Professional Documents

Culture Documents

Property Purchase - Precautions

Uploaded by

Upendra KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Purchase - Precautions

Uploaded by

Upendra KumarCopyright:

Available Formats

Property Purchase - Precautions

Purchasing a property/land requires utmost care. One has to examine and find out the title of the

seller or nature of his right. A seller can sell only what he possesses. Therefore if a seller has

proper and valid title, on purchase you will get valid title. If the seller's title is defective, you will

get only defective title. The simple reasoning is that he can sell what he has, and nothing more.

When buying a property, legal due diligence is essential to avoid getting entangled in legal issues

later. Here are some of the precautions you can take before finalizing a property deal.

Check the antecedents of the vendor(s) - We all verify title deeds and all connected documents

before buying the property. But we fail to verify the antecedents of the vendor(s) . It is better to

verify the character and antecedents of the vendor(s) beforehand.If the vendor(s) are habitual

offenders and involved in the real-estate offences or other crimes, then it is better to drop the idea

of buying the property from them notwithstanding whether the title is perfect or not. If the

vendor has good background; and his character and reputation are unquestionable, then the

transaction will be very smooth. Even, in future, if there is any dispute regarding title or any

other issue pertaining to the property, then you are dealing with a respectable person in the

society; and you need not to spend your valuable money and time on unnecessary litigation. You

are not facing any embarrassment in the shape of physical or verbal abuse. The issues can be

resolved through gentlemen agreement without involving external forces.

Check the title of the property- The title of the property forms the foundation of any contract.

According to the Indian Contract Act, no seller can pass on to the purchaser a better title than

what he already possesses. Therefore, the title of the seller must be clear and free from any

encumbrance. Before you buy a property, verify the title of the seller. A search of the records at

the sub-registrar's office may be carried out for documents that may affect the property and may

have been registered .The report will show the recorded owner of title of the property and

changes in the title of the property. If the land is an agriculture land then adangal/pahani/khata of

that land or/and Pattadar Passbook and Title Deed can be requested from the seller.Assessment

Register Ledger entry (called Khata in some parts of the country) is basically a supporting

document of title. It is the entry of the present owner in the municipal/panchayat records relating

to house properties. The absence of Assessment Register entry in the name of a current owner

can be rectified at any time by applying for mutation. This has become important because it is

required for loans, title opinions, electricity meter name change, etc. Assessment Register Ledger

entry is changed after a sale deed is executed or after a property is inherited through a will, gift,

partition, etc., if applied and requested for a mutation.

Verify the title of the seller- The vendor may have acquired his title either by purchase, by

inheritance, by partition, by gift, by settlement or by grant. To find out the source of title there

must be some document like.

Right of Purchase Sale Deed

Inheritance Entries in revenue records, and predecessor's title

Partition Deed of partition

Gift Gift deed

Settlement Settlement deed

Grant Grant order

Release Release deed

Mulgeni Deed of Mulgeni or permanent lease

Personal inspection of property under sale (site/building/flat/agricultural land) - Buyer beware is

the golden mantra in the immovable property transactions. Therefore, the entire onus lies on the

purchaser in verifying the title, ownership and possession of the property. He must take all

reasonable steps to ensure that he is purchasing the property from a right person and also a right

property. The most important precaution is undertaking a personal inspection of the property

under the sale. During the personal inspection, the buyer shall inquire with the neighbours

regarding the ownership and possession of the property, disputes if any, character of the

vendor(s), charges/mortgages on the property, joint owners of the property or part of the property

etc. This is the most important aspect of the title verification, therefore, it is better at least three

persons from buyer side shall take up this task. And they shall make discrete enquiries with

various persons in and around the property like elders of the locality, longstanding property

owners/tenants, workmen, etc. It is easy to undertake the inspection of site and building in the

densely populated areas. It is also easy to enquire in villages where the people could identify

persons by name. But it is difficult to enquire in the suburban, newly developing and agricultural

lands converted as plots where no habitation exists. In these cases a lot of effort is required to

get the right answers to the questions and at times we may not get answers at all since there

would be no person to contact except the vendor or his men.

Sale by holder of power of attorney- If the sale documents are being executed by a person

holding power of attorney on behalf of the owner, the said power of attorney should be

scrutinised thoroughly. The person must not only possess the power to sell property, the power

of attorney should also be validly executed. An agreement holder (as explained above) who also

has a power of attorney to sell the land and/or building is normally a developer. Alternatively, a

person may have paid the entire consideration to the owner and holds on to the property for some

time to sell it at a later date for a profit. The sale will be effected by the power of attorney holder

on behalf of the owner. Such power of attorney must be properly stamped and registered (if it is

coupled with sale agreement/development agreement/given for consideration) . It should also not

be revoked.

Check the original documents- Always inspect the original documents of the seller and read all

the documents carefully before signing them. If the vendor states that the original documents

were missing/stolen/lost, then it is better to know the full facts relating to missing documents.

Know whether the vendor has filed a complaint in the concerned police station and got the copy

of FIR with regard to missing of documents; and/or what are the other steps he had taken to trace

them as a prudent person. There is a possibility of keeping the original documents in

banks/financial institutions/private lenders to create mortgage/charge over the property by way

of deposit of title deeds. So it is better to get full information regarding original documents that

are missing. And it is always better to give a public notice with regard to purchase of the

property on the basis of certified copies of the title deeds instead of original documents which

were lost.

Colour Photostat copies frauds- Today, the technology used in Colour Photostat machines is

very advanced one; and copies generated using these machines are of high quality. Innocent

purchasers can be duped by clever vendors by delivering colour Photostat copies instead of

original. Therefore, a proper check shall be done in verifying whether the documents are original

or Colour Photostat copies.

Verify photographs and thumb impressions of the vendor-Section 32A of Registration Act, 1908

prescribes that in case of sale deeds both the vendors and buyers should affix their photographs

and thumb impressions along with the document. This provision has come into force from the

year 2001. Therefore, if your vendor has acquired the property after 2001 through a registered

document, then you have one more evidence to check regarding the identity of your vendor.

Verify carefully the photographs and thumb impression of the vendor in the registered document

where he appears as purchaser.

Tax receipt and bills-Property taxes which are paid to government or municipality are a first

charge on the property. Hence, enquiries must be made in government and municipal offices to

ascertain whether all taxes have been paid up to date. The owner should also possess the latest

tax receipts, which you may inspect. While investigating in different departments of the

municipality, you need to ascertain whether any notices or requisitions relating to the property

have been issued and are outstanding and not yet complied. While inspecting the property tax

receipt, it can be noted that there are two columns in the tax receipt.Make sure that the name

entered in the owner's column is correct. The second column will be for the name of the one who

paid the tax. Sometimes the owner may not have the tax receipt with him, in such cases, contact

the village office with the survey number of land and confirm the original owner of the land. If

you are buying a house along with the property, then the house tax receipt should also be

checked. Also make sure water bills and electricity bills have been paid up to date and if there is

any balance payment to be made, ensure that it is made by the seller.

Encumbrance Certificate -Before purchasing the land or house, it is important to confirm that the

land does not have any legal dues. Check the Encumbrance Certificate (EC) (EC) issued by the

sub register office where the deed has been registered /meesevacentres (in Andhra Pradesh) ,

stating that the said land does not have any legal dues and complaints.

Pledged land-Some people may have taken loan from the bank by pledging their land. Ensure

that the seller has paid back the entire amount due. Don't be satisfied with the receipt of the

payment made. Release certificate issued by the bank is necessary for all the debts over the land.

You could buy a land without the release certificate. But if you want to take a loan in future, the

release certificate is a must.

Place a public notice-A public notice may be placed in newspapers calling for claims in respect

of the property being purchased. Claims can come even afterwards, public notice helps in

proving that you purchased the property bona fide and in good faith. This will prove that you

have taken all measures that can be expected from bona fide and prudent purchaser thereby you

will get favourable order/view from the Courts, in case of any litigation that may arise in future

with regard to patent or latent defects in the title of the property.

Inspect the plans-If the building is under construction then inspect the plans to check whether

they have been sanctioned by the concerned authority. Also check whether the construction was

done according to the plan approved by Municipal authority. If there is any deviation from the

approved plan, then it is to be verified whether it can be regularized or not. In respect of

deviation that can be regularized by paying penalty to the municipal authority, it is better to

record, in the agreement, that who should pay that penalty to the municipal authority. If the

deviation is not allowed to be regularized then the purchaser is taking the risk of demolition of

the building partly/fully by the municipal authorities.

Payments of stamp duty-Always verify documents of title to check payment of stamp duty. If the

ownership of property has changed hands more than once, examine all the documents for

payment of stamp duty by the predecessors. Today, many States (including Andhra Pradesh)

have amended the Stamp law providing for creation of charge over the property in case there is

any deficit stamp duty in any document relating to property. Therefore, the present owner of the

property obliged to pay the deficit stamp duty and penalties, if any on the documents registered

earlier notwithstanding whether he is a party in it or not.

If the property belongs to a minor-In case where the property is owned by a minor, prior

approval of the court is required to enable the minor's other/natural guardian to sell the property.

In the absence of such permission, the sale could be voidable at the option of the minor on

attaining majority. Or otherwise, soon after attainment of majority, the sale has to be perfected

by obtaining a registered ratification deed by the person who was a minor at the time of sale.

Check the minimum tenure of land if taken on lease-If the flat that is being purchased is in a

building built on a land which is given on lease, lease rent would have to be paid for the land by

the flat owners. If the lease is to expire shortly, it is possible that the lease rent may increase

substantially. Hence, the terms of the lease must be verified before buying the flat. In Andhra

Pradesh this sort of arrangement is not prominent.

Property Purchase - Precautions

Engage a competent lawyer-There are several laws involved in immovable property transactions.

Therefore, it is better to engage a competent lawyer to investigate the title, possession, ownership

and other aspects. The lawyer shall associate and his scope of work shall include in investigating

the title, negotiations, drafting of agreements/sale deeds, payment of consideration, registration

of documents, mutation, etc

Reputed attesting witnesses-The attesting witnesses are the persons who actually witness the

signing of the sale or any document by the parties and sign as witnesses on the document. It is

always important to have reputed and respectable people as attesting witnesses. Attesting witness

is an important and key witness in the civil litigation in case any court case arises in future. Their

statement will be having a lot of weight in deciding the case. Therefore, it is advisable to request

good and reputed young and middle aged people as attesting witness.

Check the occupation certificate-Occupation certificate should be verified to ensure that the

building has been built legally, especially in case of new buildings as per G.O.Ms.No. 86,

Municipal Administration Department, Government of Andhra Pradesh, Dated the 3rd March,

2006.

Check whether the flat/portion is mortgaged to Municipal authority-As per the municipal

regulations, the builder/owner shall create charge over 10% of the area under construction to

ensure compliance with building regulations. So it is necessary to verify whether the flat/portion

of the building under sale is mortgaged to the municipality. If it is mortgaged, then it is not

possible to get a registered sale deed from the builder/owner. Purchaser has to wait till it is

cleared by municipality.

Check the carpet area-You can verify the carpet area by taking actual measurement of the

property if the same is ready. Plinth area includes carpet area (area between the external walls of

the flat/portion) and common areas (like passages, staircase, verandah, park etc) . Carpet area

and common area ratio varies from 88:12 to 75:25. If carpet area ratio is more, then you will get

more exclusive space within your flat on the other hand common area wherein all co-owners will

have the title, possession, access, will be more.

Search for records-A search of the records at the sub-registrar's office may be carried out for

documents that may affect the property and may have been registered. Section 57 of Registration

Act, 1908 allows citizens to get certified copies and encumbrance certificates from the

Registrar/Sub Registrar Offices. Any person can verify personally the registered document

entries in the books of the Registrar/Sub Registrar Offices by paying prescribed fee.

Certified copies-When copies of the documents are given for perusal, the buyer need rely only on

them, but instead can apply for certified copies too. The certified copies of the back (link)

documents should also be obtained. The copies of the sale deeds are preserved in the Sub-

Registrar's office in Book 1 and are given to anyone on application after paying a prescribed fee.

Power of attorney is a document in which the principal grants authority to an agent to act on his

behalf. Through executive instructions, today, in Andhra Pradesh, the power of attorney if given

in respect of immovable property is registered in Book 1 so as to enable the interested parties to

get certified copy of it. This step is a progressive one since it will check frauds being played, to

some extent, under the guise of power of attorney as it is no more a confidential document.

NOC of the society-It is advisable to obtain a no dues certificate and no encumbrance certificate

from the society (if the property is in the society) to ensure that all dues are paid and no

mortgage is registered with the society in respect of the property being purchased. In case the

property is in a society, check that all the society forms are duly filled and signed.

You might also like

- Making Money Out of Thin Air: Salesteamlive Special ReportDocument8 pagesMaking Money Out of Thin Air: Salesteamlive Special ReportThomas SettleNo ratings yet

- Impound Procedure SummaryDocument2 pagesImpound Procedure SummaryKD F2021No ratings yet

- Motor Vehicle Bill of SaleDocument2 pagesMotor Vehicle Bill of Saleapi-271129211No ratings yet

- Purchase of LandDocument55 pagesPurchase of Landsrinath1234No ratings yet

- PMS AgreementDocument41 pagesPMS AgreementSandeep BorseNo ratings yet

- CBP Bond Form Completion GuideDocument5 pagesCBP Bond Form Completion Guideph34rm3No ratings yet

- Missouri New Lease WilliamDocument25 pagesMissouri New Lease WilliamDavid FreiheitNo ratings yet

- Property Purchase PrecautionsDocument8 pagesProperty Purchase PrecautionsSuresh Aketi100% (1)

- Demand DraftDocument5 pagesDemand DraftSmartKevalNo ratings yet

- Medastro Text PDFDocument96 pagesMedastro Text PDFUpendra Kumar100% (2)

- Benefit ChangeDocument4 pagesBenefit ChangeElizabeth OctiveaNo ratings yet

- Real Estate Definits & LawsDocument42 pagesReal Estate Definits & LawsTonia SimmonsiaNo ratings yet

- Business Purchase Letter of Intent TemplateDocument3 pagesBusiness Purchase Letter of Intent TemplateGAURAV SHARMA0% (1)

- Vegas Shooting Supreme Court Appeal Filed Respondent:Cross-Appellant's Response to Appellant:Cross-Respondent's Emergency Motion for Stay Pending Appeal, Or in the Alternative Stay Pending Petition for Writ of Mandamus or Prohibition.18-15680Document279 pagesVegas Shooting Supreme Court Appeal Filed Respondent:Cross-Appellant's Response to Appellant:Cross-Respondent's Emergency Motion for Stay Pending Appeal, Or in the Alternative Stay Pending Petition for Writ of Mandamus or Prohibition.18-15680Weg OagNo ratings yet

- Purchase ReceiptDocument3 pagesPurchase ReceiptZubair MohammedNo ratings yet

- Sellers RRRR#2Document2 pagesSellers RRRR#2Enrique GuevaraNo ratings yet

- All 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchDocument50 pagesAll 60 Startups That Launched at Y Combinator Winter 2016 Demo Day 1 - TechCrunchAnonymous f9Zj4lNo ratings yet

- Sale Agreement For Vacant LandDocument24 pagesSale Agreement For Vacant LandyelzahbusinessgroupNo ratings yet

- Sbi Home Loan Application FormDocument5 pagesSbi Home Loan Application FormDhawan SandeepNo ratings yet

- Audi Alteram PartemDocument6 pagesAudi Alteram PartemArpit Jain100% (1)

- AAJ Report: Ten Worst Insurance Companies FINALDocument29 pagesAAJ Report: Ten Worst Insurance Companies FINALTimothy Richard GNo ratings yet

- GST On Construction Done For Landlords Under Joint Development Agreement PDFDocument7 pagesGST On Construction Done For Landlords Under Joint Development Agreement PDFAman JainNo ratings yet

- Real Estate Purchase Sale Agreement DocumentDocument16 pagesReal Estate Purchase Sale Agreement DocumentNew Life NetworkNo ratings yet

- Limited Civil Litigation in CaliforniaDocument3 pagesLimited Civil Litigation in CaliforniaStan Burman100% (2)

- Form 1 - ApplicationDocument2 pagesForm 1 - ApplicationAnonymous ORP6BYb4No ratings yet

- KPMBM - Bad Debts and Doubtful DebtsDocument51 pagesKPMBM - Bad Debts and Doubtful DebtsAhmad Hafiz50% (2)

- ST Audit Query FormatDocument3 pagesST Audit Query FormatpriyeshNo ratings yet

- Affidavit of ConsentDocument3 pagesAffidavit of ConsentCyrill L. MarkNo ratings yet

- 12 Important Documents To Check Before Buying A New PropertyDocument26 pages12 Important Documents To Check Before Buying A New Propertysrinath1234No ratings yet

- Mortgage Brokers AustraliaDocument4 pagesMortgage Brokers AustraliaChrisNo ratings yet

- Coinmint vs. Ashton Soniat Fraud CaseDocument8 pagesCoinmint vs. Ashton Soniat Fraud CaseDon HewlettNo ratings yet

- Bar Matter No. 1370 - Letter of Atty. Cecilio Y. Arevalo, Jr.Document1 pageBar Matter No. 1370 - Letter of Atty. Cecilio Y. Arevalo, Jr.Noreenesse Santos100% (1)

- Example of Contract John DoeDocument8 pagesExample of Contract John DoeYolanda Janice Sayan FalingaoNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument11 pagesUnit 2: Ledgers: Learning Outcomesviveo23100% (1)

- Civil Procedure - Udsm Manual 2002Document107 pagesCivil Procedure - Udsm Manual 2002habiye2013100% (1)

- Group 6 - ImpartialityDocument5 pagesGroup 6 - ImpartialityIJ SaavedraNo ratings yet

- Torts and DamagesDocument14 pagesTorts and DamagesMikkoletNo ratings yet

- Documents During Car Sale1Document11 pagesDocuments During Car Sale1Paras ShardaNo ratings yet

- Financial Payout Request Form - Updated - tcm47-63340Document16 pagesFinancial Payout Request Form - Updated - tcm47-63340Jane Tallar Rodrigueza100% (1)

- Accounts of Banking CompaniesDocument9 pagesAccounts of Banking CompaniesMd Jahir Uddin100% (1)

- Insurance Industry in IndiaDocument3 pagesInsurance Industry in Indianishant bNo ratings yet

- Company Law FiracDocument6 pagesCompany Law FiracRohan PatelNo ratings yet

- Unit-4 (Mis & E-Payment) January 10, 2023Document30 pagesUnit-4 (Mis & E-Payment) January 10, 2023Dev ParmarNo ratings yet

- How Materials Management Relates to Finance in SAPDocument14 pagesHow Materials Management Relates to Finance in SAPanon_60611043No ratings yet

- Transfer TaxesDocument25 pagesTransfer Taxeselvira bolaNo ratings yet

- Title Insurance CommitmentDocument6 pagesTitle Insurance CommitmentJordan GallNo ratings yet

- Frequently Asked Questions About Real Estate Investment TrustsDocument17 pagesFrequently Asked Questions About Real Estate Investment Trustsmichael z100% (1)

- ICIDocument228 pagesICIZerohedgeNo ratings yet

- Transfer Taxes Tax 2Document45 pagesTransfer Taxes Tax 2Nat PantsNo ratings yet

- Reliance CAF SIP Insure ArnDocument8 pagesReliance CAF SIP Insure ArnARVINDNo ratings yet

- Credit LinesDocument43 pagesCredit Linespdastous1No ratings yet

- Report on Immovable Property InvestigationDocument17 pagesReport on Immovable Property InvestigationBala_9990No ratings yet

- 9 Expenses & Other IncomesDocument22 pages9 Expenses & Other IncomesZindgiKiKhatirNo ratings yet

- Mount Prospect LL-Tenant Rights SummaryDocument2 pagesMount Prospect LL-Tenant Rights SummaryChicagoMTONo ratings yet

- RBI Response on Inoperative Bank Accounts and Unclaimed AmountsDocument29 pagesRBI Response on Inoperative Bank Accounts and Unclaimed AmountsigoysinghNo ratings yet

- Lms - Gold Audit Scope - Module 2Document24 pagesLms - Gold Audit Scope - Module 2Raghu.GNo ratings yet

- What Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?Document8 pagesWhat Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?KING ZINo ratings yet

- Guide Valuation Unregistered Land PDFDocument84 pagesGuide Valuation Unregistered Land PDFVishal BalrajNo ratings yet

- DSP BlackRock Tax Saver Fund Application FormDocument4 pagesDSP BlackRock Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- Cancellation FormDocument2 pagesCancellation FormAkash TebaliyaNo ratings yet

- SunTrust Short Sale Approval (Fannie Mae)Document3 pagesSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Lecture Slides 3 Point of Sales (POS) SystemDocument31 pagesLecture Slides 3 Point of Sales (POS) SystemAlice LowNo ratings yet

- Melvyn Hiller v. Securities and Exchange Commission, 429 F.2d 856, 2d Cir. (1970)Document5 pagesMelvyn Hiller v. Securities and Exchange Commission, 429 F.2d 856, 2d Cir. (1970)Scribd Government DocsNo ratings yet

- Short Sale Seminar Bakersfield, CADocument22 pagesShort Sale Seminar Bakersfield, CAMiguel GarciaNo ratings yet

- Rent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Document4 pagesRent Statement - House/Shop/Godown No. P-231, Punjab Town, Karachi Tenant Name: Mr. Khadam Hussain, Phone: 0300-7032976 / 0334-3727976Ummehamdan NasirNo ratings yet

- Mortgage and Property Industry TermsDocument8 pagesMortgage and Property Industry TermsGOWTHAM NandaNo ratings yet

- A Guide To Self Assessment For URSB ClientsDocument9 pagesA Guide To Self Assessment For URSB ClientsMoses Dalia0% (1)

- Business Sale Agreement SummaryDocument2 pagesBusiness Sale Agreement SummaryBazmir zaheryNo ratings yet

- PPFNomination VariationDocument1 pagePPFNomination Variationhimadri_bhattacharjeNo ratings yet

- Properties VerificationDocument3 pagesProperties VerificationHativatye DylanNo ratings yet

- Transaction Receipt: V L Upendra KumarDocument1 pageTransaction Receipt: V L Upendra KumarUpendra KumarNo ratings yet

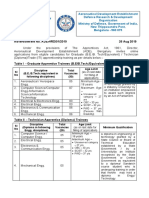

- Notification IISER Bhopal MO Office Asst Other PostDocument46 pagesNotification IISER Bhopal MO Office Asst Other PostRitesh PaliwalNo ratings yet

- NID RECRUITMENT FOR VARIOUS TEACHING, TECHNICAL AND ADMINISTRATIVE POSTSDocument29 pagesNID RECRUITMENT FOR VARIOUS TEACHING, TECHNICAL AND ADMINISTRATIVE POSTSAbhishek JainNo ratings yet

- Eoi 4Document80 pagesEoi 4VenkatGollaNo ratings yet

- Nasa Satellite Power5Document123 pagesNasa Satellite Power5Upendra KumarNo ratings yet

- 10 2018notificationDocument34 pages10 2018notificationkiranNo ratings yet

- J72203080 08-Sep-2018 1815BNGCKM Airavat Club Class 20,21 Bengaluru Kempegowda Bs Terminal 2 18:15 17 3665 Hassan Hassan 2 (Adults: 2 Children: 0)Document2 pagesJ72203080 08-Sep-2018 1815BNGCKM Airavat Club Class 20,21 Bengaluru Kempegowda Bs Terminal 2 18:15 17 3665 Hassan Hassan 2 (Adults: 2 Children: 0)Upendra KumarNo ratings yet

- Gregorian-Lunar Calendar Conversion Table of 2018 (Wu-Xu Year of The Dog)Document1 pageGregorian-Lunar Calendar Conversion Table of 2018 (Wu-Xu Year of The Dog)Wilyanto YangNo ratings yet

- Central Railway 78 Deo Executive Asst Digital Office Asst Posts Advt Details Application Form 538ba5Document5 pagesCentral Railway 78 Deo Executive Asst Digital Office Asst Posts Advt Details Application Form 538ba5Upendra KumarNo ratings yet

- Employment Notification-Cgpdtm - 07.09.2018 PDFDocument1 pageEmployment Notification-Cgpdtm - 07.09.2018 PDFUpendra KumarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Upendra KumarNo ratings yet

- SBI PO Notification 2019Document4 pagesSBI PO Notification 2019learning duniaNo ratings yet

- SBI Recruitment for Junior Associates 2019Document7 pagesSBI Recruitment for Junior Associates 2019punithrgowda22No ratings yet

- Notification IISER Bhopal MO Office Asst Other PostDocument46 pagesNotification IISER Bhopal MO Office Asst Other PostRitesh PaliwalNo ratings yet

- Cen 01 2019 RRB NTPC RrbonlinegovinDocument71 pagesCen 01 2019 RRB NTPC RrbonlinegovinIndia Jobs Seeker75% (8)

- Detailed Advertisment AM PDFDocument22 pagesDetailed Advertisment AM PDFUpendra KumarNo ratings yet

- Advertisemen MiscComm 11 3 19-1 PDFDocument17 pagesAdvertisemen MiscComm 11 3 19-1 PDFSeeTha LakshNo ratings yet

- DRDO Notice 24 08Document5 pagesDRDO Notice 24 08Shyam Prasad GNo ratings yet

- Recruitment Bulletin for Examiner of Patents & Designs PostsDocument63 pagesRecruitment Bulletin for Examiner of Patents & Designs PostsnglmeeraNo ratings yet

- NID RECRUITMENT FOR VARIOUS TEACHING, TECHNICAL AND ADMINISTRATIVE POSTSDocument29 pagesNID RECRUITMENT FOR VARIOUS TEACHING, TECHNICAL AND ADMINISTRATIVE POSTSAbhishek JainNo ratings yet

- Why and how to use tantalum capacitors in satellites secondary DC BusDocument5 pagesWhy and how to use tantalum capacitors in satellites secondary DC BusUpendra KumarNo ratings yet

- 5.0 Power SubsystemDocument25 pages5.0 Power SubsystemAadarsh BhatNo ratings yet

- DFCCIL Revised Advertisement For WebsiteDocument14 pagesDFCCIL Revised Advertisement For WebsiteDharmvir KumarNo ratings yet

- About IRCTC Ewallet PDFDocument2 pagesAbout IRCTC Ewallet PDFDeepak sutarNo ratings yet

- CERA Display CentresDocument12 pagesCERA Display CentresUpendra KumarNo ratings yet

- Employment Notification-Cgpdtm - 07.09.2018 PDFDocument1 pageEmployment Notification-Cgpdtm - 07.09.2018 PDFUpendra KumarNo ratings yet

- J72203080 08-Sep-2018 1815BNGCKM Airavat Club Class 20,21 Bengaluru Kempegowda Bs Terminal 2 18:15 17 3665 Hassan Hassan 2 (Adults: 2 Children: 0)Document2 pagesJ72203080 08-Sep-2018 1815BNGCKM Airavat Club Class 20,21 Bengaluru Kempegowda Bs Terminal 2 18:15 17 3665 Hassan Hassan 2 (Adults: 2 Children: 0)Upendra KumarNo ratings yet

- Gregorian-Lunar Calendar Conversion Table of 2018 (Wu-Xu Year of The Dog)Document1 pageGregorian-Lunar Calendar Conversion Table of 2018 (Wu-Xu Year of The Dog)Wilyanto YangNo ratings yet

- Advertisemen MiscComm 11 3 19-1 PDFDocument17 pagesAdvertisemen MiscComm 11 3 19-1 PDFSeeTha LakshNo ratings yet

- Email To NY Times Fact Checker About NYPD Detective David TerrellDocument16 pagesEmail To NY Times Fact Checker About NYPD Detective David TerrellEric SandersNo ratings yet

- BR Sebastian V CaDocument2 pagesBR Sebastian V CaCristineNo ratings yet

- Filed: Patrick FisherDocument5 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Serven Lamps of AdvocacyDocument9 pagesServen Lamps of AdvocacyAkankshaNo ratings yet

- United States v. Robert A. Bloomer, JR., 150 F.3d 146, 2d Cir. (1998)Document4 pagesUnited States v. Robert A. Bloomer, JR., 150 F.3d 146, 2d Cir. (1998)Scribd Government DocsNo ratings yet

- Manalapan OPRA Request FormDocument3 pagesManalapan OPRA Request FormThe Citizens CampaignNo ratings yet

- Raghavendra Letter To Judge Hon. PitmanDocument10 pagesRaghavendra Letter To Judge Hon. PitmanIvyGateNo ratings yet

- McIntosh ChronologyDocument9 pagesMcIntosh ChronologyDarin Reboot CongressNo ratings yet

- Francel Realty CORPORATION, Petitioners, v. RICARDO T. SYCIP, RespondentDocument12 pagesFrancel Realty CORPORATION, Petitioners, v. RICARDO T. SYCIP, RespondentMark FernandezNo ratings yet

- 1996 09-19-1996 1 Lns 537 Ban Hin Lee Bank Berhad V Tan Chong Keat SDN BHD EdDocument4 pages1996 09-19-1996 1 Lns 537 Ban Hin Lee Bank Berhad V Tan Chong Keat SDN BHD EdooiNo ratings yet

- CHPT 3 GtranspoDocument15 pagesCHPT 3 GtranspoGIGI KHONo ratings yet

- JDR PPT FinalDocument32 pagesJDR PPT FinalWes ChanNo ratings yet

- Mapulo Mining Association vs Secretary of AgricultureDocument15 pagesMapulo Mining Association vs Secretary of AgricultureAriel MolinaNo ratings yet

- Gregorio Sancianco's 1881 Treatise on Economic Reforms for the PhilippinesDocument1 pageGregorio Sancianco's 1881 Treatise on Economic Reforms for the PhilippinesCarol Ferreros PanganNo ratings yet

- United States v. William Haskell Farmer, 274 F.3d 800, 4th Cir. (2001)Document8 pagesUnited States v. William Haskell Farmer, 274 F.3d 800, 4th Cir. (2001)Scribd Government DocsNo ratings yet

- Defendants Dismas Charties, Inc., Ana Gispert, Derek Thomas and Adams Leshota's Motion and Brief in Support of Their For Hearing and Status ConferenceDocument5 pagesDefendants Dismas Charties, Inc., Ana Gispert, Derek Thomas and Adams Leshota's Motion and Brief in Support of Their For Hearing and Status ConferencecinaripatNo ratings yet

- Cases On MisconductDocument2 pagesCases On MisconductDisha MalkaniNo ratings yet

- FARVACE Contracts Unsoundness of MindDocument14 pagesFARVACE Contracts Unsoundness of MindsandeepNo ratings yet

- Complaint Robert Hall V Malcolm McCormickDocument53 pagesComplaint Robert Hall V Malcolm McCormickLara PearsonNo ratings yet

- Nowak Case Representation by David MeisterDocument38 pagesNowak Case Representation by David Meister92589258No ratings yet

- English For Law File 1Document13 pagesEnglish For Law File 1Lisa NassarNo ratings yet