Professional Documents

Culture Documents

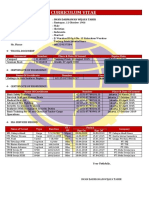

Siw - 05-09-2014

Uploaded by

Savishesh0 ratings0% found this document useful (0 votes)

148 views20 pagesclark

Original Title

SIW -05-09-2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentclark

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

148 views20 pagesSiw - 05-09-2014

Uploaded by

Savisheshclark

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 20

Clarkson Research Services

Shipping Intelligence Weekly

Issue No. 1,137 5-Sep-2014 ISSN: 1358-8028

ClarkSea Index $10,654

Vessel Charter Rates This Week

1 Year VLCC TC Rate | 1 Year Capesize TC Rate

1 Year MR TC Rate | 6-12m 2750 TEU TC Rate

Asset Prices This Week

VLCC N/B $98.0m | Capesize N/B $55.3m | 2750 TEU N/B $32.0m

VLCC 5yo

$74.0m | Capesize 5yo $48.0m | 2750 TEU 5yo $15.3m

This Week's Analysis (see Back Page)

LNG Trade - Stiff Competition In The Energy World

But Long-Term Trends Are Dynamic

$29,000/day $21,500/day

$14,000/day $7,600/day

5

10

15

20

25

30

35

40

S

e

p

-

0

8

J

a

n

-

0

9

M

a

y

-

0

9

S

e

p

-

0

9

J

a

n

-

1

0

M

a

y

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

M

a

y

-

1

1

S

e

p

-

1

1

J

a

n

-

1

2

M

a

y

-

1

2

S

e

p

-

1

2

J

a

n

-

1

3

M

a

y

-

1

3

S

e

p

-

1

3

J

a

n

-

1

4

M

a

y

-

1

4

$,000/day

CONTENTS

Crude Tanker Spot Market p2

Product Tanker Spot Market p3

Large Bulk Carrier Market p4

Tripcharter Market, Freight Indices

& Futures p5

Gas & Chemical Markets p6

Liner & Offshore Markets p7

Secondhand Prices p8

Sale & Purchase Market pi

Recent Ship Sales by Vessel Type pii

Cargo Fleet Changes & Bunkers piii

Timecharter Fixture Record piv

The Timecharter Market p9

The Shipbuilding Market p10

The Demolition Market p11

Economic Indicators p12

Ship Demand Trends p13

World Fleets & Orderbooks p14-15

Analysis p16

Roberts Bank

New York

Philadelphia

Hampton Roads

Houston New Orleans

LOOP

Selection of ports covered by the various market sectors in this report

St Eustatius

Bonaire Bolivar

Rio de Janeiro

Tubarao

Mumbai

Mundra Jamnagar

Gangavaram

Pipavav

Singapore

Jakarta

Banjarmasin

Dampier

Hay Point

Sydney

Ningbo

Beilun Oita

Chiba

Ulsan

Longkou

Qingdao

Clarkson Research Services Limited

(CRSL) is respected worldwide as the most

authoritative provider of intelligence for

global shipping. CRSL is part of the

Clarksons group, the world's largest

shipbroking and integrated shipping

services provider. For more detail about the

Clarksons group visit www.clarksons.com.

Clarkson Research will be exhibiting at

SMM 2014, Hamburg, Germany from

the 9th-12th September 2014 and will

be located in hall B1.OG. at stand 304.

Roberts Bank

New York

Philadelphia

Hampton Roads

Houston New Orleans

LOOP

Selection of ports covered by the various market sectors in this report

St Eustatius

Bonaire Bolivar

Rio de Janeiro

Tubarao

Saldanha Bay

Richards Bay

Dar es Salaam

Lome

Bonny Offshore

Sullom Voe

Primorsk

Wilhelmshaven

Rotterdam

Lavera

Arzew

Es Sider

Trieste

Odessa

Novorossiysk

Augusta

Agioi Theodoroi

Sidi Kerir

Ain Sukhna

Ras Tanura

Mumbai

Mundra Jamnagar

Gangavaram

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Crude Tanker Spot Market

Crude Tanker Highlights

VLCC Single

WS 2014 Average earnings $ per day VLCC Earnings

Voyage.....

Aug 29 Sep 05 2014 2013 2014 Aug 29 Sep 05 This Week ....

23 280,000t Gulf - Europe 27 26 30 11,486 19,638 14,043 11,430 WEAKER -19%

23 280,000t Gulf - US Gulf * 26 25 29 8,319 14,516 9,772 7,048 WEAKER!! -28%

23 265,000t Gulf - Japan * 42 42.5 45 17,710 21,629 17,296 17,340 STEADY 0%

23 265,000t Gulf - S.Korea * 42 42.5 45 16,937 20,827 16,760 16,712 STEADY 0%

23 270,000t Gulf - Sing 45 43.5 46 17,994 22,429 20,946 18,130 WEAKER -13%

23 280,000t Gulf - Red Sea 52.5 50 52 25,880 32,918 33,611 29,380 WEAKER -13%

23 260,000t WAF - China * 47.5 46 47 15,454 21,264 21,840 21,000 SOFTER -4%

23 260,000t WAF - US Gulf * 50 55 55 22,665 34,069 29,023 35,144 FIRMER 21%

23 260,000t WAF - WC India^ 4.00 3.70 3.68 20,313 24,997 31,203 24,954 WEAKER -20%

23 275,000t Caribs-Singapore^ 6.00 6.00 4.63 29,608 40,859 67,754 67,421 STEADY 0%

23 VLCC Ave. Earnings * 16,217 22,461 18,938 19,449 STEADY 3%

^ Lump sum in million dollars

Suezmax Single

WS 2014 Average earnings $ per day Suezmax Earnings

Voyage.....

Aug 29 Sep 05 2014 2013 2014 Aug 29 Sep 05 This Week ....

24 130,000t WAF - USAC * 62.5 60 72 14,245 21,006 15,580 13,738 WEAKER -12%

24 130,000t WAF - Med 62.5 60 74 13,863 21,775 14,443 12,859 WEAKER -11%

24 130,000t Med - Med * 65 65 80 16,776 27,315 16,439 16,752 STEADY 2%

24 140,000t Black Sea - Med 62.5 62.5 78 13,321 26,204 12,799 13,559 FIRM.... 6%

24 Suezmax Ave. Earnings * 15,511 24,160 16,010 15,245 SOFTER -5%

Aframax Single

WS 2014 Average earnings $ per day Aframax Earnings

Voyage.....

Aug 29 Sep 05 2014 2013 2014 Aug 29 Sep 05 This Week ....

25 100,000t Baltic - UKC * 105 65 92 19,903 27,847 37,996 11,394 WEAKER!! -70%

25 80,000t Black Sea - Med * 105 90 102 11,265 21,326 23,356 16,107 WEAKER!! -31%

25 80,000t Sidi Kerir - Trieste * 102.5 90 101 11,346 21,319 22,872 16,984 WEAKER!! -26%

25 80,000t Es Sider - Fos 117.5 105 104 7,023 18,060 25,819 19,567 WEAKER -24%

25 80,000t Med - USAC 95 87.5 97 15,525 20,228 19,735 16,276 WEAKER -18%

25 80,000t UKC - UKC * 105 95 114 11,633 22,718 17,259 10,605 WEAKER!! -39%

25 80,000t UKC - USAC 95 90 105 17,958 21,950 17,352 14,943 WEAKER -14%

25 80,000t Gulf - East * 105 102.5 103 14,185 20,921 22,111 21,102 SOFTER -5%

25 80,000t Indo - Japan * 105 102.5 100 14,076 21,065 23,467 23,030 STEADY -2%

25 70,000t Carib - US Gulf * 92.5 85 130 16,508 25,843 12,334 9,134 WEAKER!! -26%

25 Aframax Ave. Earnings * 14,131 23,005 22,771 15,479 WEAKER!! -32%

Clarkson Research Services Page 2

12,541

"Voyage Earnings" are estimated from spot freight rates (see footnote on page 4); */

#

Indicates constituent routes of "Average Earnings".

05-Sep-14

15,649

9,398

16,710

15,618

13,741

12,558

16,908

2012

12,876

12,331

11,264

6,948

18,359

2012

14,937

15,042

18,879

17,453

18,845

30,899

17,668

25,730

20,441

28,537

Crude Tanker Spot Earnings ($,000's/day)

2012

17,302

13,039

17,904

17,455

VLCCs:

It has been an uninspiring week in both the East and West

this week. In the MEG, volumes have been on the low side

with the rate on the Gulf-US Gulf route falling to WS 25. In

WAF it has been a quiet week, although the Caribs market

remains firm with the lump sum rate on the Caribs-

Singapore route at $6.0m.

Suezmaxes:

Rates in WAF began the week at WS 62.5 for Europe

bound voyages but as the fixing window stretched out to

the back of the month rates came under increasing

pressure. Charterers had multiple offers for cargoes and

subsequently the rate on both the WAF-USAC and WAF-

Med routes decreased to WS 60.

Aframaxes:

It was generally a quiet week in the Aframax market this

week and as a result the rates on all featured routes

declined w-o-w. For example, the rate on the cross-UKC

route dropped to WS 95. As a result of softening rates,

Aframax average earnings fell 32% w-o-w to $15,479/day.

10

20

30

40

50

60

70

80

90

Sep

'12

Nov

'12

Jan

'13

Mar

'13

May

'13

Jul

'13

Sep

'13

Nov

'13

Jan

'14

Mar

'14

May

'14

Aug

'14

VLCC

Suezmax

Aframax

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Product Tanker Spot Market

Product Tanker Highlights

Clean Product

WS 2014 Average earnings $ per day Clean Earnings

Single Voyage...

Aug 29 Sep 05 2014 2012 2013 2014 Aug 29 Sep 05 This Week ....

26 75,000t Gulf - Japan 117.5 115 91 13,683 14,525 25,515 24,140 SOFTER -5%

27 55,000t Gulf - Japan 117.5 113 106 12,951 12,594 16,077 14,425 WEAKER -10%

28 37,000t UKC - USAC * 90 115 112 10,469 6,735 2,787 7,925 FIRMER 184%

28 37/38kt UKC-USAC-USG-UKC 90/72.5 115/70 112/87 19,399 14,048 8,717 11,489 FIRMER 32%

28 37,000t UKC- W. Africa * 120 135 131 16,660 10,295 8,509 11,638 FIRMER 37%

28 38,000t USG - ECSA * 95 100 127 16,574 11,292 4,946 5,765 FIRMER 17%

28 30,000t Singapore-E Aus * 175 175 168 14,360 11,803 13,081 13,564 FIRM.... 4%

28 30,000t Singapore-Japan 120 112.5 113 14,517 9,542 11,349 10,016 WEAKER -12%

28 35,000t WC India - Japan * 120 120 109 10,760 8,452 11,078 11,587 FIRM.... 5%

28 35,000t Gulf - E.Africa 190 185 165 17,134 15,450 20,226 19,027 SOFTER -6%

28 40,000t Gulf-UKC * ^ 1.7 1.75 1.43 10,840 8,504 14,660 15,585 FIRM.... 6%

29 30,000t Med - Med # 120 120 136 11,354 9,009 5,569 5,873 FIRM.... 5%

29 30,000t Black Sea - Med # 120 120 140 9,981 8,949 5,469 5,702 FIRM.... 4%

Clean 'MR' Ave. Earnings * 13,277 9,514 9,177 11,011 FIRMER 20%

Clean 'Hdy' Ave. Earnings # 10,668 8,979 5,519 5,787 FIRM.... 5%

^ Lump Sum in $million. Earnings for a triangular voyage of UKC-USAC at WS 115, followed by USG-UKC at WS 70. See Sources & Methods.

Dirty Product

WS 2014 Average earnings $ per day Dirty Earnings

Single Voyage...

Aug 29 Sep 05 2014 2012 2013 2014 Aug 29 Sep 05 This Week ....

31 55,000t Med - US Gulf * 117.5 117.5 123 10,536 15,957 14,704 14,802 STEADY 1%

31 55,000t UKC - US Gulf * 112.5 117.5 128 11,648 18,309 14,014 15,493 FIRMER 11%

31 50,000t Caribs - US Gulf * 120.0 120.0 145 11,197 19,334 13,121 12,815 STEADY -2%

33 30,000t Black Sea - Med 162.5 150.0 176 10,668 12,912 15,445 12,705 WEAKER -18%

Dirty Ave. Earnings * 11,127 17,867 13,946 14,370 FIRM.... 3%

VLCC Spot

Monthly Fixture Record VLCC Spot Market

Market Activity...

Average No. Number Last This Week ...

2012 2013 Apr '14 Jun '14 Jul '14 Aug '14 4 Wks

Fixtures: Gulf-West 22 24 20 10 26 17 14 DOWN BY..... -18%

Gulf-East/Japan 93 98 102 87 74 83 73 DOWN BY..... -12%

Gulf-Red Sea 1 2 0 2 3 0 0 #DIV/0! #DIV/0!

Others 53 50 46 50 57 59 51 DOWN BY..... -14%

Total Number of Fixtures 169 173 168 149 160 159 138 DOWN BY..... -13%

Vessels due to arrive in Gulf ~ 86 82 94 98 90 94 95 UP BY.... 1%

VLCCs Spot in Gulf ~ No. 4 4 4 11 5 6 9 UP BY.... 50%

000 Dwt 1,097 1,056 1,202 3,326 1,537 1,888 2,774 UP BY.... 47%

~ As at the beginning of the month for historical data; for the next 4 weeks (vessels due) or this week (vessels spot) for current week's data.

Clarkson Research Services Page 3 05-Sep-14

0

46

148

113

9

2,755

9,912

10,592

11,671

May '14

20

82

11,527

9,657

10,589

10,592

12,087

13,014

12,422

9,292

12,056

10,156

17,897

9,576

Product Tanker Spot Earnings ($,000's/day)

14,172

12,890

9,062

14,098

13,027

Clean Products:

In the LR market the West-East naphtha arbitrage closed,

placing downward pressure on demand. As a result the

LR2 rate on the Gulf-Japan route softened to WS 115,

although the market appears to be firming going forward.

Meanwhile, in the MR market the rate on the fronthaul

UKC-USAC route firmed to WS 115 as a result of a short

supply of tonnage. Conversely, a large volume of

available tonnage in the USG depressed the rate on the

USG-UKC route, which fell to WS 70. In spite of this,

clean MR average earnings firmed 20% w-o-w to

$11,011/day.

Dirty Products:

There was a steady amount of activity in the Med and

UKC this week, with the rate on the UKC-US Gulf route

increasing to WS 117.5. With activity coming off towards

the end of the week and potential ballasters from Caribs

entering Europe it seems likely that tonnage will rebuild.

The Caribs market was relatively flat this week;

consequently the rate on the Caribs-US Gulf route

remained steady at WS 120.

5

10

15

20

25

30

35

40

45

Sep

'12

Nov

'12

Jan

'13

Mar

'13

May

'13

Jul

'13

Sep

'13

Nov

'13

Jan

'14

Mar

'14

May

'14

Aug

'14

MR Clean Tanker Earnings

Handy Clean Earnings

Dirty Panamax Earnings

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Bulkcarrier Spot Earnings ($,000's/Day) Bulkcarrier Highlights

Capesize Single

$ Per Ton Average Earnings $ Per Day Capesize Market

Voyage

Aug 29 Sep 05 2014 2012 2013 2014 Aug 29 Sep 05 This Week ...

16 165,000t ore Tubarao/Rotterdam* 10.75 9.70 9.54 -784 9,903 6,763 12,841 8,323 WEAKER!! -35%

16 165,000t ore Tubarao/El Dekheila 10.15 10.05 10.08 2,792 14,528 10,226 11,235 10,774 SOFTER -4%

16 165,000t ore Tub/Qingdao* " 24.00 23.65 21.36 18,397 24,314 25,292 32,890 31,942 STEADY -3%

16 165,000t coal Bolivar/Rotterdam* 10.25 9.90 10.13 4,761 13,696 9,277 10,469 9,143 WEAKER -13%

16 165,000t ore Dampier/Qingdao* " 9.00 8.40 8.33 5,776 13,279 9,145 12,603 10,246 WEAKER -19%

16 165,000t ore Saldanha/Qingdao " 16.75 16.25 15.19 9,118 15,759 15,852 21,185 19,645 SOFTER -7%

16 165,000t ore Dampier/Japan 18m* 8.65 8.15 8.04 7,305 17,044 13,069 16,761 14,633 WEAKER -13%

16 150,000t coal Hay Pt./Rotterdam 18.00 16.75 15.35 -6,663 475 -191 5,959 4,076 WEAKER!! -32%

16 150,000t coal Indonesia/Rotterdam 13.00 12.70 10.05 -9,667 -3,658 -3,605 4,750 4,813 STEADY 1%

16 150,000t coal Hay Pt./China 11.25 11.10 10.23 255 8,178 8,959 13,129 13,257 STEADY 1%

16 150,000t coal R.Bay/Rotterdam 11.75 11.10 9.00 -11,234 -5,769 -5,784 2,817 1,013 WEAKER!! -64%

17 150,000t coal R.Bay/EC India 12.00 12.75 11.42 10,400 15,659 13,079 15,299 17,661 FIRMER 15%

16 Ave. Earnings, 1999/00-built * 7,091 15,647 12,709 17,113 14,857 WEAKER -13%

Panamax Single

$ Per Ton Average Earnings $ Per Day Panamax Market

Voyage

Aug 29 Sep 05 2014 2012 2013 2014 Aug 29 Sep 05 This Week ...

18 70,000t coal Baltimore/ARA^ 11.00 11.29 10.66 5,309 8,106 3,739 5,077 5,794 FIRMER 14%

18 70,000t coal USGulf/ARA 14.00 14.40 14.48 7,036 8,145 4,830 4,512 5,197 FIRMER 15%

18 70,000t coal Bolivar/ARA 12.75 12.95 12.60 4,697 7,665 3,863 4,571 5,130 FIRMER 12%

18 70,000t coal Rob. Bank/N. China 12.80 14.00 15.36 5,771 7,342 9,205 4,678 7,308 FIRMER 56%

18 70,000t coal Dalrymp. B./N. China 11.00 12.00 12.83 7,338 9,731 9,641 5,501 8,233 FIRMER 50%

18 55,000t coal Roberts Bank/Rott 17.00 17.00 18.39 1,076 -163 -459 -1,838 -1,334 WEAKER!! -27%

18 70,000t coal Indonesia/Rotterdam 14.50 15.00 15.15 -689 -96 562 -253 995 WEAKER!! -494%

18 70,000t coal Dalrymple B./Rott. 17.60 17.40 18.88 -254 316 1,159 -191 140 WEAKER!! -173%

18 70,000t coal Richards B./Rott 12.05 12.40 12.49 -2,444 -1,627 167 -296 30 WEAKER!! -110%

18 72,000t coal Richards B./WC India 13.50 14.00 14.12 8,673 9,654 6,306 5,435 6,032 FIRMER 11%

18 Ave. Earnings, 1997/98-built~ 5,271 6,600 5,603 4,281 5,722 FIRMER 34%

Supramax Single

$ Per Ton Average Earnings $ Per Day Supramax Market

Voyage...

Aug 29 Sep 05 2014 2012 2013 2014 Aug 29 Sep 05 This Week ...

22 49,000t grain USGulf/Jap.(HSS) 46.50 47.50 46.29 18,701 18,828 19,053 19,751 20,578 FIRM....... 4%

22 50,000t coal Richards B./WC India 15.75 15.75 17.40 7,948 7,186 5,284 3,322 3,057 SOFTER -8%

22 Ave. Earnings, 1997/98-built 11,667 11,583 10,304 8,946 9,051 STEADY 1%

Clarkson Research Services Page 4

Large Bulk Carrier Market

"Voyage Earnings" are calculated from spot freight rates, excluding waiting time off-hire etc., for standard routes/ships, for which see the "Sources & Methods" document on our website,

"SIN 2010" (www.clarksons.net). Standard Ships are indicated by the figures on the left e.g. Modern Capesize = Standard Ship No. 16

05-Sep-14

* Indicates components of average earnings since start 2009.

~Avg Panamax earnings based on revised selection of routes from start 2014.

Selected voyage earnings featured on pages 4 & 5, including historical data, based on revised voyage cost, time and distance assumptions from 25-Jul-14.

5

10

15

20

25

30

35

40

45

50

Sep

'12

Nov

'12

Jan

'13

Mar

'13

May

'13

Jul

'13

Sep

'13

Nov

'13

Jan

'14

Mar

'14

May

'14

Aug

'14

Capesize Average Spot

Panamax Average Spot

Supramax Tripcharter

Capesize:

It was a slow start to the week in both basins. Spot

tonnage built up in the Atlantic earlier in the week,

although the tonnage situation did improve slightly as the

week went on. Elsewhere, the spot rate on the Western

Australia to China fell w-o-w to $8.40/tonne.

Panamax:

In the Atlantic, the week started with the US Gulf still

being the focal point of the market. There also was an

increase in activity on fronthaul routes. Elsewhere, there

was fresh enquiry in the Pacific, including in SE Asia and

NOPAC. Overall, average Panamax spot earnings

increased 34% w-o-w to $5,722/day.

Handy:

Rates on routes from the US Gulf continued to rise this

week for both Supramaxes and Handysizes. Meanwhile,

the Pacific market has shown a slight improvement this

week, particularly on routes from Indonesia to China and

India. Overall, average Supramax trip earnings increased

4% w-o-w to $8,600/day.

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Tripcharter Market, Freight Indices & Futures

Capesize Capesize Market

Tripcharter...

2012 2013 2014 Aug 08 Aug 15 Aug 22 Aug 29 Sep 05 This Week ....

Cont/Far East 23,389 29,692 30,708 23,000 32,000 35,500 35,500 34,000 SOFTER -4%

Transpacific R/V 7,423 14,168 13,033 9,000 16,500 16,750 17,250 16,250 SOFTER -6%

Far East/Cont -8,851 -635 -544 -4,500 1,000 2,750 3,500 3,250 SOFTER -7%

Transatlantic R/V 6,620 15,447 12,119 6,500 10,500 9,000 11,750 11,000 SOFTER -6%

Average Capesize Earnings 7,145 14,668 13,829 8,500 15,000 16,000 17,000 16,125 SOFTER -5%

Panamax Panamax Market

Tripcharter...

2012 2013 2014 Aug 08 Aug 15 Aug 22 Aug 29 Sep 05 This Week ....

Cont/Far East 15,995 17,625 15,554 12,250 14,000 14,000 15,350 15,450 STEADY 1%

Transpacific R/V 7,021 9,073 7,733 3,100 5,000 4,500 4,600 7,000 FIRMER 52%

Far East/Cont -674 349 1,119 100 0 100 100 150 FIRMER 50%

Transatlantic R/V 7,418 10,623 6,354 5,250 6,500 5,750 7,000 6,750 SOFTER -4%

Average Panamax Earnings 7,440 9,418 7,690 4,640 6,000 5,720 6,260 6,920 FIRMER 11%

Supramax Supramax Market

Tripcharter...

2012 2013 2014 Aug 08 Aug 15 Aug 22 Aug 29 Sep 05 This Week ....

Cont/Far East 15,875 15,538 15,188 10,750 12,500 12,500 12,750 13,000 STEADY 2%

Transpacific R/V 7,861 8,653 8,826 8,750 8,750 9,000 9,250 9,500 STEADY 3%

Far East/Cont 4,106 5,118 5,840 7,500 7,500 8,000 8,000 8,000 STEADY 0%

Transatlantic R/V 7,596 9,284 6,299 4,750 6,000 6,000 6,250 6,500 FIRM....... 4%

Indonesia - China~ 5,955 6,242 5,993 4,500 4,500 5,250 5,250 6,000 FIRMER 14%

Average Supramax Earnings* 8,859 9,648 9,038 7,250 7,850 8,150 8,300 8,600 FIRM....... 4%

* Does not include Indonesia-China. ~ Based on delivery North China, redelivery South China.

Handysize Handysize Market

Tripcharter...

2012 2013 2014 Aug 08 Aug 15 Aug 22 Aug 29 Sep 05 This Week ....

Cont/ECSA 5,214 6,211 5,669 3,250 3,500 4,000 4,750 5,000 FIRM....... 5%

Cont/USEC-USG 5,203 5,668 5,183 3,250 3,500 4,000 4,750 5,000 FIRM....... 5%

ECSA/Cont 12,120 11,563 10,700 8,000 8,000 8,500 8,500 8,750 STEADY 3%

USEC-USG/Cont 10,668 13,942 11,465 6,750 7,000 7,500 8,000 8,750 FIRMER 9%

SEAsia/Australia R/V 7,041 7,074 7,308 4,750 4,750 6,500 6,750 7,000 FIRM....... 4%

Transpacific R/V 6,866 7,004 7,544 5,500 5,500 6,750 7,000 7,500 FIRM....... 7%

Average Handysize Earnings 7,852 8,577 7,978 5,250 5,375 6,208 6,625 7,000 FIRM....... 6%

Note: Vessels based on Baltic standards.

Baltic Freight Indices Baltic Handysize Index Trends

Date BCI 2014 BSI BHSI BDI

26-Aug 2430 944 420 1070

27-Aug 2366 952 427 1063

28-Aug 2551 963 437 1119

29-Aug 2627 970 442 1147

01-Sep 2606 977 450 1151

02-Sep 2568 983 456 1149

03-Sep 2489 988 462 1142

04-Sep 2464 993 466 1147

Max Value 2627 993 466 1151

Min Value 2366 944 420 1063

Avg Value 2513 971 445 1124

FFA Indications*

$/day 04-Sep Sep-14 Q4 14 Cal 15

BCI 7 Bolivar-Rott. 10.15 12.88 11.75

BCI 4 R.Bay-Rott. 11.20 12.20 11.05

BPI 2A USG/F.East 17,375 19,375

BPI 3A T/P R/V 8,250 10,250

Cape TC Avg. 18,250 24,250 19,000

P'max TC Avg. 8,425 10,850 10,325

S'max TC Avg. 11,125 12,300 10,800

*FFA Indications basis closing mid-price

Clarkson Research Services Page 5 01-Sep-14

11.05

15,819

6,288

15,940

7,396

10,384

927

927

808

871

Index

9.71

811

842

871

888

903

919

Average Rate $ Per Day

Average Rate $ Per Day

Average Rate $ Per Day

Average Rate $ Per Day

BPI

808

0

125

250

375

500

625

750

875

1,000

1 3 6 8 11 13 16 18 21 23 26 28 31 33 36 38 40 43 45 48 50

Week No.

2012

2013

2014

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Gas & Chemical Markets

LPG Charter Rates, $'000/month

Markets.

2012 2013 Jul Aug 05 Sep Trends

LPG Voyage Rates, $/mt

44/46K mt Gulf/Jap* 55.29 58.49 137.25 107.60 99.00 SOFTER... -8%

LPG TCE, $/day

82,000m modern 30,396 36,446 128,682 93,602 81,207 WEAKER.. -13%

78,000m modern 29,280 35,100 122,855 91,070 84,824 SOFTER... -7%

LPG 12 mths T/C, $/day

82,000m modern 30,513 31,430 60,412 56,089 55,892 STEADY... 0%

78,000m modern 30,159 31,022 59,097 55,103 54,905 STEADY... 0%

59,000m modern 29,144 32,138 47,138 48,330 51,782 FIRM... 7%

35,000m 25,704 26,492 33,740 33,897 34,193 STEADY... 1%

22,500m modern 23,950 25,442 28,275 28,275 28,275 STEADY... 0%

20,500m Semi-Ref^ 28,104 30,162 34,110 34,686 35,343 STEADY... 2%

15,000m Semi-Ref 20,687 21,247 25,480 25,579 25,316 STEADY... -1%

8,250m Ethylene 17,744 17,295 16,932 16,932 16,932 STEADY... 0%

3,500m Pressure (East) 7,777 8,096 7,397 7,036 6,904 STEADY... -2%

LNG 12 mths T/C, $/day

160,000m modern 136,673 90,000 67,250 66,000 66,000 STEADY... 0%

*44K mt for 78K vessel/46K mt for 82K vessel. ^22,000 cbm before Jan-12.

Chemical Freight Rates, $/mt

Markets.

2012 2013 Jul Aug 05 Sep Trends

Voyage Rates ($/mt)

10,000 Gulf/WC India 30.46 31.40 34.50 35.40 37.00 FIRM... 5%

15,000 Gulf/Ulsan 46.83 49.23 52.50 52.40 54.00 FIRM... 3%

15,000 Gulf/Med 55.96 62.06 60.00 61.20 63.00 STEADY... 3%

15,000 Gulf/Rott. 67.13 69.40 66.00 67.20 69.00 STEADY... 3%

5,000 Rott/Houston 44.46 45.48 42.25 40.80 41.00 STEADY... 0%

10,000 Rott/Houston 38.62 41.11 36.00 36.00 36.00 STEADY... 0%

5,000 Rott/Ulsan 90.02 91.67 98.75 93.40 92.00 STEADY... -1%

5,000 Singapore/Rott 97.29 98.23 96.00 94.60 96.00 STEADY... 1%

1,000~ Sing./Houston 153.04 153.31 160.00 162.00 166.00 STEADY... 2%

10,000 Ulsan/Houston 50.46 60.58 58.50 58.60 60.00 STEADY... 2%

5,000 Houston/Rott 49.37 48.40 45.00 45.00 45.00 STEADY... 0%

5,000 Houston/Ulsan 70.00 73.85 58.00 53.80 52.00 SOFTER... -3%

12 mths TC, $/day

13,000 dwt IMO II* 8,000 8,583 9,250 9,250 9,250 STEADY... 0%

19,999 dwt S/S* 13,056 13,438 14,000 14,250 14,250 STEADY... 0%

Easychems except for: ~ Stainless Steel. *2012 average basis April-December data.

Clarkson Research Services Page 6 05-Sep-14

Gas Carrier

Average 2014 Gas Market

Chemicals

Average 2014 Chem Market

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

l

-

1

4

A

u

g

-

1

4

78,000m3 TCE,

Gulf - Japan

78,000m3,

1 Yr t/c

40

50

60

70

80

90

100

110

120

130

140

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

l

-

1

4

A

u

g

-

1

4

Rott/Far E.

Houston/Far E.

basis 5,000mt

Easychems

The spot market was very active

and we saw once again just how quickly

the market can turn around and an

apparent length in available tonnage

turn into a more balanced situation. As

we are seeing more regularly, ships

appearing open for Middle East loading

can quickly be soaked up by hidden

requirements as well as being drawn

into alternative load areas at short

notice.

This is what we witnessed in the

last few days with vessels not only being

picked up for AG-East voyages but also

for loading in Houston, Balboa (STS)

and Algeria. Owners were able to exert

some upward pressure on rates. There

were some exceptions, with Indian

charterers being able to secure freight

and demurrage levels arguably giving

the charterers advantageous terms over

the Baltic. As things stand, September

looks like a secure platform for owners

to keep pushing rates up and we are

already seeing requirements worked for

first half October loading out of the AG.

Term negotiations are ongoing on

a number of fronts, while a small

number of timecharters are rumoured

already concluded with periods varying

from a couple of years to long-term.

With autumn almost upon us, a

number of spot markets are beginning to

experience seasonality and the uptick in

activity which usually comes towards the

end of the year. However, the increased

volume of enquiries has so far not trans-

lated into improved spot freight rates,

with all benchmark routes remaining flat

week-on-week.

The Americas chemical and edible

oils markets are gaining strength, with

cargoes seemingly getting booked and a

number of enquiries never touching the

open market. The current assessment of

benchmark freight rates for the transpa-

cific route, at $52/mt and $49/mt for

5,000 and 10,000mt parcels of easy

chemicals, is around 30% lower com-

pared to a year ago. Furthermore, these

levels represent around a 44% fall since

the start of 2014, demonstrating the vol-

atility which can exist on this trade lane.

In the Middle East it is a similar

story, with enquiries plentiful but rates

unchanged and little in the way of tangi-

ble fixtures. With a new refinery set to

come online in the coming months, this

may help to absorb the current available

capacity. The arterial ex-Europe and

Asia trade lanes seem to be in a drifting

mode, with little evidence of any uptick

in activity and as a result, a stable rate

environment.

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Liner & Offshore Markets

Liner Market Rates ($,000's/day) Liner Market News

Container / MPP /

Average 2014 Liner Markets ....

Short Sea Markets

2010 2011 2012 2013 Jun Jul Aug Sep Trends*

Container Vessels ($/Day)

Feedermax, 725 teu grd. 4,535 5,479 4,383 4,842 5,000 4,950 4,950 4,950 STEADY... -1%

Handy, 1,000 teu grd. 6,133 7,729 5,358 6,321 6,350 6,250 6,300 6,300 STEADY... -2%

Handy, 1,700 teu grd. 6,800 10,142 6,292 7,096 7,500 7,350 7,250 7,250 STEADY... -2%

Sub-P'max, 2,000 teu g'less 7,467 10,688 6,408 6,483 7,000 7,100 7,200 7,200 STEADY... 1%

Sub-P'max, 2,750 teu g'less 9,942 13,388 6,742 6,829 7,250 7,450 7,600 7,600 FIRM....... 5%

Panamax, 3,500 teu g'less 13,250 14,871 7,179 7,021 7,800 7,850 7,850 7,850 STEADY... 1%

MPP Tonnage ($/Day)

17,000 dwt, grd. 1 yr. t/c (liner) 9,604 9,729 8,988 8,358 7,500 7,500 7,500 7,500 STEADY... 0%

9,000 dwt, 1 yr. t/c (liner) 6,425 6,425 6,042 5,875 6,000 6,000 6,000 6,000 STEADY... 0%

European Short Sea 3,000dwt ($/t)

ECUK/ARAG - N.Spain 24.17 22.31 22.73 22.85 24.36 23.44 22.70 22.50 STEADY... -1%

French Bay - ECUK 14.93 15.72 16.73 17.96 16.75 16.94 17.05 17.25 STEADY... 1%

Lower Baltic - ARAG 19.95 20.42 20.42 20.98 20.19 19.19 19.15 19.00 STEADY... -1%

UK/ARAG - W.Med 33.50 30.71 33.22 33.22 36.13 35.00 33.25 33.00 STEADY... -1%

W.Med - UK/ARAG 25.11 24.91 26.11 27.56 25.56 24.50 24.70 24.50 STEADY... -1%

*3-mnth trend for Container/MPP; current month shows latest end month data. Change since previous month for Short Sea; see www.hcshipping.co.uk for market report.

Offshore Vessel

Average 2014 Offshore Market

Market

2010 2011 2012 2013 Jun Jul Aug 05 Sep This Month

AHTS, Large, /Day 13,509 22,152 16,303 24,142 15,635 15,472 51,444 82,160 FIRMER... 60%

AHTS, Very Large, /Day 18,717 35,114 24,252 39,085 18,966 24,623 66,493 114,450 FIRMER... 72%

PSV, Medium, /Day 10,871 11,518 9,763 13,589 9,748 10,271 10,515 13,250 FIRMER... 26%

PSV, Large, /Day 13,804 13,574 12,020 16,101 10,358 11,234 14,351 19,216 FIRMER... 34%

Basis North Sea spot market. AHTS, Large = 13-18,000 Bhp, Very Large = 18,000+ Bhp. PSV, Medium = 600-800m2, Large = >800m

2

. New size ranges adopted Aug'10.

Offshore Fleet

No. Vessels, end

AHTS Spot Rates

& Orderbook.

2011 2012 2013 Aug-14

Fleet:

Anchor Handling Tug/Supply 2,696 2,787 2,880 2,933

PSV/Supply 1,951 2,038 2,205 2,329

Crew/Workboat 1,660 1,724 1,797 1,842

Other Types 3,732 3,828 3,903 3,979

All Offshore Vessels 10,039 10,377 10,785 11,083

Orderbook:

Anchor Handling Tug/Supply 290 247 219 186

PSV/Supply 379 473 478 425

Crew/Workboat 84 112 86 45

Other Types 307 341 367 358

All Offshore Vessels 1,060 1,173 1,150 1,014

Offshore fleet includes 'ship-shaped' units only; for more detailed coverage of the full range of offshore sectors see Offshore Intelligence Monthly.

Clarkson Research Services Page 7 05-Sep-14

5

10

15

20

25

S

e

p

-

1

0

D

e

c

-

1

0

M

a

r

-

1

1

J

u

n

-

1

1

S

e

p

-

1

1

D

e

c

-

1

1

M

a

r

-

1

2

J

u

n

-

1

2

S

e

p

-

1

2

D

e

c

-

1

2

M

a

r

-

1

3

J

u

n

-

1

3

S

e

p

-

1

3

D

e

c

-

1

3

M

a

r

-

1

4

J

u

n

-

1

4

S

e

p

-

1

4

1,700 teu grd FCC

2,750 teu gls FCC

3,500 teu gls FCC

17,000 dwt MPP

0

30

60

90

120

150

S

e

p

-

1

0

D

e

c

-

1

0

M

a

r

-

1

1

J

u

n

-

1

1

S

e

p

-

1

1

D

e

c

-

1

1

M

a

r

-

1

2

J

u

n

-

1

2

S

e

p

-

1

2

D

e

c

-

1

2

M

a

r

-

1

3

J

u

n

-

1

3

S

e

p

-

1

3

D

e

c

-

1

3

M

a

r

-

1

4

J

u

n

-

1

4

18,000+ BHP

,000/day

3-week moving average

Box volumes on the Asia-Europe trade route

increased by 7.3% y-o-y in July to 1.39m TEU - according

to data provided by Container Trade Statistics. This

follows a peak leg volume increase in May of 11.7% y-o-y

and a 10.2% y-o-y rise in June. Whilst the peak leg trade

volumes have strengthened in 2014 the non-peak leg

trade volumes from Europe to Asia continued to fall y-o-y

in July by 2.8% to 0.58m TEU. Meanwhile, on the

Transpacific trade route, North American imports from

Asia in July showed a rise of 5.4% y-o-y to 1.39m TEU.

In their 2Q financial report CSAV posted a $58.5m net

loss for 2Q 2014, 11.2% better than their 1Q loss of

$65.9m. The company attributed this to depressed freight

rates, reporting them to be down 9.9% on Q2 2013, but

announced that it has achieved progress in unit operating

costs. CSAV is preparing for its merger with Hapag-Lloyd

later this year.

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Secondhand Prices

Oil Tanker

End Year, $m Three Month Asset Play in Focus

Prices

2011 2012 2013 Sep Trend

310,000 dwt d/h Resale 90.0 82.0 83.0 104.0 STEADY... 0%

310,000 dwt d/h * 5 yrs 58.0 57.0 60.0 74.0 STEADY... 0%

300,000 dwt d/h 10 yrs 36.0 37.0 41.0 48.0 STEADY... -2%

300,000 dwt d/h' 15 yrs 25.0 27.0 26.0 28.0 STEADY... -1%

160,000 dwt d/h Resale 62.0 55.0 57.0 70.0 STEADY... 2%

160,000 dwt d/h # 5 yrs 47.0 40.0 42.0 50.0 STEADY... 0%

150,000 dwt d/h 10 yrs 32.0 26.0 27.0 34.0 STEADY... 0%

105,000 dwt d/h Resale 50.0 40.0 43.0 55.0 FIRM.... 4%

105,000 dwt d/h 5 yrs 35.0 27.5 32.0 41.0 FIRM.... 4%

105,000 dwt d/h ^ 10 yrs 20.0 17.0 22.0 26.0 FIRM.... 7%

73,000 dwt d/h Resale 41.0 35.0 41.0 45.0 STEADY... -1%

73,000 dwt d/h ~ 5 yrs 31.0 25.0 31.0 32.5 STEADY... -3%

70,000 dwt d/h 10 yrs 20.5 16.5 21.0 22.0 STEADY... -1%

51,000 dwt d/h Resale 36.0 35.0 38.0 37.0 SOFTER... -4%

47,000 dwt d/h 5 yrs 26.0 25.0 29.0 25.5 SOFTER... -7%

45,000 dwt d/h 10 yrs 16.0 16.5 19.0 18.0 STEADY... -2%

45,000 dwt d/h 15 yrs 9.0 10.0 11.0 11.0 STEADY... 0%

37,000 dwt d/h 5 yrs 22.0 22.0 25.0 23.0 WEAKER.. -9%

35,000 dwt d/h 10 yrs 12.0 13.0 15.0 15.0 STEADY... -2%

19,999 dwt Chem S/S 5 yrs 21.5 24.5 28.0 STEADY... -2%

5-y-o Tanker Index 122 112 129 128 SOFTER... -5%

12 month Change -10% -8% 15% 8%

Pre Feb-10: *300k dwt #150k dwt ^95-97k dwt s/h ~70k dwt 65k dwt. Pre Jan-11: '265k.

Bulkcarrier

End Year, $m Three Month

Prices...

2011 2012 2013 Sep Trend

180,000 dwt Resale 48.0 40.0 54.0 60.0 SOFTER... -4%

180,000 dwt 5 yrs 36.0 32.5 44.0 48.0 SOFTER... -5%

170,000 dwt 10 yrs 26.5 21.0 31.0 34.0 SOFTER... -6%

170,000 dwt * 15 yrs 16.0 12.5 18.0 20.0 WEAKER.. -12%

82,000 dwt Resale 28.5 33.0 32.5 SOFTER... -7%

76,000 dwt 5 yrs 26.5 18.0 25.5 23.5 WEAKER.. -8%

75,000 dwt " 10 yrs 20.0 13.0 18.0 17.0 WEAKER.. -15%

73,000 dwt ^ 15 yrs 13.0 8.0 12.0 11.5 WEAKER.. -13%

61,000 dwt ** Resale 32.0 26.5 30.0 31.5 SOFTER... -4%

56,000 dwt 5 yrs 24.5 19.5 24.5 24.0 SOFTER... -7%

52,000 dwt # 10 yrs 17.0 14.5 17.5 17.0 WEAKER.. -14%

45-48,000 dwt ^^ 15 yrs 12.0 9.0 11.0 11.5 WEAKER.. -11%

42-45,000 dwt 20 yrs 9.0 7.0 6.5 7.5 WEAKER.. -8%

33,000 dwt ~ Resale 24.5 21.8 23.5 25.0 SOFTER... -3%

32,000 dwt ~ 5 yrs 21.0 15.5 19.0 19.0 SOFTER... -5%

32,000 dwt ~ 10 yrs 16.0 12.0 14.0 14.0 SOFTER... -4%

28,000 dwt ~ 15 yrs 11.0 7.5 9.5 9.5 STEADY... -3%

5-y-o Bulker Index 139 105 135 134 SOFTER... -6%

12 month Change -20% -25% 28% 8%

Pre Jan-14 (dwt): **58k. Pre Jan-12: 170k *150k "72k ^69k **57k #45-48k ^^42-45k ~28-30k.

Container &

End Year, $m Three Month

Ro-Ro Prices

2011 2012 2013 Sep Trend

4,500 teu 5 yrs 38.0 25.5 20.0 18.0 STEADY... 0%

2,750 teu 5 yrs 23.0 17.0 16.3 15.3 SOFTER... -4%

1,700 teu 10 yrs 12.3 8.0 9.3 8.5 SOFTER... -7%

10-y-o Container Index 65.8 36.6 37.1 33.2 WEAKER.. -10%

Ro-Ro 4,000 lm* 10 yrs 20.0 18.0 18.0 STEADY... 0%

Ro-Ro 2,500 lm* 10 yrs 22.0 21.0 17.0 17.0 STEADY... 0%

*Ro-Ro prices in euros, historical data converted using historical exchange rates

Clarkson

End Year, Index Three Month

Index

2011 2012 2013 Sep Trend

ALL VESSELS 119 96 111 110 SOFTER... -6%

Resale prices basis prompt delivery. 3-month trend: avg last 3 months vs avg previous 3 months. See SIN 2010 for full details of standard ship size history.

Clarkson Research Services Page 8 05-Sep-14

50

100

150

200

250

300

350

400

450

500

550

A

u

g

'

0

5

A

u

g

'

0

6

A

u

g

'

0

7

A

u

g

'

0

8

A

u

g

'

0

9

A

u

g

'

1

0

A

u

g

'

1

1

A

u

g

'

1

2

A

u

g

'

1

3

A

u

g

'

1

4

Long Term Price Trends

Bulkers

Tankers

Index, Start 2000 = 100

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

A

u

g

'

1

1

N

o

v

'

1

1

F

e

b

'

1

2

M

a

y

'

1

2

A

u

g

'

1

2

N

o

v

'

1

2

F

e

b

'

1

3

M

a

y

'

1

3

A

u

g

'

1

3

N

o

v

'

1

3

F

e

b

'

1

4

M

a

y

'

1

4

A

u

g

'

1

4

Short Term Tanker Trends

% Year on Year

5-year-old Tanker Price Index

Percentage Change

Year-On-Year

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

A

u

g

'

1

1

N

o

v

'

1

1

F

e

b

'

1

2

M

a

y

'

1

2

A

u

g

'

1

2

N

o

v

'

1

2

F

e

b

'

1

3

M

a

y

'

1

3

A

u

g

'

1

3

N

o

v

'

1

3

F

e

b

'

1

4

M

a

y

'

1

4

A

u

g

'

1

4

Short Term Bulk Trends

% Year on Year

5-year-old Bulker Price Index

Percentage Change

Year-On-Year

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Tanker

Y-t-d Aug

Sales* ....

2013 2014 2014

Type: VLCC 34 50 2

Suezmax 18 27 3

Aframax 42 39 3

Handy/Pmax 215 152 4

Total No. Sales 309 268 12

Total DWT (,000) 25,160 29,132 1,484

Total Value ($ m) 5,668 7,300 225

Bulker

Y-t-d Aug

Sales* ....

2013 2014 2014

Type: Capesize 60 35 1

Panamax 130 89 8

Handymax 134 101 7

Handysize 171 76 5

Total No. Sales 495 301 21

Total DWT (,000) 33,002 20,549 1,328

Total Value ($ m) 6,678 5,090 349

Other

Y-t-d Aug

Sales ....

2013 2014 2014

Total No. Sales 629 361 40

Total dwt (,000s) 7,827 9,744 1,355

Total Value ($ m) 8,112 5,272 1,020

Total

Y-t-d Aug

Sales .....

2013 2014 2014

Buyers: Greece 263 181 14

Norway 52 32 5

Germany 25 20 2

China P.R. 87 47 3

UK 42 31 3

South Korea 34 37 1

Total No. Sales 1,433 931 74

Total Dwt (,000) 65,989 59,424 4,167

Total Value ($m.) 20,459 17,661 1,594

Average $/Dwt 310 297 383

* Includes vessels over 10,000 dwt only. Sales of bulk vessels under 10,000 dwt and of non-bulk vessels are included in "Other Sales".

Clarkson Research Services i 05-Sep-14

Sale & Purchase Market

ALL DATA AND INFORMATION IN THIS REPORT ARE AS

REPORTED UP TO NOON ON THE DATE OF PUBLICATION

0

20

40

60

80

100

120

140

160

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

S

e

p

-

0

9

J

a

n

-

1

0

M

a

y

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

M

a

y

-

1

1

S

e

p

-

1

1

J

a

n

-

1

2

M

a

y

-

1

2

S

e

p

-

1

2

J

a

n

-

1

3

M

a

y

-

1

3

S

e

p

-

1

3

J

a

n

-

1

4

M

a

y

-

1

4

No. $m.

Sales Volumes & Values

Volume

Value

Tankers:

In the tanker market this week we have seen the sale of two

Chinese built coated Aframaxes, namely the BEECH 3 (109,354

dwt, built 2000, Dalian New Yard) and BEECH 4 (109,693 dwt,

built 1999, Dalian New Yard), sold by clients of Woodstreet Inc. for

$23.5m en-bloc to clients of Sinokor. Pricing appears to be in line

with that of the coated DL IRIS (89,999 dwt, built 1998, Dalian

New Yard) which was committed but failed at a price in the region of

$10.3m to Far Eastern interests last month.

The Aframax sector has seen strong levels of activity of late, re-

affirming the high level of interest among buyers across the larger

crude segments currently. This is set to continue with offers invited

this week on the German controlled SC SARA (105,344 dwt, built

2001, Sumitomo (Yokosuka)). We understand that the vessel has

seen firm levels of interest, with five buyers reportedly offering in the

region of $16m. Given this, and the general level of optimism

around the tanker S&P market at the moment, we expect to report

more sales in the coming weeks.

Dry Cargo:

This week we have seen a steady amount of dry cargo S&P activity,

focused mainly in the Handysize sector. The Japanese controlled

four hold/hatch unit FORTE (23,573 dwt, built 2001, Shin

Kurushima, C4x30T) has been sold to Greek buyers for $7.8m. The

Chinese built open-hatch BIRCH 3 (20,427 dwt, built 1999, Wuhu

Shipyard, C3x30T) has been sold for $5.3m to European buyers,

THEOMITOR (28,510 dwt, built 1994, Kanda Zosensho, C4x30T)

has been sold for $6.8m and FREE IMPALA (24,111 dwt, built

1997, Shanghai Shipyard, C4x30T) has been sold for $3.5m to

Middle Eastern interests.

Other activity includes the sale of the Panamax JINDAL VARAD

(75,460 dwt, built 1994, Burmeister & Wain) for $5.8m and the

Taiwanese controlled Handymax CHC NO.3 (46,635 dwt, built

1995, Mitsui S.B., C4x30T) which has been purchased for $7.2m by

South Korean buyers.

Baltic Sale & Purchase Assessments (weekly)

(Based on max. 5-year old vessels, as published by the Baltic

Exchange)

As of the 1

st

September 2014.

VLCC (305,000 DWT): $73.421m

Aframax (105,000 DWT): $37.731m

MR Product tanker (51,000 DWT): $26.016m

Capesize (172,000 DWT): $47.042m

Panamax (74,000 DWT): $23.452m

Super Handy (56,000 DWT): $23.678m

Note: H. Clarkson brokers did not contribute to the above Baltic Sale &

Purchase Assessment rates.

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

Recent Ship Sales by Vessel Type

Vessel Type Vessel name Dwt/Unit Blt. Yard Date Price $m. Buyers

Tanker D/Hull Beech 3* 109,354 2000 Dalian New Yard 03-Sep 23.5 Clients of Sinokor

Tanker D/Hull Beech 4* 109,693 1999 Dalian New Yard 03-Sep # Clients of Sinokor

Tanker D/Hull Cygnus Voyager* 156,835 1993 I.H.I. 28-Aug undisclosed Clients of Chevron

Tanker D/Hull Altair Voyager* 135,829 1993 Ishibras 28-Aug # Clients of Chevron

Tanker D/Hull Sirius Voyager* 156,380 1994 Ishibras 28-Aug # Clients of Chevron

Tanker D/Hull DS Victory 299,089 2001 Daewoo 27-Aug region 33.6 Clients of Moundreas

Tanker D/Hull DT Providence* 104,255 2008 Shanghai Waigaoqiao 22-Aug region 34 Undisclosed interests

Tanker D/Hull Enrica Lexie* 104,255 2008 Shanghai Waigaoqiao 22-Aug region 34 Undisclosed interests

Tanker D/Hull Ambelos 105,315 2006 Sumitomo (Yokosuka) 15-Aug 33 Clients of PNSC

TankChem IMO II/III Clipper Legacy* 10,051 2005 Yardimci Deniz 05-Sep low 7 Nigerian interests

TankChem IMO II/III Clipper Lancer* 9,971 2006 Yardimci Deniz 05-Sep low 7 Nigerian interests

TankChem IMO II Alfatem 6,753 2000 Dearsan Shipyd. 29-Aug undisclosed Undisclosed interests

TankChem IMO II N/B RESALE HULL S5126 49,990 2014 SPP Shipbuilding 21-Aug 37.1 Clients of Scorpio Tankers

TankChem IMO III Green Stars 36,039 2001 Daedong S.B. 19-Aug region 12.5 Indonesian interests

TankChem IMO II/III Chem Sea 11,642 1999 Fukuoka S.B. 07-Aug region 7.7 Undisclosed interests

Ro-Ro/Pass 1500 pass. Lefka Ori* 6,911 1992 Mitsubishi H.I. 07-Aug T/C back Euro21 Undisclosed interests

Ro-Ro/Pass 1500 pass. Sophocles V* 6,987 1990 Mitsubishi H.I. 07-Aug T/C back # Undisclosed interests

Passenger 34 pass. To Callisto 66 1963 D. W. Kremer 29-Aug undisclosed Clients of Irrawaddy

Offshore MSV Siem Daya 1* 5,000 2013 VARD Brattvaag 22-Aug 282 Clients of Daya Materials

Offshore MSV Siem Daya 2* 5,000 2013 VARD Brattvaag 22-Aug # Clients of Daya Materials

Offshore AHTS N/B RESALE HULL 3172 1,475 2014 Yuexin S.B. 12-Aug region 11.5 Clients of SC Group

Gas C'rier 6,571 cu.m Gas Puffer 7,046 1995 Asakawa S.B. 02-Sep 6.9 Clients of Laugfs Gas

Gas C'rier LPG Norgas Petaluma 9,260 2003 Zhonghua S.Y. 21-Aug 24 Clients of SGPC

Gas C'rier LNG Methane Jane Elizabeth* 78,984 2006 Samsung H.I. 14-Aug 328 Clients of GasLog Ptnrs

Gas C'rier LNG Methane Rita Andrea* 79,046 2006 Samsung H.I. 14-Aug # Clients of GasLog Ptnrs

Dry MPP 618 teu. GW Beychevelle 7,650 2009 Shandong Huanghai 04-Sep 4.5 Chinese interests

Dry MPP 224 teu. Swegard 4,956 2001 Damen Hoogezand 03-Sep 2.4 Undisclosed interests

Dry MPP 256 teu. Hudsonborg* 6,041 2006 Niestern Sander 12-Aug low euro5 Norwegian interests

Dry MPP 256 teu. Humberborg* 6,041 2006 Niestern Sander 12-Aug low euro5 Norwegian interests

Dry Genl 98 teu Sava Lake 3,050 1990 Brod. Sava 13-Aug Euro0.6 Greek interests

Container 1730 teu. N/B RESALE HULL 661* 23,245 2014 Zhejiang Ouhua 03-Sep 26 Clients of Seacon

Container 1730 teu. X-Press Nuptse* 23,245 2014 Zhejiang Ouhua 03-Sep 26 Clients of Seacon

Container 1452 teu. Novia* 20,176 1995 Kv. Warnowwerft 03-Sep 4.2 Clients of Continental Investment

Container 1452 teu. Olivia* 20,176 1995 Kv. Warnowwerft 03-Sep 4.2 Clients of Continental Investment

Container 2169 teu. Westwood Cascade* 29,700 1999 Flender Werft 29-Aug 7 Clients of Thor Dahl

Container 2169 teu. Santa Felicita* 30,135 1999 Flender Werft 29-Aug 7 Clients of Thor Dahl

Container 700 teu. Johanna 7,131 1999 J. J. Sietas 19-Aug 1.65 Clients of Foroohari Schiff.

Container 5500 teu. YM Great* 67,270 2004 Koyo Dock K.K. 07-Aug 22.175 Clients of Diana Containerships

Container 5500 teu. YM March* 67,270 2004 Koyo Dock K.K. 07-Aug 22.175 Clients of Diana Containerships

Car C'rier 4864 cars Nocc Coral 12,706 1987 Hyundai H.I. 02-Sep undisclosed Undisclosed interests

Car C'rier 254 cars Austal Hull 270 700 2010 Austal Pty. Ltd. 22-Aug 61.5 Clients of Condor Ferries

Bulk 4x30t cr. Forte 23,573 2001 Shin Kurushima 03-Sep 7.8 Greek interests

Bulk 3x30t cr. Birch 3 20,427 1999 Wuhu Shipyard 03-Sep 5.3 European interests

Bulk 4x30t cr. CHC No. 3 46,635 1995 Mitsui SB 02-Sep 7.2 South Korean interests

Bulk 4x30t cr. Theomitor 28,510 1994 Kanda Zosensho 02-Sep 6.8 Undisclosed interests

Bulk 4x30t cr. Free Impala 24,111 1997 Shanghai S.Y. 02-Sep 3.5 Middle East interests

Bulk Gearless Jindal Varad 75,460 1994 Burmeister & Wain 02-Sep 5.8 Indian interests

Bulk Gearless Zhushui 5 79,501 2012 Jinhai Heavy Ind. 29-Aug 20.9 Greek interests

Bulk 4x36t cr. Bao Bright 56,582 2011 New Hantong Shipyard 29-Aug region 19.6 Undisclosed interests

Bulk 3x30t cr. Celal Amca 12,274 2001 Shin Kurushima 29-Aug 4.9 Turkish interests

Bulk Gearless N/B RESALE HULL J0062 176,000 2014 Jinhai Heavy Ind. 28-Aug 43.5 European interests

Bulk Gearless Golden Kiji 76,596 2007 Imabari S.B. 28-Aug 19.5 Clients of Apollonia Lines

Bulk 4x30.5t cr. N/B RESALE HULL CHB001* 39,000 2014 Zhoushan Changhong 27-Aug 22.2 Hong Kong interests

Bulk 4x30.5t cr. N/B RESALE HULL CHB002* 39,000 2014 Zhoushan Changhong 27-Aug 22.2 Hong Kong interests

Bulk 4x30t cr. Fortune Frontier 29,738 2002 Shikoku Dock. 27-Aug 10.5 Undisclosed interests

Bulk 4x25t cr. Island Ranger 42,427 1994 Oshima S.B. Co. 27-Aug 8 Clients of Seorae

Bulk Gearless Red Iris 75,834 2003 Sanoyas 22-Aug 15.75 Clients of Omicron Ship Mngt.

Bulk 4x30t cr. Alianca Orient 52,454 2006 Tsuneishi Zosen 22-Aug higher 17 Undisclosed interests

Bulk Gearless N/B RESALE HULL YC015 79,659 2014 Yichun Wujiazui S.B. 15-Aug 22.5 Clients of New Shipping

Bulk 4x30t cr. Lingue 26,973 1990 Minami Nippon 12-Aug 4 Undisclosed interests

Bulk 4x30t cr. N/B RESALE HULL 865 61,000 2016 Imabari S.B. 12-Aug 31.4 Clients of Scorpio

Bulk Gearless Lowlands Nello 76,830 2004 Sasebo H.I. 08-Aug about 17.2 Norwegian interests

Bulk Gearless Michele D'Amato 76,440 2005 Tsuneishi Zosen 08-Aug around 17.7 Greek interests

* En bloc Sales. #En Bloc price shown under first ship of bloc.

Clarkson Research Services ii 05-Sep-14

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8

7

L

i

c

e

n

s

e

d

t

o

C

l

a

r

k

s

o

n

s

D

u

b

a

i

.

D

i

s

t

r

i

b

u

t

i

o

n

i

s

r

e

s

t

r

i

c

t

e

d

;

p

l

e

a

s

e

r

e

m

e

m

b

e

r

t

o

a

c

k

n

o

w

l

e

d

g

e

t

h

e

s

o

u

r

c

e

.

h

t

t

p

:

/

/

w

w

w

.

c

l

a

r

k

s

o

n

s

.

n

e

t

0

6

/

0

9

/

2

0

1

4

0

4

:

0

6

:

0

4

2

7

7

8