Professional Documents

Culture Documents

The Aim of This Study Is To Highlight The Role and Effectiveness of Microfinance in Empowering Women

Uploaded by

tafakharhasnainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Aim of This Study Is To Highlight The Role and Effectiveness of Microfinance in Empowering Women

Uploaded by

tafakharhasnainCopyright:

Available Formats

1.

0 Introduction

Women constitutes an integral part of any society but their importance is undermined due to

gender discriminatory policies set by the government and norms by societies in both developing

and developed world. The poverty burden is beard by them. Women perform 66% of the global

work, contribute to the production of 50 % of global food, and in return receive only 10% of

world income and 1% share of property. 38% of the world registered business is owned by

women and its rate of growth is increasing in Asia, Europe, Africa and Latin America

(GEM2009). Despite the fact that women constitutes major share of the population, they

experience status disparity in developing and developed nations (Rehman and Naoroze,

2007).Women are the untapped sources of economic growth. International organizations like

United nation is using women empowerment as a strategy to reduce poverty and population

growth rate (Kabeer,2001) An economically independent woman invests more in the family and

community, therefore , women economic empowerment is a prerequisite for sustainable

economic development and pro poor growth.

Hisrich (1984) argues that the financial community rates women as a second class citizen.

Financial markets have been showing gender discrimination and possess a certain bias towards

women entrepreneurs and had been a major obstacle in their efforts to start up a new business or

strengthening their position (Thabethe, 2006). Furthermore as per Khan & Noreen (2012) 70 %

of world poor are women who are rarely financially independent due to hurdles in accessing

credit and financial services. This makes them most vulnerable members of the society. In order

to overcome this financial, social, and economic instability, microfinance can be considered as

an integral source of contribution through targeting women. Littlefield, Murduch, and Hashemi

(2004) argue that microfinance can be used as a developmental tool to create emancipation and

women empowerment. In concordance Holvoet (2005) suggests that the only platform that can

encourage women social, economic and political empowerment in the wake of skeptical financial

instruments is microfinance. The role of microfinance is considered significant by many

researches (e.g. Mayoux 2001 or Gurin 2006 for the African context; Mahmud 2003, Holvoet

2005 or Moodie 2008 in Asia; Velasco and Marconi 2004 in Latin America).

Researchers from different parts of the world agreed that women empowerment is created by

microcredit if the program is structured according to social and economic context of

women.(Hartungi, 2007; Holvoet, 2005; Gurin, 2006).

Saqib, ( 2006:2) argued that Muslims deterred participation in conventional microfinance

programs due to Riba (interest) that is forbidden in Islam. This becomes the basis for the

development of Khushali microfinance products. Khushali microfinance is in nascent stage of its

evolution, contributes 1% of total Khushali banking outreach globally. The existing studies on

Khushali microfinance are mainly done in Malaysia, Bangladesh, Indonesia and Egypt. Many

writers such as El-Gamal (2006), Ahmed (2001), and others, believe in the great potential of

Khushali banking to be involved in microfinance programs to cater for the needs of the poor who

usually fall outside the formal banking sector. Moreover different researchers are of the opinion

that diverse nature of Khushali instruments in collaboration with mechanisms like Zakat, charity

and waqaf can promote entrepreneurship (Akhtar, 1996, 1998; S. Al-Harran, 1995, 1996, 1999;

S. A. S. Al-Harran, 1990 Al-ZamZami & Grace, 2000; Dhumale & Sapcanin, 1998; Hassan &

Alamgir, 2002).

There are very limited offerings of Khushali microfinance products in Pakistan. Therefore,

majority of Muslims are forced to use interest based products or exploitive informal money

lender. Only two institutions Akhuwat foundation and Wasil Foundation are offering limited

Khushali microfinance products to both men and women. No exclusive offerings are designed

for women. The importance of women empowerment through micro credit and possible bridging

of gap that exists between religious beliefs and practice demands a study to explore the role that

Khushali microfinance can play in the empowerment of women.

The aim of this research is to explore the role of Khushali Microfinance products in the

empowerment of women entrepreneurs in the light of social and financial structures in Pakistan.

The study focuses on the women entrepreneurs from Lahore District that are using Khushali

Microfinance products to reveal their rich experiences and challenges in accessing and using the

Khushali Microfinance products. In addition, the current research will explore the perspectives of

Khushali and conventional microfinance providers operating in Pakistan on the challenges faced

by them in offering the Khushali microfinance products and the possible reasons behind the low

outreach of these products.

1.1 Background of Research

Women possess a disadvantaged position in developed and developing countries. This can be

tracked from studying history starting from post-world war II period. Women were considered

unproductive and isolated as housewives till 1970. Post 1970 era is characterized by industrial

development where women remained an unequal recipient. This resulted in receipt of only 10%

of world income by women even after performing 67% of world working hours as reported by

GEM (2010). This reflects that women economic health globally. Cheston and Kuhn (2002)

argue that women hold low paid jobs mostly in informal sector in most economies of the world.

This is further supported by the work of Islam (2006) that highlights the contribution of women

in the economic development. Consequently, World bank (2002) acknowledge that the ease of

access of financial resources to women creates women empowerment and subsequently

contributes to the development of economy. Mayoux (1998) noted that increasing women's

access to micro-credit has the tendency to initiate a series of 'virtuous spirals' of economic

empowerment, increased well-being for women and their families and on the wider scale, on

social and political empowerment.

Jolosheva (2010) argued that microfinance rates are higher for women and creates distress in

women in Kyrgyzstan. The inherent problem with the conventional microfinance products are

high interest rates. Also Interest or Riba is forbidden in Islam. Therefore the conventional

microfinance products create a conflict in ones religious belief system and the practical needs.

The emergence of Khushali banking and subsequently development of Khushali microfinance

products are the solutions that can resolve this conflict but it is not that easy. Riba is prohibited

in Islam and this poses a major challenge to Khushali banks to extend credit in an efficient and

profitable manner that is Shariah compliant. A study by Isler (2010) revealed an efficiency gap

in conventional and Khushali microfinance products. He proposed that the gap can be bridged by

improving the nature of products offered by Khushali banks. He proposed a study to understand

the nature of products that can improve the profitability of banks.

A study in Bangladesh (Hossain and Siwar,2008) explores the prospects and problems of

Khushali micro finance uncover the untapped opportunity. Ahmed (2009) argues that customer

satisfaction and service quality has weak influence on the performance of Khushali banks in

Pakistan.

1.2 Aims of the Research

Research in the area of Khushali micro finance and its role in empowerment of women

entrepreneurs is considered to be important in order to deal with the issues of easy access and

interest free Khushali micro finance products for the welfare of Women in particular and society

as a whole . Specifically the studies on independent microfinance programs and

entrepreneurship are less researched areas (Islam, 2009). The emerging field of Khushali

banking and Khushali micro finance is characterized with lack of comprehensive knowledge on

the nature of Khushali micro finance products and their efficiency in serving the women.

The primary aim of this study is to explore the role of Khushali microfinance products in the

empowerment of women Entrepreneurs in Pakistan. This study will bring out the perspective of

women entrepreneurs on challenges faced by them in accessing the Khushali microfinance

products due to the nature of the products. The study will further examine the perceptions of

managers of Khushali microfinance institutions about the inherent issues and prospects in

offering Khushali micro finance products to women entrepreneurs.

1.3 Research Objectives:

To assess the effectiveness of Micro-Finance program through Khushali Bank for women

in Pakistan.

To analyze the significance of Micro - Finance on women empowerment in Pakistan

To investigate the contribution of Micro - Finance on economic development of a country

1.4 Research Questions

What role does microfinance play in the economic empowerment of women Entrepreneurs in

Pakistan?

What are the challenges faced by women entrepreneurs' in accessing the microfinance in

Khushali Bank?

What are the reasons behind the limited offering of microfinance products by Khushali Bank

in Pakistan?

What changes are required in the Khushali micro finance products to cater to the needs of

women entrepreneurs'?

Chapter #2

LITERATURE REVIEW

Women often play a sovereign role in the business and professional life by undertaking their own

small scale enterprises (Warren, 2001). New theories of economic growth also take this into

consideration that gender equality is a fundamental part for economic development and the role

of women to increase as economic well being of the society (Klasen and Wink, 2002). Gender

inequality inversely impacts on agriculture and industrial productivity (Blackden and Bhanu,

1999; World Bank, 2006).

Krishnaraj and Kay (2002) have defined the role of women empowerment and microfinance:

In Bangladesh, women have been shown a good deal of empowerment in their capacity to

articulate their needs and receptivity to new ideas. More impressive was the emergence of

womens groups as a dynamic, articulate constituency These observations and interviews come

out to certify the conclusions of other studies (Cheston and Kuhn, 2002).

MICROFINANCE IN PAKISTAN The work of microfinance started in Pakistan at the early

1980s. Aga Khan rural support program (AKRSP) was the first microfinance institute in Pakistan

which started to provide micro credit in northern area of Pakistan. In 1982 Orangi pilot project

Karachi was launched under AKRSP. Later (1990) on the model of AKRSP was extended across

the country and established National Rural Support Program which was provided country wide

microfinance facilities but the provided facilities were not sufficient according to the requirement

of Pakistan economy. In 1996 it was established as a microfinance bank, that is, Kashaf

foundation. In 1998, Pakistan micro-finance network was designed, which played a very

important role to provide microfinance facilities in Pakistan. Further, Pakistan poverty

alleviation fund (PPAF) was allocated in 2000 which provided funds to microfinance banks and

SBP (State Bank of Pakistan) established a separate unit for it. The government of Pakistan is

also creating different financial institute which provide microfinance facilities.

Leading microfinance institution in Pakistan Highlighted a portfolio position of

microfinance institution of Pakistan Microfinance institutions strive enables women to

participate in the professional activities. How much this objective has been achieved is still a

question mark with reference to microfinance providers in Pakistan. Apart from this, there are

certain hurdles on the way for women pertaining to the access to microfinance services. Figures

2 and 3 depicts scenario of the issues.

Chapter 3: Methodology:

According to Saunders (2007) Research methodology provides a crucial role for investigating a

phenomenon in a particular research, methodological issues regarding this research could be

followed according to the following structure:

3.1 Research Philosophy:

The purpose of this research is to explore the Empowering the women through microfinance in

Pakistan. Researcher has decided to follow realism approach which is the combination of both

positivism and interpretivism philosophy, to achieve research objective of this study by adopting

positivism approach some well-established variables have been standardized. On the other hand

to solve more complex and complicated variables interpretivism philosophy has been adopted.

3.2 Research Approach:

To conduct this research inductive approach will be chosen because there is no existing

hypothesis and to avoid rigidness, inductive approach has been chosen.

3.3 Research Design:

Survey method would be applicable to conduct this research because data would be collected

from large scale respondents and survey is capable to obtain information from large samples of

the population.

3.4 Data Collection Method:

Questionnaire would be used to collect data to explore the effectiveness of microfinance to

empower the women in Pakistan by taking the Khushali bank as case study. This questionnaire

would be consists of several questions associated with micro finance, poverty alleviation and

management of credit by poor and uneducated people.

3.5 Quantitative Research:

This research would be conducted according to the quantitative nature of the research as it would

be difficult to analyse data based on qualitative nature from large scale of population.

3.6 Sampling:

Population of this research would be the women Khushali Bank Pakistan and sample size would

be 100.

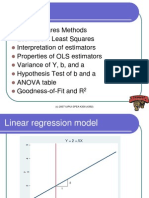

3.7 Data Analysis:

Summarizing, categorizing and structuring process with numerical analysis would be applied to

get maximum outcomes of this research. Several graphs, charts would be used to analyze data of

this research.

References

Ablorh,W.(2011). Microfinance and Socio-Economic Empowerment Of Women: A case of

opportunity international savings and loan clients. MBA Thesis. The institute of distance

learning, KWAME NKRUMAH University of Science and Technology, Retrieved October 1,

2013, KWAME NKRUMAH University of Science and Technology Digital thesis

Akhter,W.,Akhter,N. and Jaffri,K.A. (2009) Islamic micro-finance and poverty alleviation: a

case of pakistan.presented at CBRC,Lahore

Al-ZamZami, A. and Grace, L. (2000) Islamic Banking Principles Applied to Microfinance,

Special Unit for Microfinance, United Nations Capital Development Fund, November.

Al-Harran, Saad Abdul Sattar (1990) Islamic finance : the experience of the Sudanese Islamic

Bank in partnership (musharakah) financing as a tool for rural development among small farmers

in Sudan. Doctoral thesis, Durham University.

Chammas ,G.(2006). Islamic finance industry in Lebanon: Horizons, enhancements and

Projections. Master Thesis. Ecole Suprieure des Affaires, ESA- Beirut . Retrieved October 1,

2013, ESA- Beirut Digital Thesis

Essers,C.(2007).Entrepreneurship in public private divides: Business women of Turkish and

Moroccan descent playing family ties. Paper presented at reconnecting diversity to critical

organization and gender studies, Critical management studies conference,11-13

Global Entrepreneurship Monitor (GEM), 2010

http://www.gemconsortium.org/docs/266/gem-2010-global-report

Guerin,I.(2006).Women and money lessons from Sengal. Journal of Development and change.

37(3)549-570

Hossain.T.B.M. , Siwar,C. and Mubarak,T(2008).Determination of the effective ways if

microfinance for Islamic Banksto Eliminate Poverty: an empirical Investigation. PROSIDING

PERKEM III, JILID 1 822 832

Hartungi,R.(2007). Understanding the success factors of Micro-finance institution in a

developing country. International Journal of Social Economics, 34(6), 388 401

Holvoet,N.(2005). The impact of microfinance on decision making agency: Evidence from south

India. Journal of Development and change. 36(1)75-102

Hassan,K. Alamgir, D.(2002).Microfinancial Services and Poverty Alleviation in Bangladesh: A

Comparative Analysis of Secular and Islamic NGOs, in Islamic Economic Institutions and the

elimination of Poverty, ed. Munawar Iqbal, 113-86. Leicester: The Islamic Foundation.

Hisrich, R. D. & Brush, C. (1984). The woman entrepreneur: Management skills and business

problems. Journal of Small Business Management, 22, 1, 30-37 Abstract. Retrieved October 4,

2013 from the Proquest database Capella University, the Sheridan Library at Johns Hopkins

University.

Isler. B.F. (2010), The Efficiency of Microfinance Institutions Applying Principles of Islamic

Banking, Bachelor Thesis, University of Zurich, Retrieved October1,2013, from University of

Zurich digital Thesis

Islam, N., 2009. Can microfinance reduce economic insecurity and poverty? By how much and

how? [Online]. DESA Working paper No. 82, United Nations Department of Economic and

Social Affairs.

Jamali,D.(2009).Constraints and opportunities facing women entrepreneurs in developing

countries , A relational perspective: Gender in Management. An International journal,24(5),232-

251

Jolosheva,A.A.( 2010). Entrepreneurship and Microfinance: Economic Development and

Women's

Empowerment in Kyrgyzstan. Masters of Arts Thesis. University of Oregon, Retrieved October

1, 2013, University of

Oregon Digital Thesis

Jabakhail,M.(2012). Islamic Microfinance: A remedy for poverty in Afghanistan? Master of

Public Policy, University of Erfurt, Retrieved October 1, 2013, University of Erfurt Digital

Thesis

Khan, R. E. A., & Noreen, S. (2012). Microfinance and women empowerment: A case study of

District Bahawalpur (Pakistan). African Journal of Business Management, 6(12), 45144521.

Khan,M.(2012), ROSCAs and Microfinance in Pakistan: Community and Culture, PhD Thesis,

University of Leicester, Retrieved October1,2013, from University of Leicester Digital Thesis

Kossmann ,K.H.(2008). Micro Finance and empowerment from a womans perspective- The

effect of Micro-Finance on the empowerment of women in Bangladesh. Master Thesis.

Copenhagen Business School, Retrieved October 1, 2013, Copenhagen Business School Digital

Thesis

Khan,A.M. and Rehman,A.M.(2007). Impact of Microfinance on living standards,

Empowerment and Poverty Alleviation of Poor People: A case study on Microfinance in

Chittagoang District of Bangladesh. Business Administration Master Thesis. Ume School of

Business, Retrieved October 1, 2013, Ume School of Business Digital Thesis

Kabeer, N. (2001) Reflection on the measurement of women's empowerment. In discussion

women's

empowerment theory and practice, Sida studies No.3, Novum Grafishka A.B. Stockholm

Littlefield, E. and Rosenberg, R. (2004), Microfinance and the Poor;Breaking down walls

between microfinance and formal finance, Finance and Development, June, vol. 41, n2

Mahmood,S.(2013).Access to Finance and the Role of Microfinance for Women Entrepreneurs

in Pakistan. PhD Thesis. Birmingham City University. Retrieved October 1, 2013, from

Birmingham City University Digital Thesis

Mayoux, L., and M. Hartl (2009) Gender and rural microfinance: Reaching and empowering

women a guide for practitioners. IFAD report. Rome: International Fund for Agricultural

Development

Mustafa.Z. and Ismailov,N. (2008), Entrepreneurship and Microfinance-A tool for empowerment

of poor- Case of Akhuwat-Pakistan, Master Thesis, Malardalen University, Retrieved

October1,2013, from Malardalen University digital Thesis

Moodie,M. (2008). Enter microcredit: A new culture of womens Empowerment in Rajistan?

Journal of American Etnologist. 5(3)454-465

Mahmood,A.G (2006). A simple Fiqh-and Economic Rationale for mutualization in Islamic

Financial Intermediation, Rice University

Mahmud,S.(2003). Actually how empowering is microcredit? Journal of development and

change.34(4)577-605

Mayoux, L. (2000). A forthcoming. Selected Programme CaseStudies: SHDF, Zambuko Trust,

SEF, CGT and SCF-UK Vietnam Programme, ILO.

Mayoux, L. (1999). Questioning Virtuous Spirals: micro-finance and women's empowerment in

Africa. Journal of International Development 11:957-984.

Morduch, J., (1998). Does microfinance really help the poor? new evidence from flagship

programs in

Bangladesh. Working Paper No. 198. Stanford CA: Hoover Institution, Stanford University.

Mayoux, L. (1998)a. Women's Empowerment and Micro-finance programmes: Approaches,

Evidence and Ways Forward. The Open University Working Paper No 41.

Mayoux, L. (1998b). Participatory programme learning for women's empowerment in micro-

finance

programmes: negotiating complexity, conflict and change. IDS Bulletin 29:39-50.

Ufuk,H. and Ozgen ,O. (2001). Interaction between the business and family lives of women

entrepreneurs in Turkey. Journal of Business ethics, 31(6), 95-106

Velasco,C. and Marconi, R.(2004). Group Dynamics, gender and microfinance in Bolivia.

Journal of International Development. 16(3)519-528

http://www.polity.org.za/article/thabethe-address-to-women-in-ghana-24102006-2006-10-24

You might also like

- Chapter Three 3.0 Research Methodology 3.1 Introduction.Document11 pagesChapter Three 3.0 Research Methodology 3.1 Introduction.kays chapanda89% (138)

- The Truth About You: Five Keys To Enhancing Self-Esteem: by Laura DavisDocument16 pagesThe Truth About You: Five Keys To Enhancing Self-Esteem: by Laura DavisRomina RomanNo ratings yet

- Empowering Women Through MicrofinanceDocument64 pagesEmpowering Women Through MicrofinanceSocial Justice100% (2)

- Role of Self-Help Groups in Empowering Rural Women: A Case Study On Selected SHGs in Rani Block of Kamrup District of Assam.Document5 pagesRole of Self-Help Groups in Empowering Rural Women: A Case Study On Selected SHGs in Rani Block of Kamrup District of Assam.International Organization of Scientific Research (IOSR)No ratings yet

- BEED 109 The Teaching of Edukasyong Pantahanan at Pangkabuhayan EPP-1Document13 pagesBEED 109 The Teaching of Edukasyong Pantahanan at Pangkabuhayan EPP-1CionbasNo ratings yet

- Microfinance and Women Empowerment: A Case Study Among Women in Tuguegarao City, CagayanDocument24 pagesMicrofinance and Women Empowerment: A Case Study Among Women in Tuguegarao City, Cagayantricia quilangNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- 2987 6811 1 SMDocument19 pages2987 6811 1 SMno noNo ratings yet

- The Impact of Mirco Financing On The Performance of Women EntrepreneursDocument5 pagesThe Impact of Mirco Financing On The Performance of Women EntrepreneursVishal MehtaNo ratings yet

- (IJBEA - 2017) Nisser & Ayedh - Microcredit For Empowering WomenDocument7 pages(IJBEA - 2017) Nisser & Ayedh - Microcredit For Empowering WomenHanna youngNo ratings yet

- Role of Microfinance in Reducing The PovertyDocument7 pagesRole of Microfinance in Reducing The PovertyEmaaaanNo ratings yet

- Impact of Microfinance To Empower Female EntrepreneursDocument6 pagesImpact of Microfinance To Empower Female EntrepreneursInternational Journal of Business Marketing and ManagementNo ratings yet

- Propsal of Roll of Microfinance Institution in Economic Empowerment of WomenDocument29 pagesPropsal of Roll of Microfinance Institution in Economic Empowerment of WomenAmare FitaNo ratings yet

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyDocument8 pagesImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksNo ratings yet

- Women Empowerment Through MicrofinanceDocument12 pagesWomen Empowerment Through MicrofinanceHaseeb MalikNo ratings yet

- Heinrich Research ProposalDocument18 pagesHeinrich Research ProposalJustin Alinafe MangulamaNo ratings yet

- Ejbss 1792 16 EffectofmicrofinanceservicesonwomenDocument16 pagesEjbss 1792 16 EffectofmicrofinanceservicesonwomenrameshNo ratings yet

- 111-Article Text-383-1-10-20160518Document10 pages111-Article Text-383-1-10-20160518MusaabZakirNo ratings yet

- An Empirical Study On The Impact of Akhuwat Islamic Microfinance On Poverty Alleviation and Women EmpowermentDocument19 pagesAn Empirical Study On The Impact of Akhuwat Islamic Microfinance On Poverty Alleviation and Women EmpowermentmairaNo ratings yet

- Empowering Women Through Microfinance in KeralaDocument117 pagesEmpowering Women Through Microfinance in KeralakrishnanNo ratings yet

- Women's Economic Empowerment Through MicrofinanceDocument22 pagesWomen's Economic Empowerment Through MicrofinanceRonnald WanzusiNo ratings yet

- RamakantDocument41 pagesRamakantArchitNo ratings yet

- The Effect of Microfinance Service Towards Urban Women Empowerment in Hargeisa, SomalilandDocument17 pagesThe Effect of Microfinance Service Towards Urban Women Empowerment in Hargeisa, SomalilandNovelty JournalsNo ratings yet

- IJED Women Entrepreneurship 21Document19 pagesIJED Women Entrepreneurship 21Namita IndiaNo ratings yet

- 08 Role of Islamic Micro Credit Activities of Akhuwat in Poverty Alleviation in District Nowshera Pakistan by Asad Khan and OthersDocument17 pages08 Role of Islamic Micro Credit Activities of Akhuwat in Poverty Alleviation in District Nowshera Pakistan by Asad Khan and OthersFarman AliNo ratings yet

- Self Help Groups and Women Empowerment - A Study of Khurda District in OdishaDocument10 pagesSelf Help Groups and Women Empowerment - A Study of Khurda District in OdishaAbhijit MohantyNo ratings yet

- Effect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureDocument18 pagesEffect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureLealem tayeworkNo ratings yet

- Role of Microfinance in Women EmpowermentDocument10 pagesRole of Microfinance in Women EmpowermentarcherselevatorsNo ratings yet

- Women Empowerment and Making Decision ProcessDocument50 pagesWomen Empowerment and Making Decision Processfriends computerNo ratings yet

- Challenges Faced by The Islamic Microfinance Institutions in PakistanDocument13 pagesChallenges Faced by The Islamic Microfinance Institutions in PakistanmairaNo ratings yet

- 1st Old OneDocument15 pages1st Old OnehabibNo ratings yet

- Women Self-Help Groups and Women Empowerment-A Case Study of Mahila Arthik Vikas MahamandalDocument11 pagesWomen Self-Help Groups and Women Empowerment-A Case Study of Mahila Arthik Vikas MahamandaldebasisNo ratings yet

- Islamic Micro-Finance and Poverty Alleviation - A Case of Pakistan - World's Largest Interest Free Micro-Finance OrganizationDocument9 pagesIslamic Micro-Finance and Poverty Alleviation - A Case of Pakistan - World's Largest Interest Free Micro-Finance OrganizationAli Zain ParharNo ratings yet

- Ijm 11 06 235Document11 pagesIjm 11 06 235mogesgirmayNo ratings yet

- Rakesh KumarDocument19 pagesRakesh KumarArchitNo ratings yet

- Microfinance and Women EmpowermentDocument6 pagesMicrofinance and Women EmpowermentRasel Talukder100% (1)

- Impact of Microfinance On Income Generation and Living Standards A Case Study of Dera Ghazi Khan DivisionDocument8 pagesImpact of Microfinance On Income Generation and Living Standards A Case Study of Dera Ghazi Khan DivisionDia MalikNo ratings yet

- Research Proposal of Role of Cooperatives On Women EmpowermentDocument9 pagesResearch Proposal of Role of Cooperatives On Women EmpowermentSagar SunuwarNo ratings yet

- 173-Article Text-1018-1-10-20170306 (1)Document18 pages173-Article Text-1018-1-10-20170306 (1)Abraham RayaNo ratings yet

- Microfinance Effect On Poverty ReductionDocument29 pagesMicrofinance Effect On Poverty ReductionnabeelNo ratings yet

- Challenges Facing Officials of Microfinance: The Case of Amhara Credit and Saving Institution (ACSI), EthiopiaDocument9 pagesChallenges Facing Officials of Microfinance: The Case of Amhara Credit and Saving Institution (ACSI), EthiopiaMuktar jiboNo ratings yet

- Empowering Women Through MicrofinanceDocument18 pagesEmpowering Women Through MicrofinanceSadia NNo ratings yet

- Woman EmpowermentDocument16 pagesWoman EmpowermentShailendra BhattNo ratings yet

- Entrepreneurial Success Through Microfinance Services Among Women Entrepreneurs in Sri Lanka: A Pilot Study and Overview of The FindingsDocument7 pagesEntrepreneurial Success Through Microfinance Services Among Women Entrepreneurs in Sri Lanka: A Pilot Study and Overview of The FindingsTharusha DeMelNo ratings yet

- Has Microcredit Been Beneficial or Harmful For Women? Has It Empowered Women in Bangladesh?Document20 pagesHas Microcredit Been Beneficial or Harmful For Women? Has It Empowered Women in Bangladesh?Ana SolerNo ratings yet

- Financial Inclusion and Women Empowerment Through Micro FinanceDocument12 pagesFinancial Inclusion and Women Empowerment Through Micro FinanceYogasre ManasviniNo ratings yet

- Challenges Women Face Accessing Microfinance CreditDocument17 pagesChallenges Women Face Accessing Microfinance CreditJustin Alinafe MangulamaNo ratings yet

- Microfinance and Women EntrepreneurshipDocument8 pagesMicrofinance and Women EntrepreneurshipMEERA RAVI PSGRKCWNo ratings yet

- Evidence on Empowering Women through Microfinance in TanzaniaDocument29 pagesEvidence on Empowering Women through Microfinance in TanzaniatafakharhasnainNo ratings yet

- Term ReportDocument14 pagesTerm ReportShanita AhmedNo ratings yet

- Banglades PedesaanDocument22 pagesBanglades Pedesaanharis gunawanNo ratings yet

- A Case Study of Micro Financing in The Suburbs of District Rawalpindi PakistanDocument7 pagesA Case Study of Micro Financing in The Suburbs of District Rawalpindi PakistanShah WazirNo ratings yet

- Role of Micro-Financing in Women Empowerment: An Empirical Study of Urban PunjabDocument16 pagesRole of Micro-Financing in Women Empowerment: An Empirical Study of Urban PunjabAnum ZubairNo ratings yet

- Women's Empowerment and Microfinance: An Asian Perspective StudyDocument42 pagesWomen's Empowerment and Microfinance: An Asian Perspective StudyDarman TadulakoNo ratings yet

- Microloans and Women's Freedom of PhysicalDocument25 pagesMicroloans and Women's Freedom of PhysicalBimali NamamuniNo ratings yet

- Women Empowerment and Micro FinanceDocument31 pagesWomen Empowerment and Micro Financekrishnan100% (1)

- Impact of MFI - Bikash AcharyaDocument16 pagesImpact of MFI - Bikash AcharyaPrabin AcharyaNo ratings yet

- Islamic EconomyDocument8 pagesIslamic EconomyAnn PetersNo ratings yet

- Updated Synopsis AfshaDocument14 pagesUpdated Synopsis AfshaFAIZNo ratings yet

- Asian Economic and Financial Review explores zakah as Islamic microfinancingDocument9 pagesAsian Economic and Financial Review explores zakah as Islamic microfinancingYassine MabroukNo ratings yet

- Money with Morals: The Necessity of Islamic Finance in Today's WorldFrom EverandMoney with Morals: The Necessity of Islamic Finance in Today's WorldNo ratings yet

- Lecture 4Document36 pagesLecture 4tafakharhasnainNo ratings yet

- Scriptie A Von ElverfeldtDocument62 pagesScriptie A Von ElverfeldttafakharhasnainNo ratings yet

- Chapter 06Document56 pagesChapter 06navimala85No ratings yet

- Chapter 06Document56 pagesChapter 06navimala85No ratings yet

- Chapter 7 Pricing StrategiesDocument30 pagesChapter 7 Pricing StrategiestafakharhasnainNo ratings yet

- Econo Chap02Document56 pagesEcono Chap02tafakharhasnainNo ratings yet

- Data SourcesDocument26 pagesData SourcestafakharhasnainNo ratings yet

- OlsDocument34 pagesOlstafakharhasnainNo ratings yet

- Bank MotivationDocument8 pagesBank MotivationkinswNo ratings yet

- Chapter 7 Pricing StrategiesDocument30 pagesChapter 7 Pricing StrategiestafakharhasnainNo ratings yet

- Introductory Econometrics Chapter 1Document14 pagesIntroductory Econometrics Chapter 1tafakharhasnainNo ratings yet

- Scan Doc0006Document1 pageScan Doc0006tafakharhasnainNo ratings yet

- Compensation ObjectivesDocument2 pagesCompensation ObjectivestafakharhasnainNo ratings yet

- Pricing Strategy StepsDocument6 pagesPricing Strategy StepstafakharhasnainNo ratings yet

- About Compensation ManagementDocument10 pagesAbout Compensation ManagementtafakharhasnainNo ratings yet

- Performance Evaluation of Banking Sector in Pakistan: An Application of BankometerDocument6 pagesPerformance Evaluation of Banking Sector in Pakistan: An Application of BankometertafakharhasnainNo ratings yet

- Compensation Management MBA HRDocument67 pagesCompensation Management MBA HRtafakharhasnainNo ratings yet

- Tender Pricing StrategyDocument35 pagesTender Pricing StrategyWan Hakim Wan Yaacob0% (1)

- Introductory Econometrics Chapter 1Document14 pagesIntroductory Econometrics Chapter 1tafakharhasnainNo ratings yet

- Islamic Banking in The UKDocument113 pagesIslamic Banking in The UKKarun GonuNo ratings yet

- Economic IndicatorDocument11 pagesEconomic IndicatortafakharhasnainNo ratings yet

- MBR PresentationDocument21 pagesMBR PresentationtafakharhasnainNo ratings yet

- What Is Econometric SDocument5 pagesWhat Is Econometric SKhalid AfridiNo ratings yet

- Stock Exchange: Easy Way To Earn MoneyDocument26 pagesStock Exchange: Easy Way To Earn MoneytafakharhasnainNo ratings yet

- Research Proposal by Aqib & ImranDocument8 pagesResearch Proposal by Aqib & ImrantafakharhasnainNo ratings yet

- InterviewsDocument24 pagesInterviewstafakharhasnainNo ratings yet

- Meeting The Human RequirmentsDocument33 pagesMeeting The Human RequirmentstafakharhasnainNo ratings yet

- Impact of HR Practices on Human Capital Performance in Indian EducationDocument11 pagesImpact of HR Practices on Human Capital Performance in Indian Educationneha.verma_04No ratings yet

- BA 427 - Assurance and Attestation Services: Tests of ControlsDocument27 pagesBA 427 - Assurance and Attestation Services: Tests of ControlsLay TekchhayNo ratings yet

- What I Have Learned: Activity 3 My Own Guide in Choosing A CareerDocument3 pagesWhat I Have Learned: Activity 3 My Own Guide in Choosing A CareerJonrheym RemegiaNo ratings yet

- Vinit Kumar Gunjan, Vicente Garcia Diaz, Manuel Cardona, Vijender Kumar Solanki, K. V. N. Sunitha - ICICCT 2019 – System Reliability, Quality Control, Safety, Maintenance and Management_ Applications .pdfDocument894 pagesVinit Kumar Gunjan, Vicente Garcia Diaz, Manuel Cardona, Vijender Kumar Solanki, K. V. N. Sunitha - ICICCT 2019 – System Reliability, Quality Control, Safety, Maintenance and Management_ Applications .pdfepieNo ratings yet

- Effect of Owner's Equity Structure On Stock PerformanceDocument11 pagesEffect of Owner's Equity Structure On Stock Performancesita deliyana FirmialyNo ratings yet

- Women in ManagementDocument8 pagesWomen in ManagementYus NordinNo ratings yet

- Crisil'S Grading For Healthcare Institutions: CRISIL GVC Rating - MethodologyDocument6 pagesCrisil'S Grading For Healthcare Institutions: CRISIL GVC Rating - MethodologySylvia GraceNo ratings yet

- 13 Calibration WassertheurerDocument7 pages13 Calibration WassertheurerYasmine AbbaouiNo ratings yet

- Certificate of Calibration: Customer InformationDocument2 pagesCertificate of Calibration: Customer InformationSazzath HossainNo ratings yet

- Unit - Iv Testing and Maintenance Software Testing FundamentalsDocument61 pagesUnit - Iv Testing and Maintenance Software Testing Fundamentalslakshmi sNo ratings yet

- Factorial and Construct Validity of The Sibling ReDocument8 pagesFactorial and Construct Validity of The Sibling Rezakiah ulyaNo ratings yet

- Standards of Proficiency Biomedical ScientistsDocument20 pagesStandards of Proficiency Biomedical ScientistsIlfan KazaroNo ratings yet

- Servicequalityof Canara BankDocument55 pagesServicequalityof Canara BankGRAMY TRADERS SALEMNo ratings yet

- Components Research ProposalDocument3 pagesComponents Research ProposalPeter Fainsan IIINo ratings yet

- B 001 014 489 PDFDocument208 pagesB 001 014 489 PDFBubi GómezNo ratings yet

- Sport in Society: Cultures, Commerce, Media, PoliticsDocument4 pagesSport in Society: Cultures, Commerce, Media, PoliticsSysy DianitaaNo ratings yet

- Cyient - Oil and Gas IndustryDocument8 pagesCyient - Oil and Gas Industrycyient_analyticsNo ratings yet

- BriefDocument22 pagesBriefHuế NguyễnNo ratings yet

- Final Synopsis On Food Adultreation and ControlDocument5 pagesFinal Synopsis On Food Adultreation and ControlMohammad Bilal0% (1)

- CaSe StudyDocument5 pagesCaSe StudySachin YadavNo ratings yet

- Thesis Questionnaires For Pilot TestingDocument3 pagesThesis Questionnaires For Pilot TestingJJ JaumNo ratings yet

- Epi FinalDocument481 pagesEpi FinalSana Savana Aman R100% (1)

- INF70005 Unit Outline 2019Document10 pagesINF70005 Unit Outline 2019andrewbNo ratings yet

- Sustainability 13 01029 v3Document89 pagesSustainability 13 01029 v3Getacho EjetaNo ratings yet

- ProposalDocument4 pagesProposalaimeefataNo ratings yet

- Project IdentificationDocument7 pagesProject Identificationsimmi33No ratings yet

- For Progress ReportDocument6 pagesFor Progress ReportReine Chiara B. ConchaNo ratings yet