Professional Documents

Culture Documents

Polyurethane: United States

Uploaded by

Michael WarnerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Polyurethane: United States

Uploaded by

Michael WarnerCopyright:

Available Formats

Freedonia Focus Reports

US Collection

Polyurethane:

United States

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

October 2014

CH

UR

Highlights

Industry Overview

Market Size and Trends | Product Segmentation | Market Segmentation

Raw Materials | Environmental and Regulatory Factors | Product Development

BR

O

Demand Forecasts

Market Environment | Product Forecasts | Market Forecasts

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition and Characteristics | Additional Companies Cited

www.freedoniafocus.com

Polyurethane: United States

ABOUT THIS REPORT

Scope & Method

This report forecasts US polyurethane demand in pounds to 2018. Total demand is

segmented by product in terms of:

flexible foam

rigid foam

other products such as adhesives, coatings, and elastomers.

Demand figures refer to the weight of final products rather than input chemicals. Scrap

is excluded from the scope of this report. Rebond foam carpet padding, which consists

of factory scrap generated in the production of furniture, bedding, or transportation

foams, is also excluded from the scope of this report.

Total demand is also segmented by market as follows:

transportation equipment

construction products

furniture

other markets such as packaging and appliances.

To illustrate historical trends, total demand is provided in an annual series from 2003 to

2013; the various segments are reported at five-year intervals for 2008 and 2013.

Forecasts are developed via the identification and analysis of pertinent statistical

relationships and other historical trends/events as well as their expected

progression/impact over the forecast period. Changes in quantities between reported

years of a given total or segment are typically provided in terms of five-year compound

annual growth rates (CAGRs). For the sake of brevity, forecasts are generally stated in

smoothed CAGR-based descriptions to the forecast year, such as demand is projected

to rise 3.2% annually through 2018. The result of any particular year over that period,

however, may exhibit volatility and depart from a smoothed, long-term trend, as

historical data typically illustrate.

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

Sources

Polyurethane: United States represents the synthesis and analysis of data from various

primary, secondary, macroeconomic, and demographic sources including:

i

2014 by The Freedonia Group, Inc.

Polyurethane: United States

firms participating in the industry, and their suppliers and customers

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated August 2014

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

325211

2821

325510

326150

Plastics Material and Resin

Manufacturing

Paint and Coating Manufacturing

Urethane and Other Foam Product

(except Polystyrene) Manufacturing

2851

3086

Plastics Materials, Synthetic Resins, and

Nonvulcanizable Elastomers

Paints, Varnishes, Lacquers, Enamels,

and Allied Products

Plastics Foam Products

Copyright & Licensing

The full report is protected by copyright laws of the United States of America and

international treaties. The entire contents of the publication are copyrighted by The

Freedonia Group, Inc.

2014 by The Freedonia Group, Inc.

ii

Polyurethane: United States

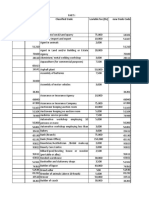

Table of Contents

Section

Page

About This Report ......................................................................................................................................... i

Highlights....................................................................................................................................................... 1

Industry Overview ......................................................................................................................................... 2

Market Size & Trends .............................................................................................................................. 2

Chart 1 | United States: Polyurethane Demand Trends, 2003-2013 .................................................. 2

Product Segmentation ............................................................................................................................. 3

Chart 2 | United States: Polyurethane Demand by Product; 2008, 2013 (mil lbs) ............................. 3

Flexible Foam. .................................................................................................................................... 3

Rigid Foam. ........................................................................................................................................ 4

Other Products.................................................................................................................................... 6

Market Segmentation ............................................................................................................................... 8

Chart 3 | United States: Polyurethane Demand by Market; 2008, 2013 (mil lbs)............................... 8

Transportation Equipment. ................................................................................................................. 8

Construction Products. ..................................................................................................................... 10

Furniture. .......................................................................................................................................... 11

Other Markets. .................................................................................................................................. 12

Raw Materials ........................................................................................................................................ 14

Environmental & Regulatory Factors ..................................................................................................... 15

Product Development ............................................................................................................................ 16

Demand Forecasts ...................................................................................................................................... 17

Market Environment ............................................................................................................................... 17

Table 1 | Key Indicators for US Polyurethane Demand; 2008, 2013, 2018 (2009US$ bil) .............. 17

Product Forecasts .................................................................................................................................. 18

Table 2 | United States: Polyurethane Demand by Product; 2008, 2013, 2018 (mil lbs) ................. 18

Flexible Foam. .................................................................................................................................. 18

Rigid Foam. ...................................................................................................................................... 18

Other Products.................................................................................................................................. 19

Market Forecasts ................................................................................................................................... 20

Table 3 | United States: Polyurethane Demand by Market; 2008, 2013, 2018 (mil lbs) .................. 20

Transportation Equipment. ............................................................................................................... 20

Construction Products. ..................................................................................................................... 20

Furniture. .......................................................................................................................................... 21

Other Markets. .................................................................................................................................. 21

Industry Structure ........................................................................................................................................ 22

Industry Composition & Characteristics ................................................................................................. 22

Company Profile 1 | Bayer AG.......................................................................................................... 23

Company Profile 2 | BASF SE .......................................................................................................... 24

Company Profile 3 | The Dow Chemical Company .......................................................................... 25

Additional Companies Cited .................................................................................................................. 26

Resources ................................................................................................................................................... 27

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

iii

2014 by The Freedonia Group, Inc.

You might also like

- Salt: United StatesDocument4 pagesSalt: United StatesMichael WarnerNo ratings yet

- World SaltDocument4 pagesWorld SaltMichael WarnerNo ratings yet

- World LabelsDocument4 pagesWorld LabelsMichael WarnerNo ratings yet

- Jewelry, Watches, & Clocks: United StatesDocument4 pagesJewelry, Watches, & Clocks: United StatesMichael WarnerNo ratings yet

- Motor Vehicle Biofuels: United StatesDocument4 pagesMotor Vehicle Biofuels: United StatesMichael WarnerNo ratings yet

- Education: United StatesDocument4 pagesEducation: United StatesMichael WarnerNo ratings yet

- World Medical DisposablesDocument4 pagesWorld Medical DisposablesMichael WarnerNo ratings yet

- Specialty Biocides: United StatesDocument4 pagesSpecialty Biocides: United StatesMichael WarnerNo ratings yet

- World Motor Vehicle BiofuelsDocument4 pagesWorld Motor Vehicle BiofuelsMichael WarnerNo ratings yet

- World Lighting FixturesDocument4 pagesWorld Lighting FixturesMichael WarnerNo ratings yet

- World Material Handling ProductsDocument4 pagesWorld Material Handling ProductsMichael WarnerNo ratings yet

- Labels: United StatesDocument4 pagesLabels: United StatesMichael WarnerNo ratings yet

- World GraphiteDocument4 pagesWorld GraphiteMichael WarnerNo ratings yet

- Graphite: United StatesDocument4 pagesGraphite: United StatesMichael WarnerNo ratings yet

- World BearingsDocument4 pagesWorld BearingsMichael WarnerNo ratings yet

- Caps & Closures: United StatesDocument4 pagesCaps & Closures: United StatesMichael WarnerNo ratings yet

- Ceilings: United StatesDocument4 pagesCeilings: United StatesMichael WarnerNo ratings yet

- Aluminum Pipe: United StatesDocument4 pagesAluminum Pipe: United StatesMichael WarnerNo ratings yet

- Industrial & Institutional Cleaning Chemicals: United StatesDocument4 pagesIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNo ratings yet

- Industrial & Institutional Cleaning Chemicals: United StatesDocument4 pagesIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNo ratings yet

- Municipal Solid Waste: United StatesDocument4 pagesMunicipal Solid Waste: United StatesMichael WarnerNo ratings yet

- Public Transport: United StatesDocument4 pagesPublic Transport: United StatesMichael WarnerNo ratings yet

- World HousingDocument4 pagesWorld HousingMichael WarnerNo ratings yet

- World Specialty SilicasDocument4 pagesWorld Specialty SilicasMichael WarnerNo ratings yet

- Plastic Pipe: United StatesDocument4 pagesPlastic Pipe: United StatesMichael WarnerNo ratings yet

- World Drywall & Building PlasterDocument4 pagesWorld Drywall & Building PlasterMichael WarnerNo ratings yet

- Pharmaceutical Packaging: United StatesDocument4 pagesPharmaceutical Packaging: United StatesMichael WarnerNo ratings yet

- Motor Vehicles: United StatesDocument4 pagesMotor Vehicles: United StatesMichael WarnerNo ratings yet

- Housing: United StatesDocument4 pagesHousing: United StatesMichael WarnerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- M. Umair Mehmood Resume Food EngineerDocument2 pagesM. Umair Mehmood Resume Food Engineerm.umair mehmoodNo ratings yet

- Textile Pretreatment Process SequenceDocument2 pagesTextile Pretreatment Process SequenceBala SubramanianNo ratings yet

- Cereal Extrusion SystemDocument2 pagesCereal Extrusion SystemMiguel Antonio Martinez BallesterosNo ratings yet

- The Pultrusion ProcessDocument2 pagesThe Pultrusion ProcessHaren SinghNo ratings yet

- Kamadhenu Coconut IndustriesDocument48 pagesKamadhenu Coconut IndustriesNavaneeth Gowda100% (4)

- RMG Industry AnalysisDocument35 pagesRMG Industry AnalysisSanjana TehjibNo ratings yet

- Fredrix 2014 Product GuideDocument48 pagesFredrix 2014 Product GuidefredrixartistcanvasNo ratings yet

- Agile Product Data MGMT Process Ds 070039Document6 pagesAgile Product Data MGMT Process Ds 070039sau6181No ratings yet

- Strategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FDocument5 pagesStrategic Management Cia 1 Component 1: Submitted By: Hrithik Agrawal 1720614 5 Bba FSAHILNo ratings yet

- Shelf Life Study Introduction - AY1819Document7 pagesShelf Life Study Introduction - AY1819RaysonChooNo ratings yet

- Water Jet Reed Best Manufacturer & Supplier in Ahmedabad, IndiaDocument8 pagesWater Jet Reed Best Manufacturer & Supplier in Ahmedabad, IndiaVijay PanchalNo ratings yet

- GPL Corporate PresentationDocument20 pagesGPL Corporate PresentationPreeti AgarwalNo ratings yet

- Quality Assurance ManualDocument58 pagesQuality Assurance Manualkingson007No ratings yet

- Audit Program: A. Reconciliation of Subsidiary Ledger With General LedgerDocument22 pagesAudit Program: A. Reconciliation of Subsidiary Ledger With General Ledgeraccounting probNo ratings yet

- X - Butyl Halobutyl For Tire Inner Liners: Product PropertiesDocument2 pagesX - Butyl Halobutyl For Tire Inner Liners: Product PropertiesDebal BaishyaNo ratings yet

- GMP SsopDocument98 pagesGMP SsopNicoel100% (21)

- TLE7-8 Learning EssentialsDocument27 pagesTLE7-8 Learning EssentialsJoan Vecilla100% (2)

- Classified Trade Leviable Fee (RS) New Trade CodeDocument9 pagesClassified Trade Leviable Fee (RS) New Trade CodeRajesh BoodhooNo ratings yet

- HACCP in The Animal Feed IndustryDocument9 pagesHACCP in The Animal Feed Industrymohd. thsnNo ratings yet

- HACCP AuditDocument1 pageHACCP Audithariprem26No ratings yet

- Cosumar ReportDocument31 pagesCosumar ReportHajar JehouNo ratings yet

- Executive Summary Abu Dhabi CateringDocument22 pagesExecutive Summary Abu Dhabi CateringGhadoor Mmsk50% (2)

- Latihan UtsDocument8 pagesLatihan UtsFadhli Aulia SNo ratings yet

- Solutions For Ketchup Production Lines - tcm11-41731Document16 pagesSolutions For Ketchup Production Lines - tcm11-41731Faheem AkramNo ratings yet

- A Report On Organisation Studyconducted at Cannanore CoDocument32 pagesA Report On Organisation Studyconducted at Cannanore ConklvigneshNo ratings yet

- TBA250E SpecificationDocument4 pagesTBA250E Specificationmashuri72100% (1)

- Lesson 1 The HK DepartmentDocument14 pagesLesson 1 The HK DepartmentReinaNo ratings yet

- Health and Safety Prepurchase Risk Assessment ChecklistDocument3 pagesHealth and Safety Prepurchase Risk Assessment ChecklistAdrian CadelNo ratings yet

- Subjectiveandobjectivefoodtech Contents1Document8 pagesSubjectiveandobjectivefoodtech Contents1TulasiNo ratings yet

- 90 Questions of Garments Washing & Dyeing.Document26 pages90 Questions of Garments Washing & Dyeing.Ferdous Khan RubelNo ratings yet