Professional Documents

Culture Documents

002 Specimen Paper 2008 - Questions

Uploaded by

Charles MK Chan0 ratings0% found this document useful (0 votes)

46 views8 pagesASE3012 Sample Paper 2008 1 answer any 4 questions SS All questions carry equal marks. Study the "REQUIRED" section of each question carefully and extract from the information supplied the data required for your answers. Write your answers in blue or black ink / ballpoint. Pencil may be used only for graphs, charts, diagrams etc.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentASE3012 Sample Paper 2008 1 answer any 4 questions SS All questions carry equal marks. Study the "REQUIRED" section of each question carefully and extract from the information supplied the data required for your answers. Write your answers in blue or black ink / ballpoint. Pencil may be used only for graphs, charts, diagrams etc.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views8 pages002 Specimen Paper 2008 - Questions

Uploaded by

Charles MK ChanASE3012 Sample Paper 2008 1 answer any 4 questions SS All questions carry equal marks. Study the "REQUIRED" section of each question carefully and extract from the information supplied the data required for your answers. Write your answers in blue or black ink / ballpoint. Pencil may be used only for graphs, charts, diagrams etc.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

ASE3012 Sample Paper 2008 1

Sample Paper 2008

INSTRUCTIONS FOR CANDIDATES

Answer any 4 questions

All questions carry equal marks.

Study the REQUIRED section of each question carefully and extract from the information

supplied the data required for your answers.

Write your answers in blue or black ink/ballpoint. Pencil may be used only for graphs, charts,

diagrams etc.

Begin your answer to each question on a new page.

All answers must be correctly numbered, but need not be in numerical order.

Workings must be shown.

You may use a calculator, provided the calculator gives no printout, has no word display

facilities, is silent and cordless. The provision of batteries and their condition is your

responsibility.

CERTIFICATE IN ACCOUNTING

Level 3

Subject Code: 3012

Time allowed: 3 hours

ASE3012 Sample Paper 2008 2

QUESTION 1

The following information relates to Oriental Trading plc:

Balance Sheets at 31 December

2006 2007

000 000 000 000

Freehold land and buildings 450 500

Provision for depreciation 45 405 50 450

Plant 340 430

Provision for depreciation 90 250 146 284

Motor Vehicles 90 90

Provision for depreciation 45 45 68 22

Long term investments (cost) 70 50

Stocks 219 229

Debtors 220 198

Cash at bank and in hand 71 137

1,280 1,370

Ordinary shares of 1 each 600 650

Share premium - 20

Profit & Loss 380 415

6% debentures 60 40

Trade creditors 200 180

Proposed dividends 40 65

1,280 1,370

Notes

(1) Plant originally costing 30,000 and with accumulated depreciation amounting to 20,000,

was sold at a profit of 2,000. Long term investments were sold at cost

(2) Some debentures were redeemed at par on 1July 2007

(3) During the year, investment income of 4,000 was received and interim dividends of 13,000

were paid

REQUIRED

(a) Calculate the operating profit of Oriental Trading plc for the year ended

31 December 2007

(4 marks)

(b) Prepare a reconciliation of operating profit to net cash inflow/(outflow) from operating activities

for the year ended 31 December 2007

(6 marks)

(c) Prepare a Cash Flow Statement in accordance with FRS1 (revised) for the year ended 31

December 2007.

(15 marks)

(Total 25 marks)

ASE3012 Sample Paper 2008 3 OVER

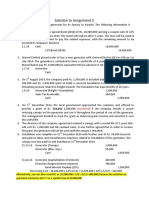

QUESTION 2

Walsham Ltd was incorporated on 1 September 2006 and took over the partnership of William and

Grace from 1 June 2006. It was agreed that all profits made during the year ending 31 May 2007

would belong to Walsham Ltd and that William and Grace would be entitled to interest on the

purchase price from 1 June 2006 to the date of payment. William and Grace became paid directors of

Walsham Ltd on 1 September 2006

The following Profit & Loss Account was prepared for Walsham Ltd for the year ended

31 May 2007:

Gross Profit 125,600

Less expenses:

Partnership salaries of William and Grace 9,000

Wages and sundry expenses 11,256

Bad debts 5,600

Rent and insurance 6,000

Commission on sales 27,470

Interest on purchase price paid to William

and Grace 1,500

Bank overdraft interest 500

Directors` fees and expenses 12,750

Year end audit fees 1,750 75,826

Net Profit before depreciation 49,774

Additional information:

(1) Sales for the nine months ended 31 May 2007 were 412,100 and amounted to four times as

much as for the three months ended 31 August 2006. Selling prices were calculated by adding

a uniform mark up to the purchase price.

(2) Commission was paid on all sales at the same rate

(3) The bank granted an overdraft in January 2007

(4) Wages and sundry expenses and rent and insurance accrued at an even rate

(5) Bad debts for the nine months to 31 May 2007 represented 1% of turnover for the nine months

(6) On 1 June 2006, vehicles were purchased for 30,000 and equipment for 10,000. On 1

September 2006, a further vehicle was purchased for 12,000 and on 1 December 2006,

further equipment was added at a cost of 5,000. Depreciation is calculated at 40% per

annum on cost for vehicles after allowing for a residual value of 10% of original cost, and 20%

per annum on cost for equipment assuming no residual value. There were no other fixed

assets

REQUIRED

Set out the Profit and Loss Account, in columnar form, showing clearly the profit earned before

incorporation, and the profit earned after incorporation. Show the basis of allocation for each

item of income and expenditure. Assume that all months have an equal number of days

(Total 25 marks)

ASE3012 Sample Paper 2008 4 OVER

QUESTION 3

The following information relates to Sino Merchandising plc:

Years ended 31 December 2006 2007

Operating profit 800,650 960,300

Debenture interest 50,000 50,000

Net profit 750,650 910,300

Dividends 330,000 430,000

Retained profit for the year 420,650 480,300

Balance Sheet extracts at 31 December 2006 2007

Ordinary shares of 1 each 2,000,000 2,000,000

6% Preference shares of 1 each 500,000 500,000

Profit & loss 1,100,400 1,580,700

5% Debentures 1,000,000 1,000,000

The companys Ordinary Share prices on 31 December 2006 and 2007 were 2 and 3 respectively

REQUIRED

(a) Calculate the following ratios, correct to two decimal places, for both 2006 and 2007:

(i) Earnings per Ordinary Share (s)

(ii) Price earnings

(iii) Dividend yield

(iv) Dividend cover for Ordinary Shares

(v) Return on total capital employed

All workings must be shown

(20 marks)

A potential investor is more likely to invest in the ordinary shares of a company with a low gearing ratio

than in the ordinary shares of a company with a high gearing ratio

REQUIRED

(b) Explain the reasons for this

(5 marks)

(Total 25 marks)

ASE3012 Sample Paper 2008 5 CONTINUED ON THE NEXT PAGE

QUESTION 4

The following are the financial statements of White Ltd and its subsidiary Power Ltd:

Profit and Loss Accounts for the year ended 31 October 2007

White Ltd Power Ltd

000 000 000 000

Turnover 245,000 95,000

Cost of sales 140,000 52,000

Gross Profit 105,000 43,000

Distribution costs 12,000 10,000

Administrative expenses 55,000 13,000

67,000 23,000

Operating profit 38,000 20,000

Dividend from Power Ltd 7,000 nil

Profit on ordinary activities 45,000 20,000

Dividends 20,000 10,000

Retained profit for the year 25,000 10,000

Balance Sheets at 31 October 2007

White Ltd Power Ltd

000 000 000 000

Fixed Assets

Tangible assets at net book value 110,000 40,000

Investment in Power Ltd 24,000 nil

134,000 40,000

Current Assets

Stock at cost 13,360 3,890

Debtors and dividend

receivable 14,640 6,280

Bank 3,500 2,570

31,500 12,740

Creditors: Amounts falling due within one year

Creditors 9,000 2,460

Dividends 20,000 10,000

29,000 12,460

Net Current Assets 2,500 280

136,500 40,280

Capital and Reserves 000 000

1 Ordinary shares 100,000 30,000

General reserve 4,400 1,000

Profit and Loss 32,100 9,280

136,500 40,280

ASE3012 Sample Paper 2008 6

QUESTION 4 (continued)

The following information is also available:

(i) White Ltd purchased 70% of the 30,000,000 Ordinary Shares in Power Ltd on 1 November

2002. At that date the balance on Power Ltds General Reserve was 500,000 and the

balance on the Profit and Loss Account was 1,500,000

(ii) White Ltd amortises goodwill on a straight-line basis over 10 years

(iii) During the year ended 31 October 2007 White Ltd sold goods, which originally cost

12,000,000, to Power Ltd. White Ltd invoiced these goods at cost plus 40%. Power Ltd still

has 30% of these goods in stock at 31 October 2007, valued at White Ltds selling price

(iv) Power Ltd owed White Ltd 1,200,000 at 31 October 2007

REQUIRED

(a) Calculate the goodwill arising on the acquisition of Power Ltd

(2 marks)

(b) Prepare the Consolidated Profit and Loss Account for the year ended

31 October 2007 up to the retained profit for the year

(8 marks)

(c) Prepare the Consolidated Balance Sheet at 31 October 2007

(15 marks)

(Total 25 marks)

ASE3012 Sample Paper 2008 7 CONTINUED ON THE NEXT PAGE

QUESTION 5

Peter manufactures and sells 500,000 plastic barrels each year. The financial information relating to

each barrel is as follows:

Selling price 5.00

Costs:

Direct materials 1.20

Direct labour 1.50

Direct overheads 0.70

Fixed overheads 0.60

4.00

Profit 1.00

REQUIRED

(a) Calculate how many barrels Peter must sell each year in order to break even

Peter wishes to increase production and sales in order to make a profit of 700,000 per year. The

selling price and direct costs will remain unchanged and the annual cost of fixed overheads will total

450,000.

(3 marks)

REQUIRED

(b) Calculate how many barrels Peter will have to manufacture and sell in order to achieve an

annual profit of 700,000

(3 marks)

Peter is now considering extending his product range but has to chose between two

competing projects as he cannot afford to undertake both. The following information has been

provided in respect of each project:

Project A Project B

Immediate capital cost of machinery 60,000 60,000

Estimated net annual cash inflows

Year 1 15,000 15,000

Year 2 15,000 15,000

Year 3 15,000 20,000

Year 4 20,000 20,000

Year 5 10,000 5,000

Anticipated scrap value at the end of five years 5,000 10,000

Peters cost of capital is 10% and the following discount factors apply:

Year 1 0.909

Year 2 0.826

Year 3 0.751

Year 4 0.683

Year 5 0.621

ASE3012 Sample Paper 2008 8 Education Development International plc 2008

QUESTION 5 (continued)

REQUIRED

(c) Calculate, in years and months, the payback period of each project

(6 marks)

(d) Calculate the net present value of each project

(8 marks)

(e) Using the results from (c) and (d) above, recommend which project Peter should adopt giving

reasons for the recommendation.

(5 marks)

(Total 25 marks)

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Kotler Pom15 Im 05Document28 pagesKotler Pom15 Im 05Charles MK ChanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Kotler-Ch 1Document34 pagesKotler-Ch 1Charles MK Chan0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Kotler Pom15 Im 03Document26 pagesKotler Pom15 Im 03Charles MK ChanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chap 017Document24 pagesChap 017Charles MK ChanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Kotler Pom15 Im 04Document27 pagesKotler Pom15 Im 04Charles MK ChanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Answer Key KinneyAISE10IM PDFDocument18 pagesAnswer Key KinneyAISE10IM PDFCharles MK ChanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Department of Business AdministrationDocument3 pagesDepartment of Business AdministrationCharles MK ChanNo ratings yet

- 9602 in Fin SolveDocument86 pages9602 in Fin SolveCharles MK Chan0% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Answer Key KinneyAISE10IM PDFDocument18 pagesAnswer Key KinneyAISE10IM PDFCharles MK ChanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 2: Methods For Describing Sets of Data: Solve The ProblemDocument6 pagesChapter 2: Methods For Describing Sets of Data: Solve The ProblemCharles MK ChanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Foreign Exchange MarketDocument40 pagesThe Foreign Exchange MarketCharles MK Chan0% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Q 18Document1 pageQ 18Charles MK ChanNo ratings yet

- LO.1-LO.3 (Relevant Costs Sunk Costs) Prior To The 2009 Super Bowl, A Phoenixarea Retailer OrderedDocument1 pageLO.1-LO.3 (Relevant Costs Sunk Costs) Prior To The 2009 Super Bowl, A Phoenixarea Retailer OrderedCharles MK ChanNo ratings yet

- Level 3 Certificate in Accounting: SyllabusDocument16 pagesLevel 3 Certificate in Accounting: SyllabusCharles MK ChanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- L3 Passport To Success - Solutions BookletDocument52 pagesL3 Passport To Success - Solutions BookletCharles MK ChanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Members' Handbook Contents of Volume Ii: Preface and FrameworkDocument4 pagesMembers' Handbook Contents of Volume Ii: Preface and FrameworkCharles MK ChanNo ratings yet

- ABA102 Assignment 1Document4 pagesABA102 Assignment 1Charles MK ChanNo ratings yet

- Important Statistics Formulas: ParametersDocument1 pageImportant Statistics Formulas: ParametersCharles MK ChanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- BB A Assign SheetDocument2 pagesBB A Assign SheetCharles MK ChanNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- ABA203 Money and Banking Lecture 3: Demand For Money: Arieswong@chuhai - Edu.hkDocument2 pagesABA203 Money and Banking Lecture 3: Demand For Money: Arieswong@chuhai - Edu.hkCharles MK ChanNo ratings yet

- Overview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument20 pagesOverview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallCharles MK ChanNo ratings yet

- ABA203 Money and Banking Lecture 4: Understanding Interest RatesDocument3 pagesABA203 Money and Banking Lecture 4: Understanding Interest RatesCharles MK ChanNo ratings yet

- Chapter 8 Revenue Recognition: 1. ObjectivesDocument16 pagesChapter 8 Revenue Recognition: 1. ObjectivesCharles MK ChanNo ratings yet

- Assignment 2 SolutionDocument4 pagesAssignment 2 SolutionSobhia Kamal100% (1)

- ADV ACC TBch03Document18 pagesADV ACC TBch03hassan nassereddineNo ratings yet

- WK 17 Ch.15-Monopolistic Competition - OKDocument24 pagesWK 17 Ch.15-Monopolistic Competition - OKkassel PlacienteNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Lesson 1 Introduction To Agricultural MarketingDocument3 pagesLesson 1 Introduction To Agricultural MarketingSittie Ainah MacapundagNo ratings yet

- Business NotesDocument9 pagesBusiness Noteskrish shahNo ratings yet

- Financial Reporting and Analysis (OUpm001111)Document10 pagesFinancial Reporting and Analysis (OUpm001111)SagarPirtheeNo ratings yet

- PE - Norway Pension Fund - Evaluatin Investments in PE (Ver P. 32)Document154 pagesPE - Norway Pension Fund - Evaluatin Investments in PE (Ver P. 32)Danilo Just SoaresNo ratings yet

- Fsa 2006 10Document880 pagesFsa 2006 10Mahmood KhanNo ratings yet

- Kirti New CV 18.04.2023Document3 pagesKirti New CV 18.04.2023Shweta jainNo ratings yet

- Ultimate Options Strategies WorkbookDocument20 pagesUltimate Options Strategies WorkbookjitendrasutarNo ratings yet

- Module4-FINANCIAL PLANNING AND FORECASTINGDocument11 pagesModule4-FINANCIAL PLANNING AND FORECASTINGRiza FarreNo ratings yet

- Amazon Stock Report $AMZNDocument7 pagesAmazon Stock Report $AMZNctringhamNo ratings yet

- Corkford Brewing Excel With Sensitivity Analysis 1Document10 pagesCorkford Brewing Excel With Sensitivity Analysis 1Rafiah JobNo ratings yet

- Handouts ConsolidationSubsequent To Date of AcquisitionDocument5 pagesHandouts ConsolidationSubsequent To Date of AcquisitionCPANo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- High Frequency Trading: by Veloxpro Limited. Page 1 of 34Document34 pagesHigh Frequency Trading: by Veloxpro Limited. Page 1 of 34Karan Goyal100% (1)

- Answer: Using A Financial Calculator or Excel The YTM Is Determined To Be 10.68%Document3 pagesAnswer: Using A Financial Calculator or Excel The YTM Is Determined To Be 10.68%rifat AlamNo ratings yet

- Topic 5 - WACC Ans 2019-20Document4 pagesTopic 5 - WACC Ans 2019-20Gaba RieleNo ratings yet

- Financial Reporting and Analysis 7Th Edition Revsine Test Bank Full Chapter PDFDocument61 pagesFinancial Reporting and Analysis 7Th Edition Revsine Test Bank Full Chapter PDFanthelioncingulumgvxq100% (10)

- Module 6 Income Taxes For Corporations - Part 1Document12 pagesModule 6 Income Taxes For Corporations - Part 1Maricar DimayugaNo ratings yet

- Forex Strategy 'Vegas-Wave'Document5 pagesForex Strategy 'Vegas-Wave'douy2t12geNo ratings yet

- Hyundai Motor Company 1q 2022 Consolidated FinalDocument61 pagesHyundai Motor Company 1q 2022 Consolidated FinalNitesh SinghNo ratings yet

- YNH Ar2023Document174 pagesYNH Ar2023Hew Jhet NungNo ratings yet

- Havells India 3QF14 Result Review 30-01-14Document8 pagesHavells India 3QF14 Result Review 30-01-14GaneshNo ratings yet

- Financial Statement AnalysisDocument30 pagesFinancial Statement AnalysisHYUN JUNG KIMNo ratings yet

- CAIIB-BFM Practice Que Set-1Document5 pagesCAIIB-BFM Practice Que Set-1Surya PillaNo ratings yet

- ACC708 Lecture 2Document26 pagesACC708 Lecture 2Emjes Giano100% (1)

- Phillip Capital IntroductionDocument23 pagesPhillip Capital IntroductionSarthakNo ratings yet

- The Importance of Credit Period in Business - SmaketDocument7 pagesThe Importance of Credit Period in Business - SmaketBarsa MohantyNo ratings yet

- Impact of Dividend Policy On A Firm PerformanceDocument11 pagesImpact of Dividend Policy On A Firm PerformanceMuhammad AnasNo ratings yet

- Capital Market Contribution in An Economic Developing Country Like BangladeshDocument42 pagesCapital Market Contribution in An Economic Developing Country Like BangladeshRaihan WorldwideNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)