Professional Documents

Culture Documents

Paddy Processing Unit

Uploaded by

bidyuttezu0 ratings0% found this document useful (0 votes)

22 views2 pagesPADDY

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPADDY

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesPaddy Processing Unit

Uploaded by

bidyuttezuPADDY

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

(29)

KHADI & VILLAGE INDUSTRIES COMMISSION

PROJECT PROFILE FOR GRAMODYOG ROJGAR YOJANA

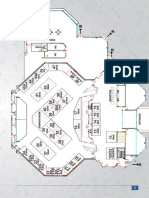

PADDY PROCESSING UNIT. (Mini Rice Mill)

India is basically depending on the Agriculture and Agricultural products. More than

70% of the population is fully engaged in Agricultural activities. The Agricultural scenario

has changed a lot with development of Science and Technology. The Indian farmers have

acquired the knowhow using the various modern technology leaving behind the decade old

traditional methods. Due to development of S & T, the production has increased to many

folds. Rice is one of the important food, setting up paddy processing unit will definitely help

entrepreneurs to earn substantial income.

1 Name of the Product : Paddy Processing

2 Project Cost :

a Capital Expenditure

Land : own

Building Shed 1000 Sq.ft : Rs. 200000.00

Equipment : Rs. 100000.00

(1). Paddy Cleaner with dust blower,

(2). Paddy Seperater, (3). Paddy Dehusker.

(4). Rice Polisher. (5). Bran Processing

System, (6) Aspirater. Etc.

Total Capital Expenditure Rs. 300000.00

b Working Capital Rs. 55000.00

TOTAL PROJECT COST : Rs. 355000.00

3 Estimated Annual Production of Paddy : (Rs. in '000)

Sr.No. Particulars Capacity Rate Total Value

1 Paddy Processing 369 1200.00 443.00

Quintal

TOTAL 369 1200.00 443.00

4 Raw Material : Rs. 100000.00

5 Lables and Packing Material : Rs. 25000.00

ABFPI-15

Price : Rs. 2/-

(30)

6 Wages (Skilled & Unskilled) : Rs. 100000.00

7 Salaries : Rs. 24000.00

8 Administrative Expenses : Rs. 20000.00

9 Overheads : Rs. 100000.00

10 Miscellaneous Expenses : Rs. 25000.00

11 Depreciation : Rs. 20000.00

12 Insurance : Rs. 3000.00

13 Interest (As per the PLR)

a. C.E.Loan : Rs. 39000.00

b. W.C.Loan : Rs. 7150.00

Total Interest Rs. 46150.00

14 Woring Capital Requirement :

Fixed Cost Rs. 111000.00

Variable Cost Rs. 332150.00

Requirement of WC per Cycle Rs. 55394.00

15 Estimated Cost Analysis

Sr.No. Particulars Capacity Utilization(Rs in '000)

100% 60% 70% 80%

1 Fixed Cost 111.00 66.60 77.70 88.80

2 Variable Cost 332.00 199.20 232.40 265.60

3 Cost of Production 443.00 265.80 310.10 354.40

4 Projected Sales 553.75 332.25 387.63 443.00

5 Gross Surplus 110.75 66.45 77.53 88.60

6 Expected Net Surplus 91.00 46.00 58.00 69.00

Note : 1. All figures mentioned above are only indicative and may vary from place to place.

2. If the investment on Building is replaced by Rental then

a. Total Cost of Project will be reduced.

b. Profitability will be increased.

c. Interest on C.E.will be reduced.

You might also like

- Receipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalDocument1 pageReceipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalbidyuttezuNo ratings yet

- Appraisal For M.I. (Agr-B1)Document3 pagesAppraisal For M.I. (Agr-B1)bidyuttezuNo ratings yet

- Appendix - V: Please Affix Passport Size PhotographDocument5 pagesAppendix - V: Please Affix Passport Size PhotographbidyuttezuNo ratings yet

- BSNL Receipt for Payment of Demand NotesDocument1 pageBSNL Receipt for Payment of Demand NotesbidyuttezuNo ratings yet

- Appraisal For Crop Loan (Agr-A)Document2 pagesAppraisal For Crop Loan (Agr-A)bidyuttezuNo ratings yet

- Appraisal For Land Development (Agr.B7)Document2 pagesAppraisal For Land Development (Agr.B7)bidyuttezuNo ratings yet

- Receipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalDocument1 pageReceipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalbidyuttezuNo ratings yet

- Receipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalDocument1 pageReceipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalbidyuttezuNo ratings yet

- Receipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalDocument1 pageReceipt For Payment of Bills/Demand Notes. This Receipt Is Generated From BSNL PortalbidyuttezuNo ratings yet

- SLNA Assam AdvtDocument1 pageSLNA Assam AdvtbidyuttezuNo ratings yet

- JAIIB LowDocument10 pagesJAIIB LowVimal RamakrishnanNo ratings yet

- Application - Ag - Credit (Agr-1)Document3 pagesApplication - Ag - Credit (Agr-1)bidyuttezuNo ratings yet

- Praveen Exam Material - IIDocument11 pagesPraveen Exam Material - IIbidyuttezuNo ratings yet

- Decl NonloaneeDocument2 pagesDecl NonloaneebidyuttezuNo ratings yet

- Hyderabadi Chicken Dum Biryani RecipeDocument3 pagesHyderabadi Chicken Dum Biryani RecipebidyuttezuNo ratings yet

- Repairs To Wells (Agr.31)Document2 pagesRepairs To Wells (Agr.31)bidyuttezuNo ratings yet

- Marketing Research Definition Functions ObjectivesDocument8 pagesMarketing Research Definition Functions ObjectivesbidyuttezuNo ratings yet

- Stamp Duty On Various DocumentsDocument6 pagesStamp Duty On Various Documentsbidyuttezu100% (1)

- Model QuestionsDocument50 pagesModel QuestionsbidyuttezuNo ratings yet

- LuaDocument1 pageLuabidyuttezuNo ratings yet

- Appraisal For Investment Credit (Agr-B)Document2 pagesAppraisal For Investment Credit (Agr-B)bidyuttezuNo ratings yet

- Stamp Duty On Various DocumentsDocument6 pagesStamp Duty On Various Documentsbidyuttezu100% (1)

- ReadmeDocument1 pageReadmeankupenNo ratings yet

- Mso Example Intl Setup File ADocument1 pageMso Example Intl Setup File AAkash NagarNo ratings yet

- Mso Example Setup File ADocument1 pageMso Example Setup File ASueño InalcanzableNo ratings yet

- Mso Example Setup File ADocument1 pageMso Example Setup File ASueño InalcanzableNo ratings yet

- Analysis of Education Loan: A Case Study of National Capital Territory of DelhiDocument14 pagesAnalysis of Education Loan: A Case Study of National Capital Territory of DelhibidyuttezuNo ratings yet

- Maureen Woodhall - Student LoansDocument16 pagesMaureen Woodhall - Student LoansOwlCakeNo ratings yet

- Indian Institute of Banking & Finance: Certificate Examination in Trade FinanceDocument8 pagesIndian Institute of Banking & Finance: Certificate Examination in Trade FinanceKinshuk ChaturvediNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Importance of E-Commerce: Riya Jacob K Dept of BCA 2020 - 21Document9 pagesImportance of E-Commerce: Riya Jacob K Dept of BCA 2020 - 21Jhon Aj CastilloNo ratings yet

- Navy Blue and Black Professional Resume PDFDocument15 pagesNavy Blue and Black Professional Resume PDFNandish NNo ratings yet

- Recruitment Process at enroute internationalDocument46 pagesRecruitment Process at enroute internationalAmina khatoonNo ratings yet

- IT Project ManagementDocument29 pagesIT Project Managementaadarsh shresthaNo ratings yet

- Working Capital Management at BEMLDocument20 pagesWorking Capital Management at BEMLadharav malikNo ratings yet

- Βιβλιαράκι Εκπαιδευτικής ΈκθεσηςDocument24 pagesΒιβλιαράκι Εκπαιδευτικής ΈκθεσηςmalekosnNo ratings yet

- Project Name: Flying Drone Revision Number: 01 DATE: 6/6/2020Document1 pageProject Name: Flying Drone Revision Number: 01 DATE: 6/6/2020Uzarerwa Lucky d'AmsonNo ratings yet

- Business Management QuizDocument6 pagesBusiness Management QuizSeckin UzunNo ratings yet

- SABSA MATRIX ASSETS BUSINESS DECISIONS CONTEXTDocument1 pageSABSA MATRIX ASSETS BUSINESS DECISIONS CONTEXTEli_HuxNo ratings yet

- PNB's vision to be the most admired financial services organizationDocument7 pagesPNB's vision to be the most admired financial services organizationHanz SoNo ratings yet

- Business Market VS Consumer MarketDocument3 pagesBusiness Market VS Consumer MarketDanielle TglgNo ratings yet

- Service Support Quick ReferenceDocument3 pagesService Support Quick ReferencemrcyberNo ratings yet

- Question 1Document1 pageQuestion 1Pragyan PrayasNo ratings yet

- Capable of Being Foretold: Found in The Ordinary Course of EventsDocument2 pagesCapable of Being Foretold: Found in The Ordinary Course of EventsIskandarAminudinNo ratings yet

- Maintenance ManagerDocument2 pagesMaintenance Managerapi-77939444No ratings yet

- Strategic Partnering Conceptual Framework - AcDocument4 pagesStrategic Partnering Conceptual Framework - AcTin Flores AlvairaNo ratings yet

- Human Relations TheoryDocument7 pagesHuman Relations Theoryg_kibrof75% (4)

- ISO 9001 Checklist Website Legal Compliance ProcedureDocument5 pagesISO 9001 Checklist Website Legal Compliance ProcedureCandiceNo ratings yet

- Tugas Cost AccountingDocument7 pagesTugas Cost AccountingRudy Setiawan KamadjajaNo ratings yet

- Accenture - The M& A EngineDocument26 pagesAccenture - The M& A EnginevarunNo ratings yet

- C TSCM52 65 Sample QuestionsDocument4 pagesC TSCM52 65 Sample Questionsolecosas4273No ratings yet

- Review: Midterm I Financial Accounting (2) Multiple Choice QuestionsDocument40 pagesReview: Midterm I Financial Accounting (2) Multiple Choice QuestionsC14041159王莫堯No ratings yet

- Concepts of Strategic Intent, Stretch, LeverageDocument16 pagesConcepts of Strategic Intent, Stretch, Leveragedhruv sharmaNo ratings yet

- Lesson 4 - The Historical Evolution of Operations ManagementDocument21 pagesLesson 4 - The Historical Evolution of Operations ManagementCherseaLizetteRoyPica100% (2)

- BSBPMG513 Task 1Document6 pagesBSBPMG513 Task 1Jose DiazNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- OS - New Balance ShoeDocument8 pagesOS - New Balance Shoe7aadkhanNo ratings yet

- Guide To Internal AuditDocument86 pagesGuide To Internal Auditradoniaina100% (1)

- 02 TQMDocument46 pages02 TQMimran27pk100% (6)