Professional Documents

Culture Documents

8.12.14 US Attorney General Response

Uploaded by

WDET 101.9 FM0 ratings0% found this document useful (0 votes)

653 views9 pagesHere is the U.S. Attorney General's opinion about the creditors in Detroit's bankruptcy case with civil rights claims.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHere is the U.S. Attorney General's opinion about the creditors in Detroit's bankruptcy case with civil rights claims.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

653 views9 pages8.12.14 US Attorney General Response

Uploaded by

WDET 101.9 FMHere is the U.S. Attorney General's opinion about the creditors in Detroit's bankruptcy case with civil rights claims.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

In re: ) Chapter 9

)

CITY OF DETROIT, MICHIGAN, ) Case No. 13-53846

)

Debtor. ) Hon. Steven W. Rhodes

________________________________ )

UNITED STATES OF AMERICAS BRIEF IN RESPONSE TO ORDER OF

CERTIFICATION PURSUANT TO 28 U.S.C. 2403(a)

The United States of America hereby responds to the Courts Order of

Certification Pursuant to 28 U.S.C. 2403(a) (the Certification Order) (Docket No.

5925), entered J uly 11, 2014. For the reasons set forth below, the United States believes

that the plan objections cited in the Certification Order raise important issues but do not

currently present a substantial constitutional challenge to chapter 9 of the Bankruptcy

Code.

The Certification Order

In the Certification Order, the Court certified to the Attorney General pursuant to

28 U.S.C. 2403(a) that the constitutionality of Chapter 9 of Title 11 of the United

States Code is drawn into question in this case. The Court identified two separate sets

of objections to the Debtors Fourth Amended Plan for the Adjustment of Debts of the

City of Detroit (the Plan) (Docket No. 4392) as having asserted that chapter 9 is

unconstitutional if it allows the discharge or impairment of the objectors claims for (a)

civil rights violations arising under 42 U.S.C. 1983 (Docket Nos. 4099, 4224, 5690 and

5693) (the Section 1983 Objections) or (b) just compensation arising under the Fifth

and Fourteenth Amendments of the United States Constitution (Docket Nos. 3412 and

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 1 of 9

5671) (the Condemnation Objections and with the Section 1983 Objections, the Plan

Objections). Certification Order at 1.

1

The Certification Order permitted the United

States to intervene for argument on these constitutional questions and requested the

Attorney General to file a brief addressing them by August 13, 2014. Id.

2

The Plan Objections

I. The Section 1983 Objections

Eight different creditors filed the Section 1983 Objections. All the creditors are

plaintiffs in pending lawsuits against the Debtor and certain of its officials arising under

the Civil Rights Act, 42 U.S.C. 1983 and 1988, Docket No. 4099 at 2; Docket No.

4224 at 1, none of which have been reduced to judgment. The Section 1983 Objections

assert that the Plan is unconstitutional because it violates the creditors rights under the

Fourteenth Amendment and 42 U.S.C. 1983, Docket No. 4099 at 10; Docket No.

4224 at 7 and 8, and seek a determination that the Plan is unconstitutional due to its

treatment of their damages claims under the Civil Rights Act of 1871, Docket No. 5690

at 12 ([I]nsofar as it includes the reduction and evisceration of 1983 claimants

damages claim, [the Plan] is unconstitutional.); Docket 5693 at 2 ([R]equesting that

this Court issue an Order stating that [the Plan] is unconstitutional as to 1983

Plaintiffs.). The Section 1983 Objections assert that the Plan must pay those creditors

1

The United States takes no position on whether the Plans treatment of the objectors

claims violates any applicable provision of title 11 of the United States Code (the

Bankruptcy Code).

2

Since the Courts issuance of the Certification Order, the Debtor has filed a fifth

amended plan, Docket No. 6257, and a corrected version thereof, Docket No. 6379.

Upon information and belief, neither affects the Courts request in the Certification Order

nor this response thereto.

2

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 2 of 9

the full amount of their claims, Docket No. 4099 at 8 (seeking an order [r]equir[ing] the

Debtor to set forth a revised Amended Plan that exempts claims brought under 42 U.S.C.

1983, 1988 from any resolution short of full and complete compensation), as opposed

to 10% - 13% of their liquidated value, Docket No. 5690 at 9 n.7. Further, the Section

1983 Objections do not request that this Court declare chapter 9, or any section within it,

unconstitutional.

II. The Condemnation Objections

Three different creditors raise the Condemnation Objections. Two have pending

condemnation or inverse condemnation cases against the Debtor. Docket No. 3412 at 2

and 4. The third holds a prepetition, final judgment for partial inverse condemnation that

requires, in part, the Debtor to pay $3,800 per month until it acquires ownership of the

subject property or lifts the restrictions on its use. Id. at 3-4. Prepetition, the Debtor

made these monthly payments but stopped when it filed bankruptcy. Id.

The Condemnation Objections assert that the Plan violates the Fifth and

Fourteenth Amendments of the U.S. Constitution, because the Plan impairs the relief

available to parties whose property has been taken by the City of Detroit through

condemnation or inverse condemnation. Docket No. 5671 at 1. Accordingly, those

objections request that the Plan be amended to rule that claims based in inverse

condemnation and condemnation, which are based on the taking of property without just

compensation, are not subject to reduction or compromise. Docket No. 3412 at 7. The

Condemnation Objections do not seek a judicial determination that chapter 9, in whole or

in part, is unconstitutional.

3

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 3 of 9

Discussion

I. The Section 1983 Objections Do Not Raise a Constitutional Issue

In section 1983, Congress created a cause of action for individuals who suffer

violations of their federal constitutional rights committed under color of state law. City

of Monterey v. Del Monte Dunes at Monterey, Ltd., 526 U.S. 687, 709 (1999) (holding

that section 1983 creates a species of tort liability to provide relief for invasions of rights

protected under federal law). The statutes purpose is: (1) to compensate persons for

injuries caused by deprivation of federal rights and (2) to serve as a deterrent against

future violations of those rights. Owen v. City of Independence, Missouri, 445 U.S. 622,

651 (1980). The statute itself, however, does not create any substantive rights. City of

Monterey, 526 U.S. at 749 n.9 (quoting Baker v. McCollan, 443 U.S. 137, 144 n.3

(1979)); Moldowan v. City of Warren, 578 F.3d 351, 376 (6

th

Cir. 2009) (same).

The damages remedy in section 1983 exists only by legislative grace and not

constitutional requirement. No provision of the Constitution requires the creation of the

damages remedy or that any claim arising from its exercise be paid in full. Underscoring

this proposition is the Supreme Courts consistent reliance on the statutes text and

legislative history to decide the scope of the damages remedy. See Monell v. Dept of

Social Servs. of the City of New York., 436 U.S. 658, 701 (1978) (overruling Monroe v.

Pape, 365 U.S. 167 (1961), in holding that Congress intended persons under section 1983

to include municipal corporations after a detailed review of the statutes text and

legislative history); Will v. Michigan Dept of State Police, 491 U.S. 58, 71 (1989)

(holding that neither a State nor its officials were persons, particularly where permitting

4

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 4 of 9

plaintiffs to name officials rather than a State would circumvent congressional intent by

a mere pleading device); Ngiraingas v. Sanchez, 495 U.S. 182, 192 (1990) (holding

neither the Territory of Guam nor its officials were persons within section 1983 after

examin[ing] the statutes language and purpose).

Because section 1983 creates a damages remedy and not substantive rights and

because that remedy arises from congressional enactment and not constitutional mandate,

the United States submits that the Plans treatment of the section 1983 claims does not

raise an issue arising under the Fourteenth Amendment.

3

II. Impairment of Claims for J ust Compensation Arising Under the Fifth Amendment

Would Raise Substantial Constitutional Concerns

The Fifth Amendment's Takings Clause prevents the Legislature (and other

government actors) from depriving private persons of vested property rights except for a

public use and upon payment of just compensation. Landgraf, 511 U.S. at 266. It

does not prohibit the taking of private property, but instead places a condition on the

exercise of that power [and] is designed not to limit the governmental interference with

property rights per se, but rather to secure compensation in the event of otherwise proper

interference amounting to a taking. First English Evangelical Lutheran Church of

Glendale v. County of Los Angeles, 482 U.S. 304, 314-15 (1987) (emphasis in original).

3

To the extent the Section 1983 Objections assert that the Plans treatment of the claims

violates the Takings Clause of the Fifth Amendment, such an assertion lacks merit. The

Takings Clause protects only vested (as opposed to inchoate) property rights, Landgraf v.

USI Film Prods., 511 U.S. 244, 266 (1994), and property rights in a cause of action, such

as the section 1983 claims, do not vest until reduced to a final unreviewable judgment,

Bowers v. Whitman, 671 F.3d 905, 914 (9

th

Cir. 2012); accord Arbour v. Jenkins, 903

F.2d 416, 420 (6

th

Cir. 1990) (The fact that the statute is retroactive does not make it

unconstitutional [because] a legal claim affords no definite or enforceable property right

until reduced to final judgment.); Stauffer v. Brooks Bros. Group, Inc., 2014 WL

3360802 *6 (Fed. Cir. 2014) (same).

5

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 5 of 9

The Supreme Court has never attempted to prescribe a rigid rule for determining

what is just compensation under all circumstances and in all cases. U.S. v.

Commodities Trading Corp., 339 U.S. 121, 123 (1950); U.S. v. Cors, 337 U.S. 325, 332

(1949) (The Court in its construction of the constitutional provision has been careful not

to reduce the concept of just compensation to a formula.). Nevertheless, the

dominant consideration always remains the same: What compensation is just both to an

owner whose property is taken and to the public that must pay the bill? Commodities

Trading Corp at 123. Articulated differently, [t]he underlying principle is that the

dispossessed owner is entitled to be put in as good a position pecuniarily as if his

property had not been taken. He must be made whole but is not entitled to more. U.S.

v. Certain Land Situated in City of Detroit, 547 F. Supp. 680, 682 (E.D. Mich. 1982)

(quoting Olson v. U.S., 292 U.S. 246, 255 (1934)).

Congresss constitutional bankruptcy power, Art. I, sec. 8, cl. 4, is subject to the

Fifth Amendment's prohibition against taking private property without compensation.

U.S. v. Security Indus. Bank, 459 U.S. 70, 75 (1982). Accordingly, a bankruptcy court

may not direct or authorize that less than just compensation may be paid for the taking of

property, whether that is through direct condemnation or inverse condemnation.

Here, whether the Plan proposes to pay less than just compensation to the

claimants asserting the Condemnation Objections or any holder of a claim for just

compensation is currently unclear. Indeed, the Debtor has conceded it does not know the

facts surrounding all of the condemnation actions to which it is a party, Docket No. 6092

(audio transcript of J uly 16, 2014 hearing), and that some of the claims arising from such

actions may ultimately receive treatment as a secured claim under the Plan, id. To the

6

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 6 of 9

extent that the Plan proposes, however, to pay less than the full amount of a claim based

on a just compensation award, regardless of when that award or the facts giving rise to it

occur, i.e., prepetition or postpetition, such treatment would raise substantial

constitutional questions. The J ust Compensation Clause would appear to require these

claims to be treated as nondischargeable.

4

The Court can avoid, however, such constitutional questions through the

discretion afforded it under section 944(c)(1) of the Bankruptcy Code, which states that a

chapter 9 debtor is not discharged under subsection (b) of this section from any debt

(1) excepted from discharge by the plan or order confirming the plan. 11 U.S.C.

944(c)(1). This provision provides the Court sufficient equitable flexibility to exclude

the just compensation claims from the discharge of section 944(b) and vindicate the Fifth

Amendments protection.

The United States is not suggesting that the flexibility to deem claims

nondischargeable in section 944(c)(1) is without bounds; however, unlike the other

bankruptcy chapters, chapter 9 contains no specific enumerations of what debts are

nondischargeable, such as in sections 523 and 1141 of the Bankruptcy Code, which

Congress expressly made inapplicable in this case, 11 U.S.C. 901(a). Therefore, no

provision of chapter 9 expressly limits a courts discretion under section 944(c)(1) or

precludes a court from ordering the nondischargeability of a just compensation claim.

Absent such statutory limitation, the United States respectfully submits that, in the

4

A determination that the condemnation claims are nondischargeable does not mean

those claims cannot receive whatever treatment the Plan may provide for them, either as

unsecured or secured claims depending on each claims facts. The determination simply

means that the Debtor remains liable to pay the balance of those just compensation claims

after deduction of whatever payments those claims may receive under the Plan.

7

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 7 of 9

interests of avoiding a constitutional question, the Court should narrowly construe section

944(c)(1) to bar the discharge of just compensation claims.

CONCLUSION

For all of the foregoing reasons, the United States believes that the Plan

Objections, while raising important issues, do not currently present a substantial

constitutional challenge to chapter 9 of the Bankruptcy Code. The United States

expressly reserves its right to intervene in this case at any point in which it appears that

the constitutionality of an Act of Congress affecting the public interest is drawn in

question.

Dated: August 12, 2014 Respectfully submitted,

STUART F. DELERY

Assistant Attorney General

BARBARA L. MCQUADE

United States Attorney

J OHN T. STEMPLEWICZ

Acting Director

/s/ Matthew J . Troy

TRACY J . WHITAKER

MATTHEW J . TROY

Attorneys, Civil Division

U.S. Department of J ustice

P.O. Box 875

Ben Franklin Station

Washington, DC 20044

Tel: (202) 514-9038

Fax: (202) 514-9163

tracy.whitaker@usdoj.gov

matthew.troy@usdoj.gov

Attorneys for the United States

8

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 8 of 9

CERTIFICATE OF SERVICE

I, Matthew J . Troy, hereby certify that the service of this United States of Americas

Brief in Response to Order of Certification Pursuant to 28 U.S.C. 2403(a) was filed and

served via the Courts electronic case filing and noticing system on August 12, 2014.

/s/ Matthew J . Troy

13-53846-swr Doc 6664 Filed 08/12/14 Entered 08/12/14 17:04:28 Page 9 of 9

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Living in The PrivateDocument31 pagesLiving in The Privatepanamahunt2292% (26)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CRDT CRD LTR 1 - Template - (Proof of Claim)Document4 pagesCRDT CRD LTR 1 - Template - (Proof of Claim)Julie Hatcher-Julie Munoz Jackson100% (10)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Jean Keating A4V process redeems debt in lawful moneyDocument7 pagesJean Keating A4V process redeems debt in lawful moneyDannyHeaggans98% (41)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Crowell and Moring Where Are They Now, Part 8Document60 pagesCrowell and Moring Where Are They Now, Part 8Kirk Hartley100% (1)

- RA 3591 (As Amended) PDIC CharterDocument39 pagesRA 3591 (As Amended) PDIC Charterchitru_chichruNo ratings yet

- Perry Q2 LetterDocument6 pagesPerry Q2 Lettermarketfolly.com100% (4)

- Ease of Doing Business in IndiaDocument3 pagesEase of Doing Business in IndiaearthwoNo ratings yet

- 2 Jo Chung Cang v. Pacific Commercial Co.Document2 pages2 Jo Chung Cang v. Pacific Commercial Co.MlaNo ratings yet

- Lichauco Vs Lichauco 1916 (D)Document2 pagesLichauco Vs Lichauco 1916 (D)Angelic ArcherNo ratings yet

- Dona Adela Export v. TIDCORPDocument2 pagesDona Adela Export v. TIDCORPLili MoreNo ratings yet

- New Century Mortgage and Home123 Bankruptcy Disclosure StatementDocument255 pagesNew Century Mortgage and Home123 Bankruptcy Disclosure Statement83jjmackNo ratings yet

- Advanced Accounting Baker Test Bank - Chap020Document31 pagesAdvanced Accounting Baker Test Bank - Chap020donkazotey100% (2)

- CA PDF 5Document222 pagesCA PDF 5ThabassumNo ratings yet

- Mental Health Across The Criminal Legal ContinuumDocument24 pagesMental Health Across The Criminal Legal ContinuumWDET 101.9 FMNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- Asian Carp Control MeasuresDocument2 pagesAsian Carp Control MeasuresWDET 101.9 FMNo ratings yet

- Did The Past Economic Recovery Result in Shared Prosperity?Document33 pagesDid The Past Economic Recovery Result in Shared Prosperity?WDET 101.9 FMNo ratings yet

- Lake Erie Harmful Algal Bloom Early ProjectionDocument1 pageLake Erie Harmful Algal Bloom Early ProjectionWDET 101.9 FMNo ratings yet

- 2019 Combined BracketsDocument2 pages2019 Combined BracketsWDET 101.9 FMNo ratings yet

- Bell Pepeprs RecipeDocument2 pagesBell Pepeprs RecipeWDET 101.9 FMNo ratings yet

- 2019 Wayne County Road ScheduleDocument7 pages2019 Wayne County Road ScheduleWDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Algae Bloom Forecast 5/23/19Document1 pageAlgae Bloom Forecast 5/23/19WDET 101.9 FMNo ratings yet

- Marathon Application and Variance RequestDocument43 pagesMarathon Application and Variance RequestWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- Lake Erie Bill of RightsDocument3 pagesLake Erie Bill of RightsWDET 101.9 FMNo ratings yet

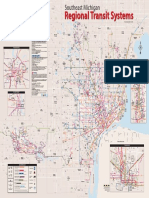

- 2014 Regional System MapDocument1 page2014 Regional System MapWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- NTSB Preliminary Report On Arizona FatalityDocument4 pagesNTSB Preliminary Report On Arizona FatalityWDET 101.9 FMNo ratings yet

- Shri Thanedar DJC Interview TranscriptDocument12 pagesShri Thanedar DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

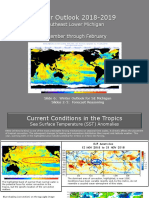

- Winter 2018-19 OutlookDocument6 pagesWinter 2018-19 OutlookWDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- Jim Hines DJC Interview TranscriptDocument15 pagesJim Hines DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Abdul El-Sayed DJC Interview TranscriptDocument18 pagesAbdul El-Sayed DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Pickled Summer SquashDocument2 pagesPickled Summer SquashWDET 101.9 FMNo ratings yet

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- What's Fresh: Sweet Corn SoupDocument2 pagesWhat's Fresh: Sweet Corn SoupWDET 101.9 FMNo ratings yet

- Patrick Colbeck DJC Interview TranscriptDocument14 pagesPatrick Colbeck DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Voters Not Politicians ProposalDocument8 pagesVoters Not Politicians ProposalWDET 101.9 FMNo ratings yet

- Brian Calley DJC Interview TranscriptDocument14 pagesBrian Calley DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Playbook - CORP-Procurement - Sep-15-2021 LIN MARTINDocument45 pagesPlaybook - CORP-Procurement - Sep-15-2021 LIN MARTINApulinaNo ratings yet

- Spot Risk SupplierDocument8 pagesSpot Risk SuppliermuputismNo ratings yet

- Service TaxDocument27 pagesService TaxJapojh GiptrdNo ratings yet

- Gaira Recording Studio AWS948 Delta Quotation 13258Document4 pagesGaira Recording Studio AWS948 Delta Quotation 13258Andrea HernándezNo ratings yet

- NCLT-Debt Recovery ProcessDocument25 pagesNCLT-Debt Recovery ProcessRedSunNo ratings yet

- Banking Law Reform Committee ReportDocument134 pagesBanking Law Reform Committee ReportLive LawNo ratings yet

- Nicco-CorpDocument6 pagesNicco-CorpPrince PathakNo ratings yet

- Corporate Insolvency Act SummaryDocument112 pagesCorporate Insolvency Act SummaryJK S1No ratings yet

- Accession Cases UndigestedDocument136 pagesAccession Cases UndigestedEllen Glae DaquipilNo ratings yet

- Dewey and LeBoeuf Statement of Financial AffairsDocument355 pagesDewey and LeBoeuf Statement of Financial Affairsdavid_latNo ratings yet

- Financial Institutional Act 2004Document101 pagesFinancial Institutional Act 2004Chicharito HernandezNo ratings yet

- Brenda Jaeke ResumeDocument2 pagesBrenda Jaeke Resumeb-marie2011No ratings yet

- Winding Up of CompaniesDocument18 pagesWinding Up of CompaniesAbbas HaiderNo ratings yet

- 2014 Civil Complaint Naming NojayDocument45 pages2014 Civil Complaint Naming NojayRochester Democrat and ChronicleNo ratings yet

- example Conveyance of SSN rev1Document1 pageexample Conveyance of SSN rev1agray43No ratings yet

- PSTCL Work Order for Outsourcing StaffDocument21 pagesPSTCL Work Order for Outsourcing StaffNavin ChandarNo ratings yet

- Truth in Lending Act-PDIC-FRIADocument14 pagesTruth in Lending Act-PDIC-FRIAKyla DabalmatNo ratings yet