Professional Documents

Culture Documents

New Microsoft Word Document

Uploaded by

atgsganeshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Microsoft Word Document

Uploaded by

atgsganeshCopyright:

Available Formats

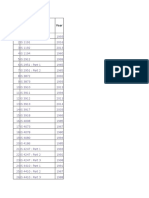

Indian Financial System jaiib important questions and answers

Sl

No

Question Answer

1 The structure that is available in an economy to mobilize the capital from

various surplus sectors of the economy and allocate and distribute the

same to the various needy sectors is known as ----------

Financial

system.

2 The transformation of savings into investment and consiumption is

facilitated by the active role played by the financial system. True or

false.

Ans True

3 Banks, Financial Institution mutual funds etc are examples of Financial

Intermediaries. True or False.

Ans: True.

4 Financial market include Money Market, Debt Market, Forex Market and ---

-

Ans Capital

Market

5 Treasury bills are money market instrument True or false. . Ans : true

6 Certificate of Deposit is a money market instrument True or false. Ans True.

7 Commercial paper is a money market instrument True or false . Ans True

8 Call money and Notice money are Money market instruments True or

false.

Ans True.

9 G Securities issued by Central and State Government are instruments in

Debt Market. True or false.

Ans True

10 Bonds issued by Financial Institution are instruments in Debt market. True

or false

Ans True.

11 Reserve Bank of India has two distinct roles one is Monetary Control

including controlling inflation and other is -----------

Ans:

Bank

supervision

12 Reserve Bank of India is exercising Monetary Control through 1)

cash Reserve Ratio, 2) Statutory Liquidity Ratio 3) REPO rate and ---------

Ans Bank

rate.

13 Central Bank (RBI) is lender of the last resort to other Banks True or false. Ans : True.

14 ------------ is responsible for ensuring an efficient payment & settlement

system. True or false.

Ans : True.

15 Reserve Bank of India has supervision over 1) Commercial Bank 2) NBFC

3) Primary dealers 4) Financial institution True or false.

Ans : True

16 Reserve Bank of India is Banker to Government True or false. Ans True.

17 Capital Market Regulator in India is SEBI True or false Ans True

18 The standard rate at which RBI is prepared to buy or re discount

bills of exchange or other eligible commercial papers from Banks is

known as

Bank rate

19 No Bank can hold shares in a company as pledge or mortgage in

excess of the limit of 30% of the paid up capital of that company or

30% of the Banks paid up capital and reserve which ever is less.

This is covered in

Sec 19(ii) of BR

Act

20 A mutual fund is a form of collective investment that pools money

from investors and invests in stocks, debt and other securities. It is

a less risky investment opinion for an individual investor.

Mutual funds require the regulators approval to start an asset

Securities and

Exchange Board

of India)

management Company (the fund) and each scheme has to be

approved by regulator before it is launched. Who is the regulator.

SEBI

21 Foreign based funds authorized by the Capital Market Regulator to

invest ion Indian Equity and debt market through stock exchanges.

These are called.

Foreign

Institutional

Investors.

22 Registrars maintain a Register of share and debenture holders and

process share and debenture allocation when issues are

subscribed. Registers need approval from Regulator. Who is the

regulator

Securities and

Exchange Board

of India)

SEBI

23 Depository hold securities in ---------- form (as opposed to Physical

form) maintains accounts of depository participants who in turn

maintains sub accounts of their customers. On receiving instructions

from Stock exchange clearing house supported by documentation a

depository transfers securities from the sellers account to buyers

account in ------------ form

Electronic form

(Demat)

24 A Bank undertake a number of activities such as undertaking the

issue of stocks fund raising and management. They also provide

advisory services and counsel on mergers amalgamation etc. They

are licensed by capital market regulators. The above Bank is called

----------

Investment

Bankers or

merchant

Bankers.

25 Brokers perform the job of intermediating between buyers and

sellers of securities. They help to build up an order book carry out

price discovery and are responsible for brokers contracts being

honoured. These services are subject to -------------

Brokerage.

26 Doing Banking business with Industrial and business entities

mostly Corporate and trading houses including multinationals

domestic business houses and prime public sector Companies.

Wholesale

Banking.

27 The Credit information Bureau (India) Ltd (CIBIL) incorporated in

2000, aim at fulfilling the need of credit granting institution for

comprehensive credit information by collecting collating and

disseminating credit information pertaining to both commercial

and ------------------ borrowers.

Consumer

(Individual)

28 ------------ refers to the dealing of commercial Banks with

individual customers. Both on liabilities and assets side of the

balance sheet. Fixed, Current, Savings accounts on the liability

side and personal loans housing auto loans and education loans

on the asset side are the important product offered by Banks to

individuals. The related ancillary service include Credit card, debit

card depository services

Retail Banking

29 Todays retail Banking sector is characterized by three basic

features. What are they.

1).Multiple product.

2).Multiple

channels of

distribution

3).Multiple

customer Group.

30 Multiple product in retail Banking means Deposit, Credit

card, Insurance ,

Investment and

securities.

31 Multiple channels of distribution in retail Banking means. Call Centres,

Branch, Internet

and ATM (Kiosk)

32 Multiple customer Group in retail Banking means Consumer, Small

Business and

Corporates.

33 Zero Balance Account for Salaried class people is a Retail Deposit

product.

34 Banks provide preshipment finance in the form of export

packing credit both in rupee as well as in foreign currencies to

assist exporters for manufacturing or packing the goods for

export from India.

Export packing

credit.

35 In respect of export bills drawn under LC , if the documents

are found to be strictly in terms with LC condition the Bank of

the export customer / or the nominated Bank make

payment of bill to the exporter and send the bill for realization

to the LC issuing Bank or reimbursing Bank. This process is

known as -----------

Negotiation of

export bill under

LC.

36 This facility enables Indian Exporters to extend term credit to

importers (overseas) of eligible goods at the post shipment

stage. This is known as --------------------

Suppliers Credit.

37 EEFC Account stands for Exchange Earners

Foreign Currency

Account.

38 ADR stands for American

Depository Receipt.

39 ADR are typically traded on US national stock exchanges such

as New York Stock exchange or American Stock Exchanges.

True

40 GDR stands for Global Depository

Receipts

41 In --------------- Securities share bond debentures are offered to

the public for subscription for the purpose of raising capital or

fund.

The primary market

42 The primary market is classified into public issue market and --

---------

Private placement.

43

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 14 Art IJNAM08Document17 pages14 Art IJNAM08atgsganeshNo ratings yet

- Recent Senario in Formwork: Aluminium FormsDocument3 pagesRecent Senario in Formwork: Aluminium FormsatgsganeshNo ratings yet

- Study On Spun Casting Pre-Stressed Concrete Technology & Its Application To Low Cost Utility Pole Production in Sri LankaDocument87 pagesStudy On Spun Casting Pre-Stressed Concrete Technology & Its Application To Low Cost Utility Pole Production in Sri LankaatgsganeshNo ratings yet

- PG CET 2017 (E Brochure) : E-Mail: Website: Helpline: 080-23 460 460 (5 Lines) From 9.30am To 6.00 PMDocument81 pagesPG CET 2017 (E Brochure) : E-Mail: Website: Helpline: 080-23 460 460 (5 Lines) From 9.30am To 6.00 PMkagwad09No ratings yet

- Plate & Shell ElementsDocument11 pagesPlate & Shell ElementsShamaNo ratings yet

- BisDocument102 pagesBisAmbarish PatkarNo ratings yet

- Design of Reinforced Concrete Buildings for Earthquake ResistanceDocument7 pagesDesign of Reinforced Concrete Buildings for Earthquake ResistanceatgsganeshNo ratings yet

- Hydraulics HydraulicAnalysis PDFDocument9 pagesHydraulics HydraulicAnalysis PDFEduardo Abbadon ZavalaNo ratings yet

- How Do I Remove A Load From A Member PDFDocument10 pagesHow Do I Remove A Load From A Member PDFarvindNo ratings yet

- BS 5950 Part 5Document2 pagesBS 5950 Part 5atgsganeshNo ratings yet

- Civil 2016Document16 pagesCivil 2016atgsganeshNo ratings yet

- Karnataka Act Determines Seniority for Reserved PromotionsDocument9 pagesKarnataka Act Determines Seniority for Reserved PromotionsatgsganeshNo ratings yet

- Chapter 19Document14 pagesChapter 19Billy ZununNo ratings yet

- Moody Charts SummaryDocument8 pagesMoody Charts SummaryatgsganeshNo ratings yet

- List of Indian Standard Code For Civil and Structural Works PDFDocument148 pagesList of Indian Standard Code For Civil and Structural Works PDFKalipada Sen100% (1)

- Is Codes Ced As On Ma7 2017Document112 pagesIs Codes Ced As On Ma7 2017atgsganeshNo ratings yet

- KPCL Recruitment for Assistant PostsDocument5 pagesKPCL Recruitment for Assistant PostsatgsganeshNo ratings yet

- WRD Water ResourcesDocument32 pagesWRD Water ResourcesatgsganeshNo ratings yet

- Model Q Paper ESE 2017 GS EngggDocument14 pagesModel Q Paper ESE 2017 GS Enggginfinityanant2400206No ratings yet

- Iso 10816 2 2001Document17 pagesIso 10816 2 2001DiegoNo ratings yet

- Design of Turbo Generator FoundationDocument2 pagesDesign of Turbo Generator Foundationatgsganesh100% (1)

- Is Codes ListDocument132 pagesIs Codes ListMuralidhar BalekundriNo ratings yet

- BHELDocument38 pagesBHELSharath Chandra100% (1)

- Criteria for Design of RCC Staging for Overhead Water TanksDocument44 pagesCriteria for Design of RCC Staging for Overhead Water TanksSyed Mohd MehdiNo ratings yet

- Design of Thermal Power Plant Turbogenerator FoundationDocument19 pagesDesign of Thermal Power Plant Turbogenerator FoundationDeepu PillaiNo ratings yet

- Dynamic Analysis and Structural Design of Turbine Generator FoundationsDocument12 pagesDynamic Analysis and Structural Design of Turbine Generator FoundationsGowrishankar1987100% (1)

- Seismic design forces for a four-storey RC buildingDocument26 pagesSeismic design forces for a four-storey RC buildingjonnyprem100% (1)

- RakMek 23 2 1990 2Document21 pagesRakMek 23 2 1990 2atgsganeshNo ratings yet

- BHEL Training Report On TURBO GENERATORDocument49 pagesBHEL Training Report On TURBO GENERATORArun Rana33% (3)

- Design of Turbo-Generator Foundations: C.Ravishankar, C. Channakeshava, B. Sreehari Kumar, G V RaoDocument8 pagesDesign of Turbo-Generator Foundations: C.Ravishankar, C. Channakeshava, B. Sreehari Kumar, G V RaoAlastair KerrNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Consumer and Business Markets: Lesson 3.4Document22 pagesConsumer and Business Markets: Lesson 3.4willsonjohndrewfNo ratings yet

- Investment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFDocument24 pagesInvestment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFQuantDev-MNo ratings yet

- Task 4 - Model Answer - RevisedDocument1 pageTask 4 - Model Answer - RevisedRoshan GaikwadNo ratings yet

- Business Simulation GuideDocument69 pagesBusiness Simulation GuideMintu Singh YadavNo ratings yet

- Accounts Receivable q3Document3 pagesAccounts Receivable q3Omnia HassanNo ratings yet

- Types of ContractsDocument3 pagesTypes of ContractsDebjit KunduNo ratings yet

- AuditorDocument7 pagesAuditorEsha JavedNo ratings yet

- Investment Analysis Icmss 2013Document20 pagesInvestment Analysis Icmss 2013Panzi Aulia RahmanNo ratings yet

- Chapter One: Cost Management and StrategyDocument29 pagesChapter One: Cost Management and StrategySupergiant EternalsNo ratings yet

- Balaji Traders: Service Operations ManagemnetDocument14 pagesBalaji Traders: Service Operations ManagemnetMihir PatelNo ratings yet

- Marketing Plan For FTTHDocument5 pagesMarketing Plan For FTTHsheinmin thuNo ratings yet

- Homework Week 5Document4 pagesHomework Week 5Naveen Tahilani0% (1)

- Designing Services and Products for OperationsDocument206 pagesDesigning Services and Products for OperationsTIZITAW MASRESHANo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleadeebaa480No ratings yet

- Test Bank For Connect With Smartbook Online Access For Managerial Accounting 11th EditionDocument24 pagesTest Bank For Connect With Smartbook Online Access For Managerial Accounting 11th Editionforceepipubica61uxl100% (48)

- Chapter 11Document11 pagesChapter 11Joan LeonorNo ratings yet

- Indian Pharma Industry OverviewDocument78 pagesIndian Pharma Industry OverviewHardik PatelNo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- Solution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Document4 pagesSolution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Kim JuanNo ratings yet

- Project 2 - Securities Law 1Document16 pagesProject 2 - Securities Law 1Zaii ZaiNo ratings yet

- Apple Inc Financial AnalysisDocument3 pagesApple Inc Financial AnalysisKarim El GazzarNo ratings yet

- ch1 Acc WsDocument4 pagesch1 Acc WspranjalNo ratings yet

- Loreal Master ThesisDocument6 pagesLoreal Master ThesisMonique Anderson100% (2)

- Franklin India Flexicap FundDocument1 pageFranklin India Flexicap FundSandeep BorseNo ratings yet

- Exercise-2 ZhengDocument3 pagesExercise-2 ZhengHiền NguyễnNo ratings yet

- Walmart Strategy AnalysisDocument12 pagesWalmart Strategy AnalysisDai Nghia100% (1)

- Stock Report For MHODocument11 pagesStock Report For MHOtaree156No ratings yet

- Sample Question Paper Economics (030) Class XIIDocument4 pagesSample Question Paper Economics (030) Class XIIMitesh SethiNo ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysiskasuri.bilal.donNo ratings yet

- Meaning/Definition and Nature of Consumer BehaviourDocument8 pagesMeaning/Definition and Nature of Consumer BehaviourThe Mentals ProfessionNo ratings yet