Professional Documents

Culture Documents

BBVA Bancomer, S.A.: Company Tear Sheet

Uploaded by

David AbonzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBVA Bancomer, S.A.: Company Tear Sheet

Uploaded by

David AbonzaCopyright:

Available Formats

Updated: September 28, 2014

COMPANY TEAR SHEET

BBVA Bancomer, S.A.

Table of Contents

I. Company Information

I/1. Contact Info

I/2. Description

I/3. NAICS Classification

I/4. Performance in Bar Charts Consolid.

I/5. Stock Price Data

I/6. Shareholders (percentage ownership)

II. Financials and Ratios

II/1. Key Financials Consolid.

II/2. Key Financial Ratios Consolid.

II/3. Ratios Consolid.

II/4. Balance Sheet - Interim Consolid.

II/5. Income Statement - Interim Consolid.

II/6. DividendFigures

II/7. Company Analysis

Contact Info

Headquarters

Av. Universidad 1200, Xoco ; Mexico City - Benito

Juarez ; Federal District of Mexico City 03339

Tel: +52 (55) 5621 3434

Fax: +52 (55) 5621 3966

Email: leobardo.ramirez@bbva.bancomer

Website: https://www.bancomer.com/

Status: Listed

Operational Status: Operational

RFC: BBA830831LJ2

Incorporation Date: August 31, 1983

Description

BBVA Bancomer S.A. is a multiple banking institution part of "Grupo Financiero BBVA Bancomer". It offers banking services, raises funds and provides consumer credit

through a network of 1.756 branches and 4.084 ATMs nationwide, also offers credit cards and debit cards, car loans, consumer loans and loans to individuals with business

activities.

Additionally, it provides financial and investment services to high-income individuals through its units "Banca Patrimonial" and "Banca Privada""

In 2009 it merged with BBVA Bancomer Servicios S.A, subsisting BBVA Bancomer S.A.

NAICS Classification

Main Activities: Banking and Credit Intermediation

Performance in Bar Charts Consolid.

Stock Price Data

BBVA Bancomer, S.A. 165.15 2.06% Sep 26

Market Data Provided by Exchange Data

International (EDI)

Shareholders (percentage ownership)

Shareholders (percentage ownership)

Grupo Financiero BBVA Bancomer, S.A. de C.V.

99.9%

Key Financials Consolid.

Name

Y - 2010 Consolid.

Y - 2011 Consolid.

Y - 2012 Consolid.

Y - 2013 Consolid.

BEGIN DATE OF REPORTING PERIOD

2010-01-01

2011-01-01

2012-01-01

2013-01-01

END DATE OF REPORTING PERIOD

2010-12-31

2011-12-31

2012-12-31

2013-12-31

ORIGINAL UNITS AS REPORTED

MXN Millions

1 MXN

1 MXN

MXN Millions

DISPLAYING UNITS

EUR Millions

EUR Millions

EUR Millions

EUR Millions

DISPLAYING UNITS

EUR Millions

EUR Millions

EUR Millions

EUR Millions

CNBV2

BMV-Banks&Fin(since 1999)

BMV-Banks&Fin(since 1999)

CNBV2

Y - 2010 Consolid.

Y - 2011 Consolid.

Y - 2012 Consolid.

Y - 2013 Consolid.

16.53

18.05

17.09

18.01

Total Assets

66,434.47

67,751.49

73,943.76

76,100.51

Current Assets

64,211.27

7,158.87

6,393.37

7,113.38

28,605.78

59,815.46

61,304.02

67,081.92

69,121.02

Total equity

6,619.01

6,447.47

6,861.84

6,979.49

Total Operating Revenue

7,000.33

6,793.97

7,573.09

7,232.83

Operating profit (EBIT)

1,807.13

1,691.45

1,652.97

1,640.57

Net Profit(Loss)

1,382.76

1,319.32

1,357.35

1,711.80

PROVIDER

Name

EXCHANGE RATE USED FOR CURRENCY CONVERSION (*)

Cash & Cash Equivalents

Total Liabilities

Current Liabilities

Key Financial Ratios Consolid.

Name

Y-2010 - Consolid.

Y-2011 - Consolid.

Y-2012 - Consolid.

Y-2013 - Consolid.

RETURN ON ASSETS (ROA)

2.05%

0.00%

1.84e-06%

2.25%

RETURN ON EQUITY (ROE)

20.6%

0.00%

0.00%

24.53%

5,860.23

6,519.18

1003.69%

0.00%

0.00%

1090.35%

Y-2010 - Consolid.

Y-2011 - Consolid.

Y-2012 - Consolid.

Y-2013 - Consolid.

RETURN ON ASSETS (ROA)

2.05%

0.00%

1.84e-06%

2.25%

ANNUALISED RETURN ON ASSETS (ROA)

2.05%

0.00%

1.84e-06%

2.25%

RETURN ON EQUITY (ROE)

20.6%

0.00%

0.00%

24.53%

ANNUALISED RETURN ON EQUITY (ROE)

20.6%

0.00%

0.00%

24.53%

EXCHANGE RATE USED FOR CURRENCY CONVERSION (*)

PROFITABILITY RATIOS

VALUATION FIGURES AND RATIOS

BOOKVALUE (BV)

LEVERAGE RATIOS

LEVERAGE RATIO

Ratios Consolid.

Name

EXCHANGE RATE USED FOR CURRENCY CONVERSION (*)

PROFITABILITY RATIOS

RETURN ON SALES (ROS)

0%

VALUATION FIGURES AND RATIOS

BOOKVALUE (BV)

5,860.23

6,519.18

0.00%

0.00%

LEVERAGE RATIOS

LEVERAGE RATIO

1003.69%

1090.35%

TREND RATIOS

NET INCOME TREND

22.2%

33.17%

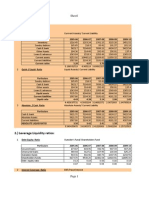

Balance Sheet - Interim Consolid.

Name

M09C-2013 - Consolid. Y-2013 - Consolid. M03C-2014 - Consolid.

M06C-2014 - Consolid.

BEGIN DATE OF REPORTING PERIOD

2013-01-01

2013-01-01

2014-01-01

2014-01-01

END DATE OF REPORTING PERIOD

2013-09-30

2013-12-31

2014-03-31

2014-06-30

ORIGINAL UNITS AS REPORTED

MXN Millions

MXN Millions

MXN Millions

MXN Millions

DISPLAYING UNITS

EUR Millions

EUR Millions

EUR Millions

EUR Millions

AUDITED

Non-Audited

Non-Audited

Non-Audited

Non-Audited

CNBV2

CNBV2

CNBV2

CNBV2

M09C-2013 - Consolid. Y-2013 - Consolid. M03C-2014 - Consolid.

M06C-2014 - Consolid.

PROVIDER

Name

EXCHANGE RATE USED FOR CURRENCY CONVERSION (*)

17.79

18.01

18.01

17.71

73,007.27

76,100.51

79,577.78

83,199.00

6,250.69

7,028.28

7,738.94

6,189.26

208.34

314.89

278.12

445.78

19,826.82

21,577.50

24,259.84

25,373.49

69.26

2.73

0.00

0.00

0.00

0.00

0.01

0.00

3,782.08

3,517.95

3,671.81

4,240.24

90.95

72.14

88.31

141.35

36,976.29

38,366.50

38,455.25

39,815.72

18,999.05

20,240.54

20,164.58

20,932.83

CONSUMER LOANS

9,847.88

10,010.84

10,061.84

10,445.64

MORTGAGE CREDITS

8,129.36

8,115.13

8,228.82

8,437.24

1,376.55

1,250.68

1,220.55

1,259.49

COMMERCIAL PORTFOLIO

380.16

315.95

299.73

284.39

CONSUMER LOANS

439.35

411.24

389.71

431.24

MORTGAGE CREDITS

557.04

523.49

531.11

543.86

-1,601.69

-1,513.14

-1,491.13

-1,516.01

COMMERCIAL PORTFOLIO

-375.80

-339.17

-333.16

-323.64

CONSUMER LOANS

-792.76

-774.23

-764.75

-803.94

MORTGAGE CREDITS

-244.97

-228.68

-221.17

-235.09

-18.38

-16.51

-10.99

-16.08

-169.78

-154.55

-161.05

-137.26

113.37

111.63

107.07

108.42

3,278.01

2,741.02

2,519.46

4,308.53

Assets

FUNDS AVAILABLE

MARGIN ACCOUNTS

INVESTMENTS IN SECURITIES

REPURCHASE AGREEMENTS RECEIVABLE

SECURITIES' LOAN

DERIVATIVE FINANCIAL INSTRUMENTS TRANSACTIONS

VALUTATION ADJUSTMENTS FOR ASSETS COVERAGE OR HEDGE

LOAN PORTFOLIO

COMMERCIAL PORTFOLIO

NON-PERFORMING LOAN PORTFOLIO

LOAN-LOSS PROVISIONS (ALLOWANCES FOR LOAN-LOSSES)

CONTINGENT OPERATIONS AND GUARANTEES

ADDITIONAL LOAN LOSS PROVISIONS

BENEFITS FROM STOCK EXCHANGE TRANSACTIONS RECEIVABLE

OTHER RECEIVABLE

ASSETS ACQUIRED THROUGH JUDICIAL PROCCEDINGS

443.17

421.93

427.64

426.15

1,109.31

1,212.35

1,253.72

1,332.07

PERMANENT INVESTMENTS

196.68

238.38

243.35

263.39

DEFERRED TAXES AND EMPLOYEE PROFIT SHARING (CHARGE)

488.20

296.42

312.90

331.69

OTHER ASSETS

399.21

461.24

491.95

479.44

65,969.56

69,121.02

72,305.43

75,585.18

38,741.70

39,536.49

39,742.33

42,931.79

27,885.80

29,218.51

29,003.42

31,255.42

TIME DEPOSITS

7,808.56

7,230.65

7,458.52

8,002.10

BONDS

3,047.34

3,087.33

3,280.39

3,674.27

792.50

1,771.22

1,980.41

3,185.25

ASSIGNED SECURITIES TO LIQUIDATE

0.00

0.00

173.91

0.00

REPURCHASE AGREEMENTS PAYABLE

11,928.78

14,228.38

14,495.92

12,731.23

0.06

0.04

0.05

0.08

COLLATERALS SOLD OR GIVEN IN WARRANTY

2,746.48

2,454.58

3,416.78

2,913.49

DERIVATIVES

4,157.29

3,676.85

3,796.98

4,568.23

37.70

16.86

45.03

86.69

3,347.00

3,457.35

4,664.96

5,134.33

1,381.67

1,202.18

1,262.00

1,425.24

3,807.70

3,587.27

3,565.51

3,620.20

410.35

391.99

423.56

413.90

7,037.70

6,979.49

7,272.35

7,613.82

2,240.80

2,213.43

2,213.43

2,250.92

CAPITAL STOCK

281.06

277.62

277.62

282.33

NON-EXHIBITED STOCK CAPITAL

-42.56

-42.04

-42.04

-42.75

ADDITIONAL PAID-IN CAPITAL

1,118.34

1,104.68

1,104.68

1,123.39

ADDITIONAL PAID-IN CAPITAL

883.96

873.16

873.16

887.95

4,796.90

4,766.06

5,058.92

5,362.90

386.81

382.09

382.09

388.56

2,845.16

2,537.97

4,135.52

4,008.09

109.98

61.18

73.77

127.24

79.13

65.65

59.01

58.90

7.74

7.38

7.27

7.19

1,368.08

1,711.80

401.26

772.92

184,792.48

182,538.45

189,647.69

196,548.54

PROPERTY, FURNITURE AND EQUIPMENT

Liabilities

FUNDING

ON DEMAND DEPOSITS

BANK LOANS AND FROM OTHER AGENCIES

SECURITY'S LOANS

VALUATION ADJUSTMENTS FOR FINANCIAL LIABILITIES COVERAGE

OTHER ACCOUNTS RECEIVABLES

ACCRUALS AND OTHER PAYABLES

SUBORDINATED DEBENTURES OUTSTANDING

DEFERRED CREDITS

Stockholders' Equity

STOCKHOLDERS' EQUITY CONTRIBUTED CAPITAL

EARNED CAPITAL

CAPITAL RESERVES

RETAINED EARNINGS (LOSSES) OF PRIOR YEARS

EARNINGS (LOSSES) FROM VALUATION OF AVAILABLE FOR SALE SECURITIES

EARNINGS (LOSSES) FROM CASH FLOW HEDGE VALUATION

NET LOSS OR GAIN FROM CUMULATIVE TRANSLATION ADJUSTMENTS

NET RESULT

Memorandum Accounts

Income Statement - Interim Consolid.

Name

M09C-2013 - Consolid.

Y-2013 - Consolid.

M03C-2014 - Consolid.

M06C-2014 - Consolid.

BEGIN DATE OF REPORTING PERIOD

2013-01-01

2013-01-01

2014-01-01

2014-01-01

END DATE OF REPORTING PERIOD

2013-09-30

2013-12-31

2014-03-31

2014-06-30

ORIGINAL UNITS AS REPORTED

MXN Millions

MXN Millions

MXN Millions

MXN Millions

DISPLAYING UNITS

EUR Millions

EUR Millions

EUR Millions

EUR Millions

AUDITED

Non-Audited

Non-Audited

Non-Audited

Non-Audited

CNBV2

CNBV2

CNBV2

CNBV2

M09C-2013 - Consolid.

Y-2013 - Consolid.

M03C-2014 - Consolid.

M06C-2014 - Consolid.

17.79

18.01

18.01

17.71

4,298.00

5,714.06

1,504.04

3,072.82

123.80

159.04

34.79

71.68

5.00

6.81

2.21

4.07

715.02

967.35

285.67

570.16

54.82

65.71

2.92

7.16

1.54

2.63

1.22

4.02

3,271.74

4,342.90

1,129.46

2,330.20

FROM NON-PERFORMING LOAN PORTFOLIO

14.04

18.12

3.72

7.41

COMMISSIONS FROM THE INITIAL GRANTING OF CREDITS

41.82

56.30

15.20

30.90

PREMIUMS (CHARGE)

0.02

0.02

0.05

0.09

PAID-IN DEBT OFFERING

7.97

10.52

2.61

4.74

DIVIDENDS

2.59

4.87

0.15

3.29

59.64

79.78

26.04

39.09

1,237.66

1,619.60

384.35

764.81

FROM DEMAND DEPOSITS

167.13

210.68

51.34

108.17

FROM TIME DEPOSITS

199.37

256.50

52.97

111.91

FROM BONDS

96.24

124.66

28.02

61.08

FROM BANK LOANS AND FROM OTHER AGENCIES

30.47

39.64

12.37

22.81

FROM SUBORDINATED DEBENTURES OUTSTANDING

176.48

230.85

56.36

88.67

FROM SECURITIES LOANS AND REPURCHASE AGREEMENTS PAYABLE

480.37

627.71

144.91

299.80

0.35

1.08

0.98

1.98

63.56

85.87

17.56

48.00

DEBT OFFERING DISCOUNTS

2.12

2.80

0.71

1.51

DEBT OFFERING OR ISSUING EXPENSES

1.29

1.81

1.32

3.42

EXPENSES ASSOCIATED TO INTIAL GRANT OF MORTGAGES

2.31

3.40

1.61

3.63

REVALUATION LOSS

17.96

34.61

16.19

13.82

Net Margin Loss (Earn)

3,060.35

4,094.45

1,119.69

2,308.01

Preventive reserve for possible credit risks

1,008.40

1,306.66

312.68

689.52

Net margin loss adjusted by credit risk

2,051.95

2,787.80

807.01

1,618.49

Comissions and tariffs colected

1,136.97

1,518.77

379.92

784.57

Comissions and tariffs paid

356.57

475.73

113.30

229.42

Gain on brokerage activities

98.90

161.25

70.20

104.67

Loss (gain) for intermediation restatement

19.83

-4.52

7.05

14.50

Administrative expenses

1,779.79

2,347.01

628.82

1,293.83

Operating loss or profit

1,171.29

1,640.57

522.05

998.99

18.22

25.81

5.43

11.97

1,189.51

1,666.38

527.48

1,010.96

Income taxes current

367.23

285.05

149.42

303.12

Income taxes deferred (Net)

-95.79

-303.31

23.19

65.08

PROVIDER

Name

EXCHANGE RATE USED FOR CURRENCY CONVERSION (*)

Interest revenue

FROM FUNDS AVAILABLE

FROM MARGIN ACCOUNTS

FROM INVESTMENTS IN SECURITIES AND DEPOSITS

FROM REPURCHASE AGREEMENTS PAYABLE

FROM HEDGING OPERATIONS

FROM LOAN PORTFOLIO

APPRECIATION PROFIT

Interest expense

SECURITY'S LOANS PREMIUMS (CHARGE)

PAID PREMIUM IN SECURITIES INVESTMENTS

Participation in subsidiaries and associates

Earnings before taxes

Net income before discounted operations

726.48

1,078.03

401.26

772.92

Discounted operations

641.60

633.76

0.00

0.00

Net result

1,368.08

1,711.80

401.26

772.92

Majority net result

1,368.08

1,711.80

401.26

772.92

Dividend

October 29, 2013

0.1337 USD

Company Analysis

According to the Consolidated - Non-Audited financial statement for the first nine cumulated months of 2012, total net operating revenues increased with 4.27%, from MXN

90,091.133 millions to MXN 93,940.365 millions. Operating result decreased from MXN 21,753.948 millions to MXN 20,204.843 millions which means -7.12% change. The

results of the period increased 1.58% reaching MXN 16,822.387 millions at the end of the period against MXN 16,560.77 millions last year. Return on equity (Net

income/Total equity) went from 14.48% to 14.46%, the Return On Asset (Net income / Total Asset) went from 1.41% to 1.30% and the Net Profit Margin (Net Income/Net

Sales) went from 18.38% to 17.91% when compared to the same period of last year. The Debt to Equity Ratio (Total Liabilities/Equity) was 1009.58% compared to

925.15% of last year.

Please note that EMIS is a distributor (and not a publisher) of the content included in this report. The report was compiled from the information, statements or documents provided by third party data

providers. Under no circumstances will the Company be liable for any loss or damage caused by decision based on this report or information obtained through the Service . It is the responsibility of the

user to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content available from EMIS"

Copyright 2014 EMIS, all rights reserved.

A Euromoney Institutional Investor company.

You might also like

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Restoring Financial Stability: How to Repair a Failed SystemFrom EverandRestoring Financial Stability: How to Repair a Failed SystemRating: 3 out of 5 stars3/5 (3)

- Capital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeDocument13 pagesCapital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeKrunal BhuvaNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDocument16 pagesBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112No ratings yet

- Ratio 1Document35 pagesRatio 1niranjanusmsNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Financial Statement SampleDocument172 pagesFinancial Statement SampleJennybabe PetaNo ratings yet

- FORM L 3 Balance Sheet - Mar11Document1 pageFORM L 3 Balance Sheet - Mar11Mukesh Kumar MukulNo ratings yet

- Analyzing Bank Performance: Using The UbprDocument70 pagesAnalyzing Bank Performance: Using The UbpraliNo ratings yet

- Analysis of Audited Financial Statements of San Miguel Corporation 2021Document28 pagesAnalysis of Audited Financial Statements of San Miguel Corporation 2021Marquez, Jazzmine K.No ratings yet

- 2011 Interaction Audited Financial StatementsDocument16 pages2011 Interaction Audited Financial StatementsInterActionNo ratings yet

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Amadeus Export 1 Whitbread Tma1 Part2Document16 pagesAmadeus Export 1 Whitbread Tma1 Part2Hamza RamzanNo ratings yet

- 03-LBP2015 Executive Summary PDFDocument7 pages03-LBP2015 Executive Summary PDFFrens PanlarocheNo ratings yet

- CHAP - 02 - Financial Statements and Bank Performance AnalysisDocument74 pagesCHAP - 02 - Financial Statements and Bank Performance AnalysisPhuc Hoang DuongNo ratings yet

- Summer TrainingDocument30 pagesSummer TrainingFakeha BegumNo ratings yet

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Bsbfim601 FNDocument19 pagesBsbfim601 FNKitpipoj PornnongsaenNo ratings yet

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinNo ratings yet

- BHP Group PLCDocument20 pagesBHP Group PLCKishor JhaNo ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- A C V I A: Merican Ouncil For Oluntary Nternational CtionDocument16 pagesA C V I A: Merican Ouncil For Oluntary Nternational CtionInterActionNo ratings yet

- GfiDocument17 pagesGfiasfasfqweNo ratings yet

- Lagos State Audited Financial Statements, 2015Document77 pagesLagos State Audited Financial Statements, 2015Justus OhakanuNo ratings yet

- Fernando Lopez Villicaña A00941906Document12 pagesFernando Lopez Villicaña A00941906Kevin MelladoNo ratings yet

- Recent - Macroeconomic - Situation - (English) - 2009-12 - Tables - (Based On First Three Months Data of 2009-10) - NEWDocument43 pagesRecent - Macroeconomic - Situation - (English) - 2009-12 - Tables - (Based On First Three Months Data of 2009-10) - NEWChandan SapkotaNo ratings yet

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDocument3 pagesMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNo ratings yet

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDocument72 pagesForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteVenkata ChalamNo ratings yet

- At A GlanceDocument2 pagesAt A GlanceHasan KhanNo ratings yet

- AZEFCLODCHXDCDocument2 pagesAZEFCLODCHXDCThiyas Artha SariNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- CHAP - 02 - Financial Statements of BankDocument72 pagesCHAP - 02 - Financial Statements of BankTran Thanh NganNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Ho Bee - Kim EngDocument8 pagesHo Bee - Kim EngTheng RogerNo ratings yet

- Call 4T09 ENG FinalDocument10 pagesCall 4T09 ENG FinalFibriaRINo ratings yet

- UGBS Compiled Past Questions 4 PDFDocument327 pagesUGBS Compiled Past Questions 4 PDFEbunNo ratings yet

- Burberry Financial AnalysisDocument17 pagesBurberry Financial AnalysisGiulio Francesca50% (2)

- HVS Combined Report - Hotel and Convention Center Studies - Cedar Rapids IA 01 27 2011Document193 pagesHVS Combined Report - Hotel and Convention Center Studies - Cedar Rapids IA 01 27 2011Gazetteonline0% (1)

- Accounts Case StudyDocument7 pagesAccounts Case Studyshivam tripathiNo ratings yet

- Know Your Financial Statements: Finance Area KIIT School of ManagementDocument32 pagesKnow Your Financial Statements: Finance Area KIIT School of ManagementRaja RamNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- BM&F Bovespa 3Q08 Earnings Conference Call November 12Document32 pagesBM&F Bovespa 3Q08 Earnings Conference Call November 12BVMF_RINo ratings yet

- 'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Document12 pages'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Chapter 11 DocketsNo ratings yet

- BSBFIM601 Manage FinancesDocument34 pagesBSBFIM601 Manage Financesneha0% (1)

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Document30 pagesTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- First Four Months Macroecon - NRB FY 2009-10Document43 pagesFirst Four Months Macroecon - NRB FY 2009-10Chandan SapkotaNo ratings yet

- Maruti Balance SHTDocument12 pagesMaruti Balance SHTVishal KumarNo ratings yet

- Business in Portuguese BICDocument26 pagesBusiness in Portuguese BICRadu Victor TapuNo ratings yet

- Daily Trade Journal - 10.01.2014Document6 pagesDaily Trade Journal - 10.01.2014Randora LkNo ratings yet

- Analysis of Credit Management System of Jamuna Bank Limited (JBL)Document38 pagesAnalysis of Credit Management System of Jamuna Bank Limited (JBL)Sayed Farrukh AhmedNo ratings yet

- 87 Uy Vs Puzon, G.R. No. L-19819, October 26, 1977, 79 SCRA 598Document20 pages87 Uy Vs Puzon, G.R. No. L-19819, October 26, 1977, 79 SCRA 598DawnNo ratings yet

- Financial Statement of JS Bank: Submitted ToDocument22 pagesFinancial Statement of JS Bank: Submitted ToAtia KhalidNo ratings yet

- Loans Policy Fitzwilliam MuseumDocument5 pagesLoans Policy Fitzwilliam MuseumanroseyNo ratings yet

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Document109 pagesA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Financial Performance of SbiDocument55 pagesFinancial Performance of Sbimikkijain50% (2)

- Nakpil and Sons V CA DigestDocument2 pagesNakpil and Sons V CA DigestFelicia Allen100% (1)

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument46 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsyeehawwwwNo ratings yet

- Banking and Insurance NotesDocument12 pagesBanking and Insurance NotesPooja SinghNo ratings yet

- Unit 1 - 3 Corporate BankingDocument75 pagesUnit 1 - 3 Corporate BankingNarinder BhasinNo ratings yet

- Reverse Mortgage in IndiaDocument42 pagesReverse Mortgage in Indiakavi2288No ratings yet

- P ROPOSALDocument14 pagesP ROPOSALabceritreaNo ratings yet

- Airlaws IRR of RA 9497 (The Civil Aviation Authority Act of 2008)Document57 pagesAirlaws IRR of RA 9497 (The Civil Aviation Authority Act of 2008)Paolo Jinang100% (4)

- BPI Vs CA Assigned Case DigestDocument1 pageBPI Vs CA Assigned Case DigestJocelyn Yemyem Mantilla Veloso100% (2)

- Affin Bank V Zulkifli AbdullahDocument19 pagesAffin Bank V Zulkifli AbdullahAngelaJ.Bohuntung0% (1)

- Global Money Notes #6: QE, Basel III and The Fed's New Target RateDocument12 pagesGlobal Money Notes #6: QE, Basel III and The Fed's New Target RatePARTHNo ratings yet

- Loan Calculator1Document9 pagesLoan Calculator1Md Jakir HossainNo ratings yet

- Vince Young Lawsuit v. Pro Player FundingDocument15 pagesVince Young Lawsuit v. Pro Player FundingDarren Adam HeitnerNo ratings yet

- Transfer and Business Taxes Solutions Manual Tabag Garcia 3rd Edition PDF FreeDocument39 pagesTransfer and Business Taxes Solutions Manual Tabag Garcia 3rd Edition PDF FreePHILLIT CLASSNo ratings yet

- 04 Accounts Receivable Answer KeyDocument9 pages04 Accounts Receivable Answer Keywheein aegiNo ratings yet

- Alfredo V Borras Case DigestDocument1 pageAlfredo V Borras Case DigestCes Camello0% (1)

- Competition in Ethiopian Banking IndustryDocument16 pagesCompetition in Ethiopian Banking IndustryTsegaye TamratNo ratings yet

- Constantino JR Vs CuisiaDocument4 pagesConstantino JR Vs Cuisiakarl doceoNo ratings yet

- Report BMA Group 3 Final 4 1Document22 pagesReport BMA Group 3 Final 4 1Nguyễn Thị Hường 3TC-20ACNNo ratings yet

- First Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)Document4 pagesFirst Nat'l Bank of St. Paul v. Ramier, 311 N.W.2d 502 (Minn. 1981)richdebtNo ratings yet

- Rhoda Nyambura Mwaniki 33Document4 pagesRhoda Nyambura Mwaniki 33JEYMONo ratings yet

- Baldwin Technology Co., Inc.Document8 pagesBaldwin Technology Co., Inc.ArvinLedesmaChiongNo ratings yet

- 970rfs7p-YS Akamai India Emerging 100 Report PDFDocument48 pages970rfs7p-YS Akamai India Emerging 100 Report PDFShubham KumarNo ratings yet

- Stress Testing of Banks An IntroductionDocument14 pagesStress Testing of Banks An IntroductionRegards MDNo ratings yet

- CMBS Basic Overview enDocument79 pagesCMBS Basic Overview enEd HuNo ratings yet