Professional Documents

Culture Documents

Maynard Company Income Statement Explained

Uploaded by

Zereen Gail NieveraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maynard Company Income Statement Explained

Uploaded by

Zereen Gail NieveraCopyright:

Available Formats

Prepared by: JONALYN OBEJAS

11192895

CASE 3-1

Maynard Company (B)

Diane Maynard was grateful for the balance sheets that her friend prepared [see Case2-1, Maynard

Company (A)]. In going over the numbers, she remarked Its sort of surprising that cash increased by

$31,677, but net income was only $19,635. Why was that?

Her friend replied A partial answer to that question is to look at an income statement for June.

I think I can find the data I need to prepare one for you

In addition to the data given in the (A) case, her friend found a record of cash receipts and

disbursements, which is summarized in Exhibit 1. She also learned that all accounts payable were to

vendors for purchase of merchandise inventory and that cost of sales was $39,345 in June.

Questions:

1. Prepare an income statement for June in proper format. Explain the derivation of each item on

this statement, including cost of sales.

2. Explain why the change in the cash balance was greater than the net income.

3. Explain why the following amounts are incorrect cost of sales amounts for June: (a) $14,715 and

(b) $36,030. Under what circumstances would these amounts be correct cost of sales amounts?

Exhibit 1:

Cash Receipts and Disbursements

Month of June

Cash Receipts Cash Disbursements

Cash Sales $ 44,420 Equipment purchased $ 23,400

Credit customers 21,798 Other Assets purchased 408

Diane Maynard 11,700 Payments on accounts payable 8,517

Bank Loan 20,865 Cash purchases of merchandise 14,715

Total receipts $ 98,783 Cash purchase of supplies 1,671

Dividends 11,700

Wages paid 5,660

Utilities paid 900

Miscellaneous payments 135

Total Disbursements $ 67,106

Reconciliation:

Cash Balance, June 1 $ 34,983

Receipts 98,783

Subtotal $ 133,766

Disbursements 67,106

Cash Balance, June 30 $ 66,660

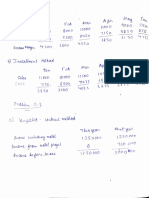

MAYNARD COMPANY

Income Statement

For the period June 30

Sales

$70,925

Less: Cost of Sales

39,345

Gross Margin

31,580

Expenses:

Wages 5,888

Utilities 900

Supplies 600

Insurance 324

Depreciation 2,574

Miscellaneous 135 10,421

Income before taxes

21,159

Income tax expense

1,524

Net Income

$19,635

Note 1- Sales

Cash Sales

44,420

Credit Sales

26,505

Gross Sales

70,925

Note 2 - Cost of sales

Beginning Inventory

29,835

Purchases (cash)

14,715

Purchases (credit)

21,315

Total

65,865

Less: Ending Inventory

(26,520)

Cost of Sales

39,345

Note 3 - Wages

Wages

5,660

Wages Payable, June 30

2,202

Wages Payable, June 1

(1,974)

5,888

Note 4 - Supplies

Supplies, June 1

5,559

Cash purchase

1,671

Supplies, June 30

(6,630)

600

Note 5 - Insurance

Insurance, June 1

3,150

Insurance, June 30

(2,826)

324

Note 6 - Depreciation

Equipment

624

Building

1,950

2,574

Income tax

Taxes payable, June 30

7,224

Taxes payable, June 1

(5,700)

1,524

2) There were cash transactions which increased cash but have no effect in the net income:

a. Cash collected for sales on credit amounting to $ 21,798

b. Bank loan amounting to $ 20,865

c. Note receivable (Diane Maynard) amounting to $11,700 offset by payment to Diane

Maynard amounting to $11,700 as dividend being the sole shareholder of the company

3) a. $14,715 is just the cash purchases of additional merchandise. Cash purchases will be equal to

cost of sales if only theres only cash purchases and in which the beginning and ending balance

of merchandise inventor are the same.

b. $36,030 is just the sum of cash and credit purchases. Purchases will be treated as cost of

sales only if the beginning and ending balance of merchandise inventory are the same.

You might also like

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Maynard Company Case 3-1 Solution Statement and Income StatementDocument1 pageMaynard Company Case 3-1 Solution Statement and Income Statementdump uwuNo ratings yet

- Assignment 3.2 LOne Pine Cafe (B) Rajesh RanjanDocument2 pagesAssignment 3.2 LOne Pine Cafe (B) Rajesh RanjanamitkrhpcicNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- COPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTDocument7 pagesCOPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTCHERRYL VALMORESNo ratings yet

- Amerbran Company A Final1Document6 pagesAmerbran Company A Final1Rio TanNo ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Harlan Foundation: Company BackgroundDocument4 pagesHarlan Foundation: Company BackgroundPrachiNo ratings yet

- Stern Corporation (B)Document3 pagesStern Corporation (B)Rahul SinghNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanySantosh GovindarajanNo ratings yet

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsSol S.No ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- CASE 8 - Norman Corporation (A) (Final)Document3 pagesCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNo ratings yet

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5-3Document2 pagesCase 5-3ragil1988No ratings yet

- Ben & Jerry's Financial PerformanceDocument9 pagesBen & Jerry's Financial Performancemark gally reboton0% (1)

- Lecture 11 Joan Holtz ADocument3 pagesLecture 11 Joan Holtz Avineetk_39100% (1)

- Lone Pine Cafe Balance SheetsDocument15 pagesLone Pine Cafe Balance SheetsCynthia Anggi Maulina100% (1)

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Chap004 SolutionsDocument7 pagesChap004 Solutionsdavegeek100% (1)

- Pinetree Case SolutionDocument1 pagePinetree Case Solutionvishakha123No ratings yet

- Caso 2 Excel 1Document8 pagesCaso 2 Excel 1Carolina NunezNo ratings yet

- Lewis Corporation case study: Analysis of inventory valuation methodsDocument7 pagesLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- Accounts Case StudyDocument9 pagesAccounts Case Studydhiraj agarwalNo ratings yet

- Case 2-1 - Cynthia Cooper and WorldComDocument4 pagesCase 2-1 - Cynthia Cooper and WorldComxstreetlightsNo ratings yet

- Lone Pine Cafe Balance Sheets Case StudyDocument13 pagesLone Pine Cafe Balance Sheets Case StudyCynthia Anggi Maulina100% (1)

- Case Study 4 - 3 Copies ExpressDocument8 pagesCase Study 4 - 3 Copies ExpressJZ0% (1)

- Balance Sheet and Transactions Analysis for Charles CompanyDocument14 pagesBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Revenue Recognition Case Study DiscussionDocument5 pagesRevenue Recognition Case Study DiscussionRahul KaulNo ratings yet

- Hardin Tool CompanyDocument42 pagesHardin Tool CompanyMayank KumarNo ratings yet

- CASE SUMMARY Waltham Oil and LubesDocument2 pagesCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNo ratings yet

- Delaney Motors Case SolutionDocument13 pagesDelaney Motors Case SolutionParambrahma Panda100% (2)

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsViren DeshpandeNo ratings yet

- Joan HoltzDocument10 pagesJoan HoltzKarlo PradoNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Chemalite financial analysisDocument12 pagesChemalite financial analysisAimane Beggar100% (1)

- Kim Fuller CaseDocument5 pagesKim Fuller CasehihiNo ratings yet

- Basic Concepts of Accounting (Balance Sheet)Document12 pagesBasic Concepts of Accounting (Balance Sheet)badtzmaru0506No ratings yet

- Chapter 6 Cost of Sales and Inventories GuideDocument62 pagesChapter 6 Cost of Sales and Inventories GuideRosedel Rosas100% (2)

- ABC QuestionsDocument14 pagesABC QuestionsLara Lewis Achilles0% (1)

- Emerald Financial CorporationDocument5 pagesEmerald Financial CorporationJanice PajutraoNo ratings yet

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Case 26-2Document3 pagesCase 26-2NishaNo ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Case Lewis CorporationDocument2 pagesCase Lewis CorporationSumit VakhariaNo ratings yet

- Marvin Co Financial StatementsDocument4 pagesMarvin Co Financial StatementsVaibhav KathjuNo ratings yet

- Problem 3-1Document2 pagesProblem 3-1Omar CirunayNo ratings yet

- Financial Statement Analysis: Amerbran Company (BDocument37 pagesFinancial Statement Analysis: Amerbran Company (BZati Ga'in100% (1)

- Case StudyDocument3 pagesCase StudyArslan AshfaqNo ratings yet

- Harlan Foundation Case SWOT AnalysisDocument9 pagesHarlan Foundation Case SWOT AnalysisNastiti KartikaNo ratings yet

- Stern Corporation Stafford PressDocument10 pagesStern Corporation Stafford Presssushie22No ratings yet

- Accounting-Lone Pine Cafe CaseDocument28 pagesAccounting-Lone Pine Cafe CaseMuadz Akbar100% (1)

- Maynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income StatementDocument2 pagesMaynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income Statementriya lakhotiaNo ratings yet

- Company CaseDocument2 pagesCompany CaseAuramax EnterprisesNo ratings yet

- Online Postgraduate Diploma in Management: Financial Accounting Case StudyDocument6 pagesOnline Postgraduate Diploma in Management: Financial Accounting Case StudyStephen dassNo ratings yet

- Letter SampleDocument2 pagesLetter SampleZereen Gail NieveraNo ratings yet

- Costco GuideDocument1 pageCostco GuideZereen Gail NieveraNo ratings yet

- Case AnalystDocument1 pageCase AnalystWendi Suharmoko0% (1)

- Mytic Monk Case QuestionsDocument1 pageMytic Monk Case QuestionsZereen Gail NieveraNo ratings yet

- How TecSmart's Practices Support Deming's 14 Points and the Baldrige CriteriaDocument7 pagesHow TecSmart's Practices Support Deming's 14 Points and the Baldrige CriteriaZereen Gail Nievera100% (1)

- Accel MotorsDocument2 pagesAccel MotorsZereen Gail NieveraNo ratings yet

- Case 21 - Diamond - ChemicalsDocument4 pagesCase 21 - Diamond - ChemicalsZereen Gail NieveraNo ratings yet

- Product ProposalDocument6 pagesProduct ProposalZereen Gail NieveraNo ratings yet

- Shelter PartnershipDocument3 pagesShelter PartnershipZereen Gail Nievera0% (1)

- Solution: RCGCDocument3 pagesSolution: RCGCZereen Gail NieveraNo ratings yet

- Ethics, Environment, and Equal Opportunity in the WorkplaceDocument2 pagesEthics, Environment, and Equal Opportunity in the WorkplaceZereen Gail NieveraNo ratings yet

- Session 1 ExerciseDocument2 pagesSession 1 ExerciseZereen Gail NieveraNo ratings yet

- Solution: RCGCDocument3 pagesSolution: RCGCZereen Gail NieveraNo ratings yet

- Ch16-2 Ave Mean - RangeDocument1 pageCh16-2 Ave Mean - RangeZereen Gail NieveraNo ratings yet

- Porter's 5 Forces Model Analysis FrameworkDocument2 pagesPorter's 5 Forces Model Analysis FrameworkZereen Gail NieveraNo ratings yet

- Proxim CaseDocument5 pagesProxim CaseZereen Gail NieveraNo ratings yet

- Clickworker Payment ConformationDocument1 pageClickworker Payment ConformationRekha RavaliNo ratings yet

- L-27, Set Off and Carry Forward of LossesDocument20 pagesL-27, Set Off and Carry Forward of LosseswhoreNo ratings yet

- Xbox LoginsDocument5 pagesXbox LoginssamnqumsiehNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerJc QuismundoNo ratings yet

- Business Taxation: History of Income Tax Law in PakistanDocument26 pagesBusiness Taxation: History of Income Tax Law in PakistanMUHAMMAD UMARNo ratings yet

- Mshs Request For Communication Expenses Jan To June 2021Document3 pagesMshs Request For Communication Expenses Jan To June 2021alexNo ratings yet

- Negotiable Instruments Types & PartiesDocument4 pagesNegotiable Instruments Types & PartiesPraveen KumarNo ratings yet

- CT Ant - Approved Quotation Repiping of WaterlineDocument1 pageCT Ant - Approved Quotation Repiping of Waterlinejohn philip OcapanNo ratings yet

- Chapter 16 - Efficient and Equitable Taxation: Public FinanceDocument36 pagesChapter 16 - Efficient and Equitable Taxation: Public FinanceDiego PalmiereNo ratings yet

- Jio Fiber InvoiceDocument1 pageJio Fiber InvoicePiyush Kumar PandeyNo ratings yet

- International payment instruments overviewDocument48 pagesInternational payment instruments overviewSimona StancioiuNo ratings yet

- Bar Exam Questions Income TaxationDocument11 pagesBar Exam Questions Income TaxationG.B. SevillaNo ratings yet

- 2306 Manila WaterDocument6 pages2306 Manila WaterRegina Raymundo AlbayNo ratings yet

- W-8BEN: Donald ChristophDocument1 pageW-8BEN: Donald ChristophpaulNo ratings yet

- Acct Statement - XX1794 - 20122023Document49 pagesAcct Statement - XX1794 - 20122023rakshit7985231877No ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- I 1040Document214 pagesI 1040Brian GohackiNo ratings yet

- NominationDocument2 pagesNominationvarun shahNo ratings yet

- Form 704Document704 pagesForm 704Dhananjay KulkarniNo ratings yet

- INVOICE 1112 NFL ENGINEERING HRDCORP SBL Khas TRAININGDocument3 pagesINVOICE 1112 NFL ENGINEERING HRDCORP SBL Khas TRAININGSITINo ratings yet

- Account Statement From 1 Oct 2019 To 18 Oct 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Oct 2019 To 18 Oct 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAjay NigamNo ratings yet

- Calculate ROI, EVA, Residual Income for Company DivisionsDocument3 pagesCalculate ROI, EVA, Residual Income for Company DivisionsDhiva Rianitha ManurungNo ratings yet

- Federal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationDocument2 pagesFederal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationMaddahayota CollegeNo ratings yet

- TAX PART 1 Compiled PDFDocument114 pagesTAX PART 1 Compiled PDFArCee SantiagoNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Maturity Date: The Maturity of A Bill of A Exchange or A Promissory Note Is The Date at Which ItDocument2 pagesMaturity Date: The Maturity of A Bill of A Exchange or A Promissory Note Is The Date at Which ItAkashNo ratings yet

- Challan of Cash Paid in To Challan NoDocument2 pagesChallan of Cash Paid in To Challan NoWnc WestridgeNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountslkuchinNo ratings yet

- RMC 78-2022Document3 pagesRMC 78-2022Ian PalmaNo ratings yet