Professional Documents

Culture Documents

Pakistan Trade Liberalization Sectoral Study On Leather Sector in Pakistan

Uploaded by

Ghulam Mohey-ud-din0 ratings0% found this document useful (0 votes)

125 views75 pagesPakistan Trade Liberalization Sectoral Study on Leather Sector in Pakistan by PITAD

Original Title

Pakistan Trade Liberalization Sectoral Study on Leather Sector in Pakistan

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPakistan Trade Liberalization Sectoral Study on Leather Sector in Pakistan by PITAD

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

125 views75 pagesPakistan Trade Liberalization Sectoral Study On Leather Sector in Pakistan

Uploaded by

Ghulam Mohey-ud-dinPakistan Trade Liberalization Sectoral Study on Leather Sector in Pakistan by PITAD

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 75

1

PAKISTAN INSTITUTE OF TRADE & DEVELOPMENT

Leather Sector Analysis

By

Osman Bin Saif

Senior Research Associate

September, 2012

2

3

List of Contents

1. INTRODUCTION....................................................................................................................................................................... 8

OBJECTIVE OF THE REPORT ................................................................................................................................................... 9

SCOPE ................................................................................................................................................................................................ 9

2. LEATHER INDUSTRY PROFILE ....................................................................................................................................... 10

2.1 HISTORY .......................................................................................................................................................................... 10

2.2 PRODUCTION CAPACITY .......................................................................................................................................... 10

2.3 LOCATIONS of tanneries and manufacturing units IN PAKISTAN........................................................... 11

2.4 CATAGORIES OF LEATHER ...................................................................................................................................... 11

2.5 SOURCES OF RAW MATERIAL ................................................................................................................................ 11

2.6 TRAINING INSTITUTES: ............................................................................................................................................ 12

2.7 CAPITAL AND MACHINERY ..................................................................................................................................... 13

2.8 RESEARCH & DEVELOPMENT: ............................................................................................................................... 13

2.9 INFRASTRUCTURE: ..................................................................................................................................................... 13

3. PRODUCTION PROCESS ..................................................................................................................................................... 13

3.1 TYPES OF PROCESSES ................................................................................................................................................ 13

3.2 STAGES OF LEATHER FORMATION: .................................................................................................................... 15

3.3 TECHNOLOGICAL LEVEL .......................................................................................................................................... 17

3.4 DYES AND CHEMICALS .............................................................................................................................................. 17

3.5 LABOUR SITUATION ................................................................................................................................................... 18

4. OVERVIEW OF GOVERMENT POLICIES AND INCENTIVES ................................................................................. 18

4.1 TRADE POLICY (STPF 2009-2012) ....................................................................................................................... 19

4.2 demand of leather industry from the government ........................................................................................ 19

4.3 performance of the government ............................................................................................................................ 20

4.4 AFTER WTO & FUTURE PERSPECTIVES ............................................................................................................ 21

5. TRADE DATA ANALYSIS .................................................................................................................................................... 22

5.1 EXPORT ANALYSIS ...................................................................................................................................................... 22

4

5.2 LEATHER GARMENTS AND GLOVES.................................................................................................................... 24

5.2.1 EXPORT COMPOSITION OF LEATHER GARMENTS AND GLOVES ...................................................... 24

5.2.2 COMPETITOR ANALYSIS FOR GARMENTS AND GLOVES ...................................................................... 25

5.2.3 POTENTIAL TRADE FOR GARMENTS AND GLOVES................................................................................. 26

5.3 LEATHER FOOTWEAR ............................................................................................................................................... 27

5.3.1 EXPORT COMPOSITION OF LEATHER FOOTWEAR .................................................................................. 27

5.3.2 COMPETITOR ANALYSIS FOR FOOTWEAR .................................................................................................. 29

5.3.3 POTENTIAL TRADE FOR LEATHER FOOTWEAR ....................................................................................... 30

5.4 LEATHER INDUSTRIAL GOODS .............................................................................................................................. 30

5.4.1 EXPORT COMPOSITION OF LEATHER INDUSTRIAL GOODS ................................................................ 30

5.4.2 COMPETITOR ANALYSIS OF LEATHER INDUSTRIAL GOODS .............................................................. 31

5.4.3 POTENTIAL TRADE FOR LEATHER GOODS INDUSTRIAL ..................................................................... 32

5.5 LEATHER GOODS CONSUMER ARTICLES .......................................................................................................... 33

5.5.1 EXPORT COMPOSITION FOR LEATHER GOODS CONSUMER ARTICLES ......................................... 33

5.5.2 COMPETITOR ANALYSIS FOR LEATHER GOODS CONSUMER ARTICLES ....................................... 35

5.5.3 POTENTIAL TRADE FOR LEATHER GOODS CONSUMER ARTICLES ................................................. 37

5.6 finished leather (hides) ............................................................................................................................................. 37

5.6.1 export composition of finished leather (hides) .......................................................................................... 37

5.6.2 competitor analysis finished leather (hides) ............................................................................................... 38

5.6.3 potential trade finished leather (hides) ......................................................................................................... 40

5.7 finished leather (skins) .............................................................................................................................................. 40

5.7.1 export composition of finished leather (skins)........................................................................................... 40

5.7.2 competitor analysis of finished leather (skins) .......................................................................................... 41

5.7.3 potential trade finished leather (skins) ......................................................................................................... 43

5.8 finished leather (other) ............................................................................................................................................. 44

5.8.1 EXPORT COMPOSITION OF FINISHED LEATHER (OTHER) .................................................................. 44

5.8.2 competitor analysis of finished leather (other) .......................................................................................... 45

5

5.8.3 potential trade for finished leather (other) .................................................................................................. 46

5.9 TARIFF ANALYSIS ....................................................................................................................................................... 47

5.10 RCA ANALYSIS ................................................................................................................................................................. 47

5.11. SWOT ANALYSIS OF INDIAN LEATHER SECTOR .............................................................................................. 51

5.12. SWOT ANALYSIS OF PAKISTANI LEATHER SECTOR ....................................................................................... 52

6. CHALLENGES FACED BY THE INDUSTRY ................................................................................................................... 53

6.1 MAJOR ISSUES ............................................................................................................................................................... 53

6.2 PRICING STRATEGIES ................................................................................................................................................ 56

6.3 ISSUES FACED BY THE INDUSTRY: ...................................................................................................................... 56

6.4 Non Tariff barriers faced by Pakistani Exporters in INDIA ........................................................................ 59

7. CONCLUSION .......................................................................................................................................................................... 61

8. RECOMMENDATIONS ......................................................................................................................................................... 63

8.1 OTHER RECOMMENDATIONS ................................................................................................................................ 64

9. BIBLIOGRAPHY ...................................................................................................................................................................... 65

ANNEXURE 1 ..................................................................................................................................................................................... 68

Bilateral trade profilesindia pakistan. ....................................................................................................................... 68

ANNEXURE 2 ..................................................................................................................................................................................... 72

RCA ANALYSIS ............................................................................................................................................................................. 72

6

List Of Tables

TABLE 1: TOTAL PRODUCTION CAPACITY OF OVERALL TANNERIES IN PAKISTAN.................................. 10

TABLE 2: HS CODE LEATHER SECTOR ............................................................................................................................. 11

TABLE 3: PERCENTAGE EXPORT GROWTH OF THE WORLD ............................................................................................ 22

TABLE 4: BILATERAL TRADE PROFILE ................................................................................................................................ 23

TABLE 5: EXPORT COMPOSITION OF LEATHER GARMENTS AND GLOVES ......................................................................... 25

TABLE 6: COMPETITOR ANALYSIS FOR LEATHER GARMENTS AND GLOVES ...................................................................... 26

TABLE 7: POTENTIAL TRADE OF LEATHER GARMENTS AND GLOVES ................................................................................. 27

TABLE 8: EXPORT COMPOSITION OF LEATHER FOOTWEAR ............................................................................................... 28

TABLE 9: COMPETITOR ANALYSIS FOR LEATHER FOOTWEAR ........................................................................................... 29

TABLE 10: POTENTIAL TRADE FOR LEATHER FOOTWEAR .................................................................................................. 30

TABLE 11: EXPORT COMPOSITION OF LEATHER GOODS FOR INDUSTRIAL USE ................................................................. 31

TABLE 12: COMPETITOR ANALYSIS OF LEATHER GOODS FOR INDUSTRIAL USE ................................................................ 32

TABLE 3: POTENTIAL TRADE FOR LEATHER GOODS FOR INDUSTRIAL USE ........................................................................ 33

TABLE 14: EXPORT COMPOSITION FOR LEATHER GOODS CONSUMER ARTICLES .............................................................. 34

TABLE 15: COMPETITOR ANALYSIS FOR LEATHER GOODS CONSUMER ARTICLES ............................................................ 36

TABLE 16: POTENTIAL TRADE FOR LEATHER GOODS CONSUMER ARTICLES ..................................................................... 37

TABLE 17: EXPORT COMPOSITION OF FINISHED LEATHER HIDES ...................................................................................... 38

TABLE 18: COMPETITOR ANALYSIS FINISHED LEATHER HIDES .......................................................................................... 39

TABLE 19: POTENTIAL TRADE FINISHED LEATHER HIDES .................................................................................................. 40

TABLE 20: EXPORT COMPOSITION OF FINISHED LEATHER SKINS ...................................................................................... 41

TABLE 21: COMPETITOR ANALYSIS OF FINISHED LEATHER SKINS ..................................................................................... 42

TABLE 22: POTENTIAL TRADE FINISHED LEATHER SKINS .................................................................................................. 43

TABLE 234: EXPORT COMPOSITION OF FINISHED LEATHER OTHER .................................................................................. 44

TABLE 24: COMPETITOR ANALYSIS OF FINISHED LEATHER OTHER ................................................................................... 45

TABLE 25: POTENTIAL TRADE FOR FINISHED LEATHER OTHER ......................................................................................... 46

TABLE 26: TARIFF ANALYSIS ............................................................................................................................................... 47

TABLE 27: RCA ANALYSIS OF LEATHER SECTOR .............................................................................................................. 48

7

ACKNOWLEDGEMENT

The author greatly acknowledges the Director Research PITAD Dr. Adil Khan Mian Khel

for his support and guidance throughout the initiation and completion of this research report. His

valuable comments and inputs add significantly in improving the research capacity of this report.

Particularly, the author is grateful to Mr. Tahir Maqsood (Director General), PITAD for his

cooperation, guidance and support all along.

The author also gratefully acknowledges the assistance of PITAD Research Team who

helped in writing this analysis through their fruitful suggestions and support. Lastly the data analysis

is the joint effort of the author and Mr. Badar ud Din Tanweer (Survey Coordinator). He has also

helped in formatting the report.

8

L E AT HE R AND F OOT WE AR I ND US T R Y

1. INTRODUCTION

Leather industry, including leather products, is the second largest export earning sector after

textiles

1

in Pakistan. Currently, this sector is contributing around $ 874 million

2

a year but has the

potential to multiply volume of exports with the improvement of quality and diversification in

different range of products, specially garments and footwear. Leather garments and footwear is a job-

oriented sector providing employment to a very large segment of the society besides earning foreign

exchange for the country.

The leather industry consists of six sub-sectors namely, Tanning, Leather, Footwear, Leather,

Garments, Leather Gloves, Leather Shoe Uppers, and Leather Goods. The Tanning industry plays a

vital role in the progress of these sub-sectors by providing the basic material i.e. leather. Today,

Pakistan is among the leading countries in the production of Leather Garments and Gloves. The

leather and leather made-ups industry plays a significant role in the economy of Pakistan and its share

in GDP is 4%

3

. The leather finishing and made ups industries represent an important sector in

Pakistan, contributing almost more than half a billion US dollars

4

in foreign exchange earnings to the

national exchequer. Export of leather and leather items was $1.22 billion in 2007-08, $959 million in

2008-09 and $867 million in 2009-10

5

. These figures show that in the year 2009-10 exports have

declined to 30 per cent of what Pakistan was exporting in the year 2007-08 which is an alarming

situation. Exports of 2010-11 have shown an upward trend but this was mainly due to higher prices of

leather in the international market while in quantitative terms the increase was negligible. 1.5 million

animals were perished in 2010 floods and 95,523 animals were exported from July 2010 to March

2011. This resulted in an acute shortage and increased prices of mutton from Rs270 to Rs450 and

beef from Rs154 to Rs350 per kg from 2008-09 to 2010-11.

The Ministry of Commerce has always been in favor of exporting value added products like

meat, its products and finished leather goods. The export of live animals affects local meat and leather

1

Pakistan Tanneries Association (PTA)

2

Figure from ITC Trade Map

3

GDP data from Federal Bureau of Statistics

4

Figure from State Bank of Pakistan Foreign Exchange Data (2011)

5

Figures from ITC Trade Map

9

industry negatively. Therefore, the government is in the process of establishing Halal Food

Certification System in Pakistan. This will help Pakistan to enter in the $600 billion

6

international

market.

OBJECTIVE OF THE REPORT

Pakistan had been conducting its trade with India on a positive list approach before 26th of

March, 2012. Recently, steps have been taken to liberalize trade from positive list to negative list. In

the wake of this liberalization, there would be challenges and opportunities by opening up the new

sectors of the economy to competition from India. In the light of above, this report is being conducted

with the following objectives:

Identification of segments of Leather industry which are competitive or not competitive vis a

vis India.

Identification of Pakistans export potential in leather sector to India.

Identification of Pakistans import potential in leather sector from India

Identify the comparative tariffs of Pakistan and India for the particular products range.

Identify the weaknesses and opportunities of Leather sector by using Revealed Comparative

Advantage (RCA) Index.

Identification of NTBs that need to be addressed to facilitate exports of the Leather sector

towards India.

SCOPE

The scope of this report is limited to analyze the Pakistan leather and footwear sector against

India by using trade data of 2010 as trade figures of the post liberalization period are not available.

The report is aimed to identify new challenges and opportunities that would be faced by Pakistan as a

result of trade liberalization between the two countries. This report is based primarily on desk

research. Due to time, resource and budgetary constraints detailed interaction with stakeholders was

not possible so the analysis done in this report is more focused on statistical data analysis rather than

direct input and feedback from the relevant stakeholders.

6

Figure from ITC Trade Map

10

2. LEATHER INDUSTRY PROFILE

2.1 HISTORY

At the time of independence there were only a few tanneries producing sole leather at a small

scale. In the early days of independence some tanneries were established in Karachi. In 1950's some

were established in Lahore and adjoining areas. The industry has flourished rapidly since then.

During 1950s well-equipped tanneries were set up at Karachi and Lahore, while during 60s and 70s

more units were established at Hyderabad , Kasur, Sialkot, Multan, Sahiwal and Gujranwala. Starting

with the production of picked and vegetable tanned hides and skins, the tanneries, today are

producing not only wet blue and crust but also fully finished leather.

2.2 PRODUCTION CAPACITY

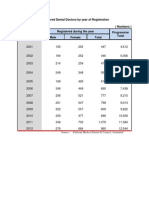

TABLE 1: TOTAL PRODUCTION CAPACITY OF OVERALL TANNERIES IN

PAKISTAN

Particulars Estimated Production

Capacity

Actual Production Utilization Rate

Tanned leather 90 Million Sqr meter 60 Million Sqr meter 67%

Leather

Garments/Apparels

7 Million Pieces 5 Million Pieces 71%

Leather Gloves 10 Million pairs 5 Million pairs 50%

Leather Footwear 200 Million Pairs 100 Million Pairs 50%

Source: Pakistan Tanneries Association

7

NOTE: Against a capacity of producing 90 million square feet of tanned leather, the tanneries

are presently producing only 60 million square feet tanned leather per year

8

.

Presently, there are some 461 leather garments/apparels making units, which annually produce

some 5.0 million pieces against a capacity of producing 7.0 million pieces. The 524 footwear units in

the country are currently producing 100 million pairs against a capacity for producing 200 million

pairs, while 348 leather gloves units are producing 5.0 million pairs against a capacity of making 10

7

Pakistan Tanneries Association Website (www.pakistantanners.org)

8

Pakistan Tanneries Association Website (www.pakistantanners.org)

11

million pairs annually

9

. These statistics clearly show that the capacity of this sector remains highly

under-utilized.

2.3 LOCATIONS OF TANNERIES AND MANUFACTURING UNITS IN PAKISTAN

In Pakistan there are more than 2500 tanneries (registered& Un registered) and footwear

manufacturing units running in Pakistan. Over the years, the number of registered tanneries in the

country has increased from 529 in 1999 to 600 in 2003 and to 725 at present.These are located in

Karachi, Hyderabad, Lahore, Multan, Kasur, Faisalabad, Gujranwala, Sialkot, Sahiwal, Sheikhupura

and Peshawar

10

.The increase in the number of tanneries and increased export can be attributed to

increase in demand of tanned leather in the foreign market.

2.4 CATAGORIES OF LEATHER

Leather Sector is divided into the following categories.

TABLE 2: HS CODE LEATHER SECTOR

S. No Leather PRODUCTS Number of Tariff Lines at 6 Digit HS

1 Leather Garments & Gloves 5

2 Leather Footwear 9

3 Leather Goods

I Industrial 3

Ii Consumer 17

4 Finished Leather

I Leather Hides 4

Ii Leather Skins 8

Iii Other Leather 6

Source : ITC Trade Map Definitions of HS

Sub sector wise percentage share in Total export of Pakistan and India has been annexed.

2.5 SOURCES OF RAW MATERIAL

Pakistan is fortunate that the raw material required by the industry is available in the country

in abundance. Local availability of raw materials and low wage cost gives the country a competitive

edge in the world market. In the leather industry the raw materials are by-products of the meat

9

Pakistan Tanneries Association (www.pakistantanners.org)

10

UNIDO. Diagnostic study of Korangi tanneries

12

industry, with the meat having higher value than the skin. Taxidermy also makes use of the skin of

animals, but generally the head and part of the back are used. Hides and skins are also used in the

manufacture of glue and gelatin. The primary sources of raw material for the tanning industry are

hides and skins from animals slaughtered for human consumption.

The following are the types of basic raw materials which are being used by this industry: -

Cow hides - Buffalo hides - Goat skins - Sheep skins.

1. Buffalo:

Buffalo is considered as the specialty of Pakistan in World, because of its ample availability in

Pakistan

2. Cow:

The cow material is considered a superior raw material upon buffalo because of its fine, tight and

comparatively uniform structure.

3. Goat:

It is good for making shoe upper leathers, garment and goods leather.

4. Sheep:

Leather made from sheep raw materials has a very good and softer touch and is considered best for

leather garments.

The industry meets 75% of its needs of raw hides from local sources while rest of the 25-30

per cent is met through imports

11

.Pakistan imports raw hides from Saudi Arabia, Iran, and China,

Dubai, Sudan, Kenya, Australia and Italy.

2.6 TRAINING INSTITUTES:

There are various training institutes that have been established to provide leather based

academic degrees. Some of them are:

1. National Institute of Leather Technology, Karachi (NILT).

2. Leather productsdevelopment Institute, Sialkot (LPDI).

3. Institute of Leather Technology, Gujranwala (ILT).

4. Footwear training Institute, Charsadda (FTI).

11

UNIDO. Diagnostic study of Korangi Tanneries Zone.(2006)

13

2.7 CAPITAL AND MACHINERY

i. Around 80 to 95% of machinery is imported from countries like Italy and France.

ii. The high percentage of import in terms of machinery is a reflection of the insignificant

manufacturing base in Pakistan.

iii. Around 5 to 10% machinery used by the small tanneries is locally produced. Such

machinery is locally known as chukrum. These are smaller in size and available at

reasonable prices.

2.8 RESEARCH & DEVELOPMENT:

i. There are numerous institutes related to leather, yet the rate at which research and

development is being carried out is very slow and is in its initial stages.

ii. The big players of the industry such as Nova leathers and Mahmood Brothers have come

up with a new dyeing technology(steel dyeing drums) which ensure better quality of

dyeing

12

.

iii. The university of veterinary and animal sciences(UVAS), Lahore and Pakistan Tanneries

Association (PTA) have signed a research project for the identification of skin diseases in

animals and geographical patterns of these diseases.

2.9 INFRASTRUCTURE:

i. There are severe infrastructure problems faced by the Leather industry.

ii. The industrial hub of Karachi, Korangi Industrial Area (sector 7-A) does not have a single

metal road. These tanneries are also deprived of the basic utilities(such as water and

electricity).

iii. Being a water-based industry, tanneries have to purchase water and they have also

arranged for company-owned generators to ensure uninterrupted power supply.

iv. The drainage system is in a very poor condition as well.

3. PRODUCTION PROCESS

3.1 TYPES OF PROCESSES

12

Pakistan Tanneries Association Website (www.pakistantanneries.org)

14

There are a number of processes whereby the skin of an animal can be formed into a supple,

strong material commonly called leather.

1. Vegetable-tanned leather is tanned using tannin (hence the name "tanning") and other

ingredients found in vegetable matter, tree bark, and other such sources. It is supple and

brown in color, with the exact shade depending on the mix of chemicals and the color of the

skin. Vegetable-tanned leather is not stable in water; it tends to discolor, and if left to soak and

then dry it will shrink and become less supple and harder. In hot water, it will shrink

drastically and partly gelatinise, becoming rigid and eventually brittle. Boiled leather is an

example where the leather has been hardened by being immersed in hot water, or in boiled

wax or similar substances. Historically, it was occasionally used as armor after hardening, and

it has also been used for book binding. This is the only form of leather suitable for use in

leather carving or stamping.

2. Chrome-tanned leather, invented in 1858, is tanned using chromium sulfate and other salts

of chromium. It is more supple and pliable than vegetable-tanned leather, and does not

discolor or lose shape as drastically in water as vegetable-tanned. Also known as wet-blue for

its color derived from the chromium. More esoteric colors are possible using chrome tanning.

3. Aldehyde-tanned leather is tanned using glutaraldehyde or oxazolidine compounds. This is

the leather that most tanners refer to as wet-white leather due to its pale cream or white color.

It is the main type of leather used in chrome-free leather often seen in infant's shoes and in

automobiles that prefer a chrome-free leather. Formaldehyde tanning (being phased out due to

its danger to workers and the sensitivity of many people to formaldehyde) is another method

of aldehyde tanning. Brain-tanned leathers fall into this category and are exceptionally water

absorbent. Brain tanned leathers are made by a labor-intensive process which uses emulsified

oils often those of animal brains. They are known for their exceptional softness and their

ability to be washed. Chamois leather also falls into the category of aldehyde tanning and like

brain tanning produces a highly water absorbent leather. Chamois leather is made by using

oils (traditionally cod oil) that oxidise easily to produce the aldehydes that tan the leather.

4. Synthetic-tanned leather is tanned using aromatic polymers such as the Novolac or Neradol

types. This leather is white in color and was invented when vegetable tannins were in short

15

supply, i.e. during the Second World War. Melamine and other amino-functional resins fall

into this category as well and they provide the filling that modern leathers often require. Urea-

formaldehyde resins were also used in this tanning method until dissatisfaction about the

formation of free formaldehyde was realized.

5. Alum-tanned leather is tanned using aluminum salts mixed with a variety of binders and

protein sources, such as flour, egg yolk, etc. Purists argue that alum-tanned leather is

technically "tawed" and not tanned, as the resulting material will rot in water. Very light

shades of leather are possible using this process, but the resulting material is not as supple as

vegetable-tanned leather.

6. Rawhide is made by scraping the skin thin, soaking it in lime, and then stretching it while it

dries. Like alum-tanning, rawhide is not technically "leather", but is usually lumped in with

the other forms. Rawhide is stiffer and more brittle than other forms of leather, and is

primarily found in uses such as drum heads where it does not need to flex significantly; it is

also cut up into cords for use in lacing or stitching, or for making many varieties of dog

chews.

3.2 STAGES OF LEATHER FORMATION:

1. Warehousing and sorting

In the raw material area the skins are preserved in salt, stored in controlled cool rooms and

before processing, presorted for quality and weight.

2. Soaking

The skin is soaked to remove dirt and salt.

3. De-Fleshing

During this process tissue, flesh and fat remnants are removed by a roller mounted knife.

4. Liming

By adding lime and sulphur compound the hair is removed from the skin.

5. Bating, pickling, tanning

16

During bating and pickling the skins are treated with acid and salt in preparation for tanning.

During tanning the skin fibres absorb the tanning agents. That's when the skin becomes

leather.

6. Samming

During this process water is removed.

7. Splitting

In order to achieve an even specified thickness the leather is reduced in substance. The

resulting split-leather can than be processed further as suede.

8. Skiving

The grain leather is brought to an even thickness. Irregularities are removed from the reverse

side and the leather is separated into color-batches.

9. Sorting

The leather is sorted into various quality grades.

10. Neutralizing, filling out, dyeing and greasing

The acid resulting from the tanning process is neutralized. Then the dyeing takes place, where

appropriate with anilin-dye-stuffs. The greasing procedure will finally achieve the correct

softness.

11. Drying

Two methods are used to dry leather. The vacuum process during which moisture is removed

by suction and the hanging process, when leather is hung and taken through ovens.

12. Staking

Following drying the leather is mechanically staked in order to soften it. Further processes

take place in preparation for finishing.

13. Finishing

Here the leather is given its final surface treatment and look. Through processes of base coat,

coloring, embossing, ironing the leather becomes, depending on the demands of fashion, matt

or shiny, two-tone or uni-coloured, smooth or grained. The art of finishing lies in working in

wafer-thin layers without disturbing the natural look of the leather and its characteristics such

as suppleness and breath ability.

14. Quality Control

In between every process quality is controlled. Final control checks to ensure each individual

production is to specification and sortation into various trades.

17

15. Dispatch

The leather is measured electronically, wrapped and dispatched.

3.3 TECHNOLOGICAL LEVEL

The tanning industry in Pakistan uses machinery which are out dated and believed to be

imported from various countries in the 1970s and 1980s. Though, the country took advantage of

these second hand machines by bringing in a large amount of foreign earnings, it failed to create a

friendly environmental atmosphere in the process. A large part of the country is subjected to air

pollution due to the burning of chemical residual during tanning process into the atmosphere. This

pollution has a dangerous effect on the health of the local population, mainly in the cities of Karachi,

Kasur and Sialkot.

The leather industry has implemented many progressive interventions and technologies in the

past to deal with its numerous environmental and energy challenges. The representative association of

leather industry i.e. Pakistan Tanners Association (PTA) has long been facilitating a number of

initiatives to address the environmental issues of the industry. This has resulted into a more

competitive, sustainable and progressive leather industry of Pakistan.

For sustainability of already implemented steps and in view of the continuous needs of the

leather and tanning sector, PISD will work and transfer environmental and energy-related knowledge

and technologies to the industry in order to address the ongoing issues of leather sector of Pakistan.

Cleaner Production Institute (CPI) has started the Programme for Industrial Sustainable

Development (PISD). Cleaner (Energy Efficiency) Technology Project for Karachi Tanneries (CTP-

KT) is a component project of PISD. CTP-KT intends to provide free of cost technical services to

Karachi-based leather processing units in implementing energy efficient and environment friendly

technologies.

3.4 DYES AND CHEMICALS

i. 90% of the dyes and chemicals used in the tanning of leather are imported mainly from

Germany, Spain and Italy.

ii. 10% dyes and chemicals are taken from MNCs which have got their set ups in Pakistan.

The big players of the Industry are Sandoz, Bayer, BASF and Clarient.

18

3.5 LABOUR SITUATION

i. The leather industry provides employment to 200,000 people of Pakistan

13

ii. Almost 80% of the labour is skilled( they have the required expertise to operate the

machinery)

14

iii. Approximately 20% are the unskilled workers who are basically helpers( they help in

unloading, loading and packaging)

15

iv. The bigger players in the Industry employ 15 to 20% graduates , engineers and diploma

holders while The smaller tanneries have 2 to 5% of graduates in their workforce.

16

v. Almost all the tanneries have the minimum age requirement of 18 years, below which

they do not employ the candidate.

vi. Basic training methodology prevalent is the Ustaad-shaagird

17

method.

vii. They believe that the expertise that the workers have is sufficient enough to meet the

buyer preferences.

4. OVERVIEW OF GOVERMENT POLICIES AND INCENTIVES

To stem decline in leather exports, the government has announced a number of steps for

giving a boost to leather apparel industry in its 3-year strategic trade policy framework 2009-12.

These steps, as announced by federal minister for commerce, on July 26, 2009, include facilities from

Export Investment Support (EIS) Fund for procurement of expert advisory services, matching grant to

establish design studios/centres and establishment of research and development centres in Karachi

and Sialkot. In addition, this sector would be able to avail EIS Fund facilities that include sharing 25

per cent financial cost of setting up laboratories and matching grant for setting up of effluent

treatment plants.

13

SMEDA . Leather Goods Sector Brief

14

Pakistan Tanners Association

15

SMEDA .Leather Goods Sector Brief

16

SMEDA. Leather Goods Sector Brief

17

In most of the Industries in Pakistan, the method of teaching and training a new worker is not through class

room or laboratory /workshop based training. Experienced workers who become masters in their field through

experience are called Ustaads and take help of new workers whoo are known as shaagirdand train them while

doing their jobs. This method is called Ustaad Shaagird method.

19

4.1 TRADE POLICY (STPF 2009-2012)

The Strategic Trade Policy Framework 2009-2012 had endeavored to come up with a clear

vision and road map in consultation with the major players of leather sector and Ministry of

Industries. To address supply side constraints and to encourage leather sector regain its lost share,

following measures had been recommended in the Trade Policy 2009-12.,

1) Providing on the floor expert advisory / consultancy services to leather apparel manufacturers

cum exporters.

2) Matching grant to establish design studios or design centers in factories.

3) Establishing R&D Centers in Karachi and Sialkot by Pakistan Leather Garments

Manufacturers and Exporters

4) Association for providing Research & Development support to Leather Garments & Leather

Goods Exporters.

5) Installation of flaying machines at district level slaughter houses.

6) Sharing 25% financial cost of setting up of design centers and labs in the individual tanneries.

7) To provide matching grant for setting up of effluent treatment plants in individual tanneries

4.2 DEMAND OF LEATHER INDUSTRY FROM THE GOVERNMENT

1) The leather garment industry strongly recommended for imposition of 20 per cent export duty

on export of semi-finished and finished leather in the new trade policy (2012-2015)

18

. This

would help availability of good quality leather produced locally.

2) 'Fox Furs' are much in demand abroad. This should be removed from negative items list

under import/export order. Export of garments using allowable fox fur trimmings for

decoration should also be permitted for boosting export of value added leather garments.

3) There is an immediate need for establishment of a Leather Board in Pakistan which should

operate as an independent body and funded by the government from export development fund.

The board should be headed by a person exporting value-added leather products.

18

http://www.fibre2fashion.com/news/daily-textile-industries-ews/newsdetails.aspx?news_id=112692

20

4) Value-added exports like leather garments where there cannot be any further value-addition

should be exempt from Export Development Surcharge.

5) Re-export of temporarily imported goods supplied by buyers should be allowed without sight

letter of credit or advance payment if supplied as free of cost. The present policy does not

provide provision for export of such goods in original and unprocessed form due to

cancellation of export order or changes in design/style of the order.

6) The exporters may also be allowed to retain 5 per cent of their export earnings for

international advertisements and commission etc

4.3 PERFORMANCE OF THE GOVERNMENT

The government has failed to implement the strategic trade policy framework (STPF) 2009-

2012. The government had not released funds for the strategic trade policy framework (STPF).

Though the budget 2009-10 earmarked a hefty amount of Rs40 billion for achieving various

initiatives under the STPF for the growth of exports but no amount has been released. It is even more

disturbing for the trade and industry that against most of the initiatives of the STPF public notices

were also issued but the ministry of finance failed to release the required funds.

Trade Development Authority of Pakistan (TDAP) under the directives of the ministry of

commerce issued public notices for various schemes included in the STPF. In response to these

notices different segments of trade and industry applied to avail the schemes and also incurred

sizeable expenditures to meet the conditions of these initiatives. Even on holding several meetings

with the high-ups of the MoC the funds were not made available. However, it was later disclosed that

the finance has not released funds allocated in the last budget for STPF because most of these funds

had been diverted to other schemes like Benazir Income Support Programme (BISP), for Internally

Displaced Persons (IDPs) and fiscal relief packages given to Khyber Pakhtunkhwa and FATA

19

.

Fawad Ijaz Khan, former chairman Pakistan Leather Garments Manufacturers and Exporters

Association (Plgmea) said in a speech that the major chunk of the Rs40 billion allocated for STPF

under the budget would have gone to the textile sector and around Rs1 billion for the leather

sector.The schemes designed under STPF included setting up of design centre for leather garments,

19

http://archives.dawn.com/archives/169664

21

hiring of foreign experts and creation of research and development cell in trade bodies, bearing 25 per

cent cost for laboratory in tanning industry and for effluent treatment plant

20

.

4.4 AFTER WTO & FUTURE PERSPECTIVES

As far as the implications of WTO on the leather industry are concerned, the Agreement on

Technical Barriers to Trade (TBT) and the Agreement on the application of Sanitary and

Phytosanitary Measures (SPS) can have significant impact on Pakistans ability to increase the

exports in this sector. TBT Agreement prevents use of national and regional technical requirements or

standards in general, as unjustified technical barriers to trade. SPS measures aim to protect human,

animal and plant life. Both the agreements lead to non-discrimination, avoidance of unnecessary

obstacles to trade, harmonization, equivalence, mutual recognition and transparency.

21

However, the

environmental issues related with the leather industry in Pakistan could have significant negative

effects on its exports. Another problem could be related to the quality of Pakistan's leather exports. If

the Pakistani exporter does not improve the quality of the product, the current competitive advantage

that Pakistan has in this field could quickly fade away.

Leather products like jackets, shoes and gloves account for more than two-thirds of leather

exports while tanned unfinished leather accounts for a third. But the industry is struggling to compete

in an increasingly tough market.

China and India are fighting for market share by beating Pakistan with cheaper input costs.

Meanwhile, in Pakistan the debate in the leather sector rages about whether unfinished leather should

be exported.

Hides and skins and leather are covered under the Agreement on Agriculture of WTO.

Moreover, the Agreement on Agriculture also has indirect implications for the sector through meat

and dairy policies. However, leather and leather products are covered under the general provisions of

the GATT 1994. No import tariffs are applied to raw hides and skins in Pakistan at present. Tariff

20

http://www.plgmea.pk/funds-not-released-for-export-schemes.php

21

Trade Liberalization and Environment Protection; Responses of Leather Industry in Brazil, China and India.

(http://www.jstor.org/discover/10.2307/4418354?uid=3738832&uid=2&uid=4&sid=56300054473)

22

escalation is an issue for leather and leather products as import tariffs vary according to the level of

processing; i.e. finished leather, leather bags, leather shoes etc. carry high tariffs in some countries.

5. TRADE DATA ANALYSIS

5.1 EXPORT ANALYSIS

TABLE 3: PERCENTAGE EXPORT GROWTH OF THE WORLD

Years

Leather Sector World Export

(US $ Billions) Growth

2005 89.16

2006 98.23 10.2%

2007 111.21 13.2%

2008 117.03 5.2%

2009 97.06 -17.1%

2010 116.82 20.4%

2011 139.48 19.4%

Source : ITC TRADE MAP

22

Total Export of Leather sector increased from the US $ 89.16 billion in 2006 to US $ 98.23

billion in 2006. 10.2% increase depicts the increased sales before the global economic recession. In

2007 the world export increased by 13.2% and by 2008 the percentage increase of the total world

export started falling .This decline attributes to overall decline in sale of Leather articles and

22

ITC Trade Map (www.trademap.org)

0.00

20.00

40.00

60.00

80.00

100.00

120.00

140.00

160.00

2005 2006 2007 2008 2009 2010 2011

Leather Sector (World Export to World)

Leather Sector World Export

23

garments due to global financial recession. In the year 2009 the export growth declined from being

positive at 5.2% to negative at 17.1%. The decrease in the leather sector was mainly due to the

Chinese Footwear and other leather articles Replica of major brands using artificial leather instead of

real leather. Their prices are less than one fourth of the actual brands but they are true copies of the

real brand. During the years 2008-09 Animal activists were successful in campaigning to stop the use

of animal skins. They argued that animals and rare animals are being killed for the sake of their skins.

A fashion show was also held in Paris and the theme of that show was Say No to Skins. This leads

to negative export growth. Another major reason was the implementation of stringent SPS laws in the

developing countries. The law prohibits handling of agricultural goods and sea food with bare hands.

In the year 2010 Total world exports of Leather sector achieved a positive 20.4% growth and an

export volume of US $ 116.82 billion. This increase in the Leather exports was due to fashion trend

of wearing leather jackets and leather trousers. The fashion hype boosted after the 2010 Gran Prix

Moto Bike Championship in Europe and USA.

TABLE 4: BILATERAL TRADE PROFILE

Product label

Bilateral Trade Profile for Leather Sector

2005 2006 2007 2008 2009 2010 2011

Total Exports of

Pakistan

16.0 16.9 17.8 20.2 17.5 21.4 25.3

Leather Sector of

Pakistan

0.9 0.8 0.9 1.0 0.7 0.8 0.9

% Share in Total

Exports

5.78% 5.27% 5.27% 5.03% 4.42% 4.08% 3.81%

Total Exports of

India

100.3 121.2 145.8 181.8 176.7 220.4 225.3

Leather Sector of

India

2.4 2.5 2.9 3.3 2.8 3.2 4.9

% Share in Total

Exports

2.41% 2.14% 1.99% 1.82% 1.63% 1.47% 2.22%

Source: ITC Trade Map US $ billion

24

The share of Leather sector in the Total export in Pakistan has always been more than what

India is contributing to its total exports. Pakistans export of the leather sector shows a stagnant trend.

Neither the export increased or decreased by large volume in the years 2005 to 2011. While Indias

leather sector has been progressing with a trough in 2009. Pakistans leather export for the year 2011

is US $ 0.9 billion while Indias export for the leather sector for the year 2011 is US $ 4.9 billion.

5.2 LEATHER GARMENTS AND GLOVES

5.2.1 EXPORT COMPOSITION OF LEATHER GARMENTS AND GLOVES

The Pakistani export of leather garments and gloves in 2010 was around $13 billion as

compared to $15 billion in 2005. The five-year trend indicates a negative growth (an average of -7%

per annum) for leather garments. Leather garments exports consist of article of leather apparel (62%)

and other leather clothing accessories (19%). China is the leading exporter of leather garments for the

last five years and shared 28 % of the total international trade for the year 2010. India comes with 8%

at number 3 while Pakistan has managed to capture 8 % at number 4 of the market in this sub sector.

Turkey has 3 % while Italy and Germany have 13 % and 5 % of the market share respectively

0

1000000

2000000

3000000

4000000

5000000

6000000

2005 2006 2007 2008 2009 2010 2011

Leather Sector of Pakistan

Leather Sector of India

25

TABLE 5: EXPORT COMPOSITION OF LEATHER GARMENTS AND GLOVES

Product code Product label

Exported

Value in

2005

Exported

Value in

2010

'420329

Gloves mittens&mitts,o/t for sport,of leather o

of composition leather

0.1 0.1

'420310

Articles of apparel of leather or of composition

leather

0.3 0.3

'420340

Clothing accessories nes, of leather or of

composition leather

0.02 0.002

'420321

Gloves,mittens & mitts,for sports,of leather or

of composition leather

0.03 0.1

'420330

Belts and bandoliers of leather or of

composition leather

0.002 0.004

Source: ITC Trade Map US $ billion

5.2.2 COMPETITOR ANALYSIS FOR GARMENTS AND GLOVES

Pakistan is the fourth largest exporter of leather garments to the world and contributed 8% of

the total leather garments export to the world. Top three exporters to the world in this product

category are China (28%), Italy (13%) and India (8%).

'420329

19%

'420310

62%

'420340

0%

'420321

18%

'420330

1%

Export Composition of Leather Garments and

Gloves (2010)

26

TABLE 6: COMPETITOR ANALYSIS FOR LEATHER GARMENTS AND GLOVES

Ranking Garments 4203

1 China (28%)

2 Italy (13%)

3 India (8%)

4 Pakistan (8%)

5 Hong Kong, China (7%)

6 Germany (5%)

7 France (5%)

8 Turkey (3%)

9 United States of America (3%)

10 Netherlands (3%)

Source: ITC Trade Map

Source: ITC Trade Map US $ billion

The above chart clearly shows that India is performing better in Leather garments and gloves sector.

5.2.3 POTENTIAL TRADE FOR GARMENTS AND GLOVES

Pakistan is exporting Leather Garments to India. Indian imports from Pakistan were US $ 0.1

million in 2010 while India imported US$8.8 million of Leather Garments from the world. Pakistan

0

200000

400000

600000

800000

1000000

1200000

Y2005 Y2006 Y2007 Y2008 Y2009 Y2010 Y2011

Leather Garments and Gloves

of Pakistan

Leather Garments and Gloves

of India

27

exported US$590.7 million of Leather to the world indicating a strong potential for Pakistan in Indian

market.

Below table also reveal that the potential for Pakistan in Leather Gloves export to India.

Pakistan exports around US$ 0.187 million of Leather Gloves to India while India imports about

US$883.3 million of Leather Gloves from the world. Pakistans export to the world is around

US$590.7 million..

TABLE 7: POTENTIAL TRADE OF LEATHER GARMENTS AND GLOVES

Product

code

Product label

Pakistan's

exports to

India

India's

imports

from world

Pakistan's

exports to

world

Indicative

potential

trade

Y 2010 Y 2010 Y 2010 Y 2010

'420321

Gloves,mittens & mitts,for

sports,of leather or of

composition leather

0.1 0.2 106.9 0.1

'420310

Articles of apparel of leather

or of composition leather

0.04 1.4 365.7 1.4

'420329

Gloves mittens&mitts,o/t for

sport,of leather o of

composition leather

0.02 1.0 111.3 0.9

'420330

Belts and bandoliers of

leather or of composition

leather

0.001 4.9 4.4 4.4

'420340

Clothing accessories nes, of

leather or of composition

leather

0 1.0 2.1 1.0

Source: ITC Trade Map US $ million

5.3 LEATHER FOOTWEAR

5.3.1 EXPORT COMPOSITION OF LEATHER FOOTWEAR

There is a huge international market for leather footwear. A total of $ 0.7 billion worth of

leather footwear was exported worldwide in 2010. Moreover, because of rising costs of

manufacturing units in the developed countries, footwear manufacturing base has shifted to low cost

regions and Asia has become a major footwear-manufacturing center. Footwear is the sub-sector that

has the maximum potential for value addition in finished leather . Pakistan has an inherent advantage

due to local availability of high quality hides & skins and a developed tanning industry. As a result,

28

good quality leather for footwear is easily available with minimum lead times. But in spite of this,

Pakistan has not been able to gain a sizable share in exports.

TABLE 8: EXPORT COMPOSITION OF LEATHER FOOTWEAR

Product

code

Product label

Exported

Value in 2005

Exported

Value in 2010

'640312 Ski-boots, snow-board boots, uppers of leather 0.00009 0.0001

'640359 Footwear, outer soles and uppers of leather, nes 0.006 0.002

'640399

Footwear, outer soles of rubber/plastics uppers of

leather, nes

0.008 0.04

'640319

Sports footwear,o/t ski,outr sole of

rbr/plas/leather&upper of leather

0.0002 0.01

'640340

Footwear,outr sole of rber/plas/leathr,uppers of

leathr w/met toe-cap

0.003 0.001

'640391

Footwear,outer soles of rubber/plast uppers of

leather covg ankle nes

0.028 0.004

'640330

Footwear,wooden,outer soles of rubber/

plas/leather&uppers of leather

0.00001 0

'640320

Footwear,outr sole/uppr of leathr,strap across the

instep/arnd big toe

0.005 0.008

'640351

Footwear, outer soles and uppers of leather,

covering the ankle, nes

0.0006 0.000007

Source: ITC Trade Map US $ billion

'640312

0%

'640359

4%

'640399

56%

'640319

21%

'640340

1%

'640391

6%

'640330

0%

'640320

12%

'640351

0%

Composition of Leather Footwear Export of

Pakistan (2010)

29

5.3.2 COMPETITOR ANALYSIS FOR FOOTWEAR

China is the biggest Exporter of leather Footwear of the world with 35% share in world top

ten exporters and Italy is number 2 with a 27% share in world top ten exporters. Pakistan and India

are not present in the top ten leather footwear exporters list. Pakistan stands at 44rth while India at

29

th

ranking in the world.

TABLE 9: COMPETITOR ANALYSIS FOR LEATHER FOOTWEAR

Ranking Footwear 6403

1 China (35%)

2 Italy (27%)

3 Germany (8%)

4 Belgium (6%)

5 Indonesia (7%)

6 Spain (6%)

7 Portugal (6%)

8 Netherlands (5%)

29 India (0.03%)

44 Pakistan (0.01%)

Source: ITC Trade Map

Source: ITC Trade Map US $ 000

Likewise the Leather Garments and Gloves sector , India is performing better in Leather

Footwear sector as well. Total leather sector exports for the year 2011 for Pakistan is US $ 0.085

billion while for India is US $ 2.0 billion.

0

500000

1000000

1500000

2000000

2500000

Y2005 Y2006 Y2007 Y2008 Y2009 Y2010 Y2011

Leather Footwear of Pakistan

Leather Footwear of India

30

5.3.3 POTENTIAL TRADE FOR LEATHER FOOTWEAR

TABLE 10: POTENTIAL TRADE FOR LEATHER FOOTWEAR

Product

code

Product label

Pakistan's

exports to

India

India's

imports

from world

Pakistan's

exports to

world

Indicative

potential

trade

Y 2010 Y 2010 Y 2010 Y 2010

'640320

Footwear,outr sole/uppr of leathr,strap across

the instep/arnd big toe

0.004 8.5 8.9 0

'640319

Sports footwear,o/t ski,outr sole of

rbr/plas/leather&upper of leather

0.003 7.8 15.4 0.1

'640340

Footwear,outr sole of rber/plas/leathr,uppers

of leathr w/met toe-cap

0 0.2 1.0 9.4

'640391

Footwear,outer soles of rubber/plast uppers

of leather covg ankle nes

0 3.6 4.7 4.5

'640359

Footwear, outer soles and uppers of leather,

nes

0 3.5 2.8 0.003

'640399

Footwear, outer soles of rubber/plastics

uppers of leather, nes

0 12.4 41.5 0.001

'640351

Footwear, outer soles and uppers of leather,

covering the ankle, nes

0 2.3 0.007 0

'640312

Ski-boots, snow-board boots, uppers of

leather

0 0.8 0.1 3.8

'640330

Footwear,wooden,outer soles of rubber/

plas/leather&uppers of leather

0 0 0 0.3

Source: ITC Trade Map US $ million

Table shows that Pakistan is currently exporting Leather Footwear to India. Indian imports

from Pakistan were only US$ 0.007 million in 2010 while Table shows that India imported

US$394.02 million of Leather from the world. Pakistan exported US$747.5 million of Leather to the

world and so a strong potential lies with Pakistan to export more to India.

5.4 LEATHER INDUSTRIAL GOODS

5.4.1 EXPORT COMPOSITION OF LEATHER INDUSTRIAL GOODS

Pakistan also produces saddlery and harness goods and export it to the world. The saddlery

industry was established in the 19th century primarily to cater to the needs of military and police.

Karachi and Sialkot are the major production centre for saddlery goods in Pakistan accounting for

more than 95% of the total exports of saddlery items from Pakistan. Karachi because of its

specialisation in tanning and finishing of buffalo hides is the only centre in the country where harness

31

leather, which is major input for saddlery industry, is manufactured. The export of saddlery and

harn'ess items have showed an annual negative growth rate of about 40% reaching US $ 1.3 million

in 2010 from US $ 6.4 million in 2005. The major importers of Pakistani saddlery are Germany,

USA, UK, France, Scandinavia, Netherlands, Japan, Australia and New Zealand.

TABLE 11: EXPORT COMPOSITION OF LEATHER GOODS FOR INDUSTRIAL USE

Product

code

Product label

Exported

Value in 2005

Exported

Value in 2010

'420400

Articles of leather or of composition leather, for

technical uses

0.01 0

'420500 Articles of leather or of composition leather, nes 0.04 0.006

'420100

Saddlery and harness for any animal, of any

material

0.002 0.006

Source: ITC Trade Map US $ billion

5.4.2 COMPETITOR ANALYSIS OF LEATHER I NDUSTRIAL GOODS

The largest exporters for Leather Goods for Industrial use (HS 420100) are China (36%) and

Germany (18%). The third largest exporter in the list is India with 11% export share in the world.

France with 24% share and China with 23% export share are the first and second largest exporters of

Leather Goods for Industrial use (HS 420500).

'420400

0%

'420500

50%

'420100

50%

Composition of Leather Goods (Industrial) Export

of Pakistan (2010)

32

TABLE 12: COMPETITOR ANALYSIS OF LEATHER GOODS FOR INDUSTRIAL USE

Ranking Goods 420400 Goods 420100 Goods 420500

1 Morocco (80%) China (36%) France (24%)

2 Ukraine (10%) Germany (18%) China (23%)

3 Netherland Antilles (7%) India (11%) Hungary (9%)

4 United Arab Emirates (3%)

United States of

America (7%)

United States of

America (8%)

5 Italy (6%) Mexico (7%)

6 France (6%) Hong Kong, China (7%)

7 United Kingdom (5%) Croatia (6%)

8 Chinese Taipei (5%) Italy (6%)

9 Viet Nam (3%) Poland (5%)

10 Ireland (3%) Austria (5%)

Source: ITC Trade Map

Source: ITC Trade Map

Total Leather Goods for Industrial use sector export for the year 2011 for Pakistan is US $

0.15 billion while for India it is US $ 0.2 billion.

5.4.3 POTENTIAL TRADE FOR LEATHER GOODS INDUSTRIAL

It is evident that Pakistan exported Leather Goods (Industrial) to India. Indian import from

Pakistan was only US$ 0.025 million in 2010 while India imported US$ 8.0 million of Leather from

0

50,000

100,000

150,000

200,000

250,000

Y2005 Y2006 Y2007 Y2008 Y2009 Y2010 Y2011

Leather Goods Industrial of

Pakistan

Leather Goods Industrial of

India

33

the world. Pakistan was exporting US$13.2 million US Dollars of Leather to the world. So a strong

potential lies with Pakistan, to export more to India.

TABLE 3: POTENTIAL TRADE FOR LEATHER GOODS FOR INDUSTRIAL USE

Product

code

Product label

Pakistan's

exports to

India

India's

imports

from

world

Pakistan's

exports to

world

Indicative

potential

trade

Y 2010 Y 2010 Y 2010 Y 2010

'420400

Articles of leather or of

composition leather, for

technical uses

0 0 0 0

'420100

Saddlery and harness for any

animal, of any material

0.005 0.1 6.5 6.5

'420500

Articles of leather or of

composition leather, nes

0.02 7.9 6.6 6.6

Source: ITC Trade Map US $ million

5.5 LEATHER GOODS CONSUMER ARTICLES

5.5.1 EXPORT COMPOSITION FOR LEATHER GOODS CONSUMER ARTICLES

Items produced by this sector include bags, handbags, handgloves and industrial gloves,

wallets, ruck sacks, folios, brief cases, travelware, belts, sports goods, upholstery. A surfeit of modern

units in Sialkot, Karachi and Kasur employing skilled human resources and sophisticated machinery

account for a diversified range of superlative small leather goods including bags, purses, wallets,

industrial gloves etc. made of quality leathers of cows, sheep, goats and buffaloes. The products meet

the requirement of bulk buyers and consumers in Europe, USA and Australia. The major market for

Pakistani leather goods is Germany, USA, UK, France and Italy. With products ranging from

designer collections to personal leather accessories, this sector has a share of 20.53 per cent in the

leather industry.

34

TABLE 14: EXPORT COMPOSITION FOR LEATHER GOODS CONSUMER ARTICLES

Product code Product label

Exported

Value in

2005

Exported

Value in

2010

'420221 Handbags with outer surface of leather 0.002 0.003

'420229 Handbags, of vulcanised fibre or of paperboard 0.0002 0.0009

'420292

Containers,with outer surface of sheeting of plas or tex

materials,nes

0.00009 0.003

'420231

Articles carried in pocket or handbag, with outer

surface of leather

0.001 0.0009

'420219 Trunks, suit-cases and similar containers, nes 0.0006 0.0005

'420222

Handbags w outer surface of sheetg of plastics o of

textile materials

0.00009 0.002

'420299 Containers, nes 0.0004 0.0004

'420211

Trunks,suit-cases & similar containers with outer

surface of leather

0.0009 0.001

'420212

Trunks,suit-cases&sim container w/outer surface of

plastics/textiles

0.0007 0.0009

'420232

Articles carrid in pocket/handbag,w/outer surface

sheetg of plas/tex

0.000004 0.00005

'420239 Articles carried in pocket or handbag, nes 0.0006 0.0001

'420291 Containers, with outer surface of leather, nes 0.00001 0.0003

'420329

Gloves mittens&mitts,o/t for sport,of leather o of

composition leather 0.1 0.1

'420310 Articles of apparel of leather or of composition leather 0.3 0.3

'420340

Clothing accessories nes, of leather or of composition

leather 0.028 0.002

'420321

Gloves,mittens & mitts,for sports,of leather or of

composition leather 0.03 0.1

'420330

Belts and bandoliers of leather or of composition

leather 0.002 0.004

Source: ITC Trade Map US $ billion

35

5.5.2 COMPETITOR ANALYSIS FOR LEATHER GOODS CONSUMER ARTICLES

Though India has 2% share in the top ten exports of Leather Goods for Consumer use

(Chapter 42) but Pakistan is not there. China is the biggest Exporter (49% share followed by Hong

Kong (15% share) France 11% share and Italy 11% share.

India and Pakistan both stand at an Export share of 10% in the top ten total world exports of

Leather Goods for Consumer use (Chapter 43) ,. While the largest exporters are China with 34%

export share and Italy with 16% export share.

0

50000

100000

150000

200000

250000

300000

350000

400000

'

4

2

0

2

2

1

'

4

2

0

2

2

9

'

4

2

0

2

9

2

'

4

2

0

2

3

1

'

4

2

0

2

1

9

'

4

2

0

2

2

2

'

4

2

0

2

9

9

'

4

2

0

2

1

1

'

4

2

0

2

1

2

'

4

2

0

2

3

2

'

4

2

0

2

3

9

'

4

2

0

2

9

1

'

4

2

0

3

2

9

'

4

2

0

3

1

0

'

4

2

0

3

4

0

'

4

2

0

3

2

1

'

4

2

0

3

3

0

Composition of Leather Goods (consumer) Export

of Pakistan (2010)

Composition of Leather Goods

(consumer) Export of Pakistan

(2010)

36

TABLE 15: COMPETITOR ANALYSIS FOR LEATHER GOODS CONSUMER

ARTICLES

Ranking Goods (Chapter 42) Goods (Chapter 43)

1 China (49%) China (35%)

2 Hong Kong, China (15%) Italy (16%)

3 France (11%) India (9%)

4 Italy (11%) Pakistan (9%)

5 Germany (3%) Hong Kong, China (9%)

6 Viet Nam (3%) Germany (6%)

7 Belgium (3%) France (6%)

8 United States of America (2%) Turkey (4%)

9 India (2%) United States of America (3%)

10 United Kingdom (1%) Netherlands (3%)

Source: ITC Trade Map

Source: ITC Trade Map

Total export of Pakistan for Leather goods consumer articles for the year 2011 is US $ 0.6

billion while for India it is US $ 2.0 billion.

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

Y2005 Y2006 Y2007 Y2008 Y2009 Y2010 Y2011

Leather Goods Consumer of

Pakistan

Leather Goods Consumer of

India

37

5.5.3 POTENTIAL TRADE FOR LEATHER GOODS CONSUMER ARTICLES

Strong potential lies with Pakistan, who can export more to India. Table 14--shows that

Pakistan exported Leather Goods (Consumer) to India. Table shows that Indian imports from

Pakistan were only US$ 0.5 million 2010 while India imported US$101.7 million of Leather from the

world. Also Pakistan exported US$605.6 million US Dollars of Leather to the world.

TABLE 16: POTENTIAL TRADE FOR LEATHER GOODS CONSUMER ARTICLES

Product

code

Product label

Pakistan's

exports to

India

India's

imports

from world

Pakistan's

exports to

world

Indicative

potential

trade

Y 2010 Y 2010 Y 2010 Y 2010

'420292

Containers,with outer surface of sheeting of plas

or tex materials,nes

0.3 3.3 3.4 3.1

'420222

Handbags w outer surface of sheetg of plastics o

of textile materials

0.08 15.0 2.5 2.4

'420299 Containers, nes 0.001 10.3 0.4 0.4

'420229 Handbags, of vulcanised fibre or of paperboard 0.001 3.9 0.9 0.9

'420221 Handbags with outer surface of leather 0 7.4 3.4 3.4

'420231

Articles carried in pocket or handbag, with outer

surface of leather

0 3.2 0.9 0.9

'420219 Trunks, suit-cases and similar containers, nes 0 5.0 0.5 0.5

'420211

Trunks,suit-cases & similar containers with

outer surface of leather

0 3.4 1.1 1.1

'420212

Trunks,suit-cases&sim container w/outer surface

of plastics/textiles

0 40.0 0.9 0.9

'420232

Articles carrid in pocket/handbag,w/outer

surface sheetg of plas/tex

0 0.3 0.05 0.005

'420239 Articles carried in pocket or handbag, nes 0 0.1 0.1 0.1

'420291 Containers, with outer surface of leather, nes 0 0.3 0.3 0. 3

'420321

Gloves,mittens & mitts,for sports,of leather or of

composition leather

0.1 0.2 106.9 0.1

'420310

Articles of apparel of leather or of composition

leather

0.04 1.4 365.7 1.4

'420329

Gloves mittens&mitts,o/t for sport,of leather o

of composition leather

0.02 1.0 111.3 0.9

'420330

Belts and bandoliers of leather or of composition

leather

0.001 4.9 4.4 4.4

'420340

Clothing accessories nes, of leather or of

composition leather

0 1.0 2.1 1.0

Source: ITC Trade Map US $ million

5.6 FINISHED LEATHER (HI DES)

5.6.1 EXPORT COMPOSITION OF FINISHED LEATHER (HI DES)

38

The annual availability of 166 million pieces of hides and skins is the main strength of the

industry. This is expected to go up to 218 million

23

pieces by the end of year 2010. Some of the

goat/calf/sheep skins available in Pakistan are regarded as specialty products commanding a good

market. Abundance of traditional skills in training, finishing and manufacturing downstream products

and relatively low wage rates are the two other factors of comparative advantage for Pakistan.

TABLE 17: EXPORT COMPOSITION OF FINISHED LEATHER HIDES

Produc

t code

Product label

Exported

Value in 2005

Exported

Value in 2010

'410441

Full grains leather, unsplit and grain splits leather, in

the dry stat

0.03 0

'410449

Hides and skins of bovine "incl. buffalo" or equine

animals, in the dr

0.1 0.01

'410411

Full grains, unsplit and grain splits, in the wet state

"incl. wet-blu

0.001 0.000007

'410419

Hides and skins of bovine "incl. buffalo" or equine

animals, in the we

0.0007 0.001

Source: ITC Trade Map US $ billion

5.6.2 COMPETITOR ANALYSIS FINISHED LEATHER (HI DES)

23

UNIDO. Daignostic study of Korangi Tanneries. 2006

'410441

0%

'410449

89%

'410411

0%

'410419

11%

Composition of Finished Leather (hides) Export of

Pakistan (2010)

39

The biggest exporter among the top ten Exporters of the World for Finished Leather (Leather

hides Chapter 41) are Argentina (19%) and Brazil (19%). They are followed by the USA with 17%

export share and Italy 12% export share. Pakistan and India do not fall among the top ten exporters of

the World. Pakistan has 1.2% export share while India has less than 1% export share for the world

export of finished leather (Leather hides Chapter 41).

TABLE 18: COMPETITOR ANALYSIS FINISHED LEATHER HIDES

Ranking Finished 4104

1 Brazil (19%)

2 Argentina (19%)

3 United States of America (17%)

4 Italy (12%)

5 Chinese Taipei (9%)

6 Hong Kong, China (7%)

7 Thailand (6%)

8 Australia (4%)

9 Viet Nam (4%)

10 Egypt (3%)

11 Pakistan (1.2%)

12 India (0.9%)

Source: ITC Trade Map

Source: ITC Trade Map

The above chart clearly shows that India is performing better in Leather garments and gloves sector.

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

Y2005 Y2006 Y2007 Y2008 Y2009 Y2010 Y2011

Finished Leather Hides of

Pakistan

Finished Leather Hides of India

40

Total Finished Leather (Hides) sector export for the year 2011 for Pakistan is US $ 0.00 5

billion while for India it is US $ 0.07 billion. Pakistan export is declining because its own leather

manufacturer industry has so grown that the leather hides production barely meets its local demand.

5.6.3 POTENTIAL TRADE FINI SHED LEATHER (HIDES)

Trade statistics for Finished Leather reveal that Indian imports from Pakistan were valued at

US$10.3 million while Indian imports from the world were valued at US$297.6 million. Pakistan

exports about US$180.7 million of Finished Leather and so in the category of Finished Leather

Pakistan has weak potential while India has a strong position.

TABLE 19: POTENTIAL TRADE FINISHED LEATHER HIDES

Product

code

Product label

Pakistan's

exports to

India

India's

imports

from world

Pakistan's

exports to

world

Indicative

potential

trade

Y 2010 Y 2010 Y 2010 Y 2010

'410449

Hides and skins of bovine "incl.

buffalo" or equine animals, in the dr

0.5 62.5 15.3 14.8

'410419

Hides and skins of bovine "incl.

buffalo" or equine animals, in the we

0.001 103.5 1.8 1.8

'410441

Full grains leather, unsplit and grain

splits leather, in the dry stat

0 2.7 0 0

'410411

Full grains, unsplit and grain splits,