Professional Documents

Culture Documents

Case On India and China Corporations and Small Farmers Fin

Uploaded by

Sivakumar SurampudiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case On India and China Corporations and Small Farmers Fin

Uploaded by

Sivakumar SurampudiCopyright:

Available Formats

Large Corporations Engaging Small Producers—

Fruits and Vegetables in India and China

Live Case prepared and presented by Nancy Barry, President of NBA Enterprise Solutions to

Poverty at the Harvard Business School Forum on the Future of Market Capitalism, October 9

and 10, 2009

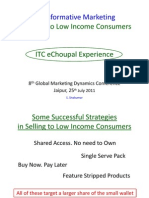

S. Sivakumar (Shiv), CEO Agribusiness of ITC, was intrigued to see what he could learn from

a week in rural China. Shiv had built the Agribusiness Group of ITC to US$1 billion in revenues,

with sourcing and input distribution in over 40,000 villages through his world famous eChoupal

system. ITC was already purchasing cereals directly from over 3 million small farmers, having

introduced pricing based on quality, rather that the traditional weight-based pricing from

middlemen.

Over the last two years, through Enterprise Solutions to Poverty (ESP) Innovation Group for

Agribusiness in India, which Shiv helped create, Shiv had been working with agribusiness CEOs

of five other Indian giants. Together, they were building a major fruit and vegetable initiative with

small farmers in India. Leaders of these companies were now traveling to China to see major

fruit and vegetable companies of China, also engaged in ESP. Shiv knew that each of

agribusiness leaders and their companies brought different experience, company cultures and

strengths to the challenges ahead: Traveling with him were executives from:

Tata Chemicals Ltd is a subsidiary of the US$62.5 million Tata Group, one of India’s

largest and most respected conglomerates. TCL’s revenues approach US$3 billion, largely in

fertilizers and inorganic chemicals. TCL has built a successful agricultural input distribution

system using its fertilizer output as the core. In 2007, Tata Chemicals entered into a 50:50 joint

venture with Total Produce PLC, one of Europe’s largest fresh produce providers. The joint

venture, Khet-Se Agriproduce, is geared to leveraging TCL’s relationship with farmers and

presence in rural communities to create a state of the art supply chain and wholesale operation in

fresh fruits and vegetables. TCL is focused on building solid production in bananas for domestic

and export sales, in building out value chain operations with small vegetable producers for

domestic wholesale, with a focus on building productivity, quality and earnings of smallholder

farmers As an international joint venture, Tata Khet-Se is precluded from retail sales and is

pursuing measures to mobilize push cart venders as a formal-informal sector alliance, building on

the traditional mode of retail purchase in India.

Mahindra and Mahindra, with US$6.8 billion in annual revenues, mainly from tractors and

other automotive established MSSL as its agribusiness arm in 2000 with an initial focus on grape

exports. Mahindra had built a successful collaboration and co-branding strategy with Capespan,

to become India’s leading grape exporter with US$5.3 million in export sales, with MSSL the first

to receive GLOBALGAP certification. Mahindra is using its tractor financing company to build out

broad-based rural finance. At the same time, Mahindra had closed down its capital intensive hub

and spoke agricultural input operations. Mahindra management was uncertain on how much of its

resources to commit to agribusiness. MSSL is now focusing on pomegranates and seed potato

operations.

Bharti, with its US$1.3 billion in revenues coming largely from having become India’s largest

mobile phone provider, is a new entrant to fruits and vegetables. Bharti is pursuing local and

export sales of fresh and processed fruits and vegetables under a joint venture with Del Monte

and is the Indian partner of Wal-Mart. As an international joint venture, Bharti-Wal-Mart is

pursuing wholesale, with a separate company, Bharti Field Fresh, opening domestic retail stores.

The CEO of Bharti is pushing to reach US$1 billion in revenues from fruits and vegetables in ten

years.

PDF created with pdfFactory trial version www.pdffactory.com

Jain Irrigation is slated to become the world’s leading drip irrigation manufacturer by the

end of 2009, with revenues of over US$600 million. Beginning in 2004, Jain Irrigation has utilized

its deep knowledge of farming and its connections with farmers to build export operations with

small farmers in dried mango and dried onion, and has now become India’s leading exporter of

both.

ITC is one of India’s largest companies with 2008 revenues of over US$5 billion, nearly US$1

billion in its Agribusiness Division. ITC is considered by all to be the natural leader in this group

of six industry leaders in agribusiness with small farmers. ITC has 30 years of experience

working with small farmers in tobacco. ITC has invested in understanding the dynamics of small

farmers and rural markets; its e-Choupal and Choupal Sagaar systems co-opted many traditional

middlemen to become operators of ITC’s information service and hub and spoke platform for

sourcing and distribution of agricultural inputs. ITC has been a leader in applying information

technology to build efficient rural distribution platforms. 6500 e-Choupals reach 40,000 villages

and 4 million farmers; this system has evolved to become a sourcing and distribution platform,

now sourcing from over 3 million cereal farmers, and used to sell agro-inputs and fast moving

consumer goods in rural areas. And having built solid early fruit and vegetable operations in

mango, green vegetables and seed potatoes with its Choupal Fresh operations and small format

stores, S. Sivakumar is the leader of the ESP Innovation Group on Agribusiness in India.

Reliance Industries, active in the ESP Fruit and Vegetable initiative, was unable to

participate in the China trip. The annual revenues of Reliance exceed US$34 billion, is India’s

largest conglomerate, with major operations in oil and gas, petroleum and petrochemicals, and

mobile telecom. Reliance was the first Indian giant to enter into “farm to fork” fruit and vegetable

operations three years ago. Reliance had assumed that its unmatched executing capabilities in

rolling out petrochemical plants and mobile phone distribution would translate into value chain

operations with small farmers, with RIL’s CEO having targeted doubling the income of 10 million

small farmers through Reliance’s disruptive business models over ten years. Early frustrations

for Reliance included resistance by small shopkeepers, local politicians and consumers as it

rolled out its small format Reliance Fresh stores before having organized procurement of quality

produce.

Challenges

These industry leaders have recognized that if they are going to succeed, they will need to

find ways to shorten the value chains and deal more directly with producers. In their desire to fill

their small format stores, several companies fell back on purchasing from the traditional

government markets and middlemen. The result was low quality, low freshness, and no price

advantage. The ESP Fruit and Vegetable initiative involves commodity-specific approaches to

increase quality, productivity and efficiency of direct procurement from small farmers. Key

components are different aggregation models, include producer companies; collaborations with

banks to enable small farmers to make the needed investments in green housings, shade nets

and irrigation; and introduction of crop insurance, tracing, and certification measures.

While ESP and agribusiness leaders of India realize that these measures will provide a solid

base from competitive operations, in many cases doubling the incomes of participating small

farmers, there is a sense that greater innovation in business models will be important in creating

rapid growth and competitiveness in fruits and vegetables. ESP, which also works with leading

agribusinesses in China, has organized a trip in September 2009, to explore what methods and

lessons can be learned for Indian fruit and vegetable operations.

PDF created with pdfFactory trial version www.pdffactory.com

Shiv and the other agribusiness leaders realize that Indian and Chinese farmers face some

similar realities in building fruit and vegetable operations with small farmers.

Characteristics India China

People making under US$2 880 million 620 million

per day

Percentage of people Over 60% About 60%, declining

dependent of agriculture for

majority of livelihood

Percentage of farmers with Over 80%, 87 million small Over 80%--farmers had given

under 1 hectare of land holdings accounting for 52% of about 0.3 to 0.5 hectare of

fruit and 61% of vegetable land for rights of use by

production. Large farms government.

average 7 hectares.

Number of people in middle 100 million, growing by over

class, and annual growth 10% pa

Annual growth in fruit and 6% pa growth since 1990, from Exponential growth: 146

vegetable production, ten 76 million mt to 170 million mt in million in 1990 to 502 million in

years 2008. Second only to China in 2004.

output and growth.

Competitiveness in High in vegetables, some High in temperate fruits

productivity in fruits and tropical fruits

vegetables

Lessons from Agribusiness Leaders in China

Shiv joined the other Indian agribusiness leaders in China in early September 2009, meeting

with the leading wholesaler and retailer in Beijing, and visiting ten companies in three provinces

where fruit and vegetable operations are concentrated. Two of the three are Western provinces,

in the part of China where poverty is concentrated. Each company visit illuminated a facet of the

rapidly evolving agricultural sector in China:

COFCO, on the Fortune 500 list since 1994, is the large import-export government-controlled

agribusiness with US$ billion in revenues in 2008. In 2005, COFCO purchased controlling

interests in Tunhe, a leading tomato paste producer operating in thinly populated northwest

China. COFCO Tunhe has forged highly effective collaboration with Heinz and other leaders in

tomato production and processing. In 2007, COFCO Tunhe purchased 2.2.million metric tons of

fresh tomatoes from over 200,000 mainly small farmers who worked 33,000 hectares. By 2009,

with encouragement from Heinz to improve quality and productivity, COFCO Tunhe had taken

advantage of the available large tracks of government land to move rapidly to one third large

plantation farming, one third contracting with farmers for efficient production on COFCO

controlled land, and one third in integrated operations with small farmers. Productivity on large

farms has been double that of yields from small holdings.

The Wumart Group, Beijing’s largest retail chain, has grown rapidly, with over 104

superstores and 330 mini-marts and revenues of US$1.4 billion at end 2008. .Piloted over the last

two years, Wumart is moving from traditional reliance on fruit and vegetable wholesalers,

launching its direct sourcing model, primarily in Shandong province. This direct procurement

operation works with specialty cooperatives and the small farmers associated with these

PDF created with pdfFactory trial version www.pdffactory.com

cooperatives. Specialty cooperatives in Shandong have leased land from some small farmers to

establish larger proprietary production units; these same specialty cooperatives, closely linked to

local government, are working with several thousand small farmers to promote investments in

small, modern 0.1 hectare greenhouses, improved planting materials, inputs and methods.

Wumart has established the largest sourcing-distribution center in northern China, in Shandong,

to organize these operations. As a result of this direct procurement, Wumart has been able to

reduce consumer prices by 5 to 10%, earn more per unit, shift consumer perception to establish

supermarkets and small Wumart stores as the place for fresh produce (with farm to final sales in

under 24 hours) and increase produce sales by over 50%. As a result of this success, Wumart

is converting its community mini-marts to fresh produce focus stores with fresh produce sales

expected to contribute over 50% of revenue. Farmers get prices set 10% to 20% higher than

prices in local markets, and have long term relationships with Wumart.

Longda is China’s leading exporter of processed vegetables, mainly serving demanding

consumers in Japan. Its products include flour, freeze-dried foods, frozen fruits and vegetables,

noodles, peanut oil, processed pork, prepared foods, and soy sauces. In 2008, Longda’s annual

revenues totaled US$720 million, with 70% of its diversified operations in food products. Longda

used to be an export focused fruits and vegetables producer. Now it has diversified into wood and

packaging business, though foodstuff still accounts for over 70% of its sales. Over the last five

years, Longda has moved aggressively to establish its own farms, each averaging 10 to 20

hectares in the populated Western Provinces, with larger fields in the sparsely populated

Northeast and Northwest. The majority of these farms are contracted back to farmers as farm

managers, working larger than traditional tracts under the direct supervision of Longda. Longda

has established and implements in both types a protocol of “uniform seed supplies, uniform field

management, uniform pesticide spray, uniform fertilizer and uniform harvesting”. Longda has

built up a complete trace system based on the integrated supply chain. For any one packaged

processed product, the bar code can help you find where the vegetables come from, when they

are planted, what fertilizers were used and who grows it, etc. It can achieve traceability “from

table to the field”. Longda supports farm operations through input supplies on account,

participates in financing investments selectively. Longda would provide seeds, fertilizer and other

necessary agricultural supplies as account sales, and shares risks with contract farmers. Longda

uses basic, labor-intensive processes to cook and package its vegetables for export to Japan; the

technology innovation is in Longda’s rigorous measures to ensure sanitary conditions in its

processing plants.

Guang-You Sweet Potato and Food Products in Sichuan and Huasheng Apples

in Shaanxi. Guang-You uses its proprietary technology to extrude vermilli pasta directly from

the sweet potato. Huasheng is China’s leading fresh apple exporter, with China now producing

over 70% of the world’s apples. Both companies use efficient, relatively simple methods for

processing or packaging. Huasheng works with over 600,000 small apple growers and Guang-

You works directly with over 400,000 small sweet potato producers. Both pride themselves on

successful, t simple hub and spoke systems to work directly with small producers in upgrading

productivity and quality through extension services, improved inputs, seeds and saplings.

Tingbo Kiwi. Mr. Zao, a successful lawyer and serial entrepreneur from Sichuan, has

established a 700 hectare kiwi plantation in Sichuan. When Mr. Zao established these operations

in 2007, he had no prior experience in agribusiness. He has built a tight collaboration with the

leading kiwi company of New Zealand. His strong connections with the Sichuan government

enabled Mr. Zao to lease a relatively large tract of land from 3,000 small farmers, with lease

payments set to equal how much the farm family would have earned growing maize, the

dominant local crop. Tingbo hired back about 1,000 of the farmers to cultivate segments of this

large holding under tight supervision from Tingbo; those farmers that are not able to achieve the

required quality and productivity will be replaced by other farmers. Tingo has provided these

farmers with leasing fees, housing, and a flat rate during the three years needed for the kiwi

plants to bear fruit. The farmers will now be moved to compensation based largely on yields and

quality.

PDF created with pdfFactory trial version www.pdffactory.com

What the Indian agribusiness leaders learned

Shiv and the other Indian agribusiness leaders were amazed with what they saw. Some of

their observations:

• Where are the poor people? The infrastructure in rural areas across the province of

Shandong, and three hours outside of the capital cities of Sichuan and Shaanxi, is superb.

Modern freeways make transport of fruits and vegetables cheap and quick. Farmers have

water and electricity and live in homes that look simple but comfortable. In cities, no slums

are to be seen; in rural areas, no one looks miserable. While income levels may be

similar to those in India, the Chinese government has provided supporting infrastructure-

roads, water, electricity—that make the de facto living standards in China higher and more

conducive to good agricultural practices.

• New aggregation models abound. Over the last two years, the Chinese government

has encouraged small farmers, each with an average of half an acre (quarter of a hectare)

to lease their land to other farmers, specialty cooperatives and corporations, with a major

move to medium sized farms by many companies, making efficiency and traceability in

value chains easier. In China, over 200 million young people from single child families

have migrated from rural to urban areas, giving the central government the opening to

encourage aggregation of small farms.

• Simple, effective protocols for working with large numbers of small farmers are in

place. Several companies have opted to continue working with large numbers of small

farmers, using strong organization to provide inputs, advice on productivity enhancing

methods, and procurement—with large companies working directly with small farmers and

through producer associations.

• Technology is being introduced at several points in the value chain. Past abuses

have made companies obsessed with methods to ensure traceability and food safety,

through testing with internationally reputable companies, greater control over production

processes, means to trace produce through the different stages, and radical clean

methods in simple processing facilities. Improved planting materials are being introduced

by the companies and specialty cooperatives. Relatively expensive greenhouses, and

simpler ones, enable small farmers to produce a third crop.

What next for India?

S. Sivakumar and the other Indian agribusiness leaders are seeking strategies that reflect the

following premises:

• All the aggregation models in China could be adapted to Indian realities, with some

requiring government policy change and support

• On the output side, the objective is to build competitive value chains that have a positive

impact on productivity and net incomes of large numbers of small farmers. Shiv believes

that the means are combinations of any or all of the following: higher productivity, lower

costs, lower risks, and better quality.

• Different crops have different optimal levels of aggregation at different points in the value

chain e.g. some crops require heavy investment and high technology at different stages

while others require labor-intensive care.

Shiv sees three broad business models: companies work with small farmers, companies lease

and farm the land, and companies adopt a hybrid model leasing the land and then allocating it

back to farmers as entrepreneurs on contiguous plots of economic scale.

PDF created with pdfFactory trial version www.pdffactory.com

You might also like

- Election Eve Special Interview To Eenadu 29 Apr 2014Document2 pagesElection Eve Special Interview To Eenadu 29 Apr 2014Sivakumar SurampudiNo ratings yet

- Global Food & Agri Business at Globoil Sep 2012Document2 pagesGlobal Food & Agri Business at Globoil Sep 2012Sivakumar SurampudiNo ratings yet

- Supply Chains For Horticultural ProductsDocument4 pagesSupply Chains For Horticultural ProductsSivakumar SurampudiNo ratings yet

- Transformative Marketing in Selling To Low Income Consumers at Global Marketing Dynamics Conference 25 July 2011Document22 pagesTransformative Marketing in Selling To Low Income Consumers at Global Marketing Dynamics Conference 25 July 2011Sivakumar SurampudiNo ratings yet

- Swimming Through Blue Ocean ITC Echoupal Story 18 Sep 2010Document12 pagesSwimming Through Blue Ocean ITC Echoupal Story 18 Sep 2010Sivakumar SurampudiNo ratings yet

- As We Flew Over The Sparrows NestDocument17 pagesAs We Flew Over The Sparrows NestSivakumar SurampudiNo ratings yet

- Oilseeds Productivity at SEA AGM 23 Sep 2011Document11 pagesOilseeds Productivity at SEA AGM 23 Sep 2011Sivakumar SurampudiNo ratings yet

- Lessons From Contract Farming Experiences 2004Document12 pagesLessons From Contract Farming Experiences 2004Sivakumar SurampudiNo ratings yet

- ITC's Rural Networks and Financial Inclusion Aug 2010Document9 pagesITC's Rural Networks and Financial Inclusion Aug 2010Sivakumar SurampudiNo ratings yet

- The Ecstasy and More Ecstasy Oct 2007Document46 pagesThe Ecstasy and More Ecstasy Oct 2007Sivakumar SurampudiNo ratings yet

- Reaching Commodity Derivatives To Farmers May 2006Document20 pagesReaching Commodity Derivatives To Farmers May 2006Sivakumar SurampudiNo ratings yet

- Agri Revolution at Millennium Mams 28 Apr 2009Document35 pagesAgri Revolution at Millennium Mams 28 Apr 2009Sivakumar SurampudiNo ratings yet

- Sivakumar at UBS CLE 11 Sep 2008Document16 pagesSivakumar at UBS CLE 11 Sep 2008Sivakumar SurampudiNo ratings yet

- Leadership Development in Corporate Sector at NAARM 27 Aug 2010Document13 pagesLeadership Development in Corporate Sector at NAARM 27 Aug 2010Sivakumar SurampudiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.GDocument59 pagesA Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.Gjassi7nishadNo ratings yet

- TractorDocument19 pagesTractorRahul DeshmukhNo ratings yet

- Summer Vacation Training Report Conducted at Mahindra ON Vehicle Loan Financing ProcessDocument11 pagesSummer Vacation Training Report Conducted at Mahindra ON Vehicle Loan Financing ProcesstaseerNo ratings yet

- Mahindra and Mahindra HistoryDocument20 pagesMahindra and Mahindra HistoryPrabhaharan ThangamuthuNo ratings yet

- Lost SafariDocument54 pagesLost SafariMohit AgarwalNo ratings yet

- Used Cars DataDocument5 pagesUsed Cars Datalucky guptaNo ratings yet

- Kotak Mahindra TRAINING & DevelopmentDocument92 pagesKotak Mahindra TRAINING & Developmentprateek mishra86% (7)

- Vehicles Recommended For Sale March 2015 PublicDocument103 pagesVehicles Recommended For Sale March 2015 PublicKatu2010No ratings yet

- All 10Document70 pagesAll 10Ankit BinjolaNo ratings yet

- Mega Projects Approved by Govt of MaharashtraDocument6 pagesMega Projects Approved by Govt of MaharashtraSumedh M PanchporNo ratings yet

- Transfer of Franchisee Division of Mahindra Retail Private Limited, A Subsidiary of The Company On A Slump Sale Basis To Brainbees Solutions Private Limited (Company Update)Document6 pagesTransfer of Franchisee Division of Mahindra Retail Private Limited, A Subsidiary of The Company On A Slump Sale Basis To Brainbees Solutions Private Limited (Company Update)Shyam SunderNo ratings yet

- Mahindra: Smart TV?Document82 pagesMahindra: Smart TV?NagsNo ratings yet

- Competitive AdvantageDocument19 pagesCompetitive AdvantageosaidNo ratings yet

- Financial Products in Kotak Mahiindra Bank and Its CompetitorsDocument93 pagesFinancial Products in Kotak Mahiindra Bank and Its CompetitorsShobhit GoswamiNo ratings yet

- Business Environment PESTLE ANALYSISDocument19 pagesBusiness Environment PESTLE ANALYSISAbhay GuptaNo ratings yet

- Auto Industry Report AnalysisDocument24 pagesAuto Industry Report AnalysisAman KhantedNo ratings yet

- M&M Case Study - Ansh DeepDocument8 pagesM&M Case Study - Ansh DeepAbhi AgarwalNo ratings yet

- 12-07-2022 BL ChennaiDocument12 pages12-07-2022 BL Chennaimoneesh 99No ratings yet

- Thesis Mahindra FormatedDocument103 pagesThesis Mahindra Formatedrahulranjan201No ratings yet

- Mahindra Marine Business CaseletDocument4 pagesMahindra Marine Business CaseletSaurabh KadamNo ratings yet

- Project Senior PDFDocument89 pagesProject Senior PDFPavani SimhadriNo ratings yet

- FaiseDocument2 pagesFaiseAditya vashishthNo ratings yet

- Smart Investment E Copy Vol 16 Issue No 26 6th August 2023 1Document86 pagesSmart Investment E Copy Vol 16 Issue No 26 6th August 2023 1Chirag ShahNo ratings yet

- Price List of Automobile in NepalDocument1 pagePrice List of Automobile in NepalSaroj Acharya0% (1)

- ProjectDocument79 pagesProjectbhagathnagarNo ratings yet

- A Study On Consumer Satisfaction Towards Non-Gear Two Wheeler of Honda in Nodia MarketingDocument103 pagesA Study On Consumer Satisfaction Towards Non-Gear Two Wheeler of Honda in Nodia MarketingUmesh JoshiNo ratings yet

- PradeepDocument11 pagesPradeepSJNo ratings yet

- Rajesh Exports: Global Leader in Gold Exports to Over 60 CountriesDocument8 pagesRajesh Exports: Global Leader in Gold Exports to Over 60 CountriesShreepal ParekhNo ratings yet

- 288 Comparative Study in Life Insurance Sector For Kotak MahindraDocument87 pages288 Comparative Study in Life Insurance Sector For Kotak MahindraKaran LuthraNo ratings yet

- Business Models, Institutional Change, and Identity Shifts in Indian Automobile IndustryDocument26 pagesBusiness Models, Institutional Change, and Identity Shifts in Indian Automobile IndustryGowri J BabuNo ratings yet