Professional Documents

Culture Documents

Budgetary Control - L G Electonics

Uploaded by

saiyuvatechOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgetary Control - L G Electonics

Uploaded by

saiyuvatechCopyright:

Available Formats

CHAPTER 1

INTRODUCTION

1

INTRODUCTION TO BUDGET AND BUDGETARY CONROL

BUDGET:

Budget is essential in every walk of our life national, domestic and Business. A

budget is prepared to have effective utilization of funds and for the realization of objective

as efficiently as possible. Budgeting is a powerful tool to the management for performing

its functions i.e., formulation plans, coordination activities and controlling operations etc.,

efficiently. or efficient and effective management planning and control are tow highly

essential functions. Budget and budgetary control provide a set of basic techni!ues for

planning and control.

A budget fi"es a target in terms of rupees or !uantities against which the actual

performance is measured. A budget is closely related to both the management function as

well as the accounting function of an organization.

As the size of the organization increases, the need for budgeting is correspondingly

more because a budget is an effective tool of planning and control. Budget is helpful in

coordinating the various activities #such as production, sales, purchase etc$ of the

organization with result that all the activities precede according to the objective. Budgets

are means of communication. %deas of the top management are given the practical shape.

As the activities of various department heads are coordinated at the much needed for the

very success of an organization. Budget is necessary to future to motivate the staff

associated, to coordinate the activities of different departments and to control the

performance of various persons operating at different levels.

Budgets may be divided into two basic classes. &apital and operating budgets.

&apital budget are directed towards proposed e"penditure for new projects and often

re!uire special financing.

'he operating budgets are directed towards achieving short(term operational goals

of the organization for instance, production or profit goals in a business firm. )perating

budgets may be sub(divided into various departmental of functional budgets.

*

Definitions of Budget:

According to %nstitute of &harted +anagement Accountants, ,ngland - A plan

!uantified in monetary term prepared and approved prior to a defined period of time

usually showing planned income to be generated and . or to be incurred during that period

and the capital to be employed to attain a given objective./

According to %&+A, ,ngland, a budget is, -a financial and.or !uantitative

statement, prepared and approved prior to a defined period of time, of the policy to be

pursed during the period for the purpose of attaining a given objective./

%t is also defined as, -a blue print of projected plan of a action of a business for a

definite period of time./

BUDGETARY CONTROL:

0o system of planning can be successful without having an effective and efficient

system of control. Budgeting is closely connected with control. 'he e"ercise of control in

the organization with the help of budgets is known as budgetary control. 'he process of

budgetary control includes.

1. ,stablishment of budget for each function and section of the organization.

*. ,"ecutive responsibility in order to perform the specific tasks so that objectives of

the enterprise may be attained.

1. &ontinues comparison of the actual performance with that of the budget and placing

the responsibility of e"ecutives for failure to achieve the desired result a given in

the budget.

2. 'aking suitable remedial action to achieve the desired objective if there is a

variation of the actual performance from the budgeted performance.

3. 4evision of budgets in the light of changed circumstances.

1

Definitions of Budgeta! Conto":

According to the Brown and 5oward -Budgetary control is the system of

controlling costs which includes the preparation of Budgets, co(coordinating the

department and establishing the responsibilities, comparing the actual performance with the

budgeted and acing upon the results to achieve the ma"imum profitability/

According to the 6.Betty7 -A system which uses budgets as a means of planning

and controlling all aspects of producing and . or selling commodities and services/

According to the &%+A, 8ondon, -Budgetary control is the establishment of

budgets relating to responsibilities of e"ecutives to the re!uirement of a policy, and the

continuous comparison of actual with budged results, either to secure by individual action

the objective of that policy or to provide a basis for revision.

OB#ECTI$E% O& %TUDY:

1. 'o analyze the revenue budgets and budgetary control policies of 89

,8,&'4)0%&: through the analysis of financial statements.

*. 'o study the revenue budgets as it serves as a mechanism through which his

objectives and policies are affected.

1. %n the light of the findings can be offered for the improvement of its budgetary

control.

2. 'o give a suggestion for the better ; successful budgetary control.

3. 'o organize data for the past five years, compare and study the trend possible.

2

%TATE'ENT O& PROBLE'

'he importance of budgeting and budgetary control in the decision making, revenue

budget estimate of a business needs no emphasis. 'herefore, an analysis of the budgeting

and budgetary control of a business firm is always a dynamic subject for research and

development. <ith this back drop a humble attempt is being made to analyze the

budgeting control of 89 ,8,&'4)0%&: %0=%A 8'=.

'ETHODOLOGY:

%n this case study. 'he budgeting control of the 89 ,8,&'4)0%&: is analyzed in

this study. 'he re!uired data has been collected from primary data and such as annual

reports were taken. And reasons for variances were analyzed. 'he variances between the

revised estimates and actuals were computed. And finally suggestions and conclusion.

irstly, the revenue budget estimates for the past five years were taken.

:econdly, the variance between the revised estimates and actuals were computed.

'hirdly, the reasons for variances were analyzed and measures were taken. 9raphs are

given regarding variances of sales, total cost of production, sales !uantity and inventory,

and interpretation.

%COPE O& THE %TUDY:

>nder this study the budgeting and budgetary control under study is done from the

angles of efficient controlling and corrective decisions and operational efficiency.

RE&ERENCE PERIOD:

'he period of the study was done with reference to the past ? years i.e. from *@@?(*@1*.

3

%OURCE% O& DATA:

'he main source of data is through primary sources and secondary sources of data.

'hrough annual reports, financial statements of the company and also secondary data from

different books and journals.

LI'ITATION%:

'he analysis is only based on the information given in the financial statements of the

organization. 'he final accounts compared for the year *@11(1*. =ata is taken from internal

sources of the company only.

?

BUDGET( BUDGETING AND BUDGETING CONTROL

4ow land and <illiam in their book entitled Budgeting for management control has

given the difference between budge, budgeting and budgetary control as follows7

-Budgets are the individual objectives of a department etc where as budgeting may

be said to be the act of building budgets. Budgetary control embraces all this and in

addition includes the science of planning the budgets themselves and the utilization of such

budgets to effect on overall management tool for the business planning and control/. 'hus,

a budget is a financial plan and budgetary control results from the administration of the

financial plan.

A

CHAPTER )

CO'PANY PRO&ILE

B

CO'PANY PRO&ILE

About LG

,stablished in 1C3B, 89 ,lectronics, %nc. #89$ is a global leader and

technology innovator in consumer electronics, home appliances and mobile

communications, employing more than B*,@@@ people working in over 11@

operations including B1 subsidiaries around the world.

Co*oate Na+e 89 ,lectronics %nc.

Esta,"is-ed )ctober 1, 1C3B #As a private &ompany$

Co*oate Offi.e 89 'win 'owers

*@, Deouido(dong, Doungdungpo(gu, :eoul, Eorea 13@(A*1

'el7 B*(*(1AAA(1112

>487 http7..www.89,.com

$i.e C-ai+an /

CEO

Dong 0am

Business Aea and

'ain Podu.t

'o,i"e Co++uni.ations Co+*an!

&=+A 5andsets, 9:+ 5andsets, 19 5andsets

+onitor, F=F +odule, )8,= Fanel, >:B +emory

Digita" 'edia Co+*an!

5ome 'heater :ystem, =G= 4ecorder, :uper +ulti =G=

4ewriter, &=H4<, 0otebook F&, =esktop F&, F=A, F=A

Fhone, +F1 Flayer, 0ew Earaoke :ystem, &ar %nfotainment

Nu+,e of

E+*"o!ees

B*,AA* #*C,C2B in Eorea. 3*,B*2 overseas$ ( as of *@@?

&omprising four business units ( +obile &ommunications, =igital

Appliance, =igital =isplay and =igital +edia with *@@? global sales of >:=

1B.3 billion ( 89 is the worldI s leading producer of &=+A.9:+ handsets, air

conditioners, front(loading washing machine, optical storage products, =G=

players, flat panel 'Gs and home theater systems.

C

&inan.ia" Hig-"ig-ts 0in ,i""ion 1on2

)334 )335 )336 )337 )313 )311

%ALE% 1?,?@1 16(43) )3(154 )8(497 *1,AA2 *1,1A@

=omestic 4(368 4(498 8(57: 9(364 3,3@C 3,C2A

,"port 13(914 11(786 19(:6: 17(95: 1B,*?2 1A,**1

Odina!

Pofit

)rdinary

Frofit

95: 459 6:4 1(643 A21 *?1

History

1C3B

ounded as 9old:tar

1C?@Is Froduces EoreaI s first radios, 'Gs, refrigerators, washing machines and air

conditioners

1CC3 4enamed 89 ,lectronics

Ac!uires >:(based Jenith

1CCA <orldKs first &=+A digital mobile handsets supplied to Ameritech and 9', in

>.:. Achieves >8 certification in >.:. =evelops worldKs first %& set for ='G

1CCB =evelops worldKs first ?@(inch plasma 'G

1CCC ,stablishes 89.Fhilips 8&=, a joint venture with Fhilips

*@@1 8aunches worldKs first internet refrigerator ,"ports synchronous %+'(*@@@ to

+arconi <ireless of %taly :ignificant e"ports to Gerizon <ireless in >.:.

*@@* 9:+ mobile handset e"ports to 4ussia, %taly and %ndonesia ,stablishes market

leadership in Australian &=+A market 8aunches worldKs first internet washing

machine, air conditioner, and microwave oven

1@

*@@1 >nder 89 5olding &ompany system, spins off to become 89 ,lectronics and 89

&orporation ull(scale e"port of 9F4: color mobile phones to ,urope ,stablishes

&=+A handset production line and 4;= center in &hina

*@@2 ,nters 0orth(,uropean and +iddle ,ast 9:+ handset market Achieves monthly

e"port volume above *.3 million units #6uly$ 'op global &=+A producer

*@@3 ,G:B, the ne"t(generation ='G transmission technology, chosen to be the

>:.&anada %ndustry standard by the >: A':& &ommercializes worldKs first 33L

all(in(one 8&= 'G

&ommercializes worldKs first A1L plasma 'G =evelops worldKs first :atellite( and

'errestrial(=+B handsets

*@@? Becomes fourth(largest supplier of mobile handsets market worldwide =evelops

worldKs first 19 >+': =+B handset, 19(based =GB(5 and +edia8) phones,

=+B Fhone with time(shift function, and =+B notebook computer ,stablishes

89(0ortel, a network solution joint venture with 0ortel

*@@C 89 &hocolate, the first model in 89Ks Black 8abel series of premium handsets,

sells A.3million units world wide =evelops the first single(scan ?@L 5= F=F

module ,stablishes the strategic partnership with >8

Ac!uires the worldKs first %Fv? 9old 4eady logo

*@1@ 8aunches the industry(first dual(format high(definition disc player and drive

%ntroduces new global brand identity7 L:tylish design and smart technology, in products

that fit our consumerIs lives.L

11

CEO PROFILE

Bioga*-!

Dong 0am was appointed Gice &hairman and &,) of 89 ,lectronics effective

6anuary 1, *@@A. 5is appointment signifies 89I s desire to achieve the status of a

highly profitable, technological leader with strong brand power.

+r. 0am honed his strong business insight during his 1@ years of e"perience with

89 ,lectronics, 89 &orporate and 89 'elecom. 5e is well(known in the industry

for his strategic outlook, in(depth %' e"perience and global perspective.

Frior to his appointment, +r. 0am served as 5ead of :trategic Business for 89

&orporation and was responsible for overall strategic business initiatives. 5e

directly supported the 89 9roup chairman on a variety of business issues, including

telecommunications.

+r. 0am served as the Fresident and &,) of 89 'elecom from 1CCB until *@@?.

>nder his leadership, the companyI s revenue increased fivefold from M3?@ million to

M*.? billionN subscribers tripled from *.1 million to nearly A millionN and profits

grew to around M*3@ million in *@@3. 5e was instrumental in introducing the world

first mobile internet service, ez(i, and in commercializing mobile banking service

Bank)0, now the number one convergence service in Eorea.

%n 1CCA, he assumed additional responsibilities, overseeing the ,"ecutive )ffice for

:trategic Frojects, 89I s corporate(level new business development arm. 8ater that

year, he led the +ultimedia =ivision of 89 ,lectronics as Gice Fresident and

transformed the division into a profitable business within just one year.

+r. 0am joined the 89 &hairmanI s )ffice in 1CB?. As a :pecial Assistant to the

9roup &hairman, he ran the in(house team that drove change management. 5e also

1*

led corporate(wide efforts to achieve operational e"cellence and redefine 89I s

strategic direction.

+r. 0amI s career at 89 began in 1CA? when he joined 89 ,lectronics in the

overseas business planning division. As part of this role, he spent seven years in the

>.:. in several management positions centered on marketing and sales, which helped

him, develop a global perspective on 89I s business.

+r. 0am is a graduate of :eoul 0ational >niversity, and is fluent in ,nglish and

6apanese in addition to his native Eorean. 5e and enjoys golf, reading and hiking

during his leisure time.

Dong 0am was appointed Gice &hairman and &,) of 89 ,lectronics effective

6anuary 1, *@@A. 5is appointment signifies 89I s desire to achieve the status of a

highly profitable, technological leader with strong brand power.

+r. 0am honed his strong business insight during his 1@ years of e"perience with

89 ,lectronics, 89 &orporate and 89 'elecom. 5e is well(known in the industry

for his strategic outlook, in(depth %' e"perience and global perspective.

Frior to his appointment, +r. 0am served as 5ead of :trategic Business for 89

&orporation and was responsible for overall strategic business initiatives. 5e

directly supported the 89 9roup chairman on a variety of business issues, including

telecommunications.

+r. 0am served as the Fresident and &,) of 89 'elecom from 1CCB until *@@?.

>nder his leadership, the companyI s revenue increased fivefold from M3?@ million to

M*.? billionN subscribers tripled from *.1 million to nearly A millionN and profits

grew to around M*3@ million in *@@3. 5e was instrumental in introducing the world

first mobile internet service, ez(i, and in commercializing mobile banking service

Bank)0, now the number one convergence service in Eorea.

%n 1CCA, he assumed additional responsibilities, overseeing the ,"ecutive )ffice for

:trategic Frojects, 89I s corporate(level new business development arm. 8ater that

year, he led the +ultimedia =ivision of 89 ,lectronics as Gice Fresident and

transformed the division into a profitable business within just one year.

+r. 0am joined the 89 &hairmanI s )ffice in 1CB?. As a :pecial Assistant to the

9roup &hairman, he ran the in(house team that drove change management. 5e also

led corporate(wide efforts to achieve operational e"cellence and redefine 89I s

strategic direction.

+r. 0amI s career at 89 began in 1CA? when he joined 89 ,lectronics in the

overseas business planning division. As part of this role, he spent seven years in the

>.:. in several management positions centered on marketing and sales, which helped

him develop a global perspective on 89I s business.

11

+r. 0am is a graduate of :eoul 0ational >niversity, and is fluent in ,nglish and

6apanese in addition to his native Eorean. 5e and enjoys golf, reading and hiking

during his leisure time.

'a;o A1ads Re.ei<ed ,! LG E"e.toni.s

ollowing its L:elect ; ocusL strategy, 89 ,lectronics has resolutely maintained

its efforts towards corporate restructuring. %n the process, many of its

accomplishments in its management innovation and productivity innovation

activities were recognized with awards.

)335 A1ads

12

No<e+,e )335 89 ,lectronics received Best :how Award at the publicity film

9ala"y Award, and the 9rand Award in the corporate brochures

category.

No<e+,e )335 89 ,lectronics grabbed Best +anufacturer in <hite 9oods

Award in Eazakhstan for the 2th year in a row.

De.e+,e )335 89 ,lectronics received Fresidential Frize in the labor(

management culture category for large corporations.

De.e+,e )335 89 ,lectronics was chosen among BeijingI s 1@ +ost %nfluential

,nterprises by Beijing 'G#B'G$.

De.e+,e )335 89 ,lectronics received +ost Fromising Gendor of the Dear

Award at the Lrost ;:ullivan Asia Facific 'echnology Awards

*@@A.L

13

1?

#anua!

)336

89 ,lectronics received the most number of innovation awards at &,:

#total of 1? awards$.

5onored with 1? &,: %nnovation Awards 89 ,lectronics received the

most number of innovation awards for the *nd consecutive year #1A

categories in *@@A and 1? categories in *@@B$

#anua!

)336

89 ,lectronics received 'ransparent +anagement 9rand Frize

organized by five economic bodies.

&e,ua!

)336

89 ,lectronics picked up *@@B % =esign Awards for C products at &,:

*@@B.

#une )336 89 ,lectronics received +ost Fromising Gendor of the Dear Award at

the rost ;:ullivan Asia Facific 'echnology Awards *@@B.

O.to,e )336 89 ,lectronics was chosen as one of the top 1@ electronics

brands in :outh Africa ( for#or by$ people aged *3O, and across

businesses and products.

O.to,e )336 89 ,lectronics received 0o. 1 ,nterprise in ,lectronics and

&ommunications Award and %nnovation Award as selected by

BrazilI s most prestigious economic magazine %sto e =inheiro.

A*= 17( )336

LG ELECTRONIC% REPORT% &IR%T >UARTER )336 EARNING% RE%ULT%

89 ,lectronics #89$, a leader in consumer electronics and mobile communications,

announced un(audited earnings results of the three month period ended +arch 11,

*@@B. Amount in Eorean <on #E4<$ are translated into >: dollars #>:=$ at the

average rate of three month period in each !uarter, which was E4< C1C per >:

dollar #*@@B 1P$, E4< C1B per >: dollar #*@@A. 2P, PoP$, E4< CAA per >: dollar

#*@@A. 1P, DoD$.

'o accommodate comprehension of 89Ks global business, the company released

financial earnings in parent format plus additional consolidated earnings of each

division and overseas subsidiaries.

%a"es and Pofit

or the !uarter, the company posted a revenue of E4< ?.@1 trillion #>:= ?.21

billion$ on a parent basis, increased by 2.@Q from a year earlier thanks to robust

sales of premium handsets and home appliances. )n a consolidated basis which

includes sales of 89Ks overseas subsidiaries, revenue reached E4< C.3C trillion

#>:= 1@.** billion$, increased by B.1Q from the previous year.

)perating profit was E4< 1A1 billion #>:= 1B2 million$ on a parent basis with a

margin of *.CQ compared to E4< 1C1 billion #>:= *@2 million$ from a year

earlier primarily due to a sluggish display and media business in spite of a

remarkable turnover in mobile business and solid performance of appliance

business. :ituation on a consolidated basis was E4< *B billion #>:= *C.2 million$

hurt by overseas subsidiariesK operating loss of E4< 111 billion #>:= 12*

million$.

0et Frofit was a loss of E4< 1*1 billion #>:= 111 million$ on a parent basis

mainly due to loss in e!uity method of E4< 1C1 billion #>:= *@3 million$ from

89.Fhilips 8&= and overseas subsidiaries.

&onsolidated performances by business division are as followsN

+obile &ommunication &ompany recordedsales of E4< *.31 trillion #>:= *.?A

billion$, 12.AQ higher than a year earlier. 4evenue from the handset business rose

1A.BQ to E4< *.13 trillion #>:= *.3@ billion$ from E4< *.@@ trillion #>:= *.@3

billion$. &onsolidated sales based total shipments were 13.B million units, compared

to 12.1 million units DoD and 1A.C million units PoP.

:uccess of R:hineK phone and =+B line(ups in Eorea pushed up shipments 2?Q

PoP, and continued high demand of premium R&hocolateK phone in 9:+ open(

markets led a shift of *BQ PoP. :trong growth in <&=+A phones sales was

1A

realized in Eorea and the >nited :tates. )perating margin was 2.AQ, a bit less than

?.?Q on a parent basis, but recovered from a loss of *.?Q from the first !uarter of

*@@?.

=igital Appliance &ompany sales rose 13.1Q to E4< *.C2 trillion #>:= 1.11

billion$ from a year earlier, thanks to growth in premium product lines.

%mprovement of an operating profit was remarkable. E4< 1?C billion #>:= 1A.C

million$ was 21.?Q higher than a year earlier and 1A.1Q from the previous !uarter.

)perating margin increased 1.1Q point to 3.AQ despite won appreciation and rise in

material costs. )n a parent basis the margin rose 1.BQ point to 1*.@Q.

=igital =isplay &ompany sales including plasma display panels and flat panel 'Gs

and monitors rose 1.3Q to E4< *.A3 trillion #>:= *.C1 billion$ from the previous

year, but posted an operating loss of E4< *?* billion #>:= *.AC million$. :ales

from =igital +edia &ompanyKs media and %' products posted E4< 1.1B trillion

#>:= 1.2A million$, 2.A Q down from a year earlier. :low in display and media

business stems from seasonality plus intensified price erosion, but mainly due to

lower efficiency in capacity of plasma display panels.

INDU%TRY PRO&ILE

E"e.toni.s is the study of the flow of charge through various materials and devices

such as, semiconductors, resistors, inductors, capacitors, nano(structures, and

vacuum tubes. All applications of electronics involve the transmission of either

information or power. Although considered to be a theoretical branch of physics, the

design and construction of electronic circuits to solve practical problems is an

essential techni!ue in the fields of electronics engineering and computer

engineering.

'he study of new semiconductor devices and surrounding technology is sometimes

considered a branch of physics. 'his article focuses on engineering aspects of

electronics. )ther important topics include electronic waste and occupational health

impacts of semiconductor manufacturing.

1B

Consu+e Dua,"es

0Data ta,"e -eadings ae s-o1n Yea?1ise in des.ending ode2

Air &onditioners

Bicycles

&rystal 9lass

=omestic ,lectrical Appliances

9ems and 6ewellery

9lass Froducts

Eitchen ,!uipment

8i!uefied Fetroleum 9as &ylinders

+icrowave )vens

4efrigerators

:ewing +achines

:unglasses

'oys and 9ames

<ashing +achines and Gacuum &leaners

<atches and &locks

<hite 9oods

<riting %nstruments

1C

CHAPTER ?:

RE$IE@ O& LITERATURE

BUDGET AND BUDGETARY CONROL

BUDGET:

Budget is essential in every walk of our life national, domestic and Business. A

budget is prepared to have effective utilization of funds and for the realization of objective

as efficiently as possible. Budgeting is a powerful tool to the management for performing

its functions i.e., formulation plans, coordination activities and controlling operations etc.,

efficiently. or efficient and effective management planning and control are tow highly

*@

essential functions. Budget and budgetary control provide a set of basic techni!ues for

planning and control.

A budget fi"es a target in terms of rupees or !uantities against which the actual

performance is measured. A budget is closely related to both the management function as

well as the accounting function of an organization.

As the size of the organization increases, the need for budgeting is correspondingly

more because a budget is an effective tool of planning and control. Budget is helpful in

coordinating the various activities #such as production, sales, purchase etc$ of the

organization with result that all the activities precede according to the objective. Budgets

are means of communication. %deas of the top management are given the practical shape.

As the activities of various department heads are coordinated at the much needed for the

very success of an organization. Budget is necessary to future to motivate the staff

associated, to coordinate the activities of different departments and to control the

performance of various persons operating at different levels.

Budgets may be divided into two basic classes. &apital and operating budgets.

&apital budget are directed towards proposed e"penditure for new projects and often

re!uire special financing.

'he operating budgets are directed towards achieving short(term operational goals

of the organization for instance, production or profit goals in a business firm. )perating

budgets may be sub(divided into various departmental of functional budgets.

Definitions of Budget:

According to %nstitute of &harted +anagement Accountants, ,ngland - A plan

!uantified in monetary term prepared and approved prior to a defined period of time

usually showing planned income to be generated and . or to be incurred during that period

and the capital to be employed to attain a given objective./

*1

According to %&+A, ,ngland, a budget is, -a financial and.or !uantitative

statement, prepared and approved prior to a defined period of time, of the policy to be

pursed during the period for the purpose of attaining a given objective./

%t is also defined as, -a blue print of projected plan of a action of a business for a

definite period of time./

BUDGETARY CONTROL:

0o system of planning can be successful without having an effective and efficient

system of control. Budgeting is closely connected with control. 'he e"ercise of control in

the organization with the help of budgets is known as budgetary control. 'he process of

budgetary control includes.

?. ,stablishment of budget for each function and section of the organization.

A. ,"ecutive responsibility in order to perform the specific tasks so that objectives of

the enterprise may be attained.

B. &ontinues comparison of the actual performance with that of the budget and placing

the responsibility of e"ecutives for failure to achieve the desired result a given in

the budget.

C. 'aking suitable remedial action to achieve the desired objective if there is a

variation of the actual performance from the budgeted performance.

1@. 4evision of budgets in the light of changed circumstances.

Definitions of Budgeta! Conto":

According to the Brown and 5oward -Budgetary control is the system of

controlling costs which includes the preparation of Budgets, co(coordinating the

department and establishing the responsibilities, comparing the actual performance with the

budgeted and acing upon the results to achieve the ma"imum profitability/

**

According to the 6.Betty7 -A system which uses budgets as a means of planning

and controlling all aspects of producing and . or selling commodities and services/

According to the &%+A, 8ondon, -Budgetary control is the establishment of

budgets relating to responsibilities of e"ecutives to the re!uirement of a policy, and the

continuous comparison of actual with budged results, either to secure by individual action

the objective of that policy or to provide a basis for revision.

BUDGET( BUDGETING AND BUDGETING CONTROL

4ow land and <illiam in their book entitled Budgeting for management control has

given the difference between budge, budgeting and budgetary control as follows7

-Budgets are the individual objectives of a department etc where as budgeting may

be said to be the act of building budgets. Budgetary control embraces all this and in

addition includes the science of planning the budgets themselves and the utilization of such

budgets to effect on overall management tool for the business planning and control/. 'hus,

a budget is a financial plan and budgetary control results from the administration of the

financial plan.

Essentia" &eatues of a Budgeta!:

Budgetary control defines the objectives and policies of the undertaking as a whole.

%t is an effective method of controlling the activities of various departments of a

business unit. %t fi"ed targets and the various departments have to efficiently to

reach the targets.

*1

%t secures proper co(ordination among the activities of various departments.

%t helps the management to fi" up responsibility in case the performance is below

e"pectations.

%t helps the management to reduce wasteful e"penditure. 'his leads to reduction in

the cost of production.

%t brings in efficiency and economy by promoting cost consciousness among the

employees.

%t facilitates centralized control with decentralized activity.

%t acts as internal audit by a continuous evaluation of departmental results and costs.

Li+itations of Budgeta! Conto":

'he preparation of a budget under inflationary conditions and changing

9overnment policies is really difficult. 'hus, the accurate position of the business

can not be estimated.

Accuracy in budgeting comes through e"penditure. 5ence it should not be relied on

too much in the initial stages.

Budget is only a management tool. %t is not a substitute for management. %t can not

replace management in decision making.

Budgeting involves a heavy e"penditure, which small concerns cannot afford.

'here will be active and passive resistance to budgetary control as it points out the

efficiency or inefficiency of individuals.

'he success of budgetary control depends upon wiling co(operation and team work.

'his is often lacking.

*2

re!uent changes maybe called for in budgets due to fast changing industrial

climate. %t may be difficult for a company to keep pace with these fast changes,

because revision of budgets is e"pensive e"ercise.

OB#ECTI$E% O& BUDGETARY CONTROL:

P"anning:

*3

A budget is a plan of the policy to be pursued during the defined period of time to

attain a given objective. 'he budgetary control will force management at all the activities to

be done during the future periods. A budget as a plan of action achieves the following

purposes7

Action is guided by well thought out plan because a budget is prepared after a

careful sturdy and research.

'he budget serves as a mechanism through which.

+anagementKs objectives and policies are affected.

%t is a bridge through which communication is establishment between the top

management and the operatives who are to implement the policies of the top

management.

'he most profitable course of action is selected from the various available

alternatives.

Co?odination:

'he budgetary control co(ordinates the various activities of the firm and secures

co(operation of all concerned so that the common objective of the firm may be successfully

achieved. %t forces e"ecutives to think and think as a group. %t co(coordinating the policies,

plans and actions. An organization without a budgetary control is like a ship sailing in a

chartered sea. A budget gives direction to the business and imparts meaning and

significance to its achievement by making comparison of actual performance and budgeted

performance.

'oti<ation:

%t employees have actively participated in budget preparation and if they are

convinced that their personal interests are closely associated with the success of

*?

organizational plan, budgets provide motivation in the form of goals to be achieved. 'he

budgets will motivate the workers, depends purely on how the workers have been mentally

and physically involved with the process of budgeting.

Conto"7

&ontrol consists of the action necessary to ensure the performance of the

organization conforms to the plans and objectives. &ontrol of performance is possible with

predetermined standards which are laid down in a budget. 'hus, budgetary control makes

control possible by continuous comparison of actual performance with that of the budget so

as to report the variations from the budget to the management of corrective action.

'hus, budgeting system integrates key managerial functions as it links top

managementKs planning function with the control function performed at all levels in the

managerial hierarchy. But the efficiency of the budget as a planning and control device

depends upon the activity in which it is being used. A more accurate budget can be

developed for those activities where direct relationship e"ists between inputs and outputs.

'he relationship between inputs and outputs becomes the basis for developing budgets and

e"ercising control.

A**o<ed P"an:

A mater budget provides an approved summary of results to be e"pected from

proposed plan of operations. %t concerns all functions of organization and serves as a guide

to e"ecutives and departmental heads responsible for various departmental objectives.

Co++uni.ation:

'he employees of an organization should know organizational aims, objectives of

subunits #budgets centers$ and the part that they have to play for their attainment. Budgets

effectively communicate this information to employees. Besides, budges keep different

*A

sections of the organization informed about the contribution of different subunits in the

attainment of overall organizational objective.

Budget *o.edues:

5aving the budget organization and fi"ed the period, the actual work or budgetary

control can be taken upon the following pattern.

%TEP% IN BUDGETING CONROL:

OganiAation fo ,udgeting:

'he setting up of a definite plan of organization is the first step towards installing

budgetary controlling system in an organization a budget manual should be prepared giving

details of the powers, duties, responsibilities and areas of operation of each e"ecutive in the

organization.

Budget 'anua":

A Budget manual lays down the details of the organizational set up, the routine

procedures and programmers to be followed for developing budgets for various items and

the duties and responsibilities of the e"ecutives regarding the operation of the budgetary

control system. &%+A ,ngland defines a budget manual as -a document schedule or

booklet which sets out, inter alia, the routine of and the forms and records re!uired for

budgetary control/. 'hus, it is a written document which guides the e"ecutives in preparing

various budgets. Budgets are to be drawn keeping in view the objectives of the organization

given in the budget manual. 4esponsibility and functions of each e"ecutive in regard to

budgeting are written down in the budget manual to avoid any duplication or overlapping

of responsibilities. :teps and the methods for developing various budgets and the methods

of reporting performance against the budget are written down in the budget manual. %n

short it is a written document which gives everything relating to the preparation and

e"ecution of various budgets. %t should be clear and there should be no ambiguity in it.

*B

'he following are some of the most important matters covered in a Budget manual7

a$ %ntroducing and brief e"planation of the objects, benefits and principles of

budgetary control.

b$ )rganization chart giving the titles to different personnelKs with full e"planation

of the duties of each to operating system and preparation of departmental and

functional budgets.

c$ 8ength of budget periods and control periods should be clearly stated.

d$ A method of accounting and control of e"penditure.

e$ A statement showing the responsibility and of authority given to each manger

for approval of budgets, vouchers and all other forms and documents which

authorize them to spend the money. 'he authority for granting approval must be

clearly stated.

f$ 'he entire process of budgeting programme including the time table for

periodical reporting. A schedule should be drawn for this.

g$ Furpose, specimen form and number of copies to be used for each report and

statement. Budget centers involved should also be stated clearly.

h$ )utline of main budgets and their accounting relationships.

i$ ,"planation of key budgets.

&IBATION O& BUDGET PERIOD:

'he budget period mean the period for which a budget is prepared and employed.

'he budget period will depend upon the type of business and the control aspect.

*C

Budget period mean the period for which a budge is prepared and employed. 'he

budget period depends upon the nature of the business and the control techni!ues. or

e"ample, in case of seasonal industries #i.e., food or clothing$ the budget period should be a

short one and should cover one season. But in case of industries with heavy capital

e"penditure such as heavy engineering works, the budget period should be long enough to

meet the re!uirements of the business. rom control point of view, the budget period

should be a short one so that the actual results may be compared with the budget each week

end or month end and discussed with and discussed with the Budget committee. 8ong term

budgets should be supplemented by short term budgets to make the budgetary control

successful, as short(terms budgets will helping e"ercising control over day(today

operations. %n short, the budget period should not be too long so that there may be

sufficient time before budget implementation. or most business, annual budget is !uite

common because it compares with the financial accounting year.

'here should be a regular time plan for budget preparation. %t may be on the following

lines.

8ong(term budgets for three to five years should be prepared for e"pansion and

modernization of the undertaking, introduction of new products or new projects and

undertaking heavy advertisement.

Annual budgets coinciding with financial accounting year should be prepared for

the operations activities #i.e., sales, purchases, and production etc, of the business$

or control purposes, short(term budgets(monthly or even weekly budget(should be

prepared for watching progress of actual performance against targets. :hort(term

budgets are prepared to see that actual performance is proceeding according to the

budgets and early corrective action may be taken if there is any pitfall.

'he responsibility for preparation and implementation of the budgets may be fi"ed

as under.

1@

Budgeta! .onto""e:

Although the chief e"ecutive l finally responsible for the budgetary programme. %t

is better if a large part of the supervisory responsibility is deluged to an official designated

as Budget &ontroller or Budget =irector. :uch a person should have knowledge of the

technical details of the business and report directly to the president or the chief e"ecutive.

Ro""ing 0Continues2 Budget:

'his is a budget which is updated continuously by adding a further period #a

monthS!uarter$ and deducting a corresponding earlier period. Budgeting is a continuous

process under these methods of preparation of budget. )nce the first period elapses, the

forecast for that period is dropped and the forecast for the future period beyond the e"isting

could not be predicted and forecast reliably, this method is useful. 5owever, it is a costly

e"ercise but matched by considerable reduction in operational variances.

Annua" $s Continues ,udgeting s!ste+:

%n some organizations budgets are prepared on annual basis. But annual budgets

may not help the management to have control because variances due to rapidly changing

conditions affect the sales in !uantity and prices, severe rapidly changing conditions affect

the sales in !uantity and prices, severe inflationary conditions e"ist resulting fast increase

in the prices of inputs without reflecting in sales prices immediately and wide range of

products being produced making it not feasible to have precise estimate of levels of activity

for a year.

'he procedure in continuous budgeting will be that a year will be divided into four

!uarters. +onthly budgets for the first !uarter and three !uarterly budgets for the ne"t year

can be prepared. or the first !uarter precise estimates can be drawn up monthly. 'he

budget estimates for the second !uarter may be revised working out separately monthly

estimates on more precise basis for control purposes before the starting of the second

!uarter.

11

:imilarly procedure may be followed for third and fourth !uarters. 'his method a time

which need not be in respect of or coincide with the financial year. %t will enable to evolve

a precise plan of action and control of variance functions at least for the immediate !uarter

and a broad tentative one the subse!uent three !uarters on a continues basis.

Pin.i*a" Budget 0"i+iting2 fa.to:

Frincipal budget factor is such an important factor that it would affect all the

functional budgets to a large e"tent. 'he e"tent of its influence must be assessed first in

order to ensure that functional budgets are reasonably capable of fulfillment. 'his is the

factor in the activities of an undertaking which at a particular point in time or over a period

will limit the volume of output. %t is the governing factor which is a major constraint on all

the operational activities of the organization, so this factor is taken into consideration to

determine whether the budgets are capable of attainment. %t is essential to locate the

limiting factor may be any one of the following7

%s there sufficient demand for the productT #customer demand$

<ill a re!uired !uality and !uantity of materials be availableT #availability of raw material$

%s the plant capacity sufficient to cope up with the e"pected salesT #plant capacity$

%s the re!uired type of labor availableT #available of labor$

%s cash position sufficient to finance the e"pected volume of salesT #cash position$

Are there any 9overnment restrictionsT #9overnment restrictions$

or e"ample, a concern has the capacity to produce 3@,@@@ units of particular item per year.

But only 1@, @@@ units can be sold in the market. %n this case, low demand for the product is

the limiting factor. 'herefore, sales budget should be prepared first and other functional

budgets such as production budget, labor budget, plant utilization budget, cash budget etc.

should be prepared in accordance with this case plant capacity is limited. 'herefore,

production budget should be prepared first and other budgets should follow the production

budget.

'hus, the budget relating to limiting factor should be prepared first and the other

budgets should be prepared in the light of that factor. All budgets should be co(coordinated

keeping in view the principal budget factor if the budgetary control is to achieve the desired

results.

1*

Frincipal budget factor is not static. %t may vary rapidly from time to time due to

internal and e"ternal factors. %t is of temporary nature and in the long run can be overcome

by suitable management taking sales promotion steps as increasing sales staff and

advertising. Flant capacity can be improved by better planning, simplification of product or

e"tension of plant.

DI&&ERENT TYPE% O& BUDGET:

=ifferent types of budgets have been developed keeping in view the different

purposes they serve. Budgets can be classified according to7

'he coverage they encompassN

'he capacity to which they are relatedN

'he conditions on which they are basedN and

'he periods which they cover.

&un.tiona" Budget:

A functional budget is a budget which relates to any of the functions of an

undertaking e.g., sales, production, research and development, cash etc, the following

budgets are generally prepared.

Budget *e*aed ,!

1. :ales Budget including selling and :ales +anager

=istribution &ost Budget

*. Froduction Budget Froduction +anager

1. +aterial Budget Furchase +anager

11

2. 8abor and Fersonnel Budget Fersonnel +anager

3. +anufacturing )verheads Froduction +anager

?. Administration &ost Budget inance +anager

A. Flant >tilization Budget Froduction +anager

B. &apital ,"penditure Budget &hief ,"ecutive

C. 4esearch and =evelopment

&ost Budget 4;= +anager

1@. &ash Budget inance +anager

%a"es Budget:

:ales budget is the most important budget and of primary importance. %t forms the

basis on which all the budgets are built up. 'his budget is a forecast of !uantities and

values of sales to be achieved in a budget in a budget period. ,very effort should be made

to ensure that its figures are as accurate as possible because this is usually the starting

budget #sales being limiting factor on which all the other budgets are built up$. 'he sales

+anger should be made directly responsible for the preparation and e"ecution of the

budget. 'he sales budget may be prepared according to products, sales territories, types of

customersN salesmen etc., in the preparation of the sales budget, the sales manager should

take into consideration the following factors7

1. Fast :ales igures and 'rends.

*. :alesmenKs ,stimation.

1. Flant &apacity.

2. Availability of 4aw +aterial and other :upplies.

3. 9eneral 'rade Frospects.

12

?. )rders in 5and.

A. :easonal luctuations.

B. inancial Aspect.

C. Ade!uate 4eturn on &apital ,mployed.

1@. &ompetition.

11. +iscellaneous &onsiderations.

Podu.tion Budget:

Froduction budget is a forecast of the total output of the whole organization broken

down into estimates of output of each type of product with a scheduling of operations #by

weeks and months$ to be performed and a forecast of the closing finished stock. 'his

budget may be e"pressed in !uantitative #weight, units etc$ r financial #rupees$ units or

both. 'his budget is prepared after taking into consideration the estimated opening stock,

the estimated sales and the desired closing finished stock of each product. 'he works

manger is responsible for the total production budget and the departmental managers are

responsible for the departmental production budget. %n preparing the production budget, the

following factors are considered.

'he time lag between the production in the factor and sales to the customer should

be considered so as to allow fro the time re!uired or the dispatch of goods from the factory

to the place of the customers.

'he stock of goods to be maintained both at the factoryKs go gown and at he sales centers.

'he level of production needed to meet the sales programme. +onthly production

targets should be fi"ed and it should be seen that production is kept more or less at uniform

level throughout the year. 'he material labor and plant re!uirements should be ascertained

to have the desired production to meet the sales programme.

13

'he sales and the production are inter(dependant because production budget

is governed by the sales budget and the sales budget is largely determined by the

production capacity and by production costs.

Cost of *odu.tion Budget:

After determining the volume of output the cost of procuring the output must be

obtained by preparing a cost of production budget. 'his budget is an estimate of cost of

output planned for a budget period and may be classified into material cost budget, labor

cost budget and overhead budget because cost of production includes material, labor and

overheads.

'ateia"s Budget:

%n drawing up the production budget, one of the first re!uirements to be considered

is material. As we know, materials may be direct or indirect. 'he materials budget deals

with the re!uirements and procurement of direct materials. %ndirect materials are dealt with

under the works overhead budget. 'he budget should be related to the production budget

and the period of the budget should be of short duration because this budget has an

important bearing on the cash budget.

Pu.-ase Budget:

Furchase Budget is mainly dependent on production budget and material

re!uirement budget. 'his budget provides information about the materials to be ac!uired

from the market during the budget period.

1?

Furchase budget should be prepared by the purchase manger by getting relevant

information about capital items, tools, general supplies and direct materials re!uired during

the budget period from other related departments. 8ike other budgets, the purchase budget

has to be approved by the budget committee. After approval it becomes the responsibility

of the purchase officer to see that purchases are made as per the purchase budget.

:ometimes additional purchases which are not covered by the purchase budget are made

under the following circumstances.

%f there is increase in production not anticipated while preparing the purchase

budget and purchase of larger !uantities of materials becomes necessary.

%f accumulation of stock becomes necessary to avoid shortage of materials.

%f overstocking is desired to take advantage of lower prices and there is fear that

price will increase in near future.

'he purchase manger should get additional sanctions from the higher authorities for

making the additional purchases not covered by the purchase budget.

Die.t La,o Budget:

'his budget gives as estimate of the re!uirements of direct labor essential to meet

the production target. 'his budget may be classified into labor 4e!uirements budget and

recruitment budget. 'he labor recruitment budget is developed on the basis of re!uirement

of the production budget given and detailed information regarding he different classes of

labor e.g., fitters, welders, turner, millers, and grinders and drillers etc., re!uired for each

department, their scales of pay and hours to be spent. 'his budget is prepared with a view

too enable the personnel department to carry out programmers of training and transfer and

to find out sources of labour needed so that every effort may be made to remove difficulties

arising in production the available workers in each department, the e"pected changes in the

labour force during the budget period due to the labour turnover. 'his budget gives

information about the personnel specification for the jobs for which workers are to be

recruited, the degree for skill and e"perience re!uired and the rates of pay. <here standard

costing system is applied, the labor cost budget is dev eloped on the basis of standard labor

cost per unit multiplied by the !uantity of anticipated production determined in the

production budget. %f standard costing system is not being followed in the organization, the

information of labour cost may be obtained from past records or estimated cost.

1A

:ometimes another budget known as +anpower budget is prepared. 'his budget

gives the re!uirements of direct and indirect labour necessary to meet the programme set

out in the sales, manufacturing, maintenance, research and development and capital

e"penditure budgets. 'he labor terms are e"pressed of rupee value, number of labour hours,

number and grade of workers etc. this budget makes provision for shift and overtime work

and for the effective training for new workers on labour cost.

'anufa.tuing O<e-eads Budget:

'his budget gives an estimate of the works overhead e"penses to be incurred in a

budget period to achieve the production target. 'he budget includes the cost of indirect

material, indirect labour and indirect works e"penses. 'he budget may be classified into

fi"ed cost, variable cost and semi(variable cost. %t can be broken into departmental

overhead budget to facilitate control. %n preparing the budget, fi"ed works overhead can be

estimated on the basis of past information after taking into consideration the e"pected

changes which may occur during the budget period. Gariable e"penses are estimated on the

basis of the budgeted output because these e"penses are bound to change with the change

in output.

'he &ost Accountant prepares this budget on the basis of figures available in the

manufacturing overhead ledger or the head of the workshop may be asked to give estimates

for the manufacturing e"penses. A good method is to combine the estimates of the &ost

Accountant and the shop e"ecutive.

Ad+inistati<e EC*enses Budget:

'his budget covers the e"penses incurred in framing policies, directing the

organization and controlling the business operations. %n other words, the budget provides as

estimate of the e"penses of the central office and of management salaries. 'he budget can

be prepared with the help of past e"perience and anticipated changes. Budget may be

prepared be prepared for each administration department so that responsibility for

1B

increasing such e"penses. 'his budget covers the e"penses incurred in framing policies,

directing the organization and controlling the business operations. %n other words, the

budget provides an e"ecutive. +uch difficulty is not e"periences in developing such budget

as most of the administration e"penses are of a fi"ed nature. Although fi"ed e"penses

remain constant and are not related to sale volume in the sort run, they are dependent upon

sales in the long run. <ith a small change in output, they do not change. 5owever, if there

is persistent fall in output, administration e"penses will have to be reduced by discharging

the services of some members of the staff and taking other economy measures. )n the

other hand, with persistent increase in output or business activity, administration e"penses

will increase but they may lag behind business activity.

Budgeted In.o+e %tate+ent:

A budgeted income statement summarizes all the individual budges i.e., sales

budget, cost of goods sold budget, selling budget, and administrative sales budget. 'his

budget determines income before ta"es. %f the ta" rate is available net income after ta"es

can also be computed.

%e""ing and Disti,ution Costs Budget:

'his budget is the forecast of the cost selling and distribution for budget

period and is clearly related to the sale budget. All e"penses related to selling and

distributions of the various products as indicated in the sales budget are included in it.

'hese e"penses are based on the volume of sales set in the sales budget and budget and

budgets are prepared for each item of selling and distribution overhead. 8ong term

e"penses.

As advertisement are spread over more than one period. :elling and distribution

overheads are divided into fi"ed and variable category with reference to volume of sales.

:eparate budgets are prepared for variable and fi"ed items of selling and distribution

overheads. &ertain items of selling and distribution costs as cost of transport department

are included in the departmental production cost budget from control point of view rather

that including in selling and distribution costs budget.

1C

P"ant Uti"iAation Budget:

'his budget lays down the re!uirements of plant capacity to carry out the

production as per the production programme. 'his budget is terms of convenient physical

units as weight or number of products or working hours. 'he main functions of this budget

are7

%t will show the machine load in each department during the

Budget period.

%t will indicate the overloading on some departments, machine or group of machine

and alternative courses of actions as working overtime, off loading, procurement or

e"pansion of plants, sub(contracting etc., can be taken.

%dle capacity in some departments may be utilized by making efforts to increase the

demand for the products by providing after sale service, conducting advertisement

campaign, reducing prices, introducing lucky prize coupons, recruiting efficient

sales staff etc.

Ca*ita" EC*enditue Budget:

'he capital e"penditure budget gives an estimate of the amount of capital that may

be needed for ac!uiring the assets re!uired for fulfilling production re!uirements a

specified in the production budget. 'he budget is prepared after taking into consideration in

the available productive capacities, probable reallocation of the e"isting assets such as plant

and e!uipment budget, building budget etc. 'he capital e"penditure budget is an important

budget proving for ac!uisition of assets, necessitated by the following factors7

RE%EARCH AND DE$ELOP'ENT CO%T BUDGET:

<hile developing research and development cost budget, it should be clear in mind

that work relating to research and development is different from that relating to the

manufacturing function. +anufacturing function gives !uicker results than research and

development which may go on for several years. 'herefore, these budgets are established

2@

on a long term basisN say for 3 to 1@ years which can be further subdivided into short(term

budgets on annual basis. As a rule research workers are less cost consciousN so they are not

susceptible to strict control. A research and development budget is prepared taking into

consideration the research projects in hand and the new research projects in hand and the

new search and development projects to be taken up. 'hus this budget provides an

estimate of the e"penditure to be incurred on research and development during the budget

period.

After fi"ation of the research and development cost budget, the research e"ecutive

fi"es priorities for the various research and development projects and submits research and

development project authorization forms to the budget committee. 'he projects are finally

approved by the senior e"ecutive. Before giving the approval, the e"penditure on research

and development is matched against the benefits likely to be availed of from the new

projectN after the approval of the budget, a close watch is kept on the e"penditure so that it

may not e"ceed budget provisions. %t is also seen that e"tent of progress made is

commensurate with the e"penditure incurred.

CA%H 0&INANCIAL2 BUDGET:

'he cash budget can be prepared by any of the following method7

1. 4eceipts and payments method

*. 'he adjusted profit and loss method

1. 'he balance sheet method

1. 4eceipts and payments method7 %n case of this method the cash receipts from

various sources and the cash payments to various agencies are estimated. %n the

opening balance of cash, estimated cash receipts are added and from the total of

estimated cash payments are deducted to find out of the closing balance.

21

*. 'he adjusted profit and loss method7 %n case of this method the cash budget is

prepared n the basis of opening cash and bank balance of the various assets an

liabilities.

1. 'he balance sheet method7 <ith the help of budget balances at end e"cept cash and

bank balances, a budgeted balance sheet can be prepared and the balancing figure

would be the estimated closing cashSbank balance.

'hus under this method, closing balances, other than cashSbank will have to be found out

first to be put in the budget balance sheet. 'his can be done by adjusting the anticipated.

'aste Budget 0&ina"iAed Pofit P"an2:

'he +aster Budget is consolidated summary of the various functional budgets. %t

has been defined as -a summary of the budget schedules in capsule form made for the

purpose of presenting, in one report, the highlights of the budget forecast/. 'he definition

of this budget given by the &hartered %nstitute of +anagement Accountant, ,ngland, is as

follows7

-'hus summary budget incorporating its components functional budgets and which

are finally approved and employed/

'he master budget is prepared by the budget committee on the basis of co(

coordinated functional budgets and becomes the target for the company during the budget

period when it is finally approved by the committee. 'his budget summaries functional

budget to produce a budgeted Frofit and 8oss Account and a Budget Balance :heet as at

the end of the budget period.

&iCed Budget:

'his budget is drawn for one level of activity and one set of conditions. %t has been

defined as a budget which is designed to remain unchanged irrespective of the volume of

2*

output or turnover attained. %t is rigid budget and is drawn on the assumption that there

will be no change in the budgeted level of activity. A fi"ed budget will, therefore, be useful

only when the actual level of activity corresponds to the budgeted level of activity. A

master budget tailored to a single output level of #say$ *@,@@@ units of sales is a typical

e"ample of a fi"ed budget. But in practice, the level of activity and set conditions will

change as a result of internal limitations and e"ternal factors like changes in demand and

price, shortage of materials and power, acute competition etc. %t is hardly of any use as a

mechanism of budgetary control because it does not make any distinction between fi"ed,

variable and semi(variable costs and provides for no adjustment in the budget fi"ed as

result of change in cost due to change in level of activity. %t is also not helpful at all in the

fi"ation of price and submission of tenders.

&"eCi,"e Budget:

'he &hartered %nstitute of +anagement Accountants, defines a fle"ible budget also

called sliding scale budget as a budget which, by recognizing the difference in behavior

between field an d variable costs in relation to fluctuations in output, turnover, or other

variable factors such a number of employees, is designed to change appropriately with such

fluctuations. 'his, a fle"ible budget gives different budgeted costs for different levels of

activity. A fle"ible budget making an intelligent classification of all e"penses between

fi"ed, semi(variable and variable because the usefulness of such a budget depend upon the

accuracy with which the e"penses can be classified. :uch a budget is prescribed in the

following cases.

<here the level of activity during the year varies from period, either due to

the seasonal nature of the industry or to variation in demand.

21

<here the business is a new one and it is difficult to foresee the demand.

<here the undertaking is suffering from shortage of a factor of production

such as materials, labour, plant, capacity etc. 'he level of activity depends

upon the availability of such a factor of production.

<here an industry is influenced by changes in fashion.

<here there are general changes in sales.

<here the business units keep on introducing new products or make

changes in the design of its products fre!uently.

<here the industries are engaged in make to order business like

shipbuilding.

Basi. Budget:

A Basic budget has been defined as a budget which is prepared for use unaltered

over a long period of time. 'his does not take into consideration current conditions and can

be attainable under standard conditions.

Cuent Budget:

A &urrent budget can be defined a budget which is related to the current conditions

and is prepared for use over a short period of time. 'his budget is more useful than a basic

budget, as a target of lays down will be corrected to current conditions.

Long?Te+ Budget:

22

A 8ong(term budget can be defined as a budget which is prepared for periods

longer than a year. 'hese budgets help in business forecasting and forward planning.

&apital ,"penditure Budget and 4esearch and =evelopment Budget are e"amples of long(

term budgets.

%-ot? Te+ Budget:

'his budget is defined as a budget which is prepared for period less than year and is

very useful to lower levels of management for control purposes. :uch budgets are prepared

for those activities the trend in which is difficult to foresee over longer periods. &ash

budget and material budget are e"amples of short term budget.

Pefo+an.e Budget:

Ferformance Budgeting has its origin in >.:.A. After :econd <orld <ar it tries to

rectify some of the shortcoming in the traditional budget. %n the traditional budget amount

are earmarked for the objects of e"penditures such as salaries, travel, office e"penses, grant

in aid etc. %n such system of budgeting the money concept was given more prominence i.e.

estimating or projecting rupee value for the various accounting heads or classification of

revenue and cost. :uch system of budgeting was more popularly used in government

department and many business enterprises. But is such system of budgeting control of

performance in terms of physical units or the related costs cannot be achieved.

Ferformance oriented budgets are established in such a manner that each item of

e"penditure related to a specific responsibility centre is closely linked with the performance

of that centre. 'he basic issue involved in the fi"ation of performance budgets is that of

developing work programmers and performance e"pectation by assigned responsibility,

necessary for the attainment of goals and objectives of the enterprise, it involves

establishment of well defined centers of responsibilities, establishment for each

responsibility centre(a programmed of target performance e in physical units, forecasting

the amount of e"penditure re!uired to meet the physic al plan laid down and evaluation of

performance.

Deo Based Budgets:

23

'his budge is the preparation of budget starting from Jero or from a clean state. As

a new techni!ue it was proposed by Fatter Feal of 'e"as %nstruments %nc., >.:.A. 'his

techni!ue was introduced in the budgeting in the state of 9eorgia by +r. 6immy &arter who

was then the 9overnment of that state. JBB was tried in federal budgeting as a means of

controlling state e"penditures.

'he use of zero(based budgeting as a managerial tool has become increasingly

popular since the early 1CA@Ks %t is steadily gaining acceptance e in the business world

because it is providing it utility as a tool integrating the managerial function of planning

and control. JBB is not based on the incremental approach and previous yearKs figures are

not adopted as a base. 4ather, zero is taken as a base aw the name goes. 'aking zero as a

base, a budget is developed on the basis of likely activities for the future period. %n JBB,

by declining the budget from the past, the past mistakes are not repeated. unds re!uired

for any for the ne"t budget period should be obtained by presenting a convincing case.

unds will not be available as a matter of course.

AD$ANTAGE% O& BUDGETARY CONTROL:

2?

'he most important advantage of a budgetary control is to enable management to

conduct business in the most efficient manner because budgets are prepared to get the

effective utilization of resources and the realization of objectives as efficiently.

%t lies down as objective for the business as a whole. ,ven though a monetary

reward is not offered the budget becomes a game a goal to achieve or a target to shoot at

and hence it is more likely to be achieved or hit that if there was no predetermined goal or

target. 'he budget is an impersonal policeman that maintains ordered effort and brings

about efficiency in result. %t ensures effective utilization of men, materials, machines and

money because production is planned according to the availability of these items.

,veryone working in the concern knows what e"actly to do because budgetary

control laid emphasis on the staff organization. %t ensures that individual responsibilities

are clearly defined and that the re!uired authority commensurate with the responsibility is

delegated so that buck passing ay is prevented when the budgeted results are not achieved.

Budgetary control takes the help of different levels of management in the preparations of

the budget. Budget finally approved represents the judgment of the entire organization and

not merely that of an individual or a group of individuals. 'hus, it ensures team work.

+anagement by e"ception is possible because the comparison of actual and budgeted

results points out weak spots so that remedial action is taken against weak spots which are

not in conformity with the budgeted performance.

Budgetary control creates conditions for setting up a system of standard costing.

%t is helpful in reviewing current trends in the business and in determining further

policy of the business because current and future trends are studied in the preparation of the

budget.

DI%AD$ANTAGE% O& A BUDGET:

2A

<hile budgets may be essential part of activity they do have number of disadvantages,

particularly in perception terms.

Budgets can be seen pressure devices imposed by management, thus resulting in7

a$ bad labor relations

b$ %naccurate record(keeping.

=epartmental conflict arises due to7

a$ dispute over resources allocation

b$ =epartmental blaming each other if targets are not attained. %t is difficult to reconcile

personalSindividual and corporate goals. <aste may arise as managers adopt the view, -we

had better sped it or we will lose it/. 'his is often coupled with -empire building/ in order

to enhance the prestige of department. 4esponsibility versus controlling, i.e. some costs

are under the influence of more than one person, eg. Fower costs.

2B

CHAPTER 8

DATA ANALY%I%

/

INTERPRETATION

2C

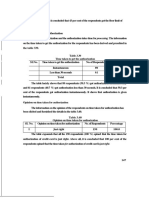

CO%T O& PRODUCTION BUDGET 0)336?)3372

PARTICULAR% BE RE Esti+ate fo a.tua"

Out*ut

A.tua"s $aian.e Eof

<o*

:ales 1*@@@ 1*@@@ 1@21@ 13A@#adv$

Galue of production 111A* 1@A3@ CA@1 1@2C#adv$

&ost of production

4aw materials 1A1@ 2@*B #CA@1.1@A3@$U 2@*B

1?13

133? AC#fav$ 1A.2

A

1?.??

&onsumables A1@ ?2@ #CA@1.1@A3@$U?2@ 3AB 2C* B?#fav$ 3.C3 3.@A

Fower A1A ?CA #CA@1.1@A3@$U?CA ?*C 31A C*#fav$ ?.2B 3.32

uel C2? ??? #CA@1.1@A3@$U??? ?@1 23? 123#fav$ ?.* 2.A

4epairs ;

+aintenance

13@ 13@ #CA@1.1@A3@$U13@ 11? 1?A 31#adv$ 1.*? 1.AB

)ff loading ?@1 ??B@ #CA@1.1@A3@$U?B@ ?12 ?3@ 1?#adv$ ?.11 ?.A

'otal variable cost A@3? A@?1 4:5) ?@3B 112#fav$

:alaries ; <ages 11B* 1@CC 1@C1 ?#fav$

)ther e"penses

actory ,"penses A* 3? AA *1#adv$

Admin ; :ellingKs 13B 1AA *B1 C?#fav$

=epreciation 23@ 1@@ 1A3 A3#adv$

4;= 1@1 B1 @ B1#fav$

Amortization 1@ 3 1@ 3#adv$

%nterest *@ *3 2 *1#fav$

'otal fi"ed cost 21C3 1C23 1B2@ 1@3#fav$

'otal &ost of Frod 11*31 11@@? CBCB 11@B#fav$

)perating profit (AC (*3? (1C? ?@#fav$

&apacity utilization AAQ C?Q A2Q **Q#adv$

:ales !uantity #tones$ *1@B *?11 *@1A 3C2#adv$

IN$ENTORY BUDGET 0)336?)3372

3@

0Rs= In LaF-s2

ARTPCULAR% BE 4, ACTUAL% $ARIANCE

4aw materials 11@@ B@@ 11*3 1*3#adv$

&onsumables A@@ ?@@ ?*3 *3#adv$

:pares 2*3 13@ *BA ?1#fav$

%nternally generated 33@ B@@ 1@B3 *B3#adv$

<ork in progress 1*11 *C12 12*3 2C1#adv$

inished goods 1@ 1@ 1*2 112#adv$

'otal inventory ?1C? 32C2 ??A1 11AA#adv$

DETAIL% O& %ALARIE% AND BENE&IT% 0)336?)3372

31

0Rs= In LaF-s2

PARTICULAR% BE RE ACTUAL% $ARIANCE

:alaries ; Allowances *@2A 1CC* *@32 ?*#adv$

8eave encashment C1 1*3 112 C#Adv$

&omp )ff C@ A* *A 22#fav$

%ncentive Bonus 1@@ 13 BA 3*#adv$

:tatutory Bonus 12 @ @ @

:tipend to 'rainees 13 13 11 *#fav$

F#%ncl. %nsp.$ *1? *@3 **3 *@#Adv$

9ratuity 1?1 1B? CA BC#fav$

G4: 32 112 113 *1#adv$

+isc 3 A 2 1#fav$

*B11 *A31 *AA? *3#adv$

<,8A4,

,VF,0:,:

&anteen ,"penses ?3 3@ 2A 1#fav$

#8ess 4eceipts$ @ (1@ (1? ?#fav$

5ealth &are C@ C3 1@@ 3#adv$

amily <elfare ? 3 3.21 @.21#adv$

8iveries ? 1* 12.31 *.31#adv$

8'& 1A 11 1.2* C.3B#fav$

'ransport C1 ?@ 33 3#fav$

8ess 4eceipts$ (? (1.3 (?.*B @.*B#fav$

&onv. Allowance *B 13 22 C#adv$

&hildren ,ducation

Allowance

1@ 1* 1*.1C @.1C#adv$

:taff <elfare ? B @.@3 A.C3#fav$

%nt. :ubsidy on *? *3 1B A#fav$

5ouse 8oans

'ownship ,"penses ** 1B 1A 1#fav$

8ess 4eceipts$ (1 (1 (*.2A @.31#adv$

'ownship ,"penses *C 11 *3 ?#adv$

:chool

TOTAL @EL&ARE :67 :85=9 :15=35 )60fa<2

GRAND TOTAL :)3) :376=9 :37:=35 :0fa<2

DETAIL% O& OTHER EBPEN%E% 0)336?)3372

3*

PARTICULAR% BE RE ACTUAL% $ARIANCE

&ACTORY EBP 0A2

<ater *A 1@ 11 *1#Adv$

4ates ; 'a"es 1 1 1.3A @.3A#Adv$

%nsurance 13 *B ** ?#fav$

Amortizing 'ools 1 @.A3 @.21 @.1*#fav$

+iscellaneous 13 12 1B 2#adv$

B1 33.A3 AA *1#Adv$

AD'N= EBP 0B2

4ent ; service charge 1.3 1* 1* *#fav$

Fostage 'elephone ;

'ele"

21 1@ 1*.3 *.3@#fav$

Frinting ; :tationery 13 *@ 1? 2#fav$

'ravel ,"penses 2@ ?@ 1? *2#fav$

Bank charges ?@ 1@ 1A 11#fav$

Advertisement C 1? 1@ ?#fav$

Audit ees @.2* @.B2 1.A* @.BB#adv$

8egal ,"p *.A3 *.3 @.AA 1.A1#fav$

&onveyance charges B 1@ 11.1? 1.1?#adv$

Books ; Feriodicals 2.3 1 *.1* @.BB#fav$

+embership ; seminars

fees etc.

?.A3 A3 A.C* ?A.@B#fav$

&ommittee meetings ;

,ntertainment e"p

2 1.3 1.3C @.@C#adv$

5ostel ; 9uest 5ouse 2.3 ?.3 3.3 1#fav$

8ess %ncome (1.*3 (1.*3 (1.13 @.1#fav$

&onsultancy e"p 3.3 1 @.11 @.?A#fav$

+isc 3*.3 11A.3 A@.3B 2A#fav$

*3B.1A 1B?.3C **3.B2

1?1#fav$

%ELLING EBP 0C2

:elling Agency com 1 2 1 1#fav$

Fublicity ,"p A.3 A 1@ 1#adv$

,"port Fromotion ,"p A.3 * @ *#fav$

+isc *3 3 A.B1 *.B1#adv$

21 1B 1B.B1 1#adv$

CHARGED O&&( 0D2

<4%'',0 );F4)

+ise ?@ 2@ 2@.13 @.13#adv$

Tota" of AGBGCGD 88)=15 933=:8 :41=6) 1:6=9)0fa<2

REA%ON% &OR $ARIANCE% &OR THE YEAR )336?)337

31

'he performance in respect of both Gop and sales was lower than the targets and is mainly

because of the receipts of most orders at the fag end of the financial year and delays in

import of critical raw materials from 4ussia.

A. 4aw materials7 =ue to continued efforts by the organization to overcome the

problems arises due to imposition of restrictions on supply of materials and as a

result procurement of this material at higher prices and increased utilization of

internally generated scrap has resulted cost of 4aw material consumption.