Professional Documents

Culture Documents

Special Provisions For Computing Income Under Sections 44AD

Uploaded by

Shweta Narkhede0 ratings0% found this document useful (0 votes)

19 views3 pagestax

Original Title

Special Provisions for Computing Income Under Sections 44AD

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesSpecial Provisions For Computing Income Under Sections 44AD

Uploaded by

Shweta Narkhedetax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

SECTION 44AD

Special provisions for computing income under sections 44AD

Sec.44AD is applicable only if following conditions are satisfied

Eligible Assessee-

Eligible assessee for this purpose is a

resident individual,

a resident HUF or

a resident partnership firm(not being a limited liability firm)

Has not claimed some deductions-

The assessee has not claimed any deduction under sections 10A, 10AA,

10B, 10BA, 80HH to 80RB in the relevant assessment year

Eligible business

The assessee should be engaged in any business except the business of

plying, hiring or leasing goods carriage referred to in section44AE

Turnover

Total turnover/gross receipts in the previous year of the eligible business

should not exceed Rs.60 lakh.

Consequences if Section 44AD is Applicable

If the above conditions are satisfied, the income from the eligible business is estimated at 8%

of the gross receipt or total turnover

All deductions under section 30 to 38, including depreciation & unabsorbed depreciation are

deemed to have been already allowed and no further deduction is allowed under these

sections.

An assessee opting for the above scheme shall be exempted from payment of advance tax

related to such business

An assessee opting for the above scheme shall be exempted from maintenance of books of

account related to such business as required under section 44Aa

Is it possible to declare lower income A taxpayer can declare his income to be lower than

the deemed profits and gains

The following consequences are applicable if the taxpayer declares his income to be

lower

The taxpayer will have to maintain the books of accounts as per section44AA if his

total income exceeds the exemption limit.

The taxpayer will have to get his books of accounts audited under section 44AB if

his total income exceeds the exemption limit.

SECTION 44AE

In the case of taxpayers engaged in the business of plying, leasing or hiring trucks.

Broad features:

Applicable to an assesse who owns not mopre than 10 goods carriages at any time

during previous year.

Profit & Gains for such goods carriage are,

o Heavy Goods Vehicle Rs. 5000 for every month or part of a month during

which vehicle is owned.

o Other Goods Rs. 4500 every month or part of month during which vehicle is

owned

Assessee may declare a higher incone than the specified above

Consequences if presumptive income scheme is opted

All deductions under section 30 to 38 including depreciation and unabsorbed depreciation,

are deemed to have been already allowed and no further deduction is allowed under this

section

Turnover of this business not to be included for computing limit of section 44AA & 44AB

Consequences if presumptive income scheme is not opted

Assessee may choose not to opt for the scheme and may declare income lower than the specified

amount and needs to maintain books of account.(similar to sec 44ad)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Premium, Inc. 2018 Tax Return - RRossDocument36 pagesPremium, Inc. 2018 Tax Return - RRossRaychael Ross100% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finals Quiz 1 Dealings in Properties Answer KeyDocument6 pagesFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- K-Electric Bill by NajeebDocument1 pageK-Electric Bill by Najeebapi-408604908No ratings yet

- ButterflyDocument2 pagesButterflyShweta NarkhedeNo ratings yet

- Special Provisions For Computing Income Under Sections 44ADDocument4 pagesSpecial Provisions For Computing Income Under Sections 44ADShweta NarkhedeNo ratings yet

- AnalysisDocument2 pagesAnalysisShweta NarkhedeNo ratings yet

- AnalysisDocument2 pagesAnalysisShweta NarkhedeNo ratings yet

- Hema Urban Heaven Cost SheetDocument1 pageHema Urban Heaven Cost Sheetitjob65No ratings yet

- Greater Visakhapatnam Municipal Corporation Vacant Land Tax FormDocument1 pageGreater Visakhapatnam Municipal Corporation Vacant Land Tax FormggNo ratings yet

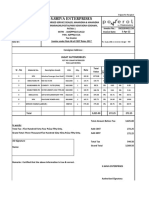

- Tax invoices for LED lights and bulbsDocument2 pagesTax invoices for LED lights and bulbsMohd Mohiuddin786No ratings yet

- Source:: Dion Global Solutions LimitedDocument1 pageSource:: Dion Global Solutions LimitedPRATEEK JAROLIANo ratings yet

- Tax Invoice Confirm Ticket Online Solutions Private Limited No.410 NR Complex 22nd Cross, 24th Main HSR 2nd Sector Bengaluru, Karnataka-560102Document1 pageTax Invoice Confirm Ticket Online Solutions Private Limited No.410 NR Complex 22nd Cross, 24th Main HSR 2nd Sector Bengaluru, Karnataka-560102Sarath KumarNo ratings yet

- Income tax payment receipt detailsDocument1 pageIncome tax payment receipt detailsM Naveed SultanNo ratings yet

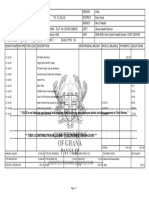

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- Cmlertrt3Y: /3ofto/o G7-Ig/2022-23Document22 pagesCmlertrt3Y: /3ofto/o G7-Ig/2022-23R-TECH ComputersNo ratings yet

- Vasu Vaccines &speciality Drugs Private Limited Invoice-310520Document1 pageVasu Vaccines &speciality Drugs Private Limited Invoice-310520sadiq shaikNo ratings yet

- GST & Central ExciseDocument2 pagesGST & Central ExciseAnandd BabunathNo ratings yet

- Salary Slip Title GeneratorDocument1 pageSalary Slip Title Generatornishu singhNo ratings yet

- Balance Sheet Analysis of Manufacturing CompanyDocument3 pagesBalance Sheet Analysis of Manufacturing CompanyPrateek JainNo ratings yet

- CIR v. Juliane Baier-Nickel - SUBADocument2 pagesCIR v. Juliane Baier-Nickel - SUBAPaul Joshua Torda SubaNo ratings yet

- LEI-Advance Reciept 39739 040720191718Document1 pageLEI-Advance Reciept 39739 040720191718Rubesh KumarNo ratings yet

- TaxDocument7 pagesTaxSaloni Jain 1820343No ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- Invoices CR - Sale 129 VDPM Lnd4nTfROp4mieDocument1 pageInvoices CR - Sale 129 VDPM Lnd4nTfROp4mieAcer UserNo ratings yet

- Project On Capital GainsDocument14 pagesProject On Capital Gainsanuragsingh55No ratings yet

- Adjustment Prepaid ExpensesDocument12 pagesAdjustment Prepaid ExpensesverawatidahlaniNo ratings yet

- Certificate of Residency Requirements For IndividualsDocument2 pagesCertificate of Residency Requirements For IndividualsViAnne ReyesNo ratings yet

- Paye Coding Notice PDFDocument2 pagesPaye Coding Notice PDFNebu MathewsNo ratings yet

- July 2022 PayslipDocument1 pageJuly 2022 Payslipalumi ghodNo ratings yet

- GST Tax Invoice FormatDocument1 pageGST Tax Invoice FormatsuchjazzNo ratings yet

- Business EINDocument2 pagesBusiness EINДмитрий КалиненкоNo ratings yet

- Chapter 8 - TaxationDocument35 pagesChapter 8 - Taxationancaye1962No ratings yet

- 2004 BIR Ruling on Property TransferDocument2 pages2004 BIR Ruling on Property TransferPhoebe SpaurekNo ratings yet