Professional Documents

Culture Documents

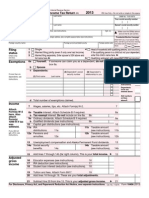

2013 Form IL-1040: Personal Information

Uploaded by

vimal_pro222-scribd0 ratings0% found this document useful (0 votes)

42 views2 pagesillinois doc

Original Title

2013 IL-1040

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentillinois doc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views2 pages2013 Form IL-1040: Personal Information

Uploaded by

vimal_pro222-scribdillinois doc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Illinois Department of Revenue

Individual Income Tax Return

Do not write above this line.

IL-1040 front (R-12/13)

2013 Form IL-1040

Step 1: Personal Information

1 Federal adjusted gross income from your U.S. 1040, Line 37; U.S. 1040A, Line 21; or

U.S. 1040EZ, Line 4 1 .00

2 Federally tax-exempt interest and dividend income from your U.S. 1040 or 1040A, Line 8b;

or U.S. 1040EZ 2 .00

3 Other additions. Attach Schedule M. 3 .00

4 Total income. Add Lines 1 through 3. 4 .00

5 Social Security benets and certain retirement plan income

received if included in Line 1. Attach Page 1 of federal return. 5 .00

6 Illinois Income Tax overpayment included in U.S. 1040, Line 10 6 .00

7 Other subtractions. Attach Schedule M. 7 .00

Check if Line 7 includes any amount from Schedule 1299-C.

8 Add Lines 5, 6, and 7. This is the total of your subtractions. 8 .00

9 Illinois base income. Subtract Line 8 from Line 4. 9 .00

10 a Number of exemptions from your federal return x $2,100 a .00

b If someone can claim you as a dependent, see instructions. x $2,100 b .00

c Check if 65 or older: You + Spouse = x $1,000 c .00

d Check if legally blind: You + Spouse = x $1,000 d .00

Exemption allowance. Add Lines a through d. 10 .00

11 Residents: Net income. Subtract Line 10 from Line 9. Skip Line 12. 11 .00

12 Nonresidents and part-year residents:

Check the box that applies to you during 2013 Nonresident Part-year resident, and

write the Illinois base income from Schedule NR. Attach Schedule NR. 12 .00

13 Residents: Multiply Line 11 by 5% (.05). Cannot be less than zero.

Nonresidents and part-year residents: Write the tax from Schedule NR. 13 .00

14 Recapture of investment tax credits. Attach Schedule 4255. 14 .00

15 Income tax. Add Lines 13 and 14. Cannot be less than zero. 15 .00

16 Income tax paid to another state while an Illinois resident.

Attach Schedule CR. 16 .00

17 Property tax and K-12 education expense credit amount from

Schedule ICR. Attach Schedule ICR. 17 .00

18 Credit amount from Schedule 1299-C. Attach Schedule 1299-C. 18 .00

19 Add Lines 16, 17, and 18. This is the total of your credits. Cannot

exceed the tax amount on Line 15. 19 .00

20 Tax after nonrefundable credits. Subtract Line 19 from Line 15. 20 .00

or for scal year ending /

S

t

a

p

l

e

y

o

u

r

c

h

e

c

k

a

n

d

I

L

-

1

0

4

0

-

V

S

t

a

p

l

e

W

-

2

a

n

d

1

0

9

9

f

o

r

m

s

h

e

r

e

(Whole dollars only)

Step 2:

Income

Step 3:

Base

Income

Step 4:

Exemptions

Step 5:

Net

Income

Step 6:

Tax

Step 7:

Tax After

Non-

refundable

Credits

A Social Security numbers in the order they appear on your federal return

- - - -

Your Social Security number Spouses Social Security number

B Personal information

C Filing status (see instructions)

Single or head of household Married ling jointly Married ling separately Widowed

D Check if you are in a civil union (see instructions).

Your rst name and initial Your last name

Spouses rst name and initial Spouses last name

Mailing address (See instructions if foreign address) Apartment number

City State ZIP or Postal Code

Foreign Nation, if not United States (do not abbreviate)

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

*360001110*

Over 80% of taxpayers le electronically. It is easy and you will get your refund faster. Visit tax.illinois.gov.

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

21 Tax after nonrefundable credits from Page 1, Line 20 21 .00

22 Household employment tax. See instructions. 22 .00

23 Use tax on internet, mail order, or other out-of-state purchases from

UT Worksheet or UT Table in the instructions. Do not leave blank. 23 .00

24 Total Tax. Add Lines 21, 22, and 23. 24 .00

25 Illinois Income Tax withheld. Attach all W-2 and 1099 forms. 25 .00

26 Estimated payments from Forms IL-1040-ES and IL-505-I,

including overpayment applied from 2012 return 26 .00

27 Pass-through entity tax payments. Attach Schedule K-1-P or K-1-T. 27 .00

28 Earned Income Credit from Schedule ICR. Attach Schedule ICR. 28 .00

29 Total payments and refundable credit. Add Lines 25 through 28. 29 .00

30 Overpayment. If Line 29 is greater than Line 24, subtract Line 24 from Line 29. 30 .00

31 Underpayment. If Line 24 is greater than Line 29, subtract Line 29 from Line 24. 31 .00

32 Late-payment penalty for underpayment of estimated tax. 32 .00

a Check if at least two-thirds of your federal gross income is from farming.

b Check if you or your spouse are 65 or older and permanently

living in a nursing home.

c Check if your income was not received evenly during the year and

you annualized your income on Form IL-2210. Attach Form IL-2210.

d Check if you were not required to le an Illinois Individual Income Tax

return in the previous tax year.

33 Voluntary charitable donations. Attach Schedule G. 33 .00

34 Total penalty and donations. Add Lines 32 and 33. 34 .00

35 If you have an overpayment on Line 30 and this amount is greater than

Line 34, subtract Line 34 from Line 30. This is your remaining overpayment. 35 .00

36 Amount from Line 35 you want refunded to you. Check one box on Line 37. See instructions. 36 .00

37 I choose to receive my refund by

direct deposit - Complete the information below if you check this box.

Routing number

Checking or

Savings

Account number

Illinois Individual Income Tax refund debit card

paper check

38 Subtract Line 36 from Line 35. This amount will be applied to your 2014 estimated tax. 38 .00

39 If you have an underpayment on Line 31, add Lines 31 and 34. or

If you have an overpayment on Line 30 and this amount is less than Line 34,

subtract Line 30 from Line 34. This is the amount you owe. See instructions. 39 .00

Under penalties of perjury, I state that I have examined this return, and, to the best of my knowledge, it is true, correct, and

complete.

Your signature Date Daytime phone number Your spouses signature Date

Paid preparers signature Date Preparers phone number Preparers FEIN, SSN, or PTIN

IL-1040 back (R-12/13)

If no payment enclosed, mail to: If payment enclosed, mail to:

ILLINOIS DEPARTMENT OF REVENUE ILLINOIS DEPARTMENT OF REVENUE

PO BOX 1040 SPRINGFIELD IL 62726-0001

GALESBURG IL 61402-1040

DR AP RR DC IR

Step 8:

Other

Taxes

Step 9:

Payments

and

Refundable

Credit

Step 10:

Result

Step 11:

Underpayment

of Estimated Tax

Penalty and

Donations

Step 12:

Refund or

Amount You

Owe

Step 13:

Sign and

Date

Check, and complete below, to allow another person to discuss this return with the Illinois Department of Revenue.

Designees name (please print) Designees phone number

Third Party

Designee

Form 1099-G

Information

*360002110*

We no longer automatically mail 1099-G forms. Instead, we ask that you get this information from our website.

Check the box to receive a paper Form 1099-G next year, if you meet the criteria requiring us to issue a Form 1099-G.

Reset Print

You might also like

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Document2 pagesU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocument3 pages2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNo ratings yet

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyNo ratings yet

- 2015 TaxReturn GregAbbottDocument14 pages2015 TaxReturn GregAbbottDana ThompsonNo ratings yet

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525No ratings yet

- Mikeandjennykelly@Gmail - Com 2011Document6 pagesMikeandjennykelly@Gmail - Com 2011Melanie RoseNo ratings yet

- TAX Return ProjectDocument17 pagesTAX Return Projectqlcjung09No ratings yet

- 2014 Schedule NR: Nonresident and Part-Year Resident Computation of Illinois TaxDocument2 pages2014 Schedule NR: Nonresident and Part-Year Resident Computation of Illinois TaxDarius SamahNo ratings yet

- 2011 Federal 1040Document2 pages2011 Federal 1040Swati SarangNo ratings yet

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Taxes Are FunDocument2 pagesTaxes Are Funlfoirirjrkjbghghg999No ratings yet

- Glacier Tax User GuideDocument5 pagesGlacier Tax User Guideinter4ever77No ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- Scan 0001Document11 pagesScan 0001Kimmie3050% (2)

- 2013 Pennsylvania ReturnDocument2 pages2013 Pennsylvania ReturnVictoriaChristianDukesNo ratings yet

- Form 1040nrez 2010Document2 pagesForm 1040nrez 2010David A. VestNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Form 9465 (Installment Agreement Request)Document2 pagesForm 9465 (Installment Agreement Request)Benne JamesNo ratings yet

- I Pay Statements ServncoDocument2 pagesI Pay Statements ServncoPablito Padilla100% (2)

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNo ratings yet

- US Internal Revenue Service: p967 - 1996Document5 pagesUS Internal Revenue Service: p967 - 1996IRSNo ratings yet

- Marylynn Huggins - Clifden Ut State Tax Return 2013Document4 pagesMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- File 1040EZ Tax ReturnDocument1 pageFile 1040EZ Tax Return24male86No ratings yet

- US Internal Revenue Service: f2210f - 2003Document2 pagesUS Internal Revenue Service: f2210f - 2003IRSNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- Income Analysis WorksheetDocument11 pagesIncome Analysis WorksheetRajasekhar Reddy AnekalluNo ratings yet

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986No ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- US Internal Revenue Service: p967 - 1997Document5 pagesUS Internal Revenue Service: p967 - 1997IRSNo ratings yet

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanNo ratings yet

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- SCHEDULES A&B DEDUCTIONS AND INTEREST/DIVIDENDSDocument4 pagesSCHEDULES A&B DEDUCTIONS AND INTEREST/DIVIDENDSSyed Aziz HussainNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- Household Employment Taxes: Schedule H (Form 1040) 44Document2 pagesHousehold Employment Taxes: Schedule H (Form 1040) 44api-253299751No ratings yet

- 2015 Battle Creek Individual Income Tax Forms and InstructionsDocument24 pages2015 Battle Creek Individual Income Tax Forms and InstructionsHelpin HandNo ratings yet

- Calculate Federal and Provincial TaxesDocument36 pagesCalculate Federal and Provincial TaxesRyan YangNo ratings yet

- Employer's Annual Railroad Retirement Tax ReturnDocument4 pagesEmployer's Annual Railroad Retirement Tax Returneric_in_westyNo ratings yet

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Form 1040 Tax ReturnDocument2 pagesForm 1040 Tax ReturnHamzah B ShakeelNo ratings yet

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- US Internal Revenue Service: f2210f - 1995Document2 pagesUS Internal Revenue Service: f2210f - 1995IRSNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Alija Izetbegović - Islam Between East and West - NOT - COMPLETEDocument225 pagesAlija Izetbegović - Islam Between East and West - NOT - COMPLETEHmjaffar Mhj100% (9)

- Barriers of Free TradeDocument3 pagesBarriers of Free TradeangelikaNo ratings yet

- List of Guidelines Shifted To Archive: //192.168.4.1/e/public Enterprises (2018) /4077PE/4077PE (Annexure)Document36 pagesList of Guidelines Shifted To Archive: //192.168.4.1/e/public Enterprises (2018) /4077PE/4077PE (Annexure)vivekkaushikNo ratings yet

- States' cooperation key to ICC effectivenessDocument2 pagesStates' cooperation key to ICC effectivenesspradeep_dhote9No ratings yet

- HistoryDocument2 pagesHistoryKalliste HeartNo ratings yet

- Thoo Brahmanwad - DR BR Ambedkar BooksDocument294 pagesThoo Brahmanwad - DR BR Ambedkar BooksAdhar_Chawhan100% (1)

- Technological, Legal and Ethical ConsiderationsDocument21 pagesTechnological, Legal and Ethical ConsiderationsAngela Dudley100% (2)

- A Study On Women Safety in Public Transport in Lucknow by Pooja ShuklaDocument94 pagesA Study On Women Safety in Public Transport in Lucknow by Pooja ShuklaTahir HussainNo ratings yet

- Dr. Paul Cameron - Psychiatric Professions Falsely Claim Gays No More Apt To MolestDocument13 pagesDr. Paul Cameron - Psychiatric Professions Falsely Claim Gays No More Apt To MolestRuben MicleaNo ratings yet

- Gamboa v. Chan G.R. No. 193636 July 24, 2012 Justice Sereno FactsDocument3 pagesGamboa v. Chan G.R. No. 193636 July 24, 2012 Justice Sereno FactsBill MarNo ratings yet

- Pinochet CaseDocument42 pagesPinochet Casemilanfpn2010No ratings yet

- 6 Reason Why We Agree With Polygamy: 1. Qur'an Permits Limited Polygamy. Before The Qur'an Was Revealed, ThereDocument3 pages6 Reason Why We Agree With Polygamy: 1. Qur'an Permits Limited Polygamy. Before The Qur'an Was Revealed, ThereMad DanNo ratings yet

- State Directed DevelopmentDocument20 pagesState Directed DevelopmentDevendra Pal0% (1)

- Free Legal Form: Vehicle Deed of SaleDocument2 pagesFree Legal Form: Vehicle Deed of SaleArchie Joseph LlanaNo ratings yet

- Digest Moldex V SaberonDocument2 pagesDigest Moldex V SaberonJetJuárez100% (1)

- Review of Related Literature 2Document3 pagesReview of Related Literature 2Erick Anopol Del Monte100% (2)

- 5-Gatt, WtoDocument15 pages5-Gatt, WtoNitesh Kumar Jha100% (1)

- Women Empowerment - Through Panchayat Raj System - Law Times Journal PDFDocument6 pagesWomen Empowerment - Through Panchayat Raj System - Law Times Journal PDFShivaraj ItagiNo ratings yet

- Boothe v. Director of Patents GR No. L - 24919 January 28, 1980 FactsDocument1 pageBoothe v. Director of Patents GR No. L - 24919 January 28, 1980 FactsLei SantosNo ratings yet

- National Seminar BrochureDocument2 pagesNational Seminar BrochureRamachandran ThalaNo ratings yet

- Impact of Globalisation Social and Cultural Values in IndiaDocument37 pagesImpact of Globalisation Social and Cultural Values in IndiaRavikiranNo ratings yet

- Statutory Interpretation (Study Paper)Document10 pagesStatutory Interpretation (Study Paper)nhsajibNo ratings yet

- Break Criminal Syndicate Among Central Zoo Authority and Maneka Gandi Gang: Exposed by Naresh KadyanDocument53 pagesBreak Criminal Syndicate Among Central Zoo Authority and Maneka Gandi Gang: Exposed by Naresh KadyanNaresh KadyanNo ratings yet

- THailand UCS Achievement and ChallengesDocument124 pagesTHailand UCS Achievement and ChallengeshsrimediaNo ratings yet

- Gender Development Theories ExplainedDocument11 pagesGender Development Theories ExplainedMalik AmmarNo ratings yet

- 033 Intestate Estate of The Deceased Marcelo de BorjaDocument2 pages033 Intestate Estate of The Deceased Marcelo de BorjaKim Guevarra100% (1)

- United States Court of Appeals Third CircuitDocument7 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Race MixingDocument2 pagesRace MixingmansuradjvNo ratings yet

- Administrative Law Exam FrameworkDocument20 pagesAdministrative Law Exam FrameworkH100% (1)

- Kuzio Disinformation Soviet Origins of Contemporary Russian UkrainophobiaDocument39 pagesKuzio Disinformation Soviet Origins of Contemporary Russian UkrainophobiaOleh KostiukNo ratings yet