Professional Documents

Culture Documents

Accounts

Uploaded by

afnankhan1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts

Uploaded by

afnankhan1Copyright:

Available Formats

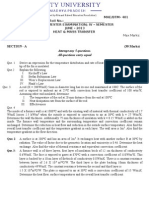

FIT

Summer 2014

Q.1 Pakistans exchange policy has undergone several changes, since inception. Up until 1971,

the countrys exchange rate remained pegged to the British Pound Sterling. In 1982, an

exchange rate regime of managed float was adopted, which was based on a basket of

currencies. After 1991, the process of financial sector reforms was initiated.

List 5 key measures taken by State Bank of Pakistan in the last decade for reforming the Foreign

Exchange regime.

Q.2 A. List at least 2 advantages and 3 disadvantages of a letter of credit to an exporter.

B. List at least 3 advantages and 2 disadvantages of a letter of credit to an importer.

Q.3 Say, the Advising Bank fails to advise a L/C to the beneficiary, who consequently suffers

losses and files a suit against the Advising Bank. Is the Advising Bank legally responsible for any

loss? Please explain with the help of an example.

Q.4 A. Differentiate between Combined and Multimode transport documents?

B. Describe major risks associated with a shipment under charter party Bill of Lading?

C. Explain the procedure for issuance of a Shipping Guarantee?

Q.5 A. How do correspondent banking arrangements help the respondent bank in facilitation of

international trade transactions?

B. What is meant by Relationship Management Agreement (RMA)? Can two banks have an RMA

in absence of any correspondent bank arrangement?

Q.6 Explain any 5 intermediaries that are involved in international trade transactions.

Q.7 A. A company, Awan Traders deals in hardware goods. At present, the company is buying

from a wholesaler in the local market but it wants to evaluate the idea of importing the same

products from Germany. Awan Trader believes that this will improve its profit margin. Since it

will be Awan Traders first order, suppliers in Germany will demand payment on a sight letter of

credit. Elaborate the various steps, (at least 5) with proper explanation, that would be involved

in the import process until final clearance of the consignment.

B. Explain any 2 types of finance facilities that are extended by banks to importers.

Q.8 A. Describe any 3 benefits of INCOTERMS in international trade transactions. (Marks 3)

B. Describe the main point of difference(s) between CPT and CIP terms and state whether

these INCOTERMS are permissible under local exchange control regulations. (Marks 2)

Q.9 A. Explain any 3 objectives of the World Trade Organization.

B. List any two ways by which the Prudential Regulations facilitate international trade

transactions.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- OpenVov BE200/BE400 Series BRI Card DatasheetDocument1 pageOpenVov BE200/BE400 Series BRI Card Datasheetmaple4VOIPNo ratings yet

- Aron Bean and The HealthSouth FraudDocument6 pagesAron Bean and The HealthSouth FraudAkhil KrishnanNo ratings yet

- Wireless Sensor Network Based Home Monitoring System For Wellness Determination of Elderly PDFDocument4 pagesWireless Sensor Network Based Home Monitoring System For Wellness Determination of Elderly PDFsrcembeddedNo ratings yet

- IfDocument13 pagesIfeuropanporecNo ratings yet

- Market Leader - Verb TensesDocument1 pageMarket Leader - Verb TensesDanielle SilvaNo ratings yet

- Measurement of GasDocument2 pagesMeasurement of Gasrobertz_tolentino014No ratings yet

- HMT Question PaperDocument1 pageHMT Question PaperSanjay GomastaNo ratings yet

- MC 07 130 WDocument1 pageMC 07 130 WErick Rodrigo PeñaNo ratings yet

- INS - Alternating Current Field Measurement (ACFM)Document2 pagesINS - Alternating Current Field Measurement (ACFM)Mehmet SoysalNo ratings yet

- Board Resolution For HDFCDocument3 pagesBoard Resolution For HDFCShridhar MuthuNo ratings yet

- Dissertation Registration FormDocument3 pagesDissertation Registration Formneill_bursellNo ratings yet

- Phyllanthus KeyDocument1 pagePhyllanthus Keyvarunsharma26No ratings yet

- English Ujian PraktekDocument2 pagesEnglish Ujian PraktekbradonheatNo ratings yet

- Arguments For and Against GlobalizationDocument6 pagesArguments For and Against GlobalizationHo Thuy Dung0% (1)

- Subaru Impreza 2002Document3,366 pagesSubaru Impreza 2002Tamás Nagy67% (3)

- Asean Quiz For Kids 7Document2 pagesAsean Quiz For Kids 7Kru Ekachai100% (1)

- Explosion Proof Cable Glands Prysmian Barrier Glands (424TW) For SWA Steel Wire Armour CableDocument2 pagesExplosion Proof Cable Glands Prysmian Barrier Glands (424TW) For SWA Steel Wire Armour CablerocketvtNo ratings yet

- Vehicle Sale AgreementDocument1 pageVehicle Sale AgreementSaravanan ThangaveluNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireMayur RathodNo ratings yet

- Schmieding Certified Home Caregiver TrainingDocument1 pageSchmieding Certified Home Caregiver Trainingapi-200977699No ratings yet

- Dts IDocument13 pagesDts IHarish ShivakumarNo ratings yet

- Scrap Metal Procedures FinalDocument1 pageScrap Metal Procedures Finalkr__santoshNo ratings yet

- Foreign TravelDocument1 pageForeign Traveldanny2100No ratings yet

- First Law Control Volume Isentropic EfficiencyDocument3 pagesFirst Law Control Volume Isentropic EfficiencyYogesh ChaudhariNo ratings yet

- Cbse Class 8 SST Worksheet - Natural Resource - WaterDocument2 pagesCbse Class 8 SST Worksheet - Natural Resource - Waterravilulla0% (1)

- Your Electronic Ticket ReceiptDocument2 pagesYour Electronic Ticket ReceiptKampus Akper JayakartaNo ratings yet

- Fatbox Gprsv2 RouterDocument1 pageFatbox Gprsv2 Routerjlro84No ratings yet

- Sodium PercarbonateDocument2 pagesSodium PercarbonateSyahrul RamadhanNo ratings yet

- Capital Budgeting - Practical QuestionsDocument2 pagesCapital Budgeting - Practical QuestionsAlexander KotlerNo ratings yet

- Throat PacksDocument2 pagesThroat PacksdocivirusNo ratings yet