Professional Documents

Culture Documents

Revised VAT Guidelines for Philippine Taxpayers

Uploaded by

dencave1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised VAT Guidelines for Philippine Taxpayers

Uploaded by

dencave1Copyright:

Available Formats

REPUBLIKA NG PILIPINAS

KAGAWARAN NG PANANALAPI

KAGAWARAN NG RENTAS INTERNAS

Quezon City

October 18, 2005

REVENUE MEMORANDUM CIRCULAR NO. 62 - 2005

SUBJECT : Revised Guidelines in the Registration & Invoicing Requirements

Including Clarification on Common Issues Affecting Value

Added Tax (VAT) Taxpayers Pursuant to RA 9337 (An Act

Amending Sections 27, 28, 34, 106, 108, 109, 110, 111, 112, 113,

114, 116, 117, 119, 121, 148, 151, 236, 237 and 288 of the

National Internal Revenue Code of 1997, as Amended, and for

other Purposes).

TO : All Internal Revenue Officials and Employees and Others Concerned

Hereunder are guidelines in the form of basic questions and answers regarding the

registration and invoicing requirements relative to VAT taxpayers as required under RA

9337:

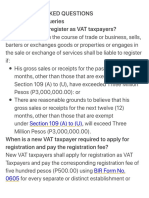

Q1 : Who are liable to register as VAT taxpayers?

A1 : Any person who, in the course of trade or business, sells, barters or exchanges

goods or properties or engages in the sale or exchange of services shall be liable

to register if:

(a) His gross sales or receipts for the past twelve (12) months, other than

those that are exempt under Section 109 (A) to (U), have exceeded one

million five hundred thousand pesos (P1,500,000); or

(b) There are reasonable grounds to believe that his gross sales or receipts for

the next twelve (12) months, other than those that are exempt under

Section 109 (A) to (U), will exceed one million five hundred thousand pesos

(P1,500,000).

Q2 : Are all VAT taxpayers mentioned in Q-1 above still required to

register?

A2 : Those taxpayers previously registered as VAT taxpayers under the old VAT

Law are not required to register anew, taxpayers who are previously registered

as non-VAT taxpayers but are now covered by the VAT Law shall update their

2

registration by filing BIR Form 1905 (Application for Registration Information

Update) at the RDO having jurisdiction over the taxpayers Head Office.

Q3 : Can the BIR automatically register previously Non-VAT taxpayers

who are now subject to VAT?

A3 : Yes, the BIR will automatically register taxpayers who were previously

registered as Non-VAT but are now subject to VAT through its Information

System Group.

Q4 : What is the criterion to be considered to be automatically registered

in relation to No. 3 above?

A4 : Those taxpayers whose transactions were previously not subject to VAT but

are now VATable (including previously VAT-exempt transactions), provided his

gross sales exceeded the P1.5M threshold.

Q5 : May a taxpayer already registered as VAT taxpayer under the old

VAT Law but whose annual gross sales does not exceed P1.5M change

his status to non-VAT taxpayer?

A5 : Yes, previously registered VAT taxpayer under the old VAT Law may change his

status to non-VAT taxpayer by making a written application, filing BIR Form

1905 and by demonstrating to the Commissioners satisfaction that his gross

sales or receipts for the following twelve (12) months, other than those that are

exempt under Section 109 (A) to (U), will not exceed one million five hundred

thousand pesos (P1,500,000.00).

Q6 : What will be the registration requirements of professionals now

covered by VAT pursuant to R.A. 9337 (e.g. doctors and lawyers)?

A6 : Following are the registration requirements:

1. Professionals now covered by VAT pursuant to R.A. 9337 are required to

update their registration using BIR Form 1905:

1.1 If their gross sales or receipts for the past twelve (12) months have

exceeded the P1.5M threshold, they are required to register as

VAT taxpayers by registering VAT as additional tax type of said

taxpayers. They have to accomplish BIR Form No. 1905;

1.2 If their gross sales or receipts for the past twelve months have not

exceeded the P1.5M threshold, they are still required to update

3

their registration by registering PT as tax type because they are

now subject to percentage tax.

2. Apply for Authority to Print Receipts (ATP) using BIR Form 1906 to be

able to have printed VAT Receipts.

Q7 : Where should a new VAT taxpayer register?

A7 : All taxpayers are required to register with the RDO having jurisdiction over the

taxpayers principal place of business following existing procedures on

registration.

Q8 : When is a new VAT taxpayer required to apply for registration and

pay the registration fee?

A8 : New VAT taxpayers shall apply for registration as VAT Taxpayers and pay the

corresponding registration fee of five hundred pesos (P500.00) before the start

of their business following existing issuances on registration.

Thereafter, taxpayers are required to pay the annual registration fee of five

hundred pesos (P500) not later than January 31, every year.

Q9 : What is the liability of a taxpayer becoming liable to VAT and did not

register as such?

A9 : Any person who becomes liable to VAT and fails to register as such shall be

liable to pay the output tax as if he were a VAT-registered person, but without

the benefit of input tax credits for the period in which he was not properly

registered.

Q10 : Who may opt to register as VAT and what will be his liability?

A10 :

1. Any person who is VAT-exempt under Sec. 4.109-1 (B) (1) (V) not

required to register for VAT may, in relation to Sec. 4.109-2, elect to be

VAT-registered by registering with the RDO that has jurisdiction over

the head office of that person, and pay the annual registration fee of

P500.00 for every separate and distinct establishment.

2. Any person who is VAT-registered but enters into transactions which

are exempt from VAT (mixed transactions) may opt that the VAT apply

to his transactions which would have been exempt under Section 109(1)

of the Tax Code, as amended. [Sec. 109(2)].

4

3. Franchise grantees of radio and/or television broadcasting whose annual

gross receipts of the preceding year do not exceed ten million pesos

(P10,000,000.00) derived from the business covered by the law granting

the franchise may opt for VAT registration. This option, once exercised,

shall be irrevocable. (Sec. 119, Tax Code).

4. Any person who elects to register under subsections (1) and (2) above

shall not be allowed to cancel his registration for the next three (3)

years.

The above-stated taxpayers may apply for VAT registration not later than ten

(10) days before the beginning of the calendar quarter and shall pay the

registration fee prescribed under sub-paragraph (a) of this Section, unless they

have already paid at the beginning of the year. In any case, the Commissioner of

Internal Revenue may, for administrative reason deny any application for

registration. Once registered as a VAT person, the taxpayer shall be liable to

output tax and be entitled to input tax credit beginning on the first day of the

month following registration.

Q11 : What are the instances when a VAT-registered person may cancel his

VAT registration?

A11 : 1. If he makes a written application and can demonstrate to the

commissioners satisfaction that his gross sales or receipts for the following

twelve (12) months, other than those that are exempt under Section 109

(A) to (U), will not exceed one million five hundred thousand pesos

(P1,500,000); or

2. If he has ceased to carry on his trade or business, and does not expect to

recommence any trade or business within the next twelve (12) months.

Q12 : When will the cancellation for registration be effective?

A12 : The cancellation for registration will be effective from the first day of the

following month the cancellation was approved.

Q13 : What is the invoicing/receipt requirement of a VAT-registered

person?

A13 : A VAT registered person shall issue:

(1) A VAT invoice for every sale, barter or exchange of goods or properties;

and

5

(2) A VAT official receipt for every lease of goods or properties and for every

sale, barter or exchange of services.

Q14 : May a VAT registered person issue a single invoice/receipt involving

VAT and Non-VAT transactions?

A14 : Yes. He may issue a single invoice/receipt involving VAT and non-VAT

transactions provided that the invoice or receipt shall clearly indicate the break-

down of the sales price between its taxable, exempt and zero-rated

components and the calculation of the Value Added Tax on each portion of the

sale shall be shown on the invoice or receipt.

Q15 : May a VAT registered person issue separate invoices/receipts

involving VAT and Non-VAT transactions?

A15 : Yes. A VAT registered person may issue separate invoices/receipts for the

taxable, exempt, and zero-rated component of its sales provided that if the sale

is exempt from value-added tax, the term VAT-EXEMPT SALE shall be

written or printed prominently on the invoice or receipt and if the sale is

subject to zero percent (0%) VAT, the term ZERO-RATED SALE shall be

written or printed prominently on the invoice or receipt.

Q16 : How is the Value Added Tax presented in the receipt/invoice?

A16 : The amount of the tax shall be shown as a separate item in the invoice or

receipt.

Sample:

Sales Price P100,000.00

VAT 10,000.00

Invoice Amount P110,000.00

Q17 : What is the information that must be contained in the VAT invoice

or VAT official receipt?

A17 : 1. Name of the Seller

2. Business Style of the Seller

3. Business Address of Seller

4. A statement that the seller is a VAT-registered person, followed by his TIN

5. Name of Buyer

6. Business Style of Buyer

6

7. Address of Buyer

8. TIN of buyer, if VAT-registered and amount exceed P1,000.00

9. Date of transaction

10. Quantity

11. Unit cost

12. Description of the goods or properties or nature of the service

13. Purchase price plus the VAT, provided that:

! The amount of tax shall be shown as a separate item in the invoice or

receipt;

! If the sale is exempt from VAT, the term VAT-EXEMPT SALE shall

be written or printed prominently on the invoice or receipt;

! If the sale is subject to zero percent (0%) VAT, the term ZERO-

RATED SALE shall be written or printed prominently on the invoice

receipt;

! If the sale involves goods, properties or services some of which are

subject to and some of which are zero-rated or exempt from VAT, the

invoice or receipt shall clearly indicate the breakdown of the sales price

between its taxable, exempt and zero-rated components, and the

calculation of the VAT on each portion of the sale shall be shown on

the invoice or receipt.

14. Authority to Print Receipt Number at the lower left corner of the invoice

or receipt.

Sample Receipt/Invoice:

1. Invoice for manually issued receipt:

7

2. Official Receipt generated by CRM/POS:

Q18 : What additional information must be contained in the VAT invoice or

VAT receipt in the case of sales in the amount of one thousand pesos

(P1,000.00) or more?

A18 : In the case of sales in the amount of one thousand pesos (P1,000.00) or more

where the sale or transfer is made by a VAT-registered taxpayer to another

VAT-registered person, the name, business style, if any, address and Taxpayer

Identification Number (TIN) of the purchaser, customer or client.

Q19 : What is the liability of a taxpayer not registered as VAT and issues a

VAT invoice/receipt?

A19 : The non-VAT registered person shall, in addition to paying other percentage

taxes, be liable to the tax imposed in Section 106 or 108 of the Tax Code

without the benefit of any input tax credit plus 50% surcharge on the VAT

payable (output tax). If the invoice/receipts contain the required information,

purchaser shall be allowed to recognize an input tax credit.

Q20 : What is the liability of a VAT-registered person in the issuance of a

VAT invoice/receipt for VAT-exempt transactions?

A20 : If a VAT-registered person issues a VAT invoice or VAT official receipt for a

8

VAT-exempt transaction, but fails to display prominently on the invoice or

receipt the words VAT-EXEMPT SALE, the transactions shall become taxable

and the issuer shall be liable to pay the VAT thereon. The purchaser shall be

entitled to claim an input tax credit on his purchase.

Q21 : Are transactions deemed sale on withdrawal of goods for personal

use required to issue invoice for VAT purposes?

A21 : In the case of deemed sale on withdrawal of goods for personal use, a memo

entry in the subsidiary sales journal to record withdrawal of goods for personal

use is required.

The data appearing in the subsidiary sales journal and the total amount of

deemed sale shall be included in the return to be filed for the month or

quarter.

Q22 : Can a VAT taxpayer engaged in sale of goods who usually makes sales

of goods on credit issue CASH RECEIPT document for the collection

of accounts receivable and other miscellaneous receipts?

A22 : Yes, provided the format of the CASH RECEIPT document is such that it shall

not show the breakdown of the quantity, description, unit cost and total price

of the goods sold. The reason for this is to prevent the recipient of this

document to use it as proof for claiming input tax.

Q23 : Are franchise grantees of radio and television required to register as

VAT taxpayer?

A23 : If their annual gross receipt for the preceding calendar year exceeded ten

million pesos (P10,000,000.00), they are required to register within thirty (30)

days after the end of the calendar year.

Q24 : Can taxpayers previously registered as VAT who are now not subject

to VAT still use their existing VAT invoices/receipts?

A24 : Yes. Taxpayers previously registered as VAT may continue to issue VAT

invoices and VAT official receipts for the period November 1, 2005 to

December 31, 2005, in accordance with the Bureau of Internal Revenue

administrative practices that existed as of December 31, 2004 provided these

receipts/invoices are stamped by the word NON-VAT registered as of

November 1, 2005.

9

Q25 : Can taxpayers who were previously registered as non-VAT who are

now subject to VAT still use their existing Non-VAT receipts/invoices?

A25 : Yes, non-VAT receipts/invoices may still be used by the new VAT taxpayer for

the period November 1, 2005 to December 31, 2005, provided these

receipts/invoices are stamped by the word VAT registered as of November 1,

2005.

Q26 : What is the effect of the New VAT law on CRM/POS and other sales

machines relative to the issuance of receipts?

A26 Taxpayer-users who have been issued permit to use sales machines are required

to re-configure their machines in conformity with the new VAT law and have

until December 31, 2005 to do so.

Suppliers who have been granted accreditation are not required to apply for re-

accreditation but they have the responsibility to re-configure the machines they

intend to sell in conformity with the new VAT law. However the Bureau

reserves the right to randomly check their compliance and if found to be non-

compliant, the Bureau shall withdraw their accreditation.

Sample Receipt to be generated by CRM/POS and other sales machines:

Q27 : What will be the basis of the Output VAT Payable if, as part of the

transitory provision, the generated receipts of CRM/POS are inclusive

10

of VAT which shall be allowed up to December 31, 2005 pending re-

configuration of their systems?

A27 : The Output VAT Payable shall be computed by multiplying the total

invoice/receipt amount by 1/11.

Q28 : What are the requirements to be submitted to the BIR concerned

office on or before November 30, 2005 by those taxpayers becoming

liable to pay VAT?

A28 : 1. A list of inventory of goods or supplies as of October 31, 2005 showing

the quantity, description and amount.

2. A list of inventory of unused invoice or receipt as of October 31, 2005.

Q29 : What is the rule on claims for input tax on purchases of depreciable

capital goods (local/imported) if purchase amount exceeds P1M?

A29 : If aggregate acquisition cost of all depreciable goods acquired in a month

exceeded P1M, the claims for input tax shall be spread over the life of the

depreciable goods or sixty (60) months, whichever is shorter.

Q30 : What are the accounting requirements in the acquisition, purchase or

importation of depreciable assets or capital goods?

A30 : A subsidiary record in ledger form shall be maintained for the acquisition,

purchase or importation of depreciable assets or capital goods which shall

contain, among others, information on the purchase amount, date of purchase,

description of the goods, total input tax thereon as well as the monthly input

tax claimed in the VAT declaration or return.

Q31 : How much input tax on sale of goods and services to the government

or any of its political subdivisions, instrumentalities or agencies,

including government-owned and controlled corporations (GOCCs)

can a VAT taxpayer claim?

A31 : The allowable input tax for sales of goods and services to the government shall

not exceed five percent (5%) of the selling price/gross receipts. If actual input

tax exceeds five percent (5%) of gross payments, the excess shall form part of

the sellers cost or expense. On the other hand, if actual input VAT is less than

five (5%) of gross payments, the difference shall be closed to cost or expense of

the seller.

11

Illustration:

Assumption No. 1: Sales P100,000.00; Output VAT 10,000.00; Purchase

P90,000.00; Input VAT 9,000.00.

Sales Invoice

Selling Price P100,000.00

VAT 10,000.00

Total Invoice Amount P110,000.00

Balance Sheet/Income Statement:

Output VAT Payable P10,000.00

Actual Input VAT P 9,000.00

Less: Standard Input VAT (5%) 5,000.00 5,000.00

Income & Expense Summary P 4,000.00

Net VAT Payable P 5,000.00

Less: Creditable Withholding Input 5,000.00

VAT

Output Tax Payable P 0.00

DEBIT CREDIT

Journal Entry to take up Sales:

Cash/AR 105,000.00

Creditable Withholding VAT 5,000.00

Sales 100,000.00

Output VAT Payable 10,000.00

Journal Entry to take up Purchases:

Purchases 90,000.00

Input Tax 9,000.00

Cash/Accounts Payable 99,000.00

Journal Entry to reflect the excess of actual input VAT over the

allowable input tax of 5% of gross payments/gross sales:

Output VAT Payable 1 0,000.00

Income & Expense Summary 4,000.00

Input Tax 9,000.00

Creditable Withholding VAT 5,000.00

12

Assumption No. 2: Sales P100,000.00; Output VAT Payable P10,000.00;

Purchases P10,000.00; Input Tax P1,000.00.

Balance Sheet/Income Statement:

Output VAT P 10,000.00

Actual Input VAT P 1,000.00

Less: Standard Input VAT (5%) 5,000.00 5,000.00

Income & Expense Summary (P4,000.00)

Net Output VAT Payable P 5,000.00

Less: Creditable Withholding Input 5,000.00

VAT

Output Tax Payable P 0.00

DEBIT CREDIT

Journal Entry to take up Sales:

Cash/AR 105,000.00

Creditable Withholding VAT 5,000.00

Sales 100,000.00

Output VAT Payable 10,000.00

Journal Entry to take up Purchases:

Purchases 10,000.00

Input Tax 1,000.00

Cash/Accounts Payable 11,000.00

Journal Entry to reflect the actual input VAT which is less than (5%) of

gross payments:

Output VAT Payable 10,000.00

Input Tax 1,000.00

Income & Expense Summary 4,000.00

Creditable Withholding Input VAT 5,000.00

Q32 : Who are entitled to transitional input tax?

A32 : Taxpayers who become VAT-registered persons upon exceeding Gross Sales or

Gross Receipts amounting to P1,500,000.00 or who voluntarily register even if

the Gross Sales or Gross Receipts does not exceed P1,500,000.00 are entitled

to transitional input tax.

13

Q33 : What is the rate of transitional input tax allowed for every VAT

registered taxpayer?

A33 : A VAT taxpayer is allowed a transitional input tax on his inventory of goods,

materials and supplies equivalent to two percent (2%) value thereof or the

actual VAT paid on such goods, materials and supplies whichever is higher.

Goods exempt from VAT shall be excluded in the computation of transitional

input tax.

Q34 : What is the adjusting entry to record/set-up the transitional input

tax?

A34 : J ournal entry:

DEBIT CREDIT

Input Tax xxx

Inventory xxx

Q35 : Who are entitled to presumptive input tax?

A35 : Persons or firms engaged in the processing of the following products are

entitled to presumptive input tax:

a. Sardines;

b. Mackerel;

c. Milk;

d. Refined sugar;

e. Cooking oil; and

f. Packed noodle-based instant meals.

Q36 : What is the rate and basis of presumptive input tax?

A36 : A VAT taxpayer is allowed a presumptive input tax equivalent to four percent

(4%) of the gross value of his purchases of primary agricultural products used in

his production.

Q37 : How is VAT payable computed?

A37 : The VAT payable is computed by deducting the allowable input tax credit of a

VAT registered taxpayer from his output tax. However, in no case shall the

VAT payable be less than 30% of the output tax due for VAT taxpayers with

excess input taxes. The amount of input tax not claimed as a credit against

14

output tax during the period shall be carried over to the succeeding taxable

period/s.

Q38 : What is the basis in computing output tax?

A38 : The basis for computing the output tax is either the gross selling price or the

gross receipts.

Gross Selling Price means the total amount of money or its equivalent which

the purchaser pays or is obligated to pay the seller in consideration of the sale,

barter or exchange of the goods or properties, excluding the VAT. The excise

tax, if any on such goods or properties shall form part of the gross selling price.

For sale, barter or exchange of real property subject to VAT, gross selling price

shall mean the consideration stated in the sales documents or the fair market

value of the property whichever is higher. The fair market value of the

property, shall be the FMV as determined by the BIR, or the FMV as determined

by the assessor, whichever is higher.

If the selling price is based on the fair market value of the asset, such fair market

value shall be inclusive of VAT.

If the amount of VAT is erroneously billed in the invoice, it shall be presumed

that the invoice amount is VAT inclusive. Hence, the output tax shall be

computed by multiplying the total invoice amount by a fraction using the rate of

VAT as numerator and one hundred percent (100%) plus rate of VAT as the

denominator (e.g. VAT is 10%, invoice amount shall be multiplied by 1/11 to get

the Output VAT).

Q39 : What is the difference between actual and allowable input tax?

A39 : Actual input tax means the VAT due from or paid by a VAT-registered person

on importation of goods or local purchases of goods, properties or services

including lease or use of properties, in the course of his trade or business. It

shall also include the input tax carry over from previous period, transitional

input tax and presumptive input tax determined in accordance with Section 111

of the Tax Code.

Allowable input tax is the amount of creditable input tax to be deducted from

the output tax payable. The creditable input tax is computed by deducting from

actual input taxes all the required deductions from available input taxes. This

15

applies only in cases where input tax inclusive of input tax carried over from the

previous quarter exceeds the output tax.

All revenue officials and employees are enjoined to give this Circular as wide a

publicity as possible.

(Original Signed)

JOSE MARIO C. BUNAG

OIC-Commissioner of Internal Revenue

You might also like

- MOA For MARKETING AGREEMENT For MiningDocument3 pagesMOA For MARKETING AGREEMENT For Miningjharry_amarNo ratings yet

- Efficiency Paper RuleDocument2 pagesEfficiency Paper Rulesharoncerro81No ratings yet

- BP 220 - Registration & License To SellDocument6 pagesBP 220 - Registration & License To SellKLASANTOSNo ratings yet

- RR No. 13-98Document16 pagesRR No. 13-98Ana DocallosNo ratings yet

- Hlurb-Br 871 2011 Rules of ProcedureDocument31 pagesHlurb-Br 871 2011 Rules of ProcedureTata Hitokiri0% (1)

- States: Court " of For AllDocument2 pagesStates: Court " of For AllMau Z MacDayNo ratings yet

- CLV Joint VenturesDocument28 pagesCLV Joint VenturesleahtabsNo ratings yet

- Bir Ruling No. Dac168 519-08Document12 pagesBir Ruling No. Dac168 519-08Jasreel DomasingNo ratings yet

- AM No. 05-11-07-CTADocument10 pagesAM No. 05-11-07-CTAPrincess MelodyNo ratings yet

- 2011 Revised Rules of Procedure - HLURBDocument15 pages2011 Revised Rules of Procedure - HLURBLyrr ehcNo ratings yet

- REAL ESTATE MORTGAGE CabatoDocument3 pagesREAL ESTATE MORTGAGE CabatoHash IbrahimNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Share For Share Under Section 40 CDocument13 pagesShare For Share Under Section 40 CCkey ArNo ratings yet

- OmbDocument11 pagesOmbromeo n bartolomeNo ratings yet

- Government Bank Account ReportingDocument4 pagesGovernment Bank Account Reportingponak001No ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Resolution Approving and Adopting The Policy On Contract of Service and Job WorkersDocument3 pagesResolution Approving and Adopting The Policy On Contract of Service and Job WorkersCamNo ratings yet

- Extend transport certificateDocument2 pagesExtend transport certificateRemz Prin Ting LaoagNo ratings yet

- Chapter 1 Cases RianoDocument479 pagesChapter 1 Cases RianoAnonymous 4WA9UcnU2XNo ratings yet

- Procedure For Land AcquisitionDocument25 pagesProcedure For Land AcquisitionRob ClosasNo ratings yet

- Key LS Personnel: PNP Retirement LawsDocument6 pagesKey LS Personnel: PNP Retirement Lawssc law officeNo ratings yet

- MR Omb SampleDocument5 pagesMR Omb SampleVinz G. VizNo ratings yet

- Joint Venture Agreement ADocument6 pagesJoint Venture Agreement AJohn Mark TamanoNo ratings yet

- Guidelines On Applying For BOI RegistrationDocument12 pagesGuidelines On Applying For BOI RegistrationCarol DonsolNo ratings yet

- Loan Agreement - TemplateDocument2 pagesLoan Agreement - TemplateGerry DarmawanNo ratings yet

- Is Foreign Equity Possible in The Philippine Book Publishing Industry?Document12 pagesIs Foreign Equity Possible in The Philippine Book Publishing Industry?Ed Sabalvoro MPANo ratings yet

- Requirements Merger-ConsolidationDocument1 pageRequirements Merger-ConsolidationmarjNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- SBFZ Business Registration RequirementsDocument1 pageSBFZ Business Registration RequirementsInquiry PVMNo ratings yet

- The Validity of Perpetual Alienation of Property Imposed by The Donee or DonorDocument10 pagesThe Validity of Perpetual Alienation of Property Imposed by The Donee or Donoraya5monteroNo ratings yet

- Psalm Uc Guidelines PDFDocument19 pagesPsalm Uc Guidelines PDFRj FashionhouseNo ratings yet

- Auditor Evaluation Form 2018Document2 pagesAuditor Evaluation Form 2018nesliebarramedaNo ratings yet

- OCA Circular No.157 2006 Notarial Register GuidelinesDocument3 pagesOCA Circular No.157 2006 Notarial Register GuidelinesNic NalpenNo ratings yet

- 6-Motion To Plead As IndigentDocument1 page6-Motion To Plead As IndigentAnob EhijNo ratings yet

- Consti 2 ReviewerDocument8 pagesConsti 2 ReviewerJet GarciaNo ratings yet

- 1st Week of March, 2016 15-Aug-16: General Information Sheet (Gis)Document4 pages1st Week of March, 2016 15-Aug-16: General Information Sheet (Gis)Lustre JeromeNo ratings yet

- Motion For ReconsiderationDocument8 pagesMotion For ReconsiderationManny B. Victor VIIINo ratings yet

- Gadon QuashDocument9 pagesGadon QuashYNNA DERAYNo ratings yet

- 6 - Last in First Out Rule 1. Maya Farms Employees Organization Vs National Labor Relations Commission G.R. No. 106256, December 28, 1994Document6 pages6 - Last in First Out Rule 1. Maya Farms Employees Organization Vs National Labor Relations Commission G.R. No. 106256, December 28, 1994Romar John M. GadotNo ratings yet

- Rmo 15-03 - Car and OnettDocument81 pagesRmo 15-03 - Car and OnettHomerNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Escrow AgreementDocument2 pagesEscrow Agreementlexman88No ratings yet

- Executive Summary Enclosed for Investment Opportunity in Growing Industry CompanyDocument2 pagesExecutive Summary Enclosed for Investment Opportunity in Growing Industry CompanySunil Soni100% (1)

- Agreement - HOE & KwinjcoDocument2 pagesAgreement - HOE & Kwinjcojayar medicoNo ratings yet

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Document2 pages2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- Application Form For 47 (1) (2) VisaDocument3 pagesApplication Form For 47 (1) (2) VisaEugene BeckNo ratings yet

- Retainer ContractDocument4 pagesRetainer ContractLgayLecage TiieeNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Document18 pagesRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipNo ratings yet

- Sample Board ResolutionDocument2 pagesSample Board ResolutionJen GamilNo ratings yet

- RMC No. 32-2022Document5 pagesRMC No. 32-2022Shiela Marie MaraonNo ratings yet

- Bantay KorapsyonDocument20 pagesBantay KorapsyonAirah GolingayNo ratings yet

- DOF Local Finance Circular 03-93Document4 pagesDOF Local Finance Circular 03-93Peggy SalazarNo ratings yet

- RESEARCH - Motion For InterventionDocument9 pagesRESEARCH - Motion For InterventionSherlyn Paran Paquit-SeldaNo ratings yet

- Revenue Memorandum Circular No. 62-05: SubjectDocument12 pagesRevenue Memorandum Circular No. 62-05: Subject김비앙카No ratings yet

- Invoicing and Regn FlyerDocument2 pagesInvoicing and Regn FlyerMie TotNo ratings yet

- Business-Tax VAT FAQsDocument11 pagesBusiness-Tax VAT FAQsBryan VidalNo ratings yet

- Frequently Asked Questions On VatDocument9 pagesFrequently Asked Questions On VatSteve SantillanNo ratings yet

- Frequently Asked QuestionsDocument40 pagesFrequently Asked Questionsroy rebosuraNo ratings yet

- Chapter 22Document25 pagesChapter 22Rachel Pepito BaladjayNo ratings yet

- Bidding DocumentsDocument90 pagesBidding Documentsdencave1No ratings yet

- 04 AnchorsDocument28 pages04 Anchorsdencave1No ratings yet

- Zinc Oxide ArresterDocument16 pagesZinc Oxide ArresterzerferuzNo ratings yet

- 26 HiLiteDocument36 pages26 HiLitedencave1No ratings yet

- Guides For: Electric Cooperative Development and Rural Electrifi CationDocument37 pagesGuides For: Electric Cooperative Development and Rural Electrifi Cationanon_127477839No ratings yet

- Distributed Generation and Impact StudyDocument33 pagesDistributed Generation and Impact Studydencave1No ratings yet

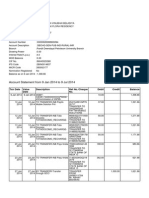

- K V2 CDocument4 pagesK V2 Cdencave1No ratings yet

- 1150 PwrHoist PDFDocument8 pages1150 PwrHoist PDFDenverLimNo ratings yet

- Philippine Renewable Energy MarketDocument1 pagePhilippine Renewable Energy Marketdencave1No ratings yet

- 2010-2019 DDP Final Ver 2 PDFDocument168 pages2010-2019 DDP Final Ver 2 PDFAndrew SalenNo ratings yet

- Fujii Denko Harness PDFDocument14 pagesFujii Denko Harness PDFdencave1No ratings yet

- Tax Lien SaleDocument29 pagesTax Lien SaleRhett MillerNo ratings yet

- Source-2 Zeenat MahalDocument2 pagesSource-2 Zeenat MahalSaad AnwarNo ratings yet

- Book InvoiceDocument1 pageBook InvoiceAshutosh AgarwalNo ratings yet

- 2023 CTA Exam - Paper 3 Syllabus - Mar23Document5 pages2023 CTA Exam - Paper 3 Syllabus - Mar23FuchingAuntieNo ratings yet

- GPR 2020Document133 pagesGPR 2020Jugal Asher0% (1)

- Tax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6Document1 pageTax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6VIDHI JAINENDRASINH RANANo ratings yet

- Glopack Industries Pvt. LTD.: Party DetailsDocument2 pagesGlopack Industries Pvt. LTD.: Party DetailsVIR MALIKNo ratings yet

- (Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardDocument6 pages(Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardDaniel Smart OdogwuNo ratings yet

- Chapter 2 - Income Statement QuestionsDocument3 pagesChapter 2 - Income Statement QuestionsMuntasir Ahmmed0% (1)

- Issuance-of-Certification PROPERTYDocument1 pageIssuance-of-Certification PROPERTYAngela I.No ratings yet

- BQs Tax 2011 2012Document44 pagesBQs Tax 2011 2012Dem SalazarNo ratings yet

- The Cash Transactions and Cash Balances of Banner Inc ForDocument1 pageThe Cash Transactions and Cash Balances of Banner Inc Foramit raajNo ratings yet

- Ahrefs Invoice AzyXd0TAryqTu49wHDocument1 pageAhrefs Invoice AzyXd0TAryqTu49wHsophia galvinNo ratings yet

- Fee Voucher Fee Voucher Fee Voucher Voucher # 499276 Voucher # 499276 Voucher # 499276Document1 pageFee Voucher Fee Voucher Fee Voucher Voucher # 499276 Voucher # 499276 Voucher # 499276M Irfan IqbalNo ratings yet

- Bmupd6b1aa6a 7939 4F06102021103240064Document1 pageBmupd6b1aa6a 7939 4F06102021103240064Gaurav RajputNo ratings yet

- Aug 10 PayslipDocument1 pageAug 10 PayslipBry GutierrezNo ratings yet

- Midterm Tasks1Document24 pagesMidterm Tasks1Kamran Memmedov100% (1)

- Inv 407306401237Document2 pagesInv 407306401237hesima4637 bodeem.comNo ratings yet

- BIR HistoryDocument6 pagesBIR HistoryJayphi Taganas BaddungonNo ratings yet

- Challan Form For Written Test Fee Payment (POLICE CONSTABLE)Document1 pageChallan Form For Written Test Fee Payment (POLICE CONSTABLE)Rashid Abbas0% (1)

- Account Statement SummaryDocument5 pagesAccount Statement SummaryManthan BeladiyaNo ratings yet

- 0401-000000080251Document1 page0401-000000080251romelio salumbidesNo ratings yet

- MyVanilla Visa CFPB Long Form PDFDocument1 pageMyVanilla Visa CFPB Long Form PDFOzell Stanley0% (1)

- Chapter 4Document25 pagesChapter 4crackheads philippinesNo ratings yet

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATCharlieEleerNo ratings yet

- Marbill PDFDocument1 pageMarbill PDFLucaNo ratings yet

- Payroll TemplateDocument1 pagePayroll Templatejenny PrietoNo ratings yet

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Employee tax statement for Circor Flow Technologies India Pvt LtdDocument1 pageEmployee tax statement for Circor Flow Technologies India Pvt LtdElakkiyaNo ratings yet

- Ola ride receipt for ₹444 tripDocument3 pagesOla ride receipt for ₹444 tripseeralan_1986No ratings yet