Professional Documents

Culture Documents

Highlights of Union Budget 2012

Uploaded by

Debarun ChatterjeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Highlights of Union Budget 2012

Uploaded by

Debarun ChatterjeeCopyright:

Available Formats

Submitted by:Debarun Chatterjee

R o l l n o : 0 9 C V 2 6

E n g g . E c o n o mi c s A s s i g n me n t

S u b mi t t e d t o : Ms . V i j a y a l a k s h mi

Union Budget 2012-13

Union Budget 2012-13: Review

The Finance Minister presented the Union Budget for 2012-13 on 16-Mar-12 amidst much

expectations and hope. In this report, we look at the key highlights of the Union Budget mainly from

fixed income market perspective.

Financial Highlights of Budget 2012-13:

* Direct proposals to give in net revenue loss of Rs. 4,500 crore and net gain of Rs. 45,940 crore from indirect

taxes, resulting into a net gain of Rs. 41,440 crore.

* Fiscal deficit targeted at 5.1 per cent of GDP in 2012-13, down from 5.9 per cent in 2011-12; Central

Government debt at 45.5 per cent of GDP

* Total expenditure budgeted at Rs. 14,90,925 crore; plan expenditure at Rs. 5,21,025 crore, 18 per cent higher

than 2011-12 budget; non-plan expenditure at Rs. 9,69,900 crore.

* Gross Tax Receipts estimated at Rs. 10,77,612 crore, 15.6 per cent higher than original budget estimates and

19.5 per cent over the revised estimates for 2011-12.

* Net tax to the Centre in 2012-13 estimated at Rs. 7,71,071 crore; Non-Tax Revenue Receipts estimated at Rs.

1,64,614 crore and Non-debt Capital Receipts at Rs. 41,650 crore.

* Total expenditure for 2012-13 budgeted at Rs. 14,90,925 crore, including Rs. 5,21,025 crore of Plan

Expenditure and Rs. 9,69,900 crore as Non-Plan Expenditure.

* Defence services get Rs. 1,93,407 crore; any further requirement to be met.

I. Revenue Side

Domestic and global factors combined have had a bearing on the tax revenues during 2011-12, which

comprises the bulk of the total receipts of the government. Total revenue growth for 2011-12 which

was estimated at 3.6%, is expected to show negative growth of 3.3% as per revised estimates of the

government. However hoping a revival in economic conditions, for 2012-13 the government has

estimated a robust increase of 22.7% in total receipts at Rs 9.77 lakh cr.

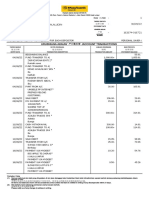

Table 1: Government Revenue (in Rs Cr)

2011-12

(BE)

2011-12

(RE)

2012-13

(BE)

Revenue Receipts 789892 766989 935685

Tax 664457 642252 771071

Non Tax 125435 124737 164614

Non Debt Capital Receipts 55020 29751 41650

Recovery of loans 15020 14258 11650

Other Receipts 40000 15493 30000

Total Receipts 844912 796740 977335

Source: Union Budget Documents

Taxes are expected to contribute close to 78% to the total revenues of the government in 2012-13.

- Mar-20

Taxes on Union Territories 1982 2317 2310

Less - Transfers to Funds 3900 3998 4620

Less - State's share 219303 255414 301921

Centre's Net Tax Revenue 569869 642252 771071

Source: Union Budget Documents

On expected lines the government brought the service tax rate and excise duty from 10% to pre

crisis level of 12% along with increase in number of services to be taxed. The government has

proposed to tax all services except those in the negative list comprising 17 heads. The government

has estimated additional revenue of Rs 18,660 Cr from the above mentioned changes in the service

tax regime. For eventual transition to GST, the government will make efforts to align service tax and

excise duty. The peak customs duty of 10% on non agricultural goods has been left unchanged.

Apart from routine items like dividends and profits under Non Tax revenues, government has

estimated to garner Rs 40,000 Cr from the sale of spectrum in 2012-13. Non debt capital receipts

include Rs 30,000 Cr through disinvestment of part of equity in various state owned enterprises.

Receipts from disinvestment remain vulnerable to performance of Equity markets as is evident from

the fact that the government has been unable to meet the target disinvestment in the last two years.

Against the BE of Rs 40,000 Cr worth of disinvestment each in 2010-11 and 2011-12, only 57% and

39% respectively were realized in each of the years. Disinvestment proceeds though are estimated to

contribute only about 3% to the total receipts in 2012-13, nevertheless in trying times every penny

counts as much.

II. Expenditure Side

Table: 3 Government Expenditure ( In Rs Cr)

Actual 2010-11 RE 2011-12 BE 2012-13

Non Plan Expenditure 818299 892116 969900

Plan Expenditure 379029 426604 521025

Total Expenditure 1197328 1318720 1490925

Source: Union Budget Documents

For 2012-13, the government appears to have forecasted more realistic growth on Total Expenditure

after failing to achieve the over optimistic targets set in the previous budget. According to the revised

estimates of 2011-12, total expenditure is estimated to record an annual growth of 10.1% against the

originally budgeted growth of 3.4%. As against an envisaged decline of 0.7% in Non Plan

Expenditure, in 2011-12 the growth has been revised up sharply to 9%. This is largely on account of

higher outgo towards subsidy payment. The government had to shell out an additional Rs 72,727 Cr

on subsidy payments over an above Rs 143,570 Cr estimated in Budget 2011.

Table: 4 Total Subsidies ( In Rs Cr)

2010-11

Actual

BE 2011-12

RE 2011-12

BE 2012-13

Petroleum Subsidy 38,371 23,640 68,481 43580.0

Food Subsidy 63,844 60,573 72,823 75000.0

Fertilizer Subsidy 62,301 49,998 67,199 60974.0

Other Subsidies 8,904 9,359 7,794 10461.0

Total Subsidies 1,73,420 1,43,570 2,16,297 190015.0

Source: Union Budget Documents

2

For 2012-13 once again the government has estimated a lower outgo towards subsidy compared to

the revised estimates of 2011-12. Fuel subsidy which comprises about 23% of the total subsidy in

2012-13 is estimated at Rs 43,580 Cr. Out of the total fuel subsidy Rs 40,000 Cr is meant for

compensating Oil Marketing Companies (OMCs) for selling diesel, PDS kerosene and Domestic

LPG at below market price. As there is an upside risk to oil prices which are currently above $125

per barrel, the only other way OMCs can be compensated is by raising prices. While this will put an

upward pressure on inflation in the short term, subsidizing these items is inflationary in the long

term.

Figure 1 Figure 2

Source: Union Budget Documents Source: Union Budget Documents

However in its bid to provide a road map for fiscal consolidation the government in the Budget 2012

has suggested some caps on subsidies. The budget says that From 2012-13 subsidies related to food and

for administrating the Food Security Bill will be fully provided for. All other subsidies would be funded to the extent

that they can be borne by the economy without any adverse implications. Accordingly the government has

proposed:

To restrict the expenditure on Central subsidies to under 2% of GDP in 2012-13

To be brought down to 1.75% of GDP over the next three years

This is a welcome step towards restricting Non Plan revenue expenditure but adherence to the

projections still remains to be tested. Interest and Defense expenditure still forms about 53% of the

total non-plan expenditure. These two categories continue to grow in double digits in line with the

trend.

Table 5: Major Heads of Non Plan Expenditure (In Rs Cr)

2010-11 Actuals 2011-12 BE 2011-12 RE 2012-13 BE

Interest Payments 234022 267986 275618 319759

Defense Expenditure 154117 164415 170937 193407

Subsidies 173420 143570 216297 190015

Pensions 57405 54521 56190 63183

Total Non Plan Expenditure 818299 816182 892116 969900

Source: Union Budget Documents

3

SECTOR BASED ALLOCATION:

The Union Minister of Finance came up with an increased budgetary allocation for various sectors

including agriculture, rural development, defence etc. While, the Plan Outlay for Department of

Agriculture and Co-operation increased by 18 percent, the target for agricultural credit raised by

100000 crore rupees to 575000 crore rupees. Budgetary allocation for rural drinking water and

sanitation received a hike of over 27 per cent. Flagship programmes like Right to Education-Sarva

Shiksha Abhiyan received an increase of 21.7 per cent in the budgetary allocation.

Some of the major allocations made for different sectors of economy are as follows:

Agriculture and Allied Activities

Budgetary allocation for agriculture and allied activities 2012-13 increased by 18%

9217 crore rupees allocated for Rashtriya Krishi Vikas Yojana.

1000 crore rupees for Bringing Green Revolution to Eastern India (BGREI) project

300 crore rupees to Vidarbha Intensified Irrigation Development Programme under RKVY.

200 crore rupees allocated for incentivising research with rewards

14242 crore rupees allocated for Accelerated Irrigation Benefit Programme (AIBP)

500 crore rupees provided to broaden scope of production of fish to coastal aquaculture

Rural Development

14,000 crore rupees allocated for rural drinking water and sanitation

24000 crore rupees allocated for Pradhan Mantri Grameen Sadak Yojna

12040 crore rupees provided for Backward Regions Grant Fund scheme

20,000 crore rupees allocated for Rural Infrastructure Development Fund

5000 crore rupees earmarked for creating warehousing facilities

Education

Sarva Siksha Abhiyan-Right to Education- 25555 crore rupees

3124 crore rupees provided for Rashtriya Madhyamik Shiksha Abhiyan (RMSA)

Health

20822 crore rupees National Rural Health Mission

Employment and skill development

3915 crore rupees provided for National Rural Livelihood Mission

1276 crore rupees allocated for Prime Ministers Employment Generation Programme

1000 crore rupees allocated for National Skill Development Fund

Defence and Security

193407 crore rupees aallocated for Defence services including 79579crore rupees for capital

expenditure

1185 crore rupees to be allocated for construction of nearly 4000 residential quarters for Central

Armed Police Forces

3280 crore rupees proposed to be allocated for construction of office building of CentralArmed

Police Forces

Infrastructure and Industrial Development

25360 crore rupees allocated for Road Transport and Highways Ministry

3884 crore rupees loan waiver for handloom weavers and their cooperative societies

500 crore rupees pilot scheme announced for promotion and application of Geo-textile in the

North Eastern Region

70 crore rupees allocated to set up a powerloom mega cluster in Ichalkaranji in Maharashtra

5000 crore rupees India Opportunities Venture Fund to be set up with SIDBI

15888 crore rupees to be provided for capitalisation of public sector banks and financial

institutions

Other major allocations

37113 crore rupees allocated for Scheduled Castes Sub Plan

21710 crore rupees earmarked for Tribal Sub Plan

INCOME TAX SLABS:

Disappointing a large section of income tax payers in the country, finance minister Pranab

Mukherjee made a small raise in the exemption limit in his Budget speech.

Pranab Mukherjee raised the exemption limit for income tax by just Rs 20,000 from Rs 1,80000 to Rs

2 lakh.

The new tax slabs are as follows:

Up to Rs 2 lakh: No tax

From Rs 2 lakh to 5 lakh: 10%

From Rs 5 lakh to 10 lakh: 20%

Above Rs 10 lakh: 30%

Promise to curb black money, major push on infrastructure, capital market reforms and huge subsidy

cut were among the other proposals listed by Pranab Mukherjee in the Union Budget for 2012-13.

The revision in tax slabs will give some direct tax relief to individuals, even as eating out, buying

luxury cars, air travel, availing some professional services and investing in gold jewellery will become

costlier.Presenting his 7th budget in the Lok Sabha on Friday, the finance minister said the

exemption limit for personal income tax was being enhanced from Rs 1,80,000 to Rs 2,00,000, even

as the limit for peak rate was being raised to Rs 10,00,000 from Rs 8,00,000.

"This will provide tax relief of Rs 2,000 to every tax payer," the finance minister said, adding: "My

proposal on direct taxes will result in a revenue loss of Rs 4,500 crore."

He also announced new tax slabs under which income up to Rs 2,00,000 would be totally exempt,

levy 10 percent for Rs 2,00,000 to Rs 5,00,000, then 20 percent for Rs 5,00,000 to Rs 10,00,000 and

30 percent for income above Rs 10,00,000.

For the corporate sector, he said, while the tax rates were remaining unchanged, he assured cheaper

access to funds for expansion, even as he tinkered with the excise rates and customs duties for

specific items.

He proposed to raise the service tax rate to 12 percent from the present 10 percent.

Assuring further liberalisation of capital markets, he announced a new equity savings scheme to

extend income tax deduction of 50 percent to those who invest up to Rs 50,000 in equities and

whose annual income is less than Rs 10 lakh.

"The global crisis has affected us. India's gross domestic product (GDP) is expected to grow at 6.9

percent in 2011-12, after having grown at 8.4 percent in each of the two preceding years," the

finance minister said

VI. Conclusion

The Union Budget 2012-13 tries to give a more realistic picture of India governments fiscal position.

However, just like previous budget some questions still remain on subsidies. Major subsidies for

2012-13 imply a decline of 14% from 2011-12. All the major subsidies are pegged to be lower

compared to 2011-12 except food subsidy. Even in food subsidy the rise is a marginal 3% considering

Food Security Act is to be implemented this year. Hence, there could again be some issues on

subsidy front. The higher than expected market borrowings will again put supply pressures on bond

markets. The revision in excise duty will put pressure on inflation trends which only recently started

to trend lower. Overall, the year 2012-13 is again expected to be a difficult and volatile year for fixed

incomes markets.

You might also like

- Union Budget 2012-13 - ReviewDocument8 pagesUnion Budget 2012-13 - Reviewkrkamaldevnlm4028No ratings yet

- Budget Main PagesDocument43 pagesBudget Main Pagesneha16septNo ratings yet

- India: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetDocument4 pagesIndia: Highlights of The 2012/2013 Budget: The Indian Government Has Announced Its Proposals For The 2012/13 BudgetVishal PranavNo ratings yet

- Union Budget Analysis 2012 13Document38 pagesUnion Budget Analysis 2012 13Richa SinghNo ratings yet

- Budget 21Document17 pagesBudget 21Raja17No ratings yet

- 2012-13 Budget Highlights in 38 CharactersDocument2 pages2012-13 Budget Highlights in 38 CharactersAnusha_SahukaraNo ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisAdeel AshrafNo ratings yet

- Budget Analysis 2011 12Document7 pagesBudget Analysis 2011 12s lalithaNo ratings yet

- Chap 1Document72 pagesChap 1rbrgroupsNo ratings yet

- Economics ProjectDocument10 pagesEconomics ProjectbhavikNo ratings yet

- Budget 2012 EconomyDocument19 pagesBudget 2012 EconomynnsriniNo ratings yet

- Budget 2012Document6 pagesBudget 2012Divya HdsNo ratings yet

- Union Budget 2012Document4 pagesUnion Budget 2012Siddhant SekharNo ratings yet

- 2012 March BudgetDocument16 pages2012 March BudgetShuvajit NayakNo ratings yet

- Budget of Bangladesh FINALDocument4 pagesBudget of Bangladesh FINALSumaiya HoqueNo ratings yet

- 5-Highlights Budget 2013-14 EnglishDocument4 pages5-Highlights Budget 2013-14 Englishsoftdev11No ratings yet

- 2012 March BudgetDocument28 pages2012 March BudgetRavi SharmaNo ratings yet

- Fiscal and Monetary Policy Developments in PakistanDocument19 pagesFiscal and Monetary Policy Developments in PakistanNazish IlyasNo ratings yet

- BETA Budget 2012 13Document8 pagesBETA Budget 2012 13Karu TyagiNo ratings yet

- An Analysis of The Budget of BangladeshDocument25 pagesAn Analysis of The Budget of Bangladeshmahbub rahmanNo ratings yet

- Budget 2012 Highlights Raises Income Tax Exemption LimitDocument5 pagesBudget 2012 Highlights Raises Income Tax Exemption LimitAswathy PkNo ratings yet

- Union Budget 2012-13: The Past and The Present Budget - BackgroundDocument18 pagesUnion Budget 2012-13: The Past and The Present Budget - BackgrounddivertyourselfNo ratings yet

- 2011 BudgetDocument7 pages2011 BudgetGIMPIRAWALNo ratings yet

- India Union Budget 2013 PWC Analysis BookletDocument40 pagesIndia Union Budget 2013 PWC Analysis BookletsuchjazzNo ratings yet

- Budget Plan Financial GuidelineDocument12 pagesBudget Plan Financial GuidelineRahul DubeyNo ratings yet

- Fiscal Deficit and Balance of Payments AnalysisDocument32 pagesFiscal Deficit and Balance of Payments AnalysismahijayNo ratings yet

- Union Budget 2019-20Document15 pagesUnion Budget 2019-20Smitha MohanNo ratings yet

- Fiscal Policy 111Document16 pagesFiscal Policy 111Syed Ahsan Hussain XaidiNo ratings yet

- BUDGET 2012: HighlightsDocument22 pagesBUDGET 2012: HighlightsSamridhi TrikhaNo ratings yet

- Budget in Brief 2012 13Document52 pagesBudget in Brief 2012 13adeelklNo ratings yet

- New Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearDocument3 pagesNew Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearTapas KumarNo ratings yet

- Pre Budget Report SMC Mar 12Document13 pagesPre Budget Report SMC Mar 12Vince GaruNo ratings yet

- Union Budget FY12 at a Glance /TITLEDocument8 pagesUnion Budget FY12 at a Glance /TITLEarvi2020No ratings yet

- Compare Budget 2023 With 2022Document8 pagesCompare Budget 2023 With 2022Vartika VNo ratings yet

- Pakistan Federal Budget 2007-08 AnalysisDocument18 pagesPakistan Federal Budget 2007-08 Analysisclimax manoNo ratings yet

- Budget 2011-12 - Analysis: Tax ProjectDocument19 pagesBudget 2011-12 - Analysis: Tax ProjectSaurabh SadaniNo ratings yet

- Ventura - Budget 2013Document47 pagesVentura - Budget 2013Manish SachdevNo ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisRishi BiggheNo ratings yet

- Budget 2010-11 Preview: EmkayDocument33 pagesBudget 2010-11 Preview: EmkayrNo ratings yet

- Budget Overvie1Document10 pagesBudget Overvie1farahnaz889No ratings yet

- Commentary On Union Budget 2011 - FinalDocument5 pagesCommentary On Union Budget 2011 - FinalJohn MinzNo ratings yet

- India BudgetDocument23 pagesIndia BudgetrachnasworldNo ratings yet

- I M S Engineering College Ghaziabad: Presented To Supriya Mam Presented by Shobhit Verma Ved PrakashDocument16 pagesI M S Engineering College Ghaziabad: Presented To Supriya Mam Presented by Shobhit Verma Ved PrakashLavi VermaNo ratings yet

- February 2013 Monthly Policy Review Highlights Key DevelopmentsDocument12 pagesFebruary 2013 Monthly Policy Review Highlights Key DevelopmentsAbhishek Mani TripathiNo ratings yet

- Budget Speech: Pu Zoramthanga Hon'Ble Chief Minister & Finance MinisterDocument16 pagesBudget Speech: Pu Zoramthanga Hon'Ble Chief Minister & Finance MinisterLalsangmawia LalsangmawiaNo ratings yet

- Budget Review 2015-2016Document6 pagesBudget Review 2015-2016S.M.HILALNo ratings yet

- An Update To The Budget and Economic Outlook: Fiscal Years 2012 To 2022Document75 pagesAn Update To The Budget and Economic Outlook: Fiscal Years 2012 To 2022api-167354334No ratings yet

- Impact of Budget 2014-15 on key sectorsDocument4 pagesImpact of Budget 2014-15 on key sectorsRaj AraNo ratings yet

- Budget 2010 Review: India-An Economic OverviewDocument6 pagesBudget 2010 Review: India-An Economic OverviewAIMS_2010No ratings yet

- ICRA Union Budget 2012-13Document7 pagesICRA Union Budget 2012-13NIKUNJ_SARAF11No ratings yet

- SA's 2013 National Budget focuses on fiscal disciplineDocument7 pagesSA's 2013 National Budget focuses on fiscal disciplineBrilliant MycriNo ratings yet

- The Kano Budget-2012Document31 pagesThe Kano Budget-2012kamalcitad100% (1)

- Budget PublicationDocument50 pagesBudget PublicationAmit RajputNo ratings yet

- Union Budget 2011-12: Key Takeaways for Equity, Debt MarketsDocument3 pagesUnion Budget 2011-12: Key Takeaways for Equity, Debt MarketsVaibhav RusiaNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- India Budget 2012-13Document5 pagesIndia Budget 2012-13findprabhuNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Jawaban Kieso Intermediate Accounting p19-4Document3 pagesJawaban Kieso Intermediate Accounting p19-4nadiaulyNo ratings yet

- Are Timeshares An Asset or Liability - Timeshare Freedom GroupDocument4 pagesAre Timeshares An Asset or Liability - Timeshare Freedom Groupد. هيثم هاشم قاسم سلطان الخفافNo ratings yet

- Understanding the business and customers of the aviation industryDocument12 pagesUnderstanding the business and customers of the aviation industryssmodakNo ratings yet

- BSBMKG608 - Assessment Task 3Document4 pagesBSBMKG608 - Assessment Task 3Ghie MoralesNo ratings yet

- Work Sheet-Ii: Dollar ($) Project A Project B Project CDocument5 pagesWork Sheet-Ii: Dollar ($) Project A Project B Project Crobel popNo ratings yet

- The Warehouse Statergy AnalysisDocument21 pagesThe Warehouse Statergy AnalysisKevin56% (16)

- CH 2 Economic IntegrationDocument19 pagesCH 2 Economic IntegrationarshaNo ratings yet

- Jamur Mushroom StrategiesDocument13 pagesJamur Mushroom StrategiesOlivia HaninNo ratings yet

- Circular Business Model CanvasDocument25 pagesCircular Business Model CanvasLeanne Angel Mendones MayaNo ratings yet

- Impacts of Leadership Styles on Employee Motivation and PerformanceDocument64 pagesImpacts of Leadership Styles on Employee Motivation and PerformanceSajib Chandra RoyNo ratings yet

- Employees' Compensation CommissionDocument5 pagesEmployees' Compensation CommissionJesús LapuzNo ratings yet

- MBBsavings - 162674 016721 - 2022 09 30 PDFDocument3 pagesMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinNo ratings yet

- Edexcel AS A Level Business Unit 1 Marketing and People Revision NotesDocument7 pagesEdexcel AS A Level Business Unit 1 Marketing and People Revision Notesayra kamalNo ratings yet

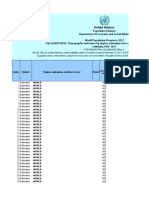

- Wpp2022 Gen f01 Demographic Indicators Compact Rev1Document6,833 pagesWpp2022 Gen f01 Demographic Indicators Compact Rev1Claudio Andre Jiménez TovarNo ratings yet

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocument31 pagesChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzNo ratings yet

- Economic Growth ProblemsDocument12 pagesEconomic Growth ProblemsAdnan Jawed100% (1)

- DẠNG BÀI TẬP TỪ VỰNG SỐ 02Document5 pagesDẠNG BÀI TẬP TỪ VỰNG SỐ 02Nguyễn HươngNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- Monetary Policy and Fiscal PolicyDocument15 pagesMonetary Policy and Fiscal Policycarmella klien GanalNo ratings yet

- GarmentsDocument191 pagesGarmentsBoopathi KalaiNo ratings yet

- Cola Wars and Porter Five Forces AnalysisDocument10 pagesCola Wars and Porter Five Forces Analysisshreyans_setNo ratings yet

- Nestle Letter To State of Ohio Announcing Layoffs in SolonDocument3 pagesNestle Letter To State of Ohio Announcing Layoffs in SolonWKYC.comNo ratings yet

- Breanne N Tillman: Please Remember, You Are Restricted From Using This Information ForDocument9 pagesBreanne N Tillman: Please Remember, You Are Restricted From Using This Information FordaNo ratings yet

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDocument36 pagesGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- 5328100312Document276 pages5328100312Nihit SandNo ratings yet

- Improvement Plan Forsachin G.I.D.C.Document8 pagesImprovement Plan Forsachin G.I.D.C.GRD JournalsNo ratings yet

- Saanika Industries PVT LTDDocument14 pagesSaanika Industries PVT LTDgarimaNo ratings yet

- Soneri Bank Ltd. Company Profile: Key PeoplesDocument4 pagesSoneri Bank Ltd. Company Profile: Key PeoplesAhmed ShazadNo ratings yet

- Human Resource ManagementDocument3 pagesHuman Resource ManagementQuestTutorials BmsNo ratings yet

- Financial Management in Public Service Delivery in Zambia A Brief Literature ReviewDocument4 pagesFinancial Management in Public Service Delivery in Zambia A Brief Literature ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet