Professional Documents

Culture Documents

Economics Notes (Chapter 1, 20-25)

Uploaded by

ST24Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economics Notes (Chapter 1, 20-25)

Uploaded by

ST24Copyright:

Available Formats

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Chapter: 1 Purpose: Readings Date: Tues. January 8

th

, 2013

WHAT IS ECONOMICS?

Definition of Economics

Scarcity: inability to get everything we want (therefore we must make choices)

- What society can get is limited by productive resources available from nature, human labour and tools/equipment

- My choices must be consistent with choices of others (e.g. if I want to buy an iPad, someone must sell it)

incentives reconcile choices

Incentive: reward that encourages an action or penalty that discourages one (e.g. ssPrice)

Economics: social science that studies choices that individuals, businesses, governments, and entire societies make as

they cope with scarcity and the incentives that influence and reconcile those choi ces

Microeconomics: study of choices that individuals and businesses make, the way these choices interact in markets,

and the influence of governments.

Macroeconomics: study of performance of national economy and global economy.

Two Big Economic Questions

1. How do choices end up determining WHAT, HOW, and FOR WHOM goods and services are produced?

2. Can the choices that people make in pursuit of their own self-interest also promote broader social interest?

What, How, and For Whom?

- Goods and Services: objects that people value and produce to satisfy human wants.

Goods physical objects (e.g. cellphones or cars) Services tasks performed for people (auto-repair)

WHAT What we produce varies across countries and changes over periods of time.

- So what determines patterns of production? How do we make choices on QTY? etc.

HOW Factors of Production: what goods and services are produced of

Land Natural resource (so is minerals, oil, gas, coal, water, air, fish, etc.)

- Land and water = renewable

- Energy resources = non-renewable

Labour Time and effort people devote to producing goods and services

- Includes both physical and mental efforts put into work

- Quality of labour depends on human capital

Human Capital: knowledge and skill that people obtain from education,

training, and work experience

Capital Physical Capital: Tools, instruments, machines, buildings, and etc. used to

produce goods and services

- Financial capital: money, stocks, bonds; used to borrow funds in order

to buy physical capital

Entrepreneurship Human resource that organizes labour, land, and capital

FOR WHOM Dependent on the incomes that people earn

- Land earns rent, labour earns wages, capital earns interest, entrepreneurship earns profit

- The disparity of incomes between rich and poor is insanely large

Example: women and minorities earn less than white males; but why?

Can the Pursuit of Self-Interest Promote the Social Interest?

Self-Interest If you think choice is best one available for you

e.g. Im hungry so I order pizza (Im doing it for my benefit) but the delivery guy does it for an income

and is just hoping for a good tip (not for my benefit)

Social Interest If it leads to an outcome that is best for society as a whole

Efficiency Achieved when available resources are used to produce goods and services at

lowest possible cost and quantity that gives greatest possible value/benefit

Equity Fairness.

The Big Question : can choices made in pursuit of self-interest promote social-interest too?

- e.g. Can trading in free markets or international cooperation achieve social interest?

Globalization Expansion of international trade, borrowing and lending, and investment

e.g. people working in third world countries for Nike to make shoes

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- Self: I get lower cost shoes, how about for workers?; Is it of Social-interest?

The information-age

economy

Information revolution

e.g. Windows, Apple, and Intel executives benefited a lot but so have I (internet, cellphones,

laptops, etc.) but would social interest been better served if these firms had more

competition?

Climate change Huge political issue

e.g. when I make decision to use electricity and gasoline, I contribute to carbon emissions.

Not everyone will make decisions to contribute to the social interest (welfare) of reducing

Earths carbon-dioxide accumulation

Economic instability Great Moderation

e.g. banks were borrowing and lending way too much that they had to get bailouts loans from

governments and central banks. Similarly, GM received govt bailouts but did it serve social

interest?

The Economic Way of Thinking

A Choice is a Tradeoff Tradeoff: an exchange giving up one thing to get something else

- This is because we are given alternatives and we cant choose both

Making a Rational Choice Rational Choice: one that compares costs and benefits and achieves the greatest

benefit over cost for person making choice

- Provides answer to What goods and services will be produced and in what

quantities? well, obviously its those that people rationally choose to buy!

Benefit: What you gain Benefits: gain or pleasure that it brings and determined by Preferences: what a

person likes and dislikes and intensity of those feelings

- Economist will measure benefit as the most that a person is willing to give up

to get something else

Cost: What you must give up Opportunity cost: highest-valued alternative that must be given up to get it

- Most situations dont involve all or nothing costs

How Much? Choosing at the

Margin

Marginal Benefit: benefit that arises from an increase in an activity

Marginal Cost: opportunity cost of an increase in an activity

- If MB > MC, it is good and you would choose that

Choices Respond to

Incentives

Everyone will pursue their self-interest (not necessarily selfish actions)

e.g. macro teacher gives us problem set to solve and tells us it will be on the test; I

will want to solve these questions to prepare for test; lots of MB!

e.g. math teacher gives us problem set to solve but it wont be on test. I will not want

to solve it because it offers little marginal benefit

Economics as Social Science and Policy Tool

Positive Statements Normative Statements

What is What is ought to be

Many questions arise. (e.g. are computers cheaper because people are buying them in greater quantities? Or are people

buying computers in greater quantities because they are getting cheaper? In order to test this, we use economic models!

Economic Model: description of some aspect of the economic world that includes only those features that are needed for

the purpose at hand

Chapter: 2 Purpose: Readings Date:

Chapter: 3 Purpose: Readings Date:

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Chapter: 20 Purpose: Readings Date: January 9

th

, 2013

MEASURING GDP AND ECONOMIC GROWTH

Gross Domestic Product : market value of final G/S produced within a country in a given time period (4)

Market Value - Total production is calculated by valuing items at their market values (price at which

items are traded in markets)

Final Goods and

Services

- GDP is calculated by valuing final G/S produced

Final G/S: item that is bought by its final (end) user during specified time period

Intermediate G/S: item that is produced by one firm, bought by another firm, and used as

a component of final G/S

- Adding value of intermediate G/S produced to value of final G/S would be double

counting (adding it more than once)

- Some items are neither final goods nor intermediate goods and are not part of GDP

(e.g. financial assets, stocks/bonds)

Secondhand good: part of GDP in year in which it was produced, but not in GDP this year

Produced Within a

Country

- Only G/S produced within a country count as part of the countrys GDP

In a Given Time Period - GDP measures value of production in a given time period (e.g. Quarterly GDP data:

quarter of a year. Annual GDP data: yearly)

- GDP also measures total income and total expenditure

- Standard of living rises when our incomes rise

- Rising incomes and rising value of production go together (increasing productivity)

GDP and the Circular Flow of expenditure and income

Households and Firms - Households make Consumption Expenditures: total payment for G/S

- Firms buy services of labour, capital, and land in factor markets

- Firms pay income to households, wages for labour services, interest for use of

capital, and rent for use of land; entrepreneurship receives profit

Retained earnings: profits that are not distributed to households

Aggregate income: received by households, including retained earnings

- Firms make investments

Investment: purchase of new plant, equipment, and buildings and the additions to

inventories

Governments - Govts buy G/S from firms

Govt Expenditure: their expenditure on G/S

- Govt finance expenditure with taxes.

- Financial transfers (e.g. taxes are not part of circular flow of expenditure and

income

- Pays subsidies to firms, unemployment benefits, social security benefits

Rest of the World Exports: G/S sold to the rest of the world

Imports: G/S bought from the rest of the world

- Rest of the world buys net exports (value of X-M); net flow is dependent on the (-)

or (+) of that value

GDP Equals Expenditure

Equals Income

- GDP measured by;

1

total expenditure on G/S or by

2

total income earned producing G/S

Aggregate Expenditure (total expenditure): equals consumption expenditure

plus investment plus govt expenditure plus net exports

(Y = C + I + G + X M)

- Aggregate income = total amount paid for services of factors of production used to

produce final G/S (wages, interest, rent, profit)

[GDP = Aggregate expenditure = Aggregate income]

Why is Domestic Product Gross?

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Depreciation: decrease in value of firms capital that result from wear and tear and obsolescence.

Gross investment: total amount spent both buying new capital and replacing depreciated capital

Net investment: amount by which value of capital increases

[Net investment = Gross investment Depreciation]

Gross investment: one of the expenditures included in expenditure approach to measuring GDP

Gross profit: firms profit before subtracting depreciation, included in income approach

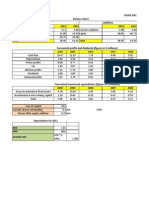

Measuring Canadas GDP

Expenditure Approach Income Approach

- Measures GDP as the sum of:

Consumption

expenditure (C)

Expenditure by Canadian

households on G/S produced in

Canada and in rest of the world

- Includes consumer

durable goods

(computers/ovens) but not

purchases of new homes

Investment (I) Expenditure on capital equipment

and buildings by firms and

additions to business inventories

- Includes purchases of

new homes by

households

Govt expenditure

on G/S (G)

Expenditure by all levels of govt

on G/S

- Includes national defence

and garbage collection but

not transfer payments

(unemployment benefits)

[overlap]

Net exports of

goods and

services (X-M)

Value of exports minutes value of

imports

- Includes DVD players

made in China but sold

here

- Measures sum of incomes that firms pay

households for factors of production hired

Wages, salaries,

supplementary

labour income

Payment for labour services

- Includes gross wages plus

benefits (pension

contributions)

Other Factor

incomes

A mixture of interest, rent, and

profit, and some labour income from

self-employment

- Corporate profits, farmers

income. etc.

Indirect Tax: tax paid by consumers when G/S are

bought; makes market price exceed factor cost

Direct Tax: tax on income

Subsidy: payment by govt to a producer. Makes factor

cost exceed market price

Net domestic income at market prices: make factor cost to

market price by adding indirect taxes and subtract

subsidies

- Total expenditure is a gross number because it

includes gross investment

- Net domestic income at MP is a net income

measure bc corporate profits are measured after

deducting depreciation

- - to get from net income to gross income, we add

depreciation

Statistical Discrepancy: gap between expenditure

approach and income approach (small #)

(GDP expenditure total GDP income total)

Nominal GDP Real GDP

Value of final G/S produced in a given year when valued

at prices of that year.

- More precise name for GDP

Value of final G/S produced in a given year when valued

at prices of a reference base year

- Reveals change in production

Calculating Real GDP:

USES AND LIMITATIONS OF REAL GDP

Economists use estimates of real GDP for two main purposes:

Compare standard of

living over time

The Standard of Living Over Time

Real GDP per Person: real GDP divided by population; tells us value of G/S avrg

person can enjoy. By using Real GDP, we avoid influence of rising prices and rising

cost of living

Long-Term

Trend

- Good because it expresses it as a ratio of some reference year

Growth of potential GDP: maximum level of real GDP that can be

produced while avoiding shortages of L

and

,C

apital

,L

abour

,E

ntreprenural ability

that

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Graph p.

474

would bring rising inflation

- It does not grow at a constant pace

Fluctuations of Real GDP: sometimes real GDP per person will shrink

Productivity

Growth

Slowdown

Graph p.

475

Lucas wedge (Nobel Laureate Robert E. Lucas Jr): dollar value of

accumulated gap b/w what real GDP per person would have been if growth

rate of 1960s had persisted and what real GDP per person turned out to be

Real GDP

Fluctuations

Business

Cycle

Graph

p.475

- B.C. is not as predictable as the moon but it has two phases

1. Expansion: period during which real GDP increases

(Early stage: real GDP =potential GDP

Later stage: real exceeds potential)

2. Recession: real GDP decreases (growth rate is negative for at least

2 successive quarters)

Turn points:

1. Peak: highest level that real GDP has attained up to that point

2. Trough: real GDP reaches temporary low point and next expansion

begins

Compare standard of

living across

countries

1. Real GDP of one country must be converted into same currency units as real GDP of

other country

2. G/S in both countries must be valued at same prices

Example of China compared to U.S

China and

the US in

U.S. $

2010

Real GDP per person in US = $43,800

China = 23,400 yuan = US$2,850

- Market exchange rate was 8.2 per US$1

- Real GDP/person in US was 15 times that in China

China and

the United

States at

PPP

- Estimation of Chinas real GDP/person by assessing Chinas

production on same terms as U.S. production

- Purchasing Power Parity (PPP): same prices for both countries

2010

Chicago Big Mac = $3.75

Shanghai Big Mac = 13.25 yuan = US$1.62

- In terms of Chinas real GDP, a Big Mac gets less than half the weight

that it gets in U.S. real GDP

- U.S was 6.5 times that of China (not 15)

Limitations of Real GDP (7)

- These are not part of GDP but influence standard of living

Household Production Production that takes place at home (e.g. preparing meals, cleaning, changing light

bulb, cutting grass, etc.)

- GDP understates total production and overestimates growth rate of total production

- Growth rate of market production (in GDP) is a replacement for home production

- Increase in GDP arises from decrease in home production

- Real GDP grows more rapidly than does REAL GDP + home production

Underground economy

activity

Part of the economy that is purposely hidden from the view of the govt to avoid taxes

and regulations or bc G/S being produced are illegal

- Omitted from GDP because it is unprotected

(e.g. illegal drugs, labour less than minimum wage, jobs done for cash)

(e.g. tips earned by cab drivers, hairdressers, hotel/restaurant workers)

- Estimate of Canadas underground accounts for 5-15% of GDP

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- Production shifts from underground to rest of the economy (or vice versa)

-

Health and life

expectancy

- Life expectancy has lengthened since WWII

- When taking negative influences (e.g. drug abuse), real GDP growth overstates

improvements in standard of living

Leisure time - Economic good that adds to our economic well-being and standard of living

- More we have of leisure time, obviously, the better we are!

- Leisure time must be at least as valuable as wage workedotherwise, we would all

work!

- Improvements in economic well-being are not reflect in real GDP

Security - We value security thats in jobs, local police services, and national defence

Environmental quality - Although resources used to protect environment is valued part of GDP, pollution of

atmosphere, deteriorating air we breathe is not counted as a (-) part of GDP

- Economic activity influences quality of environment

Political freedom and

social justice

- Value political freedoms provided by Canadian Constitution, social justice (equality),

and social security safety nets (protection from misfortunes)

- A country might have very large real GDP/person but limited political freedom and

social justice!

The Bottom Line we get the wrong message about level and growth in economic well-being and standard of living by

only looking at level and growth of real GDP

- A broader indicator of economic well-being can be expressed by the United Nations measure of Human

Development Index (HDI)

- Despite all alternatives, real GDP/person remains most widely used indicator of economic well -being and

standard of living

Real GDP Forecasts in the Uncertain Economy of 2011

ARE WE READY FOR THAT DOUBLE DIP?

2008 United States went into a recession

9 months later (Fall of 2008), Canada followed suit

Within less than 10 months, Canada recovered and was on the way to growth/expansion

It took the US 18 months to get back into stable conditions

Mid-2011, Canadian economy was performing well but risk of a double-dip recession in us hung over Canada and the

world

- Drop of 5% in US demand could translate into 1% hit to real growth here; Canada is dependent on the US like

many countries are! (1/5 of Canadas production is sold in the US)

Chapter: 21 Purpose: Readings Date: January 21

st

, 2013

MONITORING JOBS AND INFLATION

Employment and Unemployment

- During the Great Depression, 1/5 was unemployed!

Why Unemployment is a Problem? (2)

Lost Incomes and

Production

- Unemployment benefits create a safety net but dont full replace lost earnings!

Lost Human Capital - Damages persons job prospects by destroying their ability to move forth with their

learning (e.g. new MBA graduates are better off than a manager who has been

unemployed for the last 6 months! Manager lost valuable knowledge)

Labour Force Survey

- Asks about age and job market status of members of each household

- Divides individuals intoworking-age and too young/institutionalized (unable to work)

Working Age population: total number of people 15+

(1) Labour Force: sum of employed and unemployed (2) Non-Labour Force

(a) part-time or (b) full time

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

(i) voluntary part-time or (ii) involuntary part-time[want full-time]

- To be counted as unemployed, an individual must be 1/3:

(1) without work but has made specific efforts to find a job within previous four weeks

(2) laid off from a job and waiting to be called back to work

(3) waiting to start a new job within four weeks

Labour Market Indicators (4)

The Unemployment Rate % of people in labour force who are unemployed

Unemployment Rate =

Labour Force = # of people employed + # of people unemployed

The Involuntary Part-Time Rate % of people in labour force who are part-time workers but want full-time

work

Involuntary Part-time Rate =

Labour Force Participation Rate % of working-age popn who are members of labour force

Labour Force Participation Rate =

The Employment-to-Population Ratio % of people working age who have jobs

Employt to Popn =

- fluctuates with business cycle; falls in recession and rises in expansion

Other Definitions of Unemployment

- Unemployment doesnt count underutilized labour of people with PT who wants FT jobs

Marginally Attached Worker: person who currently is neither working nor looking for work but indicated he/she

wants a job and is available and has looked for work sometime in the recent past

- May become a Discouraged Worker: marginally attached worker who has stopped looking for a job bc of

repeated failure to find one

- Measure of unemployment does not count MAWs because they havent made efforts to find a job within the last

FOUR weeks.

Most Costly Unemployment

Is LONG TERM unemployment (lasting longer than 14 weeks)

- Short term (lasts for 1-13 weeks)

Unemployment and Full Employment (4)

Frictional

Unemployment

from people entering and leaving the labour force and ongoing creation/destruction of jobs; its

healthy and normal in a growing economy

- There are new businesses every day and they need time to look for employees whereas

others are going out of business

Structural

Unemployment

arise when changes in technology or international competition change skills needed to perform

jobs or change locations of jobs

- Lasts longer than frictional bc workers must retrain and relocate; painful!

Cyclical

Unemployment

higher than normal unempt at business cycle trough and lower than normal unempt at business

cycle peak

- e.g. worker getting laid off in recession but rehired during expansion stage

Natural

Unemployment

arise from frictions and structural change when there is no cyclical unemployment

N.U. Rate: % of labour force in natural unemployment

Age distribution of

population

Young popn lots of new job seekers, high frictional unempt

Aging pop fewer job seekers, low frictional unempt

Scale of structural

change

Technological upheaval lots of lost jobs, man-skill lost

Same then nothing changes, most likely

Real wage rate

(level of wage rate)

Minimum wage price flooring set by govt

Efficiency wage set above market wage to attract most productive

workers (no shirking), discourage them from quitting

Unemployment

benefits

- lowers opport. Cost of job search

Extending unempt benefits increase natural unempt rate

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Real GDP and Unemployment Over the Cycle

- quantity of real GDP at full employment is at POTENTIAL GDP

- Output Gap: difference between real and potential GDP; as it changes over B.C., unempt rate changes around

natural unempt rate

- @ Full Empt

Unempt rate = natural unempt rate & real GDP = potential GDP output gap = 0

- @ Unempt rate < natural Unempt rate

Real GDP > potential GDP output gap is (+)

- @ Unempt rate > natural unempt rate

Real GDP < potential GDP output gap is (-)

The Price Level, Inflation, and Deflation

- Measure annual % change of price level and find money values and real values of economic variables

Price Level: average level of prices and value of money

Inflation: persistently rising price level

Deflation: persistently falling price level

Why inflation and deflation are problems (the unpredicted situations)

Redistributes Income Inflation raises price but not wages; employers are better off due to higher profits but

employees wages cant buy as much now

Deflation wages dont full but price falls; workers fixed wages buy more than they

bargained for but employees receive lower profits

Redistribute Wealth Inflation - $ borrowed buys less than originally loaned; interest paid on loan doesnt

compensate lender

Deflation $ borrow repays buys more than money originally loaned

Lowers Real GDP and

Employment

Inflation raises firms profits brings rise in investment and boom in production and empt;

- real GDP > potential GDP, unempt rate falls below natural rate;

- only TEMPORARY because investment dries up, spending falls,

real < GDP, unempt rate rises

Deflation those in debt will cut their spending; fall in total spending brings recession and

rising unempt

Diverts Resources From

Production

- wasting of resources is a cost of inflation

- it is more profitable to forecast their rates than to invent new products

Hyperinflation: inflation rate of 50%+/month grinds economy to half and causes society

to collapse

The Consumer Price Index (CPI): measurement of price level by measuring avrg prices paid by urban consumers for

fixed basket of consumer G/S

Reading the CPI Numbers

- reference base period = 100 (in 2002)

e.g. in 2011 CPI = 120 therefore, it is 20% higher than 2002

Constructing the CPI

1. Selecting CPI Basket

2. Monthly Price Survey

3. Calculating CPI

(1) find cost of CPI basket at base-period prices

(2) find cost of CPI basket at current-period prices

(3) find CPI for base period and current period

CPI =

Measuring Inflation Rate

- Measures annual % change in CPI

Inflation Rate =

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Distinguishing High Inflation from a High Price Level

(a) Price level rises rapidly, inflation rate = HIGH

(b) Price level rises slowly, inflation rate = LOW

(c) Price level falls, inflation rate would be (-) = DEFLATION

- Changes in CPI overstate inflation rate!!!!!!!

The Biased CPI its main sources of bia

New Goods Bias - We would have to compare new items with old items but they dont have the same

value! Gives upward bias into CPI and inflation rate

e.g. type writer versus PC today

Quality Change Bias - Each year, items are better QUALITY but not exactly inflation! CPI counts entire

$ rise as inflation; overstates

e.g. newer generations of iPods

Commodity Substitution

Bias

- Change in relative $ lead consumers to change items they buy; although it might

be the same but CPI ignores substitution and says $ increased

e.g. chicken $ unchanged so people buy more chicken than beef bc beef $ increased

Outlet Substitution Bias - When theres higher $, people will want to go to discount stores more rather than

convenience stores; CPI does not monitor outlet substitutions

The Magnitude of the Bias James Rossiter said its about 0.6% per year

Some Consequences of the Bias

- Distorts contracts and increases govt outlays

Alternative Price Indexes

GDP Deflator index of prices of all items included in GDP and is ratio of nominal GDP to real GDP

GDP Deflator =

- Real GDP includes all the investment, govt expenditure, net exports, etc.

- Weights attached to each item are components of GDP in both current and preceding

year

Chained Price Index

for Consumption

index of prices of all items included in consumption expenditure in GDP and is ratio of

nominal consumption expenditure to real consumption expenditure

CPIC =

- Overcomes source of bias because it uses current and previous period quantities

rather than fixed quantities from earlier period (has sub effect & new goods)

Core Inflation

Core Inflation Rate: inflation rate excluding volatile elements (e.g. food and fuel)

- It gives misleading view of true underlying inflation rate: bias because food and fuel could be rising!

Real Variables in Macroeconomics

- Distinguish between Real from nominal we want to see what is really happening to variables that influence

standard living

Jobs Growth Labs Recovery

Can Canada Keep its Jobs Pace as U.S. Stumbles?

- 2011: Unemployment in US increased to 9.2%

- Canadas unemployment rate was steady at 7.4%

- Canadian jobs were mostly PT; our success is limited by U.S.s weak economy

- OUR goods: Timber, oil, metals, other commodities

Chapter: 22 Purpose: Readings Date: Friday, January 18

th

, 2013

ECONOMIC GROWTH

The Basis of Economic Growth

- Sustained expansion of production possibilities measured as the increase in real GDP over a given period

- Slow economic growth or absence of growth can hat a nation to devastating poverty (e.g. Sierra Leone)

Calculating Growth Economic Growth Rate: annual % change of real GDP

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Rates

Real GDP growth rate =

- Growth rate of real GDP tells us how rapidly total economy is expanding

- It measures usefulness of potential changes in balance of power among nations but

not changes in standard living

Real GDP per person (per capital RGDP): real GDP divided by the population

(all we do is replace whats in current formula with RGDP per person)

Example:

RGDP of current year = $1,650 billion RGDP of previous year = $1,500 billion

RGDP per person =

= $54,455

RGDP per person =

= $50,000

Real GDP growth rate =

= 8.9%

- Real GDP per person grows only if real GDP grows FASTER than popn grows

- If growth of popn exceeds growth of real GDP; real GDP per person falls

Magic of Sustained

Growth

Compound Interest

e.g. you put $100 principle and earn 5% interest in first year. This means you get

$105 at end of year 1. Second year, you earn interest on the principle AND previous

interestyou want to get to $200

But after how many years?

Rule of 70: formula which states number of years it takes for level of any variable to

double is approx. 70 divided by annual % growth rate of variable

(e.g. for $100 to get to $200, 70 5 = 14 years)

Applying Rule of 70

p.519, Figure 22.1

Putting in perspective CHINA and their Rule of 70 usage.

Economic Growth Trends

Growth in Canadian Economy

p.520, Figure 22.2

- During the 84 years from 1926 to 2010, real GDP per person in

Canada grew by 2%/year, on avrg.

- Growth was most rapid during 1960s and slowest during 1980s

Real GDP Growth in World Economy

p.521, Figure 22.3

- Canada had the second-highest real GDP per person, ahead of

Japan,

1

France,

2

Germany,

3

Italy, and the

4

UK (Europe Big 4)

- Japan was really good, caught up to Canada but then they

stagnated

- Some countries cannot catch up to Canada; drifting farther behind

- Labour productivity growth is key to rising living standards

How Potential GDP Grows

- Economic growth occurs when real GDP increases; it is a sustained, year-after-year increase in potential GDP

What determines Potential GDP? (2)

- Labour, capital, land, entrepreneurship produce real GDP, and the productivity of the factors of production

determines quantity of real GDP that can be produced

- Potential GDP is the level of real GDP when QTY of labour employed is the full-employment quantity

Aggregate Production Function - Production possibilities frontier: boundary between combo of goods and

services that can be produced and those that cannot be

e.g. more hours that are worked, less and less productive hours are used.

Each additional hour of leisure forgone, real GDP increases out by

successively smaller amount.

Aggregate Production Function: relationship that tells us how real GDP

changes as QTY of labour changes when all other influences on production

remain same

Aggregate Labour Market (3) - Pretending there is one large labour market that determines QTY of labour

employed and QTY of real GDP produced

Demand

for Labour

Relationship b/w QTY of labour demanded (hours of

labour demanded by all firms in economy in a given

period) and is dependent on real wage rate (QTY of G/S

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

that an hour of labour earns)

[

]

- Money wage rate: # of $ an hour of labour earns

- Real wage rate influences qty of labour demanded bc

what matters to firms is not number of dollars they pay,

but how much output they must sell to earn those dollars

Law of diminishing returns:

Qty of labour demanded Real wage rate

By successively small amounts

Firms will only hire more if RWR = fall in extra output

produced by that labour

Supply of

Labour

Relationship b/w QTY of labour supplied and RWR

Qty of labour supplied: # of hours all households in economy

plan to work during given period; RWR dependant

- RWR influences it bc its not how much is earned but

what they can actually buy with that $

- If one can earn more per hour, then obv. they will choose

to work longer hours

Labour

Market

Equilibrium

- $ of labour = RWR

- Forces of S/D in labour market is the same with G/S

- Shortage or surplus of labour brings only gradual change

in RWR

- During shortage of labour: RWR rises to eliminate it

- Neither: labour market is in EQ (full emplt)

Potential GDP - RGDP increases as qty of labour increases but at EQ of qty of labour (full

employment) it becomes PGDP

What Makes Potential GDP Grow?

Growth of

Supply of

Labour

- When S

L

grows, curve shifts rightward = qty of labour at given RWR increases

QTY of labour = # of workers avrg hours per worker

- QTY of labour changes as a result of:

1) Avrg hours per worker

2) Emplt to popn ratio

3) Working-age popn

In long run, working age popn grows at same rate as total popn

Effects of Population Growth

- Brings growth in S

L

Does not change D

L

nor production function

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- PGDP increases when theres increased QTY of Labour

- Increase in popn increases the full-emplt QTY of labour, increases PGDP, and lowers RWR.

BUTdecreases PGDP per hour of labour (cause of diminishing returns)

Growth of

Labour

Productivity

Labour Productivity: QTY of real GDP produced by an hour of labour

Labour Productivity = RGDP / Aggregate Labour hours

- When productivity grows, RGDP per person grows = rising standard of living

Effects of an Increase in Labour Productivity

- When labour productivity increases, production possibilities expand

- If labour = more productive = increase in willingness for firms to pay higher

- Increase in labour produc. increases D

L

and it shifts rightward

- Aggregate labour hours increase as a CONSEQUENCE (not cause) of growth of PGDP

Why Labour Productivity Grows (3)

- Fundamental precondition for labour productivity growth is incentive system created by firms, markets, property

rights (Industrial Revolution, Britain, middle 1700s), and money

Physical Capital Growth - Amount of capital per worker increases = increase in labour productivity

- Production by hand may create beautiful products but large amounts of capital

per worker are much more productive

Human Capital Growth - Human capital: accumulated skills and knowledge of human beings; fundamental

source of labour productivity growth

- It grows when new discoveries are made and when people learn from past

- It would be so hard if way to do things were only in memorieshow would other

people know about it?!

- Sometimes physical capital stays constant, but repetitive work makes individuals

more productive because the more you do it, easier it becomes

e.g. education and training, job experience

Technological Advances - Technological change: Discovery and application of new technologies

- Things are more productive than they were before because we can use

technological aspects that didnt exist back then!

Growth Theories, Evidence, and Policies (3)

Classical Growth

Theory

View that growth of real GDP per person is temporary and that when it rises above

subsistence level, popn explosion eventually brings it back to subsistence level

- Adam Smith, Thomas Robert Malthus, David Ricardo proposed this theory (often called

Malthusian Theory; sparked Charles Darwins idea of natural selection)

Modern-Day Malthusians

- They believe that if popn growth rate is growing as rapidly as predicted, then there will

not be enough resources, real GDP per person will decline, and we will return to a

primitive standard of living

- Believe that global warming and climate change = RGDP will decrease

Neoclassical Growth

Theory

Proposition that real GDP per person grows because technological change induces

savings and investment that make capital per hour of labour grow

- Robert Solow (MIT, 1950s)

Neoclassical Theory of Popn Growth

- Occurred in 18

th

century Europe when birth rate fell due to opportunity cost for women

to have children (rise in wage)

- Technological advances bring higher incomes and health care to extend lives

- Income increase = birth rate and death rate decrease

- Contradicts the Classical Growth theory

Technological Change and Diminishing Returns

- Pace of technological change influences economic growth rate not vice versa

- Brings new profit opportunities, expanded businesses, investment/savings increase

- Believes that prosperity will last but growth will not last unless technology keeps

advancing (because of diminishing marginal returns)

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- Capital falls = incentive to keep investing weakens = saving decreases = rate of capital

accumulation slows

Problem with Neoclassical Growth Theory

- RGDP growth rates and income levels per person around world will converge (growth

in countries is slow but others not so imminent)

- New growth theory overcomes shortcoming of neoclassical growth theory

New Growth Theory - RGDP per person grows because of the choices people make in the pursuit of profit

and growth will persist indefinitely

- Paul Romer (Stanford University, 1980s), based on Joseph Schumpeter (193/40s)

- Pace at which new discoveries are made is not determined by chance but depending

on people looking for new technology; how intensively the look is (incentives)

- No growth stopping mechanism

Key in growth theory:

1) Discoveries are a public capital good

Public Good: no one can be excluded from using It when one persons use does not

prevent others from using it (e.g. national defence)

2) Knowledge is capital that is not subject to diminishing marginal returns

- increase of it makes labour and machines more productive (e.g. biotech knowledge,

developing DNA)

Perpetual Motion Economy

- Our wants will always exceed ability to satisfy them

- It is a never ending cycle that just repeats itself (p.533, Figure 22.10)

New Growth Theory Malthusian Theory

- Popn growth is part of solution; people are ultimate economic resource

- Larger popn = more wants = greater scientific discovery and technological advance

- Popn growth generates faster labour productivity growth and rising RGDP per

person

- Resources are limited but human imagination and ability to increase productivity =

endless

- Popn growth is

the problem

- See end of

prosperity as we

know it today

Sorting Out Theories

Classical growth reminds us physical resources are limited and without advances = diminishing returns

Neoclassical growth says the same but due to diminishing returns to capital and reminds us we have to advance

in technology and accumulate human capital

New growth says capacity of human resources to innovate at pace offsets diminishing returns (most relatable but

not most correct)

The Empirical Evidence on Causes of Economic Growth (p.535, Table 22.1)

- Empirical Evidence data generated by history and natural experiments that it performs

- Political and economic systems are hard to change but market distortions, investment, openness to international

trade are features of nations economy that can be influenced by policy

Policies for Achieving Faster Growth (5)

Stimulate Saving - Saving finances investment so stimulating saving increases economic growth

- Tax incentives (e.g. Registered Retirement Savings Plans) can increase

saving

Stimulate Research and

Development

- Govt can direct public funds towards financing basic research

Improve Quality of Education - Free market produces too little education because it brings benefits beyond

those valued by people who receive education

- Basics give basic skills: language, math, science, etc.

- Can be stimulated and improved by using tax incentives to encourage

improved private provision

Provide International Aid to - Just because money is lent to another country for development does not

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Developing Nations always spur development; sometimes it can even be a bad turn out

Encourage International Trade - Trade, not aid, stimulates economic growth

- Extracting available gains from specialization and trade

- Lowering trade barriers against developing nations

- WTOs efforts to achieve more open trade are resisted by richer nations

Chapter: 23 Purpose: Readings Date: Tuesday, January 29

th

, 2013

FINANCE, SAVING, AND INVESTMENT

Financial Institutions and Financial Markets

Finance and Money - Finance: activity of providing funds that finance expenditures on capital; how

households and firms obtain and use it, and how they cope with risks that arise

- Money: what we use to pay for goods and services and factors of production and to

make financial transactions

- Closely related but very different

Physical Capital and

Financial Capital

- Physical capital: tools, instruments, machines, buildings, and other items that have

been produced in past to be used today to produce G/S (e.g. raw materials,

semifinished goods)

Financial Capital: funds firms use to buy physical capital

- Aggregate production function, quantity of capital is fixed (i.e. increase in QTY of

capital increases production possibilities = shifts aggregate production function

upward)

Differences

Capital Investment

- Quantities of capital changes due to investment

and depreciation

- Increases QTY of capital

- Depreciation decreases capital

Gross Investment: total amount spent on new capital

Net investment: change in value of capital

[NI = gross investment depreciation]

Wealth Savings

Value of all things that people own; related to

what they earn but not same

- Income is amount received during a period =

supplied by resources owned

- Market value of assets rises = wealth Increase

(Capital gains versus Capital losses)

Amount of income that is not paid in taxes or

spend on consumption G/S

- Increases wealth

- Used to finance investments and

supplied/demanded through loan, bond, and stock

markets

National wealth = wealth at start of year plus savings during year = income (after-tax) consumption expenditure

- To make RGDP grow, saving and wealth must be transformed into investment and capital through the following

Financial Capital

Markets

Loan Markets - In order to finance for items firms/households/businesses want/need,

they need to make loans

- e.g. houses, automobiles, appliances, furnishings

Mortgage: legal contract that gives ownership of home to lender in event

that borrower fails to meet agreed loan payments (repayments and

interest)

Bond Markets - govts: all levels, raise finance by issuing bonds

Bond: promise to make specified payments on specified dates

Bond market: bonds issued by firms and govt are traded here

- Treasury Bills: govt of Canada issues the promise of repayment

(Longterm = higher $, Shorterm = lower $; FEDERAL = least default risk)

- Mortgage-backed security: entitles its holder to income from package

of mortgages (i.e. process of many lenders to borrowers to lenders)

- Bondholder does not own part of the firm that issued the bond

Stock Markets Stock: certificate of ownership and claim to firms profits

- Stock market: financial market in which shares of stocks of

corporations are traded (e.g. Toronto Stock Exchange, New York

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Stock Exchange, London, Tokyo)

Financial Institutions (5)

Commercial Banks - Banks accept deposits; buys govt bonds and other securities to make loans

- Banks makes up 70% of total assets of Canadian financial services sector

Trust and Loan

Companies

- Like banks, largest are actually owned by banks

e.g. estates, trusts, pension plans

Credit Unions and

Caisses Populaires

- Banks that are owned and controlled by their depositors and borrowers

- Large in number but small in size (only within provincial boundaries)

Pension Funds - Receive pension contributions of firms and workers

- To buy diversified portfolio of bonds and stocks that they expect to make an income

that balances risk and return; to pay pension benefits

- Very large and play an active role in firms whose stock they hold

Insurance Companies - Enter into agreement with households/firms to provide compensation in case of

accidents, theft, fire, illness, and other misfortunes

- Receive premiums from customers and make payments against claims

- Corporate insures businesses when they cant pay their bonds, etc.

All financial institutions face these two problems

Insolvency Illiquidity

Net worth = market value of what it has lent market value of what is has borrowed

- (+) means its solvent, (-) means insolvent and must go out of

business and stock holders bears losses

Made long-term loans with borrowed

funds and is faced with a sudden

demand to repay more of what it has

borrowed than its available cash

Interest Rates and Asset Prices

- Financial assets stocks, bonds, short-term securities, and loans

- If asset price rise, while other things remain same, interest rate falls

- If asset price falls, while other things remain same, interest rate rises (harder to pay debts and net worth falls, insolvency)

Example Problem: What is the Return on Investment? It depends on how much you buy for.

Bond promise to pay holder $5/year forever

Buy bond for $50

Interest Rate = ($5 $50) x 100 = 10%

Price of bond increases to $200

Interest Rate = ($5 $200) x 100 = 2.5%

The Loanable Funds in Market

Loanable Funds Market: aggregate of all individual financial markets

Funds that Finance

Investment

p.549, Figure 23.3

Funds that finance investment

1) Household Saving

2) Govt budget surplus

3) Borrowing from rest of the world

Net taxes: taxes paid to govt cash transfers received from govt

Y = C + S + T

Remember

Y = C + I + G + X M I + G + X = M + S + T

Take away G and X from both sides

I = S + (T G) + (M X)

- This tells us that investment (I) is financed by household savings (S), govt budget

surplus (T G), and borrowing from rest of the world (M X)

- Govt budget surplus (T > G) contribute to finance investment but deficit (T < G)

competes with investment for funds

- Export less than import = use rest of world to finance some of our investment, but if

import is less = we lend, our saving finances investment in other countries

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

National Saving: private saving & govt saving (T G)

- When loanable funds market is at EQ, it is measured in REAL interest rate

The Real Interest Rate Nominal Interest Rate: # of dollars borrower pays and lender receives in interest in a

year expressed as % of # of dollars borrowed and lent

Real Interest Rate: nominal interest rate adjusted to remove effects of inflation on

buying power of money; pprox.. equal to nominal interest rate inflation rate

- real interest paid on borrowed funds = opp. Cost of borrowing

- real interest rate forgone = funds are used to buy consumption G/S or to invest in

new capital good = opp. Cost of not saving or not lending those funds

How does loanable funds market determine real interest rate? (3)

The Demand for

Loanable Funds

- Qty of loanable funds demanded is total qty of funds demanded to finance investment,

govt budget deficit, and international investment/lending during a given period

What determines investment and demand for loanable funds to finance?

1) The real interest rate

2) Expected profit

- firms would only invest in capital if they will earn profit

Higher RIR = Smaller quantity of loanable funds demanded

Lower RIR = Greater quantity of loanable funds demanded

Demand for Loanable Funds

Curve

LF = loanable funds

Changes in the Demand for

Loanable Funds

- When expected profit changes, demand of LF changes

- Expected profit rise @ expansion of BC, new

technological changes makes new products, growing

popn brings more demand for G/S, and fluctuates with

optimism and pessimism:

Animal Spirits John Maynard Keynes

Irrational exuberance Alan Greenspan

The Supply of

Loanable Funds

- Qty of loanable funds supplied is total funds available from private saving, govt budget

surplus, and international borrowing during given period

How to decide how much of income to save and supply in LF market?

1) Real interest rate

2) Disposable income

3) Expected future income

4) Wealth

5) Default risk

Higher RIR = Greater qty of LF supplied

Lower the RIR = Smaller qty of LF supplied

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Supply for Loanable Funds

Curve

Changes in the Supply for

Loanable Funds

1. Disposable income: income earned net taxes

- greater disposable income = greater savings

2. Expected future income: higher houses expected

future income, smaller its saving today

3. Wealth: Higher households wealth, smaller its savings

4. Default risk: risk that loan will not be repaid

- great risk = higher IR needed to induce person to lend

= smaller supply of loanable funds

Shifts of Supply of Loanable

Funds Curve

- When any of the above 4 changes, supply curve shifts

e.g. increase of supply of loanable funds (increase savings)

1. Increase in disposable income

2. Decrease in expected future income

3. Decrease in wealth

4. Fall in default risk

Equilibrium in the

Loanable Funds

Market

- Basically, when supply and demand are equal

- Despite shortage or surplus at given periods, the curves are always trying to get to

equilibrium

Changes in Demand

and Supply

Increase in Demand - Shift rightwards of demand curve; with no change in SLF,

causes an EQ change of a higher RIR

- Borrowers compete for funds, IR rises and lenders

increase qty of funds supplied

Increase in Supply - Borrowers find bargains and lenders are accepting lower

interest rates (in turn, borrowers find investment projects

very profitable and increase qty of LF borrowed)

Long-Run Growth of

Demand and Supply

- In the long run, both curves trend upward at similar pace

- RIR has no trend, fluctuates around constant avrg level

Government in the Loanable Funds Market (2)

Government Budget Surplus - Increases supply of LF

- RIR falls decrease household saving decrease qty of private funds

supplied

- Lower RIR increases qty of loanable funds demanded & increase investment

Government Budget Deficit - Increases demand for loanable funds

- RIR rises increases household saving and increases qty of private funds

supplied

- Higher RIR decreases investment & qty of LF demanded by firms to finance

investment

Crowding-Out Effect Tendency for govt budget deficit to raise RIR and

decrease investment

- Crowds out investment by competing with

businesses for scarce financial capital

- Effect does NOT decrease WHOLE amount of govt

budget deficit because higher RIR induces increase

in private saving that partly contributes towards

financing deficit

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Ricardo-Barro Effect Govt budget, whether in surplus or deficit, has no

effect on either RIR or investment

- tax payers can see that budget deficit today =

increase in future taxes & disposable incomes will

be smaller = saving increases today

- Private saving and private supply of loanable funds

increase to match qty of loanable funds demanded

by govt

The Global Loanable Funds Market

International Capital Mobility - Funds flow into country in which interest rate is highest and out of country in

which interest rate is lowest

- To compare real interest rates of countries, we must compare financial assets

of EQUAL RISK

- Interest Rates include Risk Premium; riskier the loan = higher interest rate

- Risk Premium: Interest rate on risky loan that on safe loan

International Borrowing and

Lending

(-) Net Export [X<M] = rest of world supplies funds to country & qty of LF in country is

greater than national saving

(+) Net Export [X>M] = the country is a net supplier of funds to rest of the world & qty of

LF in country is less than national saving

Demand and Supply in the

Global and National Markets

- In global LF market, it only determines WORLD EQ RIR not the nations (that

depends on whether the country itself is a borrower or lender)

Global Loanable Funds

Market

- Sum of both demand and supply from all countries

International Borrower p.558 Figure 23.10 (b)

- If country is integrated into global economy, funds

would flood into it

International Lender p.558 Figure 23.10

- If country is integrated into global economy, funds

would flow out of it

Changes in Demand

and Supply

- Changes within a country depends on the size of

the country itself

- Small country = no effect on global D/S =

unchanged RIR = only change countrys net

exports and international borrowing/lending

- Large country changes world RIR and countrys

net exports and international borrowing/lending

Chapter: 24 Purpose: Readings Date: Sunday, February 25

th

, 2013

MONEY, PRICE LEVEL, AND INFLATION

What is Money?

Money: any commodity or token that is generally acceptable as means of payment

Means of Payment: method of settling a debt (i.e. when a payment has been made, there is no

remaining obligation between parties to a transaction)

Medium of Exchange Any object that is generally accepted in exchange for goods and services

- w/o this, G/S must be exchanged directly for other G/S exchange called

BARTER

Barter requires double coincidence of wants (e.g. in order to sell DVDs to

get ice cream, you have to someone that wants to exchange it and they

must also have ice cream)

- Money acts as medium of exchange because people with something to sell

will always accept money in exchange for it

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- Credit Card (C.C) is not money because money is used to settle C.C debt

Unit of Account Agreed measure for stating prices of G/S

e.g. situation where you exchange ice creams for DVDs, DVDs for Paper, etc.

Store of Value Sense that it can be held and exchanged later for G/S

- If money were not a store of value, it could not serve as means of payment

e.g. house, car, work of art

- no store of value has completely stable value (i.e. always fluctuating)

- inflation lowers value of money & other commodities, and tokens used as

money

- to make money useful = low inflation rate

Money in Canada

Today

Currency notes and coins held by individuals and businesses

- notes and coins INSIDE banks are not counted as

currency because they are not held by individuals and

businesses

- currency = convenient for settling small debts and buying

low-priced items

Deposits - Deposits of individuals and businesses and banks/other

depository inst.

e.g. trust and mortgage companies, credit unions, and

caisses populaires

- Deposits = money bc it can use it to make payments

Official

Measures of

Money

M1: consists currency held by individuals and businesses plus

chequable deposits owned by individuals and businesses

- Does not include notes and coins held by banks, and it

does not include chequable deposits by Government of

Canada

M2: consists of M1 plus all other deposits (i.e. non-chequable

deposits and fixed term deposits)

Are M1 and M2 Really Money?

- Chequable deposits = money bc it can be transferred from one person to

another by writing a cheque or using a debit card

- M1 consists of currency PLUS chequable deposits and each of these =

payment means

- M2 has some savings deposits = not means of payment (liquid assets)

Liquidity: property of being easily convertible into means of payment with

loss in value

* since deposits in M2 are not means of payment AND easily converted into

means of payment they ARE COUNTED AS MONEY

Deposits are money but cheques are not

- Cheques itself is never money because it only instructs bank to transfer

money between parties, there was not $### added into the flow circulation

- In essence: one persons money reduces while another persons increases;

therefore, nothing additional occurred in the stage of transfer

Credit cards are not money

- It is just an ID like your drivers licence

- CC lets you take out a loan at instant you buy something

- To make payment, you need money (which you need to have currency or

chequable deposit to pay CC company

- Although you use CC when you buy something, CC is not means of

payment and it is not money

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

INSERT GRAPH HERE P.569

The Banking System

Depository Institutions

Private firm

that takes

deposits from

households

and firms, and

makes loans

to other

households

and firms

Charterered Banks Private firm, chartered under Bank Act of 1992 to

receive deposits and make loans

- Largest institutions in banking system and conducts

all types of banking and financial business

Credit Unions and

Caisses Populaires

Credit Union: cooperative organization that operates

under Co0operative Credit Association Act of 1992 and

receives deposits from and makes loans to its members

Caisse populaire: similar type of institution that operates

in Quebec

Trust and Mortgage

Loan Companies

Privately owned depository institution that operates

under Trust and Loan Companies Act of 1992

Receives deposits, make loans, and act as trustee

for pension funds and for estates

All Banks Now - Economic functions of all depository institutions

have grown increasingly similar

- They all perform same essential economic

functions (therefore, well call all BANKS)

What Depository Institutions Do:

- Provide services such as cheque clearing, account management, credit

cards, and Internet banking (income comes from service fees)

- They earn most of income by using funds received from depositors to make

loans, buy securities that earn higher interest rate than paid to depositors

- Must balance act weighting return against risk

Put funds into one of the four of the following:

1. Reserves Notes and coins in its vault or its deposit account at

Bank of Canada

- These funds are used to meet depositors currency

withdrawals and to make payments to other banks

- Normal times: bank keeps about half of 1% here

2. Liquid Assets Government Canada Treasury bills and commercial

bills

- Banks first line of defence if need reserves

- Can be sold and instantly converted into reserves

with almost no risk of loss

But Low risk = low interest rate

3. Securities Government of Canada bonds and other bonds (e.g.

mortgage-backed securities)

- Can be converted into reserves but at prices that

fluctuate

- Prices shift because assets are riskier than liquid

But Risker = higher interest rate

4. Loans Commitments of funds for agreed-upon period of

time

- Banks make loans to corporations to finance

purchase of capital

- Make mortgage loans to finance purchase of homes

and consumer durable goods (e.g. cars/boats)

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

- Cannot be converted into reserves until dues are

repaid (some borrowers default and never pay!)

But riskiest asset = highest interest rate

Economic Benefits Provided by Depository Institutions (DI)

1. Create Liquidity - By borrowing short and lending long

i.e. taking deposits and standing ready to repay on short

notice/demand; making loan commitments that run for

terms of many years

2. Pool Risk - Loan might not be repaid (default!)

i.e. lend to one person that doesnt repay, full amount lost;

but lend to 100 and one person defaults, its not that bad

3. Lower the cost

of borrowing

- Lowers cost of search to borrow funds

i.e. firm that borrows gets money from single institution (DI)

that gets deposits from large number of people but spreads

cost of activity over many borrowers

4. Lower the cost

of monitoring

borrowers

- By monitoring, lender can encourage good

decisions that prevent defaults

i.e. activity is costly if household monitors their $$ lent to

firms; therefore DI does task at lower cost

The Bank of Canada Central Bank: a public authority that supervises other banks and financial

institutions, financial markets, and payments systems, and conducts monetary

policy

Bank of Canada (BoC) is special in 3 important ways:

Banker to Banks and

Government

- BoC has restricted list of customers to

receive deposits

(Chartered banks, credit unions and caisses

populaires, and trust/mortgage loan

companies; Govt of Canada, and central

banks of other countries)

Lender of Last Resort - BoC makes loans to banks

Lender of Last resort: stands ready to make loans

when banking system as whole is short of reserves

- Some banks are short of reserves while

others have surplus reserves; overnight loan

market moves funds from one bank to

another

Sole Issuer of Bank Notes - BoC is the only bank that is allowed to issue

bank notes

- They have a monopoly (actually not natural)

The Bank of Canadas Balance Sheet

- BoC influences economy by changing interest rates

- Bank must change quantity of money in economy (depends on size and

composition of balance sheet items)

Bank of Canadas Assets 1. Government Securities

2. Loans to Depository Institutions

- BoC holds Govt of Canada securities

(treasury bills) that it buys in bills market

- Normal times: this item is small, or zero

(0 in 2011)

Bank of Canadas Liabilities 1. Bank of Canada Notes

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

2. Depository Institution Deposits

- DI deposits at BoC are part of reserves of

these institutions

The Monetary Base

- BoCs liabilities together with coins issued by royal Canadian Mint (coins are

not liabilities of BoC) make up monetary base

Monetary base: sum of Bank of Canada notes, coins, and depository institution

deposists at Bank of Canada; acts as base that supports nations money

Open Market Operation

Purchase of sale of Govt securities by BoC in open market

Open Market Purchase

Open Market Sale

How Banks Create Money

- Money is both currency and bank deposits

- Banks create deposits and do so by making loans

Creating Deposits by making loans

- Outcome is same when two banks are involved in process of transfer of

money

(e.g. if Shell Gas Stations bank is RBC, then CIBC uses its reserves to pay

RBC. CIBC has increase in loans and decrease in reserves; RBC has

increase in reserves and increase in deposits; banking system as a whole

has increase in loans and deposits but no change in reserves)

Factors limit quantity of loans and deposits that banking system can create:

1. Monetary

Base

Sum of BoC notes, coins, and banks deposits at BoC

- Size of monetary base limits total quantity of money that

banking systems can create

Reason: banks have desired level of reserves, households

and firms have desired holding of currency, and both of

these desired holdings of monetary base depend on

quantity of deposits

2. Desired

Reserves

Reserves that it PLANS to hold

- Different from required reserves (which is minimum

quantity that bank MUST hold)

- What bank plans to hold depends on level of deposits

Desired reserve ratio: ratio of reserves to deposits that

banks plan to hold

- Desired reserve ratio > required reserve ratio by amount

that banks themselves determine

3. Desired

Currency

Holding

Portions of money held as currency and bank deposits

- Ratio of currency to deposits depends on households

and firms choose to make payments

(whether: use currency or debit cards/cheques)

If bank deposists increase = desired currency holding increase

If decrease = decrease too

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

Thats why when bank makes loans that increase deposits,

some currency leaves banks which leaks reserves

- Currency Drain: leakage of bank reserves into currency

Currency Drain Ratio: ratio of currency to deposits

Money Creation Process (p.576-p.578)

1. Banks have excess reserves

2. Banks lend excess reserves

3. Quantity of money increases

4. New money is used to make payments

5. Some of new money remains on deposit

6. Some new money is a CURRENCY DRAIN

7. Desired reserves increase because deposits have increased

8. Excess reserves decrease

- If BoC sells securities in an open market operation, then banks have

negative excess reserves

(i.e. they are short of reserves)

Money Multiplier: ratio of change in quantity of money to change in monetary base

e.g. if $1 million increase in monetary base increases quantity of money by

$2.5 million, money multiplier is 2.5

Smaller banks desired reserve ratio & currency drain ratio = larger money multiplier

The Money Market

- No limit to amount of money we like to RECEIVE in payment for labour/interest on savings

- IS limit to how big inventory of money we would like to HOLD and neither spend/use to buy assets that

generate income

- Quantity of money demanded: inventory of money that people plan to hold on any given day; in our

wallets and in our deposit accounts at banks

- Quantity of money held must = Quantity supplied

Influences on Money Holding

Price Level - Quantity of money is measured in nominal money dollars

- Quantity of nominal money demanded: proportional to price level,

other things remaining constant

- Real money = nominal money price level

(measured in terms of what it will buy)

Nominal Interest Rate - Higher opportunity cost of holding money, other things remaining

same, smaller quantity of real money demanded

Opportunity cost of holding money Nominal Interest Rate on other

assets nominal interest rate on money

- Holding money, you forgo interest you might otherwise have got

- Money loses value due to inflation; higher expected inflation rate,

higher the nominal interest rate

Real GDP - Quantity of money that households and firms plan to hold depends

on amount they are spending

- Economy as a whole depends on aggregate expenditure (REAL GDP)

Financial Innovation - Technological change and arrival of new financial products

influence quantity of money held

Financial innovations include:

1. Daily interest chequable deposits

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

2. Automatic transfers between chequable and saving deposits

3. Automatic teller machines

4. Credit cards and debit cards

5. Internet banking and bill paying

The Demand for Money

Relationship between quantity of real money demanded and nominal

interest rate when all other influences on amount of money that people

wish to hold remain same

See p.579 for FIGURE 24.3 illustration

Shifts in Demand for

Money Curve

Shifting of demand curve:

1. Change in REAL GDP

- Decrease in real GDP decreases demand for money (shifts leftward)

- increase in real GDP increases demand for money (shifts rightward)

2. Financial innovation Changes in demand for money

- decreases demand for currency, might increase demand for some types

of deposits and decrease demand for others

- generally, innovation decreases demand for money (leftward)

See p.579 for FIGURE 24.4 illustration

Money Market

Equilibrium

Occurs when

demand =

supplied

(long run vs short run)

Short-Run Equilibrium - As BoC adjusts quantity of money, interest

rate changes

` let EQ be at 5%/year

` if it were 4%/year: people will sell bonds, bid down

price, and interest rate would rise

` if it were 6%/year: people will buy bonds, big up

price, and interest rate would fall

See p.580 for FIGURE 24.5 illustration

Short-Run Effect of a

Change in Supply of

Money

If BoC increases quantity of money

- People will hold more money than demanded

- SURPLUS

- People enter loanable funds market and

increase in demand for bonds raises its price;

lowers IR

If BoC decreases qty of money, peoplehold less

money than demanded

- Enter LFM to sell bonds; decrease in demand

for bonds lowers their price; raises IR

See p.580 for FIGURE 24.6 illustration

Long-Run Equilibrium - When inflation rate = expected inflation rate

and when real GDP = potential GDP; money

market, loanable funds market, goods market,

and labour market are in long-run EQ (so is

economy)

If BoC increases qty of money, eventually a new LR

EQ is reached which nothing real has changed

- Real GDP, employment, real qty of money,

and real interest rate all return to original

levels

- Only PRICE LEVEL changes; rises by

Professor: Mokhles, HOSSAIN Weiting Xu | York University

Textbook: MACROECONOMICS Canada in the Global Environment (PARKIN, BADE)

same % as rise in qty of money

Why?

- Real GDP and emplt are determined by

demand for labour, supply of labour, and

production function

- Real interest rate determined by demand for

supply of real loanable funds

- Only variable free to change is the long run

price level

Transition from Short

Run to Long Run

Example:

BoC increases qty of money by 10%

1. Nominal interest rate falls; real interest rate

falls too as people try to get rid of excess

money holdings and buy bonds

2. Lower real interest rate, people want to

borrow and spend more; more investment by

firms and want to buy consumer goods

3. Increase in demand for goods cannot be met

by supply because its already at full emplt

(SHORTAGE!)

4. Shortage forces price level to rise

5. Price level rises = real qty of money

decreases

- this decrease raises nominal interest rate

and real interest rate

6. Interest rate rises = spending plans are cut

back, eventually original full-emplt is back

7. At new Long run EQ ,price level rose by 10%

and nothing real changed

The Quantity Theory of Money

Quantity Theory of Money: proposition that in long run, increase in quantity of money brings equal

percentage increase in price level

Velocity of Circulation: average number of times dollar money is used annually to buy G/S that make up

GDP

GDP = price level real GDP

GDP = PY

Velocity of circulation = (Price level x real GDP) / Qty of Money