Professional Documents

Culture Documents

Financial Management

Uploaded by

NavinYattiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management

Uploaded by

NavinYattiCopyright:

Available Formats

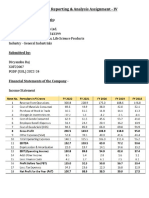

Financial management

INTRODUCTION:-

The financial management analysis the companys tactical and conduct financial ratio quantity based

on the annual reports. The grades of the financial ratio quantity are discussed classify strategy

issues faced by the company and their possible financial position. The presentation of a company is

compulsory to know about Profit and loss, financial ratios, balance sheet and trade account of a

company.

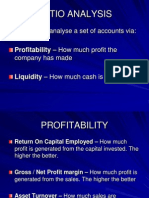

ROCE:-

ROCE is basically used to analyze how efficiently a business utilizes its assets and liabilities to

generate profit. A business that has invested more in fixed assets and earns little profit will have

smaller ROCE compare to a business which owns less fixed assets but generates the same amount

of profit. In general it is used to determine how much a business gain from its assets and looses

from its liabilities.

2008 2009 2010

= 40.36% = 32.91% = 33.65%

Interpretation:-

By looking at the ratios of return on capital employed for the year 2008 which was 40.36% it is quite

obvious that the company managed to get a good ratio than the subsequent years because of the

efficient use of its assets with having no long term liabilities but the ratio had fallen down to 32.91%

in the year 2009 and the company took long term loan to increase the assets which lead to the

decline in gross profit and net profit margins in 2009 and 2010.

Conclusion:-The company has to manage its assets well and reduce liabilities in order to earn a high

rate of return on capital employed.

NET PROFIT MARGIN:-

The net profit ratios expressed the company net profit before tax and after tax by deducting all office

expenses from gross profit we get net profit.

2008 2009 2010

= 27.54% = 21.80% = 17.37%

Interpretation:-

The substantial fall in the net profit margin in year 2010 is due to the loan interest payable which

significantly reduces the amount of net profit from the ones in prior years.

GROSS PROFIT MARGIN:-

The gross profit ratio expressed the company gross profit excluding cost of goods sold from sales

then we get gross profit

2008 2009 2010

= 20% = 16.66% = 14.94%

Interpretation:-

In the year 2008 gross profit margin is 20% which reduces down to 16.66% in the year 2009 and in

2010 there is a further reduction of 1.72% which brings the Gross profit margin down to 14.94% this

is because the inventory is held for a long period of time raising the amount of assets and poor

sales.

ASSET TURNOVER:-

All assets have been integrated in the calculation of a company which indicates an extra universal

symbol of how resourcefully a company use its assets to produce sales.

2008 2009 2010

= 2.75% = 2.49% = 2.35%

Interpretation:-

This calculation indicates that the company generates an asset turnover of 2.75% in the year 2008

with the decrease 0.26% in the year 2009 and it continues to go down with a further 0.14%

this brings it down to 2.35% in 2010. Generally, a company making a less turnover requires more

capital either in the form of shareholder or creditors to be able to increase more sales. On the other

hand a company that has a higher asset turnover can turn out a rise in sales with injecting smaller

amount of capital.

DAYS OF INVENTORY SUPPLY:-

A variant of inventory revenue is days inventory delivers. The company calculates the average

number of days sales for the record available.

2008 2009 2010

= 13 days = 17 days = 25 days

Interpretation:-

In 2008 the inventory period was 13 days which has increased by 4 days in the following year 2009

to 17 days and there is a further increase in 2010 by 8 days making it a total of 25 days. By looking

at the inventory period the number of days the stock is being held is growing each year with the

highest number of days in 2010 than in the prior years.

CURRENT RATIO:-

Current assets can be transformed into cash. In a year it contains assets such as cash, short-term

investments, accounts receivable, interest receivable, inventory, and prepaid expenses. The prepaid

expenses never will be changed into cash but will be used up within a year. Current liabilities are the

debts that will be paid. Within a year by providing goods or services and include items such as

accounts payable, the portion of any long-term debt 2008 2009 2010

= 2% = 2.31% = 2.06%

Interpretation:-

Current ratio in the year 2008 was 2% which increased up to 2.31% in year 2009 and went back

down to 2.06% in the year 2010. By looking at this ratio the Company was showing progress from

2008 to 2009.

ACID TEST RATIO:-

The quick ratio is a more fixed liquidity. Or in other way the fact that the numerator contains the

assets that can be turned into cash more quickly.

2008 2009 2010

= 1.68% = 1.97% = 1.73%

Interpretation:-

Acid test ratio in the year 2008 was 1.68% which as showed progress in the following year 2009 up

to 1.97% after the increase in the year 2009 the acid test ratio fallen down to 1.73% in the year

2010. By looking at these figures the company liquidity ratio increase in the year 2009 and than

dropped down to 1.73 in the year 2010. Which is not good for the liquidity ratio?

DEBT RATIO:-

The debt ratio measures the quantity of debt in relation to the total assets of a company. Assets

comes from everywhere both from outsiders or from owners.

2008 2009 2010

= 0.31% = 0.33% = 0.48%

Interpretation:-

Debt ratio in the year 2008 was 0.31% which has increased to 0.33% in the year 2009 and further

increase in the year 2010 up to 0.48%.This computation indicates when companys assets are

finance by creditors. The more this ratio is, the better is the risk that the company may have problem

meeting its debt obligation.

DEBTORS DAYS:-

The number of days on average that it takes a company to receive payment for what it sells

2008 2009 2010

= 27 Days = 36 Days = 59 Day

Interpretation:-

In 2008 the debtors days was 27 days and further increase in the year 2009 up to 36 days which

extended to more 59 days in the year 2010.According to these figures debtors days is continuously

increasing each year therefore the company has to give less time to recover money from debtors for

better liquidity ratio.

CREDITORS DAYS:-

A ratio measuring how long on average it takes a company to pay its creditors. Calculated by

dividing the trade creditors shown in its accounts by its cost of sales, or sales, and then multiplying

by 365.

2008 2009 2010

= 38 Days = 46 Days = 48 Days

Interpretation:-

Every year there is a rise in the number of days required to pay off the creditors which is a healthy

sign but by looking into the number of days the debtors are given to settle there accounts with the

company, the first two years 2008 and 2009 seems ok but the payment is held for longer in the year

2010 by the debtors and the company has to settle its account earlier with its creditors which makes

a significantly affects to the profit for the year 2010

STABILITY RATIOS:-

These ratios concentrate on the long-term health of a business - particularly the effect of the

capital/finance structure on the business:

GEARING RATIOS:-

In universal termdescribinga financialratio that differentiates some form of owner's justice (capital) to

lent funds. Gearing evaluate of financial leverage, representing the level in which a companys

performances are funded by owner's funds against creditor's funds.

2008 2009 2010

= 0 = 0 = 2.17%

INTERPRETATION:-

In the year 2008 and 2009 the gearing ratio was comparatively good because no long term liabilities

were acquired. The company has taken long term loan in 2010 and due to the interest payable on

this loan the gross profit and net profit ratio in 2010 had fallen.

CONCLUSION:-

I have elaborated various formulas of resource management to analyse financial statements. The

financial ratios are used in viewing interaction between the financial statement data. It also

distinguishes with the other companies or analyse the same companies overtime. The company has

to manage its assets well and reduce liabilities in order to earn a high rate of return on capital

employed. Ratios frequently classifies into dissimilar categories. The each category, the ratios

compute general components. The companys effectiveness or proficiency to pay its current debts.

From time to time the terminology of these different categories varies, but even with incompatible

terms, the concepts are the same. For business financial statement ratio is the best device. If you

know how to understand the ratio, they are just another useless numbers. The company has to

manage its assets well and reduce liabilities in order to earn a high rate of return on capital

employed.

You might also like

- FINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDDocument4 pagesFINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDROHIT SETHI100% (2)

- Series 1: 1. Profit Margin RatioDocument10 pagesSeries 1: 1. Profit Margin RatioPooja WadhwaniNo ratings yet

- Auditors Report and Financial Analysis of ITCDocument28 pagesAuditors Report and Financial Analysis of ITCNeeraj BhartiNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisBharatsinh SarvaiyaNo ratings yet

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHINo ratings yet

- Analysis of Xyz Limited' Company: Liquidity RatiosDocument7 pagesAnalysis of Xyz Limited' Company: Liquidity RatiosdharmapuriarunNo ratings yet

- Ratio Analysis of Petronas Dagangan BerhadDocument13 pagesRatio Analysis of Petronas Dagangan BerhadRishiaendra CoolNo ratings yet

- Sandip Voltas ReportDocument43 pagesSandip Voltas ReportsandipNo ratings yet

- Ratio Analysis of Renata Limited PPPDocument32 pagesRatio Analysis of Renata Limited PPPmdnabab0% (1)

- FRA Report: GMR Infrastructure: Submitted To: Submitted byDocument12 pagesFRA Report: GMR Infrastructure: Submitted To: Submitted bySunil KumarNo ratings yet

- Cash Flow and Ratio AnalysisDocument7 pagesCash Flow and Ratio AnalysisShalal Bin YousufNo ratings yet

- Financial Statement Analysis of Nokia and LGDocument35 pagesFinancial Statement Analysis of Nokia and LGeimalmalikNo ratings yet

- Financial Ratio Analysis AssignmentDocument10 pagesFinancial Ratio Analysis Assignmentzain5435467% (3)

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Document6 pagesQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607No ratings yet

- Cognizant Accounts. FinalDocument9 pagesCognizant Accounts. FinalkrunalNo ratings yet

- Mitchell's Ratio AnalysisDocument3 pagesMitchell's Ratio Analysismadnansajid8765No ratings yet

- Tata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & InterpretationDocument31 pagesTata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & Interpretationaditya_sanghviNo ratings yet

- Finance Henry BootDocument19 pagesFinance Henry BootHassanNo ratings yet

- Cases in Finance - FIN 200Document3 pagesCases in Finance - FIN 200avegaNo ratings yet

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosDocument15 pagesFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieNo ratings yet

- Ratio Analysis - Montex PensDocument28 pagesRatio Analysis - Montex Penss_sannit2k9No ratings yet

- Financial Analysis of Chandni TextilesDocument9 pagesFinancial Analysis of Chandni TextilesM43CherryAroraNo ratings yet

- Apollo Tyres' Financial Performance Analysis from 2004-2009Document65 pagesApollo Tyres' Financial Performance Analysis from 2004-2009Mitisha GaurNo ratings yet

- Financial Statement Analysis - Bhanero Textile MillsDocument28 pagesFinancial Statement Analysis - Bhanero Textile MillstabinahassanNo ratings yet

- Data Analysis and Interpretation Calculation and Interpretation of RatiosDocument27 pagesData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNNo ratings yet

- 03-Measures of Perfomance in Private SectorDocument5 pages03-Measures of Perfomance in Private SectorHastings KapalaNo ratings yet

- Lucky Cement AnalysisDocument6 pagesLucky Cement AnalysisKhadija JawedNo ratings yet

- NPV, IRR and Financial Evaluation for Waste Collection ContractDocument9 pagesNPV, IRR and Financial Evaluation for Waste Collection ContractTwafik MoNo ratings yet

- Financial Analysis of Tesco PLCDocument7 pagesFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- Financial Management at Bajaj AutoDocument8 pagesFinancial Management at Bajaj AutoNavin KumarNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisDharmesh PrajapatiNo ratings yet

- Ratio Analysis of ITCDocument22 pagesRatio Analysis of ITCDheeraj Girase100% (1)

- Ma Assignment-2: Analysis of Tata Global Beverages LTDocument7 pagesMa Assignment-2: Analysis of Tata Global Beverages LTdecem440No ratings yet

- Fsa Assignment Report On Financial Health of Companies by Group 3 Industry - It Companies - Wipro, TCS, Infosys. Ratio AnalysisDocument20 pagesFsa Assignment Report On Financial Health of Companies by Group 3 Industry - It Companies - Wipro, TCS, Infosys. Ratio AnalysissanhithNo ratings yet

- Introduction of The Ratio AnalysisDocument11 pagesIntroduction of The Ratio AnalysisAlisha SharmaNo ratings yet

- Financial planning & forecasting assignmentDocument3 pagesFinancial planning & forecasting assignmentAhmedNo ratings yet

- Financial Accounting And The Financial StatementsDocument10 pagesFinancial Accounting And The Financial StatementsRajiv RankawatNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Company AnalysisDocument20 pagesCompany AnalysisRamazan BarbariNo ratings yet

- Current Ratio Analysis of Jai Bhagwati Textile MillsDocument6 pagesCurrent Ratio Analysis of Jai Bhagwati Textile Millsabhishek27panwalaNo ratings yet

- FSA of Nalin LeaseDocument8 pagesFSA of Nalin LeaseM43CherryAroraNo ratings yet

- Interpretation of Financial StatementsDocument4 pagesInterpretation of Financial StatementsTinashe MashoyoyaNo ratings yet

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- ACC Limited: India's leading cement manufacturer with a presence across the countryDocument6 pagesACC Limited: India's leading cement manufacturer with a presence across the countrydivya wagaralkarNo ratings yet

- Task (3.4) Calculate RatiosDocument7 pagesTask (3.4) Calculate RatiosAnonymous xOqiXnW9No ratings yet

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDocument27 pagesWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalNo ratings yet

- Lion Grange Financial AnalysisDocument18 pagesLion Grange Financial AnalysisRamesh BabuNo ratings yet

- UK GDP decline and telecom sector recoveryDocument13 pagesUK GDP decline and telecom sector recoveryprahladtripathiNo ratings yet

- Costco Wholesale Corporation Financial AnalysisDocument14 pagesCostco Wholesale Corporation Financial Analysisdejong100% (1)

- FRA - IV (Tarsons Products)Document9 pagesFRA - IV (Tarsons Products)RR AnalystNo ratings yet

- Term Paper of Reliance Weaving LTDDocument12 pagesTerm Paper of Reliance Weaving LTDadeelasghar091No ratings yet

- Ratio Analysis ExplainedDocument16 pagesRatio Analysis ExplainedChris LaiNo ratings yet

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarNo ratings yet

- Financial Ratio AnalysisDocument42 pagesFinancial Ratio Analysisfattiq_1No ratings yet

- Financial ratio analysis guideDocument7 pagesFinancial ratio analysis guideYasirNo ratings yet

- Ratio Analysis 2Document15 pagesRatio Analysis 2Azmira RoslanNo ratings yet

- Ratio Analysis of PTCLDocument21 pagesRatio Analysis of PTCLNeelofar Saeed33% (6)

- Financial Statement Analysis ReportDocument30 pagesFinancial Statement Analysis ReportMariyam LiaqatNo ratings yet

- Financial Statement Analysis and Creative Accounting TechniquesDocument12 pagesFinancial Statement Analysis and Creative Accounting TechniquesMahmoud EsmaeilNo ratings yet

- SQL-Ch12-CreateDBDocument9 pagesSQL-Ch12-CreateDBNavinYattiNo ratings yet

- SQL-Ch12-CreateDBDocument9 pagesSQL-Ch12-CreateDBNavinYattiNo ratings yet

- The Views of Flighty Wrongful DismissalDocument2 pagesThe Views of Flighty Wrongful DismissalNavinYattiNo ratings yet

- The Non Technical Skill of Leadership Nursing EssayDocument3 pagesThe Non Technical Skill of Leadership Nursing EssayNavinYattiNo ratings yet

- Study and Research of Complementary Alternative MedicineDocument2 pagesStudy and Research of Complementary Alternative MedicineNavinYattiNo ratings yet

- The Religion Promotes Mental Health Nursing EssayDocument2 pagesThe Religion Promotes Mental Health Nursing EssayNavinYattiNo ratings yet

- The Psychosocial Adaptation To The Diagnosis of Multiple SclerosisDocument2 pagesThe Psychosocial Adaptation To The Diagnosis of Multiple SclerosisNavinYattiNo ratings yet

- The Impact of Informatics On The Delivery of HealthcareDocument2 pagesThe Impact of Informatics On The Delivery of HealthcareNavinYattiNo ratings yet

- The Psychosocial Adaptation To The Diagnosis of Multiple SclerosisDocument2 pagesThe Psychosocial Adaptation To The Diagnosis of Multiple SclerosisNavinYattiNo ratings yet

- The Prohibition of Euthanasia Nursing EssayDocument2 pagesThe Prohibition of Euthanasia Nursing EssayNavinYattiNo ratings yet

- The Non Technical Skill of Leadership Nursing EssayDocument3 pagesThe Non Technical Skill of Leadership Nursing EssayNavinYattiNo ratings yet

- The Impact of Informatics On The Delivery of HealthcareDocument2 pagesThe Impact of Informatics On The Delivery of HealthcareNavinYattiNo ratings yet

- Personal Reflection On Practicing A Clinical Skill Nursing EssayDocument2 pagesPersonal Reflection On Practicing A Clinical Skill Nursing EssayNavinYatti100% (2)

- Study and Research of Complementary Alternative MedicineDocument2 pagesStudy and Research of Complementary Alternative MedicineNavinYattiNo ratings yet

- Study Effectiveness of Nebulization Improving Childrens Respiratory Status Nursing EssayDocument2 pagesStudy Effectiveness of Nebulization Improving Childrens Respiratory Status Nursing EssayNavinYattiNo ratings yet

- Law Society RuleDocument2 pagesLaw Society RuleNavinYattiNo ratings yet

- Why Students PlagiarizeDocument2 pagesWhy Students PlagiarizeNavinYattiNo ratings yet

- Why Students PlagiarizeDocument2 pagesWhy Students PlagiarizeNavinYattiNo ratings yet

- Medicare Patients Readmitted Within 30 Days Nursing EssayDocument3 pagesMedicare Patients Readmitted Within 30 Days Nursing EssayNavinYattiNo ratings yet

- Personal Reflection On Practicing A Clinical Skill Nursing EssayDocument2 pagesPersonal Reflection On Practicing A Clinical Skill Nursing EssayNavinYatti100% (2)

- PD Program Was Successful in Hong KongDocument2 pagesPD Program Was Successful in Hong KongNavinYattiNo ratings yet

- Reflection Has Become An Important Concept in Nursing Nursing EssayDocument3 pagesReflection Has Become An Important Concept in Nursing Nursing EssayNavinYattiNo ratings yet

- Mental Capacity ActDocument1 pageMental Capacity ActNavinYattiNo ratings yet

- Medicare Patients Readmitted Within 30 Days Nursing EssayDocument3 pagesMedicare Patients Readmitted Within 30 Days Nursing EssayNavinYattiNo ratings yet

- Mental Capacity ActDocument1 pageMental Capacity ActNavinYattiNo ratings yet

- Improving Quality of Care To PatientsDocument2 pagesImproving Quality of Care To PatientsNavinYattiNo ratings yet

- Meetings With Project MentorDocument3 pagesMeetings With Project MentorNavinYattiNo ratings yet

- Glucose Tolerance Tests Accuracy in Diagnosing DiabetesDocument3 pagesGlucose Tolerance Tests Accuracy in Diagnosing DiabetesNavinYattiNo ratings yet

- Journey Through Criminal Justice Systems Law EssayDocument2 pagesJourney Through Criminal Justice Systems Law EssayNavinYattiNo ratings yet

- Discussion of Management For Hip Replacement Surgery Patients Nursing EssayDocument2 pagesDiscussion of Management For Hip Replacement Surgery Patients Nursing EssayNavinYattiNo ratings yet

- Schedule of Documentary Stamp Tax and Withholding Tax PayableDocument11 pagesSchedule of Documentary Stamp Tax and Withholding Tax PayableMa. Cristy BroncateNo ratings yet

- Based on the ABC analysis, the classification would be:A items: 1, 2 B items: 3, 4C items: 5, 6, 7 Mr. John Pradeep K, KJSOM 23Document47 pagesBased on the ABC analysis, the classification would be:A items: 1, 2 B items: 3, 4C items: 5, 6, 7 Mr. John Pradeep K, KJSOM 23Mebin MathewNo ratings yet

- Financial Management Assignment (4) : Muhammad Fathy Dr. Sherif Abdel FattahDocument21 pagesFinancial Management Assignment (4) : Muhammad Fathy Dr. Sherif Abdel FattahNerissa Mendoza RapanutNo ratings yet

- Trading Agreement - Capital 88Document1 pageTrading Agreement - Capital 88Eduardo Velarde QuevedoNo ratings yet

- Outline (LONG) Real Estate Trans. (Dewey, 2017 Spring)Document52 pagesOutline (LONG) Real Estate Trans. (Dewey, 2017 Spring)Larry Rogers100% (1)

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- VATable TransactionsDocument2 pagesVATable TransactionsAngelo D. AventuradoNo ratings yet

- PJSC National Bank Trust and Anor V Boris Mints and OrsDocument33 pagesPJSC National Bank Trust and Anor V Boris Mints and OrshyenadogNo ratings yet

- ForeignCashDepositEURDocument1 pageForeignCashDepositEURmohamedNo ratings yet

- Re - 37323 - Goetz Gold LLC, Tony Goetz PDFDocument13 pagesRe - 37323 - Goetz Gold LLC, Tony Goetz PDFJason MartinNo ratings yet

- Africa Grant Funding Guide for EducationDocument2 pagesAfrica Grant Funding Guide for EducationFampau CoulibalyNo ratings yet

- USD Credit Sensitive Rates For LIBOR Replacement Libor Sofr Bsby Crits Ameribor Bank Yield IndexDocument6 pagesUSD Credit Sensitive Rates For LIBOR Replacement Libor Sofr Bsby Crits Ameribor Bank Yield IndexMohammad Abdul Latif TanveerNo ratings yet

- Principle of Corporate FinanceDocument23 pagesPrinciple of Corporate FinanceRapat TrinhNo ratings yet

- 2017 1 1501 39247 Judgement 19-Oct-2022Document149 pages2017 1 1501 39247 Judgement 19-Oct-2022aasthadip7No ratings yet

- Sicav Annual Report Final Audited and Signed 2021Document465 pagesSicav Annual Report Final Audited and Signed 2021sirinekadhi7No ratings yet

- MRCE Data Dictionary v1.0Document4 pagesMRCE Data Dictionary v1.0Chandrima DasNo ratings yet

- G Holdings Vs National Mines and Allied Workers UnionDocument1 pageG Holdings Vs National Mines and Allied Workers UnionKrizea Marie DuronNo ratings yet

- Agricultural Weather Index Insurance in ThailandDocument46 pagesAgricultural Weather Index Insurance in ThailandAsian Development BankNo ratings yet

- Truth and Transparency in LendingDocument21 pagesTruth and Transparency in Lendingatty_gie3743No ratings yet

- Deed of Partition Between Two Co owners-Deeds-Partition-1669Document2 pagesDeed of Partition Between Two Co owners-Deeds-Partition-1669Atoy SantosNo ratings yet

- Gill Wilkins Technology Transfer For Renewable Energy Overcoming Barriers in Developing CountriesDocument256 pagesGill Wilkins Technology Transfer For Renewable Energy Overcoming Barriers in Developing CountriesmshameliNo ratings yet

- Awareness About Cash Less Economy Among Students: K. Girija & M. NandhiniDocument8 pagesAwareness About Cash Less Economy Among Students: K. Girija & M. NandhiniTJPRC PublicationsNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Shipping Invoice: Collectable Amount: 2999.50Document2 pagesShipping Invoice: Collectable Amount: 2999.50HARIDWARNA CHARITABLE TRUSTNo ratings yet

- Canadian Securities Institute Learning Catalogue: Csi Learning Solutions GuideDocument11 pagesCanadian Securities Institute Learning Catalogue: Csi Learning Solutions Guidemuhammadanasmustafa0% (1)

- Written by Professor Gregory M. Burbage, MBA, CPA, CMA, CFM: C 12 - Segment Reporting and DecentralizationDocument3 pagesWritten by Professor Gregory M. Burbage, MBA, CPA, CMA, CFM: C 12 - Segment Reporting and DecentralizationSamael LightbringerNo ratings yet

- Teaching Money Creation and Monetary PolicyDocument21 pagesTeaching Money Creation and Monetary PolicyJuan Diego González Bustillo100% (1)

- Bir Form 1903 - Registration Corp (Blank)Document2 pagesBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- ACTB212F Introduction To Accounting 2. (1) DocxDocument18 pagesACTB212F Introduction To Accounting 2. (1) DocxUsmän MïrżäNo ratings yet

- Perbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurDocument16 pagesPerbadanan Pengurusan Sentosa Court Pejabat Pengurusan Sentosa Court Ac-3 No.4 JLN TMN Sri Sentosa, JLN Klang Lama 58000 Kuala LumpurkswongNo ratings yet