Professional Documents

Culture Documents

DPL2

Uploaded by

Jordan ReeseCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DPL2

Uploaded by

Jordan ReeseCopyright:

Available Formats

DPL2

TERMS:

o The Borrower selected a US denominated, Commitment-linked IBRD

o Flexible Loan with a variable spread, with level repayments on June 1 and December 1 of each

year, with a Grace Period of 10 years and a Final Maturity of 25 years, with all conversion

options selected.

o The Front EndFee and the Premia for Interest Rate Caps and Collars will be capitalized.

o The Lending Rate for the Loan would be US$ 6 month LIBOR + variable spread (resets every 6

months). The Lending Rate would be approximately:

0.344% (US$ 6 month LIBOR) + 0.47% (variable spread) = 0.814% based on today's rates.

PROPOSED QUICK-DISBURSING BUDGET SUPPORT OPERATION

This document describes a proposed US$500 million Supplemental Financing to the second operation in

the programmatic development policy lending series (DPL2). The Philippines DPL series, launched in

2011, aims to support the Governments objective of fostering more inclusive growth. The proposed

Supplemental Financing to the DPL2 will assist in addressing the unanticipated financing gap caused by

the unprecedented magnitude of the typhoon which could jeopardize the Government's reform

program.

A new investment operation to support medium-term reconstruction needs. Based on the

Governments reconstruction plans, still to be defined, the Bank could prepare a new investment or

results-based (Program for Results) operation to support post-recovery and reconstruction efforts by

national and local governments. A typical package could include financing of: (i) critical infrastructure

and lifelines such as water supply, sanitation, roads, electricity transmission, or temporary housing; (ii)

reconstruction of and retrofitting to new standards of public buildings (e.g. schools, hospitals,

emergency response facilities); (iii) livelihood restoration; and (iv) restoration of urban and rural housing

and settlements, including through voucher grant financing to poor and vulnerable households.

In parallel, the Bank will continue to provide technical assistance to manage the risk from natural

hazards and future catastrophic events. It would achieve this through: (i)\ prioritization and retrofitting

of key public buildings (schools and hospitals) and utilities (water, gas, electricity supply and distribution

infrastructure); (ii) improving the preparedness and capacities for disaster risk management and

response; 12 (iii) strengthening risk-informed land use and development planning at the disaster-prone

LGUs; (iv) enhancing disaster risk financing capacity through support to the institutional strengthening

and contingent liability risk transfer tools in order to achieve fiscal resilience in times of calamity.

The IFC is also ready to provide advisory and financing support for the private sector. The IFC is in

contact with its client banks (universal banks, thrift/rural banks, and microfinance institutions) to

develop specific programs to facilitate private sector recovery. Financing facilities including risk share

facilities and advisory services could be extended to private sector banks in order to help small and

medium size companies in the affected areas recover. IFC is also reaching out by extending financing to

power transmission and generation companies to repair damage caused by the typhoon, as well as for

rebuilding of hotel and retail facilities in the affected areas.

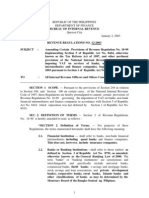

World Bank

(IBRD)

Bangko Sentral

ng Pilipinas in

US $

Tranferred to

Government

Account

Available to

Finance

Budgeted

Expenditures

Account in

Philippine

General Fund

Borrower's

Budget System

in PH

Fund Now

Available for

Budget

Expenditures

Written

Confirmation

of Accounting

Completion to

WB

IFC is also planning to conduct an Emerging Market Mapping and Analysis (EMMA). This is a market

analysis to determine the best approach for humanitarian groups to carry out emergency responses as

well as determine the appropriate delivery of investments or advisory services to restore private sector

activities.

For instance, the DOF has been working with the Bank on catastrophe risk modeling. The model can

evaluate options for risk transfer (e.g., insurance, catastrophe pool) in order to minimize and efficiently

manage the fiscal burden of disaster impacts.

FUNDS FLOW AND AUDITING REQUIREMENTS FOR THE SUPPLEMENTAL FINANCING

The proceeds from the loan will be deposited into a deposit account in US dollars at the Central Bank or

Bangko Sentral ng Pilipinas (BSP). The equivalent local currency amount will immediately be transferred

to an account of the government available to finance budgeted expenditures. After disbursement of the

loan, the Government will ensure that the equivalent Peso amount of this loan amount is promptly

accounted for (in Philippine Pesos) in the Borrowers budget system in the General Fund, and thereby be

available to finance budgetexpenditures. The Borrower will provide to the Bank a written confirmation

that this accounting has been completed.

Disbursement of the loan will not be linked to any specific purchases and no procurement requirements

have to be satisfied. The proceeds of the operation would not be used to finance expenditures excluded

under the Loan Agreement. If, after being deposited in a government account, the proceeds of the loan

are used for ineligible purposes as defined in the Loan Agreement, the Bank will require the Borrower to

refund the amount directly to the Bank.

(KALAHI-CIDSS National Community Driven Development Project)

Part 1. Barangay (Community) Sub-Grants for Planning and Investment

(a) Provision of Sub-grants to beneficiary Barangays to: (i) carry out specific

activities for the orientation, consultation, participatory priority-setting, action planning,

review and approval of Sub-projects at Barangay and inter-Barangay (municipal) levels,

including the provision of technical assistance to ensure the quality of design and

development of community infrastructure, facilities, services and other priority activities

identified by communities; and (ii) develop and/or improve community-identified priority

infrastructure, facilities and services and other priority activities identified by

communities, including activities in response to an Eligible Crisis or Emergency, as

needed.

(b) Provision of training and other technical support to strengthen the

capacity of community volunteers to facilitate the implementation of Sub-projects.

Part 2. Local Capacity Building and Implementation Support

Carrying out of specific activities to strengthen the capacity of local government

units and area coordination teams to conduct poverty reduction action planning, budget

execution and public financial management, including to facilitate and oversee the

planning and implementation of Sub-projects; carrying out of specific activities to

strengthen the capacity of relevant sector and sub-national units and staff of national

government agencies to enhance their community based activities; and review and

revision of legal instruments, policies and guidelines to integrate and mainstream

community-driven development principles.

Part 3. Project Administration, Monitoring and Evaluation

Carrying out of the day-to-day coordination, administration, procurement,

financial management, environmental and social management; communication and

dissemination of information to sensitize stakeholders to the Project's objectives,

strategies and lessons learned; monitoring, evaluation and audit of the Project at the

national, regional and sub-regional levels, including the carrying out of relevant studies-6-

for the purposes of the Project such as reviews of the technical quality of infrastructure,

economic rates of return on investments, process monitoring of procedural variations in

different contexts (conflict, disasters, indigenous populations), and analyses of outcomes

of different methodological approaches; and provision of operational assistance to

regional and municipal offices of DSWD in disaster affected areas to reestablish

operational capacity.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Topic 3 Managing A Law FirmDocument34 pagesTopic 3 Managing A Law FirmsyakirahNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Common Accounting HeadsDocument3 pagesCommon Accounting HeadsPremanand Shenoy100% (3)

- TRANSPORTATION AND PUBLIC UTILITY LAW REVIEWERDocument104 pagesTRANSPORTATION AND PUBLIC UTILITY LAW REVIEWERJordan Reese100% (1)

- Quiziz Compilation Chapter 1-3 Govt AccountingDocument12 pagesQuiziz Compilation Chapter 1-3 Govt AccountingReggie Alis100% (1)

- Philippine Deposit Insurance Corporation ExplainedDocument9 pagesPhilippine Deposit Insurance Corporation ExplainedJust ForNo ratings yet

- Dingcong vs. KanaanDocument1 pageDingcong vs. KanaanJordan ReeseNo ratings yet

- Word DocumentDocument6 pagesWord DocumentJordan ReeseNo ratings yet

- Bir RR 12-2003Document10 pagesBir RR 12-2003HjktdmhmNo ratings yet

- BIR RMC 17 2006Document2 pagesBIR RMC 17 2006Mary Anne BantogNo ratings yet

- Bir RR 12-2003Document10 pagesBir RR 12-2003HjktdmhmNo ratings yet

- Dela Cruz Vs PeopleDocument2 pagesDela Cruz Vs PeopleJordan ReeseNo ratings yet

- RR 09-2004 of The Bureau of Internal RevenueDocument13 pagesRR 09-2004 of The Bureau of Internal RevenuecompaddictNo ratings yet

- Nacu Vs CSCDocument2 pagesNacu Vs CSCJordan ReeseNo ratings yet

- LAGMAY City of Naga Vs AgnaDocument3 pagesLAGMAY City of Naga Vs AgnaJordan ReeseNo ratings yet

- Protecting Exclusive Distribution RightsDocument5 pagesProtecting Exclusive Distribution RightsJordan ReeseNo ratings yet

- 47 Lagmay Gan Vs YapDocument1 page47 Lagmay Gan Vs YapJordan ReeseNo ratings yet

- Mustang Lumber V CADocument3 pagesMustang Lumber V CAJordan ReeseNo ratings yet

- Najera V de Asis - Comment To Petition - 4Document8 pagesNajera V de Asis - Comment To Petition - 4Jordan ReeseNo ratings yet

- (Puboff) (Reyes v. Rural Bank of San Miguel) (Francisco)Document4 pages(Puboff) (Reyes v. Rural Bank of San Miguel) (Francisco)Jordan ReeseNo ratings yet

- (Puboff) (Reyes v. Rural Bank of San Miguel) (Francisco)Document4 pages(Puboff) (Reyes v. Rural Bank of San Miguel) (Francisco)Jordan ReeseNo ratings yet

- Alvarado vs. GaviolaDocument3 pagesAlvarado vs. GaviolaJordan ReeseNo ratings yet

- Foreign Supervisor PerformaDocument2 pagesForeign Supervisor PerformaMushtaq Hussain Khan100% (3)

- United States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportDocument17 pagesUnited States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportChapter 11 DocketsNo ratings yet

- Soal Bahasa Inggris Kelas 12Document14 pagesSoal Bahasa Inggris Kelas 12siti maroatul janahNo ratings yet

- 272 1 1337 1 10 20190716 PDFDocument8 pages272 1 1337 1 10 20190716 PDFSubu MariapanNo ratings yet

- PFP-Workshop & Tutorial 7-April 2023-Suggested SolutionsDocument17 pagesPFP-Workshop & Tutorial 7-April 2023-Suggested SolutionsChristine VunNo ratings yet

- Profit and Loss Statement TemplateDocument3 pagesProfit and Loss Statement TemplateMervat AboureslanNo ratings yet

- UTTARA BANK Formula SheetDocument15 pagesUTTARA BANK Formula SheetAlamesuNo ratings yet

- Executive Summary - BD Thai FoodDocument3 pagesExecutive Summary - BD Thai Foodmunna zamanNo ratings yet

- IDirect Media SectorUpdate June22Document4 pagesIDirect Media SectorUpdate June22bradburywillsNo ratings yet

- Auditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDocument12 pagesAuditing Standards and Practices Council: Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresnikNo ratings yet

- The Wall Street Journal - 01.09.22Document28 pagesThe Wall Street Journal - 01.09.22Ra DaniloNo ratings yet

- LedgerDocument4 pagesLedgerஒப்பிலியப்பன்No ratings yet

- Angol Szakmai Szobeli TetelekDocument19 pagesAngol Szakmai Szobeli Tetelekgiranzoltan100% (1)

- Case StudyDocument19 pagesCase Studynida100% (3)

- FYBCOM Business IntroductionDocument290 pagesFYBCOM Business IntroductionMaggie Wa Magu0% (1)

- Corey Brothers (1897) A.C. 286Document13 pagesCorey Brothers (1897) A.C. 286Ashish AroraNo ratings yet

- CountrySpecificFunctionalityGuide Mexico 905 700Document35 pagesCountrySpecificFunctionalityGuide Mexico 905 700Victor Motolinia100% (1)

- Chap - 9 Book Keeping XI HALLDocument114 pagesChap - 9 Book Keeping XI HALLKirtee TiwariNo ratings yet

- Application To Open An Account: Individual Tier IiiDocument11 pagesApplication To Open An Account: Individual Tier IiiUche Maxwell TivolyNo ratings yet

- SSDDDocument2 pagesSSDDDan NgugiNo ratings yet

- Asian Godfathers: Focus Take-AwaysDocument5 pagesAsian Godfathers: Focus Take-AwaysDarwin SutjiawanNo ratings yet

- Research Paper Topics in Corporate FinanceDocument7 pagesResearch Paper Topics in Corporate Financeefecep7d100% (1)

- Ms. Aye Aye Mar: Work Experience ProfileDocument2 pagesMs. Aye Aye Mar: Work Experience ProfileJob GoNo ratings yet

- Avi Volunteer GuidebookDocument44 pagesAvi Volunteer GuidebookReuben Henry HartNo ratings yet

- Gtbank ProposalDocument18 pagesGtbank Proposalmeaudmajor majwalaNo ratings yet

- Risq Vba JDDocument6 pagesRisq Vba JDabhijeetkaushalNo ratings yet