Professional Documents

Culture Documents

Matrix XXX

Uploaded by

Icyy Dela PeñaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matrix XXX

Uploaded by

Icyy Dela PeñaCopyright:

Available Formats

Template Instructions

1. Read all instructions on the Template for detailed advice and tips.

2. Never type in a red area unless otherwise noted. Save frequent backup copies of this

Template in case you do this by mistake.

3. If you have a problem viewing any of your text on a long sentence, select the problem

cell and use the text wrap feature. It can be found under the home tab on Excel 2007.

You may have to click wrap text twice (just a bug in Excel).

4. To get your matrices and charts into Excel or Power Point, highlight them and then copy

and paste special into Word or Power Point. If you dont use paste special then it will not

work properly.

5. Paste special will give you several options, be sure to use the MS Excel Worksheet

Object Option. You must also check paste or paste link

6. The advantages of using the paste link option are as you change the data in Excel it will

change in your Word or Power Point file provide both are open. This is a nice feature as

if you decide to change some data, you dont have to paste special everything back over

into Power Point or Word.

7. The advantage of just using paste option is your file is not linked to Excel. If

something where to happen with Excel or MS Office wants to be temperamental on the

day of your presentation, and you had checked the paste link option, then your data will

not show on Word or Power Point.

8. You may also use a program called Jing, found at http://www.techsmith.com/jing.html

to copy the matrices and save as jpeg files for later entry into Power Point. The program

is free.

Template Instructions

1. Read all instructions on the Template for detailed advice and tips.

2. Never type in a red area unless otherwise noted. Save frequent backup copies of this

Template in case you do this by mistake.

3. If you have a problem viewing any of your text on a long sentence, select the problem

cell and use the text wrap feature. It can be found under the home tab on Excel 2007.

You may have to click wrap text twice (just a bug in Excel).

4. To get your matrices and charts into Excel or Power Point, highlight them and then copy

and paste special into Word or Power Point. If you dont use paste special then it will not

work properly.

5. Paste special will give you several options, be sure to use the MS Excel Worksheet

Object Option. You must also check paste or paste link

6. The advantages of using the paste link option are as you change the data in Excel it will

change in your Word or Power Point file provide both are open. This is a nice feature as

if you decide to change some data, you dont have to paste special everything back over

into Power Point or Word.

7. The advantage of just using paste option is your file is not linked to Excel. If

something where to happen with Excel or MS Office wants to be temperamental on the

day of your presentation, and you had checked the paste link option, then your data will

not show on Word or Power Point.

8. You may also use a program called Jing, found at http://www.techsmith.com/jing.html

to copy the matrices and save as jpeg files for later entry into Power Point. The program

is free.

Free Excel Student Template

Dear Student,

By using this Template, you hereby agree to the Copyright terms and

conditions. This Template should save you considerable time and allow for

your presentation to be more professional. Do not mistake this Template

for doing all of the work. Your assignment is to analyze and present

strategies for the next three years. You will still need to do the research

and enter key internal and external information into the Template. The

Template does not gather or prioritize information. It does however

assimilate information you enter in a professional way and does many

calculations for you once that critical information is entered. Best of luck,

with your project.

INSTRUCTIONS FOR TEMPLATE

1

Please read all Template instructions below carefully before you start each

new section of this Template. Only type in the green boxes unless

otherwise noted. Please read the Read ME tab at the bottom of Excel

before you start.

INSTRUCTIONS FOR EXTERNAL AUDIT

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1. To perform an External Audit, enter ten opportunities and ten threats. For

purposes of this Template, it is vital you have ten of each, no more, no less.

2. After entering ten opportunities and ten threats, enter the weight you want

to assign to each factor. Be sure to check the bottom of the "Enter Weight

Below" column, to make sure your entire column sums is equal to 1.00

3. After entering in the weights, then enter in a corresponding rating in the

"Enter Rating Below" column. The coding scheme is provided below.

1 = "company's response to the external factor is poor"

2 = "company's response to the external factor is average"

3 = "company's response to the external factor is above average"

4 = "company's response to the external factor is superior"

Enter Ten Opportunities Below

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Enter Ten Threats Below

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Instructions for Competitive Profile Matrix (CPM)

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

To perform the CPM, enter in twelve critical success factors. You may use

some of the ones listed below if you like but try to use ones that are more

pertinent to your company. For example, if your case is Delta Airlines,

having a) on time arrival b) extra fees c) frequent flyer points, etc may be

better choices than the canned ones below. For purposes of this Template,

it is vital you have twelve factors no more, no less.

2.

After entering in twelve critical success factors, enter in the weight you

want to assign each one. Be sure to check the bottom of the "Enter Weight

Below" column, to make sure your sum weight is equal to 1.00

3. After entering in your weights, type the name of your company and two

other competitors in the corresponding boxes.

4.

After entering in the weights and identifying your company and two rival

firms, then enter in a corresponding rating in the "Enter Rating Below"

column for each organization. DO NOT ASSIGN THE COMPANIES

THE SAME RATING, TAKE A STAND, MAKE A CHOICE. The coding

scheme is provided below.

CPM Matrix

Advertising

Market Penetration

Customer Service

Store Locations

R&D

Employee Dedication

Financial Profit

Customer Loyalty

Market Share

Product Quality

Top Management

Price Competitiveness

1 = "major weaknesses"

2 = "minor weaknesses"

3 = "minor strength"

4 = "major strength"

INSTRUCTIONS FOR INTERNAL AUDIT

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

To perform an Internal Audit, enter in ten strengths and ten weaknesses

For purposes of this Template, it is vital you have ten of each, no more, no

less.

2.

After entering in ten strengths and ten weaknesses scroll down the page and

enter in the weight you want to assign each one. Be sure to check the

bottom of the "Enter Weight Below" column, to make sure your sum

weight is equal to 1.00

3.

After entering in the weights, then enter in a corresponding rating in the

"Enter Rating Below" column. The coding scheme is provided below.

Reminder weaknesses must be 1 or 2 and strengths must be 3 or 4

1 = "major weaknesses"

2 = "minor weaknesses"

3 = "minor strength"

4 = "major strength"

Enter Ten Strengths Below

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Enter Ten Weaknesses Below

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

INSTRUCTIONS FOR COMPANY WORTH

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

To perform the company worth, enter in corresponding financial

information you are prompted for in the boxes to the right and press enter.

Everything is calculated automatically and posted into the matrix.

2.

Hints are provided below on where to find any particular information. If

you wish to enter data for a competitor or a company you plan to acquire,

scroll over. If acquiring a competitor, this value would constitute a large

portion of your "amount needed" in the EPS/EBIT Analysis.

Stockholders' Equity - Can be found near bottom of Balance Sheet. It

might be called total equity.

Net Income - Can be found on the Income Statement. It might be called net

earnings or net profits.

Share Price - Can be found on Yahoo Finance.

EPS - Can be found on Yahoo Finance.

Shares Outstanding - www.money.msn.com.

INSTRUCTIONS FOR SWOT

1

INSTRUCTIONS FOR BCG and IE Matrix

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

The Template allows for a two, three, or a four division company. (If the

company has more than 4 divisions, combine the divisions with the least

amount of revenue and mention the adjustment to the class during your

presentation.) <You will have to read the Annual Report to find this

information> It is quite okay to do a BCG/IE for BOTH geographic and by

product revenues/profits. To develop BCG and IE matrices, Step 1: enter

in the corresponding profits you are prompted for in the boxes (for the

corresponding divisions) below. Also, change the division name to match

your case (The 2 division example is for domestic and international.) Pie

slices are automatically calculated and labeled. In the example profits were

500 million and 800 million. Do not put a M or B to signal million or

billion. If you can not find profit information, estimate this and explain to

the class during your presentation. At a bare minimum, have the

appropriately sized circles (even if you do not use pie slices). However, an

educated profit estimation is more prudent if divisional profits are not

reported.

2.

After finishing Step 1, click on the BCG hyperlink to the right (Step 2,

once there click on the pie slices. Here you can adjust the size of the

circles (which represent revenues). Move the "pies" into the quadrant you

desire. Don't worry about the "light green warning" when adjusting the

pies.

3.

After finishing Step 2, click on the IE matrix link to the right. Then

perform the same tasks you performed for the BCG. Also, be sure to type

in your company name in the appropriate quadrant according to your IFE

and EFE scores. These may be found on the EFE-IFE tab at the bottom of

your Excel Spreadsheet. Don't worry about the "light green warning"

when adjusting the pies.

Click on the SWOT Hyperlink to the right and add your SO,WO,ST, and WT Strategies.

Profits

INSTRUCTIONS FOR SPACE Matrix

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

Use five (and only five) factors for each Financial Position (FP), Stability

Position (SP), Competitive Position (CP), and Industry Position (IP).

2.

Enter the five factors you wish to use each for FP, SP, CP, and IP and the

corresponding rating each factor should receive. You may use the factors

provided here, but try to determine key factors related to your company and

industry in the same manner you did with the CPM. The calculations are

done automatically and the rating scale is provided below

3.

Next click the SPACE Link to your right. There move the box to the plot

location derived from step two. These numbers will be located to the left

of the SPACE Matrix on the SPACE page. After moving the box to the

corresponding area, then click the arrow portion of the vector and move it

so the arrow goes though the box. Don't worry about the "light green

warning" when adjusting the box and vector

FP and IP

Positive 1 (worst) to Positive 7 (best)

CP and SP

Negative 1 (best) to Negative 7 (worst)

Financial Position (FP)

Return on Investment (ROI)

Leverage

Liquidity

Working Capital

Cash Flow

Industry Position (IP)

Growth Potential

Financial Stability

Ease of Entry into Market

Resource Utilization

Profit Potential

Competitive Position (CP)

Market Share

Product Quality

Customer Loyalty

Technological know-how

Control over Suppliers and Distributors

Stability Position (SP)

Rate of Inflation

Technological Changes

Price Elasticity of Demand

Competitive Pressure

Barriers to Entry into Market

INSTRUCTIONS FOR GRAND Matrix

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

Type your company in the appropriate quadrant to the right. Click in the

remaining quadrants and press the space bar to avoid Excel placing a 0 in

those respective quadrants.

Grand Strategy Matrix

INSTRUCTIONS FOR QSPM Matrix

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

To perform a QSPM, enter two strategies in the corresponding green boxes

below. These two strategies should be derived from your BCG, IE,

SPACE, GRAND, and SWOT. You will need to provide a

recommendations section on your own with the expected cost after

performing the QSPM. These recommendations and costs lead into the

"amount needed" for the EPS/EBIT Analysis. You may have multiple

recommendations, including both the ones used in the QSPM.

2.

After entering in your strategies, then rate each strategy based on the

strengths, weaknesses, opportunities, and threats (factors). Do not to rate

each strategy the same for a particular strength, weakness, opportunity, or

threat. (the exception is if you enter 0 you MUST enter 0 for the other. For

example, if one strategy deserves a rating of 4 and the other factor has

nothing to do with the strategy, just rate that factor a 1)

0 = Not applicable

1 = Not attractive

2 = Somewhat attractive

3 = Reasonably attractive

4 = Highly attractive

Opportunities

1.

0

2.

0

3.

0

4.

0

5.

0

6.

0

7.

0

8.

0

9.

0

10.

0

Threats

1.

0

2.

0

3.

0

4.

0

5.

0

6.

0

7.

0

8.

0

9.

0

10.

0

Strengths

1. 0

2. 0

3. 0

4. 0

5. 0

6. 0

7. 0

8. 0

9. 0

10. 0

Weaknesses

1. 0

2. 0

3. 0

4. 0

5. 0

6. 0

7. 0

8. 0

9. 0

10. 0

INSTRUCTIONS FOR EPS - EBIT

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

To perform an EPS - EBIT Analysis, enter in the corresponding data in the

light green boxes to your right. Everything else is calculated automatically.

Including the EPS - EBIT Chart. The amount needed should be the total

cost of your recommendations. If you notice little to no change over stock

to debt financing on EPS, the total amount of your recommendations is

likely too low. Unless of course, you are recommending defensive

strategies were you are not acquiring substantial new capital.

EPS-EBIT Chart

Scroll down

INSTRUCTIONS FOR Financial Charts

<ONLY ENTER DATA IN THE LIGHT GREEN BOXES>

1.

Enter the data in the cells below. You need to use the same years for your

company and competitor for the charts to be compared. If your company's

year end is (for example) in July 2009, and the competitors is in December

2008. It is not the end of the world, just enter the most recent data and tell

the class this when you present the charts. All data should be in millions.

2.

Do not use the historical percent change method blindly for determining

the respective proforma year. The respective proforma year information

should be estimates based on the financial numbers from your

recommendations. The template only performs proforma data for your

company.

3.

Scan the financial charts (click the blue link below) and select graphs that

reveal the most information. It is not expected nor a wise use of time to

discuss every graph.

Click Here to View Financial Graphs

Warning, do not change the information below, it will make all your charts wrong!

Inventory

Cash

Liabilities

Apple

Revenue

Net Income

Assets

Goodwill + Intangibles

2 The ratios below are calculated for you automatically using the

equations given (there are slightly different ways to calculate the same

ratio.) You may cut and paste special this into your power point or you

may use the graphs that are also generated for you automatically. If

you are getting a number different from one published online for a

ratio, it is likely the online version used a different equation for the

ratios, rounding, a different year was used, or maybe you just entered

the data wrong (typo). The answers the template generates are 100%

accurate because they come straight from the data you entered off the

financial statements. Just make sure you are using the same equations

for your company and the competitor. For example. Debt/Equity can

be calculated Total Debt/Equity or Total Liabilities/Equity. They are

both correct and both called Debt/Equity but will generate quite

different numbers. If you are going to compare your company to a

competitor, make sure you are using the same equation for both

(obviously, the Template accomplishes this for you).

Current Ratio

Long Term Debt

Stockholders' Equity

Cost of Goods Sold

Current Assets

Current Liabilities

Net Income

Assets

Liabilities

Cash

Stockholders' Equity

Cost of Goods Sold

Current Assets

Current Liabilities

Accounts Receivable

Goodwill + Intangibles

Inventory

IBM

Revenue

Long Term Debt

Accounts Receivable

Quick Ratio

Long Term Debt to Equity

Inventory Turnover

Total Assets Turnover

Accounts Receivable Turnover

Average Collection Period

Gross Profit Margin

Net Profit Margin

Return on Total Assets (ROA)

Return on Equity (ROE)

Click Here To View Financial Ratio Graphs

Current Ratio =

Quick Ratio =

Long Term Debt to Equity =

Inventory Turnover =

Total Assets Turnover =

Accounts Receivable Turnover =

Average Collection Period =

Gross Profit Margin =

Net Profit Margin =

Return on Total Assets (ROA) =

Return on Equity (ROE) =

Enter Weight

Below

Enter Rating

Below

EFE Matrix

Enter Weight

Below

Enter Rating

Below

0.00

Enter Rating

Below

Enter Rating

Below

Enter Weight

Below Your Company Competitor

0.00

Enter Weight

Below

Enter Rating

Below

IFE Matrix

Enter Weight

Below

Enter Rating

Below

0.00

Stockholders'

Equity

Net Income

Share Price EPS

Shares

Outstanding

Company Worth

BCG Matrix

IE Matrix

2 Division Company 3 Division Company

Click on the SWOT Hyperlink to the right and add your SO,WO,ST, and WT Strategies. Click Here to View SWOT

Domestic International Men

500 800 20

Ratings

1

1

1

1

1

Scroll over for 4 division company

Space Matrix

2

2

2

2

2

Ratings

-1

-1

-1

-1

-1

-7

-6

-5

-2

-2

Quadrant 1 Quadrant 2 Quadrant 3 Quadrant 4

QSPM

Strategy One Strategy Two

AS Ratings AS Ratings

1 2

1 2

1 2

1 2

1 2

1 2

1 2

1 2

1 2

1 2

AS Ratings AS Ratings

3 4

3 4

3 4

3 4

3 4

3 4

3 4

3 4

3 4

3 4

AS Ratings AS Ratings

3 2

3 2

3 2

3 2

3 2

3 2

3 2

3 2

3 2

3 2

AS Ratings AS Ratings

0 0

3 0

3 0

0 2

0 2

0 2

0 2

0 2

0 2

2 2

Recession Normal Boom

$2,000 $2,001 $4,000

Debt Financing

Percent

Stock Financing

Percent

Amounted Needed

Interest Rate

(decimal form)

0.80 0.20

$500 0.05

Tax Rate (decimal

form)

Current Shares

Outstanding

0.30 500

Share Price

New Shares

Outstanding

$65.00 508

EBIT

Combination Financing (decimal form)

DO NOT ENTER DATA IN "NEW SHARES

OUTSTANDING" BOX. THIS IS DONE FOR

YOU.

Your Company Top Competitor

Apple IBM

Historical Year 1 Historical Year 2 Historical Year 3 Proforma Year 1 Proforma Year 2 Proforma Year 3

1990 1991 1992 1993 1994 1995

$1 $1 $1 $1 $1 $1

$2 $2 $2 $2 $2 $2

$3 $3 $3 $3 $3 $3

$4 $4 $4 $4 $4 $4

$5 $5 $5 $5 $5 $5

$6 $6 $6 $6 $6 $6

$7 $7 $7 $7 $7 $7

$8 $8 $8 $8 $8 $8

$9 $9 $9 $9 $9 $9

$11 $11 $11 $11 $11 $11

$22 $22 $22 $22 $22 $22

$33 $33 $33 $33 $33 $33

$44 $44 $44 $44 $44 $44

Historical Year 1 Historical Year 2 Historical Year 3

1990 1991 1992

$2 $2 $2

$3 $3 $3

$4 $4 $4

$5 $5 $5

$6 $6 $6

$7 $7 $7

$8 $8 $8

$9 $9 $9

$11 $11 $11

$22 $22 $22

$33 $33 $33

$44 $44 $44

$55 $55 $55

1990 1991 1992 1993 1994 1995

0.7 0.7 0.7 0.7 0.7 0.7

Apple

0.5 0.5 0.5 0.5 0.5 0.5

0.9 0.9 0.9 0.9 0.9 0.9

0.1 0.1 0.1 0.1 0.1 0.1

0.3 0.3 0.3 0.3 0.3 0.3

0.0 0.0 0.0 0.0 0.0 0.0

16060.0 16060.0 16060.0 16060.0 16060.0 16060.0

-10.0 -10.0 -10.0 -10.0 -10.0 -10.0

2.0 2.0 2.0 2.0 2.0 2.0

0.7 0.7 0.7 0.7 0.7 0.7

0.2 0.2 0.2 0.2 0.2 0.2

Net Income / Stockholders Equity

Sales / Total Assets

Sales / Accounts Receivable

Accounts Receivable / (Sales/365)

(Sales - Cost of Goods Sold) / Sales

Net Income / Sales

Net Income / Total Assets

Current Assets / Current Liabilities

(Current Assets - Inventory) / Current Liabilities

Long Term Debt / Equity

Sales / Inventory

Enter Rating

Below

Competitor

Stockholders'

Equity

Net Income

Share Price EPS

Shares

Outstanding

Top competitor or who you wish to acquire.

4 Division Company 3 Division Company

Women Children North America South America

70 10 5 5

Must Equal 1.0

1.0

Combination Financing (decimal form)

DO NOT ENTER DATA IN "NEW SHARES

OUTSTANDING" BOX. THIS IS DONE FOR

YOU.

1990 1991 1992

0.8 0.8 0.8

IBM

0.6 0.6 0.6

0.8 0.8 0.8

0.3 0.3 0.3

0.5 0.5 0.5

0.0 0.0 0.0

10037.5 10037.5 10037.5

-10.0 -10.0 -10.0

1.5 1.5 1.5

0.8 0.8 0.8

0.3 0.3 0.3

4 Division Company

Asia Europe

40 70

Weight Rating Score Rating Score Rating Score

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0 0.00 0 0.00 0 0.00

0.00 0.00 0.00 0.00

Financial Profit

Advertising

Market Penetration

Customer Service

Store Locations

R&D

Totals

Price Competitiveness

This sheet is protected

Customer Loyalty

Market Share

Product Quality

Top Management

Critical Success Factors

Your

Company

Competitive Profile Matrix (CPM)

Competitor Competitor

Employee Dedication

Return to Start

Do not enter any data on this page. If data is missing

here, recheck the "START" page.. This page is not

protected so be careful.

External Factor Evaluation Matrix (EFE)

Opportunities

Weight Rating Weighted Score

1. 0 0.00 0 0.00

2. 0 0.00 0 0.00

3. 0 0.00 0 0.00

4. 0 0.00 0 0.00

5. 0 0.00 0 0.00

6. 0 0.00 0 0.00

7. 0 0.00 0 0.00

8. 0 0.00 0 0.00

9. 0 0.00 0 0.00

10. 0 0.00 0 0.00

Threats

Weight Rating Weighted Score

1. 0 0.00 0 0.00

2. 0 0.00 0 0.00

3. 0 0.00 0 0.00

4.

0 0.00 0 0.00

5. 0 0.00 0 0.00

6.

0 0.00 0 0.00

7. 0 0.00 0 0.00

8. 0 0.00 0 0.00

9. 0 0.00 0 0.00

10. 0 0.00 0 0.00

TOTALS 0.00 0.00

Internal Factor Evaluation Matrix (IFE)

Strengths Weight Rating Weighted Score

1. 0 0.00 0 0.00

2. 0 0.00 0 0.00

3. 0 0.00 0 0.00

4. 0 0.00 0 0.00

If your text is not showing highlight it (be careful not to click), use the text wrap option under the "home" Tab on Excel 2007. You may have to click it three times. Then expand the rows with your mouse if needed.

5. 0 0.00 0 0.00

6. 0 0.00 0 0.00

7. 0 0.00 0 0.00

8. 0 0.00 0 0.00

9. 0 0.00 0 0.00

10.

0 0.00 0 0.00

Weaknesses Weight Rating Weighted Score

1. 0 0.00 0 0.00

2. 0 0.00 0 0.00

3. 0 0.00 0 0.00

4. 0 0.00 0 0.00

5. 0 0.00 0 0.00

6. 0 0.00 0 0.00

7. 0 0.00 0 0.00

8. 0 0.00 0 0.00

9. 0 0.00 0 0.00

10. 0 0.00 0 0.00

TOTALS 0.00 0.00

Return to Start

If your text is not showing highlight it (be careful not to click), use the text wrap option under the "home" Tab on Excel 2007. You may have to click it three times. Then expand the rows with your mouse if needed.

Return to Start

If your text is not showing highlight it (be careful not to click), use the text wrap option under the "home" Tab on Excel 2007. You may have to click it three times. Then expand the rows with your mouse if needed.

High +20 Star

Industry

Sales

Growth Medium 0 Cash Cow

Rate

(Percentage)

Low -20

Scroll down for 3 and 4 division BCG

Don't worry about the axis spacing here. This will look perfect in Word and PowerPoint.

High Medium Low

1.0 .50 0.0

Relative Market Share Position

800

500

High +20 Star

Industry

Sales

Growth Medium 0 Cash Cow

Rate

(Percentage)

Low -20

High +20 Star

High Medium Low

1.0 .50 0.0

Relative Market Share Position

High Medium Low

1.0 .50 0.0

Relative Market Share Position

Industry

Sales

Growth Medium 0 Cash Cow

Rate

(Percentage)

Low -20

Return to START

Question Mark

Profits

Domestic

Domestic 500

International 800

International

International 800

Domestic 500

Dog

<Don't type in the red boxes below, this sheet is not protected so be careful>

Scroll down for 3 and 4 division BCG

Don't worry about the axis spacing here. This will look perfect in Word and PowerPoint.

High Medium Low

1.0 .50 0.0

Relative Market Share Position

Question Mark

Men

Profit

Remaning Profits

Women

Profit

Remaning Profits

Dog

Children

Profit

Remaning Profits

Question Mark

North America

Profit

Remaning Profits

South America

High Medium Low

1.0 .50 0.0

Relative Market Share Position

High Medium Low

1.0 .50 0.0

Relative Market Share Position

Profit

Remaning Profits

Dog

Asia

Profit

Remaning Profits

Europe

Profit

Remaning Profits

<Don't type in the red boxes below, this sheet is not protected so be careful>

20

80

70

30

10

90

5

115

5

115

40

80

70

50

Return to START

4.0 I II III

High

3.0 IV V VI

The

EFE

Total Medium

Weighted

Scores

2.0 VII VIII IX

Low

1.0

4.0 I II III

High

scroll down for 3 and 4 division IE

Don't worry about axis spacing here. This will look perfect in Word and PowerPoint.

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

<This sheet is not protected so be careful>

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

The Total IFE Weighted Scores

The Total IFE Weighted Scores

3.0 IV V VI

The

EFE

Total Medium

Weighted

Scores

2.0 VII VIII IX

Low

1.0

4.0 I II III

High

3.0 IV V VI

The

EFE

Total Medium

Weighted

Scores

2.0 VII VIII IX

Low

The Total IFE Weighted Scores

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

1.0

<This sheet is not protected so be careful>

<Do Not Type In The Red Boxes Below> IF they are Blank Click The Link Below. This page is not protected, so you can really mess up the info in the red boxes. This page must be left unprotected so you can move the vector and box.

7

6

5

4

3

2

1

-7 -6 -5 -4 -3 -2 -1 1 2 3 4 5

-1

-2

-3

-4

-5

-6

-7

Internal Analysis: External Analysis:

Financial Position (FP) Stability Position (SP)

1

1

1

1

1

Financial Position (FP) Average 1.0 Stability Position (SP) Average

Internal Analysis: External Analysis:

Competitive Position (CP) Industry Position (IP)

-1

Rate of Inflation

Technological Changes

Price Elasticity of Demand

Competitive Pressure

Barriers to Entry into Market

Growth Potential Market Share

Return on Investment (ROI)

Leverage

Liquidity

Working Capital

Cash Flow

Move the Arrow and the box with your mouse.

CP

Defensive

Aggressive Conservative

FP

Competitive

SP

<Do Not Type In The Red Boxes Below> IF they are Blank Click The Link Below. This page is not protected, so you can really mess up the info in the red boxes. This page must be left unprotected so you can move the vector and box.

X-axis 1.0

Y-axis -3.4

6 7

-7

-6

-5

-2

-2

Stability Position (SP) Average -4.4

2

Return to Start

Rate of Inflation

Technological Changes

Price Elasticity of Demand

Competitive Pressure

IP

Barriers to Entry into Market

Growth Potential

Aggressive

Competitive

<Do Not Type In The Red Boxes Below> IF they are Blank Click The Link Below. This page is not protected, so you can really mess up the info in the red boxes. This page must be left unprotected so you can move the vector and box.

This page is protected.

0

0

0

Rapid Market Growth

Quadrant II Quadrant I

0

Slow Market Growth

Weak

Competitive

Position

Quadrant III Quadrant IV

Return to Start

Quadrant I

0

Strong

Competitive

Position

Quadrant IV

This page is not protected, so be careful.

Opportunities

Weight AS TAS AS

TAS

1. 0 0.00 1 0.00 2 0.00

2. 0 0.00 1 0.00 2 0.00

3. 0 0.00 1 0.00 2 0.00

4. 0

0.00 1 0.00 2 0.00

5. 0 0.00 1 0.00 2 0.00

6. 0

0.00 1 0.00 2 0.00

7. 0 0.00 1 0.00 2 0.00

8. 0 0.00 1 0.00 2 0.00

9. 0 0.00 1 0.00 2 0.00

10. 0 0.00 1 0.00 2 0.00

Threats

Weight AS TAS AS

TAS

1. 0 0.00 3 0.00 4 0.00

2. 0 0.00 3 0.00 4 0.00

3. 0 0.00 3 0.00 4 0.00

4. 0 0.00 3 0.00 4 0.00

5. 0 0.00 3 0.00 4 0.00

6. 0 0.00 3 0.00 4 0.00

7. 0 0.00 3 0.00 4 0.00

8. 0 0.00 3 0.00 4 0.00

9. 0 0.00 3 0.00 4 0.00

10. 0 0.00 3 0.00 4 0.00

scroll down

Strengths

Weight AS TAS AS

TAS

1. 0 0.00 3 0.00 2 0.00

2. 0 0.00 3 0.00 2 0.00

If your text is not showing highlight it (be careful not to click), use the text wrap option under the "home" Tab on Excel 2007. You may have to click it three times. Then expand the rows with your mouse if needed.

0 0

0 0

Click here to Return to Start

3. 0 0.00 3 0.00 2 0.00

4. 0 0.00 3 0.00 2 0.00

5. 0 0.00 3 0.00 2 0.00

6. 0 0.00 3 0.00 2 0.00

7. 0 0.00 3 0.00 2 0.00

8. 0 0.00 3 0.00 2 0.00

9. 0 0.00 3 0.00 2 0.00

10. 0 0.00 3 0.00 2 0.00

Weaknesses Weight AS TAS AS TAS

1. 0 0.00 0 0.00 0 0.00

2. 0 0.00 3 0.00 0 0.00

3. 0 0.00 3 0.00 0 0.00

4. 0 0.00 0 0.00 2 0.00

5. 0 0.00 0 0.00 2 0.00

6. 0 0.00 0 0.00 2 0.00

7. 0 0.00 0 0.00 2 0.00

8. 0 0.00 0 0.00 2 0.00

9. 0 0.00 0 0.00 2 0.00

10. 0 0.00 2 0.00 2 0.00

TOTALS 0.00 0.00

If your text is not showing highlight it (be careful not to click), use the text wrap option under the "home" Tab on Excel 2007. You may have to click it three times. Then expand the rows with your mouse if needed.

Click here to Return to Start

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

SO Strategies

ST Strategies

Add your information below.

WO Strategies

WT Strategies

Click Here to Return to Start Page

SO Strategies

ST Strategies

WO Strategies

WT Strategies

You might also like

- Copia de Free-Excel-Student-Template May 2013Document145 pagesCopia de Free-Excel-Student-Template May 2013Jorge Martin Doroteo RojasNo ratings yet

- Excel Template For Finding Out Company's Details May 2013Document144 pagesExcel Template For Finding Out Company's Details May 2013Sudhindra T KumaraNo ratings yet

- Free Excel Student Template October 20141Document140 pagesFree Excel Student Template October 20141Sthephany Granados0% (1)

- All Matrix PrototypeDocument100 pagesAll Matrix PrototypeTahirNo ratings yet

- Business ModelingDocument145 pagesBusiness Modelingsahashuvo90No ratings yet

- Template_16_4_30_21Document85 pagesTemplate_16_4_30_21Giang NgânNo ratings yet

- Excel As A Tool in Financial Modelling: Basic Excel in BriefDocument36 pagesExcel As A Tool in Financial Modelling: Basic Excel in Briefnikita bajpaiNo ratings yet

- Excel 2007 Chapter 6 and 7Document37 pagesExcel 2007 Chapter 6 and 7sujai_saNo ratings yet

- Excel Financial Modeling BasicsDocument36 pagesExcel Financial Modeling BasicsSanyam SinghNo ratings yet

- Template IFE-EFE Matrks - Kelompok 6Document99 pagesTemplate IFE-EFE Matrks - Kelompok 6people pressureNo ratings yet

- Excel Help 01Document23 pagesExcel Help 01KeashanJayaweeraNo ratings yet

- SM Frameworks-Group 5Document89 pagesSM Frameworks-Group 5Junaid AhmadNo ratings yet

- GE Tutorial PDFDocument11 pagesGE Tutorial PDFjegosssNo ratings yet

- Excel Data Validation RulesDocument14 pagesExcel Data Validation RulesNomaan TanveerNo ratings yet

- Excel Advanced Pivot TablesDocument26 pagesExcel Advanced Pivot TablesMCTCOLTD100% (1)

- Spreadsheet Lab Assignment GuideDocument23 pagesSpreadsheet Lab Assignment Guidesunn24orama7381No ratings yet

- Xin Yao ITSS 3300 07/04/2020Document10 pagesXin Yao ITSS 3300 07/04/2020VIKRAM KUMARNo ratings yet

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- Processing Is Broken Down Into Simple Steps: Ravi Jaiswani FMA Quiz 2Document5 pagesProcessing Is Broken Down Into Simple Steps: Ravi Jaiswani FMA Quiz 2RAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Ex Ell Decision MakingDocument14 pagesEx Ell Decision MakingHerdiyantoGoAheadNo ratings yet

- Mastering Excel To Save Precious TimeDocument33 pagesMastering Excel To Save Precious TimedillehNo ratings yet

- Flat File AutoAccessory inDocument4,760 pagesFlat File AutoAccessory inSakthi SaravananNo ratings yet

- Excel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007From EverandExcel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007No ratings yet

- Flat - File.jewelry 2015 MPDocument5,104 pagesFlat - File.jewelry 2015 MPAurora Garcia Dela CruzNo ratings yet

- Excel Formulas & FunctionsDocument22 pagesExcel Formulas & Functions5iregarNo ratings yet

- 10+ Simple Yet Powerful Excel Tricks for Data AnalysisDocument8 pages10+ Simple Yet Powerful Excel Tricks for Data Analysissamar1976No ratings yet

- Flat File ShoesDocument1,659 pagesFlat File ShoesRahul AgarwalNo ratings yet

- Excel tips for building modelsDocument17 pagesExcel tips for building modelscoolmanzNo ratings yet

- Calculate variable costs and contribution margins in Power BIDocument12 pagesCalculate variable costs and contribution margins in Power BIEmon HossainNo ratings yet

- PowerBIPRIAD Lab05ADocument27 pagesPowerBIPRIAD Lab05AJaved KhanNo ratings yet

- Template Builder For Word TutorialDocument8 pagesTemplate Builder For Word TutorialAshutosh UpadhyayNo ratings yet

- Dulha RahulDocument57 pagesDulha RahulranjeetNo ratings yet

- LP4.1 Assignment - Chapter 4 Text ProblemsDocument10 pagesLP4.1 Assignment - Chapter 4 Text ProblemslisaNo ratings yet

- How To Make A PERT-CPM Chart and SWOT AnalysisDocument8 pagesHow To Make A PERT-CPM Chart and SWOT Analysis'Ronnel Cris ⎝⏠⏝⏠⎠ Consul'0% (1)

- TITC Final Exam Study Questions IOU PsichologyDocument8 pagesTITC Final Exam Study Questions IOU PsichologyElwyn Rahmat HidayatNo ratings yet

- Access PracticeDocument4 pagesAccess Practicemark1matthewsNo ratings yet

- Tutorial Rapid Miner Life Insurance Promotion PDFDocument11 pagesTutorial Rapid Miner Life Insurance Promotion PDFAnonymous atrs1INo ratings yet

- Using your Inventory File Template Print this pageDocument1,688 pagesUsing your Inventory File Template Print this pageS KNo ratings yet

- Welcome To The Topic On The Import From Excel UtilityDocument19 pagesWelcome To The Topic On The Import From Excel UtilityMCrisNo ratings yet

- 27 Excel Hacks To Make You A Superstar PDFDocument33 pages27 Excel Hacks To Make You A Superstar PDFellaine mirandaNo ratings yet

- Estimatepro HelpDocument17 pagesEstimatepro HelpNavin KumarNo ratings yet

- Creating A Report Using The Report WizardDocument9 pagesCreating A Report Using The Report WizardSwapnil YeoleNo ratings yet

- Microsoft Excel ThesisDocument6 pagesMicrosoft Excel Thesistracyclarkwarren100% (2)

- Create A Sentiment Analysis Worksheet in ExcelDocument9 pagesCreate A Sentiment Analysis Worksheet in ExcelAnthony LunaNo ratings yet

- Allegro (Smart Sheet) PDFDocument5 pagesAllegro (Smart Sheet) PDFNoureddine DjerroudNo ratings yet

- Office 365 TCO Tool v3 User GuideDocument20 pagesOffice 365 TCO Tool v3 User GuideSant.santiNo ratings yet

- Excel Data Entry TipsDocument6 pagesExcel Data Entry TipsMojca ImasNo ratings yet

- Using Analytic Solver Appendix4Document16 pagesUsing Analytic Solver Appendix4CDH2346No ratings yet

- Xmlptem Platesbyexample yDocument15 pagesXmlptem Platesbyexample yMudit MishraNo ratings yet

- Create Stunning, Insightful Dashboard Reports Like These, Using Only Excel..Document5 pagesCreate Stunning, Insightful Dashboard Reports Like These, Using Only Excel..Rahdi SumitroNo ratings yet

- 7 Data Handling Techniques in ExcelDocument22 pages7 Data Handling Techniques in ExcelChandniNo ratings yet

- 10th Praticals ExcelDocument10 pages10th Praticals ExcelEA0792 Y VenkateshNo ratings yet

- Working With Forms in Hyperion Smart ViewDocument21 pagesWorking With Forms in Hyperion Smart ViewprernachughNo ratings yet

- L4 Revised 2023Document24 pagesL4 Revised 2023Garie PanganibanNo ratings yet

- Template Builder For Word Tutorial - enDocument12 pagesTemplate Builder For Word Tutorial - enBhargav Reddy ReddivariNo ratings yet

- IT SKILLS FILE Anjali MishraDocument24 pagesIT SKILLS FILE Anjali MishraAnjali MishraNo ratings yet

- OPTIMIZE PRODUCT DESIGN WITH CONJOINT ANALYSISDocument20 pagesOPTIMIZE PRODUCT DESIGN WITH CONJOINT ANALYSISsakura_0914No ratings yet

- Creating Reports in Oracle E-Business Suite Using XML PublisherDocument49 pagesCreating Reports in Oracle E-Business Suite Using XML PublisherRishabh BhagchandaniNo ratings yet

- Envizi L4 POX - Setup custom factors.pdfDocument8 pagesEnvizi L4 POX - Setup custom factors.pdfzvranicNo ratings yet

- Belonging Through A Psychoanalytic LensDocument237 pagesBelonging Through A Psychoanalytic LensFelicity Spyder100% (1)

- Leku Pilli V Anyama (Election Petition No 4 of 2021) 2021 UGHCEP 24 (8 October 2021)Document52 pagesLeku Pilli V Anyama (Election Petition No 4 of 2021) 2021 UGHCEP 24 (8 October 2021)Yokana MugabiNo ratings yet

- Ejercicio 1.4. Passion Into ProfitDocument4 pagesEjercicio 1.4. Passion Into ProfitsrsuaveeeNo ratings yet

- Notes Socialism in Europe and RussianDocument11 pagesNotes Socialism in Europe and RussianAyaan ImamNo ratings yet

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingDocument2 pagesJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiNo ratings yet

- Javascript The Web Warrior Series 6Th Edition Vodnik Test Bank Full Chapter PDFDocument31 pagesJavascript The Web Warrior Series 6Th Edition Vodnik Test Bank Full Chapter PDFtina.bobbitt231100% (10)

- Nazi UFOs - Another View On The MatterDocument4 pagesNazi UFOs - Another View On The Mattermoderatemammal100% (3)

- Edition 100Document30 pagesEdition 100Tockington Manor SchoolNo ratings yet

- Barra de Pinos 90G 2x5 P. 2,54mm - WE 612 010 217 21Document2 pagesBarra de Pinos 90G 2x5 P. 2,54mm - WE 612 010 217 21Conrado Almeida De OliveiraNo ratings yet

- Role of Rahu and Ketu at The Time of DeathDocument7 pagesRole of Rahu and Ketu at The Time of DeathAnton Duda HerediaNo ratings yet

- Environmental Science PDFDocument118 pagesEnvironmental Science PDFJieyan OliverosNo ratings yet

- Md. Raju Ahmed RonyDocument13 pagesMd. Raju Ahmed RonyCar UseNo ratings yet

- Research PhilosophyDocument4 pagesResearch Philosophygdayanand4uNo ratings yet

- Kids' Web 1 S&s PDFDocument1 pageKids' Web 1 S&s PDFkkpereiraNo ratings yet

- P.E 4 Midterm Exam 2 9Document5 pagesP.E 4 Midterm Exam 2 9Xena IngalNo ratings yet

- Offer Letter for Tele Sales ExecutiveDocument3 pagesOffer Letter for Tele Sales Executivemamatha vemulaNo ratings yet

- 05 Gregor and The Code of ClawDocument621 pages05 Gregor and The Code of ClawFaye Alonzo100% (7)

- Should Animals Be Banned From Circuses.Document2 pagesShould Animals Be Banned From Circuses.Minh Nguyệt TrịnhNo ratings yet

- BICON Prysmian Cable Cleats Selection ChartDocument1 pageBICON Prysmian Cable Cleats Selection ChartMacobNo ratings yet

- 4AD15ME053Document25 pages4AD15ME053Yàshánk GøwdàNo ratings yet

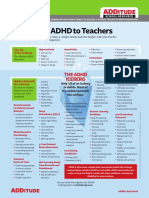

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Tata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleDocument1 pageTata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleMahajan VickyNo ratings yet

- Jaap Rousseau: Master ExtraodinaireDocument4 pagesJaap Rousseau: Master ExtraodinaireKeithBeavonNo ratings yet

- Midgard - Player's Guide To The Seven Cities PDFDocument32 pagesMidgard - Player's Guide To The Seven Cities PDFColin Khoo100% (8)

- Supreme Court declares Pork Barrel System unconstitutionalDocument3 pagesSupreme Court declares Pork Barrel System unconstitutionalDom Robinson BaggayanNo ratings yet

- 2 - How To Create Business ValueDocument16 pages2 - How To Create Business ValueSorin GabrielNo ratings yet

- Topic 1 in 21st CneturyDocument8 pagesTopic 1 in 21st CneturyLuwisa RamosNo ratings yet

- Ultramat 2 instructions for useDocument2 pagesUltramat 2 instructions for useBalaji BalasubramanianNo ratings yet

- Brain Chip ReportDocument30 pagesBrain Chip Reportsrikanthkalemla100% (3)

- 2010 Economics Syllabus For SHSDocument133 pages2010 Economics Syllabus For SHSfrimpongbenardghNo ratings yet