Professional Documents

Culture Documents

Aguinaldo Vs Commissioner

Uploaded by

samantha.tirthdas2758Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aguinaldo Vs Commissioner

Uploaded by

samantha.tirthdas2758Copyright:

Available Formats

AGUINALDO INDUSTRIES CORPORATION (FISHING NETS DIVISION) VS.

COMMISSIONER OF INTERNAL

REVENUE AND THE COURT OF TAX APPEALS

25 February 1982; G.R. No. L-29790; Plana, J.

FACTS

Aguinaldo Industries Corporation (AIC) is a domestic corporation engaged in the manufacture of

fishing nets, a tax-exempt industry and the manufacture of furniture.

For accounting purposes, each division is provided with separate books of accounts. Previously,

AIC acquired a parcel of land in Muntinlupa, Rizal, as site of the fishing net factory.

Later, it sold the Muntinlupa property. AIC derived profit from this sale which was entered in

the books of the Fish Nets Division as miscellaneous income to distinguish it from its tax-exempt

income.

For the year 1957, AIC filed two separate income tax returns for each division.

After investigation, the examiners of the BIR found that the Fish Nets Division deducted from its

gross income for that year the amount of P61,187.48 as additional remuneration paid to the

officers of AIC.

This amount was taken from the net profit of an isolated transaction (sale of Muntinlupa land)

not in the course of or carrying on of AIC's trade or business, and was reported as part of the

selling expenses of the Muntinlupa land.

Upon recommendation of the examiner that the said sum of P61,187.48 be disallowed as

deduction from gross income, petitioner asserted in its letter of February 19, 1958, that said

amount should be allowed as deduction because it was paid to its officers as allowance or bonus

pursuant to its by-laws.

ISSUE

W/N the bonus given to the officers of the petitioner upon the sale of its Muntinlupa land is an ordinary

and necessary business expense deductible for income tax purposes NO

RATIO

Sec. 30 (a) (1) of the Tax Code provides that in computing net income, there shall be allowed as

deductions Expenses, including all the ordinary and necessary expenses paid or incurred during the

taxable year in carrying on any trade or business, including a reasonable allowance for personal services

actually rendered.

The bonus given to the officers of the petitioner as their share of the profit realized from the sale of

petitioner's Muntinglupa land cannot be deemed a deductible expense for tax purposes, even if the

aforesaid sale could be considered as a transaction for carrying on the trade or business of the

petitioner and the grant of the bonus to the corporate officers pursuant to petitioner's by-laws could, as

an intra-corporate matter, be sustained. The records show that the sale was effected through a broker

who was paid by petitioner a commission of P51,723.72 for his services. On the other hand, there is

absolutely no evidence of any service actually rendered by petitioner's officers which could be the basis

of a grant to them of a bonus out of the profit derived from the sale. This being so, the payment of a

bonus to them out of the gain realized from the sale cannot be considered as a selling expense; nor can

it be deemed reasonable and necessary so as to make it deductible for tax purposes. The extraordinary

and unusual amounts paid by petitioner to these directors in the guise and form of compensation for

their supposed services as such, without any relation to the measure of their actual services, cannot be

regarded as ordinary and necessary expenses within the meaning of the law. This is in line with the

doctrine in the law of taxation that the taxpayer must show that its claimed deductions clearly come

within the language of the law since allowances, like exemptions, are matters of legislative grace.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample PDFDocument2 pagesSample PDFkorean languageNo ratings yet

- Digest CompilationDocument4 pagesDigest Compilationsamantha.tirthdas2758No ratings yet

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- Payslip - 2023 01 31Document1 pagePayslip - 2023 01 31mateivalentin94No ratings yet

- Abella Vs ComelecDocument4 pagesAbella Vs Comelecsamantha.tirthdas2758100% (1)

- Chung Fu v. CADocument13 pagesChung Fu v. CAsamantha.tirthdas2758No ratings yet

- Romeo Lonzanida Vs Comelec and Eufemio MuliDocument3 pagesRomeo Lonzanida Vs Comelec and Eufemio Mulisamantha.tirthdas2758No ratings yet

- Paternity and Filiation ModuleDocument5 pagesPaternity and Filiation Modulesamantha.tirthdas2758No ratings yet

- MEDJUR - Expanded Outline For MidtermsDocument9 pagesMEDJUR - Expanded Outline For Midtermssamantha.tirthdas2758No ratings yet

- Babst V NIB GRDocument4 pagesBabst V NIB GRsamantha.tirthdas2758100% (1)

- Sun Insurance V AsuncionDocument2 pagesSun Insurance V Asuncionsamantha.tirthdas2758No ratings yet

- People V CachuelaDocument1 pagePeople V Cachuelasamantha.tirthdas2758No ratings yet

- Adonis V TesoroDocument1 pageAdonis V Tesorosamantha.tirthdas2758No ratings yet

- Chapter VIII Duties of DirectorsDocument9 pagesChapter VIII Duties of Directorssamantha.tirthdas2758No ratings yet

- NIL Section 1 and 52Document1 pageNIL Section 1 and 52samantha.tirthdas2758No ratings yet

- Beatriz Legarda Gonzalez Vs CFI ManilaDocument3 pagesBeatriz Legarda Gonzalez Vs CFI Manilasamantha.tirthdas2758No ratings yet

- ExpropriationDocument29 pagesExpropriationsamantha.tirthdas2758No ratings yet

- Labor Cases - PreEmploymentDocument197 pagesLabor Cases - PreEmploymentsamantha.tirthdas2758No ratings yet

- Maninang Vs CADocument2 pagesManinang Vs CAsamantha.tirthdas2758No ratings yet

- Labor Cases - PreEmploymentDocument197 pagesLabor Cases - PreEmploymentsamantha.tirthdas2758No ratings yet

- ICJ StatuteDocument15 pagesICJ Statutesamantha.tirthdas2758No ratings yet

- Product Launch ChecklistDocument6 pagesProduct Launch Checklistsamantha.tirthdas2758100% (3)

- 17 - Clavano, Inc. v. HLURBDocument1 page17 - Clavano, Inc. v. HLURBsamantha.tirthdas2758No ratings yet

- Beginning Reading Teacher StrategiesDocument13 pagesBeginning Reading Teacher Strategiessamantha.tirthdas2758No ratings yet

- Analisa Penerapan Perhitungan Rekonsoliasi Fiskal Terhadap Laporan Keungan KomersialDocument17 pagesAnalisa Penerapan Perhitungan Rekonsoliasi Fiskal Terhadap Laporan Keungan KomersialNur Afiah MilleniaNo ratings yet

- 2307 TemplateDocument4 pages2307 TemplateMarianneRoseBrusolaNo ratings yet

- Taxation LawDocument5 pagesTaxation LawSayan GhoshNo ratings yet

- KPMG Flash News Texas Instruments India PVT LTD 2Document5 pagesKPMG Flash News Texas Instruments India PVT LTD 2ABHIJEET CHAKRABORTY RCBSNo ratings yet

- Quiz Number 4Document24 pagesQuiz Number 4justine cabanaNo ratings yet

- Single Payer HealthcareDocument25 pagesSingle Payer HealthcareChristopher ServantNo ratings yet

- Net of Tax Meaning - Google SearchDocument1 pageNet of Tax Meaning - Google SearchEmmanuel ShaushiNo ratings yet

- 132 Preet PDFDocument1 page132 Preet PDFUdhav RohiraNo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- Double Taxation AssignmentDocument12 pagesDouble Taxation AssignmentVishal Salwan100% (1)

- FIN104 Public Finance Course SyllabusDocument5 pagesFIN104 Public Finance Course SyllabusSeth HughesNo ratings yet

- LTO Form 27 Tax Data SheetDocument1 pageLTO Form 27 Tax Data Sheettinee tiny tinNo ratings yet

- Delinquent Taxpayers BusinessesDocument56 pagesDelinquent Taxpayers BusinessesCara MatthewsNo ratings yet

- Prepaid: Avenue E-Commerce LimitedDocument1 pagePrepaid: Avenue E-Commerce LimitedKavya shahNo ratings yet

- KMC Constructions Limited: Payslip For November - 2018Document1 pageKMC Constructions Limited: Payslip For November - 2018Srinuvasulu ReddyNo ratings yet

- PFM Reform in Nepal: Towards Better Financial GovernanceDocument74 pagesPFM Reform in Nepal: Towards Better Financial GovernanceInternational Consortium on Governmental Financial ManagementNo ratings yet

- Taxes On Savings: 22.1 Taxation and Savings - Capital Income Taxation TheDocument27 pagesTaxes On Savings: 22.1 Taxation and Savings - Capital Income Taxation TheWisnu Saka100No ratings yet

- Paye Coding Notice PDFDocument2 pagesPaye Coding Notice PDFNebu MathewsNo ratings yet

- Analysis of MCX Stock Exchange Ltd. vs. National Stock Exchange of India LTDDocument8 pagesAnalysis of MCX Stock Exchange Ltd. vs. National Stock Exchange of India LTDAyush Kumar SinghNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

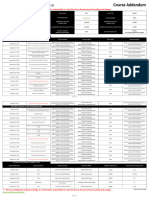

- Fall 2023 ACC400 NKK Course AddendumDocument2 pagesFall 2023 ACC400 NKK Course AddendumGKNo ratings yet

- RR 1-79Document2 pagesRR 1-79Edione CueNo ratings yet

- IT AE 36 G05 Comprehensive Guide To The ITR12 Income Tax Return For Individuals External GuideDocument114 pagesIT AE 36 G05 Comprehensive Guide To The ITR12 Income Tax Return For Individuals External GuideMario BorgesNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPriya SinghNo ratings yet

- April Bill PDFDocument1 pageApril Bill PDFAnand KumarNo ratings yet

- Invoice 3076474063Document2 pagesInvoice 3076474063Lingua TimeNo ratings yet

- NGA - JE ExercisesDocument3 pagesNGA - JE ExercisesShannise Dayne ChuaNo ratings yet