Professional Documents

Culture Documents

2316

Uploaded by

Mika AkimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2316

Uploaded by

Mika AkimCopyright:

Available Formats

DLN:

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Year 2 For the Period

( YYYY ) From (MM/DD) To (MM/DD)

Part I Employee Information Part IV-B Details of Compensation Income and Tax Withheld from Present Employer

3 Taxpayer Amount

Identification No. A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code

32 Basic Salary/ 32

Statutory Minimum Wage

6 Registered Address 6A Zip Code Minimum Wage Earner (MWE)

33 Holiday Pay (MWE) 33

6B Local Home Address 6C Zip Code

34 Overtime Pay (MWE) 34

6D Foreign Address 6E Zip Code

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number 36 Hazard Pay (MWE) 36

37 13th Month Pay 37

9 Exemption Status and Other Benefits

Single Married

9A Is the wife claiming the additional exemption for qualified dependent children? 38 De Minimis Benefits 38

Yes No

10 Name of Qualified Dependent Children 11 Date of Birth (MM/DD/YYYY)

39 SSS, GSIS, PHIC & Pag-ibig 39

Contributions, & Union Dues

40 Salaries & Other Forms of 40

12 Statutory Minimum Wage rate per day 12 Compensation

13 Statutory Minimum Wage rate per month 13 41 Total Non-Taxable/Exempt 41

Compensation Income

14 Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax B. TAXABLE COMPENSATION INCOME

Part II Employer Information (Present) REGULAR

15 Taxpayer

Identification No. 42 Basic Salary 42

16 Employer's Name

43

17 Registered Address 17A Zip Code

Main Employer Secondary Employer 45 Cost of Living Allowance 45

Part III Employer Information (Previous)

18 Taxpayer 46 Fixed Housing Allowance 46

Identification No.

19 Employer's Name 47 Others (Specify)

47A 47A

20 Registered Address 20A Zip Code 47B 47B

SUPPLEMENTARY

Part IV-A Summary 48 Commission 48

21 Gross Compensation Income from

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable/ 49 Profit Sharing 49

Exempt (Item 41)

23 Taxable Compensation Income

from Present Employer (Item 55) 50 Fees Including Director's 50

24 Add: Taxable Compensation Fees

Income from Previous Employer

25 Gross Taxable 51 Taxable 13th Month Pay 51

Compensation Income and Other Benefits

26 Less: Total Exemptions

52 Hazard Pay 52

27 Less: Premium Paid on Health

and/or Hospital Insurance (If applicable)

28 Net Taxable 53 Overtime Pay 53

Compensation Income

29 Tax Due 54 Others (Specify)

30 Amount of Taxes Withheld 54A 54A

30APresent Employer

54B 54B

30B Previous Employer

55 Total Taxable Compensation 55

As adjusted Income

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

56

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57 Date Signed

CTC No.

of Employee Place of Issue Date of Issue

I declare, under the penalties of perjury, that the information herein stated are reported I declare,under the penalties of perjury that I am qualified under substituted filing of

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue. Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Phils. for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

58 No. 1604CF filed by my employer to the BIR shall constitute as my income tax return;

and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59

25

26

27

28

29

21

22

23

24

30A

30B

Present Employer/ Authorized Agent Signature Over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

Employee Signature Over Printed Name

Date Signed

Employee Signature Over Printed Name Amount Paid

To be accomplished under substituted filing

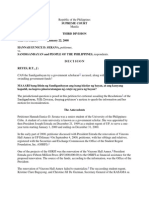

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

2316

Certificate of Compensation

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld July 2008 (ENCS)

BIR Form No.

31 31 Total Amount of Taxes Withheld

(Employee share only)

43 Representation

44 Transportation

44

35 Night Shift Differential (MWE)

35

You might also like

- Study in Australia and New Zealand! - MANILA: Jo-Anne Navarro Free OrderDocument2 pagesStudy in Australia and New Zealand! - MANILA: Jo-Anne Navarro Free OrderMika AkimNo ratings yet

- IC Requirements - Renewal of AccreditationDocument4 pagesIC Requirements - Renewal of AccreditationMika AkimNo ratings yet

- Ophthalmic Drops 101Document4 pagesOphthalmic Drops 101Mika AkimNo ratings yet

- Adaptive ReuseDocument20 pagesAdaptive ReuseJaysharavanan Jayaraman100% (1)

- People v. JabinalDocument6 pagesPeople v. JabinalJulian Paul CachoNo ratings yet

- People Vs Mapa y MapulongDocument3 pagesPeople Vs Mapa y MapulongAnonymous 96BXHnSziNo ratings yet

- City of Manila vs. Judge Laguio Gr. No. 118127Document29 pagesCity of Manila vs. Judge Laguio Gr. No. 118127Hanelizan Ert RoadNo ratings yet

- Hanna Serana Vs Court of AppealsDocument19 pagesHanna Serana Vs Court of AppealsAnonymous 96BXHnSziNo ratings yet

- G.R. No. 181556Document4 pagesG.R. No. 181556Mika AkimNo ratings yet

- Constantino V MendezDocument4 pagesConstantino V Mendezherbs22221473No ratings yet

- 2307Document16 pages2307Mika AkimNo ratings yet

- G.R. No. L-50999Document6 pagesG.R. No. L-50999Mika AkimNo ratings yet

- The Rule Against SurplusageDocument29 pagesThe Rule Against SurplusageMika AkimNo ratings yet

- CD Tanjanco vs. CADocument1 pageCD Tanjanco vs. CAMika AkimNo ratings yet

- Transfer of Property After DeathDocument55 pagesTransfer of Property After DeathMika Akim73% (11)

- RA 8791 General Banking ActDocument22 pagesRA 8791 General Banking ActStephanie Mei100% (1)

- Malong V PNRDocument3 pagesMalong V PNRMika AkimNo ratings yet

- Luzon Surety v. de GarciaDocument6 pagesLuzon Surety v. de GarciaJoey YusingcoNo ratings yet

- People Vs Mapa y MapulongDocument3 pagesPeople Vs Mapa y MapulongAnonymous 96BXHnSziNo ratings yet

- Chiongbian Et Al. vs. OrbosDocument6 pagesChiongbian Et Al. vs. OrbosrenzyNo ratings yet

- BSP Requirements - Renewal of Accreditation PDFDocument17 pagesBSP Requirements - Renewal of Accreditation PDFMika AkimNo ratings yet

- Amores vs. HretDocument5 pagesAmores vs. HretMitch LimNo ratings yet

- LORNA GUILLEN PESCA, Petitioner, vs. ZOSIMO A. PESCA, Respondent. DecisionDocument4 pagesLORNA GUILLEN PESCA, Petitioner, vs. ZOSIMO A. PESCA, Respondent. DecisionMika AkimNo ratings yet

- G.R. No. 74851Document8 pagesG.R. No. 74851Mika AkimNo ratings yet

- G.R. No. 74851Document8 pagesG.R. No. 74851Mika AkimNo ratings yet

- GR No. 192716Document13 pagesGR No. 192716Mika AkimNo ratings yet

- Rules of CourtDocument91 pagesRules of CourtMika AkimNo ratings yet

- DigestsDocument13 pagesDigestsMika AkimNo ratings yet

- G.R. No. 185758 Kent Vs MicarezDocument10 pagesG.R. No. 185758 Kent Vs MicarezMika AkimNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (m12) Att Paper 1 - Part 1 QPDocument16 pages(m12) Att Paper 1 - Part 1 QPAhmad Jehangiri100% (1)

- Coles Car Insurance Policy ScheduleDocument5 pagesColes Car Insurance Policy Schedulemark georgeNo ratings yet

- General Banking Law ReviewerDocument89 pagesGeneral Banking Law ReviewerKarla Marie Tumulak67% (3)

- March 18 2011Document48 pagesMarch 18 2011fijitimescanadaNo ratings yet

- BK Adversarial ProceedingDocument23 pagesBK Adversarial Proceedingjaniceshell100% (1)

- Construction Contract Sample 2Document26 pagesConstruction Contract Sample 2Karthik Kumar100% (2)

- PWC Top Financial Services Issues 2017Document30 pagesPWC Top Financial Services Issues 2017Ankur PandeyNo ratings yet

- Lic Agent SatisfactionDocument32 pagesLic Agent SatisfactionAmit Pasi100% (1)

- Shipping Glossary of Terms - MSCDocument19 pagesShipping Glossary of Terms - MSCAlex PeraNo ratings yet

- SbiDocument55 pagesSbiJaiHanumankiNo ratings yet

- IR Political Risk SyllabDocument16 pagesIR Political Risk SyllabkitemakerNo ratings yet

- Icici PrudentialDocument141 pagesIcici PrudentialBura NareshNo ratings yet

- Understanding Real Property Interests and DeedsDocument9 pagesUnderstanding Real Property Interests and DeedsLisa Stinocher OHanlon100% (1)

- ERM in Pharmaceutical Industry - Case Study of Johnson & JohnsonDocument12 pagesERM in Pharmaceutical Industry - Case Study of Johnson & JohnsonSamhitha KandlakuntaNo ratings yet

- Sample Business Plan - Car HireDocument16 pagesSample Business Plan - Car HireBuali Yahya100% (5)

- Local Government Academy Executive Summary 2021Document6 pagesLocal Government Academy Executive Summary 2021Rg PerolaNo ratings yet

- 3 Manila Bankers V AbanDocument2 pages3 Manila Bankers V AbanRoger Pascual CuaresmaNo ratings yet

- Job CostingDocument67 pagesJob CostingAhmed FahmyNo ratings yet

- Shandaken Payroll AuditDocument15 pagesShandaken Payroll AuditDaily FreemanNo ratings yet

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument29 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzNo ratings yet

- Updated KYCDocument3 pagesUpdated KYCSarvar PathanNo ratings yet

- Axis Bank Term Paper on Strategic ManagementDocument16 pagesAxis Bank Term Paper on Strategic ManagementRoshan KamathNo ratings yet

- Martel Law OfficeDocument6 pagesMartel Law Officechrisguamos69% (16)

- Class Action LawsuitDocument78 pagesClass Action LawsuitLindsey BasyeNo ratings yet

- What is General Insurance and its History in IndiaDocument79 pagesWhat is General Insurance and its History in Indiapatesweetu1No ratings yet

- VIETNAM 2018 SALARY GUIDEDocument31 pagesVIETNAM 2018 SALARY GUIDEChu ToànNo ratings yet

- Financial Accounting Assignment 2 EGMP-45 Group2B V6Document14 pagesFinancial Accounting Assignment 2 EGMP-45 Group2B V6jayasharma10No ratings yet

- Importer Wins Insurance Claim for Spilled Lactose CrystalsDocument1 pageImporter Wins Insurance Claim for Spilled Lactose CrystalsSopongco ColeenNo ratings yet

- Understanding employee attitudes in organizationsDocument57 pagesUnderstanding employee attitudes in organizationspujanswetal100% (1)

- Offer Letter TCS PDFDocument6 pagesOffer Letter TCS PDFrqqpu100% (1)