Professional Documents

Culture Documents

Ratios - Gma

Uploaded by

Clarisse Policios100%(2)100% found this document useful (2 votes)

280 views4 pagesComputed

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentComputed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

280 views4 pagesRatios - Gma

Uploaded by

Clarisse PoliciosComputed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

1

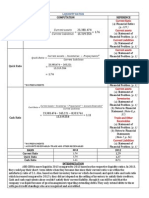

GMA NETWORK, INC.

RATIO ANALYSIS

CATEGORY DESCRIPTION COMPUTATION RATIO REFERENCE INTERPRETATION

LIQUIDITY RATIOS

GMA NETWORK INC. has a good degree of

liquidity. Based on its current ratio, it has

2.15pesos of current assets for every peso

of liability. It's quick ratio points to adequate

liquidity even after excluding pre-payments,

with 2.10 pesos in assets that can be

converted rapidly to cash for every peso of

current liabilities. A material change that

leads to the increase of the computed ratio

is the increase in cash and short-term by 5%

which is equivalent to P1, 758 million at

year-end which is directly attributed to this

years result of operation.

1. Liquid/ Acid Test

Ratio

(Cash and Cash

Equivalents +

Short-Term

Investments

Trade and Other

Receivables)/Curr

ent Liabilities

(1,749,631,196+7,874,00

2+3,521,430,443)/3,314,3

37,516 1.59

Financial

Position, page

2

2. Cash Ratio

Cash and Cash

Equivalents/

Current Liabilities

1,749,631,196/3,314,337,

517 0.582

Financial

Position, page

2

3. Current Ratio

Current

Assets/Current

Liabilities

7,123,258,726/3,314,337,

516 2.15

Financial

Position, page

2

ACTIVITY/EFFICIENCY

RATIOS

1. Accounts Receivable

Turnover

Sales on

Account(Net

Income)/Average

Accounts

Receivable*

12,950,879,332/3,681,905

,190

3.5174396

55

Accounts

Receivable=Fi

nancial

Position, page

2; Net

Income=

Comprehensiv

e Income,

page 2

GMA NETWORK INC. has a better

Accounts Receivable turnover compared to

last year which is 3.020077558 which

means that the company maybe had extra

efforts during 2013 than 2012 which

eventually improved their accounts

receivable turnover by approximately 0.49

times which is significant. This also indicates

that they had collected on an average of 104

days their accounts receivable during the

years as compared to last year which took

them approximately 121 days with their

collection of accounts receivable.

*Average

Accounts

Receivable=

(Accounts

Receivable, beg

+Accounts

Receivable, end

)/2

3,512,420,443+3,842,389

,937)/2=3,681,905,190

2

GMA NETWORK, INC.

RATIO ANALYSIS

2. Average Collection

Period

365

days/Accounts

Receivable

Turnover 365dats/3.517439665

103.76866

01days

SOLVENCY RATIOS

1. Debt to Equity Ratio

Total Liabilities/

Average

Shareholder's

Equity

1,106,875000/8,788,423,8

23 0.13

Financial

Position, page

2

Financial leverage based on its solvency

ratio appears to be at comfortable levels

with debt at only 13% equity and only 33%

of assets are financed by debt. Since we are

comparing short-term loans over total equity,

the decrease of debt-to-equity ratio is

caused by decrease of short term loans by

35% as payments made are higher P2,

5000M versus payment of only P1, 825M

during 2012. Moreover interest expense can

be covered by earnings before income tax

and interest expense by 4.95 times.

Although it was a decrease from 2012 ratio it

is still good because we have greater

earnings in 2013-2012.

2.Times Interest-Earned

Ratio

EBIT/Interest

Expense 2,440,421,287/53,115,234 45.95

Comprehensiv

e Income,

page 2

3. Debt to Asset Ratio

Total

Liabilities/Averag

e Total Assets

4,258,863,770/[(13,083,9

36,951+12,682,283,099)/

2] 0.33

Financial

Position, page

2

PROFITABILTY

RATIOS

1.Gross Profit Margin Gross Profit/Sales

6,994,497,617/12,950,879

,322 54.00%

Comprehensiv

e Income,

page 2

A 54% gross margin ratio means that the

company is profitable. It has a positive

investment quality meaning it has a high

earning that drives up its stock price. The

company management is also effective and

flexible in adapting trends, events, demands

or uncertainties that have or which are

reasonably expected to have a material

impact on their revenue or income. The

company management is also efficient and

effective in employing and utilizing its

assets. Because the company is profitable,

2. Return on Sales

Net Income/Net

Sales

1,674,975,012/12,950,879

,322 12.93%

Comprehensiv

e Income,

page 2

3. Total Asset Turnover

Net Sales

/Average Total

Assets1,674,975,

013/12,950,879,3

22

12,950,879,332/3,681,905

,190 1.005x

Net

Income=Comp

rehensive

Income, page

2; Total

Assets=Financ

3

GMA NETWORK, INC.

RATIO ANALYSIS

ial Position,

page 2

shareholders earned 19.74% for their

investment in the company.

4. Return on Total

Assets

(Net

Income+[Interest

Expense(1-Tax

Rate)]/Average

Total Assets

1,674,975,012+[53,115,2

34(1-

30%)]/[(13,083,936,9510+

12,682,283,099)/2] 13.29%

Net Income

and Interest

expense,=Co

mprehensive

Income page

2; Average

Total

Assets=Financ

ial Position,

page 2

5. Return on Equity

Net Income/

Average Total

Equity

1,674,975,012/[(8,825,07

3,181+8,149,431,500)/2] 19.74

Net

Income=Comp

rehensive

Income page

2; Average

Total

Equity=Financi

al Position,

page 2

6. Earnings per share

Net Income-

Preferred

Dividends/

Average Number

of Ordinary Share

Outstanding

1,666,949,855-

514,435,885/3,360,297,00

0 0.343

Note 29 pages

60-61

7. Dividend Payout Ratio

Dividend per

share/EPS 0.25/0.343 0.73

Notes 19 page

50

8.Book value per share

Ordinary

Shareholder's

Equity/ Number of

Ordinary Shares

Outstanding, end

5,000,000,000/3,361,047,

000 1.49

Independent

Report on

Supplementary

Schedules,

Schedule H

9. Working Capital

Current Assets-

Current Liabilities

7,123,258,726-

3,314,337,516

38089212

10

Financial

Position, page

2

4

GMA NETWORK, INC.

RATIO ANALYSIS

ADDITIONAL RATIOS

1. Asset to Equity

Total Asset/Total

Equity

13,083,936,951/8,825,073

,181 1.48

Financial

Position, page

2

2. Net Income Margin

Net Income/Net

Revenue

1,674,975,012/12,950,879

,322 12.93

Comprehensiv

e Income,

page 2

P/E RATIO AS OF SEPTEMBER 19, 2014= 21.98

You might also like

- 2: Quick Ratio / Acid Test RatioDocument10 pages2: Quick Ratio / Acid Test RatioTousiefiftikharNo ratings yet

- Ratio AnalysisDocument16 pagesRatio AnalysisAbdul RehmanNo ratings yet

- Liquidity and Profitability Ratios for Adelaide BrightonDocument5 pagesLiquidity and Profitability Ratios for Adelaide BrightonAtul GirhotraNo ratings yet

- Ford Financial Statement AnalysisDocument5 pagesFord Financial Statement Analysissumeet kumarNo ratings yet

- Measuring and Evaluating Financial PerformanceDocument12 pagesMeasuring and Evaluating Financial PerformanceNishtha SisodiaNo ratings yet

- Lecture 3 - Assignment - Jaimin PandyaDocument10 pagesLecture 3 - Assignment - Jaimin PandyajaiminNo ratings yet

- Practice Set 10 FSA 2Document5 pagesPractice Set 10 FSA 2AashiNo ratings yet

- HLKDocument24 pagesHLKMinza JahangirNo ratings yet

- Term Paper - Accounting and FinanceDocument3 pagesTerm Paper - Accounting and FinanceJayNo ratings yet

- Christina Shaw - 0704202 Korie Hyde - 1102595 Natalie Richards-Miller - 1205568 Tashane Amos - 0908041Document26 pagesChristina Shaw - 0704202 Korie Hyde - 1102595 Natalie Richards-Miller - 1205568 Tashane Amos - 0908041Kameisha Isityou Taylor100% (1)

- HeinekenDocument8 pagesHeinekenErick KinotiNo ratings yet

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1No ratings yet

- Financial Accountin G& Analysis: Case Study Adept Chemical IncDocument15 pagesFinancial Accountin G& Analysis: Case Study Adept Chemical IncvatsalamNo ratings yet

- Econ 3073 Assignment - 1 and 2 CompleteDocument12 pagesEcon 3073 Assignment - 1 and 2 CompleteMudassar Gul Bin AshrafNo ratings yet

- Current Asset Management SolutionsDocument40 pagesCurrent Asset Management Solutionstseboblessing7No ratings yet

- Ratio Analysis DG Khan Cement CompanyDocument6 pagesRatio Analysis DG Khan Cement CompanysaleihasharifNo ratings yet

- Financial Management and Control - AssignmentDocument7 pagesFinancial Management and Control - AssignmentSabahat BashirNo ratings yet

- Analysis Far (Unit)Document5 pagesAnalysis Far (Unit)Asfatin AmranNo ratings yet

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHINo ratings yet

- Fiancial AnalysisDocument5 pagesFiancial AnalysisLorena TudorascuNo ratings yet

- Financial Accounting And The Financial StatementsDocument10 pagesFinancial Accounting And The Financial StatementsRajiv RankawatNo ratings yet

- Current Ratio Analysis of Jai Bhagwati Textile MillsDocument6 pagesCurrent Ratio Analysis of Jai Bhagwati Textile Millsabhishek27panwalaNo ratings yet

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Solution Manual For Corporate Finance 3rd Edition Megginson, Smart, GrahamDocument15 pagesSolution Manual For Corporate Finance 3rd Edition Megginson, Smart, Grahama748173243No ratings yet

- SAI FY13 - Results Investor PresentationDocument29 pagesSAI FY13 - Results Investor PresentationdigifiNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Module 1 Homework AssignmentDocument3 pagesModule 1 Homework Assignmentlgarman01No ratings yet

- Liquidity and Profitability RatioDocument5 pagesLiquidity and Profitability RatioRituraj RanjanNo ratings yet

- Financial Analysis of Idea: Case Studies in Telecom BusinessDocument8 pagesFinancial Analysis of Idea: Case Studies in Telecom BusinessKrishnakant NeekhraNo ratings yet

- CH 13 SM FAF5eDocument48 pagesCH 13 SM FAF5eSonora Nguyen100% (1)

- BNL Stores Case Analysis: Declining Profitability and High Leverage Led to Falling Share PriceDocument19 pagesBNL Stores Case Analysis: Declining Profitability and High Leverage Led to Falling Share PriceAnshuman PandeyNo ratings yet

- Zambian Breweries Report 2018Document8 pagesZambian Breweries Report 2018Mumbi MwansaNo ratings yet

- Rider University PMBA 8020 Module 1 Solutions: ($ Millions)Document5 pagesRider University PMBA 8020 Module 1 Solutions: ($ Millions)krunalparikhNo ratings yet

- Documents Tips Pgbm01-Finance-Management PDFDocument25 pagesDocuments Tips Pgbm01-Finance-Management PDFJonathan LimNo ratings yet

- Oil Company Cash Flow AnalysisDocument22 pagesOil Company Cash Flow AnalysisShah Obaid MannanNo ratings yet

- Report On: Ratio Analysis of GSX Techedu Inc, Inc. & Helen of Troy LimitedDocument11 pagesReport On: Ratio Analysis of GSX Techedu Inc, Inc. & Helen of Troy LimitedAiman KhanNo ratings yet

- 3 CompaniesreportfinanceDocument45 pages3 CompaniesreportfinanceMarisha RizalNo ratings yet

- This Study Resource Was Shared Via: Liu Djiu Fun 17525Document7 pagesThis Study Resource Was Shared Via: Liu Djiu Fun 17525Priyanka AggarwalNo ratings yet

- Financial Statement Analysis and Creative Accounting TechniquesDocument12 pagesFinancial Statement Analysis and Creative Accounting TechniquesMahmoud EsmaeilNo ratings yet

- Nike Company/ Essay / PaperDocument8 pagesNike Company/ Essay / PaperAssignmentLab.com100% (1)

- Financial Analysis of Next Plc Reveals Profitability and Liquidity StrengthsDocument11 pagesFinancial Analysis of Next Plc Reveals Profitability and Liquidity StrengthsHamza AminNo ratings yet

- Qantus - WACC - Project SolutionDocument11 pagesQantus - WACC - Project SolutionJehanzaibNo ratings yet

- Corporate Reporting AssignmentDocument5 pagesCorporate Reporting AssignmentAbubakari Abdul MananNo ratings yet

- Case FinalDocument11 pagesCase FinalshakeelsajjadNo ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Analysis of Liquidity, Turnover and Profitability RatiosDocument9 pagesAnalysis of Liquidity, Turnover and Profitability RatiosvivekchittoriaNo ratings yet

- Aetna Financial Analysis Reveals Strategic Investments for Future GrowthDocument11 pagesAetna Financial Analysis Reveals Strategic Investments for Future GrowthKimberlyHerringNo ratings yet

- Profitability AnalysisDocument9 pagesProfitability AnalysisAnkit TyagiNo ratings yet

- Financial Accounting - Starbucks CaseDocument14 pagesFinancial Accounting - Starbucks CaseHạnh TrầnNo ratings yet

- Cash Flow and Ratio AnalysisDocument7 pagesCash Flow and Ratio AnalysisShalal Bin YousufNo ratings yet

- ACC08101 Introductory AccountingDocument12 pagesACC08101 Introductory AccountingBólájí AkínyemíNo ratings yet

- 5ffb Ims03Document32 pages5ffb Ims03Azadeh AkbariNo ratings yet

- Evaluating The Ability To Pay Long-Term DebtDocument3 pagesEvaluating The Ability To Pay Long-Term DebtIntan HidayahNo ratings yet

- CREDITFAQ30 Pitfalls of EBITDA 092016Document3 pagesCREDITFAQ30 Pitfalls of EBITDA 092016handsomepeeyushNo ratings yet

- Financial Analysis of A CompanyDocument10 pagesFinancial Analysis of A CompanyRupesh PuriNo ratings yet

- Concept Questions: Chapter Twelve The Analysis of Growth and Sustainable EarningsDocument64 pagesConcept Questions: Chapter Twelve The Analysis of Growth and Sustainable EarningsceojiNo ratings yet

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- James Latham PLCDocument13 pagesJames Latham PLCBólájí AkínyemíNo ratings yet

- Renuka Foods PLC and HVA Foods PLC (1200)Document21 pagesRenuka Foods PLC and HVA Foods PLC (1200)Bajalock VirusNo ratings yet

- Adjust pretax income for errorsDocument2 pagesAdjust pretax income for errorsClarisse PoliciosNo ratings yet

- Thesis - Definition of TermsDocument2 pagesThesis - Definition of TermsClarisse Policios0% (1)

- Dividend Irrelevance Theory DefinitionDocument2 pagesDividend Irrelevance Theory DefinitionpsyashNo ratings yet

- 404B - Financial InstDocument11 pages404B - Financial InstClarisse PoliciosNo ratings yet

- IAP Feasibility Study Outline Proposal Template Ver1.0Document12 pagesIAP Feasibility Study Outline Proposal Template Ver1.0JD MoralesNo ratings yet

- THESIS - The Research Problem With UnderlineDocument4 pagesTHESIS - The Research Problem With UnderlineClarisse PoliciosNo ratings yet

- Manila To Cebu Airfare Air Asia: SourceDocument3 pagesManila To Cebu Airfare Air Asia: SourceClarisse PoliciosNo ratings yet

- 404b Dividends HomeworkDocument7 pages404b Dividends HomeworkClarisse PoliciosNo ratings yet

- Diarrhea Unknown EtiologyDocument2 pagesDiarrhea Unknown EtiologyClarisse PoliciosNo ratings yet

- Hello Ivan. Here Are Some of Our Ideas.Document1 pageHello Ivan. Here Are Some of Our Ideas.Clarisse PoliciosNo ratings yet

- #5Document1 page#5Clarisse PoliciosNo ratings yet

- For ConsultationDocument11 pagesFor ConsultationClarisse PoliciosNo ratings yet

- SyllabusDocument3 pagesSyllabusClarisse PoliciosNo ratings yet

- Reference 1Document2 pagesReference 1Clarisse PoliciosNo ratings yet

- Thesis403a EditedDocument3 pagesThesis403a EditedClarisse PoliciosNo ratings yet

- Thesis - The Research ParadigmDocument1 pageThesis - The Research ParadigmClarisse PoliciosNo ratings yet

- 404A - Balanced Scorecard BasicsDocument5 pages404A - Balanced Scorecard BasicsClarisse PoliciosNo ratings yet

- Costs.: Course On Managerial EconomicsDocument2 pagesCosts.: Course On Managerial EconomicsClarisse PoliciosNo ratings yet

- LCCM Feasibility Study Business Plan GuideDocument37 pagesLCCM Feasibility Study Business Plan GuideRadu Dimana82% (11)

- MAS - 22806765-0505-MAS-PreweekDocument32 pagesMAS - 22806765-0505-MAS-PreweekClarisse PoliciosNo ratings yet

- Thesis VariablesDocument1 pageThesis VariablesClarisse PoliciosNo ratings yet

- SyllabusDocument3 pagesSyllabusClarisse PoliciosNo ratings yet

- Abs CB NNNNNNDocument8 pagesAbs CB NNNNNNClarisse PoliciosNo ratings yet

- Junior Philippine Institute of Accountants School of Accountancy and Business Management Saint Louis UniversityDocument1 pageJunior Philippine Institute of Accountants School of Accountancy and Business Management Saint Louis UniversityClarisse PoliciosNo ratings yet

- RRL HighlightsDocument2 pagesRRL HighlightsClarisse PoliciosNo ratings yet

- Introduction AddDocument1 pageIntroduction AddClarisse PoliciosNo ratings yet

- Liquidity Ratios: Current RatioDocument7 pagesLiquidity Ratios: Current RatioClarisse PoliciosNo ratings yet

- Tally Sheet 1Document4 pagesTally Sheet 1Clarisse PoliciosNo ratings yet

- Industrial Average of Profitability RatioDocument2 pagesIndustrial Average of Profitability RatioClarisse PoliciosNo ratings yet

- BUS 206 Final Project Guidelines and Rubric PDFDocument7 pagesBUS 206 Final Project Guidelines and Rubric PDFTrish FranksNo ratings yet

- EStmtPrintingServlet 3Document5 pagesEStmtPrintingServlet 3Ahmad Al FaizNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument20 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelMERCY LAWNo ratings yet

- CS 803 (D) MIE Unit 1Document9 pagesCS 803 (D) MIE Unit 1Neha MishraNo ratings yet

- Enterprise Data Management Data Governance PlanDocument36 pagesEnterprise Data Management Data Governance PlanSujin Prabhakar89% (9)

- MCQ Supply chain management multiple choice questionsDocument53 pagesMCQ Supply chain management multiple choice questionsmoniNo ratings yet

- CRM AssignmentDocument5 pagesCRM Assignmentmalobika chakravartyNo ratings yet

- Salesforce RFP for Energy Project ManagementDocument14 pagesSalesforce RFP for Energy Project ManagementDoddy PrimaNo ratings yet

- Expert Tech Leader Scales StartupsDocument3 pagesExpert Tech Leader Scales StartupsDevi InstituteNo ratings yet

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDocument11 pagesA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNo ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- StemGenex Files For BankruptcyDocument53 pagesStemGenex Files For BankruptcyLeighTurnerNo ratings yet

- Leps 580 Mod 7Document2 pagesLeps 580 Mod 7api-463751208No ratings yet

- Mcom Sales QuotaDocument14 pagesMcom Sales QuotaShyna aroraNo ratings yet

- The Effect of The Covid19 Pandemic On The BPO0991234Document8 pagesThe Effect of The Covid19 Pandemic On The BPO0991234Test TwoNo ratings yet

- Ruston, Louisiana: Zion Traveler Baptist ChurchDocument19 pagesRuston, Louisiana: Zion Traveler Baptist ChurchGilbert LomofioNo ratings yet

- Term Paper: On A Rising Market Giant of BangladeshDocument46 pagesTerm Paper: On A Rising Market Giant of BangladeshSanjeed Ahamed SajeebNo ratings yet

- Total Productive MaintenanceDocument53 pagesTotal Productive MaintenanceamitwadaskarNo ratings yet

- Jack Welch's Motivational Approach at GEDocument5 pagesJack Welch's Motivational Approach at GEVerma1311No ratings yet

- HRP - Monitoring and EvaluationDocument2 pagesHRP - Monitoring and EvaluationRichard SikiraNo ratings yet

- MCQ'sDocument14 pagesMCQ'sKawalpreet Singh Makkar71% (7)

- Non-Banking Financial Institutions Types UPSC NotesDocument3 pagesNon-Banking Financial Institutions Types UPSC NotesBappaditya RoyNo ratings yet

- Indonesia Banking Booklet 2017Document244 pagesIndonesia Banking Booklet 2017ntc7035100% (1)

- IBM CloudDocument2 pagesIBM CloudNihar RoutrayNo ratings yet

- National Agricultural (Co-Operative Marketing) Federation of India Ltd.Document18 pagesNational Agricultural (Co-Operative Marketing) Federation of India Ltd.Sonam Gupta100% (3)

- Jfia 2014 2 - 7 PDFDocument35 pagesJfia 2014 2 - 7 PDFdesikudi9000No ratings yet

- Every brand is a niche brandDocument28 pagesEvery brand is a niche brandSandip ShahNo ratings yet

- Design of E-Commerce Information System On Web-Based Online ShoppingDocument11 pagesDesign of E-Commerce Information System On Web-Based Online ShoppingHARINo ratings yet

- TX-UK Syllabus - J22-M23 FinalDocument27 pagesTX-UK Syllabus - J22-M23 FinalAcca BooksNo ratings yet

- This Study Resource Was: Tourism and Hospitality MidtermDocument9 pagesThis Study Resource Was: Tourism and Hospitality MidtermMark John Paul CablingNo ratings yet