Professional Documents

Culture Documents

Bonanza of Well-Regulated Micro Finance

Uploaded by

Thavam0 ratings0% found this document useful (0 votes)

234 views10 pagesBonanza according to Oxford Dictionary is 'a situation in which people can a!e a lot of oney or be "ery successful#$ %ecent de"elopents in &ndia show the bene'ts an econoy can obtain by ha"ing in place a well( regulated regie for the icro 'nance industry$. Icro lenders are strictly regulated by the %eser"e )an!

Original Description:

Original Title

Bonanza of Well-regulated Micro Finance

Copyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonanza according to Oxford Dictionary is 'a situation in which people can a!e a lot of oney or be "ery successful#$ %ecent de"elopents in &ndia show the bene'ts an econoy can obtain by ha"ing in place a well( regulated regie for the icro 'nance industry$. Icro lenders are strictly regulated by the %eser"e )an!

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

234 views10 pagesBonanza of Well-Regulated Micro Finance

Uploaded by

ThavamBonanza according to Oxford Dictionary is 'a situation in which people can a!e a lot of oney or be "ery successful#$ %ecent de"elopents in &ndia show the bene'ts an econoy can obtain by ha"ing in place a well( regulated regie for the icro 'nance industry$. Icro lenders are strictly regulated by the %eser"e )an!

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

You are on page 1of 10

Bonanza of well-regulated micro finance

October 21, 2014

A bonanza according to Oxford Dictionary is a situation in which people can

a!e a lot of oney or be "ery successful#$ %ecent de"elopents in &ndia

show the bene'ts an econoy can obtain by ha"ing in place a well(

regulated regie for the icro 'nance industry$

A bonanza according to Oxford Dictionary is a situation in which people can

a!e a lot of oney or be "ery successful#$ %ecent de"elopents in &ndia

show the bene'ts an econoy can obtain by ha"ing in place a well(

regulated regie for the icro 'nance industry$

&n

&ndia

icro

lenders are strictly regulated by the %eser"e )an! of &ndia* borrowing

custoers are barred fro ha"ing ore than two siultaneous loans with a

cobined "alue of %s$ +0,000, the burden is placed fairly and s,uarely on

the icro lenders to ensure that this regulation is coplied with$

-he icro 'nance industry has in operation two credit bureaux, with around

1.0 illion client records in its data base$ /icro lenders are able to chec!

up prospecti"e borrowers past history and current obligations fro these

bureaux$ -he %eser"e )an! of &ndia has also placed liitations on the pro't

a!ing of icro lenders by capping gross interest argins for larger icro

lenders at 100 and at 120 for saller operators$ As a result &ndia#s

a"erage icro loan lending rates are now around 21 0 to 240, said to be

aong the lowest in the world$

Alo! 2rasad, 3hief 4xecuti"e of the

/icro'nance &nstitutions 5etwor!, which

represents &ndia#s 46 largest icro'nance

copanies, says7 8-hey are a!ing decent

oney$ -he distinction is between pro'teering

and a!ing decent pro'ts$ 9ou are loo!ing at

a refored industry$ :e are once again

loo!ing at a pretty rapid growth story$ )ut this

tie the ,uality of growth is superior$;

/icro'nance crisis

&n October 2010, &ndian icro lenders and

their ban!ers and in"estors, were sent into a

tailspin when <tate authorities in Andhra

2radesh ordered an iediate halt to all

icroloan reco"eries, after a spate of suicides

by o"er indebted borrowers$ At that tie

ore that 100 of &ndia#s total icroloan

portfolio of %s$ 200 billion was concentrated

in the state$ <e"eral large players essentially

collapsed$

-he crisis exposed how soe unscrupulous

icro lenders had aggressi"ely chased growth by pushing loans to any

unsophisticated custoers who were already obligated to other icro

lenders = and were in e>ect using funds borrowed fro a recent lender to

pay o> older debts to other icro lenders? -he decision to ipose a

regulatory regie was ta!en after this crisis hit$

-he recent restrictions on /@& by the political and adinistrati"e authorities

in )atticaloa District reAect this worry of o"er(borrowing, which is said to be

an issue in Ban!a too$

&ndeed the &ndian icro lending industry has coe so far that recently the

%eser"e )an! granted in principle appro"al to a :est )engal(based icro

lender = )andhan @inancial <er"ices = to obtain a uch(co"eted ban!ing

license$

-he %eser"e )an! is now 'nalising rules for a new niche category of sall

ban!s# to ser"e the poor, and has proised ,uali'ed institutions that they

will be ha"e licenses "irtually on tap, once the schee is 'nalised$ -he

founder of )andhan 3handra <he!har Chosh, who started the icro lender

in 2001, says7 8@or a icro'nance copany getting a ban!ing license is li!e

achie"ing the Doly Crail$;

%aghura %aEan, the Co"ernor of the %eser"e )an! of &ndia, wants these

new sall ban!s# to penetrate po"erty(hit rural areas to proote lending

and sa"ing aong farers, sall businesses and others who traditional

ban!s ha"e been reluctant to ser"e$

-hese borrowers ha"e to resort to exploitati"e "illage oney lenders who

charge up to 2000 a year as interest for loans$ )andhan plans to open F00

branches in 22 states and start with at least 10 illion sa"ings accounts$

Gnder the ban!ing license conditions, one in four branches ust be in

towns with fewer than 10,000 people$

2eople#s :ealth progra

At present Eust 1+0 of &ndia#s adult population of 1$1 billion people, ha"e

ban! accounts$ A situation which the %)& has called pathetic#$ %ecently

2rie /inister 5arendra /odi launched a 2eople#s :ealth progra,

targeting the opening of 1+0 illion new ban! accounts$ -he plan is to ha"e

two accounts per household, including one in the nae of a woan$ -he

target is the F+ illion poor &ndian households$

4ach account will ha"e a local debit card = %u2y#$ -he accounts will o>er an

&ndian %s$ +,000 o"erdraft facility after six onths$ Co"ernor %aEan of the

%eser"e )an! has described this crusade of including the poor within the

ubrella of the foral ban!ing syste as a oral and econoic

iperati"e#$

Analysts say 2/ /odi is prooting the schee because he wants to

prepare for an e"entual introduction of direct cash transfers of social

welfare bene'ts to the poor$ -he current subsidy regie for food and fuel

for the poor is ineHcient and abused by the corrupt and bloats &ndia#s 'scal

de'cit$ A shift to cash deposits into a ban! account will refor the syste

and a!e it ore eHcient$

Iahangir Aziz, 3hief 4conoist at I2 /organ, coents7 8-his

is a critical step towards using cash transfers for the poor as a

eans of deli"ering po"erty alle"iation bene'ts and subsidies$

-he urgency and speed with which it is being rolled out is

because this is the easiest way of reducing subsidies without

running into political opposition$;

2/ /odi has personally eailed ore than F2+,000 branch

anagers of <tate ban!s ephasising the iportance of

'nancial inclusion and appealing for their cooperation$ Alo!

2rasad of the &ndian /icro'nance &nstitutions 5etwor!

coents7 8&t is a big abitious goal, and a lot of push is

being gi"en to this, with the 2rie /inister personally

in"esting e,uity in the atter$;

&ndia#s icro lenders, who ha"e a cobined J +$+ billion outstanding loans

to ore than 10 illion borrowers, but are barred fro holding custoer

deposits, ha"e pledged to help ban!s open accounts for all their existing

custoers$ /any are expected to becoe )an!ing 3orrespondents,#

essentially ban! agents epowered to open accounts, ta!e deposits and

allow cash withdrawals on behalf of partner ban!s$

<ri Ban!a

-he present situation in Ban!a, where icro lending by institutions other

than licensed coercial ban!s, co(operati"es, 'nance copanies, pawn

bro!ers and oney lenders is "irtually unregulated, needs to learn urgent

lessons fro the &ndian experience$

-he @inance )usiness Act has placed restrictions on use of the word

@inance# by entities and pro"ided soe exceptions or extensions of tie by

a paper notice by the /onetary )oard, which soe analysts say aounts to

a de facto aendent of the Act? As a result, deposit ta!ing by icro

lenders which are not in the categories entioned abo"e are in a legal

"acuu$ -his is not sustainable$ <ri Ban!a has to draw lessons fro the

&ndian experience$ -his is a great pity as icro lending has a long history in

Ban!a, a positi"e one in the context of alle"iating po"erty$ -he regulatory

lacuna is a huge drawbac!$

&n <ri Ban!a, 3o(operati"e %ural )an!s were introduced to proote sa"ings

aong ebers and began a sall loan schee, to support the standard

of li"ing of the borrowers and also what was then called cottage industries

to 'ght the curse of rural indebtedness to the usurious "illage oney

lender$ 2riarily these were traditional crafts or ser"ice pro"iders in the

counity who needed to raise operating capital and found the 3o(

operati"e %ural )an! a ore reasonable a>ordable alternati"e source of

funds to the usurious "illage oney lender or the pawn bro!er$

-he 'rst co(operati"e %ural )an! opened its doors in /eni!hinna in the

Kandy District in early 1L00$ :ith the co(operati"e o"eent being

allowed to run autonoously with the light hand of the <tate in a regulatory

ode, the o"eent spread rapidly to all parts of the island$ Beading and

respected ebers of the counity were in"ol"ed in de"eloping the co(

operati"e o"eent$

Dowe"er, in the early 1L.0s, the autonoy of the o"eent was

negati"ely a>ected by the 3oissioner of 3o(operati"e De"elopent

being gi"en enhanced discretionary powers o"er the co(operati"es by an

aendent to the law$ -he increased politicisation of the adinistrati"e

achinery of the Co"ernent led to unprecedented political interference in

the co(operati"es and resultant corruption, nepotis becae rapant and

decent citizens refused to get in"ol"ed, lea"ing the 'eld to political stooges$

-his is the sad story of de"elopent in any 'elds$

:hile the 3o(operati"e %ural )an!s paid an iportant role in po"erty

alle"iation, it is debateable whether their target was the absolute poor and

arginalised or the ore well o> ebers of the counity$ Dowe"er, the

iportance of the 3o(operati"e %ural )an! as a secure place where the

poor could sa"e oney securely in the counity itself and raise a loan in

an eergency or for econoic acti"ity should be noted$

@ortunately around the tie the co(operati"e o"eent was losing its

credibility and the una"ailability of a secure institution to sa"e oney and

draw eergency loans or funding for econoic acti"ity was becoing an

issue, two parallel de"elopents too! place$ <tate(owned ban!s went on a

huge binge of opening branches and one of the the 5ational <a"ings

)an!, the successor to the 2ost OHce <a"ings )an!, aggressi"ely

can"assed the opening of sa"ings accounts aong the rural and urban

poor$

Again, whether it was the 'nancially better(o> ebers of the counity

who engaged with these institutions is the issue, rather than the poor and

arginalised$ & recall one rural farer telling e that he felt challenged by

the need of getting passed the ared security guard at his local branch of

the <tate ban! to get inside?

4ntry of non go"ernent institutions

-he other parallel de"elopent was the eergence of non go"ernent

institutions into the area of icro 'nance$ -hese inter"entions were based

on the highly(successful Craeen )an! inter"ention by 2rof$ 9unus in

)angladesh, in 1LF4$ &t was based on collateral free, group lending with

inter se guarantees and ar!et rates on interest$

:oen bas!et wea"ers li"ing in poor counities around 3hittagong

Gni"ersity, where 2rof$ 9unus was teaching econoics were borrowing

operating 'nance fro uncurious "illage oney lenders and this left the

hardly any pro't and the end when they ar!eted their produce$ 2rof$

9unus ad"anced the the cash, J 2F to 42 ipo"erished woen, to buy

raw aterial, at the going coercial rate of interest, was far below the

local oney lenders usurious rates, and the woen were able to repay the

loan to the 2rof$ after a!ing a uch better pro't$

&nstead of collateral, the security for the indi"idual loans was the group

guarantee, the sall group of bas!et wea"ers pro"ided the certainty that

they would not let a eber default, and in the e"ent of a default, due to

death, sic!ness or such econoic shoc!, the others would contribute and

support the defaulting borrower$ 9unus and the Craeen )an! won the

200. 5obel 2eace 2rize$

5ow icro lending has orphed into a global enterprise ha"ing an acti"e

loan portfolio of J 61 billion and in"ol"ing L1 illion borrowers, according to

the /icro'nance &nforation 4xchange$

&n Ban!a the counity de"elopent organisation <ar"odaya was the

pioneer in setting up such a sa"ings and credit o"eent for the poor and

arginalised ebers of the counities they wor!ed in$ &nternational

donor agencies both go"ernent and pri"ate supported this initiati"e and

in tie it de"eloped into an organisation called <ar"odaya <44D<$ -oday it

is registered as the Deshodaya 'nance copany and is aong those being

consolidated#$

<aller initiati"es

Other saller initiati"es of this nature were also being de"eloped in "arious

parts of Ban!a$ -he other Co"ernent(led initiati"e resulted fro the

expansion of "ocational and technical training in the late 1LF0s by the

expansion of the 5ational Apprentice )oard M5A)N, the 5ational 9outh

<er"ices 3ouncil M59<3N and other "ocational and technical training

institutes$

:hen the output of these progras reached the ar!et, the econoy had

not expanded ,uic!ly enough to absorb their s!ills$ &t was only when the

Accelerated /ahaweli De"elopent <chee, the housing de"elopent

progras and foreign eployent in west Asia hit full pace, were they

absorbed fully$

&n the interi, it was decided to pro"ide to those who interested, aong

these s!illed trainees with funding to start up their own sall scale ser"ice

businesses$ -he 5ational 9outh <er"ices <a"ings and 3redit 3o(operati"e

M59<3ON was begun with this idea, s!illed youth in"ested in shares in

59<3O and they could borrow in proportion to their in"estent, on a

collateral free, inter se guarantee pro"ided by other ebers$ Boans were

also pro"ided to purchase a basic tool tic!et, which was an attraction for

contractors to eploy the$

@or those who wanted to start an enterprise, with the assistance of the

&nternational Babour Organization M&BON, the <all <cale 4nterprise

De"elopent Di"ision M<<4DN of the /inistry of 9outh A>airs and

4ployent was set up to pro"ide business training based on the highly

successful odel of <tart 9our )usiness# based on a progra conducted by

<weden#s 3haber of 3oerce for their ebers and prooted

worldwide by the &BO$

<eeing the success of these initiati"es the 3entral )an! of <ri Ban!a also

started the &suru progra funded by the Iapanese Co"ernent, sall

groups ta!ing sall loans for econoic acti"ity through collateral free inter

se guarantees$

Ianasa"iya progra

-he next big initiati"e was the po"erty alle"iation proEect of the Ianasa"iya

-rust @und, a ultipronged integrated approach to po"erty alle"iation

through, counity infrastructure proEects selected by the counity,

ipleented by counity participation with a cost contribution, a

nutrition inter"ention, a icro credit facility and a counity obilisation

fund$

-his was ipleented through partner organisations in the counity$

O"er 100 counity organisations which had no pre"ious experience in

icro credit were inducted into the 'eld through this initiati"e$ -his was

probably the largest expansion of icro credit e"er, in Ban!a$

At this sae tie, the Ianasa"iya 2rogra of the Co"ernent was

launched, which was designed to gi"e a poor faily a onthly grant, for a

'xed period, to held the to graduate out of po"erty$ -his progra

reAected the arguent that icrocredit is no panacea to an extreely poor

faily, which are thereby being put under a debt burden, out of which they

cannot escape, and that initially a icro grant will help the ore$ -his

sae concept was carried through into the <aurdhi progra and its

successor Di"i 5egua, but there was no tie liit for the icro grant, it

was open ended$

)andhan

A study by 4sther DuAo, an econoist at the /assachusetts &nstitute of

-echnology, presented at Dar"ard Gni"ersity, seeed to strengthen the

arguent for one(o> icro grants rather than icro credit$ DuAo e"aluated

a proEect ipleented in the &ndia state of :est )engal by an &ndian icro

'nance institution called )andhan, yes, the "ery sae one, which has now

recei"ed a ban!ing license fro the %)&$

)andhan ipleented a progra designed by )%A3 of )angladesh*

wor!ing with failies li"ing in extree penury, )andhan ga"e each of the

a sall producti"e asset = a cow, a couple of goats or soe chic!ens$ &t also

pro"ided a sall stipend to reduce the teptation to eat or sell the asset

iediately, as well as wee!ly training sessions to teach the how to tend

to anials and anage their households$

)andhan hoped that there would be a sall increase incoe fro selling

the products of far anials pro"ided, and that people would becoe ore

adept at anaging their own 'nances$ &n fact DuAo#s research showed the

results were uch ore draatic$ :ell after the 'nancial help and the

handholding had stopped, the failies of those who had been randoly

chosen for the )andhan progra were eating 1+0 ore, earning 200 ore

each onth and s!ipping fewer eals than people in a coparati"e group$

-hey were also sa"ing ore$

-he e>ects were so large and persistent that they could not be attributed

only to the direct e>ects of the grants* people could not ha"e sold enough

il!, eggs or eat to explain the incoe gains$ <o what was the real

reasonO DuAo#s research showed that the recipients wor!ed 260 ore

hours* ostly on acti"ities not directly related to the assets they were

gi"en$ -he researchers found that the bene'ciaries# ental health ipro"ed

draatically, the progra had cut the rate of depression sharply$

DuAo argues that the progra pro"ided these extreely poor people with

the ental space to thin! about ore than Eust scraping by or sur"i"ing

day(to(day$ &n addition to 'nding ore wor! on existing acti"ities, li!e

casual agricultural labour, they also started exploring new lines of wor!$

DuAo reasoned that the absence of hope had helped to !eep these people

in penury* the )andhan inter"ention inEected a dose of optiis into their

desperate li"es$ :here the grants coponent is not one(o>, but paid e"ery

onth, there being no exit echanis, a dependency syndroe is created

and the brea!out of po"erty rarely achie"ed$

Bessons for Ban!a

<ri Ban!an policya!ers need to study, learn and internalise urgent lessons

fro the &ndian experience, in regard to the bonanza in total 'nancial

inclusion achie"able through the proper and e>ecti"e regulation of icro

'nance$

/icro entrepreneurs are the initiators who later blosso into sall and

ediu businesses$ -he cutting(edge s!ills pic!ed up in nurturing a icro

enterprise, through the ris!y initial phase, is the !indergarten, the boot

cap, of sall business de"elopent$ -he sur"i"ors, who pull through are

the ones who ha"e to be cherry(pic!ed and supported, with all the facilities

being trupeted for sall and ediu businesses$

Gnless this fundaental econoic truth is understood and the foundation

for business de"elopent laid through a positi"e icro lending

en"ironent, the whole push at the </4 le"el, notwithstanding all the

recent high le"el song and dance, is dooed to be a non starter$

<ri Ban!a has the infrastructure, through a <tate and non <tate icro

'nance institutional structure, but the law, the regulatory regie, has to fall

into place, as in &ndia$ &f the next phase of 'nancial inclusion is to be

achie"ed and the natural business s!ills and ingenuity of the poor,

arginalised and excluded is to be gi"en an opportunity for a full Aowering$

-hen only will the econoic bonanza be achie"ed$

M-he writer is a lawyer, who has o"er 10 years of experience as a 34O in

both <tate and pri"ate sectors$ De retired fro the oHce of <ecretary,

/inistry of @inance and currently is the /anaging Director of the <ri Ban!a

)usiness De"elopent 3entre$N

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Inside Job TermsDocument8 pagesInside Job TermsKavita SinghNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Payment SystemDocument24 pagesPayment SystemTooba HashmiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- New World Order A Cup of TeaDocument48 pagesNew World Order A Cup of Teaapi-19972088100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Program of WorksDocument53 pagesProgram of Worksrhea gayoNo ratings yet

- Bollinger: The SqueezeDocument4 pagesBollinger: The SqueezeshorttermblogNo ratings yet

- Banking Law Syllabus Atty VeraDocument2 pagesBanking Law Syllabus Atty VeraLawrence Villamar100% (1)

- When Israel's Black Panthers Found Common Cause With PalestiniansDocument19 pagesWhen Israel's Black Panthers Found Common Cause With PalestiniansThavamNo ratings yet

- Mining IndustryDocument115 pagesMining Industrykanchanthebest100% (1)

- Our Duty To Fight' The Rise of Militant BuddhismDocument21 pagesOur Duty To Fight' The Rise of Militant BuddhismThavamNo ratings yet

- Sri Lanka Nagananda Filed Corruption Case Against Judges in Top CourtDocument25 pagesSri Lanka Nagananda Filed Corruption Case Against Judges in Top CourtThavamNo ratings yet

- Why Activists FailDocument21 pagesWhy Activists FailThavamNo ratings yet

- Murder, Rape and Claims of Contamination at A Tanzanian GoldmineDocument19 pagesMurder, Rape and Claims of Contamination at A Tanzanian GoldmineThavamNo ratings yet

- NECC SriLanka To 40 TH Session of The UNHRC February 2019 English 2 PDFDocument15 pagesNECC SriLanka To 40 TH Session of The UNHRC February 2019 English 2 PDFThavamNo ratings yet

- Uksc 2017 0124 Judgment PDFDocument17 pagesUksc 2017 0124 Judgment PDFThavamNo ratings yet

- Gonojagoron Mancha Movement in BangladeshDocument17 pagesGonojagoron Mancha Movement in BangladeshThavamNo ratings yet

- The Crisis in Sri Lanka - Kanishka GoonewardenaDocument14 pagesThe Crisis in Sri Lanka - Kanishka GoonewardenaThavamNo ratings yet

- The "Debt-Trap" Narrative Around Chinese Loans Shows Africa's Weak Economic DiplomacyDocument6 pagesThe "Debt-Trap" Narrative Around Chinese Loans Shows Africa's Weak Economic DiplomacyThavamNo ratings yet

- The Crisis in Sri LankaDocument18 pagesThe Crisis in Sri LankaThavamNo ratings yet

- The Subaltern in Search of SpeechDocument19 pagesThe Subaltern in Search of SpeechThavamNo ratings yet

- Good Governance and Economic DevelopmentDocument10 pagesGood Governance and Economic DevelopmentThavamNo ratings yet

- Asa3797702019english PDFDocument12 pagesAsa3797702019english PDFThavamNo ratings yet

- The Man Who Attacked Me Works in Your KitchenDocument24 pagesThe Man Who Attacked Me Works in Your KitchenThavamNo ratings yet

- ITJP Shavendra Silva Dossier PDFDocument137 pagesITJP Shavendra Silva Dossier PDFThavamNo ratings yet

- Cabinet Members 2020Document2 pagesCabinet Members 2020AMNo ratings yet

- Fuel CellDocument14 pagesFuel Celltest 123testNo ratings yet

- Solution Homework 5Document5 pagesSolution Homework 5AtiaTahira100% (1)

- TCW MODULE Complete Version 2pdfdocxDocument188 pagesTCW MODULE Complete Version 2pdfdocxReñer Aquino BystanderNo ratings yet

- Samplepractice Exam 12 April 2017 Questions and AnswersDocument17 pagesSamplepractice Exam 12 April 2017 Questions and AnswersMelody YayongNo ratings yet

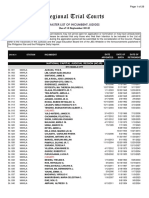

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNo ratings yet

- My Energy Charging StationDocument8 pagesMy Energy Charging StationsvabaNo ratings yet

- Ftna History 5Document9 pagesFtna History 5Macame Junior100% (1)

- Daily Technical Analysis Report: Main IndexDocument3 pagesDaily Technical Analysis Report: Main IndexAbdullah MantawyNo ratings yet

- Microfinance & Rural Banking Conventional and IslamicDocument20 pagesMicrofinance & Rural Banking Conventional and IslamicIstiaqueNo ratings yet

- Cityam 2012-06-29Document39 pagesCityam 2012-06-29City A.M.No ratings yet

- Cap RootDocument11 pagesCap Rootrobokrish6No ratings yet

- Business Chapter 1 - 24 4 2018Document14 pagesBusiness Chapter 1 - 24 4 2018Aishani ToolseeNo ratings yet

- Manifest Trigana Air YulyzanataDocument16 pagesManifest Trigana Air YulyzanataRendi WibowoNo ratings yet

- Property Acquisition and Cost RecoveryDocument40 pagesProperty Acquisition and Cost RecoveryMo ZhuNo ratings yet

- AFST Sample TestDocument1 pageAFST Sample Testsad gurlNo ratings yet

- Case For High Conviction InvestingDocument2 pagesCase For High Conviction Investingkenneth1195No ratings yet

- Q2e LS5 U07 VideoTranscriptDocument2 pagesQ2e LS5 U07 VideoTranscriptTrần Chí Bảo XuyênNo ratings yet

- Invoice 20240210154116V500Document1 pageInvoice 20240210154116V500MadihaNo ratings yet

- Aviation Sector PresentationDocument16 pagesAviation Sector PresentationJitendra GuptaNo ratings yet

- Basic Processes, Production, Consumption, ExchangeDocument3 pagesBasic Processes, Production, Consumption, ExchangeMmapontsho TshabalalaNo ratings yet

- AP Govt Latest DA Arrears Software For 27.248%Document1 pageAP Govt Latest DA Arrears Software For 27.248%shabbir ahamed SkNo ratings yet

- 1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFDocument168 pages1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFPranav PuriNo ratings yet