multiplex.

It's an experience, a lifestyle destination, mesmerizing families with

hours of quality time.

42

Comparative Study on Shopping Malls

Indirapuram is an upcoming retail hub after Gurgaon and Noida.

Being a junction for three cities i.e. Ghaziabad, Noida and NCR,

Indirapuram has become a destination point with an easy access.

Shipra Mall promises to offer customers a never-ending shopping

experience under one roof as well as convenience of ample parking

space.

The Shipra Mall is the first and the only International Standard Retail

cum Entertainment Mall and the launch pad of more than a dozen

retail and food brands in the city.

Outlets / Stores

Type

Phone / Mobile

Bombay Selections

0120-2957788

Cottons by Century

Menswear

0120-2957637, 9213970761

Fashion Station

Apparel,

Accessories &

More

0120-2957652

Food Bazaar

Gangoly Bros.

0120-3028393

Watches

0120-2957581

43

Description

Comparative Study on Shopping Malls

Hakoba

Womenswear

0120-3029290

Jashn

Sarees

0120-3208002, 3208811

Just About Movies (JAM)

Multiplex

01202957610,2957620,2957630

Koutons

Menswear

0120-2957572

Men.xs

Menswear

0120-2957575

Paisleys

Womenswear

0120-2957579

Planet M

Music Store, Gifts 0120-2957661-63

Shoppers' Stop

Multi-brand Outlet 0120-3028070, 3028072

Sona Exclusive

Women

Spaces

Home Furnishings 0120-3026702

Zodiac

Menswear

0120-5517728

44

Comparative Study on Shopping Malls

CENTRE STAGE MALL

L-1, SECTOR 18

NOIDA - 201301

TEL :+( 91)-(120)-2512260, 25122642626 1305

Centra Stage Mall is a hot entertainment destination for those living in the

vicinity while for others it doubles up as a great landmark in Noida. It offers

include Waves- a three-screen multiplex, posh showrooms from USI,

Westside, Gyans and Meena Bazar among others eateries like Geoffrey's

Mircheez, McDonald's and Ruby Tuesday. Representing global trends in

retail and entertainment, Centrestage Mall, a joint venture of the Chadha

group and the Shipra group, located in sector 18, the shopping hub of

NOIDA, plans to offer world class shopping ambience with cinema

experience.

This is the beginning. The retailing map of India seems to be in for a sea

change. Retailing is emerging in all sorts of permutations and combinations.

Various international role models are there but it remains to be seen how

much we would be ready to absorb and assimilate.

It is located in the commercial hub of Noida that is in sector 18. It is the most

popular shopping mall in NCR. All popular showrooms have now opened in

this mall. It also has a popular Cinema Theatre called Waves. There is a

food court in the basement. Centrestage Mall also provides underground

parking.

45

Comparative Study on Shopping Malls

Centrestage mall was a project that was first of its kind taken up by Shipra in

NCR that today is a landmark in Noida. Spread in an area of more than

3-lakh sq. Ft with 5 movie theatres, kids zone, food court etc. Owing to

its appeal and the variety it offers, it acts as a sheer crowd puller. The

mall had witnessed phenomenal footfalls of over 25,000 on Christmas

last year.

The Centrestage Mall (CSM) is designed to be more than just a Cineplex /

multiplex. Its an experience, a lifestyle destination, mesmerizing families

with hours of quality time.

Taking retail to a mega scale, with an area of 3,48,460 sq ft comprising of

1,38,500 sq ft of retail space, 12,000 sq ft of night club, 93,000 sq ft

for parking in 2 levels and 1,04,360 sq ft of food & entertainment

area.

Features

In the offer are a 63 seater multi-branded Food Court and WAVE SHIPRA,

the 1770 + 34 Platinum Class seater Multiplex (5 theaters) making it as one

of the first in the city. The anchor shop, Tata Westside spread over two floors

46

Comparative Study on Shopping Malls

covers an area of 14,500 sq. ft. Also, CSM is the first and only International

Standard Retail cum Entertainment Mall and the launch pad of more than a

dozen Retail and food brands in the city.

The building is earthquake resistant with state-of-the-art technology. It

operates on a an integrated Building Management System with multiple

levels of Intelligence centralized operations of building services. It gives

absolute control over the operation and monitoring of HVAC, Lighting, FireAlarm, Plumbing and DG systems. The building has a centrally air

conditioned system with ionization for regular inflow of pure fresh air.

The mall has a state-of-art architecture. We can move up and down by

escalators and elevators.

50% of the 'Sector 18 Crowd' is found in the Centrestage mall. The demand

of products in the mall has led to the improvement in business of many

small shops which did not have a good income at other places.

The food court provides many different mouth watering dishes like Chinese

and Indian.

Outlets / Stores

Type

Phone / Mobile

Barista

Cafe

0120-3096236

Cafe Coffee Day

Cafe

0120-2591462, 51659403

Chikankari

Ladieswear

0120-2591549, 5312207

Cookie Man

Bakery

0120-5312708

Elevate

Club (Weekends)

0120-2513904

FoodPlus

Supermarket & Family Store

0120-2513445

47

Comparative Study on Shopping Malls

Geoffrey's

British-style pub

0120-2512020

Maamouchee

Food Multi-cuisine

0120-5312241, 2517036-37

McDonald's

Fast Food

0120-2511024, 3090408

Men.xs

Menswear

0120-2513722

Mircheez

Food - Indian

0120-3092726

Orange Caezar

Food Multi-cuisine

0120-3948422, 33

Pizza Corner

Fast Food Dine in outlet

0120-51664110, 11

Planet M

Music Store, Gifts

0120-2517773

Ruby Tuesday

Food, drinks

0120-5332477, 5313478

Shayan

Home Furnishings

0120-2510408

Shiva Motors

Car

9891755603, 9837500981

Subway

Fast Food

0120-3947679

Tropical Smoothie Cafe

Beverages

0120-3944729

Walk in M&B

Footwear

Wave

Multiplex

011-51832222

Westside

Men, Women, Kids, Home

0120-2517761

48

Comparative Study on Shopping Malls

RESEARCH METHODOLOGY

Research Plan: Research Plan is no specific for all types of research; it is

decided depending upon the nature of the problem. It can be Exploratory,

Descriptive or Causal.

To study the Consumer Behavior and experience about Shopping Malls is a

descriptive research.

Designing a research plan calls for decisions on

1. Data sources

2. Research Instruments

3. Sampling plan

4. Contact methods.

Data Sources: The research involves gathering Secondary as well as

Primary data.

Primary data: A survey was conducted to gather primary data from the

market here the main emphasis will be given on the consumers to gather

information as consumers are the ones who decide the brand of any

shopping mall and they are different from each other on various aspects. It

will help us to know their purchasing behavior in different shopping malls.

They are the one who constitute the market and the target of the business.

In Shopping Malls Industry until and unless we have the knowledge of

consumer buying behavior and where they spend the most and what they

think about the mall cannot increase the footfall and conversion ratio.

49

Comparative Study on Shopping Malls

Secondary data: Secondary data regarding foot falls in shopping mall,

buying pattern and other related was collected from the internet and mall

management itself.

Research Instrument

In marketing research the main research instrument used in collecting

primary data is the Questionnaire. For this research a set of questionnaire

was used to gather information on the consumer buying behavior and their

perception towards the shopping malls. The questionnaire had both open

ended and close ended.

Sample Plan

The Sample Plan calls for three decision

Sampling Unit,

Sample Size,

Sampling Procedure

CONSUMER SURVEY: Sample Unit: Consumers.

Sample Size: 100

Sample Unit: Sahara Mall, Shipra Mall, Metropolitan Mall, Ansal Plaza &

Center Stage Mall.

RETAILER SURVEY: Sample Size: 50

50

Comparative Study on Shopping Malls

Sample Procedure: (Random Sampling) Non-probability Convinces Sample

is adopted i.e. the most accessible members of the population are randomly

selected.

CONTACT METHOD:

The best-suited method for this kind of survey is

Personal Interview. Through this method of conducting research more

questions can be asked and it helps in collecting additional information.

51

Comparative Study on Shopping Malls

DATA ANALYSIS PREPARATION

RETAILERS

Do you agree that there is trend towards organised retail in India?

50

50

40

30

20

10

0

0

YES

NO

Do you think large organized retailers would be controlling a substantial

portion of the retail trade?

50

50

40

30

20

10

0

0

YES

NO

52

Comparative Study on Shopping Malls

How do you perceive the development of Shopping malls in NCR and NCR

Region?

45

40

35

30

25

20

15

10

5

0

45

5

Healthy Trend

Unhealthy Trend

What according to you is the purpose of the customers visit to the Shopping

Malls?

45

50

50

45

38

40

42

40

30

20

10

12

10

0

Yes

Food and Beverages

Life style products

Choosing gifts

No

Music and Entertainm ent

Latest Fashion and Clothing

Consum er Durable

53

Comparative Study on Shopping Malls

What according to you are the reasons for buying at that particular shopping

mall (Please rank them in order of preference?)

5

5

4

3

4

3

2

1

0

2

1

Nearness to house/locality

Friendly shopkeeper/ good relations

Good bargain

Good range available

Good ambience

Rank (1-6) the following factors, which influence the customer purchase

decision at a shopping mall.

6

5

4

3

2

0

Price

Brand

Location of Mall

Parking At Outlet/Mall

Appealing Ambience

3-D Column 6

54

Comparative Study on Shopping Malls

Do shopping malls have the following advantages?

50

48

50

45

39

40

35

50

32

32

30

25

18

20

18

15

11

10

2

0

Yes

No

Tim e Factor

Discount schem es

Adequate parking space

Individual sections for all categories

Good shopping experience in better place w ith convenience and variety.

Organized shops w ith international am bience &air condition all-around.

Do you think India has a potential in the Retail industry?

50

50

40

30

20

10

0

0

YES

NO

55

Comparative Study on Shopping Malls

Do you think that organized retail will provide many opportunities both to

existing players as well as new entrants?

50

50

40

30

20

10

0

0

YES

NO

Do you think India is prepared for open competition?

50

50

40

30

20

10

0

0

YES

NO

56

Comparative Study on Shopping Malls

PRE-REQUISITES FOR SHOPPING MALLS

A good anchor: for the generation of initial foot falls, the anchor store

comes in handy. Sahara mall for example, the biggest crowd puller

there being the big bazaar. The anchor store also communicates the

positioning of the mall.

A kids center: young mothers dont want to divide their attention

between the various flashy brands, stores on one hand and their kids

on the other. So the malls should arrange for a set up where

caretakers are present to take care of their kids.

Food courts: people are spending more chucks of time in the malls.

So they are likely to get hungry as well. Families who come for a real

shopping

experience

necessarily

look

for

wholesome

eating

experience as well. This can be provided not by one particular kind of

cuisine but one, which can satisfy many a taste bug. A good example

is the food court in the metropolitan mall on mg road in GURGAON.

Disciplined parking: it goes with out saying that majority of the

footfalls in any shopping mall belong to the own vehicle category.

Visitors expect guidance inside the parking and speedy acceptance of

payment and verification.

Valet parking: nothing at all should lead to exit of a prospective

footfall. So better still give the visitors the comfort from the moment

he/she enters the premises. Given the condition of traffic, they would

57

Comparative Study on Shopping Malls

welcome if some one could park the car and they are ready to pay for

it.

Centralized administration: such a move should provide for an office

inside the mall premises where the customers can avail the following

services:

1.

Lost and found

2.

Announcements for lost children or relatives

3.

Baby carts

4.

Common shopping carts

5.

Lockers for the visitors

Sticky tools: these are the facilities which encourage the customers to

sit and while away time inside the mall and lead to greater

conversions of footfalls into sales. The mall should provide for free

sitting area so that each time the visitor is tired after shopping they

dont necessary spend money to sit inside a foot parlor and take rest.

Signages: This would guide the customers towards the store as they

would not face any difficulties in locating the shop.

Lift & Escalators: Lift & Escalators are integral for the convenience of

the customers.

Fire Security: Proper security against fire is an essential pre-requisite

for the convenience of the customers in Shopping Malls.

58

Comparative Study on Shopping Malls

Schemes: Various schemes are essential to attract the customers for

e.g. lucky draw organised by Malls.

Air Conditioning: Air conditioning of the mall is also a very important

pre requisite of shopping malls.

ADVANTAGES OF SHOPPING MALLS

Time Factor: As consumers get one stop shopping for their entire

daily needs; it cuts down on their time, money and energy. One stop

shopping is very convenient for them especially when they have less

time to spend on shopping.

Discount schemes: on their bulk purchases they receive good

discounts so they prefer shopping from shopping mal

Fun and entertainment and the varieties offered by shopping malls.

Adequate parking space: especially for four wheelers.

Kids section: customers can make their babies sit there while they are

shopping; this is more convenient for the working mothers who are

tired after their long working hours.

More disposable income in hand: people prefer to gain shopping

experience in better place with convenience and variety.

The shops are scattered all over the place in the normal market which

lead the customer to do a lot of running around, which saps the

energy while in shopping malls one can shop in an international

ambience with air condition all-around.

59

Comparative Study on Shopping Malls

Indian consumer is on a spending spree, burning 90% of disposable

income on non-essential items. There is a major cultural shift for a

traditionally savings- conscious India people want good life, they have

money, they are willing to spend and they find shopping malls the best

place to fulfill their needs.

Malls are anchored in our sociological evolution: it is about being

seen at prices that we cannot afford but in reality the products

available in Malls are not only affordable but are off good quality and

are also conveniently available.

The malls are being built to take advantage of a real estate boom and

not necessarily a shopping boom. Gurgaon is the mall capital of India,

almost 82% of the revenues in the malls are generated from movies

and food than any other thing but this phenomenon is rapidly

changing and now customers do go to Malls for purchasing goods.

THE PROBLEMS FACED BY SHOPPING MALLS

High rentals: The malls are being sold and as a result speculators

enter the market and charge high rentals.

Preference of customers towards kirana stores: customers still prefer

kirana store than shopping malls as the people living in NCR still find

difficult for them to reach Gurgaon as it takes more than 90 minutes

for them to reach there so they prefer to shop from near by stores

instead of wasting their time reaching Gurgaon in huge traffic and

facing difficulty parking their vehicles.

60

Comparative Study on Shopping Malls

Retailers not getting enough discounts from the manufacturers: the

manufacturers dont want to give huge discounts, even if the retailers

are reasonably big, because that causes dissonance with other

dealers who would then refuse to stock their goods.

Developing a supply chain with consistent and large enough

quantities is easier said than done especially for the Indian suppliers.

The behavior of and Indian consumer is not conductive to malls: As

we still dont have multi shop options to scour for the same kind of

product since one mall will carry only one brand of home furnishings

secondly we are convinced that if a shop is in a mall, then the pricing

is loaded and we are paying for that shops rent and infrastructure

costs, not to mention the air-conditioning. And we also believe that the

mall choices are very limited.

India is a check out nation: we check out pieces and then checkout of

the store. Rarely will we make purchases without checking the

competitive scene.