Professional Documents

Culture Documents

Report On Hyundai I20

Uploaded by

Sandarbh AgarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report On Hyundai I20

Uploaded by

Sandarbh AgarwalCopyright:

Available Formats

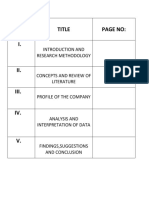

Page 1 of 10

SERIAL

No.

TOPIC

PAGE

No.

1.

ABOUT THE COMPANY

2.

2.

MARKET SHARE

2.

3.

GROWTH & DECLINE

3-5.

4.

MARKET TRENDS

5.

5.

SWOT ANALYSIS

6-7.

6.

CONSUMER BEHAVIOUR ANALYSIS

7-8.

7.

PRESENT MARKETING STRATEGIES

8-9.

8.

PROPOSED MARKETING STRATEGIES

9.

9.

OUR PROPOSALS FOR INCREASING MARKET

SHARE

9.

10.

REFERENCES

10.

CONTENTS

Page 2 of 10

Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai Motor

Company (HMC). Established in 1996.HMIL is the largest passenger car exporter and the

second largest car manufacturer in India. It currently markets nine car models across segments -

in the A2 segment it has the Eon, Santro, i10 and the i20, in the A3 segment the Accent and the

Verna, in the A4 segment the Elantra, in the A5 segment Sonata and in the SUV segment the

Santa Fe.

In 2008, HMIL also successfully completed 10 glorious years of operations in India and

to commemorate its achievements, initiated a unique trans-continental drive from Delhi to

Paris in two of its hugely popular i10 Kappa cars. The drive created automobile history by

completing a distance of 10,000km in just 17 days after which the i10s were showcased at

the Paris Motor Show in October. In fact it was at the Paris Motor Show that HMIL first

unveiled the Hyundai i20 and the car received a phenomenal response from the auto

enthusiasts across the world. Hyundai Motor India also accomplished the landmark of

producing the fastest 20th lakh cars in India in 2008.

In overall passenger vehicle market:

In the overall passenger vehicle market, Hyundai had a share of 14.27% in FY13.

In compact small car market:

The compact small car segment constituted 52% of the overall passenger vehicle market in the

country with sales of 1.41 million cars in FY13. Hyundai is on the 2

nd

position in the market with

22% share.

1.ABOUT THE COMPANY

2. MARKET SHARE

Page 3 of 10

In overall passenger vehicle market

In the first quarter ended June, it increased its market share to 15.67%.

Incompact small car market:

Hyundai managed to increase its market share to 25% and it expects the new cars to push this up

in the coming months.

a) PREMIUM HATCHBACKS GROWTH & DECLINE

India has a large proportion of first-time car buyers that are withering away due to the grim economic

conditions. Premium hatchbacks are additional cars in the family and the segment has taken a hit as

potential customers are postponing new purchases.

FROM 2012-13

Sales fell in 2012-13 by 7%, the highest in any fiscal over the past decade, demand has grown for entry-

level cars at the expense of the more aspirational models.

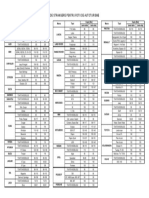

MANUFACTURER MODEL JUN'13 JUNE'12

GROWTH%(12-

13)

HYUNDAI i20 5628 7676 -26.681%

HONDA BRIO 2375 609 289.984%

MARUTI SUZUKI SWIFT 17236 15682 9.909%

VOLKSWAGEN POLO 3200 2418 32.341%

SKODA FABIA 132 594 -77.778%

TOYOTA LIVA 1951 2096 -6.918%

NISSAN MICRA 1989 1091 82.310%

3. GROWTH & DECLINE

Page 4 of 10

FIRST QUARTER FY13

Sales of premium hatchbacks slipped to 38,640 a month on average in first quarter of FY13

compared with 44,730 units in the year-ago period, a trend that reflects the broader market where

sales have continued to decline for the past seven months in a row.

Premium hatchback cars have failed to override the sluggish market conditions, with cumulative

sales in the once fastest-growing segment declining 14% in the first quarter of the year as buyers

switched to the cheaper entry-level models.

b) Hyundai i20 growth in market share

The i20 has been a strong performer with diesel and petrol power train. Its Uber life positioning

with sporty styling, premium features helped to differentiate to create a premium compact

segment and increase its market share in the compact segment.

The Hyundai i20, gained about 5.3% share in the segment during the first quarter of the year

2013 as the company pushed the petrol variant amid rising diesel prices and continued to refresh

the model.Hyundai's i20, which posted an impressive gain of 19% in sales, all other hatchback models

hit the reverse gear.

-26.681%

289.984%

9.909%

32.341%

-77.778%

-6.918%

82.310%

Sales growth in the FY 2012-13

HYUNDAI

HONDA

MARUTI SUZUKI

VOLKSWAGEN

SKODA

TOYOTA

NISSAN

Page 5 of 10

India has a large proportion of first-time car buyers that are withering away due to the grim

economic conditions. Premium hatchbacks are additional cars in the family and the segment has

taken a hit as potential customers are postponing new purchases.

From the past couple of years, it has been observed that most of the car manufacturers have

adopted a skeptical view in launching a new car in the luxury hatchback segment and most of the

cars are being launched in the hatchback segment.

Cars manufacturers are providing diesel variants for their current cars and new cars due to

increase in petrol prices. Many cars are being launched with ecofriendly and pocket friendly fuel

variants.

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

19%

-7%

-6%

-5%

-20%

-28%

-62%

sales change in first quarter for the

period 2012-13

sales change in first

quarter for the period

2012-13

H

O

N

D

A

B

R

I

O

M

A

R

U

T

I

S

U

Z

U

K

I

S

W

I

F

T

V

O

L

S

W

A

G

E

N

P

O

L

O

S

K

O

D

A

F

A

B

I

A

T

O

Y

O

T

A

L

I

V

A

N

I

S

S

A

N

M

I

C

R

A

H

y

u

n

d

a

i

i

2

0

4. MARKET TRENDS

Page 6 of 10

Strengths

The Quality Advantage: Hyundai owners experience fewer problems with their vehicles

than any other car manufacturer in India. Hyundai i20 gives features as provided by

luxurious cars.

A Buying Experience Like No Other: Hyundai has a sales network of 250 state-of-the-art

showrooms across 189 cities, with a workforce of over 6000 trained sales personnel to

guide the customers in finding the right car.

Weaknesses

Commodity Price Risks: Hyundai commodity price risks to higher costs due to changes

in prices of inputs such as steel, aluminum, plastics and rubber, which go into the

production of automobiles. In order to mitigate these risks, the company continues to

attempts to enter into long term contracts based on its projections of prices. They also

help minimize the impact of growing input prices.

Exchange Rate Risk: The Company is exposed to the risks associated with fluctuations in

foreign exchange rates mainly of import of components & raw materials and export of

vehicles. The company has a well-structured exchange risk management policy. The

company manages the exchange risk by using appropriate hedge instruments depending

on the prevailing market conditions and the view on the currency.

Opportunities

Hyundai i20s target is a demographic bracket below 35 years of age but there liessw potential to

expand its target base as there is a lot of appeal for older audience.

Limited completion in the segment could lead to Hyundai acquiring a grip on the market share

with introduction of variants that appeal to a wide variety of proposed customers.

5. SWOT ANALYSIS

Page 7 of 10

Threats

Risk Factors: In the course of its business, Hyundai is exposed to a variety of market and other

risks including the effects of demand dynamics, commodity prices, currency exchange rates,

interest rates, as well as risk associated with financial issues, hazard events and specific assets

risk. Whenever possible, the instrument of insurance is used to mitigate the risk.

Business Risks: The automotive industry is very capital intensive. Such investments require a

certain scale of operation to generate viable returns. These scales depend on demand.

The above graph suggest that majority of the respondent would like to buy a hatchback.

This shows that now people are preferring hatchback over other segments of car.

The above graph show that if provided a budget constraint of 6-7 Lacs, majority of the

respondents would like to buy Hyundai i20. This suggests that in this price range, Hyundai i20 is

the best considered option. However, we can see that it face competition from Maruti Suzuki

Swift and Volkswagen Polo. Hence according to the above graph and charts, Hyundai i20 enjoys

6. CONSUMER BEHAVIOUR ANALYSIS

In which of the following

segments, would you

buy a car?

If you want to buy a

car, provide your

budget is Rs 6-7 lacs,

which car would you

buy?

Page 8 of 10

a dominant position in Hatchback car market where prices are from 6-7 lacs but is facing

competition from Maruti Suzuki Swift and Volkswagen Polo.

The above graph and table represent the ratings that Hyundai i20 got on various

parameters from the respondents. They show the percentage of people who give higher

ratings to each of the mentioned parameter. It is evident that maximum people gave

Comfortability and Looks/Design higher ratings. Also, Mileage got the lowest rating.

Through this, we can say that Hyundai i20 is a success in terms of comfortability and

Looks/Design. However, it needs to work on its mileage to satisfy its customer and

hence, to capture better market in future.

Viral campaign Casts a Spell Crosses over 1 Million Viewers

Advantage department- Exchange offers : Customers can exchange their cars of any

brand, with our brand new i20 with some discount based on the resale price of their old

car as per analyzed by analyst.

This will increase market share as other brand users will shift to Hyundai.

56

58

60

62

64

66

68

70

72

74

76

Rate Hyundai

i20 on the basis

of following

characteristics.

7. PRESENT MARKETING STRATEGIES

Page 9 of 10

Occasional Discounts : special discount on Diwali ,other festivals and occasions

Goodies and Accessories: giving free goods and accessories with cars

Event marketing

Featuring our product through movies and TV serials. Organizing events in malls and

shopping centers. Tie up with reality shows and offering i20 as prize.

Flexible EMI Scheme

Variant finance schemes so that people from all income groups can buy our product

without thinking much about the cost. Attractive 0% interest offers. Tie ups with

financial institutions.

Strategic alliance with oil and Gas companies

Special facilities and attention ould be given to Hyundai user on particular Oil company

outlets.

Mobile and online services

Consumers can request for free pick and drop service.

They can check at which stage their car is being services at that very moment of time.

Product proposals: Introducing CNG

In todays market scenario, customer has less buying power, increasing petrol and diesel

prices forces customer not to become consumer of Car.Moreover, people want to have

status edge over others while paying less out of their pockets.

In these conditions, HYUNDAI i20 can give the option of CNG in its petrol cars.

Customers can customize their car booking and select whether they want CNG in their

petrol car or not.

Special discounts for first time car buyers.

8. OUR PROPOSALS FOR INCREASING MARKET SHARE

7. PROPOPSED MARKETING STRATEGIES

Page 10 of 10

www.Gaadi.com

Hyundai Motor India Limited annual reports

www.hyundai.com

www.economictimes.com/

www.livemint.com

www.motoring.com.au

www.bizcommunity.com

9. REFERENCES

You might also like

- Vehicle Inspection ReportDocument1 pageVehicle Inspection ReportAnonymous 1XBCMXNo ratings yet

- Mitsubishi ManualDocument20 pagesMitsubishi ManualThyo Augustin100% (1)

- 4runner 2005 PDFDocument426 pages4runner 2005 PDFAnthonio Jesús Lezkano MNo ratings yet

- Porsche 993 Workshop ManualsDocument20 pagesPorsche 993 Workshop Manualsmarilyn100% (50)

- Bull Cat d8rDocument1,050 pagesBull Cat d8rRached Rabhi100% (4)

- Car ABS Sensor Catalog PDFDocument61 pagesCar ABS Sensor Catalog PDFvandrake10No ratings yet

- Maruti Marketing MixDocument25 pagesMaruti Marketing Mixpaurak100% (3)

- Competitor Analysis of Tata MotorsDocument9 pagesCompetitor Analysis of Tata MotorsDevanshi AroraNo ratings yet

- Performance Differentials: Choosing A Performance DifferentialDocument25 pagesPerformance Differentials: Choosing A Performance DifferentialAlex BazorNo ratings yet

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- Gantt Chart For UpdatingDocument5 pagesGantt Chart For UpdatingsaidNo ratings yet

- Honda Forza 300 Parts Catalog - ENDocument134 pagesHonda Forza 300 Parts Catalog - ENK ZinNo ratings yet

- Jetta mk6 Body RepairDocument328 pagesJetta mk6 Body RepairjuventinocoronapNo ratings yet

- HONDA Marketing Strategies of Honda SIEL Cars India LTDDocument12 pagesHONDA Marketing Strategies of Honda SIEL Cars India LTDKunal Behrani0% (1)

- Chandan MB-1442 (Consumer Behaviour Towards Honda Cars)Document101 pagesChandan MB-1442 (Consumer Behaviour Towards Honda Cars)SoniaNo ratings yet

- Customer Satisfaction Tvs Motors Project Report Mba MarketingDocument68 pagesCustomer Satisfaction Tvs Motors Project Report Mba MarketingVaskar Jung KarkiNo ratings yet

- Brand Image HyundaiDocument60 pagesBrand Image HyundaiIsmail Shaik33% (6)

- Demand Analysis & Forecasting - The Car Industry: Presented byDocument31 pagesDemand Analysis & Forecasting - The Car Industry: Presented byprerna_bafnaNo ratings yet

- Comparative Marketing Strategies of Maruti Suzuki and HyundaiDocument82 pagesComparative Marketing Strategies of Maruti Suzuki and Hyundaidiwakar0000000No ratings yet

- CUSTOMER SATISFACTION STUDY OF HYUNDAI CARSDocument85 pagesCUSTOMER SATISFACTION STUDY OF HYUNDAI CARSMano Raja100% (1)

- HyundaiDocument17 pagesHyundaisapna50% (4)

- Minor Project ReportDocument24 pagesMinor Project ReportSanchit JainNo ratings yet

- Comparative Analysis of Maruti Zen and Hyundai SantroDocument73 pagesComparative Analysis of Maruti Zen and Hyundai SantroSami ZamaNo ratings yet

- Marketing Strategy of Hyundai FinalDocument21 pagesMarketing Strategy of Hyundai FinalMonika SoodNo ratings yet

- Project Report On Hyundai Santro For MarketingDocument41 pagesProject Report On Hyundai Santro For MarketingHarshad Patel33% (3)

- Customer Satisfaction of Mahadev Hyundai Motors Pvt. LtdDocument79 pagesCustomer Satisfaction of Mahadev Hyundai Motors Pvt. LtdGauravNo ratings yet

- Maruti Suzuki market potential study in TrivandrumDocument81 pagesMaruti Suzuki market potential study in TrivandrumAru.SNo ratings yet

- Hyundai Motor India Limited: An Overview: Maketting ManagementDocument17 pagesHyundai Motor India Limited: An Overview: Maketting ManagementAkshit GuptaNo ratings yet

- A Project On "Customer Satisfaction Towards Hyundai Motors"Document73 pagesA Project On "Customer Satisfaction Towards Hyundai Motors"Neelima ChauhanNo ratings yet

- Summer Training Project Report ON Title of Project Report Undertaken atDocument65 pagesSummer Training Project Report ON Title of Project Report Undertaken atGaurav ChauhanNo ratings yet

- Summer Training Proj. Hero Honda by Sahil NagpalDocument75 pagesSummer Training Proj. Hero Honda by Sahil NagpalPriya Rahul Kalra100% (1)

- Maruti SuzukiDocument33 pagesMaruti SuzukiNaman Arya100% (4)

- Marketing Mix For Mahindra ScorpioDocument7 pagesMarketing Mix For Mahindra ScorpioSushant PatilNo ratings yet

- Consumer's Perception Towards FOUR WHEELER INDUSTRYDocument91 pagesConsumer's Perception Towards FOUR WHEELER INDUSTRYShubhamprataps0% (1)

- 7 Marketing Strategies of India Automobile CompaniesDocument7 pages7 Marketing Strategies of India Automobile CompaniesamritNo ratings yet

- Mini Project HyundaiDocument28 pagesMini Project Hyundaimaraimalai2010No ratings yet

- Marketing Strategy of Maruti SuzukiDocument88 pagesMarketing Strategy of Maruti SuzukiApoorva KohliNo ratings yet

- A Case Study Report ON "Mahindra and Mahindra": Presented byDocument39 pagesA Case Study Report ON "Mahindra and Mahindra": Presented bySourabh RaoraneNo ratings yet

- A Study On Employee Welfare at Bimal Auto AgencyDocument73 pagesA Study On Employee Welfare at Bimal Auto AgencypraveenNo ratings yet

- "Consumer Behaviour in Automobile: Research Project Report TitledDocument94 pages"Consumer Behaviour in Automobile: Research Project Report Titledshakti shankerNo ratings yet

- Hatchback CarDocument13 pagesHatchback Carmrunal mehtaNo ratings yet

- Maruti SuzukiDocument79 pagesMaruti SuzukiSamuel Davis100% (1)

- Hero MotorDocument50 pagesHero MotorVignesh SNo ratings yet

- Brand Building Concern - Kia Motors: Marketing ManagementDocument7 pagesBrand Building Concern - Kia Motors: Marketing Managementbhaveshhard100% (1)

- Report On Mahindra BoleroDocument39 pagesReport On Mahindra BoleroÊvîl TɘʀɱiŋʌtorNo ratings yet

- Final Report Renault KWIDDocument6 pagesFinal Report Renault KWIDrajeshNo ratings yet

- Yamaha FZ, Mini ProjectDocument66 pagesYamaha FZ, Mini ProjectNishanth C Mohan100% (3)

- Parag Milk and Kautuki Milk in Ghazipur CityDocument59 pagesParag Milk and Kautuki Milk in Ghazipur CityPrashant SinghNo ratings yet

- A Study On Customer Perception Towards Major Brands of Two Wheelers in Villupuram Town and Its Impact On Buying BehaviourDocument6 pagesA Study On Customer Perception Towards Major Brands of Two Wheelers in Villupuram Town and Its Impact On Buying BehaviourarcherselevatorsNo ratings yet

- Customer Satisfaction Towards Hero Motocorp in Pilibhit After SeparationDocument67 pagesCustomer Satisfaction Towards Hero Motocorp in Pilibhit After SeparationSarathKumarNo ratings yet

- Report On Maruti Suzaki Ltd.Document54 pagesReport On Maruti Suzaki Ltd.rony guy100% (1)

- Customer Satisfaction - HyundaiDocument42 pagesCustomer Satisfaction - HyundaiManish RajakNo ratings yet

- hYUNDAI ProjectDocument20 pageshYUNDAI ProjectShradha PereiraNo ratings yet

- Positioning - Small Cars, IndiaDocument9 pagesPositioning - Small Cars, Indiasankalp_iet100% (4)

- MahindraDocument68 pagesMahindraJerrod DavisNo ratings yet

- What Is Honda?: Chief ProductsDocument24 pagesWhat Is Honda?: Chief ProductsAnjum hayatNo ratings yet

- Marketing Strategy of Maruti SuzukiDocument50 pagesMarketing Strategy of Maruti Suzukijameskuriakose24_5210% (1)

- About Mahindra and MahindraDocument34 pagesAbout Mahindra and MahindrareesmechNo ratings yet

- Toyota Kirloskar Motor Limited Project NewestDocument63 pagesToyota Kirloskar Motor Limited Project Newestpunkaduck690% (1)

- Kia MotorsDocument2 pagesKia MotorsfhrburNo ratings yet

- Project Marketing Strategy of Maruti SuzukiDocument38 pagesProject Marketing Strategy of Maruti SuzukiJalesh mehta100% (1)

- Strategic ManagementDocument9 pagesStrategic Managementpranaya_88No ratings yet

- Marketing Mix Plan and Consumer Feedback For Bajaj BikesDocument82 pagesMarketing Mix Plan and Consumer Feedback For Bajaj BikesPriyendra Kumar SinghNo ratings yet

- Ce at Tyre Prati K FinalDocument87 pagesCe at Tyre Prati K Finalajay sharmaNo ratings yet

- Consumer Behavior Towards Hyundai CarsDocument21 pagesConsumer Behavior Towards Hyundai CarskumardattNo ratings yet

- Minor Project Report On Maruti Suzuki Vs Hyundai I20Document61 pagesMinor Project Report On Maruti Suzuki Vs Hyundai I20Aradhya Darshan SharmaNo ratings yet

- Hyundai CompanyDocument67 pagesHyundai CompanySandeep SinghNo ratings yet

- Brand Image Hyundai SynopsisDocument16 pagesBrand Image Hyundai SynopsisShubhendu OjhaNo ratings yet

- Hyundai Market AnalysisDocument21 pagesHyundai Market AnalysisABINASH MAHAPATRANo ratings yet

- Tata Steel Corus Acquisition Financial DetailsDocument6 pagesTata Steel Corus Acquisition Financial DetailsSandarbh Agarwal0% (1)

- 5 Things People Reading Your Resume Wish YouDocument19 pages5 Things People Reading Your Resume Wish YouVikashKumarNo ratings yet

- Final Report R.J EditedDocument37 pagesFinal Report R.J EditedSandarbh AgarwalNo ratings yet

- Horz VertDocument37 pagesHorz VertSandarbh AgarwalNo ratings yet

- Or Customs,: Tel 11 - 14 - SDocument5 pagesOr Customs,: Tel 11 - 14 - SAsif SolangiNo ratings yet

- CAT 330 B 9 HN Parts Catalog PDF - Part12Document1 pageCAT 330 B 9 HN Parts Catalog PDF - Part12riansiregarNo ratings yet

- Cuplu Stragere Roti PDFDocument1 pageCuplu Stragere Roti PDFCharles MorrisonNo ratings yet

- AUTOINSPEKT-PI11340934 AhsanDocument4 pagesAUTOINSPEKT-PI11340934 AhsananshiNo ratings yet

- Alok Bajaj Auto LTDDocument3 pagesAlok Bajaj Auto LTDSiji VargheseNo ratings yet

- Master List of CSD Cars Updated 29 Jul 2011Document31 pagesMaster List of CSD Cars Updated 29 Jul 2011Ashish Kumar RoyNo ratings yet

- Vehicle MasterDocument29 pagesVehicle MasterBrian0% (1)

- Automotive PDFDocument38 pagesAutomotive PDFMuhammad JunaidNo ratings yet

- Universal LightsDocument27 pagesUniversal LightsarchychenNo ratings yet

- Autocar UK 05 September 2018 Download PDFDocument92 pagesAutocar UK 05 September 2018 Download PDFTHREEDOZ100% (1)

- FUELSYTEAMDocument65 pagesFUELSYTEAMabdi zerihunNo ratings yet

- Webdata CNGDocument2 pagesWebdata CNGsafvanshaikhNo ratings yet

- CatalogDocument11 pagesCatalogFelix Albit Ogabang IiiNo ratings yet

- Private Car Mar'23 Partner PayoutDocument5 pagesPrivate Car Mar'23 Partner Payoutyash aggarwalNo ratings yet

- Owner's Handbook Bonneville Bobber, Bonneville Bobber Black and Bonneville SpeedmasterDocument136 pagesOwner's Handbook Bonneville Bobber, Bonneville Bobber Black and Bonneville SpeedmasterCharles SaraivaNo ratings yet

- User Manual: Rearward-& Forward-FacingDocument11 pagesUser Manual: Rearward-& Forward-FacingUfuk UzundağNo ratings yet

- Ground Support Equipment Information Details: MANILA STATION - List of GSE As of 02 Feb 2021Document25 pagesGround Support Equipment Information Details: MANILA STATION - List of GSE As of 02 Feb 2021nasser ondilloNo ratings yet

- Medical Report Form for Driver LicensingDocument2 pagesMedical Report Form for Driver LicensingnechiforpNo ratings yet

- Dynapac Cc1200c Spare Parts CatalogueDocument20 pagesDynapac Cc1200c Spare Parts CatalogueCharles100% (52)

- Toyota Rush Pros and ConsDocument6 pagesToyota Rush Pros and Consamelna enterpriNo ratings yet