Professional Documents

Culture Documents

Your Southdowns Travel Insurance Policy

Uploaded by

lachanbc0 ratings0% found this document useful (0 votes)

173 views2 pagesThis document summarizes Lukeman Chand's travel insurance policy with Southdowns. It provides his personal details, policy dates and numbers, lists additional insured travelers, and outlines key policy details such as covered geographical areas, emergency contact information, and payment amounts. It also highlights important notices about policy coverage, conditions, exclusions, cancellation rights, and how to file complaints.

Original Description:

policy

Original Title

Policy Schedule

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes Lukeman Chand's travel insurance policy with Southdowns. It provides his personal details, policy dates and numbers, lists additional insured travelers, and outlines key policy details such as covered geographical areas, emergency contact information, and payment amounts. It also highlights important notices about policy coverage, conditions, exclusions, cancellation rights, and how to file complaints.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

173 views2 pagesYour Southdowns Travel Insurance Policy

Uploaded by

lachanbcThis document summarizes Lukeman Chand's travel insurance policy with Southdowns. It provides his personal details, policy dates and numbers, lists additional insured travelers, and outlines key policy details such as covered geographical areas, emergency contact information, and payment amounts. It also highlights important notices about policy coverage, conditions, exclusions, cancellation rights, and how to file complaints.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

southdowns

Your Southdowns Travel Policy Schedule

Policy number: Date of issue:

Issued by:

Personal Details:

Main policy holder: Age: Medical reference:

Travel Policy Details:

Period of insurance commences: Expires:

Product type: Policy type:

Number of days: Geographical area:

24-Hour Emergency Medical Assistance +44 (0) 845 873 4426

Claims Line +44 (0) 845 873 4425

Customer Sales and Services (sales, queries and policy administration)

+44 (0) 845 519 7080

Other insured person(s): Age: Medical reference:

THIS DOCUMENT IS IMPORTANT. IT IS ADVISABLE TO TAKE A PRINTED COPY OF YOUR POLICY SCHEDULE WITH YOU WHEN YOU TRAVEL,

AS IT MAY BE REQUIRED IN THE EVENT OF A MEDICAL EMERGENCY TO SECURE YOUR TREATMENT, OR WHEN TRAVELLING REMOTELY

TO ASSIST WITH ENTRY TO SOME COUNTRIES.

EMERGENCY MEDICAL ASSISTANCE AVAILABLE 24 HOURS 7 DAYS A WEEK ON: 0845 873 4426

You must contact us within 14 days of receipt of your documents if you are not completely satisfied and we will refund your payment;

(See Important Notice Document or your policy wording for full details). If any of the information is incorrect, or if you have any questions,please contact

the sales and service office immediately.

Options:

Thank you for choosing to take out your travel insurance with Southdowns. The attached policy wording together with this

schedule, is your policy document. Your policy contains certain conditions, exclusions and limitations.

It is important that you familiarise yourself with your cover to ensure that it meets your needs and personal circumstances.

If you have any questions concerning your cover, please call us on 0845 519 7080.

Payment:

Insurance premium: Insurance premium tax: Documentation: Total paid:

23038962 17/07/2014

https://www.southdownsinsurance.co.uk

Mr Lukeman Chand 32

17/07/2014 07/08/2014

Silver Single Trip Insurance

Worldwide (exc. USA, Canada

and Caribbean)

Mr Ahmed Chand

Mrs Mehrunnisha Chand

Miss Nargis Chand

60

57

27

51.09 10.22 0.00 61.31 0.00

22

IMPORTANT NOTICE - PLEASE MAKE SURE YOU READ YOUR POLICY CAREFULLY

Policy Coverage: This insurance policy is designed to protect you against specific situations or losses that result from

sudden and unexpected conditions or events that occur after the inception of the policy. No insurance coverage is provided

for events that were expected at the time of booking your trip and/or insurance.

Conditions and Exclusions: Conditions and exclusions apply to individual sections of your policy, while general exclusions

and general conditions will apply to the whole of your policy.

Statutory cancellation rights: You may cancel this policy within 14 days of receipt of the policy documents (new business)

and for annual policies the renewal date (the cancellation period) by writing to Southdowns Insurance Services Ltd, 77 High

Street, Steyning, West Sussex, BN44 3RE during the cancellation period. Any premium already paid will be refunded to you

providing you have not travelled, no claim has been made or is intended to be made and no incident likely to result in a

claim has occurred.

Cancellation outside the statutory period: You may cancel this policy at any time after the cancellation period by writing

to Southdowns Insurance Services Ltd, 77 High Street, Steyning, West Sussex, BN44 3RE. If you cancel after the

cancellation period no premium refund will be made.

Excess: Under most sections of the policy, claims will be subject to an excess. This means that you will be

responsible for paying the first part of each claim per incident claimed for, under each section by each insured person,

unless you have paid the additional premium to waive the excess as stated in the schedule.

Sports and Other Activities: Insurance cover is provided for a large number of non-professional sports and activities.

Please take some time to view the Sports and activities list to ensure that you have selected a policy that adequately provides

cover for the activity you intend to participate in as we do not offer the option of partial cover.

Pre-existing medical conditions: This policy contains restrictions, conditions and exclusions regarding the pre-existing

medical conditions of the travellers listed on your policy schedule, your close relatives and other third parties upon whom

your trip/s may depend.

To make sure you understand how pre-existing medical conditions affect your cover please refer to the important

conditions relating to health within the policy wording or, if you would prefer to discuss your personal circumstances please

contact our UK call centre on 0845 519 7080 for further information.

EHIC application: If you intend to travel within the EU, it is advisable to apply for an EHIC prior to leaving the UK. If the

EHIC is presented to a hospital, clinic or doctor and your medical claim is reduced as a result of its use, you will not have to

pay the medical expenses excess. The EHIC is free and can be obtained quickly and easily from the official government

website at www.dh.gov.uk/travellers or by telephoning +44 (0)845 606 2030.

Reasonable precautions: At all times you must take all reasonable precautions to avoid injury, illness, disease, loss, theft

or damage and take all reasonable steps to safeguard your property from loss or damage and to recover property lost or

stolen.

Policy limits: Each section of your policy has a limit on the amount that we will pay under that section in the event of a

claim. Some sections have specific inner limits such as a maximum amount we will pay for a single item or for valuables in

total under the baggage section.

Maximum trip durations: Annual multi trip policies contain restrictions on the number of days you are allowed to travel on

the policy per trip. If any trip exceeds the specified trip duration there is absolutely no cover under your policy for that trip,

unless you have contacted us and we have agreed in writing to provide cover. For full details please view the definition of

Trip within your policy wording.

Automatic Extensions to your insurance cover: Your insurance cover will be automatically extended for the period of

the delay in the event that your return to your home area is unavoidably delayed due to an event covered under your policy.

Law Applicable: You and we can choose the law which applies to this policy. We propose that English Law applies. Unless

we and you agree otherwise English Law will apply to this policy.

Complaints: it is our intention to provide you with a high level of customer service at all times, if there is an

occasion when your standards have not been met, please let us know: If you wish to register a sales or administration

complaint, please contact Southdowns Insurance Services Ltd:

By phone - Telephone the Duty Manager on 0845 519 7080.

In writing - Write to the Operations Manager, 77-79 High Street Steyning, West Sussex BN44 3RE.

If you wish to register a claims complaint, please write to, or telephone the claims unit dealing with your claim.

If you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service. Full details

can be found within the making a complaint section of the policy wording.

V1-08/13

You might also like

- Mindef Benefit SummaryDocument17 pagesMindef Benefit SummaryJedrek TeoNo ratings yet

- Cover Page Highlights Key FeaturesDocument60 pagesCover Page Highlights Key FeaturesWenwei ChionhNo ratings yet

- Statement Ilps 2020Document8 pagesStatement Ilps 2020Faiz RosliNo ratings yet

- PRUlink One EngDocument11 pagesPRUlink One Engsabrewilde29No ratings yet

- Form A - Consent Form SGH - NATIONAL CANCER CENTER SINGAPOREDocument1 pageForm A - Consent Form SGH - NATIONAL CANCER CENTER SINGAPOREChika KhakaNo ratings yet

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- SMU Claim Form GuideDocument1 pageSMU Claim Form GuideCalvin LimNo ratings yet

- Annual Statement: Life Assured Policy No. Mode of Premium Premium Application Date Commencement Date Maturity DateDocument6 pagesAnnual Statement: Life Assured Policy No. Mode of Premium Premium Application Date Commencement Date Maturity DateshafwanNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vNo ratings yet

- Singlife - Change of Servicing AdviserDocument1 pageSinglife - Change of Servicing AdviserCarlo Louis Martinez RodriguezNo ratings yet

- RAMACHANDRANDocument40 pagesRAMACHANDRANYoges YogeswaranNo ratings yet

- Investment Linked Statement of Account: Reg. No 199002477ZDocument8 pagesInvestment Linked Statement of Account: Reg. No 199002477Zgunat dhanapalNo ratings yet

- Motor Proposal Form: Particulars of Proposer Particulars of VehicleDocument1 pageMotor Proposal Form: Particulars of Proposer Particulars of Vehiclecutiemocha1No ratings yet

- Statement of Fact: What You Have Told UsDocument4 pagesStatement of Fact: What You Have Told UsRhys HarryNo ratings yet

- SID - Kotak NASDAQ 100 Fund of Fund-1-10Document10 pagesSID - Kotak NASDAQ 100 Fund of Fund-1-10nicenikeNo ratings yet

- WelcomeLetterDocument4 pagesWelcomeLetterIndrani RayNo ratings yet

- Missing Miles Request Form enDocument2 pagesMissing Miles Request Form enazrarajanNo ratings yet

- License Application SummaryDocument9 pagesLicense Application SummaryWesley James ViejoNo ratings yet

- Dushyant HP Apollo 2017Document10 pagesDushyant HP Apollo 2017niren4u1567No ratings yet

- Ola0195171 722009 1 5693505 20230914-0903592202968Document3 pagesOla0195171 722009 1 5693505 20230914-0903592202968Jade KayceeNo ratings yet

- Pru LifeDocument20 pagesPru LifeJaboh LabohNo ratings yet

- Motor Takaful Quotation Slip: RestrictedDocument2 pagesMotor Takaful Quotation Slip: Restrictednur irdynaNo ratings yet

- Prop Af223025a99kjen2 PDFDocument8 pagesProp Af223025a99kjen2 PDFCKhae SumaitNo ratings yet

- 12go Booking 5475333Document5 pages12go Booking 5475333SherlockNo ratings yet

- Booking Confirmation PDFDocument3 pagesBooking Confirmation PDFtaherNo ratings yet

- 14-09-2022 Policy DocDocument4 pages14-09-2022 Policy DocVanshika GrewalNo ratings yet

- Government of Gujarat: Student Basic DetailsDocument3 pagesGovernment of Gujarat: Student Basic DetailsMohan JeparNo ratings yet

- Business Travel Insurance Policy ACE InsuranceDocument1 pageBusiness Travel Insurance Policy ACE InsuranceWaseela AdamNo ratings yet

- Insurance VoucherDocument2 pagesInsurance VoucherZuraida BashariNo ratings yet

- Policy Mcd1795Document7 pagesPolicy Mcd1795surya namahaNo ratings yet

- Tokio Marine Motor Insurance ScheduleDocument11 pagesTokio Marine Motor Insurance ScheduleANG FEI MING MoeNo ratings yet

- Policy Owners Protection Scheme PPF Scheme For Life InsuranceDocument16 pagesPolicy Owners Protection Scheme PPF Scheme For Life InsuranceAlan PohNo ratings yet

- Hall Ticket Insurance - Ibu PDFDocument2 pagesHall Ticket Insurance - Ibu PDFMohamed IbrahimNo ratings yet

- U740046133Document32 pagesU740046133Daniel CopelandNo ratings yet

- 121000008-890223086161x - Product Disclosure Sheet FinalDocument9 pages121000008-890223086161x - Product Disclosure Sheet FinalpubalanNo ratings yet

- Svvq8ym7 PDFDocument2 pagesSvvq8ym7 PDFWan RidhwanNo ratings yet

- Your e-ticket and travel detailsDocument5 pagesYour e-ticket and travel detailsPau AguilellaNo ratings yet

- Challan Form PDFDocument4 pagesChallan Form PDFSyed Waqar Ul HaqNo ratings yet

- Your Booking at Hotel PK Residency Is Confirmed!: Full Amount of INR 7248 Has Already Been PAIDDocument4 pagesYour Booking at Hotel PK Residency Is Confirmed!: Full Amount of INR 7248 Has Already Been PAIDAmith KumarNo ratings yet

- MMJ QS 2022 0804 2Document1 pageMMJ QS 2022 0804 2Terra ByteNo ratings yet

- Cigna Global GOP ProviderDocument2 pagesCigna Global GOP ProviderRoyer HyacintheNo ratings yet

- ICSI receipt summary for Nidhi NandeDocument1 pageICSI receipt summary for Nidhi NandeAnkit NandeNo ratings yet

- ConfirmationDocument2 pagesConfirmationBrihattar Chandla Probashi Islami SkPNo ratings yet

- UK Visa ApplicationDocument11 pagesUK Visa ApplicationShayanNo ratings yet

- CPF Withdrawal ApplicationDocument4 pagesCPF Withdrawal ApplicationkyinekyineNo ratings yet

- RkriDocument19 pagesRkriKalai Vani KarthiNo ratings yet

- QBE Reports First-Half FinancialsDocument55 pagesQBE Reports First-Half FinancialsTim MooreNo ratings yet

- Claims Reimbursement Form: Member General InformationDocument1 pageClaims Reimbursement Form: Member General InformationHarold TanNo ratings yet

- Petrolimex Singapore Pte LTDDocument9 pagesPetrolimex Singapore Pte LTDPhan KhảiNo ratings yet

- Tax Invoice / Statement of Account: Invois Cukai / Penyata AkaunDocument3 pagesTax Invoice / Statement of Account: Invois Cukai / Penyata AkaunTasaka AmbotangNo ratings yet

- Virendra NabadDocument4 pagesVirendra NabadRAJEEVNo ratings yet

- Instructions To Candidates:: AITT Hall Ticket Generated by Apprenticeship Portal (For Online Theory Exam Only)Document2 pagesInstructions To Candidates:: AITT Hall Ticket Generated by Apprenticeship Portal (For Online Theory Exam Only)SUNIL KUMAR GUPTANo ratings yet

- TCS Campus Hiring Admit CardDocument2 pagesTCS Campus Hiring Admit CardggfNo ratings yet

- Hotel Confirmation Voucher - SushilDocument3 pagesHotel Confirmation Voucher - SushilPitm BungachinaNo ratings yet

- OHRA Application FormDocument4 pagesOHRA Application FormwangchanghuiNo ratings yet

- Ma-Id Name Relation Pribeneficiary Polhldr Emp. No.: 4023721080: Suhas Lokesh: Self: Suhas Lokesh: Gallagher Service Center LLP: G3496Document2 pagesMa-Id Name Relation Pribeneficiary Polhldr Emp. No.: 4023721080: Suhas Lokesh: Self: Suhas Lokesh: Gallagher Service Center LLP: G3496SuhasSuNo ratings yet

- Invoice 9302974416 225390094Document4 pagesInvoice 9302974416 225390094williamNo ratings yet

- Appointment Letter for Saudi VisaDocument3 pagesAppointment Letter for Saudi VisaAnsarMahmoodNo ratings yet

- Ma-Id Name Relation Pribenef Polhldr Emp. No.: 5039695822: Harsh Tyagi: Self: Harsh Tyagi: Bundl Technologies PVT LTD: 155522Document1 pageMa-Id Name Relation Pribenef Polhldr Emp. No.: 5039695822: Harsh Tyagi: Self: Harsh Tyagi: Bundl Technologies PVT LTD: 155522Karan WasanNo ratings yet

- 167 19396 PDFDocument36 pages167 19396 PDFAnonymous FYSfr1No ratings yet

- SUD Life Elite Assure PlusDocument4 pagesSUD Life Elite Assure Plussourav agarwalNo ratings yet

- Ins275 271Document3 pagesIns275 271aisyah zolkafliNo ratings yet

- Plagiarism - ReportDocument27 pagesPlagiarism - ReportBhavaniNo ratings yet

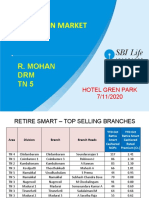

- Pension Market InsightsDocument37 pagesPension Market InsightsPranav WarneNo ratings yet

- COOPER INDUSTRIES LTD 10-K (Annual Reports) 2009-02-24Document230 pagesCOOPER INDUSTRIES LTD 10-K (Annual Reports) 2009-02-24http://secwatch.com100% (1)

- نواف الصواب تامينDocument1 pageنواف الصواب تامينs1.saad2021No ratings yet

- TANTRANSCO TENDER Supply of 11kV & 33kV Outdoor Vacuum Circuit BreakersDocument71 pagesTANTRANSCO TENDER Supply of 11kV & 33kV Outdoor Vacuum Circuit BreakersKrishnaFBNo ratings yet

- Assumptions SettingDocument43 pagesAssumptions SettingphilipoNo ratings yet

- Kenya: The Gateway to AfricaDocument38 pagesKenya: The Gateway to AfricaEdward NjorogeNo ratings yet

- Various Purposes of ValuationDocument36 pagesVarious Purposes of ValuationAshwini GambhirNo ratings yet

- Assignment - Case of Ai Applied To NHSDocument2 pagesAssignment - Case of Ai Applied To NHSManu Lazaro PuenteNo ratings yet

- Bus Fin - QTR 2 Week 3 - Personal FinanceDocument33 pagesBus Fin - QTR 2 Week 3 - Personal FinanceSheila Marie Ann Magcalas-GaluraNo ratings yet

- Goods in Transit Insurance CoverageDocument3 pagesGoods in Transit Insurance CoverageCharlesNo ratings yet

- Renewal Premium ChallanDocument1 pageRenewal Premium ChallanDipra DasNo ratings yet

- Math 11 ABM Business Math Q2 Week 3Document18 pagesMath 11 ABM Business Math Q2 Week 3Flordilyn DichonNo ratings yet

- Turbine Generator Lube Oil FiresDocument3 pagesTurbine Generator Lube Oil Firesman_iphNo ratings yet

- Lancaster ISD Amended PetitionDocument45 pagesLancaster ISD Amended PetitionThe TexanNo ratings yet

- 2.5 B583 - SCC - LSTK - Rev - 0 - STD - 14 - Oct - 2022Document139 pages2.5 B583 - SCC - LSTK - Rev - 0 - STD - 14 - Oct - 2022raghav joshiNo ratings yet

- Apply Home Loan FormDocument7 pagesApply Home Loan Formrahulgeo05No ratings yet

- Supplementary GN GICDocument20 pagesSupplementary GN GICABC 123No ratings yet

- Improvement Works on Khulla manch Estimate and Cost DetailsDocument7 pagesImprovement Works on Khulla manch Estimate and Cost Detailstrilokbist04No ratings yet

- What Is LloydsDocument14 pagesWhat Is LloydsYang X WangNo ratings yet

- Summer Repot Training & Viva 5th SemDocument185 pagesSummer Repot Training & Viva 5th SemAvi Raj0% (1)

- 2420 Honolulu Avenue LLC v. The Travelers Indemnity Company of Connecticut Et Al (4!9!2020)Document7 pages2420 Honolulu Avenue LLC v. The Travelers Indemnity Company of Connecticut Et Al (4!9!2020)Law&CrimeNo ratings yet

- Is The Occurrence of A Typhoon A Fortuitous EventDocument60 pagesIs The Occurrence of A Typhoon A Fortuitous EventMaria Linda GabitNo ratings yet

- Using The RIMS ERM Starter Kit 2013Document12 pagesUsing The RIMS ERM Starter Kit 2013ST KnightNo ratings yet

- VP0514Document20 pagesVP0514Anonymous 9eadjPSJNgNo ratings yet

- Musngi Vs West Coast InsuranceDocument1 pageMusngi Vs West Coast InsuranceSimon James SemillaNo ratings yet

- Muhammad Ade Mirza Kurniawan - 8111419237 - EnglishDocument10 pagesMuhammad Ade Mirza Kurniawan - 8111419237 - EnglishRaafi RahmanNo ratings yet