Professional Documents

Culture Documents

2014 CoOportunity Health Rate Proposal Iowa

Uploaded by

IOWANEWS1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 CoOportunity Health Rate Proposal Iowa

Uploaded by

IOWANEWS1Copyright:

Available Formats

2014 CoOportunity Health RATE PROPOSAL

REVIEW DECISION

Issued October 8, 2014

Introduction

The Iowa Insurance Division (the Division) received an annual individual insurance

premium rate (ratefiling for CoOpportunity Health in June, 2014. In June, 2014,

CoOpportunity proposed a rate increase, varying by plan and region, effective January

1, 2015, of an average of 14.3%. This rate increase request was filed based on limited

claims data and experience. As experience developed, the carrier updated the data

and, on September 4, 2014, filed with the Division a supplemental request to revise its

initial rate request to an average of 19%, varying by plan and region, effective January

1, 2015. The original rate increase request for 2015 was based on claims experience

which lacked sufficient credible information on which to base trend estimates and

projected member movement from the entire insured and uninsured population. As

claims experience developed in 2014 and more data became available, the carrier

demonstrated that the claims experience is considerably higher than was projected in

the initial rates filed in 2013. Therefore, a significant portion of the rate request is due to

higher than expected claims experience.

Rate Filing and Review Procedure

Pursuant to a Governors directive from 2010, and in accordance with Iowa Code

section 505.15, whenever any health insurance company that conducts business in

Iowa submits a health insurance premium rate increase request to the Division, the

Commissioner must utilize an independent, qualified third-party actuary to conduct a

secondary review to determine the adequacy and appropriateness of the proposed

rate. The Division maintains a list of independent actuarial firms, and selected from

them NovaRest to perform the independent actuarial review. The report of NovaRest is

available on the Division website (as an attachment to the posted version of this Review

Decision at www.iid.iowa.gov). Specific tests and criteria used to determine the validity

of the request is outlined in each of the detailed reports. The independent review is

performed simultaneously with the statutorily required Division in-house review.

In addition, Iowa Code section 505.19 requires the Iowa Insurance Commissioner, (the

Commissioner) to hold a public hearing on a proposed health insurance rate increase

which exceeds the average annual health spending growth rate as published by the

Centers for Medicare and Medicaid Services of the United State Department of Health

and Human Services. The current rate is 6.1%. Prior to the public hearing, the

Consumer Advocate for the Division solicits and receives public comments on the

proposed health insurance rate increase. Those comments are posted online (as an

attachment to the posted version of this Review Decision at www.iid.iowa.gov).

A hearing on the proposed rate increase was held on Saturday, July 26, 2014, at 10:30

a.m. at the Mercy College of Health Sciences, Sullivan Center, Des Moines,

Iowa. Access to the hearing was made available at six locations around the state via

the Iowa Communications Network (ICN). The Divisions Consumer Advocate

presented public testimony on the written comments previously received from

consumers. The Commissioner took comments from policyholders and concerned

citizens present at the hearing. Comments also were received from citizens accessing

the hearing through the ICN sites.

The Commissioner reviewed the actuarial reports from NovaRest. In addition, the

Commissioner reviewed the comments made at the public hearing on July 26, 2014 and

the comments received through phone calls, mail and the internet to the Consumer

Advocate. The Commissioner also consulted with financial and actuarial staff within the

Division.

Consumer Concerns and Issues

The Consumer Advocate received 16 comments and concerns directly from

policyholders or members of the public. The reasons given for requesting a denial of

the proposed rate increase varied, but the most frequently cited reason was in regard to

affordability of health insurance and the inability to fit an increased cost of health

insurance into fixed budgets. Some comments reflected that people were

contemplating the possibility of dropping coverage due to the increase. Disappointment

was expressed regarding how soon after policies were issued that the rate increase was

needed. Some commenters questioned the effectiveness of the federal Patient

Protection and Affordable Care Act (ACA) and the long term ability of the law to

ensure affordable health care coverage.

Conclusion and Decision

The Division is mindful that several key provisions of the ACA went into effect in 2014

that impacted health insurance premium rates and pricing. As noted earlier, carriers did

not possess much claims data on these changes prior to formulating their rates for the

2014 enrollment season. Even at the time of this rate increase request for 2015, the

carrier did not possess much claims data. Some of the items impacting health

insurance premiums, beginning in 2014, include: insurers are not able to decline

coverage to applicants with pre-existing conditions; insurers are required to provide

plans with minimum essential health benefits that may be broader than benefits

provided under certain pre-ACA plans; and gender and health risks were eliminated as

rating factors and limits were placed on age rating.

CoOportunity Health is a new entrant in the Iowa and Nebraska health insurance

market. It is one of many Consumer Operated and Oriented Plans (CO-OPs)

established by the ACA. CoOportunity Health is a non-profit organization with funding

from the federal government in the form of start-up and solvency loans. The

Commissioner reviewed the rate increase request keeping in mind the unique nature of

the organization, and its entrance into the market as a new player. The carrier does not

have legacy (non-ACA-compliant grandfathered or transitional plans or large group)

plans to supplement any rate impacts, unlike its competitors. This fact led to the carrier

needing a larger rate increase than some competitors.

The Commissioner has reviewed the testimony of policyholders and consumers, studied

the actuarial reports, and consulted with various Division staff regarding the Wellmark

rate increase proposal. Whether to approve the rate increase is not a decision the

Commissioner has taken lightly. Thousands of Iowans will be impacted by this

decision. Balancing the needs of Iowa consumers and the solvency of an insurance

carrier must be weighed carefully.

The carrier demonstrated the need for higher rates, given the makeup of its

membership, higher utilization, and position in the market as a new entrant. The risk

mitigation tools (reinsurance, risk corridor, and risk adjustment) should help stabilize the

carriers rates through 2016.

The Commissioner finds that there is no evidence that the proposed rate filings are

discriminatory or excessive under Iowa law. The Commissioner therefore approves the

proposed individual rate increase filed by CoOportunity Health for implementation.

Dated October 8, 2014

Nick Gerhart

Commissioner

Iowa Insurance Division

You might also like

- Redacted Complaint Against Iowa Finance Authority Former Director Dave JamisonDocument3 pagesRedacted Complaint Against Iowa Finance Authority Former Director Dave JamisonIOWANEWS1No ratings yet

- Kati Huffman V Fareway Stores Complaint in Polk County District CourtDocument7 pagesKati Huffman V Fareway Stores Complaint in Polk County District CourtIOWANEWS1No ratings yet

- Iowa School Report Card 2017Document42 pagesIowa School Report Card 2017IOWANEWS1No ratings yet

- 3 Teens Sue The State of Iowa Over Treatment at The State Training School For Boys in EldoraDocument61 pages3 Teens Sue The State of Iowa Over Treatment at The State Training School For Boys in EldoraIOWANEWS1No ratings yet

- Supreme Court of Iowa (No. 17-0708)Document3 pagesSupreme Court of Iowa (No. 17-0708)GazetteonlineNo ratings yet

- Bertrand Press Release DIX ResignationDocument2 pagesBertrand Press Release DIX ResignationIOWANEWS1No ratings yet

- Charleston TerminationDocument7 pagesCharleston TerminationdmronlineNo ratings yet

- Iowa Budget Cuts in SSB Approved by Senate Appropriations Committee 10-25-2018Document4 pagesIowa Budget Cuts in SSB Approved by Senate Appropriations Committee 10-25-2018IOWANEWS1No ratings yet

- School Report Card 2017 Central Iowa and StatewideDocument9 pagesSchool Report Card 2017 Central Iowa and StatewideIOWANEWS1No ratings yet

- Released by Flathead County, Montana Sheriff: Ransom Note To School District From "Thedarkoverlord"Document7 pagesReleased by Flathead County, Montana Sheriff: Ransom Note To School District From "Thedarkoverlord"IOWANEWS1No ratings yet

- Tuition Hikes Iowa Regent UniversitiesDocument4 pagesTuition Hikes Iowa Regent UniversitiesIOWANEWS1No ratings yet

- Planned Parenthood-ACLU of Iowa V BranstadDocument21 pagesPlanned Parenthood-ACLU of Iowa V BranstadIOWANEWS1No ratings yet

- Jesse Vroegh LawsuitDocument11 pagesJesse Vroegh LawsuitdmronlineNo ratings yet

- Petition For Security Guard-Des Moines City CouncilDocument7 pagesPetition For Security Guard-Des Moines City CouncilIOWANEWS1No ratings yet

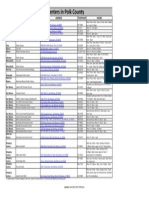

- 2017 Daytime Cooling Centers in Polk CountyDocument7 pages2017 Daytime Cooling Centers in Polk CountyIOWANEWS1No ratings yet

- Iowa Board of Chiropractic Vs Andrew KearseDocument15 pagesIowa Board of Chiropractic Vs Andrew KearseIOWANEWS1No ratings yet

- Warren County CourthouseDocument6 pagesWarren County CourthousedmronlineNo ratings yet

- Jorge Pena Redacted IndictmentDocument3 pagesJorge Pena Redacted IndictmentIOWANEWS1No ratings yet

- FT DM Church of Christ vs. Iowa Civil Rights Commission Et AlDocument32 pagesFT DM Church of Christ vs. Iowa Civil Rights Commission Et AlIOWANEWS1No ratings yet

- 2016 First Legislative Funnel SurvivorsDocument22 pages2016 First Legislative Funnel SurvivorsIOWANEWS1No ratings yet

- Maintenance Enterprises V OrescomDocument21 pagesMaintenance Enterprises V OrescomIOWANEWS1No ratings yet

- Statement of Ben Beary's FamilyDocument1 pageStatement of Ben Beary's FamilyIOWANEWS1No ratings yet

- 2016 First Legislative Funnel SurvivorsDocument22 pages2016 First Legislative Funnel SurvivorsIOWANEWS1No ratings yet

- List of Polk County Cooling CentersDocument1 pageList of Polk County Cooling CentersIOWANEWS1No ratings yet

- Des Moines Water Works 2014 Cost of Service StudyDocument29 pagesDes Moines Water Works 2014 Cost of Service StudyIOWANEWS1No ratings yet

- Complaint and Affidavit-Eddie Tipton Filed 10-8-15Document4 pagesComplaint and Affidavit-Eddie Tipton Filed 10-8-15IOWANEWS1No ratings yet

- S.1881: Bill To Defund Planned ParenthoodDocument2 pagesS.1881: Bill To Defund Planned ParenthoodPaul ConnerNo ratings yet

- Iowa Legislative Services Bureau Analysis of Health and Human Services Conference Committee Report 6-3-15Document30 pagesIowa Legislative Services Bureau Analysis of Health and Human Services Conference Committee Report 6-3-15IOWANEWS1No ratings yet

- Avian Flu Report From The USDADocument38 pagesAvian Flu Report From The USDAMinnesota Public RadioNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cavinkare ProductDocument17 pagesCavinkare ProductgirishNo ratings yet

- How Do Smart Grids Differ From The Current Electricity Infrastructure in The United States?Document3 pagesHow Do Smart Grids Differ From The Current Electricity Infrastructure in The United States?ruwanvigamgaeNo ratings yet

- SELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESDocument19 pagesSELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESNatsu DeAcnologiaNo ratings yet

- Creating Customer Relationships and Value Through Marketing: Because Learning Changes EverythingDocument48 pagesCreating Customer Relationships and Value Through Marketing: Because Learning Changes Everythingdoeun3851No ratings yet

- ItcDocument19 pagesItcRahul JayaramanNo ratings yet

- RESEARCH PAPER - Growth Strategy of Mercedes BenzDocument8 pagesRESEARCH PAPER - Growth Strategy of Mercedes Benzsanjana rao100% (1)

- Factors Influencing Consumer BehaviourDocument18 pagesFactors Influencing Consumer BehaviourjijuloveuNo ratings yet

- Glimpses of Consumer Behaviour Towards 2020Document196 pagesGlimpses of Consumer Behaviour Towards 2020Najeemudeen K.P100% (1)

- Prelims Vision MissionDocument6 pagesPrelims Vision MissionveidabadongNo ratings yet

- Toyota Recalls Revealing The Value of SeDocument138 pagesToyota Recalls Revealing The Value of SeMohamed BayoumyNo ratings yet

- Travel+Leisure USA-May 2017Document100 pagesTravel+Leisure USA-May 2017Dringo AlexNo ratings yet

- Case Study Toyota Cultural CrisisDocument9 pagesCase Study Toyota Cultural CrisisDragos CirnealaNo ratings yet

- Summary of Lean Thinking PDFDocument2 pagesSummary of Lean Thinking PDFAmr M. AbdelhadyNo ratings yet

- University of Toronto - Department of Economics - ECO 204 - Summer 2013 - Ajaz HussainDocument26 pagesUniversity of Toronto - Department of Economics - ECO 204 - Summer 2013 - Ajaz Hussainexamkiller100% (1)

- Unilever Marketing ProjectDocument18 pagesUnilever Marketing ProjectWaqas MehmoodNo ratings yet

- Perspectives On Retail & Consumer Goods - Summer 2014 FINALDocument84 pagesPerspectives On Retail & Consumer Goods - Summer 2014 FINALzskebapciNo ratings yet

- Measuring of Customer Satisfaction and Availability of Several Staffs at The Web Portal of FlipkartDocument32 pagesMeasuring of Customer Satisfaction and Availability of Several Staffs at The Web Portal of FlipkartChandan Srivastava0% (1)

- BMC Editable TPLDocument1 pageBMC Editable TPLbayu dimasaputriNo ratings yet

- Final Exam BMGT 350Document16 pagesFinal Exam BMGT 350johnnyscansNo ratings yet

- Understanding How Consumers Make Buying DecisionsDocument14 pagesUnderstanding How Consumers Make Buying DecisionsRAGOS Jeffrey Miguel P.No ratings yet

- The Mcdonald'S Supply ChainDocument4 pagesThe Mcdonald'S Supply ChainBuwan BhattacharyyaNo ratings yet

- Task 1: Upload The Word Doc To The Moodle (Name Surname)Document2 pagesTask 1: Upload The Word Doc To The Moodle (Name Surname)Lyana LubachevskayaNo ratings yet

- 466Document79 pages466Poonam HaraniNo ratings yet

- IBS Deployment GuideDocument20 pagesIBS Deployment Guidevenetinto75No ratings yet

- Marketing Management Full Notes at MbaDocument308 pagesMarketing Management Full Notes at MbaBabasab Patil (Karrisatte)100% (1)

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocument4 pagesHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Big Data Real World Application in Palm Oil IndustryDocument4 pagesBig Data Real World Application in Palm Oil IndustrymaryNo ratings yet

- 1-Case StudyDocument2 pages1-Case StudyEsha AmirNo ratings yet

- CocaCola MagsDocument8 pagesCocaCola Magsanuj_khemkaNo ratings yet

- Theory of Consumer BehaviorDocument7 pagesTheory of Consumer BehaviorGladz De ChavezNo ratings yet