Professional Documents

Culture Documents

Auditor's Procedures & Performance 2010

Uploaded by

Hanifah SilfianieOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditor's Procedures & Performance 2010

Uploaded by

Hanifah SilfianieCopyright:

Available Formats

The Effect of Alternative Types of Review on

Auditors Procedures and Performance

Elizabeth A. Payne, Robert J. Ramsay, and E. Michael Bamber

SUMMARY: Audit workpaper review is a primary means of quality control in auditing

rms. While prior research shows that anticipation of a review affects preparers judg-

ments, there is little research on the effects of the different review formats that occur in

practice. The research that does exist examines the effects of adding discussion after

the preparation of written review notes. We compare the effects on preparers of antici-

pating a real-time interactive review where review notes are not prepared in advance

to the effects of anticipating receipt of more traditional written review notes. We also

examine how these two different types of review affect the actual audit procedures

preparers perform. A path analysis reveals that an interactive review leads auditors to

focus more on the cognitively demanding, conclusion-oriented audit procedures. This,

in turn, leads to better performance in identifying a trend that is indicative of fraud. We

nd no evidence that dysfunctional behavioral strategies operate under the less struc-

tured interactive review to compromise audit performance.

Keywords: review process; interactive review; written review.

INTRODUCTION

A

udit review is a primary means of audit quality control and auditor training see Rich et al.

1997a for a review. All work performed and documented in the workpapers by auditors

preparers, hereafter is reviewed by more senior members of the audit team reviewers,

hereafter. With more than 50 percent of audit manager time and 30 percent of total audit hours

allocated to review, audit rms are constantly examining ways to increase both the effectiveness

and efciency of review Bamber and Bylinski 1987; Rich et al. 1997a; Gibbins and Trotman

2002; Miller et al. 2006. Traditionally, reviewers examine the documentation independently and

create written review notes for the preparer to follow-up. The reviewer either 1 meets with the

Elizabeth A. Payne is an Assistant Professor at the University of Louisville, Robert J. Ramsay is a Professor

at the University of Kentucky, and E. Michael Bamber is Chair of Public Accounting at The University of

Georgia.

We acknowledge many helpful comments given on earlier versions of this paper from Linda Bamber, Tina Carpenter, Mary

Curtis, Jeremy Grifn, Susan McCracken, Chad Simon, reviewers and participants at the 2007 CAAAAnnual Conference,

the 2006 AAA Annual Meeting, the 2006 AAA Auditing Section Midyear meeting, and workshop participants at the

University of Kentucky, University of Louisville, and The University of Mississippi. We are also thankful for the support

from three international accounting rms.

Editors note: Accepted by Ken Trotman.

Auditing: A Journal of Practice &Theory American Accounting Association

Vol. 29, No. 1 DOI: 10.2308/aud.2010.29.1.207

May 2010

pp. 207220

Submitted: November 2008

Accepted: July 2009

Published Online: April 2010

207

preparer face-to-face to discuss the review notes, or 2 sends the review notes to the preparer

electronically by email or intranet, intending for the preparer to respond in writing Winograd et

al. 2000.

An alternative approach that has gained in popularity is a real-time interactive review Rich et

al. 1997a; Gibbins and Trotman 2002; Fargher et al. 2005. In this type of review, reviewers do not

prepare written review notes prior to the review. Instead, the reviewer sits down with the preparer

with the review done face-to-face with the le reviewer before comments had been written

Fargher et al. 2005, 105. This interaction generates the written comments for the preparer to

follow-up rather than these written comments being prepared in advance. Auditors in Fargher et

al.s 2005 study report experiencing this type of review 33.5 percent of the time. Moreover, the

auditors in their study report being aware of reviewers preferences and preparing the workpaper

le accordingly.

Our discussions with practicing auditors indicate that they view an interactive review differ-

ently to other forms of review where review notes are prepared in advance. The absence of written

review notes and the interactive nature of the review reduce the reviews structure. Reviewers

appreciate the time saved by not having to prepare review notes in advance, especially when a

short discussion could avoid a lengthy review note or response. But without having received

review notes in advance, preparers do not have time to think about the reviewers questions before

responding. They can feel pressure by having to respond on their feet. On the other hand, when

there are no review notes prepared in advance, some of this pressure is mitigated because prepar-

ers have the opportunity to explain themselves to reviewers during the review and even inuence

the direction of the review. Preparers do not have the same opportunity when the reviewer sits

down with a set list of questions already prepared i.e., the written review notes prepared in

advance. The interactive review also tends to focus more on the process, not just the general

ndings and their documentation.

Given the unique features of an interactive review, our study examines how preparers antici-

pation of this type of review affects their performance of audit procedures and, in turn, audit

effectiveness. The extensive resources devoted to the audit review process means that evidence on

how alternative types of review affect preparers performance and effectiveness is important.

In our experiment, 117 auditors performed a partial accounts receivable audit program using

electronic workpapers. Participants expected either 1 an interactive review of their work by an

audit manager, or 2 a traditional review where the manager independently reviews the preparers

work and then sends without face-to-face discussion written review notes for the preparer to

clear. A path analysis nds that anticipating an interactive review leads auditors to focus more on

cognitively demanding, conclusion-oriented audit procedures. This, in turn, leads to better perfor-

mance in identifying items that are indicative of fraud.

1

We nd no evidence that auditors perform

at a less effective level in expectation that they can rely on impression management during the

interactive review to achieve a satisfactory review. While the initial impetus for real-time review

may have been to improve audit efciency, especially the reviewers time Rich et al. 1997a, our

results suggest that the type of review anticipated can affect how auditors perform the audit. In

particular, anticipating an interactive review can improve audit effectiveness by encouraging pre-

parers efforts toward more cognitively demanding, conclusion-oriented audit procedures.

1

Prior workpaper review research e.g., Ramsay 1994; Bamber and Ramsay 1997; Harding and Trotman 1999; Gibbins

and Trotman 2002; Fargher et al. 2005 distinguishes between conclusion-oriented audit procedures and the more

mechanical, documentation-oriented audit procedures. Compared to mechanical, documentation-oriented audit proce-

dures, conclusion-oriented audit procedures are typically less structured and more cognitively demanding, requiring the

auditor to exercise more judgment in performing the procedure. As we explain subsequently, they are more likely to

uncover conceptual errors such as our experimental cases identication of a trend indicative of fraud.

208 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

Evidence that interactive review improves auditors performance addresses an issue of prac-

tical relevance. The study also contributes by making two important extensions of the existing

literature on the audit review process. We are the rst to examine the effect of auditors anticipa-

tion of real-time interactive review. We compare preparers response to the anticipation of this

interactive review to the traditional review where the preparer receives written review notes

independently prepared by the reviewer. In contrast, Brazel et al. 2004 examine preparers

anticipation of face-to-face discussion with the reviewer when the reviewer has prepared review

notes in advance. They compare anticipation of this form of review to the anticipation of receiving

emailed review notes. Brazel et al. 2004 nd that the lack of time to formulate a written response

in a face-to-face discussion of written review notes improves preparers performance. We nd

that this result also extends to interactive review, where the reviewer has not prepared review notes

in advance. This extension is important because it reveals that the advantages of requiring prepar-

ers to respond on their feet outweigh any dysfunctional effects from preparers attempting to

manipulate the review by engaging in impression management.

Our second contribution is to examine how the type of review affects the specic audit

procedures the preparer performs. While prior research focuses on how the type of review affects

judgment and documentation outcomes, Gibbins and Trotman 2002 report that reviewers believe

preparers also adjust the actual work performed in response to the type of the anticipated review.

However, they provide no information on whether this improves or impairs audit quality. We nd

that preparers do adjust how they perform their work and that interactive review has the potential

to enhance audit effectiveness by encouraging auditors efforts toward more cognitively demand-

ing, conclusion-oriented audit procedures.

The next section of the paper discusses the related literature and develops the hypotheses. The

third and fourth sections describe the studys method and the results, respectively. The nal section

discusses the results and their implications.

PRIOR RESEARCH, THEORY, AND HYPOTHESES

Workpaper review is an important source of quality control and feedback in auditing AICPA

2006. During the audit, all work performed should be reviewed to determine the adequacy of the

procedures performed and the appropriateness of the conclusions drawn AICPA 2009. As a

result, review is an important source of accountability for eld auditors, and the anticipation of

review increases audit effort and improves audit performance e.g., Johnson and Kaplan 1991;

Lord 1992; Kennedy 1993; Tan 1995; Tan and Kao 1999. However, there is little research on the

demands associated with the alternative forms of review and their effects on audit performance.

Several studies examine the role of discussion in review. Ismail and Trotman 1995 examine

discussion during review and nd that discussion results in auditors generating more plausible

hypotheses in an analytical review case. Favere-Marchesi 2006 extended this work by examining

the timing of the discussion. He compares discussion after the reviewer has completed the review

called post-review discussions with concurrent discussions i.e., an interactive review. He nds

the audit teams post-review discussions lead to the generation of more hypotheses. Favere-

Marchesi 2006 attributes this nding to reviewers generating more diverse judgments in the

pre-discussion task. Miller et al. 2006 investigate the effects of discussion during review on

preparers motivation and performance. They are interested in discussion in review as an effective

feedback mechanism. Using questionnaire responses from both reviewers and preparers on actual

audit engagements, they nd that the presence of discussion during the review increases the

motivation of preparers to perform better after the review.

Brazel et al. 2004 specically examine the effects of alternative review types on preparers.

The authors use a going-concern task to explore the effects of anticipation of face-to-face discus-

The Effect of Alternative Types of Review on Auditors Procedures and Performance 209

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

sion of previously prepared review notes compared to review notes provided by email. They nd

preparers who expect face-to-face discussion have better memos and judgments i.e., less devia-

tion from experts judgments, but less efciency than do preparers who expect emailed review

notes. The authors attribute their ndings to preparers lack of time to formulate responses in the

face-to-face condition, which makes preparers feel more stress and accountability and which, in

turn, leads to more effortful and systematic processing.

2

However, all participants in their study

knew that the reviewer had prepared detailed review notes prior to any interaction with the

preparer. It is not clear how preparers will respond when the reviewer has not made the initial

investment to prepare review notes before their meeting.

In an interactive review, there is typically no independent detailed review of the workpaper

documentation by the reviewer or the creation of review notes prior to face-to-face interaction.

Rather, the reviewer sits down with the preparer to discuss the workpapers completed to date and

evaluate the procedures performed and conclusions reached by the preparer. Brazel et al.s 2004

hypothesis that preparers concern about being put on-the-spot by inquiries that require imme-

diate, in-person, oral responses will induce stronger feelings of accountability should also apply to

an interactive review. Indeed, interactive review could further increase preparers stress because

preparers will witness their reviewers initial reactions to the work they have performed and,

without a set of existing review notes, preparers responses can affect the direction of the review.

This added stress may improve preparers performance. Alternatively, because the reviewer does

not have a set of written notes with which to structure the review discussion, the preparer can

potentially engage in strategic behavior such as impression management, guiding the review in a

direction that favors the preparer Schlenker 1980; Rich et al. 1997b; Favere-Marchesi 2006.

3

As

a result, an auditor could feel less threatened by interactive review and this review could have

dysfunctional consequences for preparers performance.

Auditors expecting an interactive review are likely to anticipate questions a reviewer will ask

and to take steps to improve their understanding of the evidence in order to better explain their

work. While the preparer may not be able to predict the reviewers initial questions, these ques-

tions are likely to reect the reviewers concern for conceptual, conclusion-oriented issues Ram-

say 1994; Gibbins and Trotman 2002. Steps to prepare for the interactive review could include

deeper elaboration Craik and Lockhart 1972, generating questions Rosenshine et al. 1996,

increased systematic processing Brazel et al. 2004, and more cognitively complex analyses Tan

and Kao 1999. Accordingly, to the extent that interactive review induces greater accountability,

we expect preparers to put more effort into those procedures most closely related to the reviewers

primary concerns, namely conceptual, conclusion-oriented issues. Since the audit program pro-

vides fairly explicit instructions for performing the more mechanical, documentation-oriented

audit procedures, we expect the type of review to have less of an effect on those procedures.

H1a: Auditors anticipating an interactive review will more thoroughly perform the more

cognitively demanding, conclusion-oriented steps of the audit program than auditors

anticipating receipt of written review notes.

2

Accountability is the implicit or explicit expectation that one may be called upon to justify ones beliefs, feelings, and

actions to others Lerner and Tetlock 1999. Auditors who anticipate face-to-face interaction with their reviewer are

likely to feel greater process accountability, which has been shown to increase time and effort put into tasks Doney and

Armstrong 1996. Accountability increases cognitive effort when preferences of the person to whom one is accountable

are not known Gibbins and Newton 1994. It can also increase accuracy and consensus and improve self-insight

Ashton 1990; Johnson and Kaplan 1991.

3

Prior research has not examined this type of strategic behavior, but Gibbins and Trotman 2002 and Fargher et al.

2005 report that managers believe that preparers adjust their workpaper les according to the reviewers reviewing

style.

210 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

H1b: Auditors anticipating an interactive review will not perform differently the more me-

chanical, documentation-oriented steps of the audit program than auditors anticipating

receipt of written review notes.

Of ultimate interest is whether anticipated review affects audit effectiveness, and if so, how.

Accordingly, we examine whether an increase in auditors emphasis on performing conclusion-

oriented audit procedures will improve audit effectiveness. We posit that performing the more

cognitively demanding, conclusion-oriented steps more thoroughly is more likely to lead to un-

covering conceptual errors. Conceptual errors are subjective, unveriable, and imprecise in con-

trast to mechanical errors which are objective, veriable, and concrete Bacsik and Rizzo 1983;

Ramsay 1994.

4

Conceptual error identication typically requires higher order processing which,

in turn, involves attending to and integrating the individual stimuli Craik and Lockhart 1972;

Collins and Loftus 1975. Moeckel 1991, 270 denes integration as the identication of the

meaningful relationships that exist between separate pieces of information. Auditors must be able

to integrate disparate evidence to form appropriate audit conclusions Moeckel 1991. Therefore,

the deeper level of analysis and better integration of the evidence associated with more thoroughly

performing the conclusion-oriented steps of the audit program should lead to more effective

identication of conceptual errors.

H2: Performing the conclusion-oriented steps of the audit program is positively related to

conceptual error identication.

As hypothesized in H1a, we do not expect the anticipation of an interactive review to have an

effect on performance of the mechanical, documentation-oriented audit procedures. Both auditors

expecting to receive written review notes and those expecting an interactive review are held

accountable and should, therefore, put forth the necessary effort to complete the basic mechanical

steps of the audit program. These steps essentially involve a mechanical process where one item

is compared to another in accordance with the audit program instructions. If the items disagree, an

error is documented. However, any variability in how these basic steps are completed would likely

result in failure to detect mechanical errors.

5

H3: Performing the documentation-oriented steps in the audit program is positively related to

mechanical error detection.

METHOD

Participants

A total of 144 staff- and senior-level auditors from three international auditing rms partici-

pated in the experiment. Responses from 18 of these participants were not usable due to failure to

complete the task or loss of data because of premature exit from the computer program responses

4

Ramsay 1994 gives the following examples of audit objectives to distinguish between the two types of errors: the

allowance account agrees with the balance per workpaper mechanical versus the clients allowance for doubtful

accounts is adequately supported in the workpapers conceptual. As is explained shortly, two mechanical errors involv-

ing a posting error and a missing authorization, and a trend indicative of fraud conceptual error are embedded in the

audit evidence provided to participants.

5

We do not posit hypotheses regarding either the relation between conclusion-oriented audit procedures and mechanical

errors or the relation between documentation-oriented audit procedures and conceptual errors. Audit procedures are

performed to collect specic types of evidence to satisfy specic audit objectives. Nevertheless, performing a

conclusion-oriented procedure, for example, may uncover a mechanical error even though this was not the primary

motivation for performing the procedure. The likelihood of this will also be a function of the specic error in the clients

records.

The Effect of Alternative Types of Review on Auditors Procedures and Performance 211

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

were saved to an output le upon nal exit, leaving 126 complete responses. In addition, re-

sponses from nine participants were also discarded because they lacked an understanding of a

client control that was important for the experimental task.

6

This resulted in a nal sample size of

117.

Materials and Procedures

The experiment was administered during the rms training sessions. After a brief introduc-

tion by the researchers, computer disks containing different versions of the experiment were

randomly distributed to the participants. The auditors completed the experiment on their own

computers, in the presence of the researchers and rm instructors, and returned the disks to the

researchers upon completion. No time limits were imposed. Actual total times ranged from ap-

proximately 30 to 60 minutes.

We developed the case specically for this study.

7

The case began with background informa-

tion related to a hypothetical client and an introduction to the experimental task that involved

completing a test of internal controls for write-offs of accounts receivable. The next step was a

manipulation for the type of review to expect upon completion of the experiment. The audit

program a modied version from Ricchiute 1998; see Figure 1 was next. The audit program

contained ve audit procedures. The rst step in the program was to select a sample, and this step

had already been completed for the participants. Participants were instructed in the next three steps

6

The internal control policy required accounts receivable write-offs greater than $500 to be approved by the treasurer.

These nine participants listed every write-off without authorization as an exception, rather than only those greater than

$500. Inclusion of the responses from these nine participants does not change our reported results.

7

The experiment was pilot tested with undergraduate auditing students, doctoral students, and accounting faculty. Minor

changes were made after pilot testing to improve comprehension of questions and reduce the amount of time required

to complete the task.

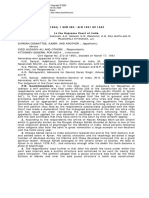

FIGURE 1

Audit Program for Internal Control Testing of Write-Offs of Accounts Receivable

AUDIT PROGRAM - Test of Controls: Uncollectible Accounts

OBJECTIVE: To determine whether write-offs of accounts

receivable are properly authorized and recorded.

1. Select a sample of write-off entries (already completed for

you).

2. Trace each entry to the related write-off authorization memo.

3. Examine the memo for appropriate authorization and

compare the authorized amount with the recorded

amount.

4. Trace each entry to a posting in the accounts receivable

subsidiary ledger.

5. Review all write-off entries for unusual items such as very

large amounts or multiple write-offs for the same

customer.

Note: The decision to write off an account originates in the credit

department at CSC. The company's internal control system requires

that all write-offs of $500 or more be approved by the treasurer,

John Smith.

212 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

ST24 to perform mechanical, documentation-oriented audit procedures e.g., ST2 directed par-

ticipants to trace each entry to the related write-off authorization memo. Step 5 ST5 was the

conceptual, conclusion-oriented audit procedure, which directed participants to review write-off

entries for unusual items, such as very large amounts or multiple write-offs for the same customer.

As no direction was given as to an unusual item, participants had to make this determination by

comparison of information across items. Such a comparison and the integration of the available

evidence would identify an unusual trend in the data which will be discussed shortly.

The test of controls task screen followed the audit program. This screen contained a summary

memo to be completed, as well as the sample items, authorization memos, and accounts receivable

subsidiary ledgers needed to perform the test of controls. These items were accessible one-at-a-

time via the drop-down menus on the computer screen. For example, participants would click on

the Sample box. A drop-down list of the 20 sample items would appear, and the participants would

then select one of the 20 sample items to view from the drop-down list. Then they could click on

the Authorization Memos box and select the corresponding memo from this drop-down list. They

could also click on the Accounts Receivable Subsidiary Ledger box and select the corresponding

ledger item from this drop-down list. Identical information was presented to the participants in the

two review treatment groups. At any time while completing the test of controls, the participants

could refer back to the audit program by clicking on the button labeled Audit Instructions.

Upon completion of the test of controls, participants were provided with a text box and

prompted to note anything unusual they had identied while performing the test of controls that

should be investigated further. An exit questionnaire concluded the experiment. The computer

program required participants to complete each response box on a current screen in order to

proceed to the next screen, so there were no missing responses.

Independent Variables

The study uses a between-participants design, incorporating two types of workpaper review:

written review notes and interactive review. Prior to beginning the experimental task, participants

were presented with one of the following manipulations for method of review:

1 Upon completion of the entire study, a sample of memos and the conclusions reached

about the internal controls for CSC will be forwarded to a manager in your rm for

review. If your work is chosen for review, the manager will prepare WRITTEN COM-

MENTS about the work you performed and will send these comments to you for clearing.

2 Upon completion of the entire study, a few individuals who participated in the study will

be asked to meet with a manager in your rm. If you are chosen for an INTERVIEW, a

manager will sit down with you and discuss/review the memo and the conclusions you

reached about the internal controls for CSC, and may possibly question you about the

procedures you performed, and allow you to clear up any concerns the manager may

have.

8

Immediately after the review method was presented, a forced manipulation check question

asked If my work is chosen for review by a manager, I expect 1 to receive written comments

from the manager, or 2 to be interviewed by the manager. If the correct response was not

selected, the computer program returned to the previous screen so the participant could reread the

8

The participants were required to provide their names during the experiment, and approximately 24 percent of the

auditors received the indicated review either written review notes or interactive review from managers in their rm

upon completion of the experiment.

The Effect of Alternative Types of Review on Auditors Procedures and Performance 213

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

manipulation information.

9

To measure participants prior experience with interactive reviews,

participants were asked in the exit questionnaire What percentage of the time do your superiors

review your work in your presence, discussing the review with you as it is performed?

Dependent Variables

We coded participants responses on two sets of dependent variables: the rst set measures

thoroughness of performance and the second set measures problem identication. The computer

program kept track of the items participants searched during the task. Accordingly, participants

output les were rst reviewed and coded based upon participants performance of the audit

program steps shown in Figure 1. The sample of 20 write-offs was already selected so the par-

ticipants did not have to actually perform Step 1. The output les were reviewed to determine if

the participants had performed the mechanical procedures required in Steps 24. This variable

ST24 was coded either 1 all steps not completed for all 20 items, 2 all steps completed for

all 20 items, or 3 some steps completed more than once for the 20 items. Next, the output les

were reviewed to determine the thoroughness with which participants performed Step 5 ST5, the

review of the write-offs for unusual items. A four-level coding scheme was used for this variable

ST5: 0 no additional items specically reviewed, 1 some, but less than all 20 items reviewed,

2 all 20 items reviewed, and 3 all 20 items reviewed and some or all viewed more than once.

10

The second set of dependent measures captures participants performance in identifying prob-

lems embedded in the evidence. First, two exceptions were embedded in the evidence: a posting

error and a missing authorization. Performing documentation-oriented procedures ST24 should

have uncovered these two mechanical errors. Additionally, a trend was embedded in the sample

that potentially indicates employee fraud via circumvention of controls. The trend related to an

internal control policy that required write-offs greater than $500 to be approved see note in the

audit program in Figure 1. Five sample items were just under this approval threshold. Numerous

items just below an authorization level are a commonly recognized red ag in fraud investigation.

Performing conclusion-oriented procedure ST5 with an appropriate deeper level of processing and

analysis should have identied this red ag for fraud.

Participants memos and the text box requesting unusual items needing further investigation

were all reviewed and coded by one of the researchers and a separate rater blind to both the

experimental hypotheses and treatment condition. Coding identied the number of exceptions #

EXC correctly identied 02 range and whether the trend indicative of fraud FRAUD was

identied 0 no, 1 yes.

11

Only one discrepancy between the raters was noted and subse-

quently resolved.

9

In our operationalization of the interactive review, we do not refer to the preparation of written comments as our

discussions with practitioners made it evident that interviews do not normally include previously written notes. In

pretests and in actual sessions where one or more investigators were always present, no participants asked or expressed

confusion about the manipulation. Given the relatively common use of interviews in practice, we believe the use of the

term interview is clear to the participants and is distinguishable from the reviewer explaining his/her existing review

notes as was done in Brazel et al. 2004. Participants took, on average, 1.4 tries to correctly identify their treatment

condition. Controlling for repeated attempts did not change the reported results. Any confusion whereby participants in

the interview condition might have expected previously written review notes would make the treatment more like the

written review treatment, which would work against our nding results.

10

We interpret participants who did not specically examine any items in performing ST5 but instead relied on their

memory of the write-offs from performing ST24 or performed ST5 concurrently with ST24 as performing the least

thorough analysis. Similarly, we interpreted participants who examined all items, some of which multiple times, as

performing the most thorough analysis.

11

Our coding rules required only that participants recognized the trend as a potential problem needing further investiga-

tion, but did not require them to write in the memo all ve problem items nor use the word fraud. Some participants

did identify the specic items in their memo while others used language such as several write-offs, many write-offs,

214 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

RESULTS

Demographic and Descriptive Statistics

The mean age of the auditors was 24.9 years, and there were 62 males and 55 females in the

sample. The participants indicated they had 1.4 years of audit experience on average and had

performed the experimental task an average of 2.3 times. Participants reported experiencing an

interactive review 45.9 percent of the time. They indicated the experimental task was realistic 6.7

mean on a 110 point scale and that they put forth a good deal of effort 7.5 mean on a 110 point

scale while completing the experiment.

12

Table 1 presents descriptive statistics for our primary variables of interest. Panel A of Table 1

provides means by total and by treatment condition. t-tests results reported in Table 1 show

support for H1. Auditors anticipating an interactive review performed a more thorough review of

the evidence items as required in Step 5 than those anticipating written review notes H1a: p

0.008, one-tailed. As expected, these tests show no difference in completion levels for the me-

chanical Steps 24 H1b: p 0.214, two-tailed. Panel B of Table 2 provides Pearson correlations

and reveals many signicant relationships. However, path analysis permits a complete test of the

hypotheses since both direct and indirect effects are examined. In particular, anticipated review

type should affect preparer effectiveness through anticipated reviews effect on how preparers

perform the audit procedures. The results are described below.

Statistical Analyses

We use path analysis to formally test the studys hypotheses. Path analysis examines the effect

of a predictor variable on an outcome variable, while controlling for other predictors. In testing

each path, nonsignicant p 0.05 standardized partial regression coefcients are removed from

the model Pedhazur 1982. The resulting model includes only signicant paths and is shown in

Figure 2. Hypothesis 1a is supported since auditors anticipating an interactive review make a more

thorough review of the audit evidence as required in Step 5 of the audit program p 0.01,

one-tailed. Table 2 provides more detail of the effect of review type. Only 26.9 percent of

participants anticipating an interactive review compared to 36.9 percent anticipating written re-

view notes did not make any additional analysis of the sample items. Further, 44.2 percent of the

auditors anticipating an interactive review reviewed all 20 sample items at least once, compared to

only 24.6 percent for the auditors anticipating written review notes.

13

Consistent with H1b, there

is no signicant path between review type and performance of the more mechanical

documentation-oriented steps, steps 24.

Hypotheses 2 and 3 are both supported in the path model. A more thorough review of the

audit evidence ST5 is positively associated with identication of the fraud red ag H2: p

0.01, one-tailed, and performance of the mechanical steps in Steps 24 of the audit program

ST24 is positively associated with mechanical error detection H3: p 0.02, one-tailed. One

a lot of write-offs, etc. were just under the approval threshold. Participants had to recognize the items whether

specically or in general as a potential problem, fraud indicator, item needing further investigation, looks

suspicious, red ag, needs additional inquiry, etc. Quotations indicate actual comments from participants.

12

Unexpectedly, participants anticipating an interactive review report a higher incidence of this type of review in actual

practice 55.3 percent than do participants in the written review notes treatment condition 38.3 percent. A possible

explanation for this result is a salience effect in that participants in the interactive review condition are more likely to

recall having this type of review in responding to the debrieng question. Participants were simply asked for the

percentage of time they experience this type of review rather than, for example, allocating 100 points over the alterna-

tive types of review found in practice. Including this variable and the other variables discussed in this section in our

analyses does not change the reported results.

13

The signicant paths in Figure 2 remain signicant when a continuous ST5 variable replaces the four-level ST5 variable

reported in Figure 2 and Table 2.

The Effect of Alternative Types of Review on Auditors Procedures and Performance 215

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

signicant relationship emerged in the path analysis that was not predicted. The extent of the

review of evidence in ST5 is positively associated with mechanical error detection p 0.00,

one-tailed. A possible explanation for this nding is that during the ST5 review of the evidence,

some of the auditors performed even more work than required and re-performed some of the

mechanical steps.

DISCUSSION

This study compares the effects on preparers of anticipating an interactive review to the

effects of anticipating the more traditional written review notes. The anticipation of an interactive

TABLE 1

Descriptive Statistics, Correlation Matrix, and Univariate Tests

Panel A: Descriptive Statistics by Review Type

Possible

Range

Means (Std. Dev.)

p-value

All Participants

(n 117)

Interactive

Review

(n 52)

Written Review

Notes

(n 65)

ST24 13 1.96 2.00 1.92 .214**

.3 .3 .3

ST5 03 1.17 1.44 .95 .008*

1.1 1.2 .9

#EXC 02 1.75 1.8 1.7 .060*

.5 .4 .5

FRAUD 0 or 1 .37 .44 .31 .070*

.5 .5 .5

Panel B: Pearson Correlations (and p-values)

R ST24 ST5 FRAUD #EXC

R 1.0

ST24 .116 1.0

.214

ST5 .230

.094 1.0

.013 .312

#EXC .142 .207

.309

1.0

.126 .025 .001

FRAUD .139 .062 .212

.100 1.0

.136 .504 .022 .282

*, ** One-tailed and two-tailed, respectively.

,

Signicant at the .05 and .01 levels, respectively, two-tailed.

R type of review expected 0 interactive, 1 written;

ST24 steps 24 tracing of audit program 1 all steps not completed for all 20 items, 2 all steps

completed for all 20 items, or 3 some steps completed more than once for the 20 items;

ST5 step 5 review for unusual items of audit program 0 no additional items specically reviewed, 1

some, but less than all 20 items reviewed, 2 all 20 items reviewed, or 3 all 20 items reviewed

and some or all viewed more than once;

#EXC number of mechanical errors i.e., exceptions identied 02; and

FRAUD identication of fraudulent trend 0 no, 1 yes.

216 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

review has the potential to enhance auditors efforts toward more cognitively demanding,

conclusion-oriented audit procedures. The results of this study support this argument. We nd no

evidence that other dysfunctional behavioral strategies operated e.g., performing less work on the

expectation that the preparer could avoid or explain away the reviewers concerns under the less

structured interactive review to compromise audit performance. Rather, auditors in the study

anticipating an interactive review upon completion of their work made a more thorough exami-

nation of the audit evidence which, in turn, led to more effective identication of a fraud red ag.

The type of review anticipated had no effect on the performance of the mechanical steps in the

audit program.

Though the initial reason for using interactive review was to increase efciency and enhance

training Rich et al. 1997a, our results show that the use of interactive review can potentially

increase audit effectiveness. Brazel et al. 2004 found that face-to-face discussion of written

review notes increases accountability and audit effectiveness. Our results show that not only is

TABLE 2

Frequency (and Percent) Distributions by Type of Review

Variable

Possible

Values

Interactive Review

(n 52)

Written Review

Notes

(n 65)

ST24 1 3

5.8%

6

9.2%

2 46

88.5%

58

89.2%

3 3

5.8%

1

1.5%

ST5 0 14

26.9%

24

36.9%

1 15

28.8%

25

38.5%

2 9

17.3%

11

16.9%

3 14

26.9%

5

7.7%

#EXC 0 1

1.9%

1

1.5%

1 7

13.5%

18

27.7%

2 44

84.6%

46

70.8%

FRAUD 0 29

55.8%

45

69.2%

1 23

44.2%

20

30.8%

ST24 steps 24 tracing of audit program 1 all steps not completed for all 20 items, 2 all steps

completed for all 20 items, or 3 some steps completed more than once for the 20 items;

ST5 step 5 review for unusual items of audit program 0 no additional items specically reviewed, 1

some, but less than all 20 items reviewed, 2 all 20 items reviewed, or 3 all 20 items reviewed

and some or all viewed more than once;

#EXC number of mechanical errors i.e., exceptions identied 02; and

FRAUD identication of fraudulent trend 0 no, 1 yes.

The Effect of Alternative Types of Review on Auditors Procedures and Performance 217

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

there a similar increase in audit effectiveness with interactive review, but that this increase in

performance occurs because auditors put forth more effort on the more cognitively demanding,

conclusion-oriented audit procedures. These results are consistent with our discussions with prac-

titioners. Auditors report that they expect a reviewer to question them about both how they

performed the audit procedures and the ndings, whereas written review comments are more

likely directed toward overall ndings and documentation issues. When auditors expect to be

quizzed about procedures they are more likely to expend greater effort on those procedures,

particularly on those that are more cognitively demanding.

This study is subject to potential limitations. Our manipulation of review type involved a brief

description of each type of review. There were subtle differences in wording that were intended to

capture the differences between the two types of review. However, these descriptions may have

contributed to how participants performed the procedures required in the experimental task. In

addition, we examined the effects of alternative review types on the performance of a routine staff

level audit proceduretests of controls related to accounts receivable write-offs. The effects may

differ for more complex tasks where higher levels of review may also be anticipated.

A more general problem researchers in this area face is that in practice a review may not fall

clearly into a specic type of review. Given that we and others have identied fundamental

differences between the types of review, we believe that future research should examine specic

features of review. For example, our comparison of anticipating an interactive review and the

receipt of written review notes does not permit us to evaluate the relative effects of 1 the role of

review notes in isolation, and 2 the role of face-to-face discussion in isolation. Identifying the

FIGURE 2

Results of PathAnalysis

H3

H2

H1a

.18 (.02)

.29 (.00)

.21 (.01)

-.23 (.01)

R

ST2-4

ST5 FRAUD

# EXC

Standardized Coefcients (p-values, one-tailed) shown for each path.

R type of review expected 0 interactive, 1 written;

ST24 steps 24 tracing of audit program 1 all steps not completed for all 20 items, 2 all

steps completed for all 20 items, or 3 some steps completed more than once for the 20

items;

ST5 step 5 review for unusual items of audit program 0 no additional items specically

reviewed, 1 some, but less than all 20 items reviewed, 2 all 20 items reviewed, or

3 all 20 items reviewed and some or all viewed more than once;

#EXC number of mechanical errors i.e., exceptions identied 02; and

FRAUD identication of fraudulent trend 0 no, 1 yes.

218 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

separate effects of each of these dimensions of review would facilitate our understanding of the

important features of review and our ability to prescribe when these features and type of review

may be particularly effective.

Future research is also needed to directly compare interactive review as in the current study,

where written comments are prepared when necessary after the discussion, to face-to-face discus-

sion with previously prepared written review notes as in the Brazel et al. 2004 study. Our

results and Favere-Marchesis 2006 nding that the timing of discussion affects the reviewer

suggest that there are potentially important differences between these two types of review. For

example, does the additional emphasis on conclusion-oriented audit procedures extend to face-to-

face discussion of written review notes? Does the quality of the audit documentation differ be-

tween the two types of face-to-face reviews? This direct comparison between these two types of

face-to-face reviews should provide additional insights into how face-to-face interaction operates

in review.

Reviewers typically have a choice of the type of review they perform. It is important that

reviewers realize that their review preferences and the choice of review type they make on a

particular audit have implications for the performance of that audit. In particular, preparers are

likely to not only interpret one type of review as more demanding than another, but to also change

how they perform their work in response to the type of review they anticipate.

REFERENCES

American Institute of Certied Public Accountants AICPA. 2006. Planning and Supervision. Statement on

Auditing Standards No. 108. New York, NY: AICPA.

. 2009. A Firms System of Quality Control. Quality Control Section 10. New York, NY: AICPA.

Ashton, R. H. 1990. Pressure and performance in accounting decision settings: Paradoxical effects of incen-

tives, feedback, and justication. Journal of Accounting Research 28 Supp: 148180.

Bamber, E. M., and J. H. Bylinski. 1987. The effects of the planning memorandum, time pressure and

individual auditor characteristics on audit managers review time judgments. Contemporary Account-

ing Research 4 1: 127143.

, and R. J. Ramsay. 1997. An investigation of the effects of specialization in audit workpaper review.

Contemporary Accounting Research 14 3: 501513.

Bacsik, J. M., and S. F. Rizzo. 1983. Review of audit workpapers. The CPA Journal 53 11: 8788.

Brazel, J. F., C. P. Agoglia, and R. C. Hateld. 2004. Electronic versus face-to-face review: The effects of

alternative forms of review on auditors performance. The Accounting Review 79 4: 949966.

Collins, A. M., and E. F. Loftus. 1975. A spreading-activation theory of semantic processing. Psychological

Review 82 6: 407428.

Craik, F. I. M., and R. S. Lockhart. 1972. Levels of processing: A framework for memory research. Journal

of Verbal Learning and Verbal Behavior 11: 671684.

Doney, P. M., and G. M. Armstrong. 1996. Effects of accountability on symbolic information search and

information analysis by organizational buyers. Academy of Marketing Science 24 1: 5765.

Fargher, N. L., D. Mayorga, and K. T. Trotman. 2005. A eld-based analysis of audit workpaper review.

Auditing: A Journal of Practice & Theory 24 2: 85110.

Favere-Marchesi, M. 2006. Audit review: The impact of discussion timing and familiarity. Behavioral Re-

search in Accounting 28: 91105.

Gibbins, M., and J. D. Newton. 1994. An empirical exploration of complex accountability in public account-

ing. Journal of Accounting Research 32 2: 165186.

, and K. T. Trotman. 2002. Audit review: Managers interpersonal expectations and conduct of the

review. Contemporary Accounting Research 19 3: 411444.

Harding, N., and . 1999. Hierarchical differences in audit workpaper review. Contemporary Accounting

Research 16 4: 671684.

Ismail, Z., and . 1995. The impact of the review process in hypothesis generation tasks. Accounting,

The Effect of Alternative Types of Review on Auditors Procedures and Performance 219

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

Organizations and Society 20 5: 345357.

Johnson, V. E., and S. E. Kaplan. 1991. Experimental evidence on the effects of accountability on auditor

judgments. Auditing: A Journal of Practice & Theory 10 Supp: 96107.

Kennedy, J. 1993. Debiasing audit judgment with accountability: A framework and experimental results.

Journal of Accounting Research 31 2: 231245.

Lerner, J. S., and P. E. Tetlock. 1999. Accounting for the effects of accountability. Psychological Bulletin

125 2: 255276.

Lord, A. T. 1992. Pressure: A methodological consideration for behavioral research in auditing. Auditing: A

Journal of Practice & Theory 11 2: 89108.

Miller, C. L., D. B. Fedor, and R. J. Ramsay. 2006. Effects of discussion of audit reviews on auditors

motivation and performance. Behavioral Research in Accounting 19: 91106.

Moeckel, C. 1991. Two factors affecting an auditors ability to integrate audit evidence. Contemporary

Accounting Research 8 1: 270292.

Pedhazur, E. J. 1982. Multiple Regression in Behavioral ResearchExplanation and Prediction. 2nd edition.

New York, NY: CBS College Publishing.

Ramsay, R. J. 1994. Senior/manager differences in audit workpaper review performance. Journal of Account-

ing Research 32 1: 127135.

Ricchiute, D. N. 1998. Auditing and Assurance Services. 5th edition. Cincinnati, OH: South-Western College

Publishing.

Rich, J. S., I. Solomon, and K. T. Trotman. 1997a. Multi-auditor judgment/decision making research: A

decade later. Journal of Accounting Literature 16: 86126.

, , and . 1997b. The audit review process: A characterization from the persuasion perspec-

tive. Accounting, Organizations and Society 22 5: 481505.

Rosenshine, B., C. Meister, and S. Chapman. 1996. Teaching students to generate questions: A review of the

intervention studies. Review of Educational Research 66 2: 181221.

Schlenker, B. R. 1980. Impression Management: The Self Concept & Social Identity, and Interpersonal

Relations. Belmont, CA: Brooks-Cole.

Tan, J. 1995. Effects of expectations, prior involvement, and review awareness on memory for audit evidence

and judgment. Journal of Accounting Research 33 1: 113135.

Tan, H., and A. Kao. 1999. Accountability effects on auditors performance: The inuence of knowledge,

problem-solving ability, and task complexity. Journal of Accounting Research 37 1: 209223.

Winograd, B. N., J. S. Gerson, and B. L. Berlin. 2000. Audit practices of PricewaterhouseCoopers. Auditing:

A Journal of Practice & Theory 19 2: 175182.

220 Payne, Ramsay, and Bamber

Auditing: A Journal of Practice &Theory May 2010

American Accounting Association

Reproducedwith permission of thecopyright owner. Further reproductionprohibited without permission.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BC C Punmia BeamDocument14 pagesBC C Punmia BeamvikrantgoudaNo ratings yet

- Frigga Haug - Beyond Female Masochism. Memory-Work and Politics (1992, Verso) PDFDocument275 pagesFrigga Haug - Beyond Female Masochism. Memory-Work and Politics (1992, Verso) PDFKalindaMarínNo ratings yet

- Protecting The Pianist's Hand: The Carrezando Touch and MoreDocument6 pagesProtecting The Pianist's Hand: The Carrezando Touch and MoreAdrianNo ratings yet

- GX Audit Internal Audit Risk and Opportunities For 2022Document26 pagesGX Audit Internal Audit Risk and Opportunities For 2022Muhammad SamiNo ratings yet

- CvaDocument20 pagesCvanuraNo ratings yet

- Effortless by Greg McKeownDocument6 pagesEffortless by Greg McKeownNaison StanleyNo ratings yet

- Parameter Pengelasan SMAW: No Bahan Diameter Ampere Polaritas Penetrasi Rekomendasi Posisi PengguanaanDocument2 pagesParameter Pengelasan SMAW: No Bahan Diameter Ampere Polaritas Penetrasi Rekomendasi Posisi PengguanaanKhamdi AfandiNo ratings yet

- MicrotoxOmni Software Version 4Document12 pagesMicrotoxOmni Software Version 4Louise Veronica JoseNo ratings yet

- Durgah Ajmer Sharif 1961Document19 pagesDurgah Ajmer Sharif 1961Deepanshu JharkhandeNo ratings yet

- The Photoconductive CellDocument4 pagesThe Photoconductive Cellfasdasd123No ratings yet

- Special Functions of Signal ProcessingDocument7 pagesSpecial Functions of Signal ProcessingSaddat ShamsuddinNo ratings yet

- Wet Specimen Preservation MethodsDocument24 pagesWet Specimen Preservation Methodstamil selvanNo ratings yet

- SPXDocument6 pagesSPXapi-3700460No ratings yet

- IFU Egg Yolk Tellurite EmulsionDocument4 pagesIFU Egg Yolk Tellurite EmulsionoktaNo ratings yet

- Chapter #11: Volume #1Document35 pagesChapter #11: Volume #1Mohamed MohamedNo ratings yet

- LNG Bunker QraDocument58 pagesLNG Bunker QraEngineer165298No ratings yet

- Anselm's Ontological Argument ExplainedDocument8 pagesAnselm's Ontological Argument ExplainedCharles NunezNo ratings yet

- INDIAMART 25012022003631 Investor Presentation Q3FY2021-22Document84 pagesINDIAMART 25012022003631 Investor Presentation Q3FY2021-22geethvazNo ratings yet

- Sidney W A Dekker From Threat and Error Management To ResilienceDocument11 pagesSidney W A Dekker From Threat and Error Management To ResilienceDaniel fabian Sánchez henaoNo ratings yet

- Introduction to Philippine LiteratureDocument61 pagesIntroduction to Philippine LiteraturealvindadacayNo ratings yet

- 8th Edition of The AJCC - TNM Staging System of Thyroid Cancer - What To Expect (ITCO#2)Document5 pages8th Edition of The AJCC - TNM Staging System of Thyroid Cancer - What To Expect (ITCO#2)Valentina IndahNo ratings yet

- What Is A Dry Well?Document4 pagesWhat Is A Dry Well?eullouNo ratings yet

- Image/Data Encryption-Decryption Using Neural Network: Shweta R. Bhamare, Dr. S.D.SawarkarDocument7 pagesImage/Data Encryption-Decryption Using Neural Network: Shweta R. Bhamare, Dr. S.D.SawarkarPavan MasaniNo ratings yet

- Should A Christian Believer Wear An ANKH?: Luxury Art By: Ketu'Rah GloreDocument4 pagesShould A Christian Believer Wear An ANKH?: Luxury Art By: Ketu'Rah GloreMyk Twentytwenty NBeyondNo ratings yet

- Checking battery control unitDocument3 pagesChecking battery control unitjuanNo ratings yet

- QF-16 Security ProceduresDocument55 pagesQF-16 Security Proceduresmaruka33No ratings yet

- Orbeez Sorting and Patterns Learning ExperienceDocument5 pagesOrbeez Sorting and Patterns Learning Experienceapi-349800041No ratings yet

- Socsci 032 Midterm Compilation NotesDocument12 pagesSocsci 032 Midterm Compilation NotesCarla AbalaNo ratings yet

- The 5th Edition of The World Health Organization Classification - of Haematolymphoid Tumours Myeloid and Histiocytic - Dendritic NeoplasmsDocument17 pagesThe 5th Edition of The World Health Organization Classification - of Haematolymphoid Tumours Myeloid and Histiocytic - Dendritic NeoplasmsADMINISTRACION LABORATORIO INTERMEDICANo ratings yet