Professional Documents

Culture Documents

Product Costing Analysis Report

Uploaded by

Deepti TripathiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Costing Analysis Report

Uploaded by

Deepti TripathiCopyright:

Available Formats

PRODUCT COSTING ANALYSIS REPORT

Introduction:

A companys research and development wing equipments are

used to create innovations, administration spends on special task

forces to complete a series of unusual assaults on the city, and

company uses machines to manufacture two different products.

So the question arises that how the cost are being allocated to

every department or every product so that it becomes easy for

decision making in future. University presidents, city managers

and company board of directors each has to face similar cost

allocation problems. So this report is on the cost allocation part

of managerial accounting.

Goal of cost accounting :

It measures the cost of designing, developing, producing,

selling, distributing, and servicing particular products or

services. Cost accounting is the heart of the accounting systems.

Its three main purposes are

1. To obtain desired motivations : Cost accounting are usually

made to influence management behaviours and top level

decision makings to promote goal congruence and

managerial efforts.

2. To compute income and asset valuations : Costs are

allocated to products to measure various aspects such as

overheads associated, inventory costs, cost of goods sold,

etc. However these costs are exploited by managers to

evaluate performance, to foster employees and to plan for

the future.

3. To justify costs or obtain reimbursement: Occasionally cost

directly influence price. So the cost allocation generates an

alternative for setting the price in usual market places.

So the processes involved in cost allocation are

1. Identifying Cost Objects : It is the cost of the objects which

we want to know the cost of. Eg : services or a product.

Cost objects co notates the batch production run in an

assembly line process or a one day production in a

continuous manufacturing processes.

2. Identify Direct Costs : Direct costs are directly attached to

the unit under consideration and can be easily traced to

Identify Cost Objects

Identify Direct Costs

Identify Overhead Costs

Select Cost Allocation Base

Develop the overhead rates

specific products. These are also called Prime Costs. It can

be like direct labor or direct materials used up to obtain the

object.

3. Overhead Costs : These are the costs that are related to the

cost objects but cannot be obtained easily in an

economically feasible way. These includes costs like

electricity cost, factory office salaries, building and

machine maintenance, depreciations or any indirect costs.

4. Select Cost Allocation Base : It is the link that is used to

associate overhead costs to the cost objects. It is very

important to identify allocation base as a varied range of

products are manufactured in an industry. Whatever cost

allocation base is chosen it must be a common denominator

across all cost objects.

5. Develop the Overhead Rates :

Overhead rates = (Overhead costs in the cost pool/ Total

quantity of the allocation base)

It represents amount of overhead costs allocated per unit of

allocation base.

So now we will consider a case of an apparel

manufacturing company which makes jeans and chinos.

Here we will understand that how important the above

processes are in the manufacturing sector and how it effects

the decision making of the managements

Assumptions made are as follows:

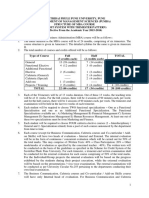

Cost allocations of jeans by XYZ in 2013 :

Cost allocation section wise in jeans :

Items Costs (all in $)

1. Raw materials for denim

fabrics(includes raw material+

movement of denim material

from receiving department to

the cutting room)

500000*5=2500000

2. Work in process (to record

sewing operator wages)

200000*14=

2800000

3. Factory overheads(including

utilities, depreciations, repairs

and maintenance, and indirect

wages and salaries)

1320000

Total Cost 6620000

Inputs Cost per jeans(all in $)

Fabric 1 yard per jeans* $5 per yard=

$5.00

Direct Labor .4 hours per jeans *$14 per

hour=5.6

Overhead .4 hours per jean* $6.6 per hour=

2.64

Total cost per

jeans

13.24

Cost allocation of Chinos by XYZ in 2013 :

Items Costs(all in

$)

1. Raw materials for cotton twill

fabrics(includes raw material+

movement of cotton twin material

from receiving department to the

cutting room)

480000*4.5

= 2160000

2. Work in process (to record sewing

operator wages

300000*14 =

4200000

3. Factory overheads(including

utilities, depreciations, repairs and

maintenance, and indirect wages and

salaries)

1980000

Total Cost 8340000

Cost allocation section wise for Chinos:

Input Costs per chinos (all in $)

Fabrics 1.2 per chinos * $4.5 per yard =

5.4

Direct Labor .75 hours per chinos * $14 per

hour = 10.50

Overhead .75 hours per chinos * $6.6 per

hour = 4.95

Total cost per

chinos

20.85

Conclusion :

Here the allocation base is direct labor hours. If the

allocation base had been something else such as machine

hours then hours per unit would only appear in the

calculation of the direct labor cost.

More overhead is allocated to each pair of chinos than to

each pair of jeans.

Altering the allocation base cannot change the total amount

of overhead incurred but will usually shift cost from some

products to the others.

Choice of allocation base should be done on industry basis.

If significant components of overhead increases as direct

labor hours increases as in this case then direct labor hour

should be the allocation base preferred over units of

products.

References:

1. http://classes.bus.oregonstate.edu/spring-

07/ba422/Management Accounting

2. http://artistsupport.topspinmedia.com/hc/en-

us/articles/467603-Product-Pricing-Analysis

3. www.pearsoned.ca%2Fhighered%2Fdivisions%2Fvirtual_t

ours%2Fhorngren%2Fman_acc%2FCh05ManAcc.pdf&ei=

YnNMVJbZEaOwmAXkpoLoAw&usg=AFQjCNGZmVr1

mBWtLWRemuDBIYtTDdWg&sig2=rJvXR_niLeXSQYi

SOtMnhg&bvm=bv.77880786,d.dGY

Thank you

You might also like

- SWOT Analysis TemplatesDocument10 pagesSWOT Analysis Templatesshubham agarwalNo ratings yet

- Pricing Product: Missie EscovidalDocument19 pagesPricing Product: Missie EscovidalChloisse EscovidalNo ratings yet

- Product Variety IntroDocument63 pagesProduct Variety IntroPratik BhagatNo ratings yet

- Instructions © 2010 Knowware International Inc: Sheet 2253 S Oneida ST Ste 3D Denver, Co 80224Document2 pagesInstructions © 2010 Knowware International Inc: Sheet 2253 S Oneida ST Ste 3D Denver, Co 80224voruganti_rajeshNo ratings yet

- International Textile Company ProfileDocument20 pagesInternational Textile Company ProfileallanbethelNo ratings yet

- Bank for Generations Annual Report 2019Document428 pagesBank for Generations Annual Report 2019Rai awais100% (1)

- Perspectives 2015: What Really Matters To Private Equity LpsDocument52 pagesPerspectives 2015: What Really Matters To Private Equity LpsTDGoddardNo ratings yet

- Effective Time, Task & Work Planning.: Presented By: Nagham OdehDocument75 pagesEffective Time, Task & Work Planning.: Presented By: Nagham OdehNaggiiNo ratings yet

- Field Technology Handbook - 2020 - V1.0Document757 pagesField Technology Handbook - 2020 - V1.0mostafa.akpbcNo ratings yet

- Cost AccountingDocument263 pagesCost AccountingSaciid Xaji AxmedNo ratings yet

- Manufacturing Potential and Capabilities of Indian MillsDocument20 pagesManufacturing Potential and Capabilities of Indian MillsApsara AngelNo ratings yet

- FMEA With NotationsDocument2 pagesFMEA With Notationstcalhoun1285100% (2)

- IFC History Book Second EditionDocument144 pagesIFC History Book Second EditionMinh Binh PhamNo ratings yet

- Corporate Finance Formula SheetDocument9 pagesCorporate Finance Formula SheetWilliamNo ratings yet

- Contracts & Claims Management Training Workshop Session - IiDocument66 pagesContracts & Claims Management Training Workshop Session - IiEmadNo ratings yet

- NPV CF K Initial Investment: CautionDocument36 pagesNPV CF K Initial Investment: CautionKhurram AbbasiNo ratings yet

- Assignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BDocument4 pagesAssignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BAnshum SethiNo ratings yet

- (Yarn Propertics) Joy SarkerDocument18 pages(Yarn Propertics) Joy SarkerMd Ariful IslamNo ratings yet

- Reference Guide Islamic Finance For Infrastructure PPP ProjectsDocument115 pagesReference Guide Islamic Finance For Infrastructure PPP ProjectsAbelDjalil BrakniaNo ratings yet

- Building The Balanced ScorecardDocument26 pagesBuilding The Balanced ScorecardpravinkavithaNo ratings yet

- Job Order Costing ExampleDocument3 pagesJob Order Costing ExampleNakkolopNo ratings yet

- Corporate Finance Cheatsheet Zhiwei NewDocument2 pagesCorporate Finance Cheatsheet Zhiwei NewZaggie NgNo ratings yet

- Paper 14Document129 pagesPaper 14dinesh kumarNo ratings yet

- Capital Budgeting MethodsDocument73 pagesCapital Budgeting MethodsAbhimanyu ChoudharyNo ratings yet

- Se 307-Chapter 5 Present Worth AnalysisDocument29 pagesSe 307-Chapter 5 Present Worth AnalysisAiman SyazwanNo ratings yet

- Cost Management SystemDocument21 pagesCost Management Systemsohail NazirNo ratings yet

- Project Finance Roles ExplainedTITLEDocument102 pagesProject Finance Roles ExplainedTITLEBlesson PerumalNo ratings yet

- Journal Processing Overview: /var/www/apps/conversion/current/tmp/scratch19142/106074982.doc Page 1 of 8Document8 pagesJournal Processing Overview: /var/www/apps/conversion/current/tmp/scratch19142/106074982.doc Page 1 of 8wendymermaidNo ratings yet

- Eisenhower Matrix 4.0 DemoDocument261 pagesEisenhower Matrix 4.0 DemoShanmugasundaram SNNo ratings yet

- SchoppDocument2 pagesSchoppYousaf BhuttaNo ratings yet

- Fancy YarnsDocument7 pagesFancy Yarnsiriarn100% (1)

- Six Change ApproachesDocument2 pagesSix Change ApproachesSanober Abdul AzizNo ratings yet

- Finding the Optimal Capital Structure: Weighing the Costs and Benefits of Debt and EquityDocument145 pagesFinding the Optimal Capital Structure: Weighing the Costs and Benefits of Debt and EquityApril N. AlfonsoNo ratings yet

- Chapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesDocument15 pagesChapter # 2 Basic Investment Appraisal Techniques Class Lecture NotesAzeezNo ratings yet

- Chapter 2-Cost ConceptDocument54 pagesChapter 2-Cost ConceptCik MinnNo ratings yet

- Cost Reduction - IntroductionDocument7 pagesCost Reduction - IntroductionBalaji0% (1)

- Analysis of Energy Consumption in WovenDocument8 pagesAnalysis of Energy Consumption in WovenmedraizNo ratings yet

- Textile Calculations and EquationsDocument1 pageTextile Calculations and Equationsarsh thakurNo ratings yet

- Topic 1: Developing Operational Plans: Continuous Improvement in Business PracticeDocument32 pagesTopic 1: Developing Operational Plans: Continuous Improvement in Business PracticeMarlette TolentinoNo ratings yet

- Product Design and Development Week 9 y 10Document70 pagesProduct Design and Development Week 9 y 10jose luis quintana hernandezNo ratings yet

- Mtic NotesDocument75 pagesMtic NotesAnshita GargNo ratings yet

- Cheat Sheet - EXAM Version - BARBARADocument2 pagesCheat Sheet - EXAM Version - BARBARAJosé António Cardoso RodriguesNo ratings yet

- Costing and Budgeting by YousufDocument23 pagesCosting and Budgeting by YousufYousuf HasanNo ratings yet

- Cost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadDocument32 pagesCost Allocations For Construction Insurance and Risk - Charlie Woodman and Caroline KoenraadvihangimaduNo ratings yet

- Everything You Need to Know About Fiber PropertiesDocument19 pagesEverything You Need to Know About Fiber PropertiesDhana SeelanNo ratings yet

- Wages and Salary AdministrationDocument47 pagesWages and Salary Administrationsaha apurvaNo ratings yet

- TRIAL Palm Oil Financial Model v.1.0Document82 pagesTRIAL Palm Oil Financial Model v.1.0Maksa CuanNo ratings yet

- Cost of QualityDocument11 pagesCost of QualityShounak DuttaNo ratings yet

- Lean ManufacturingDocument8 pagesLean ManufacturingAkash SharmaNo ratings yet

- Business Environment NotesDocument11 pagesBusiness Environment Notesयामीन अंसारीNo ratings yet

- Sensitivity and Scenario AnalysisDocument3 pagesSensitivity and Scenario AnalysisSohail AjmalNo ratings yet

- Chapter 7Document39 pagesChapter 7Aimes AliNo ratings yet

- Equity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionDocument144 pagesEquity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionAndrea SalazarNo ratings yet

- FAM - Assignment 01Document13 pagesFAM - Assignment 01Indika DissanayakeNo ratings yet

- Why Process Management Delivers Superior ResultsDocument26 pagesWhy Process Management Delivers Superior ResultstdeviyanNo ratings yet

- Cost Report Format - Efficycle 2012Document18 pagesCost Report Format - Efficycle 2012Gaurav ChhabraNo ratings yet

- 18ME51-ME-Mod-5Document12 pages18ME51-ME-Mod-5Sanjay BSNo ratings yet

- Steps in Job CostingDocument8 pagesSteps in Job CostingBhagaban DasNo ratings yet

- Ankita ProjectDocument17 pagesAnkita ProjectRaman NehraNo ratings yet

- In Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceDocument20 pagesIn Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceBHUSHAN PATILNo ratings yet

- Venture Capital India ChinaDocument4 pagesVenture Capital India ChinaDeepti TripathiNo ratings yet

- Performance Matrix For Social VentureDocument2 pagesPerformance Matrix For Social VentureDeepti TripathiNo ratings yet

- Comparative Ratio Analysis-SBDocument22 pagesComparative Ratio Analysis-SBDeepti TripathiNo ratings yet

- Strategic Investment Decision FrameworkDocument12 pagesStrategic Investment Decision FrameworkDeepti TripathiNo ratings yet

- Change in The Addressable Market and SAP's Strategy Over The YearsDocument4 pagesChange in The Addressable Market and SAP's Strategy Over The YearsDeepti TripathiNo ratings yet

- Fdi in AseanDocument17 pagesFdi in AseanDeepti TripathiNo ratings yet

- Providing Innovative Solution To The Enterprise in Networked EconomyDocument2 pagesProviding Innovative Solution To The Enterprise in Networked EconomyDeepti TripathiNo ratings yet

- About UberDocument6 pagesAbout UberDeepti Tripathi100% (1)

- New Trade Theory: Compara Tive Advanta GeDocument29 pagesNew Trade Theory: Compara Tive Advanta GeDeepti TripathiNo ratings yet

- Comparative Ratio Analysis-SBDocument22 pagesComparative Ratio Analysis-SBDeepti TripathiNo ratings yet

- Management AccountingDocument14 pagesManagement AccountingDeepti TripathiNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Atlantic Computers: Pricing For Atlantic Bundle Student # S01180176 Mailbox # 2052Document6 pagesAtlantic Computers: Pricing For Atlantic Bundle Student # S01180176 Mailbox # 2052Deepti TripathiNo ratings yet

- Problem DefinitionDocument3 pagesProblem DefinitionDeepti TripathiNo ratings yet

- Pierre Frankel Case - 140101049Document2 pagesPierre Frankel Case - 140101049Deepti TripathiNo ratings yet

- A Study On Foreign Direct Investment in Asean CountriesDocument18 pagesA Study On Foreign Direct Investment in Asean CountriesDeepti TripathiNo ratings yet

- Tata Motors Sales Decline and New Model LaunchesDocument10 pagesTata Motors Sales Decline and New Model LaunchesDeepti TripathiNo ratings yet

- Roleplay PresDocument9 pagesRoleplay PresDeepti TripathiNo ratings yet

- Fra A 4 PGDM 2014-16 ImpDocument17 pagesFra A 4 PGDM 2014-16 ImpDeepti TripathiNo ratings yet

- NCLTDocument12 pagesNCLTDeepti TripathiNo ratings yet

- BoilerDocument25 pagesBoilerDeepti TripathiNo ratings yet

- Volunteer WorkDocument1 pageVolunteer WorkDeepti TripathiNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 5 Abrasive Processes (Grinding)Document15 pages5 Abrasive Processes (Grinding)animi100% (1)

- Acc466 Excercise Chapter1Document6 pagesAcc466 Excercise Chapter1nur hadhirahNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- Chapter 5 - Activity Based Costing ProblemsDocument18 pagesChapter 5 - Activity Based Costing ProblemsAmir ContrerasNo ratings yet

- Examinable SupplementsDocument32 pagesExaminable SupplementsDanishNo ratings yet

- Question: Landau Company in Early August, Terry Silver, The New MarketDocument4 pagesQuestion: Landau Company in Early August, Terry Silver, The New MarketSebastian StanNo ratings yet

- BFT - BBM (Ib)Document97 pagesBFT - BBM (Ib)Kiran TakaleNo ratings yet

- Sol05 4eabc21133Document73 pagesSol05 4eabc21133stillwinmsNo ratings yet

- Flexible Budget and Performance AnalysisDocument22 pagesFlexible Budget and Performance AnalysisttzaxsanNo ratings yet

- Lecture NotesDocument3 pagesLecture NotesSeulgi MoonNo ratings yet

- 10, CostDocument282 pages10, CostrajNo ratings yet

- Advanced Management Accounting Vol.-Ii (Practice Manual) - g2Document532 pagesAdvanced Management Accounting Vol.-Ii (Practice Manual) - g2Anshu Goyal100% (2)

- Romney Ais13 PPT 14Document9 pagesRomney Ais13 PPT 14auditNo ratings yet

- Efficient materials management through accurate forecasting and inventory controlDocument14 pagesEfficient materials management through accurate forecasting and inventory controlElleNo ratings yet

- Rsearch TermDocument21 pagesRsearch TermSuehNo ratings yet

- Akuntansi ManajemenDocument50 pagesAkuntansi Manajemenutari yani dewiNo ratings yet

- H IIIyear Cost AccountingDocument4 pagesH IIIyear Cost AccountingPravin KatheNo ratings yet

- Notes - Management AccountingDocument54 pagesNotes - Management Accountingbenjoel1209No ratings yet

- JDE Enterprise Profitability SolutionDocument244 pagesJDE Enterprise Profitability SolutionSanjay GuptaNo ratings yet

- Cost Accounting - Bcom - Module VDocument7 pagesCost Accounting - Bcom - Module Vmohammedarshad0021No ratings yet

- Qualitative Research in Accounting & Management: Article InformationDocument23 pagesQualitative Research in Accounting & Management: Article InformationIspasMirela100% (1)

- Chapter 5 Standardization of RecipeDocument10 pagesChapter 5 Standardization of RecipeChristella Margarejo Delos ReyesNo ratings yet

- Paper 5 Cost Management AccountingDocument685 pagesPaper 5 Cost Management AccountingAlson PrasaiNo ratings yet

- Tugas RangkumanDocument18 pagesTugas RangkumaniqbalNo ratings yet

- Syllabus PUMBA PDFDocument17 pagesSyllabus PUMBA PDFVaibhav KharadeNo ratings yet

- The Impact of Activity-Based CostingDocument28 pagesThe Impact of Activity-Based CostingRika Ircivy Agita YanguNo ratings yet

- Project On Process CostingDocument38 pagesProject On Process CostingViraj Balsara78% (9)

- Cost Control Module 1Document20 pagesCost Control Module 1Samson CapayNo ratings yet

- Cost Accounting Vol. IIDocument464 pagesCost Accounting Vol. IISrinivasa Rao Bandlamudi96% (24)

- 17NMCOM005Document115 pages17NMCOM005Apoorva M V100% (1)

- Accounting For Overheads 5.1 IntroductionDocument19 pagesAccounting For Overheads 5.1 IntroductionSaiful IslamNo ratings yet