Professional Documents

Culture Documents

Marriott Valuation

Uploaded by

Oladipupo Mayowa PaulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marriott Valuation

Uploaded by

Oladipupo Mayowa PaulCopyright:

Available Formats

Valuation of Marriott International Hotels,

Incorporated

Prepared by:

Allison J ohnston

Finance 129

Dr. K.C. Chen

May 15, 2007

Table of Contents

Company Overview .......................................................................................................... 3

Background..................................................................................................................... 3

Awards and Recognition................................................................................................. 3

Recent News................................................................................................................... 4

Investment Opportunities and Risks............................................................................... 5

Investment Opportunities................................................................................................ 5

Investment Risks............................................................................................................. 6

Historical Financial Performance ................................................................................... 6

Historical NOPLAT, Historical Invested Capital, and Historical Free Cash Flow.... 8

Calculation of Historical NOPLAT................................................................................ 8

Calculation of Historical Invested Capital...................................................................... 8

Calculation of Historical Free Cash Flow....................................................................... 9

Free Cash Flow Forecast and Assumptions.................................................................... 9

Valuation.......................................................................................................................... 11

Calculating WACC....................................................................................................... 12

Free Cash Flow Approach............................................................................................ 13

NOPLAT Approach...................................................................................................... 14

EBITDA Approach....................................................................................................... 14

Relative Approach........................................................................................................ 14

Holding Period Return.............................................................................................. 15

Recommendation............................................................................................................. 15

Appendix.......................................................................................................................... 16

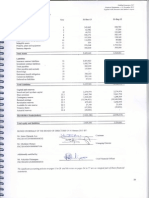

Consolidated Statement of Earnings and Shareholders Equity................................... 16

Consolidated Balance Sheets........................................................................................ 16

Historical NOPLAT...................................................................................................... 16

Historical Invested Capital............................................................................................ 16

Historical Free Cash Flows........................................................................................... 16

Beta Calculation............................................................................................................ 16

Inputs for Present Value Calculations.......................................................................... 16

Valuation Calculations.................................................................................................. 16

2

Company Overview

Background

Marriott International Hotels, Incorporated (MAR) is a worldwide operator and

franchisor of hotels and related lodging facilities. Founded in 1971, Marriott

International operates or franchises 2,832 lodging properties worldwide and provides

2,046 furnished corporate housing rental units. Marriott operates internationally in the

Americas, Europe, Asia, the Middle East, the United Kingdom, and Africa. Marriott

International is headquartered in the Washington D.C. area and as of year-end 2006

employed nearly 151,000 people.

1

Awards and Recognition

Marriott International has received numerous honors in recent years for being an

outstanding company that prides itself on employee satisfaction and its ongoing

commitment to diversity. Marriott International received the following list of awards

2

over the last year:

March 2007 Marriott International was recognized by the National Association

for Female Executives (NAFE) as one of the top 10 companies on their 2007 list

of Top 30 Companies for Executive Women.

February 2007 Marriott International was recognized as one of Americas

Most Admired Companies and for the eighth consecutive year was named the

most admired company in the lodging industry by FORTUNE Magazine.

1

source: www.marriott.com

2

source: www.marriott.com

3

J anuary 2007 Marriott International was recognized by FORTUNE Magazine,

for the 10

th

consecutive year, as one of the 100 Best Companies to Work for.

September 2006 Marriott International was ranked seventh as one of the most

innovative users of technology in the U.S. by Information Week.

September 2006 Marriott International was ranked 11

th

on the list of the Top

50 Companies for Hispanics by Hispanic Business Magazine.

J uly 2006 Marriott International was named one of the ten best companies for

teens by Seventeen Magazine.

J uly 2006 For the seventh time, Marriott International was ranked the highest of

any global lodging company in the NAACPs annual lodging industry report card.

Recent News

May 3, 2007 - Marriott Presence in Greater Shanghai Region to Expand with New

J W Marriott and Courtyard Hotels in Hangzhou

3

: By the end of 2009, Marriott

will offer travelers to the Shanghai region a choice of 15 hotels. In the next three

years, Marriott plans to open a 330-room J W Marriott Hotel Hang Zhou and a

330-room Courtyard by Marriott Hang Zhou City Center.

May 3, 2007 Pres. Bush invites Marriott to Share Successes of English Learning

Program

4

: President Bush invited Marriott to share the companys success with

Sed de Saber , a handheld device used to enhance English language skills of

Spanish-speaking employees.

3

source: www.finance.yahoo.com

4

source: www.finance.yahoo.com

4

Marriott launched the Sed de Saber nationwide in February 2007 after a study

showed that 85 percent of people who used the product improved in English

language proficiency. Marriotts participation in improving the language skills of

its employees illustrates its ongoing commitment to diversity and customer

satisfaction.

April 27, 2007 Marriott International Raises Dividend

5

: Marriott increased the

quarterly dividend 20 percent from 6.25 cents to 7.5 cents.

April 19, 2007 Marriott posts higher first-quarter profit

6

: Marriotts first-quarter

profits rose sharply due to higher revenue per available room and improved

margins. Revenue rose 7 percent and earnings beat analyst estimates. Analysts

expected first-quarter earnings per share to be $0.38, but were surpassed by actual

earnings per share of $0.40.

Investment Opportunities and Risks

Investment Opportunities

Technical Analysis

7

Overall, the stocks technical analysis shows a strong upward trend since the

beginning of 2003. From August 2006 to December 2006 the stock rose nearly

$14.00, which eventually resulted in a slight correction in the early months of

2007.

5

source: www.reuters.com

6

source: www.marketwatch.com

7

source: www.bigccharts.com

5

Earnings Estimates

8

Marriotts EPS estimates for the past two quarters, $0.30 (Sept. 06) and $0.49

(Dec. 06), were lower than the actual EPS for the quarters, $0.34 and $0.52,

respectively. These recent earnings imply that the company is outperforming

expectations.

Expansion

9

Over the next three years Marriott plans to expand business by building 85,000 to

100,000 hotel rooms worldwide. Marriott plans to open nearly one-third of these

hotel rooms outside of North America. Marriott is continuously expanding

business to remain profitable and accommodate its customers.

Investment Risks

Competitors and Industry

10

The lodging industry is highly competitive and Marriott faces challenges in

finding ways to distinguish its products from competitors. Marriott may have

difficulty finding ways of differentiating its quality, value, and efficiency from

competitors.

Historical Financial Performance

In order to conduct a thorough and accurate valuation of Marriott International, it

was necessary to examine Marriotts historical financial performance by re-creating the

balance sheet and income statement for the last five years.

11

8

source: www.finance.yahoo.com

9

source: www.marriott.com - 2006 Annual Report

10

source: www.marriott.com - 2006 Annual Report

11

source: www.ADVFN.com

6

Analyzing past performance provides insight into what can be expected from the

company in the future, as well as aid in the development of the assumptions and growth

rates used in constructing the free cash flows at the end of this analysis.

Highlights of Marriott Internationals income statement include decreasing cost of

sales as a percentage of revenue and increasing EBIT as a percentage of revenue.

Marriott has experienced steady increases in diluted earnings per share over the last five

years. Unfortunately, Marriott International encountered a significant increase in income

tax provision and an increase in the change in cumulative effect of accounting, resulting

in a lower net income for 2006 compared to the net income in 2005.

Highlights of Marriott Internationals balance sheet include: significant increase

in current assets in 2006 (large increase in inventory), significant decline in fixed assets

in 2006, increases in long-term debt, and large increases in treasury stock.

Although these financial statements provide useful data in understanding

Marriotts financial position, to project the companys future cash flows one must

separate operating performance, nonoperating performance, and capital structure, which

is where the financial statements fall short by combining these components.

12

Therefore,

the financial statements must be reorganized to calculate net operating profits less

adjusted taxes (NOPLAT) and invested capital, which are then used to calculate the free

cash flow.

12

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

7

Historical NOPLAT, Historical Invested Capital, and Historical

Free Cash Flow

Calculation of Historical NOPLAT

NOPLAT represents the total after-tax operating income generated by the

companys invested capital, available to all financial investors, which includes debt

holders and equity holders.

13

Marriotts NOPLAT is equal to earnings before interest and

taxes (EBIT) less operating cash taxes. The calculation of operating cash taxes can be

found in the spreadsheets accompanying this analysis.

To verify Marriotts NOPLAT figure is correct a reconciliation of net income was

calculated. To calculate the reconciliation, start with net income and subtract the

decrease in deferred taxes and the gain in minority interest to arrive at adjusted net

income. Next, add after-tax interest paid, add the cumulative accounting change, and the

gain/loss from discontinued operations to arrive at total income available to all investors.

With this figure, subtract after-tax interest received and subtract after-tax other income

received to arrive at NOPLAT. The reconciliation of net income method used to

calculate Marriotts NOPLAT verified that the initial NOPLAT calculation was correct

because both methods resulted in the same figure.

Calculation of Historical Invested Capital

Invested capital is the investor capital required to support operations with no

distinction made between debt and equity.

14

13

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

14

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

8

To calculate Marriotts total funds invested, (1) subtract operating liabilities from

operating assets, (2) add net property and equipment, (3) add net other assets, and (4) add

goodwill. To verify the total funds invested figure is correct the following calculation

was used as a check: (1) start with interest bearing debt, (2) subtract deferred taxes, (3)

add net common stock and paid-in capital, (4) add retained earnings, (5) subtract treasury

stock, (6) add/subtract accumulated other comprehensive income, and (7) add minority

interest.

Calculation of Historical Free Cash Flow

Free cash flow is defined as NOPLAT plus non-cash operating expenses less

investments in invested capital.

15

Marriotts historical free cash flow was calculated as

follows: depreciation was added to NOPLAT to get gross cash flow. Next, (1) subtract

increase or add decrease in operating working capital, (2) add/subtract capital

expenditures, (3) add decrease/subtract increase in other assets, (4) subtract/add

investment in intangibles and goodwill, and (5) add increase/subtract decrease in

accumulated comprehensive income to get gross investment. Last, add gross cash flow to

gross investment to arrive at free cash flow. The reconciliation of the free cash flow is

available in the spreadsheets at the end of this analysis.

Free Cash Flow Forecast and Assumptions

To construct the forecasted free cash flow, assumptions about the companys

future performance were developed. All assumptions were based on historical trends and

averages, and stock data published by Yahoo! Finance, Morningstar, Value Line,

Advanced Financial, and the companys most recent 10-K annual report.

15

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

9

To determine percentages, income statement items were divided by sales and balance

sheet items were divided by sales. The following section explains the reasoning behind

the most important assumptions used in creating Marriotts forecasted free cash flow.

Revenue: Revenue growth rates were projected based on the growth rate

estimates provided by Value Line.

16

Over the past five years, Marriott

experienced an average growth rate of 6% but is expected to see increased

revenue growth in the future. Marriott experienced strong earnings in the 1

st

quarter of 2007 and continues to expand by building new hotels in the U.S. and

overseas. Therefore, based on my research and the estimates provided by Value

Line, I expect revenue to grow at a rate of 12% from 2007 through 2011. After

2011, I project revenue growth to gradually fall to 11% in 2012 and to 7% by

2016. This slowdown in revenue growth will most likely be the result of

saturation in the market.

EBIT: Operating margins over the last five years have fluctuated between 8%

and 4%. However, I project EBIT as a percentage of sales to rise to 8.5% from

2007 to 2011. It appears Marriotts selling and occupancy expense may have

peaked in 2005 and this expense may not be has high in the future, thus resulting

in a slightly higher EBIT. After 2011, I project EBIT to decline slightly to 8%

and remain at this level until 2016.

16

source: Value Line. CSUF Library

10

NOPLAT: NOPLAT has performed in much the same way as EBIT over the last

five years. I project NOPLAT to remain around 6.57% through 2011, and then

decrease slightly to 6.18% through 2016, as margins may be affected by the

increased cost of expansion abroad.

Depreciation: Depreciation is expected to stay between 1.50 and 1.55 percent

through 2016, a little less than the historical average.

Working Capital: Working capital experienced some fluctuation over the last

five years, but is expected to remain at about 5.50% of sales through 2016.

Capital Expenditures: In 2006, Marriott experienced a significant decline in

capital expenditures. I did not predict this unusual occurrence to continue in the

future since the company appears to be growing through domestic and

international expansion. Therefore, capital expenditures from 2007 through 2016

were computed as the difference between the current and previous years fixed

assets, plus the free cash flow of the current year.

Other Assets: The other assets category encompasses many unknowns and I do

not feel comfortable forecasting this number. Therefore, I will use a constant

15% of sales through 2016, which is only a little less than the historical other

assets figure as a percent of sales in 2006.

Valuation

The enterprise discounted cash flow model was used to value Marriott because

this model focuses on the companys operating cash flows and works best with

companies that manage their capital structure at target levels.

17

17

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

11

The value of a business is defined as the present value of expected future cash flows plus

the present value of the continuing value, or the expected cash flow beyond the explicit

forecast period.

18

To find the present value of expected future cash flows and the present

value of the continuing value, one must discount the expected future cash flows and

continuing value at the weighted average cost of capital (WACC). The weighted average

cost of capital is used as the discount rate because the free cash flows are discounted to

both shareholders and bondholders.

Calculating WACC

Marriotts WACC was determined by using the following formula:

WACC =k

e

(E/(E+D)) +k

d

(1-T)(D/(E+D))

The WACC inputs were determined as follows:

k

e

(9.21%) represents the cost of equity and was determined using the Capital

Asset Pricing Model (CAPM). CAPM is calculated by multiplying beta by the

market risk premium and then adding the risk-free rate. Marriotts CAPM was

developed using the following inputs:

o Risk-free rate (4.71%) - the 10-year treasury strip as of 12/31/06.

19

o Adjusted beta (1.1250) computed by regressing Marriotts stock returns

against the markets returns over the last five years.

20

Beta was then

adjusted for regressing tendency using the following formula: .33 +

.67(beta).

18

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

19

source: Federal Reserve Bank of St. Louis

20

source: www.finance.yahoo.com

12

o Market risk premium (4%) over the last several years market risk

premiums have fluctuated between 4.5% and 5.5%,

21

but for the purposes

of this paper 4% was used.

Weight of equity (84.28%) computed by dividing the market value of equity by

the total value of debt and equity.

k

d

(5.60%, after-tax 4.33%) computed by averaging the weighted yield-to-

maturity on outstanding debt according to the S&P 500 Bond Index.

Weight of debt (15.72%) computed by dividing total interest-bearing debt by

the total value of debt and equity.

These inputs resulted in a WACC of 8.44%. WACC was then used to discount the free

cash flows and the continuing value. Three different approaches were used to calculate

the continuing value, the free cash flow approach, the NOPLAT approach, and the

EBITDA approach.

Free Cash Flow Approach

The free cash flow approach resulted in a continuing value of $18.415 billion

giving the firm a total value of $23.100 billion. After the subtraction of debt, the total

value of equity was equal to $19.638 billion. The total value of equity divided by the

number of common shares outstanding (389.5) resulted in an intrinsic share price of

$50.42. Marriotts stock price as of December 29, 2006 was $47.66,

22

indicating the

stock is undervalued.

21

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

22

source: www.finance.yahoo.com

13

NOPLAT Approach

The NOPLAT approach resulted in a continuing value of $17.685 billion giving

the firm a total value of $22.371 billion. After subtracting debt, the total value of equity

was equal to $18.908 billion. The total value of equity divided by the number of

common shares outstanding (389.5) resulted in an intrinsic share price of $48.55.

Marriotts stock price as of December 29, 2006 was $47.66,

23

indicating the stock is

slightly undervalued.

EBITDA Approach

The EBITDA approach resulted in a continuing value of $18.099 billion giving

the firm a total value of $22.785 billion. After subtracting debt, the total value of the

equity was equal to $19.322 billion. The total value of equity divided by the number of

common shares outstanding (389.5) resulted in an intrinsic share price of $49.61.

Marriotts stock price as of December 29, 2006 was $47.66,

24

indicating the stock is

slightly undervalued.

Relative Approach

The relative approach requires an earnings per share (EPS) estimate, a price-to-

earnings ratio, and the cost of equity. Marriotts normalized annual P/E of 25.29 was

computed by averaging annual P/E ratios over the last ten years, with extreme outliers

excluded.

25

According to Yahoo! Finance, Marriotts estimated EPS for December 2008

is $2.30.

26

Based on these two figures I calculated a stock price of $58.17 (25.29 x

$2.30) for the year ending December 2008.

23

source: www.finance.yahoo.com

24

source: www.finance.yahoo.com

25

source: www.morningstar.com

26

source: www.finance.yahoo.com

14

This value, discounted at the cost of equity of 9.21%, for 2 years, equals $48.77.

Marriotts estimated cost of equity was computed with a risk-free rate of 4.71%,

27

adjusted beta of 1.1250, and market risk premium of 4%. Marriotts stock price as of

December 29, 2006 was $47.66, indicating the stock is slightly undervalued.

Holding Period Return

The holding period return of Marriott if purchased December 29, 2006 and sold in

December of 2008 is 22.05% or ($58.17-$47.66/$47.66).

Recommendation

Stock Price as of 12/29/06 $47.66

FCF Approach $50.42

NOPLAT Approach $48.55

EBITDA Approach $49.61

Although the three approaches used in this valuation indicate Marriotts stock is

undervalued, I feel the free cash flow approach is the most appropriate in terms of

accuracy. I believe the NOPLAT approach understated the continuing value and the

EBITDA approachs multiple may need to be adjusted for expected investments in

working capital and property, plant, and equipment.

28

In conclusion, I believe as of

December 29, 2006 Marriotts stock was slightly undervalued and may be a worthwhile

long-term investment.

27

source: Federal Reserve Bank of St. Louis

28

source: Koller, Goedhart, and Wessels. Valuation. 4

th

ed. 2005

15

Appendix

Consolidated Statement of Earnings and Shareholders

Equity

Consolidated Balance Sheets

Historical NOPLAT

Historical Invested Capital

Historical Free Cash Flows

Beta Calculation

Inputs for Present Value Calculations

Valuation Calculations

16

You might also like

- Four Seasons Hotel SWOT and trends analysisDocument4 pagesFour Seasons Hotel SWOT and trends analysisGovinda Senapati50% (4)

- Sweat GaloreDocument17 pagesSweat GaloreMuhdAfiq50% (2)

- Marriott International (Strategic Mangment Project)Document39 pagesMarriott International (Strategic Mangment Project)faheem441290% (31)

- Marriott's Customer - FocusedDocument16 pagesMarriott's Customer - FocusedMamta DesaiNo ratings yet

- Hotel MarketingDocument5 pagesHotel MarketingAl AminNo ratings yet

- Valuation Practices Survey 2013 v3Document36 pagesValuation Practices Survey 2013 v3Deagle_zeroNo ratings yet

- Examples EconometricsDocument3 pagesExamples EconometricsHương LêNo ratings yet

- Marriott ProjectDocument12 pagesMarriott ProjectSiddhartha DudhgaonkarNo ratings yet

- Marriott InternationalDocument10 pagesMarriott InternationalYogesh Godhwani100% (1)

- Hotel IndustryDocument47 pagesHotel Industrysreenivasulu_5100% (3)

- Tanner 02Document30 pagesTanner 02Saloni JainNo ratings yet

- Balance Sheet: United Spirits Limited Annual ReportDocument4 pagesBalance Sheet: United Spirits Limited Annual ReportUppiliappan GopalanNo ratings yet

- Key Financial RatiosDocument7 pagesKey Financial RatiosDeepankumar AthiyannanNo ratings yet

- Fundamentals of Corporate Finance Chap 001Document18 pagesFundamentals of Corporate Finance Chap 001tyremiNo ratings yet

- Ratio Analysis BankDocument7 pagesRatio Analysis BankashishNo ratings yet

- Corporate finance group work analysis and WACC calculationsDocument15 pagesCorporate finance group work analysis and WACC calculationscaglar ozyesilNo ratings yet

- Fin 444 Chapter 1Document19 pagesFin 444 Chapter 1Ovick AhmedNo ratings yet

- Marriott International COPORATE STRATEGYDocument5 pagesMarriott International COPORATE STRATEGYYasir Jatoi100% (1)

- Starwood Hotel 2007Document31 pagesStarwood Hotel 2007Mohd Bunyamin Abd Rahman100% (8)

- Marriott International Research PaperDocument7 pagesMarriott International Research Paperc9s9h7r7100% (1)

- Marriott Hotels (UK)Document27 pagesMarriott Hotels (UK)Russell MonroeNo ratings yet

- Marriott 11 ArDocument116 pagesMarriott 11 ArDuskRiderNo ratings yet

- Table of ContentsDocument20 pagesTable of Contents杨滨榕No ratings yet

- Business & Company Resource Center Curriculum Support DemonstrationDocument6 pagesBusiness & Company Resource Center Curriculum Support DemonstrationEsther LywNo ratings yet

- Marriott InternationalDocument32 pagesMarriott InternationaljashanNo ratings yet

- Marriott: Individual Strategic AnalysisDocument61 pagesMarriott: Individual Strategic AnalysisErica PoyauanNo ratings yet

- Revised SWOT With ExplanationDocument6 pagesRevised SWOT With ExplanationJomar ViconiaNo ratings yet

- MarriotDocument38 pagesMarriotiqra javed100% (1)

- Marriott 11 ArDocument116 pagesMarriott 11 ArAriyo JincaNo ratings yet

- Draft of Communication Plan 1Document13 pagesDraft of Communication Plan 1api-709819015No ratings yet

- Project 3 395Document16 pagesProject 3 395books_requiredNo ratings yet

- Financial Ratio AnalysisDocument53 pagesFinancial Ratio AnalysisLaurentia Nurak100% (4)

- Executive Summary of Marriott InternationalDocument53 pagesExecutive Summary of Marriott InternationalAman Khanna67% (3)

- Marriott InternationalDocument31 pagesMarriott InternationalSalmAn WaraIch100% (3)

- Slowing in The Middle East and in AsiaDocument13 pagesSlowing in The Middle East and in AsiamartinamichealNo ratings yet

- Jones Consulting Team 4 Written Deliverable.Document24 pagesJones Consulting Team 4 Written Deliverable.JonesConsultingTCUNo ratings yet

- Marriott Research PaperDocument8 pagesMarriott Research Paperhfuwwbvkg100% (1)

- EA210115 Ionut Tepes Icon HMEDocument15 pagesEA210115 Ionut Tepes Icon HMEMinhaz RahmanNo ratings yet

- SWOT Analysis of Marriott Hotels and ResDocument6 pagesSWOT Analysis of Marriott Hotels and ResyodabyssiniabidNo ratings yet

- A Study of Customer Satisfaction Towards Marriott Hotel, JaipurDocument26 pagesA Study of Customer Satisfaction Towards Marriott Hotel, JaipurAhmed alabiNo ratings yet

- Morgan Stanley Thrives Despite Banking Industry RecessionDocument27 pagesMorgan Stanley Thrives Despite Banking Industry RecessionttsopalNo ratings yet

- Marriott International Case FinalDocument49 pagesMarriott International Case Finalapi-531824831No ratings yet

- Marriott International ReportDocument9 pagesMarriott International ReportJaivinder Singh SandhuNo ratings yet

- 50447010Document9 pages50447010Burducea Alina MirelaNo ratings yet

- IntercontinentalDocument16 pagesIntercontinentalgowtam_raviNo ratings yet

- Tourism and HospitalityDocument27 pagesTourism and HospitalityCharles WamatuNo ratings yet

- Mba Project TajhotelDocument20 pagesMba Project TajhotelAnkit KumarNo ratings yet

- OYODocument9 pagesOYOAkanksha GuptaNo ratings yet

- Final Project On Holiday InnDocument15 pagesFinal Project On Holiday InnDawud Sunny JamesNo ratings yet

- MARRIOTT: Marketing Research Leads To Expanded OfferingsDocument2 pagesMARRIOTT: Marketing Research Leads To Expanded OfferingsBhairav Mehta0% (2)

- LiveDocument31 pagesLivebkaaljdaelvNo ratings yet

- Module 5Document11 pagesModule 5okewumi.abrahamNo ratings yet

- Swot Marriott 2010Document13 pagesSwot Marriott 2010Roshchin Georgy100% (2)

- Global Banking Brands 2006Document30 pagesGlobal Banking Brands 2006bojanjokNo ratings yet

- Marriot InternationalDocument7 pagesMarriot InternationalIrish ButtNo ratings yet

- Team Executive SummaryDocument5 pagesTeam Executive Summaryapi-490169824No ratings yet

- 2.BRMDocument3 pages2.BRMHimanshi 28No ratings yet

- M6A6 Building Strategic Plan Assignment - Marriott BusinessDocument18 pagesM6A6 Building Strategic Plan Assignment - Marriott Businessokewumi.abrahamNo ratings yet

- January 12, 2021: Ahsan Ali ShawDocument8 pagesJanuary 12, 2021: Ahsan Ali ShawRina SuprinaNo ratings yet

- Financial Ratio AnalysisDocument19 pagesFinancial Ratio Analysisssophal100% (2)

- PWC Asset Management 2020 A Brave New World FinalDocument40 pagesPWC Asset Management 2020 A Brave New World FinalKostas IordanidisNo ratings yet

- MACR Marriott StarwoodDocument4 pagesMACR Marriott Starwoodaseem888No ratings yet

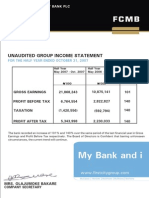

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- Assignment 1Document2 pagesAssignment 1karthikvs88No ratings yet

- I Foresaw ItDocument3 pagesI Foresaw ItGrace AvellanoNo ratings yet

- Case StudyDocument6 pagesCase Studyjuanp12560% (1)

- PC3200 DDR II RAM (DDR-400) model size compatibility guideDocument7 pagesPC3200 DDR II RAM (DDR-400) model size compatibility guideEduard RubiaNo ratings yet

- Project ShaktiDocument2 pagesProject ShaktiMaitraya0% (1)

- Hotel ReportDocument6 pagesHotel ReportRamji SimhadriNo ratings yet

- Delta AirlinesDocument14 pagesDelta AirlinesAssignmentLab.com100% (2)

- Swot Analysis of Indian Road NetworkDocument2 pagesSwot Analysis of Indian Road NetworkArpit Vaidya100% (1)

- Tortillas From The Homesick TexanDocument6 pagesTortillas From The Homesick TexannezbeNo ratings yet

- Hems For GarmentsDocument9 pagesHems For Garmentsvivek jangra100% (1)

- Engineering Steel - SBQ - Supply and Demand in EuropeDocument1 pageEngineering Steel - SBQ - Supply and Demand in EuropeAndrzej M KotasNo ratings yet

- CH 5Document10 pagesCH 5Miftahudin MiftahudinNo ratings yet

- 3 - Zahtjev Za EORI Broj Primjer Kako Se PopunjavaDocument4 pages3 - Zahtjev Za EORI Broj Primjer Kako Se PopunjavaiŠunjić_1No ratings yet

- Problems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaDocument15 pagesProblems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaRavinath NiroshanaNo ratings yet

- Ultimate Financial ModelDocument33 pagesUltimate Financial ModelTulay Farra100% (1)

- Buk 553100 BDocument7 pagesBuk 553100 BMario FloresNo ratings yet

- Shampoo Project Implications Dec Can IntellectsDocument13 pagesShampoo Project Implications Dec Can IntellectsRakesh SainikNo ratings yet

- Executive SummaryDocument1 pageExecutive SummaryGuen ParkNo ratings yet

- Bhutans Gross National HappinessDocument4 pagesBhutans Gross National HappinessscrNo ratings yet

- Problem 3-2b SolutionDocument7 pagesProblem 3-2b SolutionAbdul Rasyid RomadhoniNo ratings yet

- Eu4 Loan-To-Build Profits CalculatorDocument8 pagesEu4 Loan-To-Build Profits CalculatorAnonymous pw0ajGNo ratings yet

- Budgeting and Cost ControlDocument7 pagesBudgeting and Cost Controlnags18888No ratings yet

- Executive SummaryDocument13 pagesExecutive SummaryKamlesh SoniwalNo ratings yet

- Apple - Logo EvolutionDocument3 pagesApple - Logo EvolutionyuvashreeNo ratings yet

- Classification of Economic EnvironmentDocument5 pagesClassification of Economic Environmentashish18518No ratings yet

- PRC Room Assignment For December 2013 Nursing Board Exam (Cebu)Document150 pagesPRC Room Assignment For December 2013 Nursing Board Exam (Cebu)PhilippineNursingDirectory.comNo ratings yet

- Income Declaration Scheme 2016 Critical AnalysisDocument6 pagesIncome Declaration Scheme 2016 Critical AnalysisTaxmann PublicationNo ratings yet

- Funda 2Document20 pagesFunda 2Lorraine Miralles67% (3)