Professional Documents

Culture Documents

TCS Case Wiz

Uploaded by

sexy_sam28Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCS Case Wiz

Uploaded by

sexy_sam28Copyright:

Available Formats

The Telco Dilemma: Transform or Re-Imagine?

-CaseStudy Competition

NaTTel is a leading Telecom Operator in the Nordics Region. They are headquartered in Finland,

but provide services to the entire Nordics Region, with a minimalistic presence in some other

parts of Europe notably Austria and Czechoslovakia. They are the market leaders in Finland

and Norway and in the number 2 or 3 positions in the other Nordic countries. NaTTel went

public in the year 2001. Since then NaTTel has been showcasing good results quarter - on -

quarter until 2012.

NaTTel provides Wireline, Wireless and TV services in the Nordics region servicing different

types of customers Retail, Small and medium Businesses (SMB) and Large Enterprises. NaTTel

has traditionally been known to be a customer focused Telco, providing the best pricing for its

customers. They are touted to be the pioneers of the communications industry in the Nordics

Region. They were the pioneers in setting high benchmarks for good customer service via the

call center. They were also one of the first Telcos to provide bundled services across wireline,

wireless and TV products. NaTTel had more than a hundred stores across the Nordics region in

2003 in addition to agents. They created their online website www.NaTTel.com in 2006 and

since then have made an effort to close down 10% of store in order to push up the utilisation of

their online website.

Of late the company is facing challenges to its leadership position in the Nordics Region. The

quarterly results have almost remained flat. The company saw a considerable decline in the

subscription to the traditional products like fixed line voice & data. Though there has been

significant increase in number of subscriptions for fixed line data, but the rate of growth lagged

industry growth by wide margins. Market share witnessed a considerable decline shaking

investors sentiments which consequently eroded equity by 10%. Its closest rival UniversalTel

has been increasingly dominating the market with its attractive product bundles, competitive

pricing & new products. In the last two quarters, almost 10% of NaTTels longtime customers

have moved to UniversalTel. New subscriptions to NaTTel have also shown a south-ward

movement which is not a healthy sign indicating the deterioration in the mind-share it has

amongst its prospective customers. Within a span of two years, UniversalTel rose to the second

position from its earlier 7

th

position two years back and is now challenging NaTTel, a leader for

more than a decade in the Nordics region. UniversalTel is a relatively young organization and

employs cutting-edge digital technologies, and fast moving business/operating models and

accelerated go-to-market strategy in action.

The Telecom Industry globally, as also in Nordics, is in a flux with new players entering into the

market, changing preferences of the customers, emergence of newer technologies and

regulatory changes. And this is having an impact on NaTTel. Over the last couple of years there

has been an increase in the number of Over the Top Players (OTT). These OTT Players seem to

be targeting services, especially messaging, which have traditionally been provided by telcos

like NaTTel. Consumers seem to be quickly adopting these new services provided by the OTT

Players. Revenues from SMS and other value added services have hence seen a considerable

decline across the industry. Fixed line business, which has been the cash cow for several

decades suddenly, seems to be declining.

NaTTel is rattled with the changes in the industry and very concerned about their flat growth in

revenues. , John Eiser, CEO of NaTTel is very worried about the customer churn especially in the

long timers Category. John is worried that their current strategy does not seem to be

stemming the outflow of customers.

NaTTel has a five-point high level strategy which they are currently working towards:

Customer First Customer Centric Approach across the business in everything we do

Online First Focus on promoting www.NaTTel.com. Encourage customers to use the

online website first before calling the call center.

Outsourcing First Reduce cost by aggressively increasing outsourcing of IT Operations

and Delivery

First in the market Improve Time to Market by productivity improvements, process

simplification, reduce product creation cycles, focused marketing

Strengthening leadership position - Expanding the products & services in the fixed line

business segment to offer best in class offers to the customers and strengthen the

leadership position

With tons of unanswered questions in mind and baffled by the shakeup in industry dynamics,

leading to higher churn rate and negative customer sentiments, John Eiser, CEO of NaTTel has

called for an executive meeting with the senior leadership team consisting of COO, CIO, CTO &

CFO to get to the root of the matter and devise a strategy in order to maintain the leadership

position in the market.

Tom Selbek, CMO & COO of NaTTel makes his presentation where he focuses on the mounting

pressure from the operations side which is eroding the annual revenue of the company and

deteriorating customer experience. He puts forth some of the pain points from the operations

department which includes:

1. Rise in customer complaints which are mostly repeat problems or follow up to the

existing problems.

2. Utilisation of the online website is 30- 35 %

3. Fall of Net Promoter Score (NPS). NPS reduced to 8 out of 21 markets from 11 out of 21

markets the previous year

In his opinion, huge capital expense which was made few years back for scaling up fixed line

infrastructure capability has shown a much lower than expected rate of return hitting the

margins. Operational expenses have significantly increased which is mainly contributed by call

center costs and new customer acquisition costs. Increased number of customer complaints

and failure to resolve them in the first time has also significantly eroded customer experiences.

He suggests that NaTTel should completely revamp their operations and Business Processes in

order to enhance customer experience. He proposes that another area of focus would have to

be to improve their online utilization from 35% to 70%. He also laments a lack of consistency

across different customer channels leading to a lot of confusion in the customer mind and

increasing the cost of doing the business.

John Eiser likes the idea of improving utilization on their online website, but is not convinced

that Tom has a holistic solution. In his view, Tom is predominantly focusing on revamping the

existing channel strategy but, is missing the point on enhancing the channels holistically which

can entice digital customers more and can keep them engaged. Online portal in his mind can

only reach a subset of customers and other channels will continue to remain valid at least in the

short to medium term. Secondly, he felt that channels cannot be a complete solution but only a

part of the solution.

Tejwinder Singh, the only Indian on the companys board & CIO of NaTTel made his

presentation to the CEO. He suggests that the existing legacy systems do not offer the flexibility

in building product bundles and also inhibit faster go-to market strategy. A significant amount

of capital expenses and operational expenses would be required to consolidate the existing

legacy systems and build on the next generation digital capabilities. He suggests that they build

a completely new greenfield IT stack while also investing on disruptive technologies like Big

data, Analytics, Artificial Intelligence, Cloud services and mobility were essential in order to

develop next generation digital capabilities like an analytics platform or a data aggregation

platform. This would in turn not only aid in improving customer retention, but would also

provide a way to attract new customers with attractive products and offers. Creating real-time

personalized offers and mass customization is what CTO organization is aiming to build. For

example, Ms. Penny, who is a voracious reader, gets an offer to download latest eBook of

DanBrown at 40% discount upon using NaTTels Wi-Fi services at railway station to read book

review on Da-Vinci Code.

John agrees partly with Sam, but feels that NaTTel is not in a position to make as much

investment at this point of time, especially when they have spent considerable amount of time

and money over the last 2 years to integrate new products and Value added services on their

existing legacy stack. High debt-equity ratio on companys balance sheet and a poor gearing

ratio have brought down its credit rating inhibiting company to raise more funds. John was in

dilemma to invest in building digital capabilities as he feared the financial health of the

company would deteriorate further if the returns are not as expected.

Last but not the least, It was time for Bradley Jenks, CFO of NaTTel , who was worried about the

mounting pressures from both operations and technology areas due to increasing CAPEX &

OPEX costs, dwindling topline and lower margins hitting the bottom-line of NaTTel. Following

were the key points presented by him in the meeting.

a. Organic revenue growth dwindled by 1.9% compared to previous year

b. EBIDTA Margin reduced to 29.1 % from 34% in the previous year

c. Free cash flow reduced to $5.6 bn from $6.1 bn in the previous year

d. Returns to shareholders almost remained flat

e. ROCE also declined by 2% affecting shareholders' sentiments

f. Capital Expense is around $2.5 bn which is 8% more compared to previous year

g. The group revenue increased to $17 bn which is only 1.8% Y-o-Y increase

The scenario in the board room was gloomy and John Eiser, the CEO looked unimpressed with

the facts and numbers on the table. John Eiser decides to hire a renowned global consulting

firm Orton Consulting for advice and consultation and to help NaTTel create a new strategy for

this Digital Age.

You are the consultant hired to advise John Eiser and his team at NaTTel in this situation. You

are the head of strategy at Orton Consulting. You are resident Telecom expert and have vast

experience with helping Telcos draft their strategy as well as in the creation of the roadmap to

implementation. You have a group of consultants, business analysts and engineers, who help

you with research and perspectives. You have one month to speak to senior executives at

NaTTel and come up with suggestions for NaTTel. Do you agree with Tom Selbek, Chris Spillberg

or Bradley Jenks? Or Do you have a completely different point of View? What should NaTTel do

to retain its leadership position? How should they plan for the future?

You need to come up with a recommendation to be presented to John Eiser and his team at

NaTTel. You can structure your presentation to create maximum impact with the NaTTel team.

Please note that your presentation should cover the following key areas

1. What are the market needs?

a. A thorough analysis of Nordic telecom market - trends, products, key players,

market positioning, customer preferences , telcos undergoing transformation

journey, Major investment areas etc..

b. Competition Analysis

c. What are other Telcos (for e.g. UniversalTel) doing different?

2. NaTTels Strategy for the Future (2, 5 and 10 year plan)

3. Business Case for this strategy along with the high level roadmap

4. Create a visual representation of the Future End State of a Telco to strengthen your

business case.

This can be done with a user story showcasing how a retail customer and an enterprise

Customer will enjoy the products & services of NaTTel in future digital era. This can be

done by using power-point, or any available video tools.

While devising the strategy make use of a multi-dimensional strategic decision making table

charting out various strategy themes using excel/macros enclosing all the

suggestions/recommendations substantiated with analytical/logical reasoning. The framework

should be a working model which can be used to make recommendations to any Nordic based

Telco and the model can be re-used for presentation to any other geography. Refer to the

appendix section for facts on the market share, subscription & revenue break-up.

Note: Use credible sources of data only for any number crunching. Make a note of assumptions & pre

conditions before starting the analysis. Analysis can be submitted either in the form of a word document

or a power point presentation. Include all references. The guidelines mentioned above can be used as

reference but do not strictly restrict to the guidelines. Participants can explore beyond the mentioned

guidelines if they find anything relevant. Make assumptions around financial estimations. The focus is

more on the thought process than the accuracy of numbers.

Appendix

Total Revenue

(NaTTel)

Q42013

(In 000 $ million)

% Contribution

Mobile Services 90.5

24.88%

PayTV Services 19.7

5.42%

Broadband Services 56.3

15.48%

Fixed Network Services 197.3

54.23%

Total 363.8

Total Revenue

(UniversalTel)

Q42013

(In 000 $ million)

% Contribution

Mobile Services 40.5

24.50%

PayTV Services 19.7

11.92%

Broadband Services (Fixed Line) 26.3

15.91%

Broadband Services (Mobile) 40.5

24.50%

OTT Services ehealth, GrpChat,

mobile TV, etc.

13.5

8.17%

Connected Device Management 7.5

4.54%

Fixed Network Services 17.3

10.47%

Total 165.3

Subscription Base

(NaTTel)

x 1000 (as on Q4 2013)

Fixed Line Services 2351

PayTV Services 220

Broadband Services 448

Fixed Network Services Extends More Than 2000kms in Finland & connects 800

commercial buildings

(N.B. The values mentioned in the tables above are approximate values only.)

Subscription Base

(UniversalTel)

x 1000 (as on Q4 2013)

Fixed Line Services 2351

PayTV Services 220

Broadband Services 448

Broadband Services (Mobile) 800

OTT Services ehealth, GrpChat,

mobile TV, etc.

1500

Connected Device Management Around 200 SMB & SOHO clients

Fixed Network Services Extends around 800kms in Finland & connects 300

commercial buildings

(N.B. The values mentioned in the tables above are approximate values only.)

Market Share in Finland

Market Share in Austria

33.40%

27.70%

25.90%

Market Share

NatTel

UniversalTel

Others

25.40%

27.70%

25.90%

Market Share

NatTel

AusTel

Others

Market Share in Czech Republic

(N.B. The values mentioned in the graphs above are approximate values only.)

Deliverables for Round 1

1. Blueprint of the solution to the case study in the template provided on Campus

Commune.

2. Format- PPT/ PDF

3. Font Type-Times New Roman/ Arial/Myriad Pro/Calibri; Font Size-12/14.

4. Template can be downloaded from below link

Nextstep > Campus Commune -> Click on Casewiz Banner -> Related Communities (at

right side) -> TCS Casewiz Telecom Unit

Deliverables for Round 2

1. Solution to the case study in the template which will be shared with those qualifying for

the Round2.

2. Format-Word/PDF

3. Font Type-Times New Roman/ Arial/Myriad Pro/Calibri; Font Size-12/14

Deliverables for the Grand Finale

1. Solution to the case study in the template which will be shared with those qualifying for

the Round3.

2. Format- PPT/PDF

3. Font Type-Times New Roman/ Arial/Myriad Pro/Calibri; Font Size-12/14.

18.40%

37.70%

25.90%

Market Share

NatTel

CezTel

Others

You might also like

- Student Committee FormDocument1 pageStudent Committee Formsexy_sam28No ratings yet

- CB - TXT (20-12-2014 12:00:09 PM)Document2 pagesCB - TXT (20-12-2014 12:00:09 PM)sexy_sam28No ratings yet

- E8549 Nb-Warranty-Card 148x105mm Final 0827Document10 pagesE8549 Nb-Warranty-Card 148x105mm Final 0827gabrielvadNo ratings yet

- Important Announcement Pgp-2014 Application StatusDocument1 pageImportant Announcement Pgp-2014 Application Statussexy_sam28No ratings yet

- Ephorus Module 1.9 Moodle For Users enDocument9 pagesEphorus Module 1.9 Moodle For Users ensexy_sam28No ratings yet

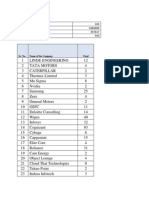

- Highest SALARY Average Salary No of Students PlacedDocument4 pagesHighest SALARY Average Salary No of Students PlacedDeep PatelNo ratings yet

- Why CommunicateDocument2 pagesWhy CommunicateAnisha JhawarNo ratings yet

- Section - I Qa & Di: SolutionDocument6 pagesSection - I Qa & Di: SolutionSonakshi BehlNo ratings yet

- Factsheet March 2013 Real World Protection TestDocument4 pagesFactsheet March 2013 Real World Protection Testsexy_sam28No ratings yet

- Day 2 Basic Tools PG 75-127Document37 pagesDay 2 Basic Tools PG 75-127sexy_sam28No ratings yet

- CL - Quantitative Methods (Module 1) - Prof. Mahima GuptaDocument7 pagesCL - Quantitative Methods (Module 1) - Prof. Mahima Guptasexy_sam28No ratings yet

- Consumer Telematics ResearchDocument17 pagesConsumer Telematics Researchsexy_sam28No ratings yet

- Article 4Document6 pagesArticle 4burcucukNo ratings yet

- Student Committee FormDocument1 pageStudent Committee Formsexy_sam28No ratings yet

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Role of The Smartphone in Parent-Child Collaboration and Its Impact On Building Media Literacy SkillsDocument125 pagesThe Role of The Smartphone in Parent-Child Collaboration and Its Impact On Building Media Literacy SkillsSalome ApkhazishviliNo ratings yet

- Steam Trap Sizing CalculationsDocument4 pagesSteam Trap Sizing CalculationsbecpavanNo ratings yet

- Artificial Intelligence For BusinessDocument103 pagesArtificial Intelligence For Businesssachjithm1No ratings yet

- Barriers in Adoption of AM in Medical Sector Supply ChainDocument24 pagesBarriers in Adoption of AM in Medical Sector Supply ChainAnonymous 5AmJ13mLkNo ratings yet

- Reference List - DemagDocument5 pagesReference List - DemagHarun Al-RasyidNo ratings yet

- Job Description Job Description: Acheron TechnologiesDocument1 pageJob Description Job Description: Acheron Technologiess_subbulakshmiNo ratings yet

- Service Manual: Surround CinemaDocument26 pagesService Manual: Surround CinemamyotezaNo ratings yet

- Ethiopian Telecom Mobile Card Distribution SystemDocument15 pagesEthiopian Telecom Mobile Card Distribution SystemMokonnin Alemu100% (2)

- "Direct / Residual Shear Test Apparatus, Digital "Touch Screen"Document45 pages"Direct / Residual Shear Test Apparatus, Digital "Touch Screen"quequma7202No ratings yet

- S4f08.23.en-Us 172Document1 pageS4f08.23.en-Us 172shreekirankumarfico88No ratings yet

- EEZY E-Catalogue Merged Compressed (1) CompressedDocument79 pagesEEZY E-Catalogue Merged Compressed (1) CompressedHASEEBNo ratings yet

- 2019 07 Cobas 8100 Overview UpdatedDocument14 pages2019 07 Cobas 8100 Overview UpdatedNguyễn Thị Kim TrọngNo ratings yet

- Kemp Model Lesson Plan Template-ExampleDocument1 pageKemp Model Lesson Plan Template-Exampleapi-489428298100% (2)

- Smart MaterialDocument12 pagesSmart MaterialPower RiderNo ratings yet

- Agile Documentation WordDocument9 pagesAgile Documentation Wordvikashraj06072000No ratings yet

- ISA-RP60.2-1995: Control Center Design Guide and TerminologyDocument24 pagesISA-RP60.2-1995: Control Center Design Guide and TerminologySergio LungrinNo ratings yet

- Website: Vce To PDF Converter: Facebook: Twitter:: 300-535.vceplus - Premium.Exam.60QDocument35 pagesWebsite: Vce To PDF Converter: Facebook: Twitter:: 300-535.vceplus - Premium.Exam.60QAla JebnounNo ratings yet

- Frame and SFRC Cover Design for 560mm Diameter ManholeDocument1 pageFrame and SFRC Cover Design for 560mm Diameter ManholejaipalNo ratings yet

- Netiquette 2 PDFDocument11 pagesNetiquette 2 PDFErickson BarrientosNo ratings yet

- CBAP HandbookDocument19 pagesCBAP HandbookarunkumarsNo ratings yet

- Fx5u Pid Control Function PDFDocument38 pagesFx5u Pid Control Function PDFNutchaiSaengsurathamNo ratings yet

- Series BootsDocument2 pagesSeries Bootsvictor laraNo ratings yet

- Innovative Project - All FormsDocument16 pagesInnovative Project - All FormsEhlee Eton TubalinalNo ratings yet

- Install MiNi01-4G Cellular CommunicatorDocument2 pagesInstall MiNi01-4G Cellular CommunicatorRoberto Silva PerronNo ratings yet

- Engine - Entire Group (7Rn01326)Document3 pagesEngine - Entire Group (7Rn01326)Dhrubajyoti BoraNo ratings yet

- Syllabus Advanced Data Models and DatabasesDocument9 pagesSyllabus Advanced Data Models and Databases체인지No ratings yet

- Cep CRM QuestionsDocument11 pagesCep CRM QuestionsFedelia ChejiehNo ratings yet

- Olympain-R450 & R448 Avr Manuall PDFDocument7 pagesOlympain-R450 & R448 Avr Manuall PDFSayed Younis SadaatNo ratings yet

- Ufc 3 310 04-Seismic Design For BuildingDocument245 pagesUfc 3 310 04-Seismic Design For BuildingDe Silva Shmapk0% (1)

- Catalogo Asientos - SMHDocument12 pagesCatalogo Asientos - SMHJohn PavalNo ratings yet