Professional Documents

Culture Documents

Prubsn Ummahlink en

Uploaded by

Yusof Prubsn0 ratings0% found this document useful (0 votes)

415 views10 pagesPrubsn Ummahlink En

Original Title

Prubsn Ummahlink En

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrubsn Ummahlink En

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

415 views10 pagesPrubsn Ummahlink en

Uploaded by

Yusof PrubsnPrubsn Ummahlink En

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

PruBSN UmmahLink

IN YOUR QUEST FOR LIFE FULFILMENT, PLAN AHEAD

How many of us have put aside some savings to use

when we encounter an unexpected nancial crisis?

We spend years of planning towards a comfortable

future but sometimes still not enough to take

care of things that matter in our life. Whether you

are planning to perform Hajj or Umrah, building

education or retirement fund or simply having

some extra cash to enjoy a nice vacation with your

family, you need a reliable plan that fulls your

every quest in life.

PruBSN UmmahLink takes you one step ahead in

growing your savings whilst providing you with

the necessary protection for your life plans. With

PruBSN UmmahLink, you will receive back your

savings through cash payout every two years,

enjoy life and nancial protection as well as having

information at your ngertips that will take you a

step closer towards life fullment.

IN YOUR QUEST FOR LIFE

FULFILMENT, PLAN AHEAD

Guides you to a remarkable

spiritual journey with information

at your ngertips.

Savings and

Cash Payout

Protection

Optimise

Potential

Investment

Returns

PruBSN

Insan

Accumulate your savings through

CashBuilder with cash payout every

two years.

Entitlement for a series of lucky draws

through your savings.

Optimise your investments via

investing in the Takafulink Funds.

Ease nancial burden with Death or Total

and Permanent Disability (TPD) Benet,

Double Takaful Benet, Badal Hajj

Benet and Compassionate Benet.

Extend your coverage in medical, critical

illness and other life protection benets

for total peace of mind.

Build and Safeguard

your Quest

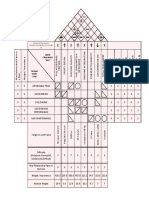

Below is an

illustration of how

PruBSN UmmahLink

with CashBuilder

rewards you in the

long run.

PruBSN

UmmahLink

C

A

S

H

B

U

I

L

D

E

R

M

O

N

T

H

LY CO

N

T

R

I

B

U

T

I

O

N

=

R

M

1

0

0

B

A

S

I

C

M

O

N

T

H

LY

CONTRIBU

T

IO

N

=

R

M

2

0

0

C

a

s

h

U

n

i

t

A

c

c

o

u

n

t

(

C

U

A

)

R

M

6

0

I

n

v

e

s

t

m

e

n

t

U

n

i

t

A

c

c

o

u

n

t

(

I

U

A

)

R

M

4

0

P

r

o

t

e

c

t

i

o

n

U

nit Acco

u

n

t

(

P

U

A

)

R

M200

Potential investment return

Total projected cash

value (excluding total

cash payout and

maturity amount from

CUA) at year 30:

Scenario 1 = RM137,098

Scenario 2 = RM55,629

RM1,000 cash payout every two

years (auto-transfer to Tabung Haji*

/ savings account)

Total cash payout over

30 years = RM15,000

Maturity amount from CUA

at year 30 = RM6,600

* This option is only

applicable to Muslim

customers only.

Plan Ahead for Endless

Reward

CashBuilder is a saving instrument that can be customised to assist you in your quest for life

fullment where it is invested in Cash Unit Account (CUA) and Investment Unit Account (IUA). One

portion of the CashBuilder provides cash payout every two years for better nancial planning with

the amount that you decide to have. You may decide whether to accumulate the cash payout in

your Cash Unit Account (CUA) for higher cash value or auto-transfer the amount to your Tabung

Haji account or personal savings account if you are planning to perform Hajj or Umrah or your other

quests in life. In order to optimise your investment growth, the other portion provides potential

returns through investment in Takafulink Dana Ekuiti.

The above diagram is for illustration purposes only based on male, 30 years old, and non-

smoker with sum covered of RM200,000 and RM1,000 cash payout for every two years.

The total projected cash value from your investment portion is based on investment in the

Takafulink Dana Ekuiti and Takafulink Dana Simpanan and is not guaranteed. Scenario 1 and

2 are based on a gross growth rate of 9% and 2% for Takafulink Dana Ekuiti respectively, and

2.42% and nil for Takafulink Dana Simpanan respectively.

Thats not all. Your savings through CashBuilder entitles you for a series of lucky draws carried

out by Bank Simpanan Nasional (BSN) through their Sijil Simpanan Premium (SSP)** draws,

thus giving you opportunities to win attractive prizes!

** SSP (which includes the lucky draws) is a Shariah-compliant product approved by the Shariah Committee of Bank

Simpanan Nasional. Subject to terms and conditions.

BASIC

COVERAGE

Sum covered

in the event

of loss of life or

Total Permanent

Disability (TPD).

COMPASSIONATE

BENEFIT

Choice to enhance

your plan to

complement your life style

and needs with additional

coverage on medical,

critical illness, accidental

or disability.

ENHANCED

BENEFITS

DOUBLE

TAKAFUL

BENEFIT

BADAL

HAJJ

Double basic

sum covered

amount in the event

of loss of life or TPD

during any

Hajj or Umrah

trip.

In the event that

you are incapable of

performing Hajj due to

loss of life or TPD, the

Badal Hajj benefit opens

up the possibility for your

nominee to perform Hajj

on your behalf with

amount payable

of RM3,000.

Provides RM2,000

for funeral expenses

in the event of death.

For non-Muslim

customers, this benefit

is payable as additional

compassionate

benefit.

Protect What Matters

the Most

Upcoming prayer

SETTINGS

PRAYER TIMES

Plan your spiritual journey ahead.

SEARCH

Find Masjid / Kiblah by Locations.

Kuala Lumpur, Malaysia

ABOUT

CALENDAR

SURAH

HAJJ

ZO

H

O

R 1:05 PM

5 October 2014

10 Zulhijjah 1435

D

O

W

N

L

O

A

D

N

O

W

!

A

v

a

ila

b

le

in

G

o

o

g

le

P

la

y

&

A

p

p

le

A

p

p

S

to

re

.

Linking You with

Technology

PruBSN Insan is a mobile app that is designed to guide you

to a remarkable spiritual journey. It provides you with:

PruBSN UmmahLink is a regular contribution investment-linked takaful plan that

provides you with protection, investment and savings.

How much is the contribution?

The minimum contribution is RM150 per month

including the contribution of CashBuilder. The

contribution for the CashBuilder is based on

the cash payout amount.

Who is eligible for this plan?

The plan is open to individual aged

between 19 and 70 years old. The expiry

age of the plan is 80 years old. Age refers

to Age Next Birthday.

What are the charges and deductions?

The details of charges and deductions are listed

in the table on the next page. All charges are not

guaranteed. PruBSN reserves the right to change the

rates by giving prior notice to customers.

About PruBSN UmmahLink

Types of Charges

and Deductions

Details

UPFRONT

WAKALAH

CHARGE

This charge allows us to pay commission and distribution related expenses

as well as management expenses. The percentage below is based on term

20 years or more. For term less than 20 years, you may refer to the Plan

Illustration.

Certicate

year

1 2 3 4 5 & 6

7 &

above

Upfront

wakalah

charge

60% 60% 50% 30% 20% 0%

For CashBuilder, the upfront wakalah charge is 5% throughout the

certicate term for contribution that is allocated into the IUA only. There

is no wakalah charge for contribution that is allocated into the CUA.

ASSET

MANAGEMENT

CHARGE

This is charged on a daily basis from your investment account value for

your investment management expenses.

Takafulink Dana Bon 0.5% p.a.

Takafulink Dana Ekuiti 1.5% p.a.

Takafulink Dana Urus 1.3% p.a.

Takafulink Dana Simpanan Not Applicable

SERVICE

CHARGE

This is charged for certicate servicing expenses.

Payment method Charge

Cash/ cheque RM6 per month

Others RM5 per month

TOP-UP

CHARGE

We charge 5% on every single contribution top-up. On top of that, for

each top-up of less than RM5,000, there will be an additional charge of

RM25.

FUND

SWITCHING

CHARGE

We provide four free switches every year. For any subsequent switches

within the year, the switch charge is set at 1% of the amount switched

(subject to maximum of RM50).

TABARRU

We deduct an amount each month from your protection account based

on your age, gender, sum covered, occupational class and smoking status.

Tabarru means a donation of a specied portion from the contribution

into the Tabarru Fund for the purpose of mutual aid and assistance among

fellow participants according to the agreed benets under the plan.

1 This is a takaful product that is tied to the performance of the underlying assets, and it is not a pure

investment product such as unit trusts.

2 This brochure does not form a contract between you and Prudential BSN Takaful Berhad (PruBSN). Please refer

to the Plan Illustration, Product Disclosure Sheet and Fund Prole before participating in the plan.

3 The contribution amount for CashBuilder will be allocated in a pre-dened amount between IUA and CUA.

The cash payout is payable from CUA which is invested in Takafulink Dana Simpanan and we reserve the right

at any time to change the underlying investment of Takafulink Dana Simpanan.

4 The chosen funds for CashBuilder are xed and cannot be changed. However, fund switching is allowed for IUA

of Takafulink Dana Ekuiti.

5 The cash payout is non-guaranteed and may be subjected to be pro-rated upon any non-payment of contribution.

6 The SSP Draw is subject to the availability as offered by Bank Simpanan Nasional.

7 The investment prot is only declared at the end of every 12 months for each contribution paid to CUA,

provided that each contribution paid has not been withdrawn by you or made as cash payout by us.

8 The investment returns from your PUA, IUA and prot rate from CUA will be based on the actual performance

of the fund and it is not guaranteed.

9 The investment risk of your fund is borne solely by you and the benets may be less than your total contributions

paid.

10 If you cease paying contribution, your coverage might terminate prematurely.

11 The contribution and Tabarru rates are not guaranteed. PruBSN reserves the right to revise the contribution

rates and/or Tabarru by giving 90 days written notice. For HealthEnrich, 30 days written notice will be provided.

12 For PruBSN UmmahLink, you are entitled to tax relief in respect of your contribution up to RM6,000. Any tax

relief is subject to terms and conditions of Inland Revenue Board (IRB).

13 PruBSN UmmahLink does not provide any benet amount from the Tabarru Fund on termination, expiry or

maturity of certicate.

14 PruBSN UmmahLink is based on Wakalah Bil Ajr model which is an arrangement for PruBSN to manage

your takaful plan. Your contribution will be placed in PUA, IUA and CUA after deducting a wakalah charge

which constitutes the fee for the overall management services provided. The takaful protection comes from

the Tabarru Fund.

15 You are entitled to receive any distributable surplus inclusive of investment prot (if any) arising from Tabarru

at the end of each nancial year. Together with other participants, you are entitled to at least 50% of the

surplus and PruBSN will receive the balance of up to 50% as incentive for managing the Tabarru Fund. Your

portion of the distributable surplus will be placed back into your PUA. The exact amount of distributable

surplus will be determined annually and is subject to approval by both the Shariah Committee and the Board

of Directors of PruBSN.

PruBSN UmmahLink does not cover any of the following situations:

1 Death is caused by suicide within one year from the date of certicate.

2 TPD is directly or indirectly caused by attempting suicide or self-inicted bodily injuries while sane or

insane.

3 TPD is directly or indirectly caused by engaging in aerial ights (including parachuting and skydiving)

other than as a crew member of or as a fare-paying passenger on a licensed passenger-carrying

commercial aircraft operating on a regular scheduled route.

The exclusion and limitations above are not exhaustive and you should refer to the certicate document for

further information.

Exclusions

Important Notes

Exclusions

Important Notes

PruBSN UmmahLink is a Shariah-compliant product.

Prudential BSN Takaful Berhad is a registered Takaful Operator under

the Islamic Financial Services Act 2013 and is regulated by Bank Negara Malaysia.

For more information/enquiries, please contact:

PRUDENTIAL BSN TAKAFUL BERHAD (740651-H)

Level 8A, Menara Prudential, No. 10, Jalan Sultan Ismail, 50250 Kuala Lumpur.

Tel: 03 2053 7188 Fax: 03 2072 6188

E-mail: customer@prubsn.com.my SMS PruBSN and send to 33080

www.prubsn.com.my

All information is correct at the time of print.

Printed 5 October 2014

Important: You must ensure that you are satised that this product will best serve your needs and that

the contribution payable under the certicate is an amount that you can afford.

You might also like

- Prubsn: Link SeriesDocument40 pagesPrubsn: Link Serieskhairul_ikram_1No ratings yet

- PRUBSN Heatlh Enrich PlusDocument2 pagesPRUBSN Heatlh Enrich PlusMalik TaufiqNo ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationimansarahNo ratings yet

- PruBSN HEP+ BrochureDocument18 pagesPruBSN HEP+ BrochureMalik TaufiqNo ratings yet

- Ali - Contoh Dewasa (In English)Document20 pagesAli - Contoh Dewasa (In English)Yusof PrubsnNo ratings yet

- Benefit Summary Takaful HealthDocument4 pagesBenefit Summary Takaful HealthNur Solehah SulaimanNo ratings yet

- Takafulink Fund Fact SheetDocument31 pagesTakafulink Fund Fact SheetCikgu AbdullahNo ratings yet

- Spreadsheet For PruBSN WARISAN Plus BARUDocument13 pagesSpreadsheet For PruBSN WARISAN Plus BARUMohd AsyrafNo ratings yet

- PRUcash premier: 15-Year Endowment PlanDocument14 pagesPRUcash premier: 15-Year Endowment PlanJaboh LabohNo ratings yet

- HLA MediShield ENG - Updated AUG 18Document16 pagesHLA MediShield ENG - Updated AUG 18Chan SCNo ratings yet

- Allianz Life Insurance Policy Sustainability QuoteDocument4 pagesAllianz Life Insurance Policy Sustainability Quotechang muiyunNo ratings yet

- DAILY INCOME FOR HOSPITAL STAYSDocument8 pagesDAILY INCOME FOR HOSPITAL STAYSnusthe2745No ratings yet

- PRUMillion Med BoosterPRUValue Med Booster FAQ v11 1655688313Document67 pagesPRUMillion Med BoosterPRUValue Med Booster FAQ v11 1655688313Amanda PJYNo ratings yet

- WARISANPLUS - 5 TahunDocument22 pagesWARISANPLUS - 5 TahunRaffy RazifNo ratings yet

- Man Guard protects male healthDocument4 pagesMan Guard protects male healthidayu9779No ratings yet

- SampleDocument5 pagesSamplenadiaNo ratings yet

- U740046133Document32 pagesU740046133Daniel CopelandNo ratings yet

- PRUwealth Prudential AssuranceDocument12 pagesPRUwealth Prudential AssuranceMalik TaufiqNo ratings yet

- PruBSN Takaful Malaysia Medical CardDocument9 pagesPruBSN Takaful Malaysia Medical CardNisa AzizNo ratings yet

- Takaful NotesDocument23 pagesTakaful NotesMomina AyazNo ratings yet

- Great Cash Wonder (Launch) Write-UpDocument8 pagesGreat Cash Wonder (Launch) Write-UpAlex GeorgeNo ratings yet

- Retirement PlanningDocument23 pagesRetirement Planningshoba v100% (1)

- RkriDocument19 pagesRkriKalai Vani KarthiNo ratings yet

- Insurance & Takaful Career Path UpdatesDocument28 pagesInsurance & Takaful Career Path UpdatesIkhwanul Shafiq0% (1)

- Segregated Funds & Annuity Study ChecklistDocument2 pagesSegregated Funds & Annuity Study ChecklistYuhui Shi0% (1)

- Minimum Deductibles Applicable For Fire & Engg Policies: Annexure 1Document6 pagesMinimum Deductibles Applicable For Fire & Engg Policies: Annexure 1m48bbsrNo ratings yet

- Great Cash Gain Ps en FW JoDocument53 pagesGreat Cash Gain Ps en FW JoGobinath SubramaniamNo ratings yet

- Term InsuranceDocument1 pageTerm Insurancearundjones1471No ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinNo ratings yet

- The Basic Of InsuranceDocument73 pagesThe Basic Of InsuranceEla DerarajNo ratings yet

- Annuity PresentationDocument16 pagesAnnuity PresentationPraveen100% (1)

- Medical Cards ComparisonDocument4 pagesMedical Cards ComparisonZulkifli Abdul MajidNo ratings yet

- House of Quality - CarDocument1 pageHouse of Quality - CarJessica YulianiNo ratings yet

- Principles of Life InsuranceDocument63 pagesPrinciples of Life InsuranceKanishk GuptaNo ratings yet

- Micro Econ EportfolioDocument2 pagesMicro Econ Eportfolioapi-269409142100% (1)

- AIA Malaysia's ExcelCare Plus & MediCover Plus provide lifetime hospitalization coverageDocument10 pagesAIA Malaysia's ExcelCare Plus & MediCover Plus provide lifetime hospitalization coveragealiNo ratings yet

- Presented By: Mr. Rashmi Ranjan PanigrahiDocument35 pagesPresented By: Mr. Rashmi Ranjan PanigrahiRashmi Ranjan PanigrahiNo ratings yet

- Old Mutual Wealth Life Wrapped Investment GuideDocument2 pagesOld Mutual Wealth Life Wrapped Investment GuideJohn SmithNo ratings yet

- NTUC Wealth SolitaireDocument36 pagesNTUC Wealth SolitaireGaryNo ratings yet

- Ultimate Kaiser Health BuilderDocument30 pagesUltimate Kaiser Health BuilderOmeng Tawid100% (7)

- Credit Point SystemDocument3 pagesCredit Point Systemshanmuga89No ratings yet

- PRUwelcome KitDocument39 pagesPRUwelcome Kitwmafendi0% (2)

- SPM Chemistry Revision Module On The BasicsDocument64 pagesSPM Chemistry Revision Module On The Basicssuritanu96No ratings yet

- CGC APPLICATION FORMDocument17 pagesCGC APPLICATION FORMslipargolok0% (1)

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantNo ratings yet

- Composite Ic38 PDFDocument631 pagesComposite Ic38 PDFPraveena.TNo ratings yet

- PruBSN Platinum Brochure EngDocument10 pagesPruBSN Platinum Brochure EngfaizahNo ratings yet

- Prubsn ProtectDocument19 pagesPrubsn ProtectYusof PrubsnNo ratings yet

- Rea T: Protection That Builds Your Wealth For Future GenerationDocument18 pagesRea T: Protection That Builds Your Wealth For Future GenerationDato SNo ratings yet

- Takafulink Hajj Brochure New Layout - GreyDocument20 pagesTakafulink Hajj Brochure New Layout - GreyKhairul MuzafarNo ratings yet

- Igreat DamaiDocument18 pagesIgreat Damaiapi-240706460No ratings yet

- FP IntroductionDocument4 pagesFP IntroductionStellina JoeshibaNo ratings yet

- HDFC Young Star SuperDocument4 pagesHDFC Young Star SuperSunil TiwariNo ratings yet

- Igreat IqraDocument24 pagesIgreat Iqraapi-240706460No ratings yet

- Hong Leong TakafulDocument43 pagesHong Leong TakafulfarahzatulizzaNo ratings yet

- Aviva MySavingsPlan PDFDocument12 pagesAviva MySavingsPlan PDFKang YaoNo ratings yet

- Tax Saving RecommendationsDocument4 pagesTax Saving RecommendationslejyjacobNo ratings yet

- Our Free Guide Today Using This LinkDocument6 pagesOur Free Guide Today Using This LinkF MyersNo ratings yet

- Grea T: Iqra'Document24 pagesGrea T: Iqra'Murnizah MokhtaruddinNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- Adi Bin Abu (Anak - in English)Document22 pagesAdi Bin Abu (Anak - in English)Yusof PrubsnNo ratings yet

- Prubsn HealthenrichDocument38 pagesPrubsn HealthenrichYusof PrubsnNo ratings yet

- Prubsn HealthenrichDocument38 pagesPrubsn HealthenrichYusof PrubsnNo ratings yet

- Prubsn ProtectDocument19 pagesPrubsn ProtectYusof PrubsnNo ratings yet

- Vegan Banana Bread Pancakes With Chocolate Chunks Recipe + VideoDocument33 pagesVegan Banana Bread Pancakes With Chocolate Chunks Recipe + VideoGiuliana FloresNo ratings yet

- Group 9 - LLIR ProjectDocument8 pagesGroup 9 - LLIR ProjectRahul RaoNo ratings yet

- The Future of Indian Economy Past Reforms and Challenges AheadDocument281 pagesThe Future of Indian Economy Past Reforms and Challenges AheadANJALINo ratings yet

- Skin Yale University Protein: Where Does Collagen Come From?Document2 pagesSkin Yale University Protein: Where Does Collagen Come From?Ellaine Pearl AlmillaNo ratings yet

- FM Stereo FM-AM Tuner: ST-SE500 ST-SE700Document64 pagesFM Stereo FM-AM Tuner: ST-SE500 ST-SE700al80al80100% (4)

- Set up pfSense transparent Web proxy with multi-WAN failoverDocument8 pagesSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithNo ratings yet

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Tes 1 KunciDocument5 pagesTes 1 Kuncieko riyadiNo ratings yet

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- 2019 Batch PapersDocument21 pages2019 Batch PaperssaranshjainworkNo ratings yet

- Year 11 Economics Introduction NotesDocument9 pagesYear 11 Economics Introduction Notesanon_3154664060% (1)

- Phasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary EssayDocument4 pagesPhasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary Essayapi-428138727No ratings yet

- Aladdin and the magical lampDocument4 pagesAladdin and the magical lampMargie Roselle Opay0% (1)

- Sample Letter of Intent To PurchaseDocument2 pagesSample Letter of Intent To PurchaseChairmanNo ratings yet

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- LTD Samplex - Serrano NotesDocument3 pagesLTD Samplex - Serrano NotesMariam BautistaNo ratings yet

- Role of Rahu and Ketu at The Time of DeathDocument7 pagesRole of Rahu and Ketu at The Time of DeathAnton Duda HerediaNo ratings yet

- Hadden Public Financial Management in Government of KosovoDocument11 pagesHadden Public Financial Management in Government of KosovoInternational Consortium on Governmental Financial ManagementNo ratings yet

- AVX EnglishDocument70 pagesAVX EnglishLeo TalisayNo ratings yet

- UNIT 2 - Belajar Bahasa Inggris Dari NolDocument10 pagesUNIT 2 - Belajar Bahasa Inggris Dari NolDyah Wahyu Mei Ima MahananiNo ratings yet

- As If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like LikeDocument23 pagesAs If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like Likemyint phyoNo ratings yet

- A Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan NajafiDocument9 pagesA Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan Najafiinfo3814No ratings yet

- Compound SentenceDocument31 pagesCompound Sentencerosemarie ricoNo ratings yet

- BICON Prysmian Cable Cleats Selection ChartDocument1 pageBICON Prysmian Cable Cleats Selection ChartMacobNo ratings yet

- Classification of Boreal Forest Ecosystem Goods and Services in FinlandDocument197 pagesClassification of Boreal Forest Ecosystem Goods and Services in FinlandSivamani SelvarajuNo ratings yet

- TorricelliDocument35 pagesTorricelliAdinda Kayla Salsabila PutriNo ratings yet

- Independent Study of Middletown Police DepartmentDocument96 pagesIndependent Study of Middletown Police DepartmentBarbara MillerNo ratings yet

- Organisation Study of KAMCODocument62 pagesOrganisation Study of KAMCORobin Thomas100% (11)

- York Product Listing 2011Document49 pagesYork Product Listing 2011designsolutionsallNo ratings yet

- Apple NotesDocument3 pagesApple NotesKrishna Mohan ChennareddyNo ratings yet