Professional Documents

Culture Documents

Memo To All SAs & ATLs On The Audit Observations o

Uploaded by

nikiboigeniusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memo To All SAs & ATLs On The Audit Observations o

Uploaded by

nikiboigeniusCopyright:

Available Formats

MEMORANDUM

TO

SUBJECT

DATE

Republic of the Philippines

COMMISSION ON AUDIT

Commonwealth Avenue, Quezon City, Philippines

CORPORATE GOVERNMENT SECTOR

Cluster 4 - Industrial and Area Development

ALL SUPERVISING AUDITORS / AUDIT TEAM LEADERS

Audit observations of the Bureau of the Treasury (BTr) Audit Team

affecting some GOCCs

September 15,2014

Attached are documents related to the above-captioned subject. Please pursue/follow up the

issues raised by the Auditor of the Bureau of Treasury as it pertains to your respective auditess.

LE~S

Director IV

LSP /medp/bdb

Re#vc 336-010-09152014

Commission on Audit

Commonwealth Ave., Quezon City

ACTION REFERRAL SLIP

OFFICJ ::: eoCGS OAC 1

09.12.14

OUT;:r:-:-: :

RI=FNO.:

(NGS -2) OAC-CG& 2014-09-12-0169

DATE RECEIVI=D; IN:

St::NDt::R;

Director Adelina Concepcion 1-. Ancajas

Auctit Observations of the Bureau of the Treasury (BTr) Audit Team affecting some

GOCCs

FOR:

o

0

o

Comments/Recommendation DSee me

lZIotners

oAppropriate Action

oReview/evaluation

oCompliance

lnforrnation

File

RI=MARKS:

.

Action

Officer

Date Ref~rredl

Date Received COMMENTS/ACTION MADE

MEMORANDUM

FOR

THRU

Assistant Commissioner WINNIE ROSE H. ENCALLADO

Head, Corporate Government Sector

Assistant CO~"issioneB~

Head, This Sector

SUBJECT Audit observations of the Bureau of the Treasury (BTr) Audit Team

affecting some GOCCs

DATE September 8, 2014

===============================================================

Attached is the matrix of issues and concerns and the corresponding resolutions

discussed during the meeting on August 15, 2014 with some CGS Cluster Directors,

Supervising Auditors, Audit Team Leaders relative to the audit observations noted by

the BTr Audit Team which are also the concern of some government-owned and/or

controlled corporations (GOCCs).

For information and appropriate action.

~.

ADELINA CONCEPCI~ ANCAJAS

Directo~~ ,

NGS/Cluster 2

ACLAlYNUIlGC

CGS-Resolution on BTR issues

Matrix of Issues and Concerns

Bureau of theTreasury-National Government

CY 2013

Agency BTr Audit Team ObservationslRecommendations Comments of CGS

.

NGS Rejoinder Resolution Agreed upon During

Concerned Directors/SAs/ ATLs the Meeting

CCP 1. Subsidies of three GOCCs for P20,190,426.00 intended for 1. Once the Subsidy to GOCCs are 1. According to SA 1. The concerned Auditors of

CIC MOOE were spent for PS received, the fund forms part of Myrna Monzon, the CGS should issue an audit

CITC CCP - 15,255,000 the Corporate Operating Budget COB should contain query onthese issues.

crc - 898,876 (COB), thus, theAuditor is information onthe

CITC - 4,035,550 unable to keep track if the Subsidy andthe Likewise, they should see to it

release was utilized as MOOE. intended purpose for that the Subsidies were utilized

which it was released. inaccordance with the

proposed project reflected in

the SARO.

LWUA 2. Subsidies ofP5,641,089.35 released to two GOCCs remained 2. Director J oseph Anacay 2. The Auditor of the LWUA

SSS unutilized as at year-end. observed that the status was as should look into the unutilized

of November 30,2013 which as balance of the Subsidy

Amount of

Amount of

of date, the amount could have

Name of Subsidy as of

Unutilized

been utilized.

GOCC November 30,

Subsidy

2013 The unexpended balance of the

1 LWUA F 10,700,000.00 P4,059,684.00 SSS had been utilized as of J uly

I

31,2014.

2 SSS 759,572,145.00 1,581,405.35

d

- - -

Total P-770,272,145.00 F5,641,089.35

.

Recommendation:

Management release funds only to GOCCs when needed to

forestall increase in unutilized subsidies and to require GOCCs

to submit reports on their utilization of subsidies received.

"

1

Agency

Concerned

Resolution Agreed upon During

the Meeting

BTr Audit Team ObservationslRecommendations

3. The subsidies given to the different GOCCs exceeded the

programmed budgetary support by M8,363,233,339.00

contrary to Chapter 35of Republic Act 10352. (Schedule 1)

Recommendation:

The Treasurer of thePhilippines request the DBM Secretary

for the legal b sis for therelease of SAROslNCAs totalling

P48,363,233,339.00 to GOCCs which exceeded their

programmed appropriations by F33,622,960,968.00

(excluding PDAF ofF57,590,000.00) and those without

programmed appropriations per GAA ofF14,740,272,371.00

(excluding PDAF ofF 58,222,265.00).

Comments of CGS

Directors/SAs/ ATLs

3. These releases may pertain to

Disbursement Acceleration

Program (DAP).

The CGS Auditors said that our

concern should only cover those

releases made after the DAP

was declared unconstitutional

since the implementing agencies

are only recipients of the fund.

Also, every Auditor should look

into the utilization of the

releases made prior to the

declaration, whether in

accordance to the projects stated

in the SAROs.

NGS Rejoinder

3. The CGS Auditors should

issuean Audit Observation

Memorandum and require that

unobligated balances should

no longer be utilized and the

corresponding balance ofNCA

bereturned to theNational

Treasury.

---. ~ ~~ _L _L ~L_ ~

DAP, DBP,

LCP, NDA,

Philhealth

4. Five GOCCs who were given budgetary support forCY 2012

were included in the thirty-one (31) GOCCs ordered to

refund to the government all bonuses, allowances and other

financial rewards given to officials and employees that were

considered by COA as unauthorized expenditure. (Schedule

2)

Recommendation:

Management coordinate with the Corporate Affairs Group

(CAG) of the DOF, in charge of the GOCCs to raise the

above cited issue in order that subsidies be given to GOCCs

who are financially unable and have really scarce/limited

resources in carrying out present Programs/Projects.

2

4. The GOCC Auditors shall look

into this issue.

Agency

Concerned

Resolution Agreed upon During

the Meeting

PAGCOR

BTr Audit Team ObservationslRecommendations

Unremitted PAGCOR share - PI8,047,297,434.29

Comments of CGS

Directors/SAs/ ATLs

NGS Rejoinder

5. NG share from PAGCOR revenues were not adjusted as at

year-end of CYs 2011-2013 resulting to under remittance of

P5,533,009,508.55 for 2011, P6,367,139,999.40 for 2012 and

P6,147,147,926.34 for 2013 or atotal ofP18,047,297,434.29

contrary to Section 12ofPD 1869

Section 12 of PD No. 1869 dated J uly 11, 1983 otherwise

known as the Charter of PAGCOR, as amended by PD 1993,

provides that after deducting five per cent (5%) from annual

gross earnings, as franchise tax, the NG shall have ashare of

fifty per cent (50%) of the gross earnings, or 60% if the

aggregate gross earnings less than ]2150,000,000.00.

Recommendation:

Require PAGCOR to remit P18,047,297,434.29, representing

unremitted share for CYs 2011-2013 and compute and

collect also the dividends due and demandable for CY 2010

andprior years since the creation of PAGCOR.

5.The computation ofNG's share

inthe earnings ofPAGCOR had

been elevated to the Supreme

Court (SC).

5. ThePAGCOR Auditor to

monitor status of thecase

elevated to the SC

PAGCOR 6. The duly certified statement disclosing gross earnings and

franchise tax payable as prescribed under par. 3.3 of the DOF

Circular 2-98 dated August 12, 1998 was not yet submitted

despite previous audit recommendation to do so.

Section 3.4 of the DOF Circular No. 2-98 dated August 12,

1998 setting the guidelines on the implementation of the

abovecited provision provides that "Adjustments in the

amount paid by PAGCOR to the National Treasury under

this Section shall be made at the end of each year based on

their audited financial statements which shall be submitted to

the BTr on or before 30 April of the fo llowing year".

3

6. The Supervising Auditor,

PAGCOR should require the

corporation to submit duly

certified statement disclosing

gross earnings and franchise

tax payable.

Agency BTr Audit Team ObservationslRecommendations Comments of CGS NGS Rejoinder Resolution Agreed upon During

Concerned Directors/SAs/ ATLs the Meeting

PAGCOR Unremitted PAGCOR share - P18,047,297,434.29

5. NG share from PAGCOR revenues were not adjusted as at 5.The computation ofNG's share 5. The PAGCOR Auditor to

year-end of CYs 2011-2013 resulting to under remittance of inthe earnings ofPAGCOR had monitor status of the case

,

P5;533,009;508.55 for 2011, P6,367,139,999.40 for 2012 and been elevated to the Supreme elevated to the SC

P6,147,147~926.34 for 2013 or atotal ofP18,047,297,434.29 Court (sq.

contrary to Section 12 of PD 1869

Section 12 of PD No. 1869 dated J uly 11, 1983 otherwise

known as the Charter of PAGCOR, as amended by PD 1993,

provides that after deducting five per cent (5%) from annual

gross earnings, as franchise tax, the NG shall have ashare of

fifty per cent (50%) of the gross earnings, or 60% if the

aggregate gross earnings less than-F150,000,000.00.

Recommendation:

Require PAGCOR to remitP18,047,297,434.29, representing

unremitted share for CYs 2011-2013 and compute and

collect also the dividends due and demandable for CY 2010

andprior years sincethe creation ofPAGCOR.

PAGCOR 6. The duly certified statement disclosing gross earnings and 6. The Supervising Auditor,

franchise tax payable as prescribed under par. 3.3 of the DOF PAGCOR should require the

Circular 2-98 dajed August 12, 1998 was not yet submitted

- -

corporation to submit duly

despite previous audit recommendation to do so. certified statement disclosing

gross earnings and franchise

Section 3.4 of the DOF Circular No. 2-98 dated August 12, tax payable.

1998 setting the guidelines on the implementation of the

abovecited provision provides that "Adjustments in the

amount paid by PAGCOR to the National Treasury under

this Section shall be made at the end of each year based on

their audited financial statements which shall be submitted to

the BTr on or before 30 April of thefollowing year".

3

Agency

Concerned

Resolution Agreed upon During

the Meeting

BTr Audit Team ObservationslRecommendations

Recommendations:

y' Require PAGCOR to adjust the 50% share of NG not later

than April 30 of each year andremit the same to theBTr.

y' Require PAGCOR to submit duly certified statement

disclosing gross earrnngs and franchise tax payable as

prescribed under par. 3.3 ofDOF Circular 2-98 since 1987.

7. Unremitted GOCCs dividend - P123,181,140,877.33

The GOCCs' dividends due and demandable of

P75,366,710,713.76 under RA 7656 for CY 2012 and 201"1

and prior years amounting to P47,814,430,163.57 or a total

of P123,181,140,877.33 had not been remitted in full, thus,

depriving the NG of additional resources to fund its

programs andprojects. (Schedule 3)

Recommendation

BTr-MAAD, in coordination with the DOF-CAG, ensure the

following:

y' Pursue aggressively the monitoring of GOCCs~compliance

to RA 7656 and enforce faithfully the penalty as provided

therefore aspart of the NG's efforts to generate theneeded

funds for the implementation of various programs and

projects; and

y' Prepare the necessary data on dividends due from the

GOCCs for CY s2012 and prior years based onnet earnings

as shown ontheir audited FSs and issue collection letters to

GOCCs on the dividends of P123,181,140,877.33 still due

the NG.

7. In2012, ameeting was 7. The GOCC Auditors shall look

attended by SA into this issue.

Monzon and Ms. Nory

J ozes-tc cliscusstk \

(

~endment toRA 7656

ontheexclusion of the

subsidies received by I )

theGOCCs fromthe V

~ ~

Comments of CGS

Directors/SAs/ ATLs

~ NGS Rejoinder

Inquiry fromDOF-

CAG onthe status

revealed that the

amendment was not yet

approved. Thus, the

audit group computed

the50% dividends due

toNG based on the net

income of the GOCCs.

This is in accordance

with Section 2 (d) and

Section 3of RA 7656

(copy of RA 7656

attached)

8. Unremitted dividends earned from NG's equity

contribution to GOCCs amounting to P3,780,907,534.02

4

8. The Auditors ofDBP, LWUA

and PADC shall look into this

Agency

Concerned

Resolution Agreed upon During

the Meeting

BTr Audit Team ObservationslRecommendations

Section 55 (4), Chapter 1, Title II, PD 1445provides that

"the auditor shall obtain through confirmation, among

others, sufficient evidential matter to afford himself a

reasonable basis for his opinions, judgments,

conclusions, and recommendations. "

Article 5 of Ownership and Operations Manual for the

GOCC Sector provides that "The State, as the Owner

representing the sovereign people, constitutes the

controlling interest in, or is the majority stockholder of

Gaees and Subsidiaries, and thereby exercises all the

prerogatives of ownership in every Gaee, including, but

not limited to the:

(a) right to register its equity holdings in the books of

the Gaee for all its equity investments therein,

together with the right to be issued certificates of stock

representing its investment in the Gaee;" State's Role

and Relationship with Gaees;

(b) right to dividends, when declared, pertaining to its

equity holdings in the Goee. ...

(g) right to receive a proportional share in the net

assets of the Gace upon its dissolution."

3,780,907~:;34.02

DBP P2,947,087,534.02 The unremitted dividend pertains

to 2013.

LWUA

8~() Q'l{\ {\{\{\ no Dividends for CYs2010 2013

PADC ~OOO,OOO.OO Y

Total

Recommendation

BTr pursue the collection of the unremitted dividends earned

from the concerned GOCCs and verify the financial status of

those GOCCs with no dividends.

Comments of CGS

Directors/SAs/ ATLs

5

NGS Rejoinder

issue.

"

REPUBLICACT NO. 7656 -

AN ACT REQUIRING GOVERNMENT-OWNED OR CONTPoLLED CORPORATiONs TO DECLARE

DiViDENDS UNDER CERTAIN CONDITIONS TO THE NATIONAL GOV~RNMENT, AND FOR OTHEIt

PURPOSES

SECTION 1. Declaration of Policy. - It is hereby declared the policy of the State that in order for

the National Government to realize additional revenues, government-owned or -controlled

corporations, without impairing their viability and the purposes for which they have been

established, shall share a substantial amount of their net earnings to the National Government.

SECTION 2. Definition of Terms. - As used in this Act, the term:

(a) "National Government" refers to the entire machinery of the central government, as

distinguished from the different forms of local governrnents.

(b) "Government-owned or controlled corporations" refers to corporations organized as a stock or

non-stock corporation vested with functions relating to public needs, whether governmental or

proprietary in nature, and owned by the Government directly or through its instrumentalitles elther

wholly or, where applicable as in the case of stock corporations, to the extent of at least fifty one

percent (51%) of ils capital stock. This term shall also include financial lnstttutlons, owned or

controlled by the National Government, but shall exclude acquired asset corporations, as defined ih

the next paragraphs, state Universities, and colleges.

(c) ."Acquired asset corporation" refers to a corporation: (1) which is under private ownership, the

voting or outstanding shares of which were: (i) conveyed to the Government or to a government

agency, instrumentality or corporation in satisfaction of debts whether by foreclosure of otherwise,

or (i1) duly acquired by the Government through final judgment in a sequestration proceeding; or (2)

which is a SUbsidiary of a government corporation organized exclusively to own and manage, or

lease, or operate specific physical assets acquired by a government financial institution In

satisfaction of debts incurred therewith, and which in anv case by law or by enunciated policy is

required to be disposed of to private ownership within a specified period of time.

(d) "Net earnlngs" shall-mean income derived from whatever source, whether exempt Or subject to

tax, het of deductions allowed Under Sectlon1.9 of the Natlonal lnternal Revenue Code, as amended,

and income tax and other taxes paid there~but in no case shall any reserve for whatever purpose

be allowed as a deduction from net earnings. ~<;,u. ?tI {7ul<A- t< J (Ile)

SECTION 3. Dividends. - All government-owned or -controlled corporations shall declare and

remit at least fifty percent (50%) of their annual net earnings as cash, stock or property dividends to

the National Government. This section shall also apply to those government-owned or -controlled

corporations whose profit distribution is provided by their respective charters or by special law, but

shall exclude those enumerated in Section 4 hereof: provided, that such dividends accruing to the

National Government shall be received by the National Treasury and recorded as income of the

General Fund.

SECTION 4. Exemptions. - The provisions of the preceding section notwithstanding, government-

owned or -controlled corporations created ( r organized 'by law to administer real or personal

properties or funds held in trust for the use and the benefit of its members, shall not be covered by

this Act such as, but not limited to: the Government Service Insurance System, the Home

Development Mutual Fund, the Employees Compensation Commission, the Overseas Workers

Welfare Administration, and the Philippine Medical Care Commission.

SECTION 5. Flexible Clause. - In the interest of national economy and general welfare, the

percentage of annual net earnings that shall be declared by a government-owned or -controlled

corporation may be adjusted by the President of the Philippines upon recommendation by the

Secretary of Finance.

SECTioN 6. Penalty. - Any member of the governing board, the chief executive officer and the

chief financial officer of a government-owned or -controlled corporation who violates any provision

of this Act or any of the implementing rules and regulations promulgated thereunder, in addition to

other sanctions provided by law, upon conviction thereof, shall suffer the penalty of a fine not less

than Ten thousand pesos (PiO,ooo.oO) but not more than Fifty thousand pesos (PsO,OOO.OO) or

imprisonment of not less than one (1) year but not more than three (3) years, or both, at the

discretion of the court.

SECTION 7. Implementing Rules and Regulations, - The Department of Finance shall formulate

and issue the necessary rules and regulations within sixty (60) days from the effectivity of this Act

and shall exercise primary jurisdiction in its implementation.

SECTION 8. Separability Clause. - If for any reason or reasons any part of the provision of this Act

shall be deemed to be unconstitutional or Invalid, the other parts or provisions hereof which are not

affected thereby shall continue to be in force and effect.

SECTION 9. Repealing Clause. - Executive Order No. 399, dated April 29, 1990, and other laws,

decrees, executive orders, letters of instruction, rules and regUlations, and portions thereof

inconsistent with the provisions of this Act are hereby repealed or modified accordingly.

SECTiON 10. Effectivity Clause. - This Act shall take effect fifteen (15) days after its publication in

the Official Gazette or in at least two (2) national newspapers of general circulation, whichever

comes earlier.

Approved: November 9, 1993

f'k< 2& ~ t?b ~ a ,f&uJ-Lr7'

p

- ...pJ is

~J g~ a-Iir~~ 7f ffA 7rf-l?-,

dde;e ~ VI' i'1'1%" t2.L ~o ~9 :!a

N~- 1) ;J If!.. (!/ -

Schedule 1- List of GOCCs that received subsidy not inaccordance with the GAA

Name of GO CC PerGAA SUbsidy Released

Under (Over)

Releases

A. GOCCs given subsidy beyond the GAA

1.

Credit Information Corporation 28,410,000.00 44,725,000.00 ( 16,315,000.00)

2. Center for International 'I rade

96,810,000.00 188,118,000.00 (91,308,000.00)

Expositions &Missions

3. Development Academy of the

129,300,000.00 135,330,920.00 (6,030,920.00)

Philippines

4. Lung Center of the Philippines 173,400,000.00 180,450,000.00 (7,050,000.00)

5. National Dairy Authority 261,744,000.00 761,744,000.00 (500,000,000.00)

6. National Electrification Administration 5,405.029,000.00 14,027 ,810,337.00 (8,622,781,337.00)

7. National Irrigation Administration 1,72_ '08,(lOO.00 3,024,241,784.00 (1,302,033,784.00)

8. National Kidney Transplant Institute 202,865,000.00 1,283,546,000.00 (1,080,681,000.00)

9. Philippine Coconut Authority 1,738,750,000.00 5,107,440,000.00 (3,368,690,000.00)

10. Philippine Center of Economic

14,500,000.00 72,835,000.00 (58,335,000.00)

Development

11.

Philippine Children Medical Center 345,000,000.00 349,330,000.00 (4,330,000.00)

12. Philippine Deposit Insurance

1,884,164,000.00 6,998,717,0001.00 (5,114,553,001.00)

Corporation

13. Philippine Heart Center 187,000,000.00 210,875,000.00 (23,875,000.00)

14. Philippine Institute for Development

33,000,000.00 37,000,000.00 (4,000,000.00)

Studies

15. Philippine Postal Corporation 301,000,000.00 1,173,548,026.00 (872,548,026.00)

16. Others 13,606,000.00 12,621,625,900.00 (J 2,608,0 19,900.00)

Sub-total l!i2,536,786,000.00 J ! 46,217,336,968.00 F(33,680,550,968.00)

B.

GOCCs not Included in the GAA as recipients of Subsidies

(/)1

17. Bangko Sentral ng Pilipinas 0.00 :317,000,000.00 (317,000,000.00)

18~Civil Aviation Authority of the Phi.i. 0.00 1,000,000,000.00 (1,000,000,000.00)

--r.Development Bank of the Philippines 0.00 420,746,708.00 (420,746,708.00)

20. Light Rail Transit Authorily 0.00 1,314,000,000.00 (1,314,000,000.00)

21. Local Water Utilities Administration 0.00 587,710,000.00 (587,710,000.00)

22. National Transmission Corporation 0.00 1,500,000,000.00 (1,500,000,000.00)

23. Philippine Health Insurance

0.00 95,047,365.00 (95,047,365.00)

Corporation (from DOH)

24. Power Sector Assets &Liabilities

0.00 8,134,690,381.00 (8,134,690,381.00)

Management Corporation

,

25. Social Housing Finance Corporation 0.00 19,728,037.00 (19,728,037.00)

~

..J~ Social Security System 0.00 759,572,145.00 (759,572,145.00)

J Tour!Sln Infrastructure and Enterprise

0.00 650,000,000.00 650,000,000.00

Zone Authority

Sub-total r 0.00 14,798,494,636.00 J !(14,798,494,636.00)

Grand Total 1'-12,536,786,000.00 I'- 61,015,831,604.00 1'-(48,479,045,604.00)

LessPDAF 115,812,265.00 (115,812,265.00)

Net l!12,536,786,OOO.OO J ! 60,900,019,339.00 J !(48,363,233,339.00)

Schedule 2 - GOCCs Who were givetl budgetary support for CY 2012 ordered to refund

Programmed Amount of Bonuses,

budgetary Actual releases in Allowances and Other

support per CY 2012 Ilnauclal rewards ordered

GAA fot refund

Development Academy of the Philippines F45,000,000.00

I! 48,195,900.00

I! 23,838,000.00

Development Bank of the Philippines 0.00 117,870,772.00 216,801,000.00

Lung Center of the Philippines 257,560,000.00 277,915,000.00 Not indicated

National Dairy Authoritv

170,472,000.00

.

170,472,000.00 Not indicated

Philltealth

1 0.00 14,068,084,040.00 1,651,084,000.00

1

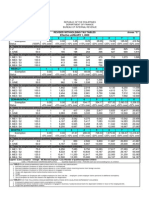

Schedule 3- Schedule of GOCCs with Unrernltted Dividends

1

.

2012 Net Income 50% Dividends Dividends paid in

Due &

Name otCorporation subjectto tu DUeunder itA CY 2013 rot 2012

Demandable

\

7656 7656 Income

A. GOCCs consldered parent corporations

-_.. -_.-.-

Bases Conversion

! fr

17 Development 5,157,550,100.00 2,578,775,050.00 679,012,168.00 1,899,762,882.00

Authority

v-----.

l1til Aviation

.

~~

32 uthority of the 1,925,707,420.00 962,853,710.00 0.00 961,853,710.00

< ~

Philippines

v 61

Laguna Lake

Development 3,062,535.00 1,531,267.50 0.00 1,531,267.50

Authority

(

/73

Manila International

2,640,559,099.00 1,320,279,549.50 1,008,034,244.89

Airport Authority

312,245,304.61

~3

National

)

Development 330,549,630.00 165,274,815.00 114,627,351.92 50,647,463.08

Company

V

94

National

Electrification 340,577,922.00 170,288,961.00 136,548,873.55 33,740,087.45

Administration

:'1

)14

Philippine

0

Aerospace

6,482,088.00 3,241,044.00 2,000,000.00 1,241,044.00

Development

Corporation o_ ____

..--

(\

V .

Philippine

4 Red arnati ort 2,163,463,965.00 1,081

1

731,982.50 0.00 1,081,731

1

982.50

Authority

..

(;

Tourism

1 5

Infrastructure and

1,236,181,257.00 618,090,628.50 0.00 618,090,628.50

Enterprise Zone

Authority

I

Tottil 1l!165

1

3:H;294,695.231'(!82;666,647,347.62 7,29~,936,633.86 75;366j710,713.16 I

;1

" ;

Dividends Due (CY 1012 AAR) and Remittances in CY 2013

Due and Demandable as GOCC

Particulars of December j 1, 2012 Remittances ill Due and Demandable

(pet 2012 AAA) 2013

2011

P-

8,242,668,532.32

P-

92,846,066.95

P-

8,149,822,465.37

2010 and orior years 39,814,607,698.20 150,000,000.00 39,664,607,698.20

Total l! 4S,057j276j230.52 l! 242,846,066.95

-P-

47,814,430,163.57

CY

2012

20li &PYs

Tota1

Amount

P 75,366,710,713.76

47,814.430,163.57

I1 12:t181.140,877.33

. "

. f .

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Executive Summary: Source/Nature Amount (In Million P)Document10 pagesExecutive Summary: Source/Nature Amount (In Million P)Unice GraceNo ratings yet

- A. Introduction The Department of Agriculture (DA) Is The Main Agency of The PhilippineDocument5 pagesA. Introduction The Department of Agriculture (DA) Is The Main Agency of The PhilippineOrlando V. Madrid Jr.No ratings yet

- 2016 3 CAAP Annual Audited Report Executive SummaryDocument4 pages2016 3 CAAP Annual Audited Report Executive SummaryKayla Christine OmbionNo ratings yet

- PHIVIDEC Industrial Authority Executive Summary 2020Document10 pagesPHIVIDEC Industrial Authority Executive Summary 2020RoNo ratings yet

- PNOC Alternative Fuels Corporation Executive Summary 2018Document4 pagesPNOC Alternative Fuels Corporation Executive Summary 2018Prabhakar BhandarkarNo ratings yet

- Executive Summary: Highlights of Financial OperationsDocument12 pagesExecutive Summary: Highlights of Financial OperationsJaniceNo ratings yet

- 2013 inDocument3 pages2013 inRahul KumarNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Aurora Executive Summary 2012Document7 pagesAurora Executive Summary 2012Mary Joy Sedenio LopezNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Moalboal Executive Summary 2014Document6 pagesMoalboal Executive Summary 2014Horace CimafrancaNo ratings yet

- Flora Executive Summary 2013Document3 pagesFlora Executive Summary 2013Drei GoNo ratings yet

- Philippine National Oil Company Executive Summary 2018Document5 pagesPhilippine National Oil Company Executive Summary 2018Charlie Maine TorresNo ratings yet

- Caap Es2012Document4 pagesCaap Es2012Winchelle Dawn Ramos LoyolaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- San Agustin Executive Summary 2016Document7 pagesSan Agustin Executive Summary 2016Ma. Danice Angela Balde-BarcomaNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- National Code: To Inform Yau of and CondudedDocument12 pagesNational Code: To Inform Yau of and CondudedKhush GosraniNo ratings yet

- SurigaoCity ES07Document4 pagesSurigaoCity ES07J JaNo ratings yet

- Doh 2011 Coa Observation RecommendationDocument71 pagesDoh 2011 Coa Observation RecommendationAnthony Sutton87% (15)

- Rizal Executive Summary 2015Document4 pagesRizal Executive Summary 2015Sittie RahmaNo ratings yet

- BinalonanWD-R1 ES2018Document4 pagesBinalonanWD-R1 ES2018J JaNo ratings yet

- Iligan City Executive Summary 2016Document11 pagesIligan City Executive Summary 2016crizeljane.enayudaNo ratings yet

- Dti Es2016Document5 pagesDti Es2016Amilius San GregorioNo ratings yet

- Executive SummaryDocument9 pagesExecutive SummaryjonquintanoNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 04-KalingaProvince2018 Executive SummaryDocument7 pages04-KalingaProvince2018 Executive SummaryMarcus SalvateroNo ratings yet

- Nickunj Exim BOI Stock AuditDocument2 pagesNickunj Exim BOI Stock AuditAvinash BaldiNo ratings yet

- Anda Executive Summary 2010Document5 pagesAnda Executive Summary 2010Henry AunzoNo ratings yet

- Bureau of Jail Management and Penology Executive Summary 2020Document6 pagesBureau of Jail Management and Penology Executive Summary 2020Jade MaratasNo ratings yet

- Gilgit Baltistan System of Financial Control 2009Document55 pagesGilgit Baltistan System of Financial Control 2009Muhammad ShakirNo ratings yet

- San Miguel Executive Summary 2012Document4 pagesSan Miguel Executive Summary 2012imnikki.gonzalesNo ratings yet

- KalingaProv ES2015Document4 pagesKalingaProv ES2015J JaNo ratings yet

- Cabatuan Executive Summary 2012Document7 pagesCabatuan Executive Summary 2012Steve RodriguezNo ratings yet

- Philippine National Construction Corporation Executive Summary 2019Document5 pagesPhilippine National Construction Corporation Executive Summary 2019reslazaroNo ratings yet

- FY 2020 Fund Release UTRMC FINAL WebsiteDocument35 pagesFY 2020 Fund Release UTRMC FINAL WebsitemgallegoNo ratings yet

- Rules of Finance & Budgeting Gilgit-Baltistan Under Self-Gov. Ordinance '09Document66 pagesRules of Finance & Budgeting Gilgit-Baltistan Under Self-Gov. Ordinance '09Razi Kazmee100% (2)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Prosperidad ADS ES2016Document66 pagesProsperidad ADS ES2016J JaNo ratings yet

- Josefina Executive Summary 2017Document8 pagesJosefina Executive Summary 2017Virgo Philip Wasil ButconNo ratings yet

- Dolores Executive Summary 2013Document6 pagesDolores Executive Summary 2013Lyrics DistrictNo ratings yet

- Land Transportation Office Executive Summary 2012Document13 pagesLand Transportation Office Executive Summary 2012lymieng Star limoicoNo ratings yet

- Sablayan Executive Summary 2016Document5 pagesSablayan Executive Summary 2016Leo M. SalibioNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- What Is GSTR-9C?: ReconciliationDocument7 pagesWhat Is GSTR-9C?: ReconciliationJatin ChoudaryNo ratings yet

- AC 518 Hand Outs Continuation Disbursements RepairedDocument17 pagesAC 518 Hand Outs Continuation Disbursements RepairedBenzell Ann BathanNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- RR No. 12-2021Document3 pagesRR No. 12-2021eric yuulNo ratings yet

- Esperanza Executive Summary 2018Document5 pagesEsperanza Executive Summary 2018Ma. Danice Angela Balde-BarcomaNo ratings yet

- Executive Summary: A. IntroductionDocument6 pagesExecutive Summary: A. IntroductionMarcoNo ratings yet

- Company Annual Report 2017-18Document27 pagesCompany Annual Report 2017-18Elaina fernandoNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Anglo Ventures Corporation Executive Summary 2020Document3 pagesAnglo Ventures Corporation Executive Summary 2020Don Michaelangelo BesabellaNo ratings yet

- PCSO Performance Scorecard 2013 2014Document12 pagesPCSO Performance Scorecard 2013 2014Rufino Gerard MorenoNo ratings yet

- Other Matter PDFDocument142 pagesOther Matter PDFMubarrach MatabalaoNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Civil Aviation Authority of The Philippines Executive Summary 2020Document6 pagesCivil Aviation Authority of The Philippines Executive Summary 2020shiela.rebamonte20No ratings yet

- Letter Head Commission On AuditDocument1 pageLetter Head Commission On AuditnikiboigeniusNo ratings yet

- Transmital Letter For CCP On Cash AdvanceDocument1 pageTransmital Letter For CCP On Cash AdvancenikiboigeniusNo ratings yet

- Live-View Remote: Rm-Lvr1Document16 pagesLive-View Remote: Rm-Lvr1nikiboigeniusNo ratings yet

- Full Texts of Cases Under Administrative LawDocument116 pagesFull Texts of Cases Under Administrative LawnikiboigeniusNo ratings yet

- BSP Papal CoinDocument1 pageBSP Papal CoinisluvhimNo ratings yet

- Revised Rules of ProcedureDocument24 pagesRevised Rules of ProcedurenikiboigeniusNo ratings yet

- Stonehill Vs DioknoDocument2 pagesStonehill Vs DioknojelyneptNo ratings yet

- Monetization of Leave Credits PDFDocument1 pageMonetization of Leave Credits PDFnikiboigeniusNo ratings yet

- GAA 2013 General ProvisionsDocument107 pagesGAA 2013 General ProvisionsnikiboigeniusNo ratings yet

- EXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UnderDocument1 pageEXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UndernikiboigeniusNo ratings yet

- Fraud Audit and Investigation Office0001Document1 pageFraud Audit and Investigation Office0001nikiboigeniusNo ratings yet

- Commission On Audit: Transmittal of Technical Evaluation ReportDocument1 pageCommission On Audit: Transmittal of Technical Evaluation ReportnikiboigeniusNo ratings yet

- Coa C2014-003Document53 pagesCoa C2014-003Mark Lester Lee AureNo ratings yet

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- Consti1 Course OutlineDocument22 pagesConsti1 Course OutlinenikiboigeniusNo ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- Republic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditDocument4 pagesRepublic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditnikiboigeniusNo ratings yet

- AutobahnDocument2 pagesAutobahnnikiboigeniusNo ratings yet

- Political LawDocument15 pagesPolitical LawRaymund Flores100% (1)

- Fina L CCP AOM 2013 01 SubsidyDocument6 pagesFina L CCP AOM 2013 01 SubsidynikiboigeniusNo ratings yet

- David vs. ArroyoDocument5 pagesDavid vs. ArroyoDeus Dulay93% (14)

- Recoletos Law Center Notes On LaborDocument33 pagesRecoletos Law Center Notes On LabornikiboigeniusNo ratings yet

- DAP Separate Opinion SAJ Antonio T. CarpioDocument27 pagesDAP Separate Opinion SAJ Antonio T. CarpioHornbook RuleNo ratings yet

- Labor LawDocument17 pagesLabor LawRaymund Flores100% (2)

- Environmental RationaleDocument97 pagesEnvironmental Rationalegoannamarie7814No ratings yet

- ATENEO EvidenceDocument51 pagesATENEO Evidencevanessa pagharion100% (9)

- Law On Natural Resources Reviewer PDFDocument108 pagesLaw On Natural Resources Reviewer PDFKrisLarrNo ratings yet

- Ateneo 2007 Criminal ProcedureDocument69 pagesAteneo 2007 Criminal ProcedureJingJing Romero98% (55)

- Judicial Affidavit RuleDocument10 pagesJudicial Affidavit RulenikiboigeniusNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument3 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Adw e 112 2002 PDFDocument6 pagesAdw e 112 2002 PDFPaapu ChellamNo ratings yet

- Vda. de Sta. Romana v. PCIBDocument2 pagesVda. de Sta. Romana v. PCIBM Grazielle Egenias100% (2)

- Parish Nurse Ministry Waiver FormDocument1 pageParish Nurse Ministry Waiver Formapi-265745737No ratings yet

- Reschenthaler DOD EcoHealth LetterDocument2 pagesReschenthaler DOD EcoHealth LetterBreitbart News100% (1)

- The Economic Loss DoctrineDocument9 pagesThe Economic Loss DoctrineK CorNo ratings yet

- Complainant,: Complaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully AllegesDocument5 pagesComplainant,: Complaint-Affidavit THE UNDERSIGNED COMPLAINANT Respectfully AllegesBeta Sigma Lambda Marawi ChapterNo ratings yet

- Socio-Economic & Political Problems (CSS - PCS.PMS)Document4 pagesSocio-Economic & Political Problems (CSS - PCS.PMS)Goharz2100% (2)

- IPAP vs. OchoaDocument15 pagesIPAP vs. OchoaDaryl YangaNo ratings yet

- Republic Act No. 9729 - Official Gazette of The Republic of The PhilippinesDocument17 pagesRepublic Act No. 9729 - Official Gazette of The Republic of The PhilippinesAbs PangaderNo ratings yet

- The Public Liability Insurance Act, 1991Document8 pagesThe Public Liability Insurance Act, 1991Karsin ManochaNo ratings yet

- Lis Mota CasesDocument42 pagesLis Mota CasesPat PatNo ratings yet

- Appeal Procedure Flowchart 2Document1 pageAppeal Procedure Flowchart 2MorphuesNo ratings yet

- Andrew Jackson EssayDocument5 pagesAndrew Jackson Essayjulie_noble_1No ratings yet

- General Exceptions To IPCDocument14 pagesGeneral Exceptions To IPCNidhi SinghNo ratings yet

- Untitled DocumentDocument40 pagesUntitled DocumentVee Jay DeeNo ratings yet

- Bench Guidelines and PoliciesDocument3 pagesBench Guidelines and PoliciesEscalation ACN Whirlpool50% (2)

- DM - 2023 Celebration of NCMDocument2 pagesDM - 2023 Celebration of NCMJoanna Marie MenorNo ratings yet

- Rule of Strict Liability in Motor Accidents Adopted - Air 2001 SC 485Document6 pagesRule of Strict Liability in Motor Accidents Adopted - Air 2001 SC 485Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- Agapito Del Rosario, Angeles City, Pampanga: May 9, 2016 National and Local ElectionsDocument2 pagesAgapito Del Rosario, Angeles City, Pampanga: May 9, 2016 National and Local ElectionsSunStar Philippine NewsNo ratings yet

- Diocese of Bacolod V COMELECDocument2 pagesDiocese of Bacolod V COMELECdragon stickNo ratings yet

- 13.1 PP 415 426 Private International Law Aspects of Intersex PDFDocument12 pages13.1 PP 415 426 Private International Law Aspects of Intersex PDFBeatrice GagliardoNo ratings yet

- Qffiq: Titlrt FDocument2 pagesQffiq: Titlrt Frebek heruNo ratings yet

- Family Law Manual 01-11 - FINAL PDFDocument346 pagesFamily Law Manual 01-11 - FINAL PDFDaisy GriffinNo ratings yet

- SEBI Vs Sahara Analysissebi Vs SaharaDocument4 pagesSEBI Vs Sahara Analysissebi Vs SaharaPratik ShuklaNo ratings yet

- Oman Income TaxDocument84 pagesOman Income TaxsoumenNo ratings yet

- Course OutlineDocument7 pagesCourse OutlineDesmondNo ratings yet

- Motion To Withdraw FundsDocument2 pagesMotion To Withdraw FundsTenshi FukuiNo ratings yet

- Simeen Hussain Rimi: Early Life and EducationDocument1 pageSimeen Hussain Rimi: Early Life and EducationDr. Molla Abdus SattarNo ratings yet