Professional Documents

Culture Documents

Pakistan Steel - Internship Report-Libre

Uploaded by

iamadnan92Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan Steel - Internship Report-Libre

Uploaded by

iamadnan92Copyright:

Available Formats

1

INTERNSHIP REPORT

SUBMITTED TO : Incharge (Trg. Wing) HRD

SUBMITTED BY : Ayesha Saeed

Umair Usman Ghani

TECHNOLOGY : B.B.A

NO. OF WEEKS : Four (4)

PERIOD OF TRG. FROM : 16-08-2010 TO 10-09-2010

NAME OF UNIVERSITY : PRESTON UNIVERSITY

2

PREFACE

This report content the briefing of selected four departments namely accounts, marketing,

finance, and information system maintains of Pakistan Steel mill, which we have visited for the

purpose to understand the procedures which are follows in this corporation to run the daily

operations.

At the first part of this report, we address accounting department. In that department we got

briefing over bill section, advances section, taxes section, sales section, store section, cost

account section, funds section, final account section, and payroll section.

Next department, which this report will discuss about marketing. In which bi-product, dealership,

data coordination cell, research, and customer service sections have to be our focus of

discussion, where deem to be done from planning to price setting, and from selling to providing

services to the customers.

Third part of the report consists on finance department activities which include scrutiny section,

local L/C and foreign L/C, tendering activities, and procurement. They perform different task

related to budget allocation for new product and ordering existing product and investigating

about ongoing orders and purchasing activities for materials and other related things.

At last, we describe the Information System Maintained department working in brief way where

they follow ISO and maintain all Pakistan Steel mills departments data requirement and

providing them information. They are also making new programs according to the needs of

particular departments and giving troubleshooting service too.

Finally we ended up this report with suggestion for improvement and for further progress in steel

industry.

3

ACKNOWLEDGEMENT

We are very thankful from the core of our to honorable Chief Executive Officer, PAKISTAN

STEEL, for providing us opportunity for training and whos intelligent, wise and sound

leadership has converted manpower into wining combination by this industry into a Gold mine.

We wish to express our deep gratefulness to Mr. Nazimuddin Sahito, APEO (A&P) for his

consideration and supervision. It was a memorable time in Pakistan Steel due to his kind

concern.

We are also thankful to Mr. Engr. Nisar A. Khowaja, Incharge (Training Wing) and Mr.

Yousuf Ayub, Deputy Manager / Incharge (In-Plant Training) for his precious advice and for

the great encouragement and corporation, because of which we have successfully completed our

internship training at PAKISTAN STEEL where we learned a lot.

4

CONTENTS

Accounting Department ---------------------------------------------------------------------------- 1 - 15

Marketing Department ----------------------------------------------------------------------------- 16 - 20

Finance Department -------------------------------------------------------------------------------- 21 - 25

ISM Department ------------------------------------------------------------------------------------ 26 27

Suggestions ------------------------------------------------------------------------------------------ 28

5

ACCOUNTSDEPARTMENT

The Pakistan Steel Mills accounts department consist on nine different sections, and all of these

are describe below with their purpose and functions in detail.

1. Bills Section:

Bills section maintains all types of bills of Pakistan Steel related to all itsexpenses and utilities.

This particular section also divided into six parts to well manage all the bills. These sections are

described as follows;

a. Miscellaneous:Miscellaneous operate to record variety of small scale of bills such as

canteen, stationery, etc. They enter product code number, its date of payment,

quantity, and amount which had to be paid.

b. Medical: Medical section manages the doctors bills that provide their service to

Pakistan Steel employees. These doctors may or may not belong to assign panels of

Pakistan Steel but as the send their bill which will have matched with employee

request for medical facility. After that particular process the required amount will

paid to doctor by Pakistan Steel through cheese.

c. Import: In import, letter of credit, bills department receive ledger from finance

department, who mention to whom L/C has been opened. They record all the

particulars of the order both in manually and digitally, and issue bills accordingly.

d. Supplier: Here theyrecodeappliers bills, which product, amount, and quantity of the

product suppliers have been supplied to the Pakistan Still Mill and how much they are

obligated to pay them. They check all the necessary requirements for issuance of the

bills plus with past balance (if any) of the supplier.

e. Taxes: Taxes section just detected tax from the bills they have received from various

departments and make sure to tax payer that their tax to govt. of Pakistan has been

paid from Pakistan Still. All the taxes have been detected according to the current tax

rate issued by the govt. of Pakistan.

6

f. Terminal: The terminal in bill section support and it is in use of Information System

Management (I.S.M.) to provide vital information in order to make Pakistan Still

paperless organization. In it, they up-date all the bill section activities on mainframe,

from which all concern departments collects their information according to their need.

2. Advances Section:

Advances section providesa fix amount of money according to the expense. They handle all P.S.

(Pakistan Still) department according to their describe limits for the expense.

In odder to deal with various types of advances, advances section made three different types of

advance accounts;

i. Imprest Account

ii. Daily Expense

iii. Advance Against Expenses

There detail is given as follows;

i. Imprest Account: The need for Imprest Account was felt when the product was

needed on urgent bases and it was not available in store. So, it is such kind of urgent

or emergency account for allocating capital to requested department.

Imprest account work under account department, in which a certain amount of money

allowed to all departments within P.S. according to their emergency needed expense.

It works under certain cases when some product is urgently needed without that the

machinery will stop working and that product is not available currently in store. To

safe from stoppage of machinery and long traditional purchase through tender,

imprest accounts idea comes. In which concern department feels its request for

particular parts or product and submit it to accounts dept. who will allocate their

requested money accordingly.

In case of exceed request out of their assign limits for money; the beneficiary dept.

will have to get special permission from chairman.

7

ii. Daily Expense:For the office purpose, if employee make tour to outside the office or

city or even country, then P.S. is obligatory to pay his or her visiting expense. To

coupe-up with this case Advance Section has made daily expense account which is

consist upon three different limits,

a. Regular T.A. & D.A. mean travel allowance and daily allowance. This facility

gives to employee when he/she travel and/or live outside office premises for job

purposes.

b. Transfer T.A. & D.A. means in the case if employee transfer from one city to

another city by the organization for work reasons, then organization will be

obligatory to pay him half of his basic salary. And if he is transfer with his family

then he will be paid in full his basic salary.

c. Foreign T.A. & D.A. for foreign visit, which is usually done by executives for

office work, P.S. will pay thoseallowances in dollar currency for their travel and

daily expenses.

Pakistan Steel mill also facilitate to their employee to avail them opportunity to take

advances, which they are obligatory to pay after fix time period. If they would not pay

after fix time limits them P.S. has the right to recover their advances from their salary.

3. Taxes Section:

Taxesare one of the big things for govt. to generate income. All over the world governments

charge taxes from all people living within their country through different ways to fulfill their

various expenses such as salary, infrastructure, security, etc. There are many kinds of taxes such

as income tax, sales tax, and excise duty. Some of them are federal taxes and some of them are

provincial taxes. Pakistan Steel mill, as the big producer in Pakistan detect different taxes before

selling the product to their consumers.

They are majorly dealing with two tax departments, which are explaining as follows;

i. Income Taxes:When we talk about corporate income tax it means tax on corporates

earning. According to Pakistans income tax law, any corporate who generate profit

in a fiscal year must pay 35% as an income tax out of itsprofit.

8

In the case if corporate does not earn profit within its fiscal year then it will

obligatory to pay 1% tax on its Net Sales + Other Income.

As the P.S. is a big organization, and it has permission to detect taxes of it consumers

on behalf of government of Pakistan, so make tax collection efficient, P.S. pay taxes

to Federal Bureau of Revenue (FBR) in four quarters in a year. Pakistan Steels

income tax include

Advance-able Return

Salary Taxes (above Rs. 25,000/-)

Customers Purchases

ii. Sales Taxes: Sales taxes charge on three months notes on Credit Receive-able when

the debit is.

Refund only related items to finished products after chemical examination.

Sales tax and excise duties are refundable but custom duty is not refunded.

4. Funds Section:

Pakistan Steel as a responsible organization and working in the benefits for all its stakeholders

including industry, country, society as well as for its employee. As it recognize and appreciate it

employees efforts to take P.S. on major identifiable position in countrys welfare, it provide

them various kinds of funds to support them financially. There detail is given as follows;

i. Provisional Funds: Provisional fund is a kind of fund which works like a saving

account for only permanent employees not for contract daily wages personal. In this

account 10% of employees basic salary detected and deposited into it, this amount of

money employee can take any withdraw anytime.

After passage of three years organization will also contribute same amount of money

which is equal to his/her 10% basic salary.

[Note: Employee would not allowed to withdraw those amount out of money from his/her

P.F. which is contributed by firm, this will only given to him on his retirement.]

Employee has two options when he is opening his P.F. account, with interest or not.

9

1) In the case of interest, if employee withdrawsP.F. 9% loan then on that particular

amount of money and not submitted within one month then 4% interest rate will be

charge and this will gradually increase till fully not submitted.

On the other hand the benefit of interest account is that on P.F. interest also increases

saving money of the employee.

2) On the other side, where employees P.F. account is not on interest benefit. Then it

will be simple account on which no interest charge on taking loan and/or no any

increase in saving money.

Another point of attention is that when employee pass 50 years of his age and

withdraw money from P.F. then it will be non-refundable.

P.F.maximum requires 48 installments.

ii. Welfare Fund: The purpose of welfare fund is to facilitate its members to avail loan

without charging interest. The amount of loan is separated according to the position

or grade of personal.

a. Rs.30, 000/- for under 16

th

grade personal which will recover with Rs.1, 000 /-

installments per month.

b. Rs.60, 000/- for above 16

th

grade personal which will recover with Rs.1, 500

/- installments per month.

Welfare fund also give Rs.35, 000/- to dependents on the death of his member.

Membership of welfare fund is only available to the percentemployees of P.S. it are

not for contract and daily wages employees.

There are three options available to refund loan, it can be submitted through;

a) Cheque

b) Payroll

c) Voucher

iii. Benevolent Fund:

Benevolent fund means the amount of money given to dependents of the employee on his/her

death which occurs during period of employment. The purpose of benevolent fund is to help

10

employees family financially on his death and give feeling of security to employee during his

employment.

Benevolent funds facility is only available to percentemployees; this facility is not for

contract and daily wages employees.

Benevolent Funds for Officers

The distribution of the amount of money is categories in six different categories according to

employment grades, which is given below;

i. Junior Officer 25

ii. Assistant Manager 30

iii. Duty Manager 35

iv. Manager 40

v. Duty General Manager 45

vi. General Manager & Above 50

There are certain pay range limits are describe from which the fix amount for benevolent

fund will be detected for officers which is describe below;

Pay Range Monthly Benevolent

Rs.2001 to 2500/- Rs.990/-

Rs.10001 to above Rs.4260/-

[Note: Benevolent fund is only given on occurrence of the death during working period. It is not

given on natural death.]

Benevolent Funds for Workers

For workers benevolent funds range is;

i. Workers 25-35

There are certain pay range limits are describe from which the fix amount for benevolent

fund will be detected for workers which is describe below;

11

Pay Range Monthly Benevolent

Rs.2000 to 5001/- Rs.700 to 1100/-

[Note: Benevolent fund is available for all workers but they must qualify 180 days job without

leave.]

iv. Worker Profit Fund:

Worker Profit Fund (W.P.F.) means corporate profit will be share with workers at the end of the

calendar year.

W.P.F. only given on the condition when corporate earns healthy profit.

It is some kind of bonus, which is given to every personal according to their basic salary. For

this purpose a committee sits to decide the distribution of it.

This is distributed through bank vouchers.

v. Worker Education Fund:

Pakistan Steel mill has categorized its workers education funds for their children are according to

their position in three different categories;

i.Worker Rs.25/- per Month

ii. From Junior Officer to Director Manager Rs.50/- per Month

iii.Manager and Above Rs.100/- per Month

For Officers W.E.F. is not allowed.

vi. Gratuity Fund:

Graduated fund means the specific amount of money given to the employee on his retirement.

There are some criteria for distribution of graduate, which is describing as follows;

Gratuity is the sum of the last 5 years basic pays of the officer.

For staffgratuity is count on his last 3 years gross pay. (Gross Pay=Basic Pay + Allowances).

For employees gratuity charge on his 1 year or 6 months last salary withdrawal.

[Note: Gratuity will not given on dismissal of the employee]

12

In the case of death the loan which is given to employee will be recovered from graduate or

Provisional fund or insurance,if any.

Gratuity is only given to parmenantemployees not for contract and/or daily wages

employees.

Function of Gratuity Section:

Gratuity section work is to check employees loan or any recovery remain or not, if any, then

detect and allocate gratuity.

This section first asks all departments within the steel mill that how many employees are

working in their department. After receiving quantity they will make gratuity for all of these

employees for that particular year and ask that particular amount of money from Pakistan Steel

mill.

As all employees will not retail on that year, the remaining amount of money of gratuity will be

invested in banks. For that purpose a 5 members committee sat for this task in which 2 are

sectaries and 3 are trustees, who will find the best deal to invest that particular amount of money

for suitable time period. The trustees must approve interest rates.

5. Payroll Section:

The payroll Section mainly deals with the salaries, allowances, loans and advances, full and final

settlement of employees at the time of retirement, resignation or filing, income tax and other

deductions from employees salaries, deposit of deducted income tax in government treasury,

etc.

The Manager Payroll is heading this section. He is granted with unlimited authority over

approval of monthly salaries of the following categories of employees:

Permanent Employees (including staff and officers)

Contract Employees

Daily Wages Employees

Deputed Employees (posted to Steel Mills from Federal Government)

Responsibilities of Payroll Section

13

The scope and functions the Payroll Section may be summarized as follows:

Payroll processing of Daily Wages Employees: Daily wages employees are appointed

by the Administration and Personnel (A&P) Department. The Payroll Section receives

the details of daily wages employees from respective departments and processes their

salaries.

Payment and Deduction of Loans and Advances: Employees are provided with loans

and advances against their salaries. These granted loans are secured against the

employees provident and gratuity fund balances. The Payroll Section receives details of

the loans and advances and initiates the payment process that ends with preparation of

cheque by Cash Section. The granted loans are deducted from the employee monthly

payroll in installments over a defined recovery period.

Payroll Processing of Employees:Payroll processing is completed as per the salary

program/ schedule prepared in advance. Payroll Section complies the attendance data

received from various departments and processed it with the help of the ISM Department.

Reconciliation of Payroll Subsidiary Ledgers: The ISM Department provides

subsidiary ledgers to the Payroll Section. The payroll Section compares these ledgers

with the control accounts and reconciles the both.

Monthly and Annual Income Tax Returns of Employees: Income tax is deducted at

source from the salaries of employees and deposited in government treasury on monthly

basis. Payroll Section prepares the annual income tax returns of the employees for

subs\mission to tax authorities.

Full and Final Settlement of Dues of Outgoing Employees:Full and final dues of

outgoing employees are calculated by the Payroll Section. The positive balance is paid to

the employee whereas, the negative balance (if any) is recovered from the employee or

from the provident / gratuity fund balances.

6. Final Account:

There are also three types of cells used to avail the financial support to any employee or

department of the organization in different conditions.

1) Fixed cell

14

2) Current cell

3) Finalization cell

Fixed Cell

There are two type of fixed cell:

a) Moveable: Such as machinery, etc.

b) Immoveable: Such as Building and Land.

Current Cell

It deals with cash that what cash is going out from organization and what is coming in.

For e.g.: - Inventory is a current cell and also deals with the inventory that how many inventories

are remains in the store.

Finalization Cell

Profit and loss are deal there; the balance sheet is prepared here, cash flow Statement, budget,

profit and loss statement, sales and revenue.

VOUCHER

There are three types of vouchers.

1) General Voucher

2) Cash Receipts Voucher (C. R.)

3) Cash Payment Vouchers (C. V.)

Fixed Accounts

There are some types of fixed account

K1 = Land

K2 = Factory and Building

15

K3 = Non FactoryBuilding

K4 = Plants

K6 = Computers and Hardware

K7 = Vehicles

7. Store Section:

Store section in accounts department do only recording works of all the stores items. In Pakistan

Steel mill, there are total 7 stores. All stores are allocated according to their concern department

or plant. The purpose of creating stores in P.S. is to provide all necessary products to concern

department on time when they need them without losing of time.

In order to run the store and it up-to-date, there are certain procedure has been followed, which is

describe below.

1. First of all Material Management Department (M.M.D.) check demand of every

departments demand for their concern products. And then issue annual Material

Inventory (M.I.) of that departments required quantity and inform this to store

department.

2. M.M.D approval goes to purchase department and then they will publish tender for

required material.

3. Central Receiving Bureau (C.R.B.) receive all the material for S.M.

4. After that Material Receiving Voucher (M.R.V.) issued to the qualified tenderer.

5. Then Material Receiving Report (M.R.R.) issued after inspection will be done by P.S.

inspectors to check the specification of the required material.

6. As the M.R.R. given then payment will be made through bill to supplier.

7. As soon as the material arrive into the store C.R.V. send to Concern Store (C.S.) through

M.R.R. in order to allocate its material.

The material has been allocated according to the Racks then Alphabetical Order and in last

according to the Code Numbers.

16

8. Before issuing material C.S. check M.M.D. of concern department. And there are three

S.R.s copies issued one for receiving end and one for issuing end and last for recording.

9. To maintain the required amount of material not in excess or short form, there is an

Internal Verification Cell has been created to check store stock material quantity. And

this check is done two time in a month.

10. Stores Account Section is responsible for valuing the raw material and spares at the time

of receipt and issuance from the stores.

11. They also update raw material and spares issue, transfer, return and adjustment made by

respective stores. And on the bases of that they make value assessment of parts and

material.

12. Store classified raw material and spares as follows;

a. Stores and spares for ongoing maintains of plant and manufacturing by third

parties.

b. Common user items such as stationery.

c. Uncommon items.

13. Allotment of change account codes to all user departments for material issues from stores

and allocation of expiry.

14. To allowed meeting of Reserve Price Fixation Committee Tender and Maintained of

related record site.

8. Sales Account Section:

As the Pakistan Steel mill is the largest steel producer in Pakistan. So, it sale its products to

wholesalers. In order to sales, the sales record maintained by sales account section.

To purchased steel products from P.S. there must be Traderor Consumer dealership.

1. Trader Dealership: As the traders are reseller or they may convert the form of the P.S.

finished product and sale to end-user. For that purpose P.S. give them commission or

Rebate. P.S. also take security deposited for dealership to ensure his safe hand from any

future deal problem.

2. Consumer Dealership: Consumers are end-user of P.S. finished products. They

transform P.S. product into their finish product for their own use such as car

manufactures. In the case of shortage of product and order come from both trader and

17

consumer, then P.S. first prefer consumer because consumers are wholly depend on P.S.

product and P.S. does not give any commission to them.

There are four types of accounts to handle different situations in P.S. which are given below;

i. Advance Account:Before plotting order from customers, P.S. take advance from dealer.

And after order has been given the Delivery Order (D.O.) will be issued in the Invoice

form.

ii. Cash Account: Deal for cash account done by Zonal Sales Office.

iii. Security Account: To bond dealer on their order so that they will never return after

placing order or lift their material on time, P.S. make security account for this.

iv. CreditAccount: In the case of specified amount by dealer does not fulfilled, it may be

short or excess lifted sometime, to tackle with this problem P.S. make credit account in

which the remaining amount of money might be refunded or adjusted in future deals, on

dealers request.

9. Cost Account Section:

Cost Account means the costing of all expenditure in P.S. They make profit and loss report on

monthly and yearly basis which will given to managers and ministry and for audit.

Process Costing: In which some products are finished goods which are produce to sale

while others are for internal use.

They calculate the cost by adding fixed cost + variable cost + production cost + wastage

cost.

For costing, data are coming from different departments such as quantitative data given

from Production Department. And financial data taken from Final Accounts from there

profit and loss account through M.I.S and other are comes from Salary and Sales Section

and utilities consumption given from Monitory Department.

Stores account givesconsumption report and other information comes from Production

Unit Department.

Miscellaneous quantity comes from production unit given by M.I.S. process.

Depreciation information given by Final Accounts.

Costing on actual consumption bases.

18

Information from cost account goes to Production, Marketing, and other related

departments and ministry.

Job Order costing calculate the value for sales.

Functions:

This section has specific functions to prepare Monthly Operating Results (M.O.R.s) of all

productions complexes and scrap shops.

Job Order Costing system is applied for calculation and valuation of job cards of all C.M.D.

clops and Personal Electric Relationship System (P.E.R.S.).

Preparation of cost sheet of S.M.C. lhr.

Service costing of various cost centers.

Section is also involved in billing of electricity settlement of accounts between K.E.S.C. and

P.S. and generalizing sales and purchase of electricity.

Finished Stock Accounting is one of the core functions of this section which involves

preparation of inventory position on monthly and annually basis reconciliation of finished

goods as well as work improves inventory and maintains of record related stock accounting.

C.M.D.: Two methods of costing

1. Seven types of shops for maintain.

2. They receiving Job Card in which Job is written, materials used in it, machinery used in

it, labor used in it is all written. Then they calculate cost of the product.

Seventh shops are;

i.Electrical

ii.Mechanical

iii.Fabricated

iv.Material

v.Repaired and Maintained

Every shop send their Job Card on monthly bases.

The basic purpose of cost is to control the cost of the product. They also make Journal Voucher

which is also called Ledger. Final Account give them actual cost after finding difference in

applied cost.

19

At the end, final and management through profit and loss account. Profit/loss account make two

things whether increase in C.O.G.S. or decrease.

20

MARKETING DEPARTMENT

INTRODUCTION

Pakistan steel is the only integrated metallurgical complex of the country.

It provide techno economic base for the development and growth of engineering and

construction industry

Established with the collaboration of the former USSR.

Designed capacity of 1.1 million tones per annum with potential up to 3.0 million tones

per annum.

Based on the utilization of high grade imported iron ore and metallurgical grade coking

coal.

Commissioned in stages between April - 1981 to august 1985

PRODUCTION UNIT OF PAKISTAN STEEL

UNIT CAPACITY (0000 TPY) DATE OF COMMISSIONING

Coke Ovens and By-Products 970 April 1981

Iron Making 1230 August 1981

Steel Making 1100 December 1982

Billet Mills 260 October 1982

Hot Strip Mills 790 December 1983

Cold Rolling Mills 200 December 1984

Galvanizing Line 100 August 1985

MAIN PRODUCTS

Coke

21

Pig Iron/ Hot Metal

Cast Billets

Rolled Billets

Hot Rolled Sheets/coils

Cold Rolled Sheets/coils

Galvanized Rolled Sheets/coils

MARKETING AND SALES SETUP

in order to ensure smooth flow of Pakistan steel products and to cover promptly and effectively

all activities relating to the customer, Marketing and sales has been organized purely on

commercial lines with zonal sales offices at Karachi, Lahore ,Gujranwala and Islamabad under a

centralized control of Marketing Department of Pakistan steel at Bin Passim..

MARKETING AND SALES SETUP

Pakistan Steel

Products Store

MARKETING

DEPARTMENT

ZONAL SALES

OFFICEKARACHI

ZONAL SALES

OFFICE

ISLAMABAD

ZONAL SALES

OFFICE LAHORE

ZONAL SALES

OFFICE GUJRAWALA

22

ON-LINE COMPUTER SALES

THE zonal sales offices organized on modern lines using computer facilities to promote

sales , provide one window operation to the customer

Available computer facilities have been utilized to develop ON LINE COMPUTER

SYSTEM for the production and marketing and sales activities

ONLINE COMPUTER SALES SYSTEM

DOWNSTREAM INDUSTRIES

Pakistan Steel has been making promotional efforts for establishment of downstream industries

in the private sector based on utilization of its main and by-products.

The Customer PSPS

Customer Services at ZSO`S

Marketing

Department Bin

Qasim

Production Planning

Department

Production

Units

On Line

Computer

23

Pakistan Steel has created a fully developed industrial estate within its periphery for the benefit

of the entrepreneurs.

The downstream industries are basically producing value added engineering goods such as steel

pipes (small, medium and large diameter) including seamless pipes wire rod & bailing hoops,

light & heavy vehicles small sections, reinforcement bars, slag cement, slag wool, automotive

parts etc.

CONTRIBUTION TO NATIONAL EX-CHEQURE

Pakistan Steel has been contributing to the national exchequer in a big way. Since the

commissioning of the Mills, over Rs. 28.0 billion have been paid to the government in the form

of Duties & Taxes, as compared to its cost of Rs 24.7 billion. It causes saving of above one billion

dollars in foreign exchange annually.

In short, a project of the size and magnitude of Pakistan Steel, if established today, would cost

more than Rs 150 billion and its cost having already paid, Pakistan Steel stands as bonus for the

nation. Apart from other innumerable collateral benefits, such as attainment of Steel

Technology, having acquired skilled manpower, and a source of employment of thousands of

families.

DEALERSHIP NETWORK

The sale of Pakistan Steel Products is channelized through Dealership Network. Dealerships

are offered in the following categories against refundable Security Deposit.

Security Amount

>Category A Coke, Pig Iron and By-Product Rs. 100,000/-

> Category B Billets and Long Products Rs 150,000/-

> Category C Flat Products Rs 350,000/-

Production and quality control

An increasing trend in production has emerged on sustained basis. By creating quality

consciousness among the employees and through introduction of proper documentation, right

from the raw-material stages up to finished state, rejection rate have decreased considerably.

24

Vigilant quality control, during the production process, has shown marked decline in

customers complaints for quality. Quality complaints are attended immediately by the

representative of Customer Service Team. All-out efforts are made to settle quality

complaints within fifteen (15) days.

25

FINANCE DEPARTMENT

Tender

Bidders are invited to submit quotations on C&F/FOR Bin Qasim, Karachi basis (For only local

manufacturers for the products produced by them). In Case of FOR , the tender documents will

only be issued to the interested parties who are registered with Sales Tax Department and will be

required to submit photo stat copies of Sales Tax Registration Certificate at the time of

purchasing tender documents.

Please collect the tender documents on payment of Rs. 300/- each (non-refundable) in the form

of pay order / bank draft in favor of PAKISTAN STEEL from the following offices of

PAKISTAN STEEL.

Purchase Department,

Barrack No.7,

PAKISTAN STEEL,

BIN QASIM, KARACHI

C&F Purchase Department,

FTCBuilding,

Shahrah-e-Faisal

KARACHI.

Zonal Sales Office (Central),

42-A, Zafar Ali Road,

Gulberg,

LAHORE

Zonal Sales Office (North),

48 Atta Turk Avenue,

Sector G-6/3,

ISLAMABAD.

Zonal Sales Office (Central)

UnitTrustPlaza,

GDA Complex,

GUJRANWALA.

Tender documents are to be dropped in Tender Box available in TOC Room-13, Barrack-7,

Purchase Department, Pakistan Steel, Bin Qasim, Karachi, before 10:30 AM which shall be

opened there at 11:00 AM in the presence of bidders who may like to attend.

It is further advised that case number and opening date be clearly mentioned on left top corner of

envelope.

Note: With special Terms & Conditions, Tender Fee Rs. 300/-

26

Budgeting

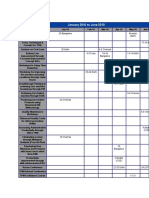

Budget is prepared each year covering the period from 1st July to 30th June. The budget exercise

is started well before the start of financial year. All the production and service departments are

advised to submit their estimates with full justification.

The process of budget making is explained as under

i) Production plan indicating the production of various steel products during the year is indicated

by the Production planning & Control Department (PP&C). Based on the production plan, The

tentative shipping schedule for import of bulk raw materials i.e. coking coal, iron ore and

manganese ore etc.; is prepared by PPC in consultation with the shipping department.

ii) Sales plan indicating quantities, price and value is submitted by the marketing department for

estimating the sales value.

iii) The quantities of raw materials required for achieving the production plan are calculated

taking into account the consumption norms indicated by the designer of the plant as well as the

past experience.

iv) Pakistan steel has concluded long-term agreements with foreign suppliers (for a period of 5

years) for supply of bulk inputs i.e. coking coal, iron ore manganese ore etc. . The prices of

theses inputs are reviewed each year effective 1st April. Similarly, contracts for transportation of

these inputs are concluded with shipping companies each year. The materials cost is worked out

on the basis of contracted rates of raw materials and its transportation.

v) The consumption of utilities i.e. natural gas, electricity, water, POL etc. is determined keeping

in view the level of production/available current norms of consumption. The utilities are valued

at prevailing prices plus anticipated future increase in rates.

vi) Personnel related cost, repair and maintenance, depreciation; overheads etc.; are estimated on

the basis of actual/past experience and anticipated future increases in such expenses.

vii) Based on the above data, the budget is compiled and the projected profit and loss and cash

flow statements are prepared.

27

viii) The budget so compiled is submitted to the steel mills management for review. After

clearance of the budget by the management, the same is submitted to finance committee of the

board for consideration and approval in the first instance. Thereafter, it is finally submitted to the

board of directors for their consideration and approval.

ix) The budget approved by the board of directors is circulated to all the concerned departments

with the advice to strictly adhere to the budgeted provisions.

Financial Scrutiny

1. Initiation of case by the respective department e.g. Billet Mill

2. Noting of fund through Finance.

3. Preparation of indent by MMD.

4. Approval of indent by competent authority

5. Tendering by purchase department

6. Technical evaluation by the respective committee.

7. RRC (if required)

8. Preparation of Purchase Proposal by the Purchase Department.

9. Processing of the case for financial concurrence by the Finance department.

10. Issuance of PO by the purchase department.

11. Billing.

12. Cash payment.

Letter of CreditSection

Functions:

Establishment of foreign and local letter of credits through commercial banks.

28

Scrutiny of purchase orders / contracts / letter of awards received from purchase / ECD /

BMD / BMR&E and other departments for establishment of LC in accordance with the

financial approval / concurrence by the competent

Maintain letter of credit opening register

Request the ministry of finance for release of foreign exchange on bi-annual basis against

total approved annual foreign exchange budgetary allocation.

Classify code number of imported items according to international trade control number

(ITC) schedule / import policy, and obtain confirmation from C&F department for ITC

code.

Submit LC opening application forms duly filled in accordance with the terms and

conditions of the purchase order, letter of award and contract.

To check LC establish by respective bank

Arrange confirmation of LC by foreign banks if allowed

Incorporation of amendments in the LC from time to time as desired by respective

departments supported with amendments to purchase orders, letter of awards and

contracts ant its approval from competent authority

Request cash section to arrange funds with bank for retirement of documents

Collection and checking of original shipping documents duly retired by bank and its

distribution to C&F and all respective departments for clearance of imported

consignments

Preparation of cash/debit voucher in respect of opening of LC(s), amendments and retired

documents after obtaining debit and Credit advises from cash section.

Maintenance of record in respect of item-wise foreign exchange allocation, utilization

there against and balance available for utilization along with its time to time

reconciliation with SBP.

To maintain and on serve record pertaining to shipping schedule of raw material LCs

(Coal, iron ores and manganese ore) issued by production planning and control (PP&C)

department.

Obtain confirmation of Shipment obtained by BMD from Coal and iron ore suppliers.

Obtain approval of Annexure-I from the state bank of Pakistan to establish letter of

credits for imports

29

Prepare and maintain record of item and value wise imports during the years.

Checking of foreign experts salary invoices and arrange monthly remittance after

obtaining permission from SBP

Examination of cases received from Secretariat / Protocol departments pertaining to

claims of excess bagged, Air Tickets etc.

Arrangement of foreign exchange covers for official visit abroad

Maintenance of records / register of foreign exchange for invisible payments.

Obtain approval of Annexure - I from the state bank of Pakistan to establish letter of

credits for imports.

Arrangement of foreign exchange remittances with regards to subscription fee, of

periodic journals, books, etc. After obtaining permission from SBP.

Examination of Documents required by suppliers directly or through concerned

department according to PO / contract / letter of awards.

Out-door follow-up cases with commercial banks, state bank and other related

departments in connection with establishment of LCs) etc.

Obtain approval from gm. finance for nomination of bank for opening of LC(s) on the

basis of volume of LC amount and according to seller nomination.

Check dispatch / demurrage calculation of BMD - shipping department before

enhancement of LC (s) of freight

Obtain acceptance of discrepant document from purchase , ECD and BMR&E to

onwards submission to bank for retirement of documents for clearance of consignment

Foreign exchange budget

Provide expenditure incurred against invisible payment to budget section for preparation

of FE budget of invisible and import.

Maintain record / register of foreign exchange for invisible payments.

Price of Coal, Iron Ore & Manganese Ore

Examination of cases received from BMD regarding revision of prices according to

contract and ascertains approval and concurrence from chairman (Pakistan steel) and

director (finance)

Function And Procedure Of Cash Section

30

CRS Sales Collection:

Receipt of instrument and issue of Cash Receipts is carried out by concerned ZSO under on line

arrangements. A daily Cash Book to the effect is received regularly through MIS, by succeeding

working day. Copies of CRS are afterwards received with in one to three days. Amount on

realization is transferred to Current Account of Pakistan Steel.

Documents Prepared:

CRV/CV (Adjustment) signed by the Sectional Head

Amount without limit Scrutiny of CRS, on Receipt of Bank Statement, the amount of CR is

matched with the Bank Statement

Auction

Amount of Official Auction of the item declared for the purpose is collected through the Bank

Account with ABL in control of Store Department. The amount collected by the Bank in this

connection is transferred to Pakistan Steel Account as per advice from Stores Department by way

of letter to the bank copy of the same is endorsed to Cash Section. On receipt of the letter, bank

transfer the amount to the Main Account of Pakistan Steel and issue Credit Advice. Credit

vouchers are passed for incorporation in Books of Accounts.

Payments

i) Employees -Payment vouchers received from Pay Roll, Bills, Advances, Final Accounts, and

Sales Accounts are entered in relevant Register.

Cheques are prepared signed joint by the signatures.

Cheques are collected by the payees on their identification.

Authority for approval of P.A.C.V.

ii) Cheque signed by authorized officials. Payments Petty Cash an amount of Rs.50, 000/- is

kept in Petty Cash, CRV/CVs are raised and signed by Sectional Head cheque is signed by the

authorized officers.

31

iii) CRV/CV/Cheques signed by authorized officer physically cash is matched with daily Cash

Book Computer Based. Soviet Expert Salaries Note to the effect is received from Finance

Department, Voucher is prepared by Cash Section, voucher on the basis of note from Finance

Department, is signed by Sectional Head, Cheque is prepared and signed by Authorized

signatories.

iv) CV amount as per Finance Note. Corporate Secretariat payment Note is moved by Corporate

Secretariat regarding filing fee for, nomination of Directors of Board of Directors, payment

relating to Security Exchange Commission of Pakistan. A voucher is prepared in the light of the

Note. Cash is sent to Corporate Secretariat for depositing the amount for the purpose.

v) CV amount limit Rs.20, 000/- signed by Sectional Head Amount of note and deposit challan

is matched. Refund of Security Deposit Request through Purchase, ECD, BMD.

32

INFORMATION SYSTEM MANAGEMENT DEPARTMENT

ISMD offer two systems to marketing department to operate its data, and these system are;

1. DB2 (Data Base-2)

2. Flat File System (VSAM)

Computer System Bureau:

1. Quality Policy: At CSB our policy is to provide our customer high quality service with

100% on time delivery and ever in growing level of satisfaction through our proactive

and dynamic team of IT. CSB is dedicated to continualimprovement.

Internal Working System:

2. Purpose: It is to define quality plan and systematic activities carried out at different

sections of CSB for providing data processing services to various departments.

General Activities:

At CSB, to perform all activities in efficient way, there work is conducted in two shifts which

handle seven sections. And all there activates are given as follows;

1. Application Development:

a. System analysis, and analyst programmer

b. Developing new system

c. Maintenance of operational system

2. System Operation/D.B.Admin:

a. Responsible for smooth functioning of mainframe and database

b. Installing hardware and configuring

c. Problem handling and trouble shooting

3. Network Admin:

33

a. Installing terminals

b. Monitoring network performance

c. Complaint handling

4. PC/Logistics:

a. Personal Computer

b. Printer and scanner

5. Data Control:

a. Smooth flow of Input and Output

b. MIS report produced

6. Data Entry:

a. Proper and timely key punching with space and accuracy.

7. Admin:

a. Attendance and absentee report and leave records of CSB employees.

b. Computer maintenance charge bills

c. Annual department budgeting and inventory.

Account and Sales Data Control:

Virtual Systems Exercise Management (VSEM) save data at tape, provide General

Journal, Trial Balance, Expense Breakup, Profit and Loss, General Ledger, Subsidiary

Ledgers, Schedule if F.A, Sub ledger, Trial Balance, MIS at requirement.

34

SUGGESTIONS

As we have spend good time at Pakistan Steel mill to learn practical work life. And this learning,

obviously, benefits us in our future career. Through this learning we observe some pros and cons

when working in Pakistan Steel. So, we would like to give our suggestion for the improvement

and creating it dynamic organization. These suggestions are as under;

Although accounts department performing well and putting fine efforts to coordinate

between paper and paperless system. We suggest that there are as already infrastructure build

for computer networking but it is not completely utilizing in the way it can perform. So, as

the latest development allows us to facilitate our firm from efficient working softwares to

give greater productivity than we should use them.

Apart from that we have not visited A. & P. department but perhaps we feel to share our

observation that Pakistan Steel need to give attention to there employee in-terms of their job

satisfaction. And this not only comes through financial reward but also through placement

and the quality and quantity of work conducted from them.

There is also need for up gradation in finance department way of processing work. There are

highly recognized and reputable softwares and programs are available in the world market

which can give better service to increase productivity ten times such as Orical, Microsoft,

and other ERP program can facilitate firm and employees as well.

You might also like

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Arl Internship ReportDocument19 pagesArl Internship ReportChaudhry RashidNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Internship Report AliDocument27 pagesInternship Report AliFaiza KhalilNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- DIC Promotes Entrepreneurship Development in UPDocument23 pagesDIC Promotes Entrepreneurship Development in UPParmeet kaurNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- PTCL ReportDocument14 pagesPTCL ReportSaeeda ChannaNo ratings yet

- Internship ReportDocument4 pagesInternship ReportMuhammad SaadNo ratings yet

- Chapter 11 - Developing A Project ReportDocument7 pagesChapter 11 - Developing A Project ReportjtpmlNo ratings yet

- 52 Msme WircDocument38 pages52 Msme WircRam NarasimhaNo ratings yet

- MSME (Micro, Small and Medium Enterprises)Document6 pagesMSME (Micro, Small and Medium Enterprises)ISU MITTALNo ratings yet

- 3rd Fortnightly ReportDocument5 pages3rd Fortnightly ReportUmair NadeemNo ratings yet

- 3rd Fortnightly ReportDocument5 pages3rd Fortnightly ReportUmair NadeemNo ratings yet

- Chapter-3 Departments of PTCLDocument6 pagesChapter-3 Departments of PTCL✬ SHANZA MALIK ✬88% (8)

- Assessable Value: Prof. P. RajendranDocument18 pagesAssessable Value: Prof. P. RajendranProfessor RajendranNo ratings yet

- Syed Sabihuddin: ObjectiveDocument7 pagesSyed Sabihuddin: ObjectiveJawed AshrafNo ratings yet

- Acconts Payable PDFDocument17 pagesAcconts Payable PDFN Tarun ManjunathNo ratings yet

- Excell On ServicesDocument4 pagesExcell On ServicesstephanrazaNo ratings yet

- Claims SPark Temp EmpDocument5 pagesClaims SPark Temp EmpShreeshakumar M P BallalNo ratings yet

- Final Internal Audit Report 12-ICSIL-Ver-DraftDocument29 pagesFinal Internal Audit Report 12-ICSIL-Ver-DraftRamesh ChandraNo ratings yet

- PBL 2015 Sep-Jan - QuestionDocument8 pagesPBL 2015 Sep-Jan - QuestionNina ZamzulyanaNo ratings yet

- Assignment Drive Fall 2013 Program Ba - Sociology Semester Ii Bas 2012 - Foundation in Business and CommerceDocument9 pagesAssignment Drive Fall 2013 Program Ba - Sociology Semester Ii Bas 2012 - Foundation in Business and CommerceMrinal KalitaNo ratings yet

- Live payroll process and checkpointsDocument7 pagesLive payroll process and checkpointsDhruv JainNo ratings yet

- Entrepreneurship ManagementDocument33 pagesEntrepreneurship ManagementhinalviraNo ratings yet

- Government's unified accounts code structure (UACS) explainedDocument5 pagesGovernment's unified accounts code structure (UACS) explainedRuiz, CherryjaneNo ratings yet

- 2019inds MS75Document4 pages2019inds MS75SubbareddyNo ratings yet

- Direct Tax and Compliance Farheen 202200535 WordsDocument11 pagesDirect Tax and Compliance Farheen 202200535 Wordsnaazfarheen7777No ratings yet

- MBA Taxation Assignment on Objectives of Tax Planning and Factors to ConsiderDocument8 pagesMBA Taxation Assignment on Objectives of Tax Planning and Factors to Considersambha86No ratings yet

- Annexure II Details of AllowancesDocument4 pagesAnnexure II Details of AllowancesPravin Balasaheb GunjalNo ratings yet

- Japonica Payroll PresentationDocument19 pagesJaponica Payroll Presentationoxeeco100% (1)

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- MSME Registration and BenefitsDocument41 pagesMSME Registration and BenefitsRajeevChandNo ratings yet

- TDS DocumentDocument34 pagesTDS DocumentSaleem JavedNo ratings yet

- Report On Ohpc 2Document26 pagesReport On Ohpc 2babublsNo ratings yet

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Document5 pagesIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- Single Desk - G.O. MS. 85Document151 pagesSingle Desk - G.O. MS. 85Sandilya CharanNo ratings yet

- Bsbfia401 Amit ChhetriDocument20 pagesBsbfia401 Amit Chhetriamitchettri419No ratings yet

- Guidelines For Conducting Revenue Audit of PSPCLDocument48 pagesGuidelines For Conducting Revenue Audit of PSPCLsahil rohitNo ratings yet

- CIN Overview SD ModuleDocument76 pagesCIN Overview SD ModuleCampa ColaNo ratings yet

- Published MaharastraDocument4 pagesPublished MaharastraCA Nagendranadh TadikondaNo ratings yet

- Procedure For Prod - CertificateDocument166 pagesProcedure For Prod - CertificatePonduru TirmualaNo ratings yet

- Thesis On Internal Revenue AllotmentDocument5 pagesThesis On Internal Revenue Allotmentafkojbvmz100% (2)

- EntrepreneursDocument123 pagesEntrepreneursBibhudatta PatnaikNo ratings yet

- Micro Small & Medium EnterprisesDocument33 pagesMicro Small & Medium EnterprisesTejaswi KarriNo ratings yet

- ICAI Elections - Your Vote Will Make The DifferenceDocument8 pagesICAI Elections - Your Vote Will Make The DifferenceNehaNo ratings yet

- Credit Rating SchemeDocument12 pagesCredit Rating SchemeAnil KumarNo ratings yet

- Financial model assumptions and key statements for opening a tea cafe in IndiaDocument3 pagesFinancial model assumptions and key statements for opening a tea cafe in IndiaYASHASVI SHARMANo ratings yet

- QUIZ in Government Accounting Disbursements: (Group 3)Document6 pagesQUIZ in Government Accounting Disbursements: (Group 3)TokkiNo ratings yet

- India Localization With Respect To INDIA: Modus Operandi Session IDocument31 pagesIndia Localization With Respect To INDIA: Modus Operandi Session IpsroyalNo ratings yet

- Small Sclae IndustriesDocument22 pagesSmall Sclae IndustriesDev kartik AgarwalNo ratings yet

- HMC Finance ReportDocument11 pagesHMC Finance Reportmajid aliNo ratings yet

- March 2010 Part 1 InsightDocument63 pagesMarch 2010 Part 1 InsightSony AxleNo ratings yet

- GST 2018 Full Solved PaperDocument15 pagesGST 2018 Full Solved PaperKomala100% (1)

- Details of MSME subsidy programme for performance and credit ratingsDocument769 pagesDetails of MSME subsidy programme for performance and credit ratingsManav Hota0% (1)

- Introduction of All DepartmentsDocument2 pagesIntroduction of All DepartmentsAbdul RehmanNo ratings yet

- GST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingDocument4 pagesGST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingPC RKNo ratings yet

- 12 Quick Success Series Asset Products SmeDocument23 pages12 Quick Success Series Asset Products SmeShubham GoyalNo ratings yet

- Chapter One .EGADocument13 pagesChapter One .EGAAdugnaNo ratings yet

- Enterprise Risk ManagementDocument3 pagesEnterprise Risk Managementiamadnan92No ratings yet

- IntroductionDocument21 pagesIntroductioniamadnan92No ratings yet

- AnxDocument98 pagesAnxHinaz AkhtarNo ratings yet

- Pakistan Steel MillDocument1 pagePakistan Steel MillZaineb JavedNo ratings yet

- BCG TATA SteelDocument2 pagesBCG TATA Steeltaruneet50% (2)

- IntroductionDocument21 pagesIntroductioniamadnan92No ratings yet

- Company Profile Law Firm Getri, Fatahul & Co. English VersionDocument9 pagesCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDNo ratings yet

- Iso 14001Document8 pagesIso 14001jacobpm2010No ratings yet

- Practice Test 1 PMDocument34 pagesPractice Test 1 PMNguyễn Lê Minh NhậtNo ratings yet

- Lokakarya 0Document14 pagesLokakarya 0Edelweiss HenriNo ratings yet

- 1ST AssDocument5 pages1ST AssMary Jescho Vidal AmpilNo ratings yet

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- FILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.Document2 pagesFILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.zacNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Insurance Basics: Characteristics, Risks, and BenefitsDocument10 pagesInsurance Basics: Characteristics, Risks, and Benefitsmark sanadNo ratings yet

- Top 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Document5 pagesTop 10 Opportunities Opportunity Title Client Status Opp Lead Est Fee (GBP K)Anonymous Xb3zHioNo ratings yet

- Ezi-Dock ChargebagsDocument1 pageEzi-Dock ChargebagsInos TechnologiesNo ratings yet

- Jedi Mind Tricks: How To Get $700,000 of Advertising For $10,000Document5 pagesJedi Mind Tricks: How To Get $700,000 of Advertising For $10,000dario_james_1No ratings yet

- Code of Professional EthicsDocument6 pagesCode of Professional EthicsMonsta XNo ratings yet

- The Importance of Reverse Logistics (#274692) - 255912Document11 pagesThe Importance of Reverse Logistics (#274692) - 255912I'malookIubeNo ratings yet

- Data Privacy Act of 2012Document28 pagesData Privacy Act of 2012SongAirene JiGonzaga Ho BonioNo ratings yet

- Integration The Growth Strategies of Hotel ChainsDocument14 pagesIntegration The Growth Strategies of Hotel ChainsTatiana PosseNo ratings yet

- High Performance OrganizationsDocument25 pagesHigh Performance OrganizationsRamakrishnanNo ratings yet

- Enterprise Structure OverviewDocument5 pagesEnterprise Structure OverviewAnonymous 7CVuZbInUNo ratings yet

- Eap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsDocument11 pagesEap Counselling: Outcomes, Impact & Return On Investment.: Paul J Flanagan & Jeffrey OtsPavan KumarNo ratings yet

- Chapter Two Strategy Formulation (The Business Vision, Mission, and Values)Document14 pagesChapter Two Strategy Formulation (The Business Vision, Mission, and Values)liyneh mebrahituNo ratings yet

- Sales Commission Quick Guide LS Retail NAV 6.3Document28 pagesSales Commission Quick Guide LS Retail NAV 6.3sangeeth_kNo ratings yet

- Agency and Mortgage Lecture NotesDocument13 pagesAgency and Mortgage Lecture NotesNA Nanorac JDNo ratings yet

- Informative advertising is used heavily when introducing a new product categoryDocument3 pagesInformative advertising is used heavily when introducing a new product categoryMalik Mohamed100% (2)

- Advertising objectives to inform, persuade and remind customersDocument2 pagesAdvertising objectives to inform, persuade and remind customersashwinibhosale37No ratings yet

- MTO CSO Interview Customer Service TrendsDocument4 pagesMTO CSO Interview Customer Service Trendsgl02ruNo ratings yet

- Management Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressDocument136 pagesManagement Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressVritika JainNo ratings yet

- TPM Event CalenderDocument3 pagesTPM Event Calenderamarpal07No ratings yet

- Eazi Buyer Pack 2023 08Document3 pagesEazi Buyer Pack 2023 08Junaid AnthonyNo ratings yet

- Strategic Leadership - CinnamonDocument24 pagesStrategic Leadership - Cinnamonaseni herathNo ratings yet

- Cost and Management Accounting I For 3rd Year Business Education StudentsDocument86 pagesCost and Management Accounting I For 3rd Year Business Education StudentsAmir Kan100% (2)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessFrom EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNo ratings yet