Professional Documents

Culture Documents

History and Role of World Bank in Economic Development

Uploaded by

Nouman MujahidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

History and Role of World Bank in Economic Development

Uploaded by

Nouman MujahidCopyright:

Available Formats

Over the years, the institutional framework of the World Bank has changed considerably.

The World

Bank (widely referred to in development circles as simply the Bank) consists of five separate organizations.

Initially, all bank lending was channelled through the International Bank for Reconstruction and

Development (IBRD), the branch of the World Bank established following Bretton Woods (introduced in Box

13.1). At the time, its principal concern was rebuilding economies shattered during World War II. Loans are

offered on commercial terms to borrowing governments or to private enterprises that have obtained

government guarantees, but rates are modest due to the banks high credit rating for its own borrowing.

Largely due to the success of the Marshal Plan, the reconstruction of Europe had become a fait accompli

by the late 1950s, at which time the World Bank turned its primary focus toward investment in the poorer

economies. In 1960, the International Development Association (IDA) was established to provide credits on

concessional terms to countries whose per capita incomes are below a critical level. These favourable

terms involve repayment periods several times longer than those on IBRD loans and are interest-free. The

preferred terms are an outgrowth of recognition that low-income countries are unable to borrow at

commercial rates because they are more economically vulnerable and the financial

Returns to investment are slower to be realized. In 1956, the International Finance Corporation (IFC) was

established to lend directly to private enterprise. In addition, through underwriting or holding equity, it is

capable of taking direct financial interests in the loan recipients to magnify economic rewards of

World Bank investments. Two smaller affiliates are the Multilateral Investment Guarantee Agency (MIGA)

and the International Centre for Settlement of Investment Disputes (ICSID).

For the first two decades following World War II, the bulk of World Bank lending was used to finance the

Building of infrastructure related to energy and transportation, As much of Europes infrastructure had been

Destroyed. Rising pressure to increase the flow of funds To poorer nations, following the economic

recovery of Europe, led to a similar pattern of investment in developing Countries. It was discovered,

however, that infrastructural Investments in the developing world failed to produce The same returns as

those in Europe due largely To a lack of institutional framework and skilled labor. It became clear that a

reordering of investment priorities Specific to the needs of developing regions was Necessary. Since that

period, the focus of the World Bank has Undergone periodic shifts, though it may be more accurate

To say that the Bank has added new activities Rather than abandoned older ones. The focus of the

Decade is a simple way to characterize the evolution Of World Bank activity favored by some economists

at The Bank. In the 1950s, the focus was on physical capital; The Bank began similar lending in a growing

Number of developing countries for infrastructure, Such as roads, electrical grids, and dams, and later

increasingly For agricultural investments to assist export Expansion. By the late 1960s, when Robert

mcnamara Became its president, for the first time the Bank began To direct its attention to poverty

reduction and so to Put a priority on rural development. One focus was on Improved access to

development resources for small Farmers who had been bypassed by previous development

Projects; success was mixed at best, however, And agricultural lending fell drastically in subsequent

Years. But in some respects work on poverty grew Through the 1970s, and the Bank has called this its

human Focus period, emphasizing access of the poor to Education and health services. But critics argued

these Efforts were ineffective due to failure to work directly With people living in poverty and comprehend

their Constraints, or to deal with elites who undermined or Siphoned resources from projects. In the 1980s,

debt And finance became the focus. In the 1970s, and early 1980s, developing countries took on a lot of

debt. The Bank started concentrating on structural adjustment Loanslarge loans that come with certain

conditions On what the country can do with the money, and What kinds of policies they need to implement,

primarily Focused on liberalization, marketization, and privatization. The activities of the Bank to a large

extent Merged with the Fund in this period and were heavily Criticized by many economic development

specialists And by developing countries. For example, the poor Were harmed by the emphasis on policies

such as cost recovery for services that in many cases in Africa and elsewhere was expected to extend to

school And health care fees. The goal of debt reduction was Often explicit; primary beneficiaries would

include Foreign banks. Structural adjustment loans were designed To promote a fundamental

restructuring of the Economies of countries plagued by chronic trade and Budget deficits by improving the

macroeconomic policy Environment with an emphasis on (a) mobilizing Domestic savings through fiscal

and financial policies, (b) improving public-sector efficiency by stressing Price-determined allocation of

public investments and Improving the efficiency of public enterprises, (c) improving The productivity of

public-sector investments By liberalizing trade and domestic economic policies, And (d) reforming

institutional arrangements to support The adjustment process. Critics of structural adjustment

Programs point to the fact that they frequently Lead to increased hardships for the very poor and on

occasion Have substantially reversed the benefits of earlier Economic progress. By the mid-1990s, the

Bank resumed A greater focus on poverty. President James Wolfensohn, in what the Bank calls its social

decade, Led a broadening of its focus on social protection. And After years in which many heavily indebted

poor countries Saw little developmentand little progress repaying Loansthe Poverty Reduction Strategy

Paper (PRSP) approach was introduced jointly with the IMF. Although intended to improve on this

experience, it Remained very uneven, most obviously because of its weak connection to actual budgets.

However, debt burdens did begin to decrease in Africa during the 2000s through various initiatives. The

Bank was sometimes criticized in this period for placing too little emphasis on government institutions for

fostering development such as coordination and industrial policy. The early 2000s also saw a focus on anti-

corruption and improvement on governance in general and of program management in particular. At

present, the Bank is positioning itself in the field of global public goods, focusing on resolution of global

aspects of the financial crisis, public health, vaccines, disease, and above all global warming, where

officials at the Bank see opportunities for an expansion of its mandate. As with the IMF, expansion of voting

shares and board chairs is at the top of the agenda for World Bank reform.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Depreciation and Carrying AmountDocument12 pagesDepreciation and Carrying AmountNouman MujahidNo ratings yet

- Notes On Inventory ValuationDocument7 pagesNotes On Inventory ValuationNouman Mujahid100% (2)

- Q13Document1 pageQ13Nouman MujahidNo ratings yet

- Quiz On DepreciationDocument1 pageQuiz On DepreciationNouman MujahidNo ratings yet

- Notes On Working Capital ManagementDocument11 pagesNotes On Working Capital ManagementNouman MujahidNo ratings yet

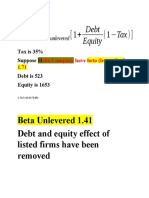

- When Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredDocument5 pagesWhen Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredNouman MujahidNo ratings yet

- Assets Liabilities and Owners EquityDocument9 pagesAssets Liabilities and Owners EquityNouman MujahidNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Merger: Acquiring CompanyDocument3 pagesMerger: Acquiring CompanyNouman MujahidNo ratings yet

- Dividends: Factors Affecting Dividend PolicyDocument7 pagesDividends: Factors Affecting Dividend PolicyNouman MujahidNo ratings yet

- How To Calculate The Beta of A Private CompanyDocument3 pagesHow To Calculate The Beta of A Private CompanyDuaa TahirNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Quiz of DividendDocument1 pageQuiz of DividendNouman Mujahid0% (1)

- Breakeven Analysis: EBIT $0Document5 pagesBreakeven Analysis: EBIT $0Nouman MujahidNo ratings yet

- Averageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Document1 pageAverageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Nouman MujahidNo ratings yet

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCDocument6 pagesEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidNo ratings yet

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- What Is Behavioral FinanceDocument4 pagesWhat Is Behavioral FinanceNouman MujahidNo ratings yet

- Personality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsDocument14 pagesPersonality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsNouman MujahidNo ratings yet

- Required Units in Sq Yard for Medical StoreDocument29 pagesRequired Units in Sq Yard for Medical StoreNouman MujahidNo ratings yet

- CH 17Document39 pagesCH 17Nouman MujahidNo ratings yet

- When Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredDocument5 pagesWhen Market Risk Plus Own Company Debt Risk Adds It Becomes Beta LeveredNouman MujahidNo ratings yet

- Accounts Payable ManagementDocument3 pagesAccounts Payable ManagementNouman MujahidNo ratings yet

- Initial Cash FlowDocument3 pagesInitial Cash FlowNouman Mujahid50% (2)

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- How To Write Effective Introduction of An ArticleDocument14 pagesHow To Write Effective Introduction of An ArticleNouman MujahidNo ratings yet

- W W W W W: Writing StrategiesDocument59 pagesW W W W W: Writing StrategiesHenao LuciaNo ratings yet

- Chapter# 7Document43 pagesChapter# 7Nouman MujahidNo ratings yet

- Finance Interview Questions: Carey CompassDocument2 pagesFinance Interview Questions: Carey CompassNouman MujahidNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BirlasoftDocument3 pagesBirlasoftlubna ghazalNo ratings yet

- Chap23 Measuring The Cost of LivingDocument85 pagesChap23 Measuring The Cost of LivingThanh Thư100% (1)

- 76948628276019714Document8 pages76948628276019714goldmine20233No ratings yet

- Contract To Sell LansanganDocument2 pagesContract To Sell LansanganTet BuanNo ratings yet

- 編曲:中島清隆 Gfes用短縮版Rev.2 湘南クラシコギターラ用 2012/3/2Document3 pages編曲:中島清隆 Gfes用短縮版Rev.2 湘南クラシコギターラ用 2012/3/2JazzNo ratings yet

- Chapter - 3Document66 pagesChapter - 3Ram KumarNo ratings yet

- Eco 101 ElasticityDocument26 pagesEco 101 ElasticityMovie SeriesNo ratings yet

- CashManagement 2019 2029Document13 pagesCashManagement 2019 2029Betre HurtoNo ratings yet

- Purchase Order Format in Excel For CompaniesDocument46 pagesPurchase Order Format in Excel For Companieshumayun shahidNo ratings yet

- Indian Economy-Pre Independace Perion (Sandeep Garg)Document13 pagesIndian Economy-Pre Independace Perion (Sandeep Garg)parthNo ratings yet

- High-tech design and innovations for maximum productivityDocument40 pagesHigh-tech design and innovations for maximum productivityvige50% (2)

- Important Questions For CBSE Class 12 Macro Economics Chapter 3 PDFDocument10 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 3 PDFAlans TechnicalNo ratings yet

- 2009 Warren Buffet Black-Scholes and Long Dated OptionsDocument13 pages2009 Warren Buffet Black-Scholes and Long Dated OptionsTerry MaNo ratings yet

- AutoSave To 77C07B0FIBM Lauren Chennai - First Cut Attendee List - 25th May 16Document22 pagesAutoSave To 77C07B0FIBM Lauren Chennai - First Cut Attendee List - 25th May 16Vicky SinhaNo ratings yet

- Board Structures in Asia - One-Tier vs Two-Tier ModelsDocument34 pagesBoard Structures in Asia - One-Tier vs Two-Tier ModelsHoangNo ratings yet

- Internet of Transactions: Bitcoin as an Open Platform for Value ExchangeDocument24 pagesInternet of Transactions: Bitcoin as an Open Platform for Value ExchangeBridget McGoldrickNo ratings yet

- School supply list and pricesDocument47 pagesSchool supply list and pricesBey IturaldeNo ratings yet

- Managerial Economics and Micro EconomicsDocument2 pagesManagerial Economics and Micro EconomicsVarun KalseNo ratings yet

- CFR ProblemsDocument28 pagesCFR ProblemsMadhu kumarNo ratings yet

- Скільки бізнесів планують залишитися в Україні - опитуванняDocument13 pagesСкільки бізнесів планують залишитися в Україні - опитуванняЮля ЗахарченкоNo ratings yet

- Investment DecisionsDocument55 pagesInvestment DecisionsKushal PandyaNo ratings yet

- Aia Philam Life Health InvestDocument6 pagesAia Philam Life Health InvestJG MespNo ratings yet

- 7 15 Sentrina Alaminos Cost ControlDocument61 pages7 15 Sentrina Alaminos Cost ControlQueenie Perez100% (1)

- Creative Use of Stops: Jason Alan JankovskyDocument22 pagesCreative Use of Stops: Jason Alan Jankovskypderby1100% (1)

- For CompletionDocument5 pagesFor CompletionMary Angelie De MesaNo ratings yet

- Performance Review of JeeraDocument13 pagesPerformance Review of JeeraMargita InfraNo ratings yet

- Eurocode 0 Structural Design Eurocode 1 Structures:: Basis Of: Actions OnDocument3 pagesEurocode 0 Structural Design Eurocode 1 Structures:: Basis Of: Actions OnSAN RAKSANo ratings yet

- AFM ASSIGNMENT UpdatedDocument10 pagesAFM ASSIGNMENT UpdatedGeorge KodomNo ratings yet

- Ch2.1. Optimal ChoiceDocument92 pagesCh2.1. Optimal ChoiceNguyễn Thị Anh ĐàiNo ratings yet

- Utility Bill Template 02Document5 pagesUtility Bill Template 02dzh4422No ratings yet